Key Insights

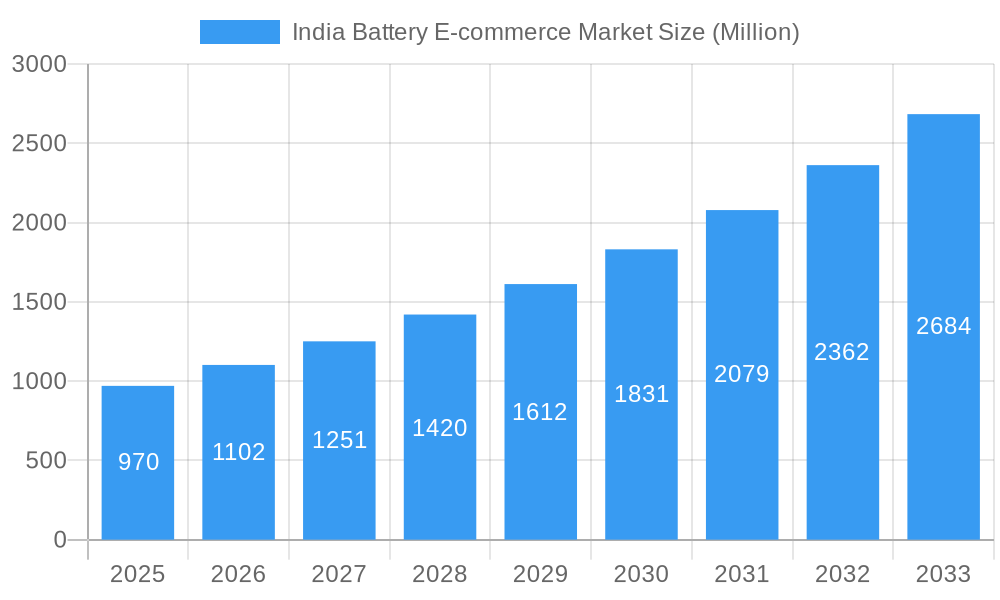

The India battery e-commerce market, valued at approximately $0.97 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 13.90% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of electric vehicles (EVs) and hybrid vehicles, coupled with the rising demand for backup power solutions during frequent power outages, significantly boosts the market. Furthermore, the expanding e-commerce infrastructure in India, providing convenient access to a wide range of battery products, contributes to market growth. Consumer preference for online shopping, particularly among younger demographics, is another driving force. However, challenges remain, including concerns about battery authenticity and safety online, and the need for improved logistics and delivery infrastructure for handling potentially hazardous goods. Competition is fierce, with established players like Exide Industries, Luminous Power Technologies, and Panasonic vying for market share alongside emerging domestic and international brands. The market is segmented by battery type (lead-acid, lithium-ion, etc.), application (automotive, UPS, portable devices), and price range. The forecast indicates significant market expansion through 2033, driven by continued growth in the EV sector, enhanced e-commerce penetration, and the ongoing development of superior, longer-lasting battery technologies. Strategic investments in enhancing consumer trust and improving delivery networks will be crucial for sustained market growth.

India Battery E-commerce Market Market Size (In Million)

The competitive landscape is dynamic, with both established international and domestic players actively vying for market share. Key strategies include brand building, competitive pricing, strategic partnerships with e-commerce platforms, and a focus on offering warranties and after-sales service to address consumer concerns about online purchases. The market is expected to see continued consolidation, with larger players acquiring smaller competitors to enhance their market reach and product portfolios. Geographical variations in market growth are likely, with urban centers experiencing faster adoption than rural areas due to greater internet penetration and e-commerce familiarity. The growing focus on sustainable and eco-friendly battery technologies will further shape market trends, with manufacturers increasingly focusing on developing and marketing environmentally conscious products to meet evolving consumer preferences and regulatory requirements.

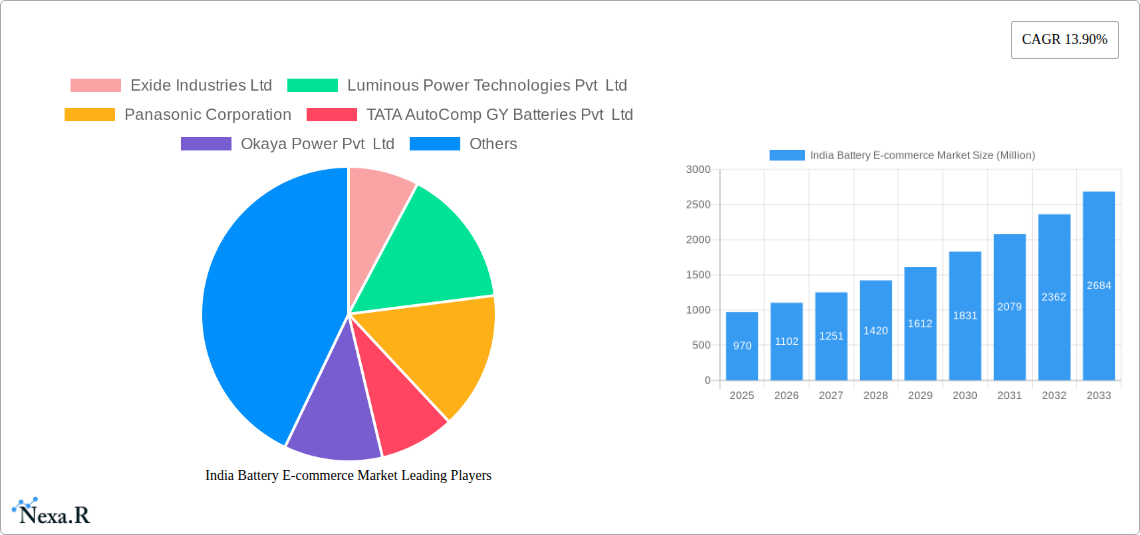

India Battery E-commerce Market Company Market Share

India Battery E-commerce Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India battery e-commerce market, offering invaluable insights for industry professionals, investors, and strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data analysis to deliver a clear picture of market dynamics, growth trends, and future opportunities. The report covers the parent market of "Batteries in India" and the child market of "E-commerce Battery Sales in India", providing a granular view of the sector. Units are presented in Millions.

India Battery E-commerce Market Dynamics & Structure

The Indian battery e-commerce market exhibits a dynamic interplay of factors shaping its growth trajectory. Market concentration is moderate, with key players holding significant shares but a considerable number of smaller competitors vying for space. Technological innovation is a primary driver, fueled by advancements in lithium-ion battery technology, demand for EVs and the rise of energy storage solutions. Regulatory frameworks, including those related to e-commerce and battery safety, play a crucial role. Competitive product substitutes, such as fuel-based power sources, still pose a challenge. End-user demographics are expanding, driven by increasing smartphone adoption, rising disposable incomes, and the growth of the e-commerce sector itself. M&A activity, while not excessively high, is impacting market consolidation.

- Market Concentration: Moderate, with top 5 players holding xx% market share (2024).

- Technological Innovation: Significant advancements in lithium-ion battery technology and energy storage systems are driving growth.

- Regulatory Framework: Government initiatives promoting electric vehicles and renewable energy are creating favorable conditions.

- Competitive Substitutes: Fuel-based power sources present competition; however, the environmental awareness pushes for battery alternatives.

- End-User Demographics: Expanding rapidly, driven by increased smartphone penetration and rising e-commerce adoption.

- M&A Trends: A modest number of mergers and acquisitions, primarily focused on consolidating market share, were recorded in the last 5 years (approx xx deals).

India Battery E-commerce Market Growth Trends & Insights

The India battery e-commerce market is experiencing robust growth, fueled by rising demand for portable electronics, increasing adoption of electric vehicles (EVs), and the expanding e-commerce infrastructure. The market size has witnessed a significant expansion, with a CAGR of xx% during the historical period (2019-2024). This growth is expected to continue, driven by factors such as increasing urbanization, rising disposable incomes, and government initiatives promoting renewable energy and electric mobility. Technological advancements, particularly in lithium-ion battery technology, are playing a crucial role in enhancing battery performance, safety, and affordability, further fueling market expansion. Consumer behaviour is also shifting towards online purchasing, providing a boost to e-commerce channels. Market penetration is currently at approximately xx% and is projected to reach xx% by 2033.

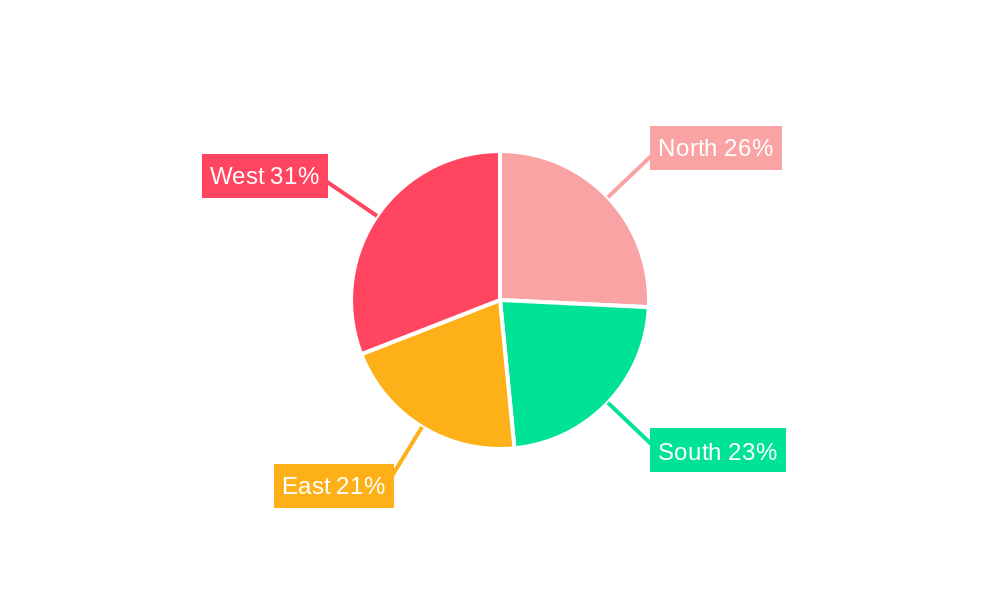

Dominant Regions, Countries, or Segments in India Battery E-commerce Market

The Indian battery e-commerce market is experiencing widespread growth, but certain regions and segments display more significant expansion. Metropolitan areas like Mumbai, Delhi, Bengaluru, and Chennai are leading in terms of market share owing to higher internet penetration, higher disposable income levels, and strong e-commerce infrastructure. The segment of mobile phone and laptop batteries shows the highest growth rate due to increased consumer electronics consumption.

- Key Drivers:

- High internet and smartphone penetration.

- Robust e-commerce ecosystem.

- Government support for electric vehicles and renewable energy.

- Growing demand for consumer electronics.

- Dominance Factors:

- Strong logistics and delivery networks in major cities.

- Higher consumer awareness and adoption of online shopping.

- Concentration of major e-commerce players in urban centers.

India Battery E-commerce Market Product Landscape

The Indian battery e-commerce market offers a diverse range of products, catering to various applications. This includes lead-acid batteries for automotive and UPS systems, lithium-ion batteries for portable electronics and EVs, and specialized batteries for industrial and energy storage solutions. Innovations focus on improved energy density, longer lifespan, faster charging times, and enhanced safety features. Unique selling propositions often revolve around price competitiveness, warranty offerings, and brand reputation. Technological advancements, especially in material science and battery management systems, are driving improvements in battery performance and sustainability.

Key Drivers, Barriers & Challenges in India Battery E-commerce Market

Key Drivers:

- Growing demand for consumer electronics.

- Government incentives for electric vehicles and renewable energy.

- Increasing adoption of online shopping.

- Technological advancements in battery technology.

Challenges:

- Supply chain disruptions impacting raw material availability and pricing.

- Regulatory hurdles related to battery safety and disposal.

- Intense competition from both domestic and international players.

- Concerns regarding battery lifespan and environmental impact.

Emerging Opportunities in India Battery E-commerce Market

- Untapped rural markets: Expanding e-commerce reach to rural areas holds significant potential.

- Innovative battery applications: Growth in energy storage systems, electric two-wheelers, and IoT devices creates new demand.

- Evolving consumer preferences: Growing preference for eco-friendly and high-performance batteries.

Growth Accelerators in the India Battery E-commerce Market Industry

Technological advancements in battery chemistry and manufacturing processes, strategic partnerships between battery manufacturers and e-commerce platforms, and expansion into new geographical regions and customer segments will be crucial in accelerating market growth. Government initiatives promoting electric vehicles and renewable energy will further propel demand.

Key Players Shaping the India Battery E-commerce Market Market

- Exide Industries Ltd

- Luminous Power Technologies Pvt Ltd

- Panasonic Corporation

- TATA AutoComp GY Batteries Pvt Ltd

- Okaya Power Pvt Ltd

- LG Chem Ltd

- Samsung SDI Co Ltd

- BYD Co Ltd

- East Penn Manufacturing Company

- Hitachi Ltd

- *List Not Exhaustive

Notable Milestones in India Battery E-commerce Market Sector

- June 2023: Tata Group's USD 1.58 billion investment in a lithium-ion cell factory signifies a significant step towards domestic EV battery production.

- October 2023: Ola Electric's USD 385 million investment in a lithium-ion cell manufacturing unit represents a major milestone in India's battery manufacturing capabilities.

In-Depth India Battery E-commerce Market Market Outlook

The India battery e-commerce market is poised for continued strong growth, driven by favorable government policies, technological advancements, and rising consumer demand. Strategic investments in research and development, coupled with expansion into new market segments and geographical areas, will be key to unlocking significant future market potential and creating lucrative strategic opportunities for industry players.

India Battery E-commerce Market Segmentation

-

1. Battery Type

- 1.1. Lead-Acid

- 1.2. Lithium-Ion

- 1.3. Others

India Battery E-commerce Market Segmentation By Geography

- 1. India

India Battery E-commerce Market Regional Market Share

Geographic Coverage of India Battery E-commerce Market

India Battery E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Electric Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Battery E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lead-Acid

- 5.1.2. Lithium-Ion

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Exide Industries Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Luminous Power Technologies Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Panasonic Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TATA AutoComp GY Batteries Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Okaya Power Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LG Chem Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samsung SDI Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BYD Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 East Penn Manufacturing Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hitachi Ltd*List Not Exhaustive 6 4 Market Ranking/Share(%) Analysis6 5 List of Other Prominent Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Exide Industries Ltd

List of Figures

- Figure 1: India Battery E-commerce Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Battery E-commerce Market Share (%) by Company 2025

List of Tables

- Table 1: India Battery E-commerce Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 2: India Battery E-commerce Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 3: India Battery E-commerce Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Battery E-commerce Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: India Battery E-commerce Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 6: India Battery E-commerce Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 7: India Battery E-commerce Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: India Battery E-commerce Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Battery E-commerce Market?

The projected CAGR is approximately 13.90%.

2. Which companies are prominent players in the India Battery E-commerce Market?

Key companies in the market include Exide Industries Ltd, Luminous Power Technologies Pvt Ltd, Panasonic Corporation, TATA AutoComp GY Batteries Pvt Ltd, Okaya Power Pvt Ltd, LG Chem Ltd, Samsung SDI Co Ltd, BYD Co Ltd, East Penn Manufacturing Company, Hitachi Ltd*List Not Exhaustive 6 4 Market Ranking/Share(%) Analysis6 5 List of Other Prominent Companie.

3. What are the main segments of the India Battery E-commerce Market?

The market segments include Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.97 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices.

6. What are the notable trends driving market growth?

Increasing Adoption of Electric Vehicles.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Electric Vehicles4.; Declining Lithium-Ion Battery Prices.

8. Can you provide examples of recent developments in the market?

October 2023: Ola Electric announced the establishment of a lithium-ion cell manufacturing unit, touted to be the first in India, with a fundraising of about USD 385 million. Ola Electric has noted its plans to set up the unit at Krishnagiri, Tamil Nadu.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Battery E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Battery E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Battery E-commerce Market?

To stay informed about further developments, trends, and reports in the India Battery E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence