Key Insights

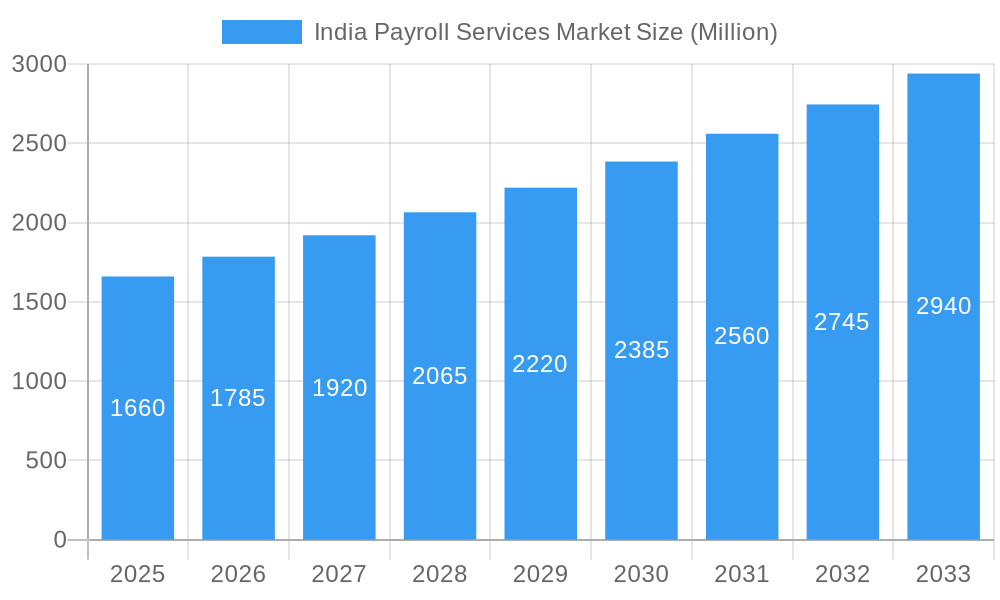

The India Payroll Services Market is experiencing robust growth, projected to reach $1.66 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 7.49% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of cloud-based payroll solutions offers scalability, cost-effectiveness, and enhanced data security, attracting businesses of all sizes. Furthermore, stringent government regulations surrounding payroll compliance and the rising need for accurate and timely salary processing are significantly boosting market demand. The burgeoning Indian IT sector and a growing formal workforce contribute to this demand, pushing companies to seek efficient and reliable payroll management solutions. Automation of payroll processes through Artificial Intelligence (AI) and machine learning (ML) is another significant trend, enhancing speed, accuracy, and reducing manual errors. However, the market faces some challenges, including the integration of legacy systems with newer technologies, concerns about data privacy and security, and the need for skilled professionals to effectively manage and implement these sophisticated systems.

India Payroll Services Market Market Size (In Billion)

Despite these challenges, the market's positive trajectory is evident. The presence of both global giants like ADP, SAP, and Oracle, and domestic players like Infosys Limited, Quikchex, Paysquare, and ZingHR, signifies a competitive yet dynamic landscape. These companies are continuously innovating to offer comprehensive solutions that cater to the evolving needs of Indian businesses. The market segmentation likely includes offerings based on deployment (cloud, on-premise), business size (SME, large enterprises), and industry vertical (IT, BFSI, manufacturing, etc.), though further data is needed to fully define the segmentation. The forecast period of 2025-2033 indicates substantial future growth potential, especially with ongoing technological advancements and favorable regulatory changes.

India Payroll Services Market Company Market Share

India Payroll Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Payroll Services Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and estimated year. The report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market. The market is segmented by deployment model (cloud-based, on-premise), organization size (SMEs, large enterprises), industry vertical (IT, BFSI, Manufacturing, etc.) and service type (payroll processing, payroll compliance, etc.). The total market size in 2025 is estimated at xx Million.

India Payroll Services Market Dynamics & Structure

The Indian Payroll Services market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. However, the market is also witnessing increased competition from smaller, specialized providers. Technological innovation, particularly in cloud-based solutions and AI-powered automation, is a key driver of market growth. Stringent regulatory frameworks, including those related to data privacy and compliance, shape market practices. The emergence of robust cloud-based solutions presents a significant substitute for traditional on-premise payroll systems. The end-user demographic is diverse, encompassing SMEs and large enterprises across various industries. M&A activity is moderate, with strategic acquisitions aimed at expanding service portfolios and geographic reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Cloud computing, AI, and automation are driving efficiency and adoption.

- Regulatory Framework: Stringent compliance requirements impacting market operations.

- Competitive Substitutes: Cloud-based solutions pose a challenge to traditional systems.

- End-User Demographics: Diverse, including SMEs and large enterprises across multiple sectors.

- M&A Trends: Moderate activity, focused on expansion and service diversification (xx deals in the past 5 years).

India Payroll Services Market Growth Trends & Insights

The India Payroll Services market has witnessed significant growth during the historical period (2019-2024), driven by factors such as increasing adoption of cloud-based solutions, rising demand for payroll outsourcing, and stringent regulatory compliance needs. The market size is projected to experience substantial growth during the forecast period (2025-2033), exhibiting a CAGR of xx%. This growth is primarily attributed to the increasing digitization of HR functions, the growing adoption of AI and automation in payroll processes, and the increasing demand for integrated HR solutions. Consumer behavior shifts toward greater reliance on technology and preference for streamlined, efficient payroll management contribute to market expansion. The market penetration rate is expected to reach xx% by 2033.

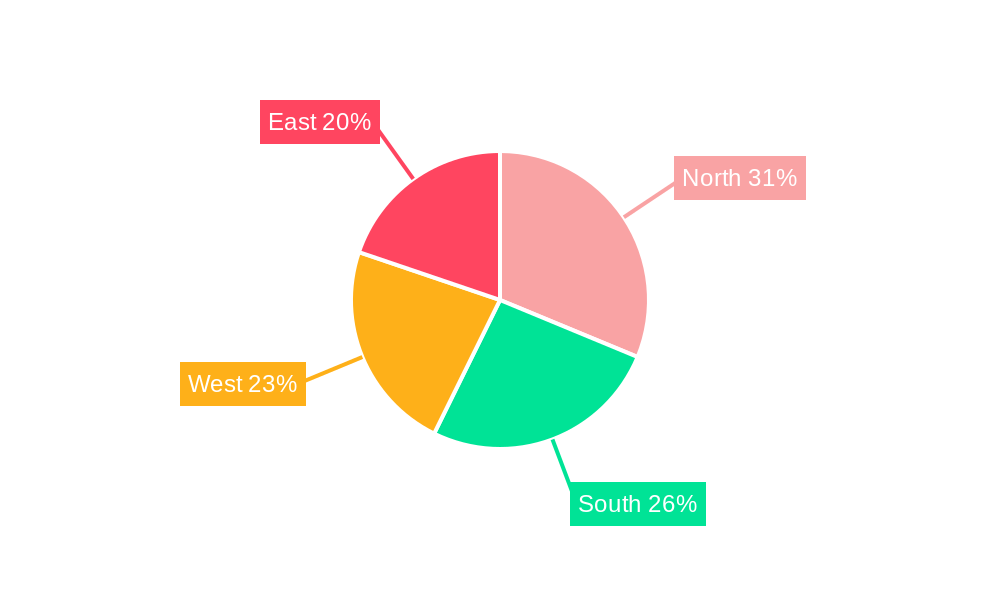

Dominant Regions, Countries, or Segments in India Payroll Services Market

The metropolitan areas of India, including Mumbai, Delhi, Bengaluru, and Hyderabad, are leading the market growth due to the high concentration of businesses and IT/ITeS companies. These regions benefit from robust infrastructure, a skilled workforce, and a high concentration of potential clients. The BFSI and IT sectors are the dominant industry verticals, driven by the need for accurate, timely, and compliant payroll processing. Government policies promoting digitalization and ease of doing business also contribute to regional dominance.

Key Drivers:

- Robust infrastructure and skilled workforce in metropolitan areas.

- High concentration of businesses and IT/ITeS companies.

- High demand for payroll solutions in BFSI and IT sectors.

- Favorable government policies promoting digitalization.

Dominance Factors:

- Market share (xx% of total market in 2025)

- Growth potential (projected CAGR of xx% during the forecast period)

India Payroll Services Market Product Landscape

The product landscape is characterized by a wide range of solutions, including cloud-based payroll software, on-premise systems, and integrated HRMS platforms. These solutions offer features such as automated tax calculations, compliance management, employee self-service portals, and robust reporting capabilities. Key differentiators include ease of use, integration capabilities, scalability, security features, and cost-effectiveness. Recent technological advancements have focused on integrating AI and machine learning to enhance accuracy, automate tasks, and improve overall efficiency.

Key Drivers, Barriers & Challenges in India Payroll Services Market

Key Drivers: The increasing need for efficient and accurate payroll processing, the rising adoption of cloud-based solutions, growing demand for compliance and data security, and the increasing number of businesses adopting HR technology are all key factors driving the market.

Challenges and Restraints: High implementation costs, complexity of integration with existing systems, and resistance to change among some businesses can hinder market growth. Furthermore, concerns regarding data security and privacy continue to present challenges. The competitive landscape, characterized by both established players and new entrants, creates intense pressure on pricing and profitability.

Emerging Opportunities in India Payroll Services Market

Emerging opportunities include the expansion into untapped markets (tier-2 and tier-3 cities), the development of specialized solutions for specific industry verticals, and the integration of advanced analytics and AI capabilities for enhanced decision-making. Increasing demand for mobile-first payroll solutions and the growing need for personalized employee experiences also presents significant opportunities for innovation and market expansion.

Growth Accelerators in the India Payroll Services Market Industry

Strategic partnerships between payroll providers and other HR technology vendors, technological breakthroughs enhancing automation and efficiency, and expansion into new markets are key growth catalysts. The increasing focus on employee experience through self-service portals and enhanced communication tools further accelerates market growth.

Notable Milestones in India Payroll Services Market Sector

- February 2024: ADP integrated generative AI into its HR tools, streamlining payroll validation.

- March 2024: Alight Inc. partnered with SAP, launching a cloud-based payroll solution using SAP S/4HANA Cloud.

In-Depth India Payroll Services Market Market Outlook

The India Payroll Services market is poised for significant long-term growth, driven by continuous technological advancements, increasing adoption of cloud-based solutions, and the growing demand for streamlined and efficient payroll processes. Strategic partnerships, expansion into new markets, and innovative product development will further fuel market expansion, presenting lucrative opportunities for both established players and new entrants. The market is expected to continue its robust growth trajectory throughout the forecast period.

India Payroll Services Market Segmentation

-

1. Type

- 1.1. Hybrid

- 1.2. Fully Outsourced

-

2. Organization Size

- 2.1. Small and Medium-Sized Enterprises

- 2.2. Large Enterprises

-

3. End-User

- 3.1. BFSI

- 3.2. Consumer and Industrial Products

- 3.3. IT and Telecommunication

- 3.4. Public Sector

- 3.5. Healthcare

- 3.6. Other End Users

India Payroll Services Market Segmentation By Geography

- 1. India

India Payroll Services Market Regional Market Share

Geographic Coverage of India Payroll Services Market

India Payroll Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions; Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape

- 3.3. Market Restrains

- 3.3.1. The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions; Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape

- 3.4. Market Trends

- 3.4.1. Technological Advancements and Cloud Services Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Payroll Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hybrid

- 5.1.2. Fully Outsourced

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium-Sized Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. BFSI

- 5.3.2. Consumer and Industrial Products

- 5.3.3. IT and Telecommunication

- 5.3.4. Public Sector

- 5.3.5. Healthcare

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SAP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oracle

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infosys Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Quikchex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Paysquare

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ZingHR

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Excelity Global

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hinduja Global Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Osourc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADP

List of Figures

- Figure 1: India Payroll Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Payroll Services Market Share (%) by Company 2025

List of Tables

- Table 1: India Payroll Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Payroll Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: India Payroll Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 4: India Payroll Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 5: India Payroll Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: India Payroll Services Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 7: India Payroll Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Payroll Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Payroll Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: India Payroll Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: India Payroll Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 12: India Payroll Services Market Volume Billion Forecast, by Organization Size 2020 & 2033

- Table 13: India Payroll Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 14: India Payroll Services Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 15: India Payroll Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Payroll Services Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Payroll Services Market?

The projected CAGR is approximately 7.49%.

2. Which companies are prominent players in the India Payroll Services Market?

Key companies in the market include ADP, SAP, Oracle, Infosys Limited, Quikchex, Paysquare, ZingHR, Excelity Global, Hinduja Global Solutions, Osourc.

3. What are the main segments of the India Payroll Services Market?

The market segments include Type, Organization Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.66 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions; Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape.

6. What are the notable trends driving market growth?

Technological Advancements and Cloud Services Driving the Market.

7. Are there any restraints impacting market growth?

The Increasing Number of SMEs is Driving the Demand for Scalable Payroll Solutions; Continuous Technological Advancements and Increasing Cloud Services are Driving the Landscape.

8. Can you provide examples of recent developments in the market?

March 2024: Alight Inc., a prominent provider of cloud-based human capital and technology services, enhanced its partnership with SAP. Through this collaboration, Alight's Worklife platform will harness the power of SAP S/4HANA Cloud, introducing a cutting-edge, cloud-based payroll solution. This innovative system not only boosts payroll efficiency and performance but also fortifies security measures for handling sensitive employee and organizational data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Payroll Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Payroll Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Payroll Services Market?

To stay informed about further developments, trends, and reports in the India Payroll Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence