Key Insights

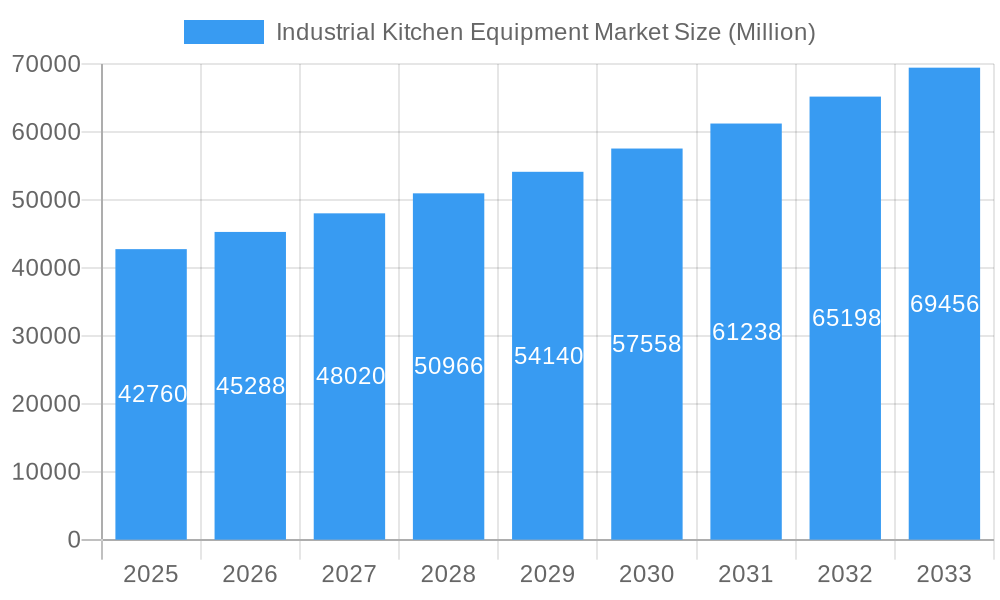

The global industrial kitchen equipment market, valued at $42.76 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.73% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food service industry, encompassing quick-service restaurants (QSRs), full-service restaurants (FSRs), hotels, and institutional canteens, necessitates advanced and efficient kitchen equipment. Rising consumer demand for diverse culinary experiences and increasing emphasis on food safety and hygiene standards further stimulate market growth. Technological advancements, such as energy-efficient appliances and automated cooking systems, enhance productivity and reduce operational costs, making them attractive investments for businesses. Furthermore, the growing popularity of cloud kitchens and ghost kitchens is creating a significant demand for compact and efficient industrial kitchen equipment. While supply chain disruptions and fluctuating raw material prices present challenges, the long-term outlook remains positive, particularly in developing economies where infrastructure development and rising disposable incomes are boosting the food service sector.

Industrial Kitchen Equipment Market Market Size (In Billion)

Regional variations in market growth are expected. North America and Europe currently hold significant market shares, driven by established food service industries and higher adoption of advanced technologies. However, the Asia-Pacific region is poised for rapid expansion due to its burgeoning population, increasing urbanization, and the rapid growth of the food service sector in countries like China and India. Competitive dynamics are characterized by a mix of established global players and regional manufacturers. Key players are investing heavily in research and development to introduce innovative products and expand their market reach. Strategic alliances, acquisitions, and technological collaborations are also shaping the competitive landscape. The market segmentation by type (refrigerators, cooking appliances, dishwashers, etc.) and application (QSR, FSR, hotels, etc.) provides insights into specific growth opportunities within the broader market. The increasing focus on sustainability and energy efficiency is expected to drive demand for eco-friendly industrial kitchen equipment in the coming years.

Industrial Kitchen Equipment Market Company Market Share

Industrial Kitchen Equipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Industrial Kitchen Equipment market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The market is segmented by type (Refrigerators, Cooking Appliances, Cooktop and Cooking Ranges, Ovens, Dishwashers, Other Types) and application (Quick Service Restaurant (QSR), Railway Dining, Institutional Canteen, Resort and Hotel, Hospital, Full Service Restaurant (FSR), Other Applications). Key players analyzed include Vulcan, Southbend, The Vollrath Company LLC, Fagor Group, Hoshizaki Corporation, Hamilton Beach, Hobart, Electrolux, Meiko International, Ali Group, Carrier Corporation, American Range, Falcon Group, Interlevin Refrigeration Ltd, Rational AG, and Duke Manufacturing Company (list not exhaustive). The report projects a market value of xx Million units by 2033.

Industrial Kitchen Equipment Market Dynamics & Structure

The industrial kitchen equipment market is characterized by moderate concentration, with a few major players holding significant market share, alongside numerous smaller niche players. Technological innovation, particularly in energy efficiency and automation, is a key driver. Stringent safety and hygiene regulations influence product design and manufacturing processes. Competitive substitutes, such as cloud kitchens and outsourcing food preparation services, exert pressure on market growth. The end-user demographic includes diverse sectors such as restaurants (QSR and FSR), hotels, hospitals, and institutional canteens, each with unique equipment needs. Mergers and acquisitions (M&A) activity is relatively frequent, as larger companies seek to expand their product portfolios and market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on energy-efficient appliances, automation (e.g., robotic cooking systems), and smart kitchen technologies.

- Regulatory Framework: Stringent food safety and hygiene regulations impacting equipment design and manufacturing.

- Competitive Substitutes: Growth of cloud kitchens and outsourced food service providers pose a challenge.

- End-User Demographics: Diverse, encompassing QSR, FSR, hotels, hospitals, and institutional settings.

- M&A Trends: Moderate level of M&A activity, driven by expansion strategies and technological integration. Approximately xx M&A deals were recorded between 2019 and 2024.

Industrial Kitchen Equipment Market Growth Trends & Insights

The industrial kitchen equipment market is experiencing steady growth, driven by several factors. The expansion of the food service industry, particularly the QSR and FSR segments, fuels demand for modern, efficient equipment. Technological advancements, such as energy-efficient appliances and automated systems, are further boosting adoption rates. Changing consumer preferences, including a growing demand for customized and high-quality food, also contribute to market growth. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. Factors like increasing disposable incomes in developing economies and rising investments in the hospitality sector are contributing to this growth trajectory. However, economic downturns and fluctuations in raw material prices can impact market growth.

Dominant Regions, Countries, or Segments in Industrial Kitchen Equipment Market

The North American market currently holds the largest share of the global industrial kitchen equipment market, driven by robust growth in the food service sector and high adoption of advanced technologies. Within this region, the United States is the leading country. The European market is another major contributor, with Western European countries showing significant demand due to established hospitality and food service industries. In terms of segmental dominance, the Cooking Appliances segment holds the largest market share, followed by Refrigerators and Dishwashers. The QSR application segment is experiencing the fastest growth, propelled by the expansion of fast-food chains globally.

- Key Drivers (North America): Strong food service industry growth, high adoption of advanced technologies, robust economy.

- Key Drivers (Europe): Established hospitality sector, high consumer spending, technological advancements.

- Dominant Segments: Cooking Appliances (largest market share), followed by Refrigerators and Dishwashers.

- Fastest Growing Segment: QSR application segment, driven by expansion of fast-food chains.

- Growth Potential: Asia-Pacific region exhibits significant growth potential due to rising disposable incomes and expanding food service sector.

Industrial Kitchen Equipment Market Product Landscape

The industrial kitchen equipment market offers a wide range of products designed to meet diverse needs, from basic appliances to highly specialized, automated systems. Recent innovations include energy-efficient models, smart appliances with connected features, and modular systems allowing for customized configurations. Key performance indicators include energy consumption, operational efficiency, durability, and safety features. Unique selling propositions often focus on enhanced productivity, reduced operational costs, and improved food quality and safety. Technological advancements are continuously improving equipment performance and user experience.

Key Drivers, Barriers & Challenges in Industrial Kitchen Equipment Market

Key Drivers: Increasing demand from the food service industry, technological advancements (automation, energy efficiency), government initiatives promoting food safety and hygiene. The rise of cloud kitchens and online food delivery services also presents a unique opportunity for this market.

Challenges: High initial investment costs for advanced equipment, fluctuations in raw material prices, intense competition, potential supply chain disruptions (e.g., semiconductor shortages), and stringent regulatory compliance requirements leading to increased compliance costs. These challenges can reduce profitability and hinder market expansion.

Emerging Opportunities in Industrial Kitchen Equipment Market

Emerging opportunities lie in the development of sustainable and energy-efficient equipment, smart kitchen technologies with data analytics capabilities, and specialized equipment for niche food service applications. Untapped markets in developing economies offer substantial growth potential. Moreover, the growing demand for customized and personalized food experiences creates opportunities for specialized equipment catering to specific dietary needs and culinary trends.

Growth Accelerators in the Industrial Kitchen Equipment Market Industry

Technological advancements, particularly in automation, energy efficiency, and smart kitchen technologies, are significant catalysts for long-term growth. Strategic partnerships between equipment manufacturers and food service companies drive innovation and market expansion. Government initiatives promoting food safety and energy efficiency further accelerate market growth. Expanding into untapped markets, particularly in developing economies with growing food service industries, presents substantial opportunities for future growth.

Key Players Shaping the Industrial Kitchen Equipment Market Market

- Vulcan

- Southbend

- The Vollrath Company LLC

- Fagor Group

- Hoshizaki Corporation

- Hamilton Beach

- Hobart

- Electrolux

- Meiko International

- Ali Group

- Carrier Corporation

- American Range

- Falcon Group

- Interlevin Refrigeration Ltd

- Rational AG

- Duke Manufacturing Company

Notable Milestones in Industrial Kitchen Equipment Market Sector

- April 2023: Carrier acquired Viessmann Climate Solutions for USD 13.11 billion, strengthening its position in the climate solutions market and potentially influencing its industrial kitchen equipment offerings through technological synergies.

- November 2023: Hamilton Beach launched in the UK market, with its Hamilton Beach Professional Juicer Mixer Grinder achieving over 1 million units in global sales, showcasing growing demand for specific types of kitchen equipment.

In-Depth Industrial Kitchen Equipment Market Market Outlook

The industrial kitchen equipment market is poised for continued growth, fueled by technological innovation, expansion of the food service industry, and increasing demand for efficient and sustainable solutions. Strategic partnerships, market expansions into developing economies, and focus on specialized equipment segments will play a crucial role in shaping future market dynamics. The market's long-term potential is substantial, offering significant opportunities for established players and new entrants alike.

Industrial Kitchen Equipment Market Segmentation

-

1. Type

- 1.1. Refrigerators

- 1.2. Cooking Appliances

- 1.3. Cooktop and Cooking Ranges

- 1.4. Ovens

- 1.5. Dishwashers

- 1.6. Other Types

-

2. Application

- 2.1. Quick Service Restaurant (QSR)

- 2.2. Railway Dining

- 2.3. Institutional Canteen

- 2.4. Resort and Hotel

- 2.5. Hospital

- 2.6. Full Service Restaurant (FSR)

- 2.7. Other Applications

Industrial Kitchen Equipment Market Segmentation By Geography

- 1. North America

- 2. South Amercia

- 3. Asia Pacific

- 4. Europe

- 5. Middle East

Industrial Kitchen Equipment Market Regional Market Share

Geographic Coverage of Industrial Kitchen Equipment Market

Industrial Kitchen Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Cook Time Drives Market Demand; Faster Cooking Time Compared to Traditional Methods Drives Market Demand

- 3.3. Market Restrains

- 3.3.1. Operational Malfunctions Impedes Market Growth; Health Issues Driven By Deep Fried Foods Acts As Impediments to Market Growth

- 3.4. Market Trends

- 3.4.1. The Introduction Of Smart Kitchen Appliances

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Kitchen Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Refrigerators

- 5.1.2. Cooking Appliances

- 5.1.3. Cooktop and Cooking Ranges

- 5.1.4. Ovens

- 5.1.5. Dishwashers

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Quick Service Restaurant (QSR)

- 5.2.2. Railway Dining

- 5.2.3. Institutional Canteen

- 5.2.4. Resort and Hotel

- 5.2.5. Hospital

- 5.2.6. Full Service Restaurant (FSR)

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South Amercia

- 5.3.3. Asia Pacific

- 5.3.4. Europe

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Industrial Kitchen Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Refrigerators

- 6.1.2. Cooking Appliances

- 6.1.3. Cooktop and Cooking Ranges

- 6.1.4. Ovens

- 6.1.5. Dishwashers

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Quick Service Restaurant (QSR)

- 6.2.2. Railway Dining

- 6.2.3. Institutional Canteen

- 6.2.4. Resort and Hotel

- 6.2.5. Hospital

- 6.2.6. Full Service Restaurant (FSR)

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South Amercia Industrial Kitchen Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Refrigerators

- 7.1.2. Cooking Appliances

- 7.1.3. Cooktop and Cooking Ranges

- 7.1.4. Ovens

- 7.1.5. Dishwashers

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Quick Service Restaurant (QSR)

- 7.2.2. Railway Dining

- 7.2.3. Institutional Canteen

- 7.2.4. Resort and Hotel

- 7.2.5. Hospital

- 7.2.6. Full Service Restaurant (FSR)

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Industrial Kitchen Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Refrigerators

- 8.1.2. Cooking Appliances

- 8.1.3. Cooktop and Cooking Ranges

- 8.1.4. Ovens

- 8.1.5. Dishwashers

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Quick Service Restaurant (QSR)

- 8.2.2. Railway Dining

- 8.2.3. Institutional Canteen

- 8.2.4. Resort and Hotel

- 8.2.5. Hospital

- 8.2.6. Full Service Restaurant (FSR)

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Europe Industrial Kitchen Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Refrigerators

- 9.1.2. Cooking Appliances

- 9.1.3. Cooktop and Cooking Ranges

- 9.1.4. Ovens

- 9.1.5. Dishwashers

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Quick Service Restaurant (QSR)

- 9.2.2. Railway Dining

- 9.2.3. Institutional Canteen

- 9.2.4. Resort and Hotel

- 9.2.5. Hospital

- 9.2.6. Full Service Restaurant (FSR)

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Industrial Kitchen Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Refrigerators

- 10.1.2. Cooking Appliances

- 10.1.3. Cooktop and Cooking Ranges

- 10.1.4. Ovens

- 10.1.5. Dishwashers

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Quick Service Restaurant (QSR)

- 10.2.2. Railway Dining

- 10.2.3. Institutional Canteen

- 10.2.4. Resort and Hotel

- 10.2.5. Hospital

- 10.2.6. Full Service Restaurant (FSR)

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vulcan

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Southbend

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Vollrath Company LLC**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fagor Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hoshizaki Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hamilton Beach

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hobart

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Electrolux

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Meiko International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ali Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Carrier Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 American Range

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Falcon Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Interlevin Refrigeration Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Rational AG

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Duke Manufacturing Company

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Vulcan

List of Figures

- Figure 1: Global Industrial Kitchen Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Industrial Kitchen Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Industrial Kitchen Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Industrial Kitchen Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Industrial Kitchen Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Industrial Kitchen Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Industrial Kitchen Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South Amercia Industrial Kitchen Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South Amercia Industrial Kitchen Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South Amercia Industrial Kitchen Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 11: South Amercia Industrial Kitchen Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: South Amercia Industrial Kitchen Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South Amercia Industrial Kitchen Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Industrial Kitchen Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Industrial Kitchen Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Industrial Kitchen Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Industrial Kitchen Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Industrial Kitchen Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Industrial Kitchen Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Europe Industrial Kitchen Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Europe Industrial Kitchen Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Industrial Kitchen Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Industrial Kitchen Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Industrial Kitchen Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Industrial Kitchen Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Industrial Kitchen Equipment Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East Industrial Kitchen Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Industrial Kitchen Equipment Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East Industrial Kitchen Equipment Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Industrial Kitchen Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Industrial Kitchen Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Industrial Kitchen Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Kitchen Equipment Market?

The projected CAGR is approximately 5.73%.

2. Which companies are prominent players in the Industrial Kitchen Equipment Market?

Key companies in the market include Vulcan, Southbend, The Vollrath Company LLC**List Not Exhaustive, Fagor Group, Hoshizaki Corporation, Hamilton Beach, Hobart, Electrolux, Meiko International, Ali Group, Carrier Corporation, American Range, Falcon Group, Interlevin Refrigeration Ltd, Rational AG, Duke Manufacturing Company.

3. What are the main segments of the Industrial Kitchen Equipment Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Low Cook Time Drives Market Demand; Faster Cooking Time Compared to Traditional Methods Drives Market Demand.

6. What are the notable trends driving market growth?

The Introduction Of Smart Kitchen Appliances.

7. Are there any restraints impacting market growth?

Operational Malfunctions Impedes Market Growth; Health Issues Driven By Deep Fried Foods Acts As Impediments to Market Growth.

8. Can you provide examples of recent developments in the market?

In April 2023, Carrier announced its acquisition of Viessmann Climate Solutions for Euro 12 billion (USD 13.11 billion) in a combination of cash and stock, directly issued to the Viessmann Group, with a promise of long-term ownership. The strategic initiatives aim to reshape the company's business portfolio, positioning Carrier as a dominant global player solely focused on innovative climate and energy solutions

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Kitchen Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Kitchen Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Kitchen Equipment Market?

To stay informed about further developments, trends, and reports in the Industrial Kitchen Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence