Key Insights

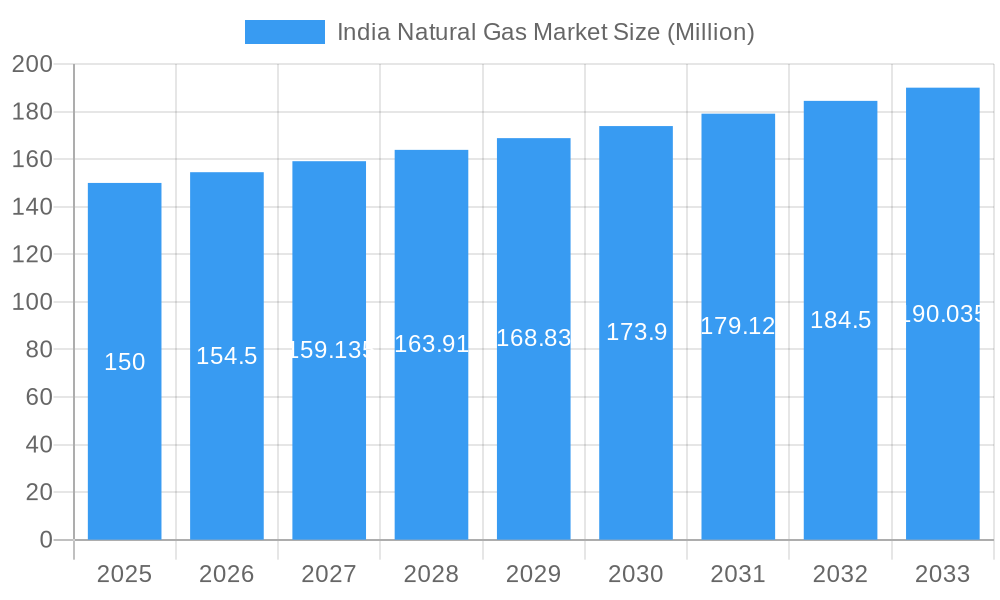

The India Natural Gas Market is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 3.62% between 2024 and 2033. This growth is driven by accelerating industrialization, escalating energy requirements across power generation, transportation, and domestic sectors, and supportive government policies advocating for cleaner energy alternatives. The market is segmented into Compressed Natural Gas (CNG), Piped Natural Gas (PNG), and Liquefied Petroleum Gas (LPG), with CNG and PNG showing notable upward trends due to their extensive deployment in vehicular and residential uses. Leading companies such as Oil and Natural Gas Corporation, Mahanagar Gas Limited, and Reliance Industries are instrumental in market expansion through infrastructure enhancement and strategic investments in exploration and production. Growth is predominantly concentrated in urban centers, with North and West India exhibiting substantial promise owing to higher population densities and industrial operations. Nevertheless, persistent challenges include regional infrastructure deficits, volatility in global gas pricing, and the ongoing necessity for investment in pipeline networks to guarantee dependable supply.

India Natural Gas Market Market Size (In Billion)

Market growth exhibits regional disparities, offering strategic expansion opportunities. While North and West India currently lead due to established infrastructure and demand, East and South India present considerable untapped potential. Bridging infrastructure gaps and improving natural gas accessibility in these regions are vital for sustained national growth. Furthermore, advancements in gas extraction, processing, and distribution technologies, coupled with an increasing emphasis on environmental sustainability, will continue to influence the market's trajectory. Competitive dynamics among existing participants and the potential emergence of new players will also shape market trends.

India Natural Gas Market Company Market Share

The market size was estimated at 61.28 billion in the base year 2024. The projected market size in 2025 is estimated to be around 63.56 billion (USD Billion).

India Natural Gas Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Natural Gas Market, covering market dynamics, growth trends, regional insights, product landscape, key players, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering valuable insights for industry professionals, investors, and stakeholders. The market is segmented by type into Compressed Natural Gas (CNG), Piped Natural Gas (PNG), and Liquified Petroleum Gas (LPG), enabling a granular understanding of individual segment performance and potential.

Keywords: India Natural Gas Market, CNG Market India, PNG Market India, LPG Market India, Natural Gas Industry India, Oil and Natural Gas Corporation, Mahanagar Gas Limited, Reliance Industries, Indraprastha Gas Limited, Vedanta Limited, Adani Total Gas Limited, Indian Oil Corporation, Punj Lloyd, City Gas Distribution (CGD), Natural Gas Pipeline, Natural Gas Consumption India, Natural Gas Production India

India Natural Gas Market Dynamics & Structure

The Indian natural gas market is characterized by a moderate level of concentration, with key players like Oil and Natural Gas Corporation (ONGC), Reliance Industries, and GAIL (Gas Authority of India Limited) holding significant market share. Technological innovation, particularly in exploration and extraction techniques, is a key driver, alongside government initiatives promoting natural gas as a cleaner fuel source. The regulatory framework, while evolving, plays a crucial role in shaping market access and investment decisions. The market faces competition from alternative energy sources, particularly coal and renewable energy, influencing the adoption rate of natural gas. End-user demographics are shifting towards increased industrial and commercial consumption. M&A activity has been relatively moderate in recent years, with a total estimated deal value of xx Million USD in the period 2019-2024, reflecting a consolidation trend among industry players.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on enhanced oil recovery (EOR) techniques and pipeline infrastructure development.

- Regulatory Framework: Government policies promoting gas-based power generation and CNG adoption.

- Competitive Substitutes: Coal, renewable energy sources (solar, wind).

- End-User Demographics: Growing demand from industrial and commercial sectors.

- M&A Trends: Consolidation among key players, with xx major deals recorded in the historical period.

India Natural Gas Market Growth Trends & Insights

The India Natural Gas Market has experienced steady growth over the historical period, driven by increasing energy demand and government support for cleaner fuel alternatives. The market size reached xx Million units in 2024, demonstrating a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024. Technological disruptions, such as advancements in LNG import infrastructure and pipeline networks, have accelerated market expansion. Consumer behavior is shifting towards preference for cleaner and more efficient fuels, particularly in the transportation and industrial sectors. Market penetration remains relatively low compared to global averages, presenting significant growth potential in the forecast period. The estimated market size for 2025 is projected to be xx Million units, with a forecast CAGR of xx% from 2025 to 2033. Factors like increasing urbanization, industrialization, and rising disposable incomes will continue to fuel market growth. However, challenges remain, including infrastructure limitations and price volatility.

Dominant Regions, Countries, or Segments in India Natural Gas Market

The Western region of India, encompassing states like Gujarat, Maharashtra, and Rajasthan, currently dominates the natural gas market. This dominance is attributed to robust industrial activity, well-established infrastructure, and significant gas discoveries in the region. Piped Natural Gas (PNG) currently holds the largest market share, driven by its increasing adoption in domestic and commercial sectors in urban areas. Key drivers for this segment include government incentives, ease of access, and relatively lower pricing compared to other fuels. Growth in this segment is further fueled by expanding pipeline infrastructure and increasing urbanization. The Compressed Natural Gas (CNG) segment also shows significant growth potential, particularly in the transportation sector. While Liquified Petroleum Gas (LPG) holds a smaller market share, its usage in rural and remote areas, where pipeline infrastructure is limited, sustains its presence.

- Key Drivers for Western Region Dominance: Strong industrial base, developed infrastructure, and gas discoveries.

- PNG Segment Drivers: Government incentives, expanding pipeline infrastructure, urbanization.

- CNG Segment Growth: Increasing vehicle penetration and government support for cleaner transportation.

- LPG Segment Persistence: Usage in rural areas with limited pipeline access.

India Natural Gas Market Product Landscape

The Indian natural gas market encompasses a diverse range of products, with Compressed Natural Gas (CNG), Piped Natural Gas (PNG), and Liquefied Petroleum Gas (LPG) leading the way. These products cater to a wide spectrum of applications, from transportation and residential use to industrial processes and power generation. Recent advancements are focused not only on improving gas quality and pipeline efficiency but also on developing sophisticated metering technologies and exploring alternative delivery systems such as virtual pipelines. Natural gas's inherent advantages, including its cleaner-burning properties compared to other fossil fuels, its high efficiency in power generation and industrial processes, and its adaptability to diverse usage patterns, continue to drive its appeal. Ongoing technological progress in exploration, extraction, processing, and distribution continuously improves efficiency, reduces costs, and enhances the overall sustainability of the sector.

Key Drivers, Barriers & Challenges in India Natural Gas Market

Key Drivers: Growing energy demand, government policies promoting cleaner fuels, investments in pipeline infrastructure, and increasing industrialization. For example, the government’s focus on city gas distribution (CGD) projects is significantly boosting PNG adoption.

Challenges: High initial investment costs for infrastructure development, price volatility linked to global gas prices, and regulatory complexities in obtaining permits and approvals. Supply chain disruptions can significantly impact gas availability, particularly during peak demand periods, with estimated losses of xx Million units in 2024 due to such disruptions.

Emerging Opportunities in India Natural Gas Market

Untapped potential exists in rural electrification, using natural gas-based power generation solutions to address energy poverty. The increasing adoption of CNG in public transportation presents significant opportunities. Moreover, the burgeoning industrial sector creates a massive demand for natural gas as a fuel source and feedstock for petrochemicals.

Growth Accelerators in the India Natural Gas Market Industry

Several key factors are poised to accelerate growth in India's natural gas market. Significant investments in exploration and extraction technologies, coupled with strategic public-private partnerships focused on infrastructure development (including pipelines and processing facilities), are laying the groundwork for substantial expansion. The aggressive expansion of the city gas distribution (CGD) network is a pivotal driver, significantly boosting the adoption of PNG across residential and commercial sectors and fostering long-term, sustainable growth. Furthermore, government policies promoting cleaner energy sources and reducing reliance on traditional fossil fuels are creating a favorable environment for natural gas adoption. The increasing affordability of natural gas, compared to other fuels, also contributes to its market appeal.

Key Players Shaping the India Natural Gas Market Market

Notable Milestones in India Natural Gas Market Sector

- January 2022: The 11th round of city gas distribution (CGD) bidding witnessed significant expansion, with Indian Oil Corporation (IOC) securing nine licenses and Bharat Petroleum Corporation Ltd (BPCL) securing six. This underscores the commitment to expanding the natural gas distribution network across the country.

- May 2022: Adani Total Private Limited's withdrawal of its Expression of Interest (EoI) for a natural gas pipeline from Haldia to Panitar highlights the complexities involved in large-scale infrastructure projects, emphasizing the need for streamlined regulatory processes and effective stakeholder engagement.

- [Add another recent milestone here, e.g., a new pipeline completion, policy change, or significant investment announcement.] This demonstrates [explain the significance of the milestone in relation to market growth or development].

In-Depth India Natural Gas Market Market Outlook

The future of the Indian natural gas market is bright, driven by sustained economic growth, increasing energy demands, and a strong push for cleaner energy sources. Strategic investments in pipeline infrastructure, coupled with technological advancements in exploration and extraction, will play a crucial role in shaping the market’s trajectory. The continued expansion of CGD networks and increasing adoption of CNG and PNG across diverse sectors promise considerable market expansion in the coming years. The market is poised for significant growth, presenting attractive opportunities for investors and industry players alike.

India Natural Gas Market Segmentation

-

1. Type

- 1.1. Compressed Natural Gas

- 1.2. Piped Natural Gas

- 1.3. Liquified Petroleum Gas

India Natural Gas Market Segmentation By Geography

- 1. India

India Natural Gas Market Regional Market Share

Geographic Coverage of India Natural Gas Market

India Natural Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investment in the Upstream Sector4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Demand to Diversify the Power Generation Mix by Introducing Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Piped Natural Gas (PNG) to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Natural Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Compressed Natural Gas

- 5.1.2. Piped Natural Gas

- 5.1.3. Liquified Petroleum Gas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Oil and Natural Gas Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mahanagar Gas Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reliance Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Indraprastha Gas Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vedanta Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Adani Total Gas Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Oil Corporation Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Punj Lloyd Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Oil and Natural Gas Corporation

List of Figures

- Figure 1: India Natural Gas Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Natural Gas Market Share (%) by Company 2025

List of Tables

- Table 1: India Natural Gas Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India Natural Gas Market Volume Tonnes Forecast, by Type 2020 & 2033

- Table 3: India Natural Gas Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Natural Gas Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: India Natural Gas Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: India Natural Gas Market Volume Tonnes Forecast, by Type 2020 & 2033

- Table 7: India Natural Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: India Natural Gas Market Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Natural Gas Market?

The projected CAGR is approximately 3.62%.

2. Which companies are prominent players in the India Natural Gas Market?

Key companies in the market include Oil and Natural Gas Corporation, Mahanagar Gas Limited, Reliance Industries, Indraprastha Gas Limited, Vedanta Limited, Adani Total Gas Limited, Indian Oil Corporation Limited, Punj Lloyd Limited.

3. What are the main segments of the India Natural Gas Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 61.28 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in the Upstream Sector4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Piped Natural Gas (PNG) to Grow Significantly.

7. Are there any restraints impacting market growth?

4.; Increasing Demand to Diversify the Power Generation Mix by Introducing Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

In January 2022, According to the results of the bid opening for the 11th round of city gas distribution (CGD) bidding, Indian Oil Corporation (IOC) stands to get nine licences and Bharat Petroleum Corporation Ltd (BPCL) 6.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Natural Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Natural Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Natural Gas Market?

To stay informed about further developments, trends, and reports in the India Natural Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence