Key Insights

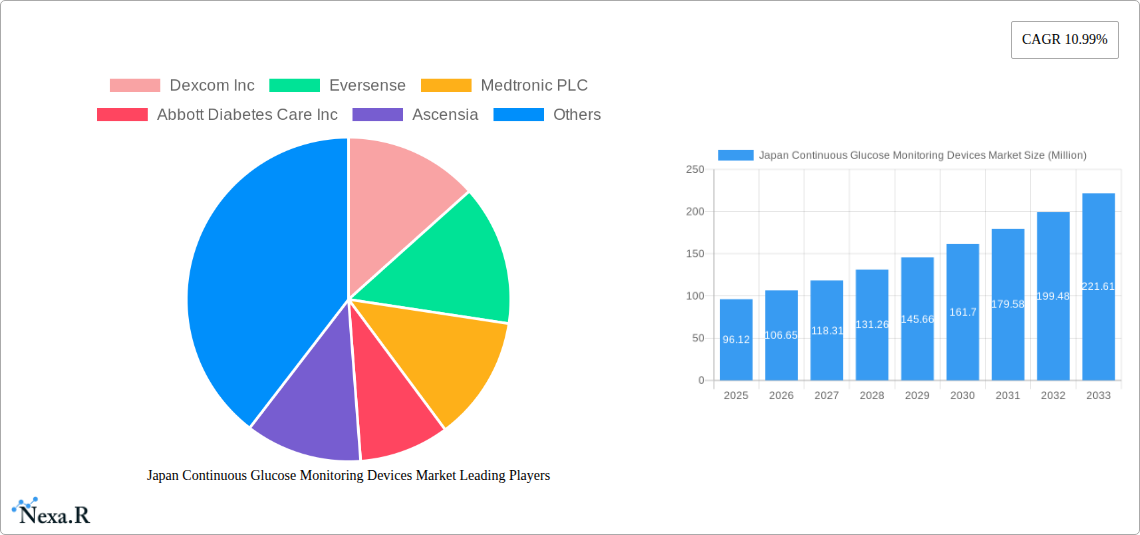

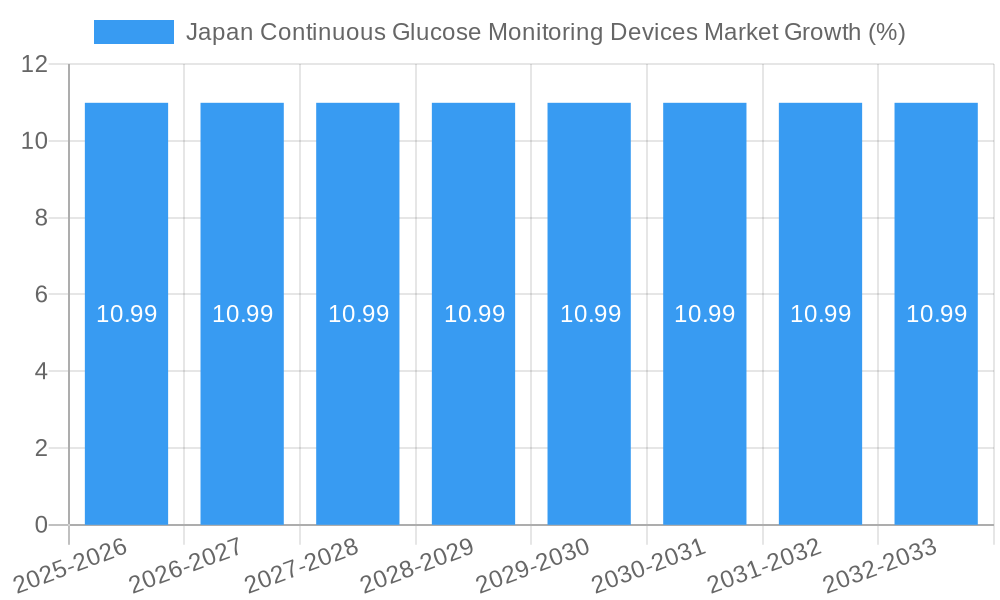

The Japan Continuous Glucose Monitoring (CGM) Devices Market is poised for substantial expansion, projected to reach approximately USD 96.12 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.99% anticipated to sustain this upward trajectory through 2033. This significant growth is primarily fueled by an increasing prevalence of diabetes across Japan, necessitating more advanced and convenient blood glucose management solutions. The aging population, a prominent demographic in Japan, contributes to this trend, as older individuals often face a higher risk of developing or managing diabetes. Furthermore, a growing awareness among both patients and healthcare professionals regarding the benefits of CGM technology, such as improved glycemic control, reduced hypoglycemia events, and enhanced quality of life, is a key driver. The demand for real-time data and seamless integration with other health monitoring devices further propels market adoption.

The market is characterized by a strong focus on innovation within its segments. The "Component" segment is dominated by the crucial role of Sensors, which are at the forefront of technological advancements in accuracy and longevity. Durables, encompassing receivers and transmitters, are also seeing innovation aimed at miniaturization and enhanced connectivity. Geographically, while specific provincial data is granular, the Kansai and Kanto regions, being densely populated economic hubs, are expected to represent significant market shares due to higher patient populations and greater accessibility to advanced healthcare. Key companies like Dexcom Inc., Medtronic PLC, and Abbott Diabetes Care Inc. are actively shaping the market landscape through their continuous research and development efforts, introducing next-generation CGM systems that offer improved user experience and clinical outcomes. The market's growth is also supported by supportive government initiatives and increasing insurance coverage for diabetes management technologies.

Japan Continuous Glucose Monitoring Devices Market: Comprehensive Market Analysis 2019–2033

This in-depth report provides a definitive analysis of the Japan Continuous Glucose Monitoring (CGM) Devices Market, offering a strategic roadmap for stakeholders navigating this dynamic sector. Delving into market dynamics, growth trends, regional dominance, product innovations, and key industry players, this report equips you with actionable insights for informed decision-making. With a focus on parent and child market segments and a robust quantitative and qualitative outlook, this analysis is your essential guide to capitalizing on the burgeoning opportunities within Japan's CGM landscape.

Japan Continuous Glucose Monitoring Devices Market Market Dynamics & Structure

The Japan Continuous Glucose Monitoring (CGM) Devices Market is characterized by a moderate to high market concentration, with a few dominant players holding significant market share. Technological innovation is a primary driver, fueled by the increasing demand for non-invasive and user-friendly diabetes management solutions. Robust regulatory frameworks, while ensuring patient safety and product efficacy, can also present barriers to entry and market expansion. The competitive landscape is shaped by the presence of effective competitive product substitutes, including traditional blood glucose meters, which necessitate continuous product differentiation and value proposition enhancement. End-user demographics are evolving, with a growing population of individuals diagnosed with diabetes, particularly type 2, and an increasing awareness among healthcare professionals and patients regarding the benefits of real-time glucose monitoring for improved glycemic control and reduced long-term complications. Merger and acquisition (M&A) trends are anticipated to increase as companies seek to consolidate market presence, acquire innovative technologies, and expand their product portfolios. The market is poised for significant growth, driven by these intricate dynamics.

- Market Concentration: Dominated by key players, with opportunities for niche players to emerge.

- Technological Innovation Drivers: Miniaturization, improved sensor accuracy, longer wear times, and enhanced data connectivity.

- Regulatory Frameworks: Stringent approval processes by the Pharmaceuticals and Medical Devices Agency (PMDA) ensuring high product standards.

- Competitive Product Substitutes: Traditional blood glucose meters, intermittently scanned glucose meters (ISMGs).

- End-User Demographics: Aging population, rising diabetes prevalence, proactive patient engagement in health management.

- M&A Trends: Strategic acquisitions to gain market share and technological expertise.

Japan Continuous Glucose Monitoring Devices Market Growth Trends & Insights

The Japan Continuous Glucose Monitoring (CGM) Devices Market is projected to witness substantial growth over the forecast period of 2025–2033, driven by a confluence of factors including increasing diabetes prevalence, a growing awareness of proactive diabetes management, and continuous technological advancements. The market size evolution will be marked by a steady upward trajectory, with the CAGR projected at XX% from 2025 to 2033. Adoption rates are steadily increasing, as healthcare providers and patients recognize the significant benefits of real-time glucose data in achieving better glycemic control, thereby reducing the risk of debilitating long-term diabetes complications such as retinopathy, nephropathy, and neuropathy. Technological disruptions are a constant feature, with ongoing innovation focused on enhancing sensor accuracy, improving wear duration, and developing more intuitive user interfaces and seamless data integration with smart devices and electronic health records. Consumer behavior shifts are evident, with a growing segment of the population actively seeking tools that empower them to manage their health proactively. This includes a greater willingness to adopt wearable technologies and digital health solutions that offer convenience and personalized insights. The penetration of CGM devices within the broader diabetes management market is expected to rise significantly as reimbursement policies become more favorable and awareness campaigns highlight the superior outcomes associated with continuous monitoring.

- Market Size Evolution: Expected to grow from an estimated XX million units in 2025 to XX million units by 2033.

- Adoption Rates: Steadily increasing due to rising diabetes diagnoses and improved understanding of CGM benefits.

- Technological Disruptions: Focus on accuracy, comfort, connectivity, and integration with artificial pancreas systems.

- Consumer Behavior Shifts: Growing demand for personalized health data, convenience, and proactive self-management tools.

- Market Penetration: Increasing as CGM devices become more accessible and affordable.

- Key Growth Drivers: Aging population, sedentary lifestyles contributing to diabetes, government initiatives for chronic disease management.

Dominant Regions, Countries, or Segments in Japan Continuous Glucose Monitoring Devices Market

The Kanto province is anticipated to emerge as the dominant region within the Japan Continuous Glucose Monitoring (CGM) Devices Market, driven by its dense population, advanced healthcare infrastructure, and a high concentration of leading medical institutions and research centers. This region consistently exhibits higher adoption rates for innovative medical technologies due to a greater propensity among its residents to embrace advancements in healthcare and a higher disposable income for specialized medical devices. The economic policies and infrastructure within Kanto are highly conducive to market growth, with robust public and private healthcare spending, well-established distribution networks, and a strong ecosystem supporting technological adoption. Furthermore, the higher prevalence of lifestyle-related diseases, including diabetes, within this urbanized province significantly contributes to the demand for effective glucose management solutions like CGM devices.

Within the Component segment, Sensors are projected to hold the largest market share and exhibit the highest growth rate. This dominance is attributed to their consumable nature, requiring regular replacement, thus creating a consistent revenue stream. Technological advancements in sensor accuracy, miniaturization, and biocompatibility are continuously driving innovation and adoption. The ongoing research and development in novel sensor materials and technologies further solidify their position as the core component of any CGM system.

The Provinces (Quantitative Analysis) also reveal a hierarchical growth pattern, with Kanto leading, followed by Kansai. These regions benefit from higher population density, greater access to specialized medical care, and a more advanced understanding of chronic disease management.

- Kanto Province Dominance:

- High population density and urbanization.

- Advanced healthcare infrastructure and access to specialized diabetes care.

- Higher disposable income and willingness to adopt advanced medical technologies.

- Greater awareness and acceptance of CGM among patients and healthcare professionals.

- Strong presence of key opinion leaders and research institutions driving innovation.

- Component Dominance (Sensors):

- Consumable nature driving recurring sales.

- Continuous innovation in accuracy, wear time, and comfort.

- Essential for real-time glucose readings.

- Technological advancements in biocompatibility and ease of insertion.

- Market Share in Components:

- Sensors: Estimated XX% in 2025.

- Durables (Receivers and Transmitters): Estimated XX% in 2025.

- Provincial Growth Dynamics:

- Kanto: Leading market share and growth.

- Kansai: Second largest market with significant growth potential.

- Chubu: Steady growth driven by industrial development and healthcare investment.

- Tohoku & Hokkaido: Emerging markets with increasing adoption driven by awareness and healthcare improvements.

Japan Continuous Glucose Monitoring Devices Market Product Landscape

The Japan Continuous Glucose Monitoring (CGM) Devices Market product landscape is characterized by continuous innovation aimed at enhancing user experience and clinical efficacy. Key product innovations include the development of smaller, more discreet, and longer-wearing sensors that reduce patient discomfort and increase compliance. Advancements in accuracy and reliability are paramount, with manufacturers focusing on minimizing sensor errors and providing real-time, actionable data to both patients and healthcare providers. Applications are expanding beyond basic glucose monitoring to include predictive alerts for hypoglycemia and hyperglycemia, integration with insulin delivery systems for automated insulin adjustment, and data analytics for personalized treatment strategies. Performance metrics such as sensor accuracy (e.g., Mean Absolute Relative Difference - MARD), wear time (typically 7-14 days), and data transmission capabilities are key differentiators. The trend towards wireless connectivity and smartphone integration allows for easier data sharing and remote monitoring, further improving patient outcomes and care management.

Key Drivers, Barriers & Challenges in Japan Continuous Glucose Monitoring Devices Market

The Japan Continuous Glucose Monitoring (CGM) Devices Market is propelled by several key drivers. Increasing diabetes prevalence, fueled by aging populations and lifestyle changes, creates a substantial demand for effective glucose management tools. Technological advancements in sensor accuracy, miniaturization, and connectivity are continuously improving the user experience and clinical utility of CGM devices. Growing awareness among patients and healthcare professionals about the benefits of real-time glucose monitoring for improved glycemic control and reduced long-term complications is a significant driver. Furthermore, government initiatives and reimbursement policies aimed at managing chronic diseases contribute to market growth by making these devices more accessible.

However, the market also faces significant barriers and challenges. High initial cost of CGM devices can be a deterrent for some patient segments, despite increasing affordability. Reimbursement policies, while improving, can still be a barrier to widespread adoption, with varying levels of coverage across different insurance plans. Technical challenges related to sensor accuracy and calibration can sometimes lead to patient frustration. Regulatory hurdles for new product approvals, though necessary for safety, can slow down market entry for innovative devices. Competition from traditional blood glucose meters, which are more affordable and widely used, also presents a challenge. Limited awareness in remote or rural areas can hinder adoption rates.

Barriers & Challenges:

- High initial device cost: Limiting accessibility for some patient demographics.

- Inconsistent reimbursement policies: Variability in coverage across different insurance plans.

- Technical challenges with sensor accuracy and calibration: Potential for user frustration.

- Stringent regulatory approval processes: Prolonging time-to-market for new innovations.

- Competition from established traditional blood glucose meters: Lower cost and long-standing user base.

- Limited awareness in less developed regions: Hindering broader market penetration.

- Supply chain disruptions: Potential for impact on device availability.

Emerging Opportunities in Japan Continuous Glucose Monitoring Devices Market

Emerging opportunities in the Japan Continuous Glucose Monitoring (CGM) Devices Market are diverse and promising. There is a significant opportunity in developing more affordable and accessible CGM solutions to cater to a wider patient population, especially those with limited financial resources. The integration of CGM data with artificial intelligence (AI) and machine learning algorithms presents a vast avenue for personalized diabetes management, predictive analytics for early detection of complications, and optimized insulin dosing recommendations. Expanding the application of CGM beyond diabetes management, such as for pre-diabetes, gestational diabetes, and critically ill patients in hospital settings, opens up new market segments. Furthermore, the growing interest in preventive healthcare and wellness creates a potential market for CGMs among individuals seeking to optimize their metabolic health even without a diabetes diagnosis. Strategic partnerships with telehealth providers and digital health platforms can enhance patient engagement and remote monitoring capabilities, thereby expanding market reach.

Growth Accelerators in the Japan Continuous Glucose Monitoring Devices Market Industry

Several catalysts are expected to accelerate the growth of the Japan Continuous Glucose Monitoring (CGM) Devices Market. Breakthroughs in sensor technology, leading to enhanced accuracy, longer wear times, and improved comfort, will significantly boost adoption. The increasing focus on closed-loop systems and artificial pancreas technology, which seamlessly integrate CGM with insulin pumps, will further drive demand by offering automated and precise glucose control. Strategic partnerships and collaborations between CGM manufacturers, pharmaceutical companies, and healthcare providers will foster innovation, improve patient access, and expand market reach. Government initiatives and evolving reimbursement policies that favor the adoption of advanced diabetes management technologies will also play a crucial role. Finally, growing patient advocacy and demand for personalized healthcare solutions will continue to push the market forward, encouraging manufacturers to develop user-centric and data-rich devices.

Key Players Shaping the Japan Continuous Glucose Monitoring Devices Market Market

- Dexcom Inc

- Eversense

- Medtronic PLC

- Abbott Diabetes Care Inc

- Ascensia

Notable Milestones in Japan Continuous Glucose Monitoring Devices Market Sector

- October 2023: Terumo and Dexcom mutually agreed to conclude their domestic sales agency contract by the end of March 2024. Upon the termination of the distributor agreement, Terumo will no longer be responsible for the sales and support of Dexcom's CGM device in Japan. Dexcom will assume full responsibility for these operations within the country. Both Terumo and Dexcom are committed to ensuring a smooth transition and will continue to provide the same level of services and support to patients and healthcare professionals during the transition period, which will extend until the end of March 2024.

- May 2023: Dexcom showcased the accuracy, reliability, and ease of use of its Dexcom G6 CGM System and highlighted the latest clinical evidence that demonstrates the effectiveness of Dexcom CGM during the 66th Annual Meeting of the Japan Diabetes Society held in Kagoshima, Japan.

In-Depth Japan Continuous Glucose Monitoring Devices Market Market Outlook

The future outlook for the Japan Continuous Glucose Monitoring (CGM) Devices Market is exceptionally promising, driven by a sustained upward trajectory of diabetes prevalence and a growing emphasis on proactive health management. Growth accelerators such as continuous technological innovations in sensor accuracy and comfort, coupled with the advancement of integrated closed-loop systems, will significantly enhance patient outcomes and drive widespread adoption. Strategic alliances and evolving reimbursement frameworks are poised to expand market accessibility, while increasing patient demand for personalized and data-driven healthcare solutions will foster product diversification. Untapped potential lies in developing more cost-effective solutions and expanding the application of CGM beyond diagnosed diabetes. This dynamic landscape presents substantial strategic opportunities for market players to innovate, collaborate, and capitalize on the evolving needs of the Japanese healthcare sector.

Japan Continuous Glucose Monitoring Devices Market Segmentation

-

1. Component

- 1.1. Sensors

- 1.2. Durables (Receivers and Transmitters)

-

2. Provinces (Quantitative Analysis)

- 2.1. Hokkaido

- 2.2. Tohoku

- 2.3. Kanto

- 2.4. Chubu

- 2.5. Kansai

- 2.6. Other Provinces

Japan Continuous Glucose Monitoring Devices Market Segmentation By Geography

- 1. Japan

Japan Continuous Glucose Monitoring Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.99% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market

- 3.3. Market Restrains

- 3.3.1. Monopolized Supply Chain and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. The Durables Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Sensors

- 5.1.2. Durables (Receivers and Transmitters)

- 5.2. Market Analysis, Insights and Forecast - by Provinces (Quantitative Analysis)

- 5.2.1. Hokkaido

- 5.2.2. Tohoku

- 5.2.3. Kanto

- 5.2.4. Chubu

- 5.2.5. Kansai

- 5.2.6. Other Provinces

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Kanto Japan Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Continuous Glucose Monitoring Devices Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dexcom Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eversense

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medtronic PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbott Diabetes Care Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ascensia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Dexcom Inc

List of Figures

- Figure 1: Japan Continuous Glucose Monitoring Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Continuous Glucose Monitoring Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Component 2019 & 2032

- Table 5: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Provinces (Quantitative Analysis) 2019 & 2032

- Table 6: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Provinces (Quantitative Analysis) 2019 & 2032

- Table 7: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Kanto Japan Continuous Glucose Monitoring Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kanto Japan Continuous Glucose Monitoring Devices Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Kansai Japan Continuous Glucose Monitoring Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Kansai Japan Continuous Glucose Monitoring Devices Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Chubu Japan Continuous Glucose Monitoring Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Chubu Japan Continuous Glucose Monitoring Devices Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Kyushu Japan Continuous Glucose Monitoring Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kyushu Japan Continuous Glucose Monitoring Devices Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Tohoku Japan Continuous Glucose Monitoring Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tohoku Japan Continuous Glucose Monitoring Devices Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 22: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Component 2019 & 2032

- Table 23: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Provinces (Quantitative Analysis) 2019 & 2032

- Table 24: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Provinces (Quantitative Analysis) 2019 & 2032

- Table 25: Japan Continuous Glucose Monitoring Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Japan Continuous Glucose Monitoring Devices Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Continuous Glucose Monitoring Devices Market?

The projected CAGR is approximately 10.99%.

2. Which companies are prominent players in the Japan Continuous Glucose Monitoring Devices Market?

Key companies in the market include Dexcom Inc, Eversense, Medtronic PLC, Abbott Diabetes Care Inc, Ascensia.

3. What are the main segments of the Japan Continuous Glucose Monitoring Devices Market?

The market segments include Component, Provinces (Quantitative Analysis).

4. Can you provide details about the market size?

The market size is estimated to be USD 96.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market.

6. What are the notable trends driving market growth?

The Durables Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

Monopolized Supply Chain and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

October 2023: Terumo and Dexcom mutually agreed to conclude their domestic sales agency contract by the end of March 2024. Upon the termination of the distributor agreement, Terumo will no longer be responsible for the sales and support of Dexcom's CGM device in Japan. Dexcom will assume full responsibility for these operations within the country. Both Terumo and Dexcom are committed to ensuring a smooth transition and will continue to provide the same level of services and support to patients and healthcare professionals during the transition period, which will extend until the end of March 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Continuous Glucose Monitoring Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Continuous Glucose Monitoring Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Continuous Glucose Monitoring Devices Market?

To stay informed about further developments, trends, and reports in the Japan Continuous Glucose Monitoring Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence