Key Insights

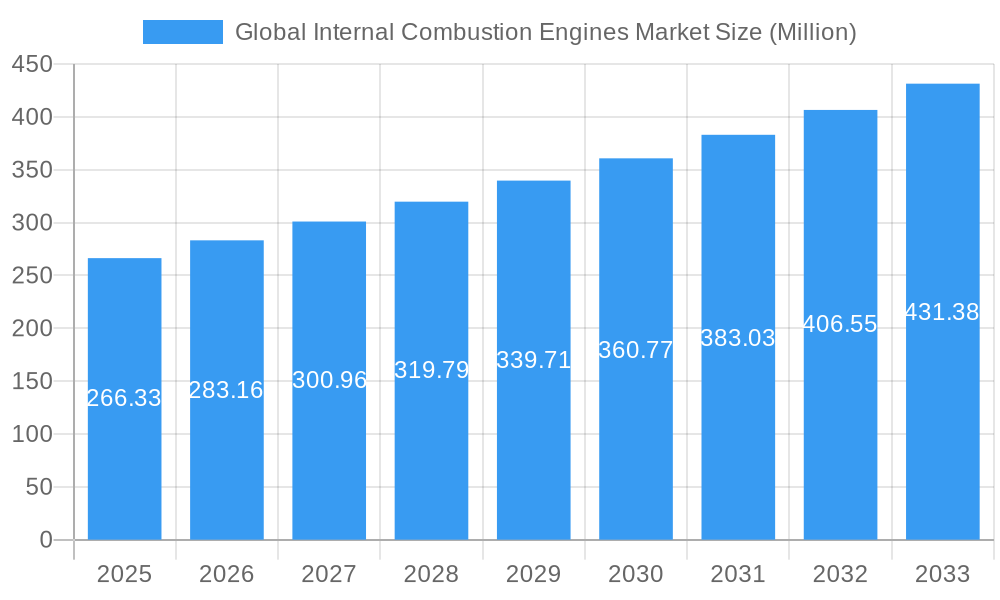

The Global Internal Combustion Engines (ICE) Market is poised for significant expansion, projected to reach a substantial market size of $266.33 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.30% expected to sustain this trajectory through 2033. This growth is primarily fueled by increasing demand across diverse applications, from automotive and industrial machinery to power generation and marine propulsion. The ongoing need for reliable and cost-effective power solutions, particularly in developing economies where electrification infrastructure is still maturing, underpins the market's resilience. Furthermore, advancements in ICE technology, focusing on improved fuel efficiency, reduced emissions, and enhanced performance, continue to drive innovation and market appeal, ensuring their relevance in the near to medium term. The market's segmentation reveals a dynamic landscape, with various capacity ranges and fuel types catering to specialized industry needs.

Global Internal Combustion Engines Market Market Size (In Million)

While the global push towards electric vehicles and alternative energy sources presents a long-term challenge, the ICE market benefits from substantial existing infrastructure, established manufacturing capabilities, and a vast installed base. Key drivers include the ever-growing global vehicle parc, the demand for heavy-duty machinery in construction and agriculture, and the need for stationary power solutions. However, stringent environmental regulations and the escalating adoption of electric and hybrid technologies are notable restraints. Companies like Yamaha Motor Co. Ltd, Volkswagen Group, and Toyota Motor Corporation are actively investing in optimizing ICE technology for greater efficiency and lower emissions, demonstrating a commitment to evolving within the changing market dynamics. Geographically, the Asia Pacific region, led by China and India, is anticipated to be a major growth engine due to rapid industrialization and a burgeoning automotive sector.

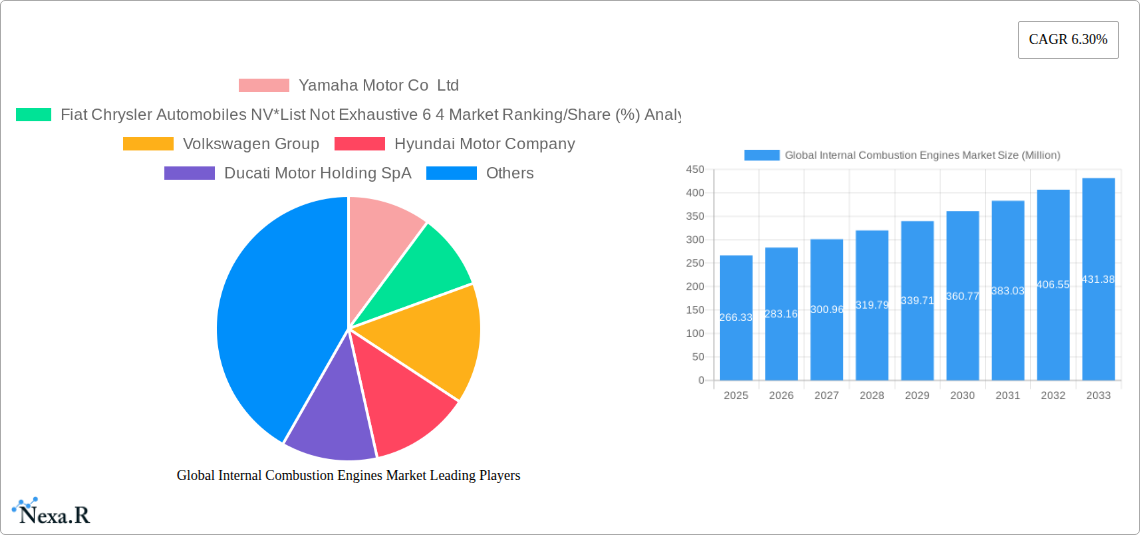

Global Internal Combustion Engines Market Company Market Share

Global Internal Combustion Engines Market: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides a definitive analysis of the global internal combustion engines (ICE) market, projecting its trajectory through 2033. We offer a granular examination of market dynamics, growth trends, regional dominance, product landscapes, and critical drivers and challenges. With a focus on high-traffic keywords such as "internal combustion engine market," "ICE engine forecast," "automotive engine segments," and "engine capacity analysis," this report is optimized for search engine visibility and designed to equip industry professionals with actionable insights.

The study covers the period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period of 2025–2033. Historical data from 2019–2024 is meticulously analyzed. Key market segments by capacity (50 cm3 to 200 cm3, 201 cm3 to 800 cm3, 801 cm3 to 1500 cm3, 1501 cm3 to 3000 cm3) and fuel type (Gasoline, Diesel, Others) are thoroughly investigated.

Featured companies include (but are not limited to): Yamaha Motor Co Ltd, Fiat Chrysler Automobiles NV, Volkswagen Group, Hyundai Motor Company, Ducati Motor Holding SpA, Toyota Motor Corporation, Volvo AB, Suzuki Motor Corp, Ford Motor Company, Man SE.

All values are presented in Million units.

Global Internal Combustion Engines Market Market Dynamics & Structure

The global internal combustion engines (ICE) market is characterized by a dynamic interplay of established players and evolving technological landscapes. Market concentration remains significant, with a few major automotive manufacturers and engine suppliers holding substantial shares. Technological innovation is a key driver, with ongoing advancements in fuel efficiency, emissions reduction, and performance optimization. However, regulatory frameworks, particularly concerning emissions standards like Euro 7 and equivalent global mandates, present both a challenge and an impetus for innovation. The emergence of hybrid and electric powertrains acts as a competitive substitute, influencing investment decisions and research and development priorities for ICE manufacturers. End-user demographics are shifting, with a growing demand for more fuel-efficient and environmentally conscious ICE options, particularly in emerging economies. Mergers and acquisitions (M&A) activity, while potentially slowing in some traditional segments, continues to be a strategic tool for consolidating market positions and acquiring new technologies, such as advanced emission control systems or alternative fuel capabilities.

- Market Concentration: Dominated by a handful of global automotive giants and specialized engine manufacturers.

- Technological Innovation: Focus on improving fuel economy, reducing emissions (e.g., particulate filters, lean burn technology), and enhancing combustion efficiency.

- Regulatory Frameworks: Stringent emissions standards are a major influencing factor, pushing for cleaner ICE technologies or necessitating a transition to alternative powertrains.

- Competitive Substitutes: Hybrid powertrains and fully electric vehicles are increasingly capturing market share, especially in developed regions.

- End-User Demographics: Growing demand for cost-effective, reliable, and increasingly efficient ICE solutions, especially in commercial vehicle and developing market segments.

- M&A Trends: Strategic acquisitions aimed at bolstering emission control technology or securing supply chains for critical components. Expected M&A deal volume of approximately 5-7 major transactions annually within the broader powertrain industry impacting ICE development.

Global Internal Combustion Engines Market Growth Trends & Insights

The global internal combustion engines (ICE) market is navigating a complex transition, marked by sustained demand in certain sectors and regions, alongside the accelerating rise of alternative powertrains. Despite the increasing prevalence of electric vehicles (EVs), the ICE market is projected to experience a moderate growth trajectory throughout the forecast period. This growth is underpinned by the sheer volume of existing and new ICE vehicles produced, particularly for commercial transportation, heavy-duty applications, and in developing nations where charging infrastructure and vehicle affordability remain significant considerations. The market size is estimated to reach approximately 210 million units in 2025 and is forecasted to grow at a Compound Annual Growth Rate (CAGR) of around 1.8% to reach approximately 245 million units by 2033.

Technological disruptions continue to reshape the ICE landscape. Innovations in gasoline direct injection (GDI), advanced turbocharging, and sophisticated exhaust aftertreatment systems are enhancing fuel efficiency and reducing emissions, thereby extending the viability of ICE technology. For instance, advancements in variable valve timing and lift technologies contribute to better combustion control and fuel economy. Consumer behavior shifts are also playing a crucial role. While environmentally conscious consumers in developed markets are increasingly opting for EVs, a significant segment of the global population still prioritizes the affordability, range, and established refueling infrastructure associated with ICE vehicles. This is particularly evident in the automotive aftermarket and in regions with nascent EV adoption.

The adoption rates for new ICE technologies are influenced by a complex interplay of consumer preference, regulatory pressures, and economic factors. While the overall penetration of ICE vehicles might decline in the long term due to electrification, the demand for highly efficient and compliant ICE powertrains within specific niches is expected to remain robust. The market penetration of advanced ICE technologies, such as those incorporating mild-hybrid systems or utilizing alternative fuels, is gradually increasing, offering a bridge for consumers transitioning towards lower-emission mobility. The industry is witnessing a growing focus on optimizing ICE performance for specific use cases, such as high-performance engines for specialized vehicles or durable, efficient engines for industrial applications.

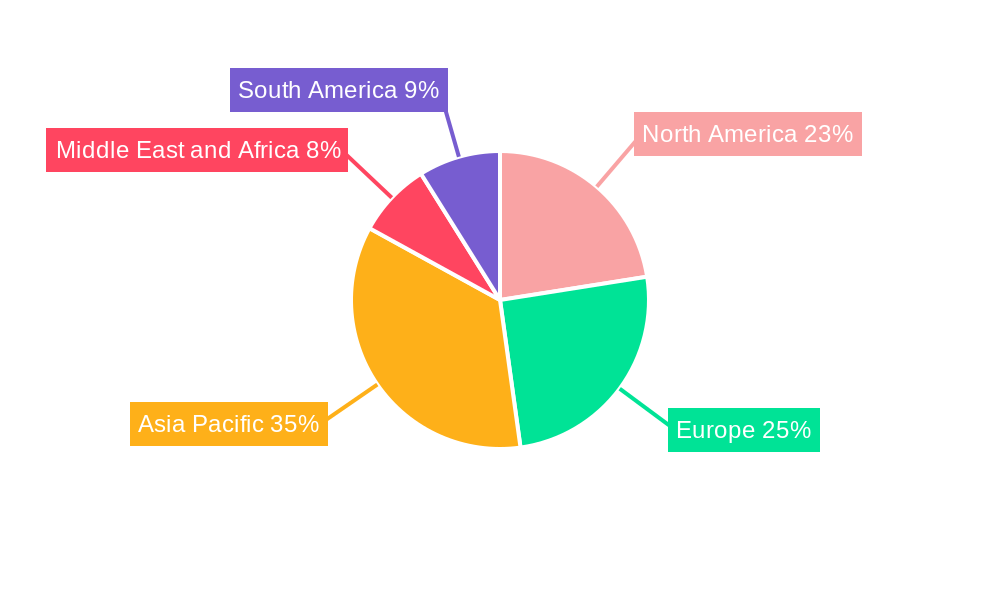

Dominant Regions, Countries, or Segments in Global Internal Combustion Engines Market

The global internal combustion engines (ICE) market’s dominance is multifaceted, with distinct regions, countries, and product segments playing pivotal roles in its growth and evolution. Among the engine capacity segments, the 201 cm3 to 800 cm3 segment is expected to remain a dominant force, driven by its widespread application in passenger cars, motorcycles, and light commercial vehicles. This segment offers a balance of performance, fuel efficiency, and cost-effectiveness, making it a preferred choice across a vast array of applications. In 2025, this segment is estimated to account for approximately 75 million units.

Gasoline fuel type continues to be the most prevalent, holding a significant market share estimated at around 60% in 2025, totaling approximately 126 million units. Its widespread availability, established infrastructure, and relative affordability contribute to its sustained dominance. However, the Diesel fuel type, particularly in heavy-duty commercial vehicles and specific industrial applications, retains substantial importance. The Others fuel type, encompassing alternative fuels like Compressed Natural Gas (CNG), Liquefied Petroleum Gas (LPG), and increasingly, hydrogen for internal combustion, is experiencing rapid growth driven by environmental regulations and technological advancements, projected to reach approximately 5% of the market by 2033.

Geographically, Asia-Pacific is anticipated to be the leading region, propelled by the burgeoning automotive industries in China and India, coupled with strong demand for motorcycles and commercial vehicles. China, in particular, with its massive manufacturing base and domestic consumption, is a significant contributor, accounting for an estimated 35% of the global ICE market share in 2025, valued at around 73.5 million units. Economic policies favoring local manufacturing and infrastructure development for transportation are key drivers in this region. North America and Europe, while experiencing a stronger push towards electrification, continue to represent substantial markets for ICE, especially for their robust commercial vehicle sectors and the ongoing need for efficient gasoline engines. The market share for North America is projected to be around 20% (42 million units), and for Europe, around 18% (37.8 million units) in 2025.

- Dominant Capacity Segment: 201 cm3 to 800 cm3 (Passenger Cars, Motorcycles, Light Commercial Vehicles) - Estimated 75 million units in 2025.

- Dominant Fuel Type: Gasoline (Widespread adoption, infrastructure, cost-effectiveness) - Estimated 126 million units in 2025.

- Leading Region: Asia-Pacific (China, India driving growth in automotive and two-wheeler segments) - Estimated 73.5 million units in 2025.

- Key Drivers in Asia-Pacific: Favorable economic policies, expanding transportation infrastructure, growing middle class, and demand for affordable mobility solutions.

- Growth Potential in Emerging Fuel Types: "Others" segment showing significant, albeit from a smaller base, growth driven by sustainability initiatives and technological innovation, projected to reach 5% of the market by 2033.

Global Internal Combustion Engines Market Product Landscape

The product landscape of the global internal combustion engines market is characterized by a relentless pursuit of enhanced performance, improved fuel economy, and reduced emissions. Manufacturers are focusing on advanced combustion technologies, such as homogeneous charge compression ignition (HCCI) and sophisticated direct injection systems, to optimize power output while minimizing fuel consumption. Innovations in materials science are leading to lighter and more durable engine components, contributing to overall vehicle efficiency. Furthermore, the integration of smart technologies, including advanced engine management systems and predictive diagnostics, is enhancing reliability and user experience. Applications span a vast spectrum, from compact engines powering motorcycles and small passenger cars to robust, high-torque engines for heavy-duty trucks and industrial machinery. The unique selling propositions increasingly revolve around lifecycle cost, emissions compliance, and adaptability to evolving fuel standards.

Key Drivers, Barriers & Challenges in Global Internal Combustion Engines Market

The global internal combustion engines (ICE) market is propelled by several key drivers. Continued demand from developing economies for affordable and accessible transportation, particularly for commercial vehicles and two-wheelers, remains a significant factor. Advancements in ICE technology, such as improved fuel efficiency and emission control systems, extend the life and competitiveness of these engines. The vast existing infrastructure for fueling and maintenance also supports their continued adoption. Technological drivers include ongoing research into cleaner combustion processes and alternative fuels compatible with ICE technology, such as synthetic fuels and hydrogen ICE.

However, the market faces substantial barriers and challenges. Stringent global emissions regulations, such as Euro 7 and similar mandates in other regions, necessitate significant investment in advanced exhaust aftertreatment systems, increasing manufacturing costs. The rapid development and increasing affordability of electric vehicles (EVs) present a formidable competitive challenge, leading to a gradual decline in ICE market share in developed countries. Supply chain disruptions, particularly for critical raw materials and components, can impact production volumes and costs. Furthermore, negative public perception regarding the environmental impact of ICE vehicles can influence consumer choices and policy decisions.

- Key Drivers:

- Sustained demand in emerging markets for cost-effective mobility.

- Technological advancements in fuel efficiency and emission reduction.

- Extensive existing fueling and maintenance infrastructure.

- Development of alternative fuels compatible with ICE.

- Barriers & Challenges:

- Increasingly stringent environmental regulations and emissions standards.

- Growing competition from electric vehicles (EVs).

- Supply chain vulnerabilities and raw material price volatility.

- Negative public perception and environmental concerns.

- High R&D costs for emission control technologies.

Emerging Opportunities in Global Internal Combustion Engines Market

Emerging opportunities in the global internal combustion engines market lie in the development of hybrid powertrains that seamlessly integrate ICE with electric systems, offering a pathway for enhanced efficiency and reduced emissions. The exploration of alternative fuels, such as e-fuels (synthetic fuels derived from renewable energy) and hydrogen, presents a significant avenue for ICE technology to remain relevant, particularly in sectors that are harder to electrify, like heavy-duty transport and aviation. Furthermore, specialized applications requiring long-range capabilities and rapid refueling, such as emergency services vehicles and remote area logistics, will continue to depend on ICE solutions. Focusing on niche markets where EVs are not yet a viable or cost-effective alternative, and leveraging advanced manufacturing techniques to reduce production costs for cleaner ICE options, represent strategic growth areas.

Growth Accelerators in the Global Internal Combustion Engines Market Industry

Several catalysts are accelerating growth within the global internal combustion engines market, particularly in specific segments and regions. Technological breakthroughs in optimizing combustion cycles, such as advancements in variable compression ratios and sophisticated cylinder deactivation, are significantly boosting fuel efficiency and reducing emissions, thereby extending the market viability of ICE. Strategic partnerships between traditional ICE manufacturers and technology providers focusing on emission control and alternative fuel integration are crucial. For instance, collaborations to develop hydrogen-powered ICE engines are a prime example. Market expansion strategies in developing economies, where the demand for affordable and reliable transportation remains high, are also key growth accelerators. Investment in robust, fuel-efficient ICE for commercial and agricultural applications will continue to be a driving force.

Key Players Shaping the Global Internal Combustion Engines Market Market

- Yamaha Motor Co Ltd

- Fiat Chrysler Automobiles NV

- Volkswagen Group

- Hyundai Motor Company

- Ducati Motor Holding SpA

- Toyota Motor Corporation

- Volvo AB

- Suzuki Motor Corp

- Ford Motor Company

- Man SE

Notable Milestones in Global Internal Combustion Engines Market Sector

- December 2023: Bosch, a German manufacturer, announced plans to launch its first hydrogen internal combustion engine for trucks, aiming to add to its existing fuel cell and battery-electric offerings. This development signals a significant push towards cleaner ICE solutions.

- March 2023: The European Union and Germany entered an agreement to allow some internal combustion engine (ICE) cars to be sold beyond 2035. Further, the German transport minister stated that vehicles with ICE engines can still be newly registered after 2035 if they are filled up exclusively with CO2-neutral fuels, indicating a pragmatic approach to emissions reduction.

In-Depth Global Internal Combustion Engines Market Market Outlook

The future outlook for the global internal combustion engines market, while facing competition from electrification, remains robust due to specific growth accelerators. The continued demand from emerging economies for affordable and reliable mobility solutions, particularly in the commercial vehicle and two-wheeler segments, will sustain the market. Technological advancements in ICE, such as the development of advanced hybrid systems and the exploration of e-fuels and hydrogen ICE, are critical for future growth and regulatory compliance. Strategic partnerships and a focus on niche applications where electrification is challenging will further bolster market prospects. The industry's ability to adapt and innovate, while meeting ever-stringent environmental standards, will be key to its long-term sustainability.

Global Internal Combustion Engines Market Segmentation

-

1. Capacity

- 1.1. 50 cm3 to 200 cm3

- 1.2. 201 cm3 to 800 cm3

- 1.3. 801 cm3 to 1500 cm3

- 1.4. 1501 cm3 to 3000 cm3

-

2. Fuel Type

- 2.1. Gasoline

- 2.2. Diesel

- 2.3. Others

Global Internal Combustion Engines Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Spain

- 2.3. Russia

- 2.4. Turkey

- 2.5. Nordic Countries

- 2.6. Norway

- 2.7. Germany

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Malaysia

- 3.5. Indonesia

- 3.6. Thailand

- 3.7. Vietnam

- 3.8. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. United Arab Emirates

- 4.2. Saudi Arabia

- 4.3. Nigeria

- 4.4. Qatar

- 4.5. Egypt

- 4.6. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Colombia

- 5.4. Rest of South America

Global Internal Combustion Engines Market Regional Market Share

Geographic Coverage of Global Internal Combustion Engines Market

Global Internal Combustion Engines Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Automobiles4.; Increasing Demand for Two-Wheeler Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Demand for Non-GHG Emitting Vehicles

- 3.4. Market Trends

- 3.4.1. The Diesel Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. 50 cm3 to 200 cm3

- 5.1.2. 201 cm3 to 800 cm3

- 5.1.3. 801 cm3 to 1500 cm3

- 5.1.4. 1501 cm3 to 3000 cm3

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gasoline

- 5.2.2. Diesel

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. North America Global Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 6.1.1. 50 cm3 to 200 cm3

- 6.1.2. 201 cm3 to 800 cm3

- 6.1.3. 801 cm3 to 1500 cm3

- 6.1.4. 1501 cm3 to 3000 cm3

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Gasoline

- 6.2.2. Diesel

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 7. Europe Global Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 7.1.1. 50 cm3 to 200 cm3

- 7.1.2. 201 cm3 to 800 cm3

- 7.1.3. 801 cm3 to 1500 cm3

- 7.1.4. 1501 cm3 to 3000 cm3

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Gasoline

- 7.2.2. Diesel

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 8. Asia Pacific Global Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 8.1.1. 50 cm3 to 200 cm3

- 8.1.2. 201 cm3 to 800 cm3

- 8.1.3. 801 cm3 to 1500 cm3

- 8.1.4. 1501 cm3 to 3000 cm3

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Gasoline

- 8.2.2. Diesel

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 9. Middle East and Africa Global Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 9.1.1. 50 cm3 to 200 cm3

- 9.1.2. 201 cm3 to 800 cm3

- 9.1.3. 801 cm3 to 1500 cm3

- 9.1.4. 1501 cm3 to 3000 cm3

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Gasoline

- 9.2.2. Diesel

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 10. South America Global Internal Combustion Engines Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 10.1.1. 50 cm3 to 200 cm3

- 10.1.2. 201 cm3 to 800 cm3

- 10.1.3. 801 cm3 to 1500 cm3

- 10.1.4. 1501 cm3 to 3000 cm3

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Gasoline

- 10.2.2. Diesel

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Yamaha Motor Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fiat Chrysler Automobiles NV*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysi

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Volkswagen Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hyundai Motor Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ducati Motor Holding SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Toyota Motor Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Volvo AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Suzuki Motor Corp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ford Motor Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Man SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Yamaha Motor Co Ltd

List of Figures

- Figure 1: Global Global Internal Combustion Engines Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Global Internal Combustion Engines Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Global Internal Combustion Engines Market Revenue (Million), by Capacity 2025 & 2033

- Figure 4: North America Global Internal Combustion Engines Market Volume (K Units), by Capacity 2025 & 2033

- Figure 5: North America Global Internal Combustion Engines Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 6: North America Global Internal Combustion Engines Market Volume Share (%), by Capacity 2025 & 2033

- Figure 7: North America Global Internal Combustion Engines Market Revenue (Million), by Fuel Type 2025 & 2033

- Figure 8: North America Global Internal Combustion Engines Market Volume (K Units), by Fuel Type 2025 & 2033

- Figure 9: North America Global Internal Combustion Engines Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 10: North America Global Internal Combustion Engines Market Volume Share (%), by Fuel Type 2025 & 2033

- Figure 11: North America Global Internal Combustion Engines Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Global Internal Combustion Engines Market Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Global Internal Combustion Engines Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Global Internal Combustion Engines Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Global Internal Combustion Engines Market Revenue (Million), by Capacity 2025 & 2033

- Figure 16: Europe Global Internal Combustion Engines Market Volume (K Units), by Capacity 2025 & 2033

- Figure 17: Europe Global Internal Combustion Engines Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 18: Europe Global Internal Combustion Engines Market Volume Share (%), by Capacity 2025 & 2033

- Figure 19: Europe Global Internal Combustion Engines Market Revenue (Million), by Fuel Type 2025 & 2033

- Figure 20: Europe Global Internal Combustion Engines Market Volume (K Units), by Fuel Type 2025 & 2033

- Figure 21: Europe Global Internal Combustion Engines Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 22: Europe Global Internal Combustion Engines Market Volume Share (%), by Fuel Type 2025 & 2033

- Figure 23: Europe Global Internal Combustion Engines Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Global Internal Combustion Engines Market Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe Global Internal Combustion Engines Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Global Internal Combustion Engines Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Global Internal Combustion Engines Market Revenue (Million), by Capacity 2025 & 2033

- Figure 28: Asia Pacific Global Internal Combustion Engines Market Volume (K Units), by Capacity 2025 & 2033

- Figure 29: Asia Pacific Global Internal Combustion Engines Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 30: Asia Pacific Global Internal Combustion Engines Market Volume Share (%), by Capacity 2025 & 2033

- Figure 31: Asia Pacific Global Internal Combustion Engines Market Revenue (Million), by Fuel Type 2025 & 2033

- Figure 32: Asia Pacific Global Internal Combustion Engines Market Volume (K Units), by Fuel Type 2025 & 2033

- Figure 33: Asia Pacific Global Internal Combustion Engines Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 34: Asia Pacific Global Internal Combustion Engines Market Volume Share (%), by Fuel Type 2025 & 2033

- Figure 35: Asia Pacific Global Internal Combustion Engines Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Global Internal Combustion Engines Market Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia Pacific Global Internal Combustion Engines Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Global Internal Combustion Engines Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Global Internal Combustion Engines Market Revenue (Million), by Capacity 2025 & 2033

- Figure 40: Middle East and Africa Global Internal Combustion Engines Market Volume (K Units), by Capacity 2025 & 2033

- Figure 41: Middle East and Africa Global Internal Combustion Engines Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 42: Middle East and Africa Global Internal Combustion Engines Market Volume Share (%), by Capacity 2025 & 2033

- Figure 43: Middle East and Africa Global Internal Combustion Engines Market Revenue (Million), by Fuel Type 2025 & 2033

- Figure 44: Middle East and Africa Global Internal Combustion Engines Market Volume (K Units), by Fuel Type 2025 & 2033

- Figure 45: Middle East and Africa Global Internal Combustion Engines Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 46: Middle East and Africa Global Internal Combustion Engines Market Volume Share (%), by Fuel Type 2025 & 2033

- Figure 47: Middle East and Africa Global Internal Combustion Engines Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Global Internal Combustion Engines Market Volume (K Units), by Country 2025 & 2033

- Figure 49: Middle East and Africa Global Internal Combustion Engines Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Global Internal Combustion Engines Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Global Internal Combustion Engines Market Revenue (Million), by Capacity 2025 & 2033

- Figure 52: South America Global Internal Combustion Engines Market Volume (K Units), by Capacity 2025 & 2033

- Figure 53: South America Global Internal Combustion Engines Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 54: South America Global Internal Combustion Engines Market Volume Share (%), by Capacity 2025 & 2033

- Figure 55: South America Global Internal Combustion Engines Market Revenue (Million), by Fuel Type 2025 & 2033

- Figure 56: South America Global Internal Combustion Engines Market Volume (K Units), by Fuel Type 2025 & 2033

- Figure 57: South America Global Internal Combustion Engines Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 58: South America Global Internal Combustion Engines Market Volume Share (%), by Fuel Type 2025 & 2033

- Figure 59: South America Global Internal Combustion Engines Market Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Global Internal Combustion Engines Market Volume (K Units), by Country 2025 & 2033

- Figure 61: South America Global Internal Combustion Engines Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Global Internal Combustion Engines Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 2: Global Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 3: Global Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: Global Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 5: Global Internal Combustion Engines Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Internal Combustion Engines Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 8: Global Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 9: Global Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 10: Global Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 11: Global Internal Combustion Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Internal Combustion Engines Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Rest of North America Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of North America Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Global Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 20: Global Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 21: Global Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 22: Global Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 23: Global Internal Combustion Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Internal Combustion Engines Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: United Kingdom Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Spain Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Spain Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Russia Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Turkey Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Turkey Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: Nordic Countries Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordic Countries Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Norway Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Norway Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Germany Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Germany Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Global Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 42: Global Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 43: Global Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 44: Global Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 45: Global Internal Combustion Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Internal Combustion Engines Market Volume K Units Forecast, by Country 2020 & 2033

- Table 47: India Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: China Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: China Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Japan Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Japan Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Malaysia Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Malaysia Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Indonesia Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Indonesia Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Thailand Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Thailand Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 59: Vietnam Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Vietnam Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Global Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 64: Global Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 65: Global Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 66: Global Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 67: Global Internal Combustion Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Internal Combustion Engines Market Volume K Units Forecast, by Country 2020 & 2033

- Table 69: United Arab Emirates Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: United Arab Emirates Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 71: Saudi Arabia Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Saudi Arabia Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: Nigeria Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Nigeria Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: Qatar Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Qatar Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Egypt Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Egypt Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 79: Rest of Middle East and Africa Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of Middle East and Africa Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 81: Global Internal Combustion Engines Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 82: Global Internal Combustion Engines Market Volume K Units Forecast, by Capacity 2020 & 2033

- Table 83: Global Internal Combustion Engines Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 84: Global Internal Combustion Engines Market Volume K Units Forecast, by Fuel Type 2020 & 2033

- Table 85: Global Internal Combustion Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 86: Global Internal Combustion Engines Market Volume K Units Forecast, by Country 2020 & 2033

- Table 87: Brazil Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Brazil Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Argentina Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Argentina Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 91: Colombia Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Colombia Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 93: Rest of South America Global Internal Combustion Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: Rest of South America Global Internal Combustion Engines Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Internal Combustion Engines Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Global Internal Combustion Engines Market?

Key companies in the market include Yamaha Motor Co Ltd, Fiat Chrysler Automobiles NV*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysi, Volkswagen Group, Hyundai Motor Company, Ducati Motor Holding SpA, Toyota Motor Corporation, Volvo AB, Suzuki Motor Corp, Ford Motor Company, Man SE.

3. What are the main segments of the Global Internal Combustion Engines Market?

The market segments include Capacity, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 266.33 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Automobiles4.; Increasing Demand for Two-Wheeler Vehicles.

6. What are the notable trends driving market growth?

The Diesel Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Rising Demand for Non-GHG Emitting Vehicles.

8. Can you provide examples of recent developments in the market?

December 2023: Bosch, a German manufacturer, announced plans to launch its first hydrogen internal combustion engine for trucks. The company was expected to add to its existing fuel cell and battery-electric offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Internal Combustion Engines Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Internal Combustion Engines Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Internal Combustion Engines Market?

To stay informed about further developments, trends, and reports in the Global Internal Combustion Engines Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence