Key Insights

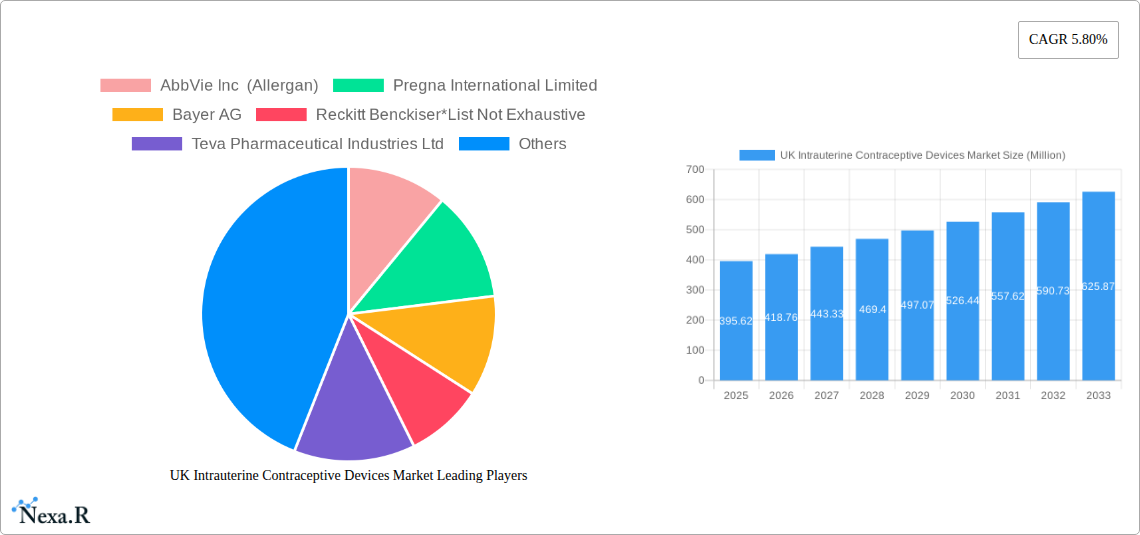

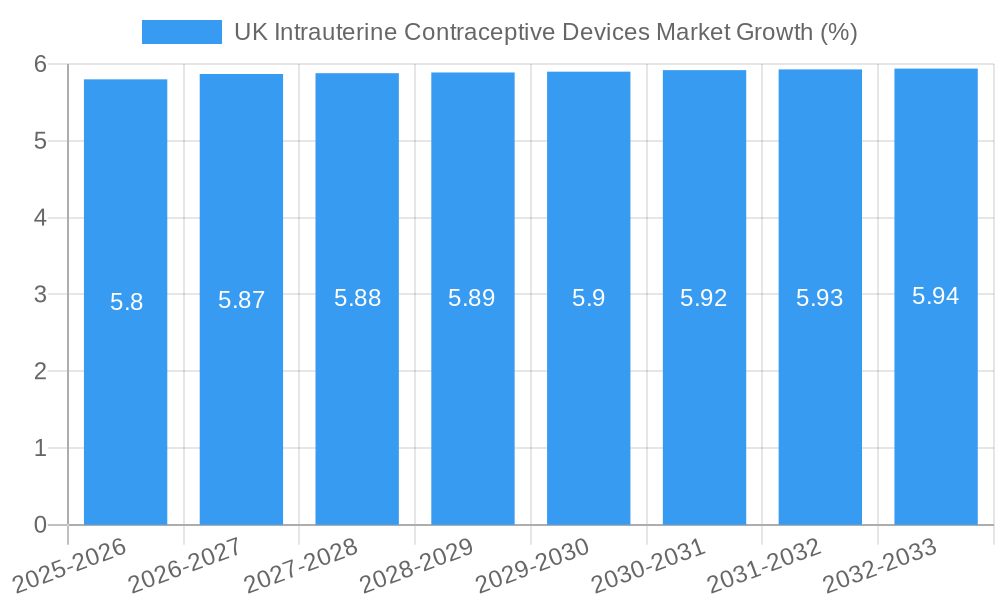

The UK Intrauterine Contraceptive Devices (IUDs) market is poised for significant expansion, with a projected market size of £395.62 million and a Compound Annual Growth Rate (CAGR) of 5.80% between 2025 and 2033. This robust growth is primarily fueled by a rising awareness of long-acting reversible contraception (LARC) methods, increasing demand for highly effective birth control solutions, and evolving healthcare policies that support access to IUDs. The market is characterized by a strong preference for IUDs due to their high efficacy, long duration of use, and the ability to address unmet needs in family planning and reproductive health. The increasing prevalence of gynecological conditions, such as heavy menstrual bleeding and endometriosis, where IUDs offer therapeutic benefits, further bolsters market demand.

The market's dynamics are further shaped by technological advancements leading to the development of more user-friendly and potentially more effective IUDs, including hormonal and non-hormonal options. Key players are actively engaged in research and development, aiming to innovate and expand their product portfolios to cater to diverse patient preferences and medical needs. While the market is experiencing a strong upward trajectory, potential restraints such as the perceived cost of insertion, concerns regarding side effects, and the need for trained healthcare professionals for correct fitting and removal could pose challenges. However, the overarching trend points towards increased adoption, driven by the clear advantages IUDs offer in terms of convenience, efficacy, and their dual role as both contraceptive and therapeutic devices.

Unlocking the UK Intrauterine Contraceptive Devices Market: A Comprehensive Report

This in-depth report delivers a granular analysis of the UK Intrauterine Contraceptive Devices Market, offering critical insights for stakeholders navigating this dynamic sector. With a focus on high-traffic keywords such as "UK IUD market," "contraceptive devices UK," and "female contraception market," this research is meticulously crafted to maximize search engine visibility and provide actionable intelligence. Delve into the intricate market structure, growth trajectories, and competitive landscape of intrauterine contraceptive devices (IUDs) and related contraceptive segments. Explore market dynamics, technological advancements, regulatory environments, and evolving consumer preferences shaping the future of reproductive health in the UK. This report encompasses a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025 and a detailed forecast period of 2025–2033, building upon historical data from 2019–2024.

UK Intrauterine Contraceptive Devices Market Market Dynamics & Structure

The UK Intrauterine Contraceptive Devices Market is characterized by a moderate concentration, with key players like Bayer AG, AbbVie Inc (Allergan), and Reckitt Benckiser holding significant market share. Technological innovation remains a primary driver, with continuous advancements in IUD design, including the development of smaller, longer-lasting, and potentially hormone-free options. Regulatory frameworks, overseen by bodies like the MHRA, play a crucial role in product approval and market access, ensuring safety and efficacy. Competitive product substitutes, ranging from hormonal pills and patches to condoms and sterilization procedures, influence market penetration. End-user demographics, particularly the increasing demand for long-acting reversible contraceptives (LARCs) among women aged 25-45, are shaping market trends. Mergers and acquisitions are present but less frequent, indicating a mature market with established players.

- Market Concentration: Moderate, with leading pharmaceutical and healthcare companies dominating market share.

- Technological Innovation Drivers: Advancements in IUD materials, drug delivery mechanisms, and user-friendliness.

- Regulatory Frameworks: Stringent approval processes by the MHRA, ensuring product safety and efficacy.

- Competitive Product Substitutes: Hormonal contraceptives, barrier methods, and surgical sterilization.

- End-User Demographics: Growing preference for LARCs among women in their reproductive years.

- M&A Trends: Present but not a dominant force; focus on organic growth and strategic partnerships.

UK Intrauterine Contraceptive Devices Market Growth Trends & Insights

The UK Intrauterine Contraceptive Devices Market is poised for substantial growth, fueled by a confluence of factors including rising awareness of LARC benefits, a shift towards highly effective and long-term contraception solutions, and an increasing emphasis on female reproductive autonomy. The market size evolution is projected to witness a healthy Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Adoption rates of IUDs are expected to climb as healthcare providers increasingly recommend them as a first-line contraceptive option due to their high efficacy and low failure rates. Technological disruptions, such as the development of novel materials and improved insertion techniques, are further enhancing user acceptance and driving market penetration. Consumer behavior shifts towards more convenient and less intrusive contraceptive methods are a significant contributor to this upward trend. The demand for both hormonal and non-hormonal IUDs is anticipated to rise as a broader range of options becomes available to cater to diverse user needs and preferences. The UK female contraception market, of which IUDs are a vital component, is projected to reach XXX Million Units by 2033, reflecting this robust growth trajectory.

Dominant Regions, Countries, or Segments in UK Intrauterine Contraceptive Devices Market

Within the UK, the Female segment is undeniably the dominant force driving the Intrauterine Contraceptive Devices Market, with the Intra Uterine Device (IUD) category itself being the primary growth engine. The increasing focus on women's health and reproductive choices has propelled IUDs to the forefront of contraceptive options. This dominance is underpinned by several key drivers:

- High Efficacy and Long-Term Protection: IUDs offer highly effective, long-acting reversible contraception, appealing to women seeking reliable and hassle-free birth control for extended periods. This aligns with evolving lifestyle choices and family planning goals.

- Growing Awareness and Education: Public health campaigns and increased access to information have significantly boosted awareness of the benefits and availability of IUDs, including both hormonal and copper variants.

- Shift Towards LARCs: There's a discernible global and national trend towards Long-Acting Reversible Contraceptives (LARCs), with IUDs being a leading LARC method. This shift is driven by their convenience and superior effectiveness compared to shorter-acting methods.

- Healthcare Provider Endorsement: Gynecologists and general practitioners are increasingly recommending IUDs, particularly for younger women and those who have had children, due to their safety profile and effectiveness.

- Product Innovation: Continuous innovation in IUD design, including smaller sizes, improved inserters, and advancements in non-hormonal options, are expanding their appeal to a wider demographic.

- Governmental Support for Family Planning: Policies and funding aimed at supporting accessible and comprehensive reproductive healthcare services indirectly bolster the market for effective contraceptive devices like IUDs.

The UK market, as a whole, exhibits strong adoption rates for advanced contraceptive technologies. While other segments like condoms remain important, the IUD segment is experiencing the most significant expansion in terms of market share and projected growth within the broader UK contraceptive landscape. The demand for IUDs is robust across all major regions of the UK, with urban centers often showing higher adoption rates due to greater access to specialized healthcare facilities and a more concentrated population. The projected market for IUDs in the UK is expected to contribute significantly to the overall XXX Million Units contraceptive market.

UK Intrauterine Contraceptive Devices Market Product Landscape

The UK Intrauterine Contraceptive Devices Market is witnessing a wave of product innovations designed to enhance efficacy, safety, and user comfort. Key advancements include the development of smaller-sized IUDs to accommodate a wider range of uterine anatomies and reduce insertion discomfort. Furthermore, research into novel materials and drug-delivery systems for hormonal IUDs aims to optimize hormone release profiles, potentially reducing side effects and extending product lifespan. The growing demand for non-hormonal options is also spurring innovation in copper IUD technology, focusing on enhanced copper release and improved retention. Performance metrics such as Pearl Index values (measuring contraceptive failure rates) continue to be a critical benchmark for product differentiation, with IUDs consistently demonstrating exceptionally low failure rates compared to other reversible methods. Unique selling propositions revolve around long-term protection (3-10 years depending on the device), high efficacy, and discreet, reversible contraception.

Key Drivers, Barriers & Challenges in UK Intrauterine Contraceptive Devices Market

Key Drivers:

The UK Intrauterine Contraceptive Devices Market is propelled by several key drivers. The increasing demand for highly effective, long-acting reversible contraception (LARC) among women seeking reliable birth control is a primary catalyst. Technological advancements leading to improved IUD designs, including smaller sizes and potentially hormone-free options, are expanding user acceptance. Furthermore, growing awareness campaigns and educational initiatives highlighting the benefits of IUDs, coupled with supportive healthcare policies promoting reproductive health, significantly contribute to market growth.

Barriers & Challenges:

Despite robust growth, the market faces certain barriers and challenges. Misconceptions and a lack of comprehensive understanding about IUDs among some segments of the population can create hesitation. The cost of IUD insertion, although often covered by the NHS, can still be a perceived barrier for some individuals. Supply chain disruptions and the availability of trained healthcare professionals for insertion and removal can also pose challenges. Moreover, competition from other contraceptive methods and the need for continuous innovation to maintain a competitive edge remain persistent concerns.

Emerging Opportunities in UK Intrauterine Contraceptive Devices Market

Emerging opportunities in the UK Intrauterine Contraceptive Devices Market lie in the continued development and promotion of non-hormonal IUDs, catering to the growing segment of users seeking alternatives to hormonal contraception. The expansion of telemedicine services for contraceptive counseling and follow-up appointments presents a significant opportunity to improve accessibility and convenience. Furthermore, exploring innovative delivery mechanisms and patient education strategies tailored to younger demographics and diverse cultural backgrounds can unlock untapped market potential. Increased research into the long-term health benefits and cost-effectiveness of IUDs will further solidify their position in the market.

Growth Accelerators in the UK Intrauterine Contraceptive Devices Market Industry

Several catalysts are accelerating the growth of the UK Intrauterine Contraceptive Devices Market. Technological breakthroughs in materials science and miniaturization are enabling the development of more advanced and user-friendly IUDs. Strategic partnerships between device manufacturers, healthcare providers, and public health organizations are crucial for expanding market reach and patient education. Government initiatives aimed at improving access to comprehensive reproductive healthcare services, including LARC methods, are also significant growth accelerators. Furthermore, a growing emphasis on preventative healthcare and personalized medicine is fostering greater adoption of long-term contraceptive solutions.

Key Players Shaping the UK Intrauterine Contraceptive Devices Market Market

- AbbVie Inc (Allergan)

- Pregna International Limited

- Bayer AG

- Reckitt Benckiser

- Teva Pharmaceutical Industries Ltd

- Viatris (Mylan Laboratories)

- Cooper Surgical Inc

- DKT International

- Pfizer Inc

Notable Milestones in UK Intrauterine Contraceptive Devices Market Sector

- September 2022: Novo Nordisk launched an over-the-counter hormone replacement therapy drug in the United Kingdom, expanding its portfolio and potentially influencing the broader hormonal health market.

- July 2022: Organon entered into a research collaboration and exclusive license agreement with Cirqle Biomedical to develop a novel investigational non-hormonal, on-demand contraceptive candidate, signaling a push towards innovative contraceptive solutions.

In-Depth UK Intrauterine Contraceptive Devices Market Market Outlook

The UK Intrauterine Contraceptive Devices Market is set for sustained expansion, driven by an increasing demand for highly effective and long-acting contraceptive solutions. Future growth will be significantly influenced by continued innovation in both hormonal and non-hormonal IUD technologies, alongside a greater emphasis on personalized reproductive healthcare. Strategic collaborations and robust public health initiatives promoting LARC methods will further solidify the market's trajectory. The increasing adoption of IUDs by younger women and the ongoing research into their long-term benefits present compelling opportunities for market players to capitalize on evolving consumer preferences and advancements in women's health.

UK Intrauterine Contraceptive Devices Market Segmentation

-

1. Type

- 1.1. Condoms

- 1.2. Diaphragms

- 1.3. Cervical Caps

- 1.4. Vaginal Rings

- 1.5. Intra Uterine Device (IUD)

- 1.6. Other Types

-

2. Gender

- 2.1. Male

- 2.2. Female

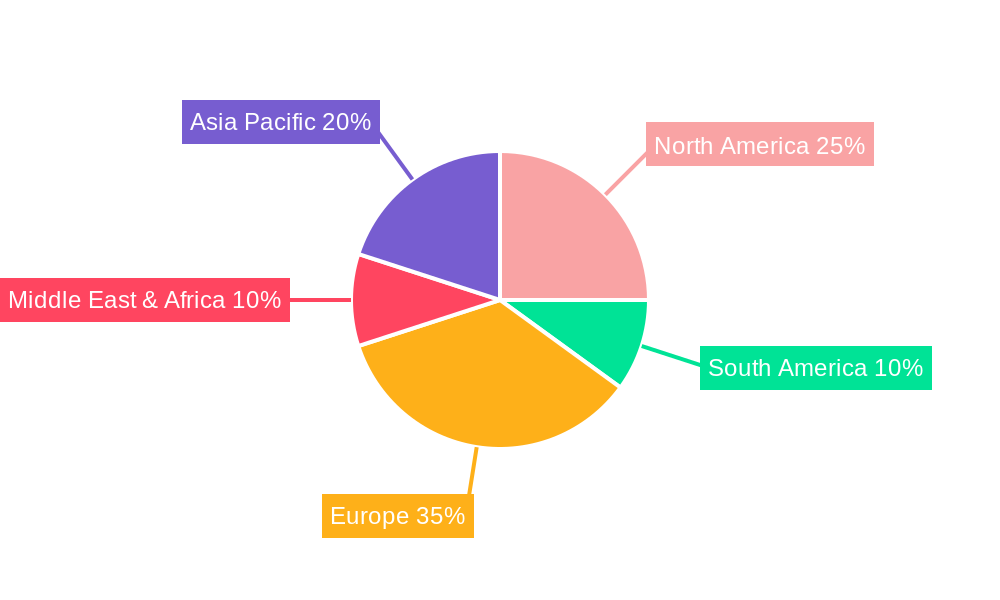

UK Intrauterine Contraceptive Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Intrauterine Contraceptive Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Prevalence of Sexually Transmitted Diseases and Increasing Awareness about STDs; Rising Rate of Unintended Pregnancies & Rise in Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Side Effects Associated with the Use of Contraceptive Devices

- 3.4. Market Trends

- 3.4.1. Condoms are Expected to Dominate the United Kingdom Contraceptive Devices Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Intrauterine Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condoms

- 5.1.2. Diaphragms

- 5.1.3. Cervical Caps

- 5.1.4. Vaginal Rings

- 5.1.5. Intra Uterine Device (IUD)

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Gender

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Intrauterine Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Condoms

- 6.1.2. Diaphragms

- 6.1.3. Cervical Caps

- 6.1.4. Vaginal Rings

- 6.1.5. Intra Uterine Device (IUD)

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Gender

- 6.2.1. Male

- 6.2.2. Female

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Intrauterine Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Condoms

- 7.1.2. Diaphragms

- 7.1.3. Cervical Caps

- 7.1.4. Vaginal Rings

- 7.1.5. Intra Uterine Device (IUD)

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Gender

- 7.2.1. Male

- 7.2.2. Female

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Intrauterine Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Condoms

- 8.1.2. Diaphragms

- 8.1.3. Cervical Caps

- 8.1.4. Vaginal Rings

- 8.1.5. Intra Uterine Device (IUD)

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Gender

- 8.2.1. Male

- 8.2.2. Female

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Intrauterine Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Condoms

- 9.1.2. Diaphragms

- 9.1.3. Cervical Caps

- 9.1.4. Vaginal Rings

- 9.1.5. Intra Uterine Device (IUD)

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Gender

- 9.2.1. Male

- 9.2.2. Female

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Intrauterine Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Condoms

- 10.1.2. Diaphragms

- 10.1.3. Cervical Caps

- 10.1.4. Vaginal Rings

- 10.1.5. Intra Uterine Device (IUD)

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Gender

- 10.2.1. Male

- 10.2.2. Female

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. England UK Intrauterine Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Intrauterine Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Intrauterine Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Intrauterine Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Intrauterine Contraceptive Devices Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 AbbVie Inc (Allergan)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Pregna International Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bayer AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Reckitt Benckiser*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Teva Pharmaceutical Industries Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Viatris (Mylan Laboratories)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Cooper Surgical Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 DKT International

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Pfizer Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 AbbVie Inc (Allergan)

List of Figures

- Figure 1: Global UK Intrauterine Contraceptive Devices Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Intrauterine Contraceptive Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Intrauterine Contraceptive Devices Market Revenue (Million), by Type 2024 & 2032

- Figure 5: North America UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America UK Intrauterine Contraceptive Devices Market Revenue (Million), by Gender 2024 & 2032

- Figure 7: North America UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Gender 2024 & 2032

- Figure 8: North America UK Intrauterine Contraceptive Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America UK Intrauterine Contraceptive Devices Market Revenue (Million), by Type 2024 & 2032

- Figure 11: South America UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America UK Intrauterine Contraceptive Devices Market Revenue (Million), by Gender 2024 & 2032

- Figure 13: South America UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Gender 2024 & 2032

- Figure 14: South America UK Intrauterine Contraceptive Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe UK Intrauterine Contraceptive Devices Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe UK Intrauterine Contraceptive Devices Market Revenue (Million), by Gender 2024 & 2032

- Figure 19: Europe UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Gender 2024 & 2032

- Figure 20: Europe UK Intrauterine Contraceptive Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa UK Intrauterine Contraceptive Devices Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa UK Intrauterine Contraceptive Devices Market Revenue (Million), by Gender 2024 & 2032

- Figure 25: Middle East & Africa UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Gender 2024 & 2032

- Figure 26: Middle East & Africa UK Intrauterine Contraceptive Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific UK Intrauterine Contraceptive Devices Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific UK Intrauterine Contraceptive Devices Market Revenue (Million), by Gender 2024 & 2032

- Figure 31: Asia Pacific UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Gender 2024 & 2032

- Figure 32: Asia Pacific UK Intrauterine Contraceptive Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific UK Intrauterine Contraceptive Devices Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Gender 2019 & 2032

- Table 4: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: England UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Wales UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Scotland UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Ireland UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Gender 2019 & 2032

- Table 13: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Gender 2019 & 2032

- Table 19: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Gender 2019 & 2032

- Table 25: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Gender 2019 & 2032

- Table 37: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Gender 2019 & 2032

- Table 46: Global UK Intrauterine Contraceptive Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific UK Intrauterine Contraceptive Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Intrauterine Contraceptive Devices Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the UK Intrauterine Contraceptive Devices Market?

Key companies in the market include AbbVie Inc (Allergan), Pregna International Limited, Bayer AG, Reckitt Benckiser*List Not Exhaustive, Teva Pharmaceutical Industries Ltd, Viatris (Mylan Laboratories), Cooper Surgical Inc, DKT International, Pfizer Inc.

3. What are the main segments of the UK Intrauterine Contraceptive Devices Market?

The market segments include Type, Gender.

4. Can you provide details about the market size?

The market size is estimated to be USD 395.62 Million as of 2022.

5. What are some drivers contributing to market growth?

High Prevalence of Sexually Transmitted Diseases and Increasing Awareness about STDs; Rising Rate of Unintended Pregnancies & Rise in Government Initiatives.

6. What are the notable trends driving market growth?

Condoms are Expected to Dominate the United Kingdom Contraceptive Devices Market.

7. Are there any restraints impacting market growth?

Side Effects Associated with the Use of Contraceptive Devices.

8. Can you provide examples of recent developments in the market?

September 2022: Novo Nordisk, a key player in the pharmaceutical industry, launched an over-the-counter hormone replacement therapy drug in the United Kingdom. This move is expected to expand the company's portfolio and increase its market share in the hormone replacement therapy segment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Intrauterine Contraceptive Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Intrauterine Contraceptive Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Intrauterine Contraceptive Devices Market?

To stay informed about further developments, trends, and reports in the UK Intrauterine Contraceptive Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence