Key Insights

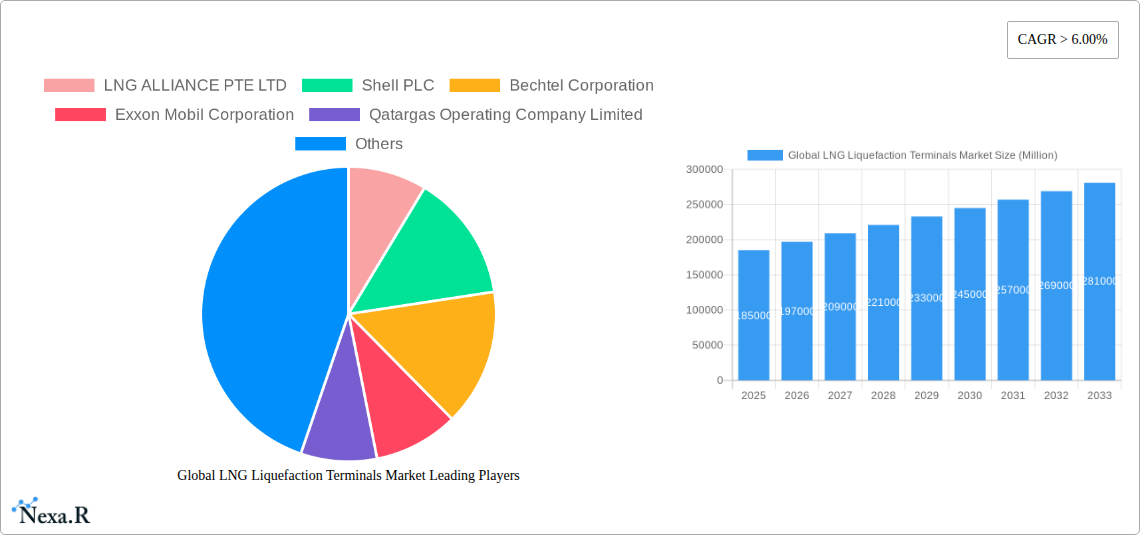

The Global LNG Liquefaction Terminals Market is poised for robust expansion, driven by the escalating global demand for cleaner energy sources and the increasing reliance on Liquefied Natural Gas (LNG) as a transitional fuel. With a projected market size in the hundreds of billions of US dollars and a Compound Annual Growth Rate (CAGR) exceeding 6.00%, this sector is set for substantial value creation. Key growth drivers include the strategic investments by major energy players and governments to enhance LNG infrastructure, particularly in regions with burgeoning energy needs and developing economies. The ongoing expansion of liquefaction capacity is crucial for meeting the world's energy security objectives and facilitating the shift away from more carbon-intensive fossil fuels. Trends such as the development of modular and floating liquefaction units are also contributing to market dynamism, offering greater flexibility and faster deployment.

Global LNG Liquefaction Terminals Market Market Size (In Billion)

The market's growth trajectory is further shaped by significant investments in new projects and expansions of existing facilities, particularly in North America and the Middle East, which are major LNG exporters. However, the market is not without its challenges. Stringent environmental regulations and permitting processes can act as restraints, potentially delaying project timelines and increasing costs. Geopolitical factors and price volatility in the natural gas market also introduce an element of risk. Despite these hurdles, the increasing adoption of LNG in power generation, industrial processes, and as a marine fuel, coupled with significant planned production capacity additions, indicates a strong underlying demand for liquefaction terminal services. The competitive landscape is characterized by the presence of large integrated energy companies and specialized engineering and construction firms, all vying for a share of this expanding market.

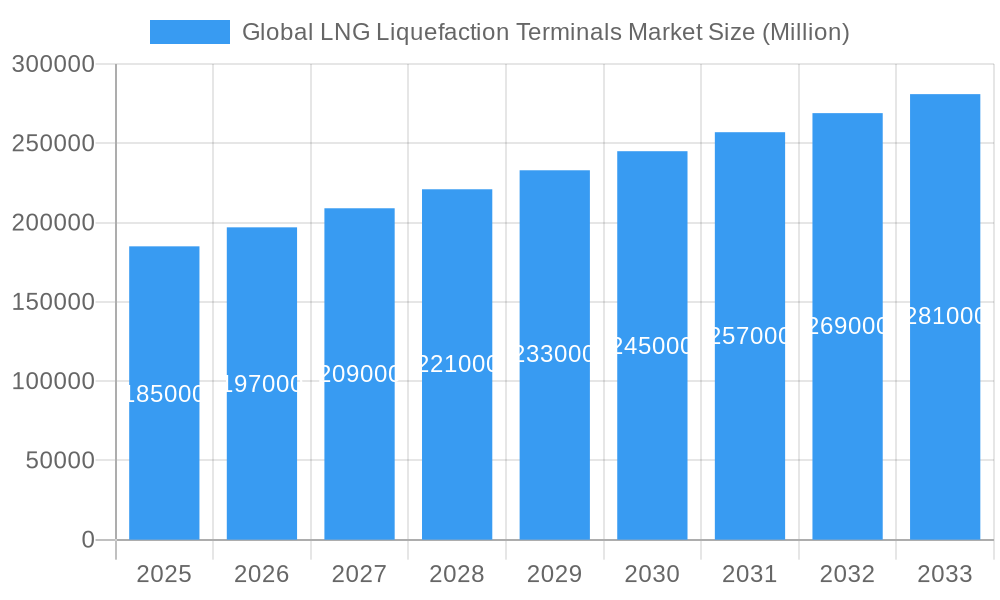

Global LNG Liquefaction Terminals Market Company Market Share

This in-depth report offers a strategic examination of the Global LNG Liquefaction Terminals Market, providing critical insights into its current landscape and projected trajectory. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves into production, consumption, import/export dynamics, and price trends. We dissect market drivers, challenges, and emerging opportunities, equipping industry stakeholders with actionable intelligence for strategic decision-making. The report encompasses detailed analyses of parent and child markets, offering a nuanced understanding of the intricate value chain.

Global LNG Liquefaction Terminals Market Market Dynamics & Structure

The Global LNG Liquefaction Terminals Market is characterized by a dynamic interplay of technological advancements, evolving regulatory frameworks, and intense competition. Market concentration varies across regions, with established players holding significant sway. Technological innovation is a key driver, particularly in developing more efficient and modular liquefaction technologies like Floating Liquefied Natural Gas (FLNG) and Fast LNG solutions. These innovations aim to reduce construction times and costs, expanding accessibility. Regulatory landscapes, including environmental standards and permitting processes, play a crucial role in project development timelines and feasibility. Competitive product substitutes, though limited in direct replacement for liquefaction itself, manifest in alternative energy sources and evolving demand patterns. End-user demographics are increasingly diverse, driven by global energy security concerns and the transition towards cleaner fuels. Mergers and Acquisitions (M&A) activity is a significant trend, indicating consolidation and strategic expansion by key market participants.

- Market Concentration: Moderate to High in developed regions, transitioning to moderate in emerging markets.

- Technological Innovation Drivers: Demand for cost-efficiency, environmental compliance, and modular solutions.

- Regulatory Frameworks: Stringent environmental regulations, permitting complexities, and trade policies influencing project approvals.

- Competitive Product Substitutes: Growing renewable energy adoption and advancements in other gas infrastructure.

- End-User Demographics: Diverse, including utilities, industrial consumers, and emerging economies seeking energy diversification.

- M&A Trends: Strategic acquisitions to gain market share, acquire new technologies, and secure supply chains.

Global LNG Liquefaction Terminals Market Growth Trends & Insights

The Global LNG Liquefaction Terminals Market is poised for substantial expansion, fueled by the escalating global demand for natural gas as a cleaner transitional fuel and its crucial role in energy security. The market size evolution is directly correlated with the increasing need for LNG export capacity, driven by the strategic advantage of accessing diverse energy sources and mitigating geopolitical risks. Adoption rates of liquefaction technologies, particularly advanced modular and offshore solutions, are on an upward trajectory, enabling faster project deployment and catering to a wider range of offshore and onshore locations. Technological disruptions, such as the development of more compact and energy-efficient liquefaction trains, are significantly impacting operational costs and environmental footprints. Consumer behavior shifts, influenced by price volatility of other energy commodities and the growing emphasis on decarbonization, are further bolstering the demand for reliable and flexible LNG supply chains. The market penetration of LNG as a fuel source in various sectors, including maritime shipping and industrial processes, is also a significant growth catalyst.

- Market Size Evolution: Projected to grow significantly, driven by increased LNG trade volumes and new terminal developments.

- Adoption Rates: Rapid adoption of modular, FLNG, and Fast LNG technologies for enhanced flexibility and reduced lead times.

- Technological Disruptions: Innovations in liquefaction processes leading to improved energy efficiency and lower emissions.

- Consumer Behavior Shifts: Growing preference for natural gas as a transitional fuel and its role in energy security strategies.

- Market Penetration: Expansion of LNG usage in sectors like shipping, power generation, and industrial feedstock.

- CAGR: Expected to witness a robust Compound Annual Growth Rate (CAGR) during the forecast period, indicating sustained expansion.

- Market Penetration Metrics: Detailed analysis of LNG's share in various energy mixes and its penetration into new applications.

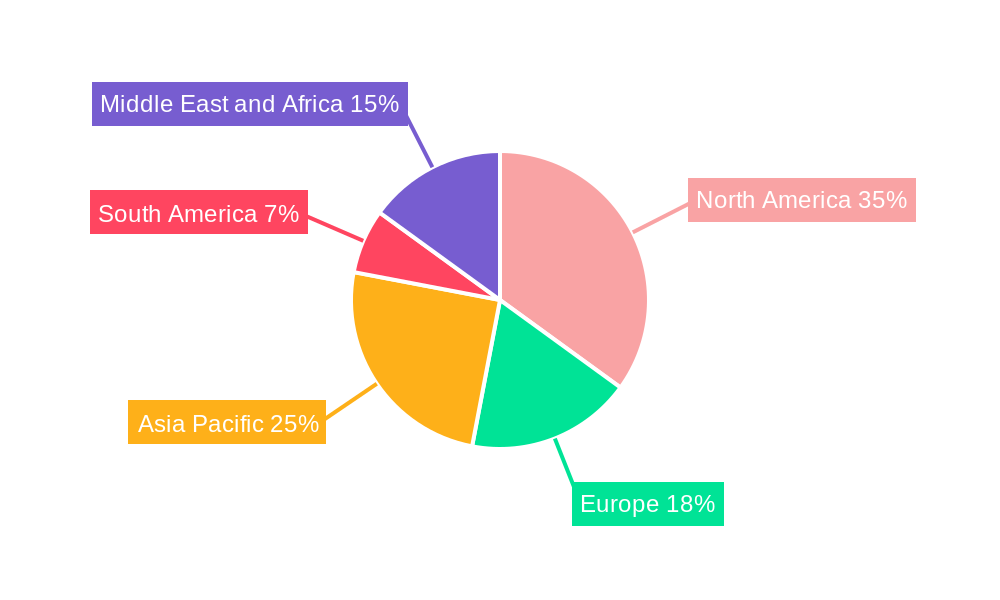

Dominant Regions, Countries, or Segments in Global LNG Liquefaction Terminals Market

The Global LNG Liquefaction Terminals Market exhibits distinct regional dominance, significantly influenced by resource availability, infrastructure development, and policy support. North America, particularly the United States, has emerged as a dominant force in both production and export capacity. This leadership is attributed to its abundant shale gas reserves, significant investments in liquefaction infrastructure, and favorable export policies. The Middle East, led by Qatar, remains a cornerstone of the global LNG market due to its vast natural gas reserves and established export capabilities.

- Production Analysis: North America (USA) and the Middle East (Qatar) are leading the pack in terms of liquefaction capacity and output, driven by extensive natural gas reserves.

- Consumption Analysis: Asia-Pacific nations, including China, Japan, and South Korea, represent the largest consumption markets, driven by industrial growth and energy demand.

- Import Market Analysis (Value & Volume): Asia-Pacific dominates global LNG imports, seeking to diversify energy sources and meet burgeoning demand. The value of these imports is substantial, reflecting the high demand and global price dynamics. Projected import volumes are expected to continue their upward trend.

- Export Market Analysis (Value & Volume): The United States and Qatar are the primary LNG exporters, capitalizing on their production capacities. Export volumes are steadily increasing, supported by new terminal expansions and strategic partnerships. The value of LNG exports contributes significantly to their respective economies.

- Price Trend Analysis: Global LNG prices are influenced by supply-demand dynamics, geopolitical events, and energy market volatility. Regional price differentials persist, creating arbitrage opportunities and influencing trade flows.

- Dominance Factors in North America: Abundant shale gas, technological advancements in extraction and liquefaction, and supportive regulatory environments.

- Dominance Factors in the Middle East: Extensive conventional gas reserves, strategic geographic location, and long-term supply contracts.

- Growth Potential in Asia-Pacific: Continued industrialization, increasing energy needs, and a strong drive towards cleaner fuel alternatives.

Global LNG Liquefaction Terminals Market Product Landscape

The product landscape of the Global LNG Liquefaction Terminals Market is defined by a spectrum of technological solutions designed for varying capacities and operational environments. This includes large-scale, onshore liquefaction facilities, often comprising multiple trains for substantial output, and increasingly, modular and offshore solutions like Floating Liquefied Natural Gas (FLNG) units and Fast LNG terminals. These innovations offer enhanced flexibility, reduced environmental impact during construction, and quicker deployment times, catering to diverse project requirements and remote locations. Performance metrics are increasingly focused on energy efficiency, reduced carbon footprint, and operational reliability. Unique selling propositions revolve around cost-effectiveness, scalability, and adaptability to specific geographical and logistical challenges.

Key Drivers, Barriers & Challenges in Global LNG Liquefaction Terminals Market

Key Drivers: The Global LNG Liquefaction Terminals Market is propelled by several significant drivers. Foremost among these is the escalating global demand for cleaner energy sources, with natural gas positioned as a crucial transitional fuel bridging the gap between fossil fuels and renewables. Energy security concerns, particularly in import-dependent nations, are also a major impetus, driving diversification of energy supplies. Technological advancements in liquefaction processes, such as modularization and FLNG, are lowering costs and accelerating project timelines, making LNG more accessible. Favorable government policies and international trade agreements that support LNG infrastructure development and trade further bolster market growth.

- Drivers:

- Growing demand for cleaner energy alternatives.

- Enhanced energy security and supply diversification strategies.

- Technological innovations in liquefaction efficiency and modular design.

- Supportive government policies and trade agreements.

- Increasing price competitiveness of natural gas against other fossil fuels.

Barriers & Challenges: Despite the strong growth outlook, the Global LNG Liquefaction Terminals Market faces several formidable barriers and challenges. High capital expenditure required for building liquefaction terminals represents a significant financial hurdle. Complex and lengthy regulatory approval processes, coupled with environmental concerns and potential community opposition, can lead to project delays. Geopolitical risks and the volatility of global energy prices can impact investment decisions and project viability. Furthermore, the availability of skilled labor and the intricate supply chain management for large-scale infrastructure projects pose persistent challenges.

- Barriers & Challenges:

- Substantial upfront capital investment.

- Complex and time-consuming regulatory and permitting processes.

- Environmental concerns and potential public opposition.

- Geopolitical uncertainties and price volatility in the energy market.

- Shortage of skilled labor and complex supply chain logistics.

- Competition from other energy sources and evolving energy policies.

Emerging Opportunities in Global LNG Liquefaction Terminals Market

Emerging opportunities in the Global LNG Liquefaction Terminals Market are manifold. The increasing focus on decarbonization is driving the development of smaller-scale, distributed liquefaction facilities to serve niche markets and remote industrial applications. The expansion of LNG as a marine fuel presents a significant opportunity for developing bunkering infrastructure and liquefaction solutions tailored for the shipping industry. Furthermore, the growing demand for LNG in developing economies in Asia and Africa, seeking to replace more polluting fuels, opens up new markets for terminal development. Innovations in carbon capture and utilization technologies integrated into liquefaction processes also present a promising avenue for sustainable growth.

- Opportunities:

- Development of smaller-scale and distributed liquefaction plants.

- Expansion of LNG bunkering infrastructure for the maritime sector.

- Untapped markets in emerging economies with growing energy demands.

- Integration of carbon capture and utilization technologies in liquefaction.

- Advancements in modular and standardized liquefaction solutions for faster deployment.

Growth Accelerators in the Global LNG Liquefaction Terminals Market Industry

Several catalysts are accelerating long-term growth in the Global LNG Liquefaction Terminals Market Industry. Technological breakthroughs in liquefaction process efficiency, leading to reduced energy consumption and operational costs, are a primary accelerator. Strategic partnerships and collaborations between project developers, technology providers, and off-takers are crucial for de-risking projects and ensuring market access. The increasing number of long-term supply agreements for LNG provides the necessary commercial certainty for investment in new liquefaction capacity. Furthermore, the growing global commitment to climate change mitigation, which positions natural gas as a vital transitional fuel, is a powerful long-term growth driver.

- Catalysts for Growth:

- Continuous technological advancements in liquefaction processes.

- Strategic partnerships and joint ventures in project development.

- Securing long-term LNG offtake agreements.

- Global policy support for natural gas as a transitional fuel.

- Expansion of LNG applications in new sectors and geographies.

Key Players Shaping the Global LNG Liquefaction Terminals Market Market

The Global LNG Liquefaction Terminals Market is shaped by a consortium of leading energy companies, engineering firms, and technology providers. These key players are instrumental in driving innovation, project development, and global supply chain integration.

- LNG ALLIANCE PTE LTD

- Shell PLC

- Bechtel Corporation

- Exxon Mobil Corporation

- Qatargas Operating Company Limited

- Chevron Corporation

- Petronet LNG Ltd

- TotalEnergies SE

- China National Offshore Oil Corporation

- McDermott International Ltd

Notable Milestones in Global LNG Liquefaction Terminals Market Sector

The Global LNG Liquefaction Terminals Market Sector has witnessed significant developments that have shaped its trajectory and capabilities.

- May 2022: New Fortress Energy plans to expand its portfolio of Fast LNG liquefaction terminals in the United States Gulf of Mexico. These Fast LNG liquefaction terminals are platform-and-jackup mounted plants designed for rapid buildout. The company would install its first two Fast LNG units in West Delta Lease Block 38, located about 16 nm off Grand Isle, Louisiana.

- March 2022: The United States increased its LNG liquefaction terminal capacity. The country has six LNG liquefaction terminals, which collectively export about 82 million metric tons of LNG per year. This was 6 million metric tons higher LNG export over 2021. This can be ascribed to completing an additional liquefaction train at the Sabine Pass LNG terminal.

In-Depth Global LNG Liquefaction Terminals Market Market Outlook

The Global LNG Liquefaction Terminals Market is set for an impressive expansion driven by escalating global energy demands and the strategic role of natural gas as a transitional fuel. Growth accelerators such as ongoing technological innovations in liquefaction efficiency and the increasing adoption of modular and FLNG solutions will continue to unlock new project opportunities. The market's future potential is particularly bright in regions with burgeoning energy needs and those seeking to enhance their energy security through diversified import sources. Strategic opportunities lie in developing specialized liquefaction infrastructure for emerging applications like LNG as a marine fuel and in catering to the specific requirements of developing economies. Continued investment in advanced technologies and supportive policy frameworks will be crucial in harnessing the full growth potential of this dynamic sector.

Global LNG Liquefaction Terminals Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Global LNG Liquefaction Terminals Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middel Eanst and Africa

Global LNG Liquefaction Terminals Market Regional Market Share

Geographic Coverage of Global LNG Liquefaction Terminals Market

Global LNG Liquefaction Terminals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Upcoming New Renewable Projects in the Country4.; Expansions of Transmission and Distribution Network

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Private Participation in the Country's Power Sector

- 3.4. Market Trends

- 3.4.1 Rising the Demand for LNG in Bunkering

- 3.4.2 Road Transportation

- 3.4.3 and Off-grid Power.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LNG Liquefaction Terminals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. South America

- 5.6.5. Middel Eanst and Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Global LNG Liquefaction Terminals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Global LNG Liquefaction Terminals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Global LNG Liquefaction Terminals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. South America Global LNG Liquefaction Terminals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Middel Eanst and Africa Global LNG Liquefaction Terminals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 LNG ALLIANCE PTE LTD

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shell PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bechtel Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Exxon Mobil Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Qatargas Operating Company Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chevron Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Petronet LNG Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TotalEnergies SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 China National Offshore Oil Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 McDermott International Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 LNG ALLIANCE PTE LTD

List of Figures

- Figure 1: Global Global LNG Liquefaction Terminals Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global LNG Liquefaction Terminals Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: North America Global LNG Liquefaction Terminals Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Global LNG Liquefaction Terminals Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: North America Global LNG Liquefaction Terminals Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Global LNG Liquefaction Terminals Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Global LNG Liquefaction Terminals Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Global LNG Liquefaction Terminals Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Global LNG Liquefaction Terminals Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Global LNG Liquefaction Terminals Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Global LNG Liquefaction Terminals Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Global LNG Liquefaction Terminals Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Global LNG Liquefaction Terminals Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Global LNG Liquefaction Terminals Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: Europe Global LNG Liquefaction Terminals Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: Europe Global LNG Liquefaction Terminals Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: Europe Global LNG Liquefaction Terminals Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: Europe Global LNG Liquefaction Terminals Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: Europe Global LNG Liquefaction Terminals Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: Europe Global LNG Liquefaction Terminals Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: Europe Global LNG Liquefaction Terminals Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: Europe Global LNG Liquefaction Terminals Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: Europe Global LNG Liquefaction Terminals Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: Europe Global LNG Liquefaction Terminals Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Global LNG Liquefaction Terminals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Global LNG Liquefaction Terminals Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Asia Pacific Global LNG Liquefaction Terminals Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Asia Pacific Global LNG Liquefaction Terminals Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Asia Pacific Global LNG Liquefaction Terminals Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Asia Pacific Global LNG Liquefaction Terminals Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Asia Pacific Global LNG Liquefaction Terminals Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Asia Pacific Global LNG Liquefaction Terminals Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Asia Pacific Global LNG Liquefaction Terminals Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Asia Pacific Global LNG Liquefaction Terminals Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Asia Pacific Global LNG Liquefaction Terminals Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Asia Pacific Global LNG Liquefaction Terminals Market Revenue (undefined), by Country 2025 & 2033

- Figure 37: Asia Pacific Global LNG Liquefaction Terminals Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: South America Global LNG Liquefaction Terminals Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: South America Global LNG Liquefaction Terminals Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: South America Global LNG Liquefaction Terminals Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: South America Global LNG Liquefaction Terminals Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: South America Global LNG Liquefaction Terminals Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: South America Global LNG Liquefaction Terminals Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: South America Global LNG Liquefaction Terminals Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: South America Global LNG Liquefaction Terminals Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: South America Global LNG Liquefaction Terminals Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: South America Global LNG Liquefaction Terminals Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: South America Global LNG Liquefaction Terminals Market Revenue (undefined), by Country 2025 & 2033

- Figure 49: South America Global LNG Liquefaction Terminals Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middel Eanst and Africa Global LNG Liquefaction Terminals Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Middel Eanst and Africa Global LNG Liquefaction Terminals Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Middel Eanst and Africa Global LNG Liquefaction Terminals Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Middel Eanst and Africa Global LNG Liquefaction Terminals Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Middel Eanst and Africa Global LNG Liquefaction Terminals Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Middel Eanst and Africa Global LNG Liquefaction Terminals Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Middel Eanst and Africa Global LNG Liquefaction Terminals Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Middel Eanst and Africa Global LNG Liquefaction Terminals Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Middel Eanst and Africa Global LNG Liquefaction Terminals Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Middel Eanst and Africa Global LNG Liquefaction Terminals Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Middel Eanst and Africa Global LNG Liquefaction Terminals Market Revenue (undefined), by Country 2025 & 2033

- Figure 61: Middel Eanst and Africa Global LNG Liquefaction Terminals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 14: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 20: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 32: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 33: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 34: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 35: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 36: Global LNG Liquefaction Terminals Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global LNG Liquefaction Terminals Market?

The projected CAGR is approximately 13.9%.

2. Which companies are prominent players in the Global LNG Liquefaction Terminals Market?

Key companies in the market include LNG ALLIANCE PTE LTD, Shell PLC, Bechtel Corporation, Exxon Mobil Corporation, Qatargas Operating Company Limited, Chevron Corporation, Petronet LNG Ltd, TotalEnergies SE, China National Offshore Oil Corporation, McDermott International Ltd.

3. What are the main segments of the Global LNG Liquefaction Terminals Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Upcoming New Renewable Projects in the Country4.; Expansions of Transmission and Distribution Network.

6. What are the notable trends driving market growth?

Rising the Demand for LNG in Bunkering. Road Transportation. and Off-grid Power..

7. Are there any restraints impacting market growth?

4.; Lack of Private Participation in the Country's Power Sector.

8. Can you provide examples of recent developments in the market?

In May 2022, New Fortress Energy plans to expand its portfolio of Fast LNG liquefaction terminals in the United States Gulf of Mexico. These Fast LNG liquefaction terminals are platform-and-jackup mounted plants designed for rapid buildout. The company would install its first two Fast LNG units in West Delta Lease Block 38, located about 16 nm off Grand Isle, Louisiana.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global LNG Liquefaction Terminals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global LNG Liquefaction Terminals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global LNG Liquefaction Terminals Market?

To stay informed about further developments, trends, and reports in the Global LNG Liquefaction Terminals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence