Key Insights

India's commercial shower cubicle market is poised for significant expansion, propelled by escalating construction in hospitality, corporate, and fitness sectors. Rising disposable incomes and a growing demand for contemporary, sanitary bathroom solutions are key drivers. The market, valued at approximately 88.5 million in the base year 2024, is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This robust growth trajectory is underpinned by the increasing adoption of eco-friendly, water-saving shower systems, a rising preference for sophisticated, customizable designs, and an enhanced focus on hygiene in commercial environments. The stainless steel segment currently leads, owing to its superior durability and low maintenance, with plastic and glass options serving diverse budgetary and aesthetic requirements. Commercial applications dominate over residential, reflecting higher installation volumes in new and renovated properties. Leading players such as Jaquar, Kohler, and Cera Sanitaryware Limited are actively influencing market dynamics through innovation, strategic alliances, and targeted marketing. Potential headwinds include raw material price volatility and supply chain disruptions. Geographically, growth patterns vary across North, South, East, and West India, mirroring regional infrastructure development.

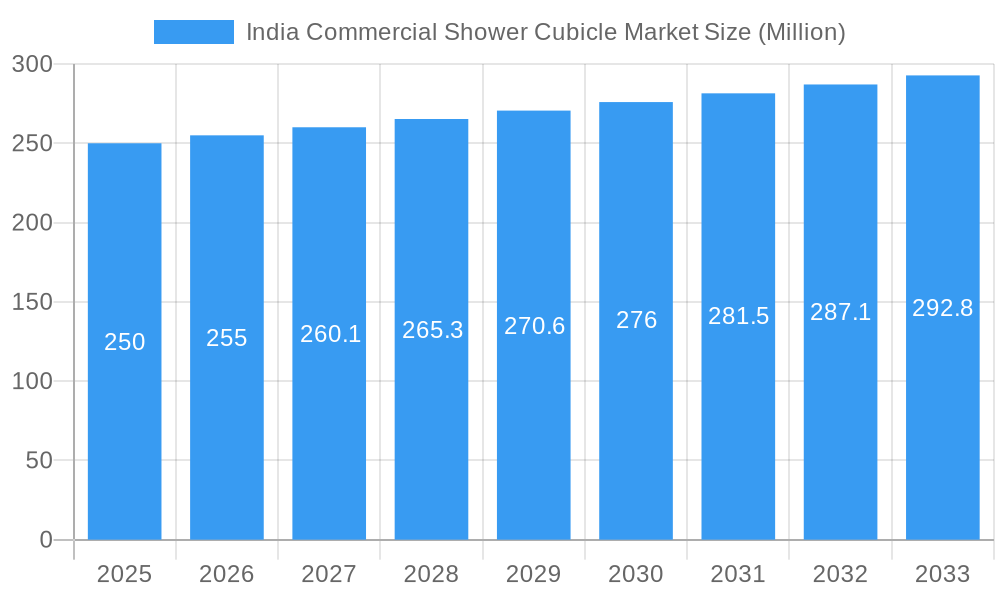

India Commercial Shower Cubicle Market Market Size (In Million)

The forecast period anticipates continued market growth, primarily fueled by the expansion of the hospitality and corporate sectors, aligning with India's robust economic development. The integration of smart technologies and an elevated focus on user experience within shower cubicles present further avenues for market penetration. While intensified competition from new entrants and established players persists, the market outlook remains positive, supported by ongoing infrastructure development and supportive government initiatives promoting sustainable construction. Effective market segmentation, addressing specific needs across diverse commercial segments, will be critical for maximizing market share.

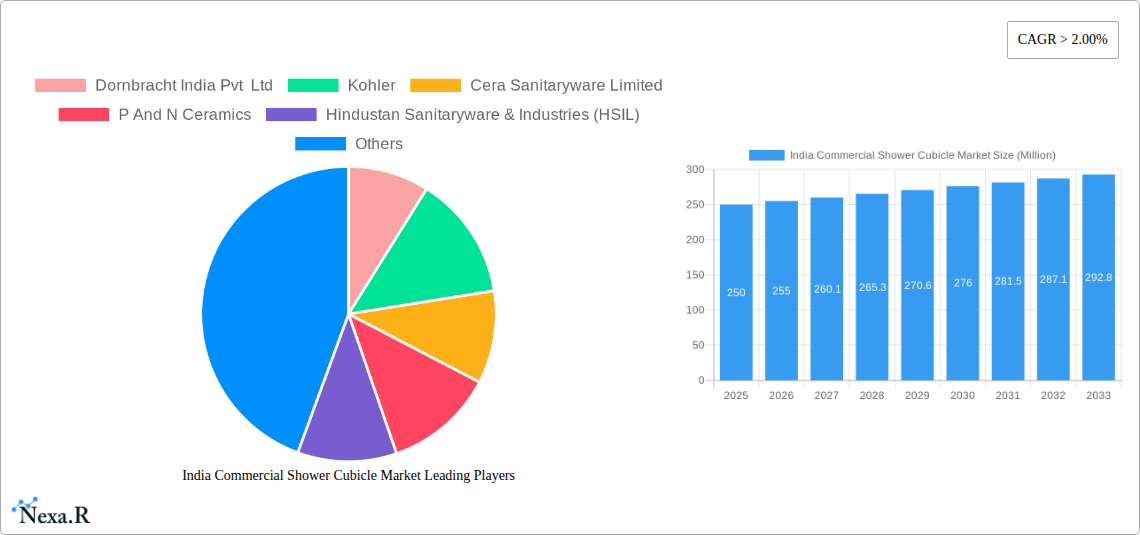

India Commercial Shower Cubicle Market Company Market Share

India Commercial Shower Cubicle Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Commercial Shower Cubicle Market, encompassing market dynamics, growth trends, dominant segments, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The market is segmented by product (Stainless Steel, Plastic, Glass, Other) and application (Residential, Commercial), providing a granular view of this dynamic sector. The total market size is projected to reach xx Million Units by 2033.

India Commercial Shower Cubicle Market Market Dynamics & Structure

The Indian commercial shower cubicle market is characterized by moderate concentration, with key players like Kohler, Jaquar, Cera Sanitaryware Limited, and HSIL holding significant market share. Technological innovation, particularly in water-saving technologies and aesthetically pleasing designs, is a key driver. Regulatory frameworks concerning water conservation and building codes influence market growth. The market faces competition from traditional bathroom fixtures. The increasing construction of commercial buildings, hotels, and hospitals fuels demand. Recent M&A activity has been relatively low (xx deals in the past 5 years), suggesting a stable but consolidating market.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Focus on water-efficient designs and smart features.

- Regulatory Framework: Emphasis on water conservation impacting product development.

- Competitive Substitutes: Traditional bathroom fixtures.

- End-User Demographics: Growth driven by commercial construction and renovation.

- M&A Trends: Relatively low activity in recent years, suggesting consolidation.

India Commercial Shower Cubicle Market Growth Trends & Insights

The India commercial shower cubicle market exhibited a CAGR of xx% during the historical period (2019-2024), driven by rising disposable incomes, increasing urbanization, and robust commercial construction activity. The market size was valued at xx Million Units in 2024 and is projected to reach xx Million Units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Adoption rates are increasing steadily, particularly in Tier 1 and Tier 2 cities, with a market penetration rate of xx% in 2024. Technological disruptions, such as the introduction of smart shower cubicles with integrated features, are further boosting market growth. Shifting consumer preferences towards premium and aesthetically pleasing designs also contribute to this trend.

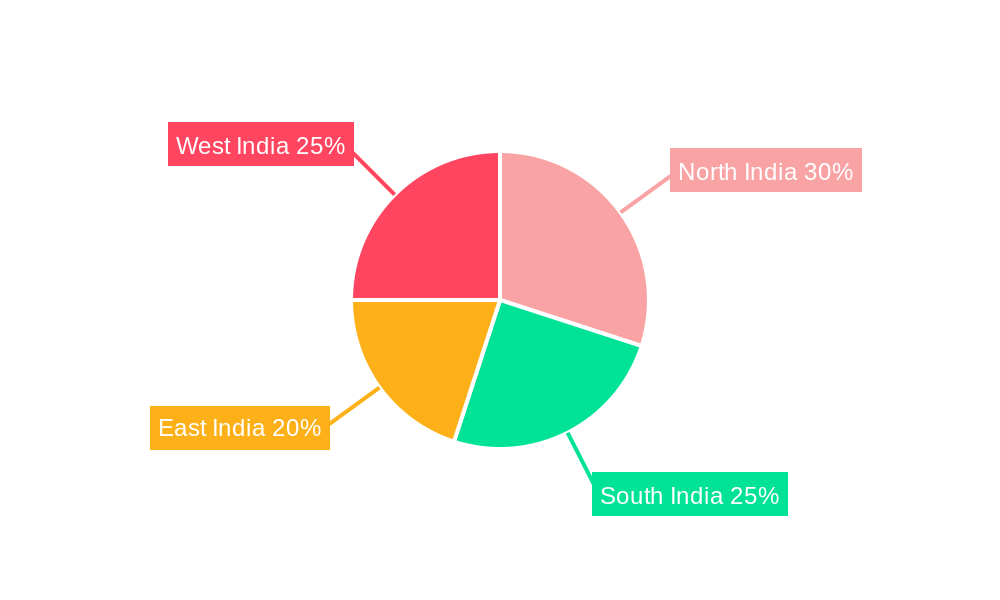

Dominant Regions, Countries, or Segments in India Commercial Shower Cubicle Market

The commercial segment significantly drives market growth, outpacing residential applications due to higher construction activity in commercial spaces. Metropolitan areas such as Mumbai, Delhi, Bangalore, and Chennai are leading regional markets, exhibiting strong demand owing to concentrated commercial development. Within product segments, stainless steel shower cubicles hold the largest market share due to their durability and hygiene attributes. The growth of the commercial segment is fueled by infrastructure development, government initiatives, and rising tourism.

- Key Drivers for Commercial Segment:

- Robust commercial construction activity.

- Growth of hospitality and healthcare sectors.

- Focus on hygiene and infection control in commercial spaces.

- Dominance Factors for Stainless Steel:

- Superior durability and longevity.

- Ease of maintenance and hygiene.

- Perception of higher quality and value.

India Commercial Shower Cubicle Market Product Landscape

The market offers a diverse range of shower cubicles made from stainless steel, plastic, glass, and other materials. Stainless steel cubicles are preferred for their durability and hygienic properties, while glass cubicles offer a modern aesthetic. Plastic cubicles are more budget-friendly. Innovations focus on water-saving features, advanced designs, and smart technologies such as integrated lighting and temperature control. Unique selling propositions include ease of installation, customizable designs, and sustainable materials.

Key Drivers, Barriers & Challenges in India Commercial Shower Cubicle Market

Key Drivers: Rising disposable incomes, increasing urbanization, robust commercial construction, government initiatives promoting sustainable building practices, and technological advancements driving product innovation.

Key Challenges: High initial investment costs, competition from traditional bathroom fixtures, supply chain disruptions, fluctuating raw material prices, and stringent regulatory compliance requirements. These challenges collectively impact market growth by approximately xx% annually.

Emerging Opportunities in India Commercial Shower Cubicle Market

Untapped markets exist in Tier 3 and Tier 4 cities, presenting opportunities for expansion. Increasing demand for smart and sustainable shower solutions, customized designs, and modular installations offers scope for innovation. Targeting specific niche markets, such as eco-friendly shower cubicles made from recycled materials, can create new avenues for growth.

Growth Accelerators in the India Commercial Shower Cubicle Market Industry

Technological advancements in water-saving technologies and smart features are key growth accelerators. Strategic partnerships between manufacturers and construction companies can enhance market penetration. Government initiatives promoting sustainable infrastructure development create favorable market conditions. Expansion into untapped markets and product diversification further accelerate growth.

Key Players Shaping the India Commercial Shower Cubicle Market Market

- Dornbracht India Pvt Ltd

- Kohler

- Cera Sanitaryware Limited

- P And N Ceramics

- Hindustan Sanitaryware & Industries (HSIL)

- Saint Gobain

- Jaquar

- TOTO Sanitary India

- Parryware

- H & R Johnson

Notable Milestones in India Commercial Shower Cubicle Market Sector

- 2021: Jaquar launches a new range of water-efficient shower cubicles.

- 2022: Government introduces stricter building codes related to water conservation.

- 2023: Kohler expands its manufacturing facility in India.

- 2024: Significant increase in commercial construction projects.

In-Depth India Commercial Shower Cubicle Market Market Outlook

The Indian commercial shower cubicle market holds significant long-term growth potential, driven by continuous urbanization, infrastructure development, and rising demand for advanced bathroom solutions. Strategic investments in research and development, focusing on sustainable and technologically advanced products, will be crucial for capturing market share. Expanding distribution networks and targeting underserved markets can further enhance market penetration. The market is expected to witness sustained growth over the forecast period, driven by both existing and emerging market forces.

India Commercial Shower Cubicle Market Segmentation

-

1. Product

- 1.1. Stainless Steel

- 1.2. Plastic

- 1.3. Glass

- 1.4. Other

-

2. Application

- 2.1. Residential

- 2.2. Commercial

India Commercial Shower Cubicle Market Segmentation By Geography

- 1. India

India Commercial Shower Cubicle Market Regional Market Share

Geographic Coverage of India Commercial Shower Cubicle Market

India Commercial Shower Cubicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Improved Ventilation in GCC Countries

- 3.3. Market Restrains

- 3.3.1. High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Growing Urbanization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Commercial Shower Cubicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Stainless Steel

- 5.1.2. Plastic

- 5.1.3. Glass

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dornbracht India Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kohler

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cera Sanitaryware Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 P And N Ceramics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hindustan Sanitaryware & Industries (HSIL)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saint Gobain

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jaquar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TOTO Sanitary India*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Parryware

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 H & R Johnson

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dornbracht India Pvt Ltd

List of Figures

- Figure 1: India Commercial Shower Cubicle Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Commercial Shower Cubicle Market Share (%) by Company 2025

List of Tables

- Table 1: India Commercial Shower Cubicle Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: India Commercial Shower Cubicle Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: India Commercial Shower Cubicle Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Commercial Shower Cubicle Market Revenue million Forecast, by Product 2020 & 2033

- Table 5: India Commercial Shower Cubicle Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: India Commercial Shower Cubicle Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Commercial Shower Cubicle Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the India Commercial Shower Cubicle Market?

Key companies in the market include Dornbracht India Pvt Ltd, Kohler, Cera Sanitaryware Limited, P And N Ceramics, Hindustan Sanitaryware & Industries (HSIL), Saint Gobain, Jaquar, TOTO Sanitary India*List Not Exhaustive, Parryware, H & R Johnson.

3. What are the main segments of the India Commercial Shower Cubicle Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.5 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Improved Ventilation in GCC Countries.

6. What are the notable trends driving market growth?

Growing Urbanization is Driving the Market.

7. Are there any restraints impacting market growth?

High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Commercial Shower Cubicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Commercial Shower Cubicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Commercial Shower Cubicle Market?

To stay informed about further developments, trends, and reports in the India Commercial Shower Cubicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence