Key Insights

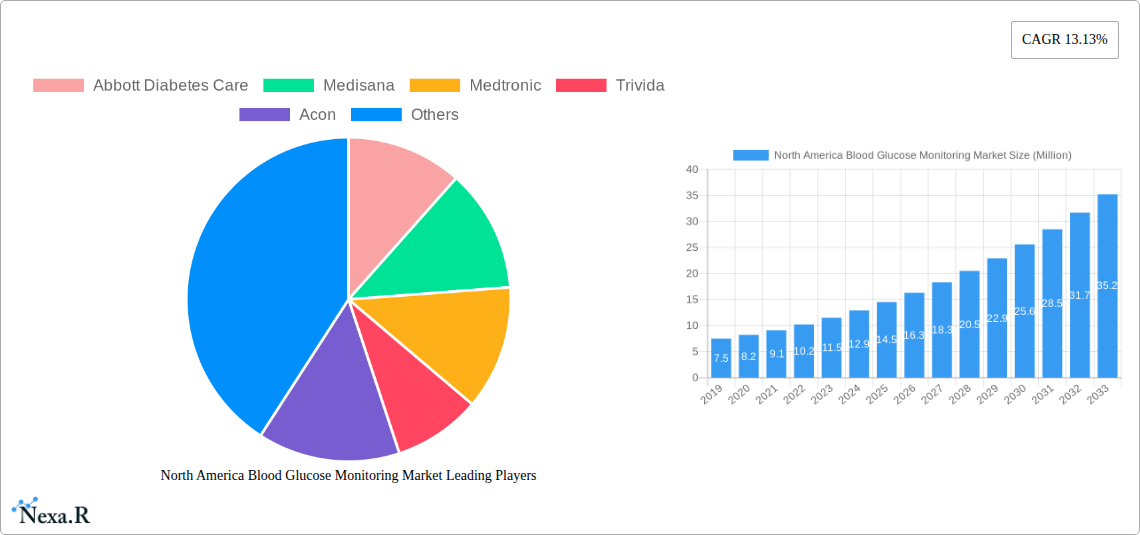

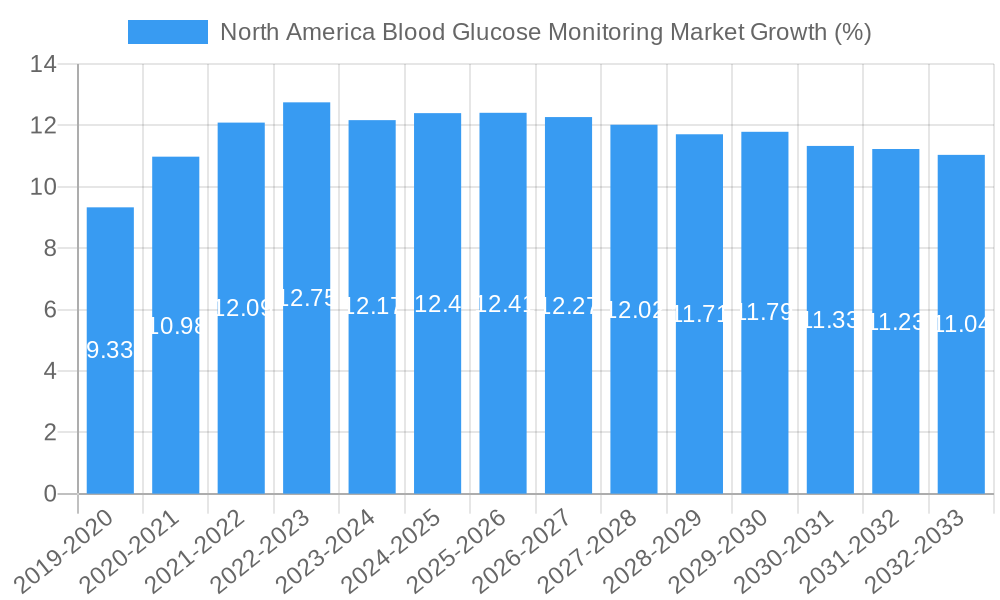

The North America Blood Glucose Monitoring Market is experiencing robust growth, projected to reach approximately USD 15.51 billion by 2025. This expansion is fueled by a significant Compound Annual Growth Rate (CAGR) of 13.13%, indicating strong momentum for the sector through 2033. Key drivers behind this impressive trajectory include the increasing prevalence of diabetes across North America, a growing awareness of proactive health management, and the continuous innovation in blood glucose monitoring technologies. The market is segmented into distinct device categories: Self-monitoring Blood Glucose Devices, encompassing glucometers, test strips, and lancets, and Continuous Glucose Monitoring (CGM) systems, which include advanced sensors and durable components. The shift towards less invasive and more integrated monitoring solutions is a prominent trend, with CGM devices gaining substantial traction due to their ability to provide real-time data and reduce the need for frequent finger pricks.

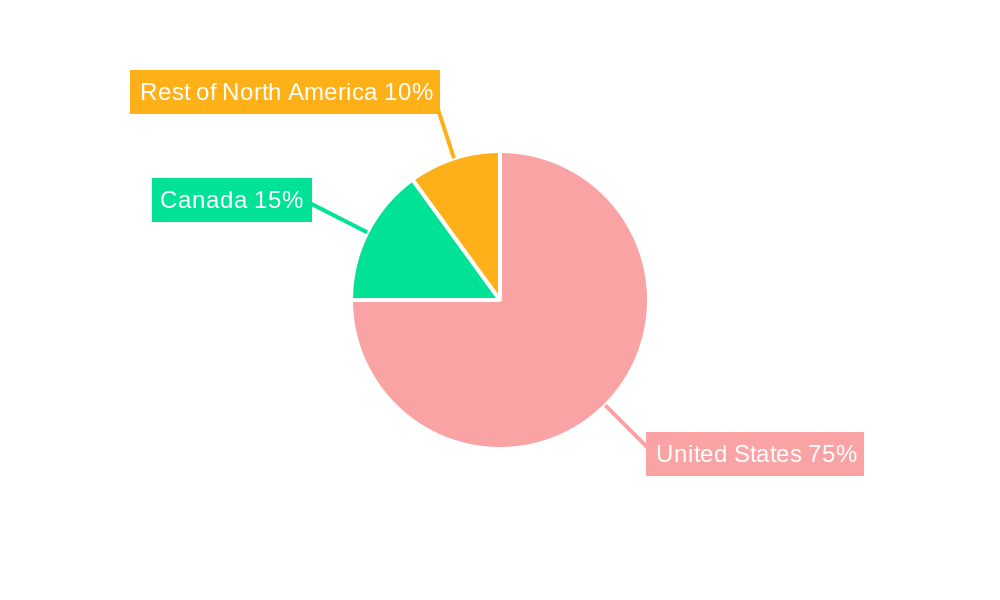

The end-user landscape is predominantly shaped by the increasing adoption of home and personal monitoring devices, driven by convenience and the desire for personalized health management. However, hospitals and clinics remain crucial for diagnosis, treatment initiation, and specialized care. Geographically, the United States commands the largest market share within North America, followed by Canada and the rest of the region. Emerging trends indicate a growing demand for smart connected devices that integrate with mobile applications and electronic health records, enhancing data accessibility and facilitating better patient-physician communication. While the market is characterized by strong growth, potential restraints could include the high cost of advanced monitoring systems and challenges related to data security and privacy. Nevertheless, the consistent advancements in technology and the escalating need for effective diabetes management solutions position the North America Blood Glucose Monitoring Market for sustained and significant expansion.

This in-depth report provides a detailed analysis of the North America Blood Glucose Monitoring Market, offering strategic insights and actionable intelligence for stakeholders. It covers market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, growth accelerators, and a comprehensive company and milestone overview. The study encompasses the historical period (2019-2024), base year (2025), estimated year (2025), and a robust forecast period (2025-2033), with all values presented in Million units.

North America Blood Glucose Monitoring Market Dynamics & Structure

The North America blood glucose monitoring market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and shifting end-user demographics. Market concentration is moderate, with a few key players holding significant shares, but a robust pipeline of emerging companies fuels competition. Technological advancements, particularly in continuous glucose monitoring (CGM) and connected devices, are primary drivers, enhancing user convenience and data accuracy. Stringent regulatory approvals, while ensuring product safety and efficacy, also present a barrier to entry for new technologies. Competitive product substitutes, such as non-invasive glucose monitoring technologies, are under development but are yet to gain widespread market traction. End-user demographics, driven by an aging population and increasing prevalence of diabetes, are expanding the demand for efficient glucose management solutions. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and technology acquisition, with a notable trend towards integration of CGM systems with insulin delivery devices. For instance, the market saw an estimated XX M&A deals in the historical period, reflecting the industry's drive for synergy.

- Market Concentration: Moderate, with key players like Abbott Diabetes Care, Medtronic, and F Hoffmann-La Roche AG holding substantial shares, but with growing influence from specialized CGM manufacturers.

- Technological Innovation Drivers: Development of advanced CGM sensors, miniaturization of devices, improved data analytics, and integration with smart devices and insulin pumps.

- Regulatory Frameworks: FDA approvals and stringent data privacy regulations influence product development and market entry timelines.

- Competitive Product Substitutes: Emerging non-invasive glucose monitoring technologies pose a long-term threat, though currently in early stages of development.

- End-User Demographics: Rising diabetes prevalence, an aging population, and increasing patient awareness are key demand drivers.

- M&A Trends: Strategic acquisitions to gain access to innovative technologies and expand product portfolios, particularly in the CGM segment.

North America Blood Glucose Monitoring Market Growth Trends & Insights

The North America blood glucose monitoring market is poised for significant expansion, fueled by an increasing diabetes prevalence and the accelerating adoption of advanced monitoring technologies. The market size is projected to grow from an estimated $X,XXX million units in the base year 2025 to $Y,YYY million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This growth is underpinned by a rise in diagnosis rates for Type 1 and Type 2 diabetes, particularly in the United States, leading to a larger patient pool requiring consistent glucose management. Continuous Glucose Monitoring (CGM) devices are experiencing particularly robust adoption rates, driven by their ability to provide real-time glucose data, trend analysis, and reduce the need for frequent fingerstick tests. Technological disruptions, such as the development of smaller, more discreet, and longer-lasting sensors, are further enhancing user experience and encouraging uptake.

Consumer behavior is also shifting towards proactive health management and a preference for connected health solutions. Patients are increasingly seeking devices that offer seamless data integration with smartphones and other health platforms, enabling better self-management and remote monitoring by healthcare providers. The convenience and improved clinical outcomes associated with CGM systems are persuading more individuals, including those with less severe forms of diabetes or prediabetes, to consider these advanced technologies. The market penetration of CGM devices, though currently lower than traditional self-monitoring blood glucose (SMBG) devices, is expected to rise dramatically as costs decrease and reimbursement policies evolve. Furthermore, the increasing awareness of the long-term complications associated with poorly controlled diabetes is driving demand for more accurate and continuous monitoring solutions. The trend towards personalized medicine and data-driven healthcare further bolsters the growth of the blood glucose monitoring market, as insights derived from glucose data can inform tailored treatment plans.

Dominant Regions, Countries, or Segments in North America Blood Glucose Monitoring Market

The United States stands as the undisputed dominant force within the North America Blood Glucose Monitoring Market, consistently outpacing Canada and the Rest of North America in terms of market size, adoption rates, and technological innovation. This dominance is driven by a confluence of factors, including its large and aging population, the highest prevalence of diabetes in the region, and a well-established healthcare infrastructure that readily adopts new medical technologies. The country's robust reimbursement landscape for diabetes management devices, coupled with a high level of health insurance coverage, significantly contributes to the accessibility and affordability of advanced blood glucose monitoring solutions, particularly Continuous Glucose Monitoring (CGM) systems.

Within the broader market segments, the Device: Continuous Glucose Monitoring (CGM) segment, comprising Sensors and Durables, is exhibiting the most rapid growth and holds significant future potential. This surge is propelled by the increasing demand for real-time glucose data, the superior clinical outcomes offered by CGM technology compared to traditional Self-Monitoring Blood Glucose (SMBG) devices, and the ongoing technological advancements that enhance sensor accuracy, wearability, and connectivity. The End User: Home/Personal segment is also a major contributor to market growth, reflecting the trend towards decentralized healthcare and increased patient empowerment in managing their chronic conditions. The convenience of home-based monitoring, coupled with the growing comfort of individuals with using connected health devices, fuels this segment's expansion.

Dominant Geography: United States

- Key Drivers: High diabetes prevalence, large aging population, advanced healthcare infrastructure, robust reimbursement policies for advanced diabetes technologies, high disposable income, and strong health insurance coverage.

- Market Share Contribution: The United States accounts for approximately XX% of the total North America market.

- Growth Potential: Continual innovation in CGM technology and increasing adoption among a wider patient demographic ensure sustained high growth.

Dominant Device Segment: Continuous Glucose Monitoring (CGM)

- Key Drivers: Superior accuracy and real-time data provision, trend analysis capabilities, reduced need for finger pricks, integration with insulin pumps, technological advancements in sensor design and lifespan.

- Market Share (CGM): Estimated to be around XX% of the total device market in the base year.

- Growth Potential: Expected to exhibit a CAGR of XX% during the forecast period, driven by technological improvements and increasing affordability.

Dominant End User Segment: Home/Personal

- Key Drivers: Increasing patient empowerment in self-management, convenience of home-based monitoring, growing adoption of connected health devices, telehealth integration, and a desire for better lifestyle integration.

- Market Share (Home/Personal): Represents approximately XX% of the total end-user market.

- Growth Potential: Continued expansion as more individuals embrace remote health monitoring and personalized data-driven health management.

North America Blood Glucose Monitoring Market Product Landscape

The North America blood glucose monitoring market is defined by continuous product innovation, enhancing both the accuracy and user-friendliness of glucose management devices. Key innovations include the development of smaller, more discreet, and longer-lasting CGM sensors, offering extended wear times and improved comfort. Advancements in data analytics and connectivity allow for seamless integration with smartphones and insulin delivery systems, providing users with comprehensive insights and automated insulin dosing capabilities. Performance metrics such as sensor accuracy (Mean Absolute Relative Difference - MARD), time in range (TIR) tracking, and ease of data sharing are critical differentiators. Unique selling propositions often revolve around reduced pain, real-time alerts for critical glucose levels, and user-friendly interfaces that empower individuals to take greater control of their diabetes management.

Key Drivers, Barriers & Challenges in North America Blood Glucose Monitoring Market

Key Drivers:

- Rising Diabetes Prevalence: The escalating rates of Type 1 and Type 2 diabetes globally and within North America necessitate continuous and accurate glucose monitoring.

- Technological Advancements: The development of Continuous Glucose Monitoring (CGM) systems, integrated devices, and data analytics platforms significantly improves patient outcomes and user experience.

- Growing Health Awareness: Increased patient education and awareness regarding diabetes management and its long-term complications drive demand for sophisticated monitoring tools.

- Reimbursement Policies: Favorable reimbursement policies for advanced monitoring technologies, particularly CGM, in countries like the United States, enhance accessibility.

Barriers & Challenges:

- High Cost of Advanced Devices: The initial cost of CGM systems and associated consumables can still be a significant barrier for a portion of the population, despite improving affordability.

- Regulatory Hurdles: Stringent regulatory approval processes by agencies like the FDA can lengthen product development cycles and increase market entry costs.

- Data Security and Privacy Concerns: The increasing volume of sensitive health data generated by connected monitoring devices raises concerns about data security and patient privacy.

- Interoperability Issues: Lack of standardized data protocols can create challenges in integrating different devices and platforms, hindering seamless data flow.

- Physician Adoption and Training: Ensuring healthcare professionals are adequately trained and comfortable recommending and utilizing advanced glucose monitoring data is crucial for widespread adoption.

Emerging Opportunities in North America Blood Glucose Monitoring Market

Emerging opportunities in the North America blood glucose monitoring market are centered around personalized diabetes care, predictive analytics, and accessibility for underserved populations. The development of AI-powered algorithms that can predict glucose trends and potential hypoglycemic or hyperglycemic events presents a significant opportunity for proactive intervention. Expansion into prediabetes management and wellness tracking, leveraging glucose monitoring data for broader metabolic health insights, is another promising avenue. Furthermore, the development of more affordable and accessible CGM solutions for lower-income segments and the integration of these devices into remote patient monitoring programs for chronic disease management offer untapped market potential. The increasing focus on preventative healthcare also opens doors for devices that can provide early warnings and actionable insights beyond just glucose levels.

Growth Accelerators in the North America Blood Glucose Monitoring Market Industry

Growth in the North America Blood Glucose Monitoring Market is being significantly accelerated by several key factors. The ongoing innovation in sensor technology, leading to improved accuracy, comfort, and longevity, directly drives adoption. Strategic partnerships and collaborations between device manufacturers, pharmaceutical companies, and healthcare providers are crucial for expanding market reach and integrating glucose monitoring into broader diabetes management ecosystems. The increasing trend towards digital health and telehealth platforms is also a major accelerator, enabling remote patient monitoring and facilitating better communication between patients and clinicians. Furthermore, the development of user-friendly mobile applications that provide actionable insights and educational resources empowers patients and fosters greater engagement with their health, thereby boosting the demand for connected monitoring devices.

Key Players Shaping the North America Blood Glucose Monitoring Market Market

- Abbott Diabetes Care

- Medtronic

- F Hoffmann-La Roche AG

- Dexcom

- Ascensia Diabetes Care

- Johnson & Johnson

- Medisana

- Trivida

- Acon

- Rossmax

- Agamatrix Inc

- Bionime Corporation

- Arkray

Notable Milestones in North America Blood Glucose Monitoring Market Sector

- March 2023: Modified Abbott CGM sensors scored FDA nod for use in automated insulin delivery systems.

- December 2022: Dexcom, a company that manufactures continuous glucose monitors (CGMs) for blood sugar management, announced the FDA approval for their next-generation product, the Dexcom G7 CGM. The G7 is approved for people with all types of diabetes from ages two years and older.

In-Depth North America Blood Glucose Monitoring Market Market Outlook

- March 2023: Modified Abbott CGM sensors scored FDA nod for use in automated insulin delivery systems.

- December 2022: Dexcom, a company that manufactures continuous glucose monitors (CGMs) for blood sugar management, announced the FDA approval for their next-generation product, the Dexcom G7 CGM. The G7 is approved for people with all types of diabetes from ages two years and older.

In-Depth North America Blood Glucose Monitoring Market Market Outlook

The future of the North America Blood Glucose Monitoring Market is exceptionally promising, driven by continuous technological breakthroughs and a growing emphasis on personalized and preventative healthcare. The integration of advanced algorithms for predictive analytics and proactive diabetes management will revolutionize how chronic conditions are managed. Strategic alliances between key market players and the expansion of digital health ecosystems are poised to create more comprehensive and user-centric solutions. The increasing demand for seamless data integration and remote monitoring capabilities will further solidify the market's upward trajectory. As wearable technology evolves and costs become more competitive, the penetration of advanced monitoring solutions will broaden, making proactive diabetes management accessible to a wider demographic. The market is set to witness significant growth, fueled by innovation and a commitment to improving the lives of individuals living with diabetes.

North America Blood Glucose Monitoring Market Segmentation

-

1. Device

-

1.1. Self-monitoring Blood Glucose Devices

- 1.1.1. Glucometer Devices

- 1.1.2. Test Strips

- 1.1.3. Lancets

-

1.2. Continuous Glucose Monitoring

- 1.2.1. Sensors

- 1.2.2. Durables

-

1.1. Self-monitoring Blood Glucose Devices

-

2. End User

- 2.1. Hospital/Clinics

- 2.2. Home/Personal

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Blood Glucose Monitoring Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Blood Glucose Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Continuous Glucose Monitoring Holds Highest Market Share in the North American Blood Glucose Monitoring Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.1. Glucometer Devices

- 5.1.1.2. Test Strips

- 5.1.1.3. Lancets

- 5.1.2. Continuous Glucose Monitoring

- 5.1.2.1. Sensors

- 5.1.2.2. Durables

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospital/Clinics

- 5.2.2. Home/Personal

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. United States North America Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Self-monitoring Blood Glucose Devices

- 6.1.1.1. Glucometer Devices

- 6.1.1.2. Test Strips

- 6.1.1.3. Lancets

- 6.1.2. Continuous Glucose Monitoring

- 6.1.2.1. Sensors

- 6.1.2.2. Durables

- 6.1.1. Self-monitoring Blood Glucose Devices

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospital/Clinics

- 6.2.2. Home/Personal

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Canada North America Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Self-monitoring Blood Glucose Devices

- 7.1.1.1. Glucometer Devices

- 7.1.1.2. Test Strips

- 7.1.1.3. Lancets

- 7.1.2. Continuous Glucose Monitoring

- 7.1.2.1. Sensors

- 7.1.2.2. Durables

- 7.1.1. Self-monitoring Blood Glucose Devices

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospital/Clinics

- 7.2.2. Home/Personal

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Rest of North America North America Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Self-monitoring Blood Glucose Devices

- 8.1.1.1. Glucometer Devices

- 8.1.1.2. Test Strips

- 8.1.1.3. Lancets

- 8.1.2. Continuous Glucose Monitoring

- 8.1.2.1. Sensors

- 8.1.2.2. Durables

- 8.1.1. Self-monitoring Blood Glucose Devices

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospital/Clinics

- 8.2.2. Home/Personal

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. United States North America Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Blood Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Abbott Diabetes Care

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Medisana

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Medtronic

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Trivida

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Acon

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Rossmax*List Not Exhaustive 7 2 Company Share Analysi

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Agamatrix Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 F Hoffmann-La Roche AG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Bionime Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Johnson & Johnson

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Arkray

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Dexcom

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Ascensia Diabetes Care

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Abbott Diabetes Care

List of Figures

- Figure 1: North America Blood Glucose Monitoring Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Blood Glucose Monitoring Market Share (%) by Company 2024

List of Tables

- Table 1: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Device 2019 & 2032

- Table 3: North America Blood Glucose Monitoring Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Blood Glucose Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Blood Glucose Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Blood Glucose Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Blood Glucose Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Device 2019 & 2032

- Table 12: North America Blood Glucose Monitoring Market Revenue Million Forecast, by End User 2019 & 2032

- Table 13: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Device 2019 & 2032

- Table 16: North America Blood Glucose Monitoring Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Device 2019 & 2032

- Table 20: North America Blood Glucose Monitoring Market Revenue Million Forecast, by End User 2019 & 2032

- Table 21: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Blood Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Blood Glucose Monitoring Market?

The projected CAGR is approximately 13.13%.

2. Which companies are prominent players in the North America Blood Glucose Monitoring Market?

Key companies in the market include Abbott Diabetes Care, Medisana, Medtronic, Trivida, Acon, Rossmax*List Not Exhaustive 7 2 Company Share Analysi, Agamatrix Inc, F Hoffmann-La Roche AG, Bionime Corporation, Johnson & Johnson, Arkray, Dexcom, Ascensia Diabetes Care.

3. What are the main segments of the North America Blood Glucose Monitoring Market?

The market segments include Device, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Continuous Glucose Monitoring Holds Highest Market Share in the North American Blood Glucose Monitoring Market..

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

March 2023: Modified Abbott CGM sensors scored FDA nod for use in automated insulin delivery systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Blood Glucose Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Blood Glucose Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Blood Glucose Monitoring Market?

To stay informed about further developments, trends, and reports in the North America Blood Glucose Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence