Key Insights

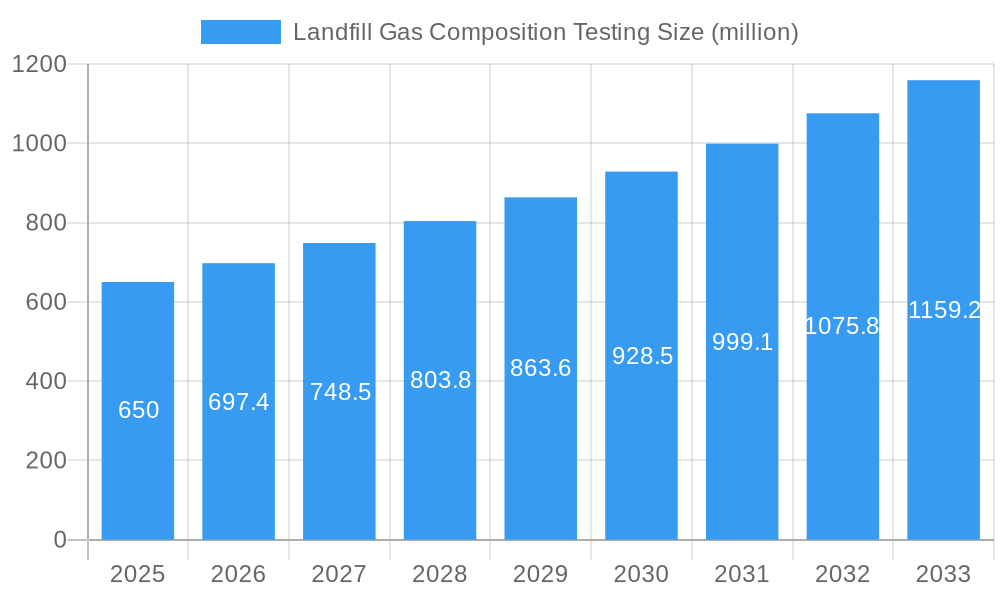

The global Landfill Gas Composition Testing market is poised for robust expansion, projected to reach an estimated USD 650 million by 2025, and grow at a Compound Annual Growth Rate (CAGR) of approximately 7.2% through 2033. This growth is significantly driven by the increasing global focus on environmental protection and sustainable waste management practices. Governments worldwide are implementing stricter regulations for monitoring landfill emissions, especially methane, a potent greenhouse gas. Consequently, the demand for accurate and reliable landfill gas composition testing services is escalating. Urban environmental protection stands out as a primary application segment, reflecting the urgent need to mitigate the environmental impact of burgeoning urban populations. Industrial safety is also a key driver, as accurate gas analysis is crucial for preventing potential hazards like explosions and ensuring worker well-being in and around landfill sites. The market's expansion is further fueled by advancements in analytical technologies, such as more sophisticated Gas Chromatography and Infrared Spectroscopy, which offer enhanced precision and efficiency in gas detection and quantification.

Landfill Gas Composition Testing Market Size (In Million)

The forecast period anticipates sustained growth due to ongoing investments in waste-to-energy projects and the expanding infrastructure for landfill gas capture and utilization. The need to comply with international environmental standards and the growing awareness of climate change are pivotal factors propelling the market forward. While the market demonstrates a positive trajectory, certain restraints may influence its pace. These could include the high initial investment cost for advanced testing equipment and the availability of skilled professionals to operate sophisticated analytical instruments. However, the overarching imperative for environmental stewardship and the economic benefits derived from landfill gas valorization are expected to outweigh these challenges. Asia Pacific, led by China and India, is anticipated to emerge as a significant growth region, driven by rapid industrialization and increasing urbanization, leading to a surge in waste generation and the subsequent need for comprehensive landfill gas management.

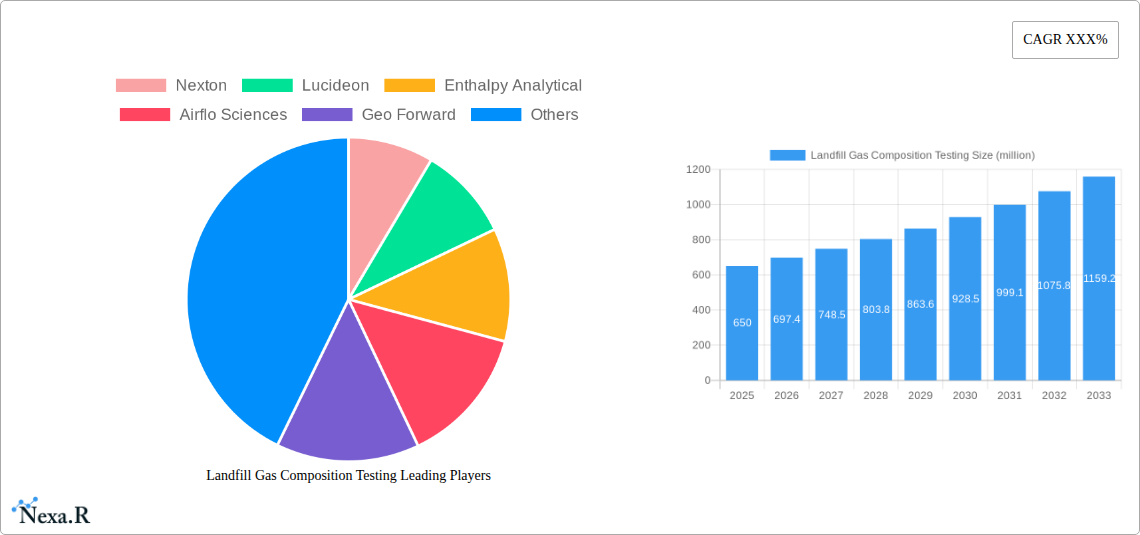

Landfill Gas Composition Testing Company Market Share

This comprehensive report delves into the global Landfill Gas Composition Testing market, providing an in-depth analysis of its dynamics, growth trends, and future outlook. We explore critical aspects such as market size evolution, technological advancements, regulatory landscapes, and key player strategies. With a focus on Urban Environmental Protection and Industrial Safety, this report is an indispensable resource for industry professionals seeking to navigate this vital sector.

Landfill Gas Composition Testing Market Dynamics & Structure

The global Landfill Gas Composition Testing market exhibits a moderately concentrated structure, with a few dominant players alongside a growing number of specialized service providers. Technological innovation is a primary driver, fueled by advancements in analytical techniques like Gas Chromatography Analysis and Infrared Spectroscopy Analysis. These innovations enable more precise and comprehensive gas characterization, crucial for effective environmental monitoring and industrial safety protocols. Regulatory frameworks, particularly those focused on emissions control and waste management, are increasingly stringent, creating sustained demand for reliable testing services. For instance, evolving regulations in the Urban Environmental Protection segment mandate rigorous monitoring of methane and other greenhouse gas emissions from landfills, directly impacting market growth. Competitive product substitutes are minimal, as landfill gas composition testing is a highly specialized service with limited direct alternatives. However, improvements in in-situ monitoring technologies and advanced modeling techniques could offer indirect competition in the long term. End-user demographics are broad, encompassing municipal waste management authorities, industrial facilities with waste processing operations, environmental consulting firms, and research institutions. Mergers and acquisitions (M&A) trends are observed as larger environmental service companies seek to broaden their capabilities and market reach, with an estimated 5-8 significant M&A deals projected within the historical period.

- Market Concentration: Moderate to High, with key players holding significant market share, estimated at 30-40% for the top 5 companies.

- Technological Innovation Drivers: Precision, speed, and cost-effectiveness of analytical techniques; development of portable and real-time monitoring devices.

- Regulatory Frameworks: Stringent emissions standards, landfill operational permits, and waste-to-energy initiatives worldwide.

- Competitive Product Substitutes: Limited, but potential indirect competition from advanced in-situ sensors and modeling software.

- End-User Demographics: Municipalities, industrial plants, environmental consultants, research bodies, and energy companies.

- M&A Trends: Strategic acquisitions for capability expansion and market consolidation, with an estimated 7 deal volumes in the historical period.

Landfill Gas Composition Testing Growth Trends & Insights

The Landfill Gas Composition Testing market is projected for robust growth, driven by escalating environmental concerns and the increasing adoption of waste-to-energy technologies. The market size is estimated to have grown from approximately $800 million in 2019 to $1.2 billion in 2024, representing a Compound Annual Growth Rate (CAGR) of around 8.5%. This growth is underpinned by a rising awareness of the environmental impact of landfill emissions and the imperative for industries to comply with stricter environmental regulations. Urban Environmental Protection remains a dominant application, with municipalities globally investing heavily in monitoring and mitigating the release of potent greenhouse gases like methane from landfill sites. The adoption rates of professional landfill gas testing services are steadily increasing as more entities recognize the long-term cost savings associated with efficient gas management and potential revenue generation from landfill gas capture. Technological disruptions are playing a significant role, with continuous advancements in Gas Chromatography Analysis leading to higher accuracy, faster sample turnaround times, and the ability to detect trace contaminants. Similarly, innovations in Infrared Spectroscopy Analysis are enhancing real-time monitoring capabilities and reducing the need for extensive laboratory analysis. Consumer behavior shifts are also influencing the market, with a growing demand for transparency and accountability in waste management practices. This translates into increased pressure on landfill operators and industrial entities to conduct regular and comprehensive gas composition testing. The market penetration of these testing services is expected to rise from approximately 55% in 2019 to an estimated 70% by 2033, reflecting the expanding reach and adoption of these critical environmental services. The base year of 2025 is anticipated to see the market size around $1.35 billion, with an estimated CAGR of 7.8% projected for the forecast period of 2025-2033.

Dominant Regions, Countries, or Segments in Landfill Gas Composition Testing

The Urban Environmental Protection segment, particularly within the Application category, stands as the dominant driver of growth in the global Landfill Gas Composition Testing market. This dominance is largely attributed to increasing urbanization worldwide, leading to a greater volume of waste generation and, consequently, a higher number of active landfills requiring rigorous environmental oversight. Countries with advanced environmental policies and robust waste management infrastructure, such as the United States, Germany, the United Kingdom, and Japan, are at the forefront of this trend. These regions are characterized by comprehensive regulatory frameworks that mandate frequent and detailed analysis of landfill gas composition to curb greenhouse gas emissions and ensure public health.

Within the Type segment, Gas Chromatography Analysis continues to be the most widely adopted and preferred method for landfill gas testing. Its superior separation capabilities allow for the precise identification and quantification of various gas components, including methane (CH4), carbon dioxide (CO2), nitrogen (N2), oxygen (O2), and trace contaminants like volatile organic compounds (VOCs) and hydrogen sulfide (H2S). The market share for Gas Chromatography Analysis is estimated to be around 60-70% of the total testing market.

Key drivers for the dominance of Urban Environmental Protection and Gas Chromatography Analysis include:

- Economic Policies: Government incentives for waste-to-energy projects and carbon emission reduction programs significantly boost the demand for accurate gas composition data. For example, the US Renewable Fuel Standard and European Union's Emissions Trading System create substantial economic impetus.

- Infrastructure Development: Continued investment in new landfill facilities and the upgrading of existing ones in developed and developing nations necessitate ongoing monitoring and testing. The estimated investment in new landfill infrastructure in the top 10 global markets is projected to reach $50 billion by 2030.

- Public Health and Safety Concerns: Rising public awareness regarding the health hazards associated with landfill emissions, such as odor pollution and the potential for explosions due to accumulated gases, drives demand for stringent testing protocols.

- Technological Advancements: Continuous improvements in Gas Chromatography technology, making it more accessible, faster, and accurate, further solidifies its position.

- Market Share and Growth Potential: The Urban Environmental Protection segment is estimated to hold a market share of over 55% and is projected to grow at a CAGR of approximately 8.0% during the forecast period. The growth potential is immense due to the vast number of active and closed landfills requiring long-term monitoring.

Landfill Gas Composition Testing Product Landscape

The product landscape for landfill gas composition testing is characterized by a suite of sophisticated analytical instruments and associated services. Gas chromatographs, equipped with various detectors like Flame Ionization Detectors (FID) and Thermal Conductivity Detectors (TCD), are central to precise component analysis, offering high accuracy in quantifying methane and carbon dioxide concentrations. Infrared spectroscopy analyzers provide complementary capabilities, particularly for real-time monitoring of key gases like CH4 and CO2, enabling rapid detection of significant fluctuations. Specialized sampling equipment, including gas bags, canisters, and probes, ensures representative sample collection from diverse landfill environments. Furthermore, the market offers integrated software solutions for data acquisition, analysis, and reporting, streamlining the entire testing workflow. Unique selling propositions often revolve around portability, automation, data integrity, and compliance with international standards like EPA Method 3C and ASTM D5212. Technological advancements focus on miniaturization, improved sensitivity for trace gas detection, and enhanced field-deployability of analytical systems, making them more robust and user-friendly for on-site testing.

Key Drivers, Barriers & Challenges in Landfill Gas Composition Testing

Key Drivers:

The global Landfill Gas Composition Testing market is propelled by several significant drivers. Increasing environmental regulations worldwide, focused on reducing greenhouse gas emissions and improving air quality, are a primary catalyst. The growing imperative for Urban Environmental Protection necessitates rigorous monitoring of landfill emissions, particularly methane. Furthermore, the burgeoning waste-to-energy sector, which leverages landfill gas as a renewable energy source, directly fuels the demand for accurate composition analysis to optimize operational efficiency and safety. Technological advancements in analytical instrumentation, leading to increased precision, speed, and cost-effectiveness, also contribute significantly.

Barriers & Challenges:

Despite the positive growth trajectory, the market faces certain barriers and challenges. The initial high cost of sophisticated analytical equipment can be a deterrent for smaller entities or regions with limited financial resources. Stringent and evolving regulatory landscapes, while a driver, can also pose a challenge due to the constant need for companies to update their testing methodologies and compliance strategies, potentially incurring additional costs. Skilled personnel with expertise in operating complex analytical instruments and interpreting data are in high demand, creating a potential talent gap. Supply chain disruptions for specialized components and reagents can impact service delivery timelines and operational continuity. Competitive pressures from alternative energy sources and evolving waste management technologies could also present long-term challenges. The cost of specialized calibration gases and consumables adds to the operational expenses, estimated to be between $500 to $2,000 per month per testing unit depending on usage.

Emerging Opportunities in Landfill Gas Composition Testing

Emerging opportunities within the Landfill Gas Composition Testing market are significantly shaped by advancements in sensor technology and the drive towards more sustainable waste management practices. The development of low-cost, high-precision portable sensors for real-time, continuous monitoring of landfill gas composition presents a substantial growth avenue. This allows for immediate detection of anomalies, reducing the reliance on periodic laboratory-based testing and enabling proactive interventions. Furthermore, the increasing focus on circular economy principles is opening doors for analyzing the composition of gas produced from various waste streams beyond traditional landfills, such as anaerobic digestion plants and industrial waste processing facilities. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into data analysis platforms offers opportunities to predict gas production trends, optimize capture systems, and identify potential operational issues before they arise, thereby enhancing the value proposition of testing services. Exploring niche applications in developing countries with rapidly expanding waste management infrastructure also represents an untapped market potential.

Growth Accelerators in the Landfill Gas Composition Testing Industry

Several key catalysts are accelerating the growth of the Landfill Gas Composition Testing industry. A significant accelerator is the increasing global commitment to climate change mitigation targets, which places a spotlight on reducing methane emissions from landfills – a potent greenhouse gas. Governments and international bodies are implementing stricter policies and offering financial incentives for landfill gas capture and utilization, thereby driving demand for reliable testing. Technological breakthroughs in analytical instrumentation, particularly in developing more sensitive, portable, and automated testing solutions, are making these services more accessible and efficient. Strategic partnerships between testing service providers, landfill operators, and technology developers are fostering innovation and expanding service offerings. Furthermore, the growing demand for renewable energy sources is promoting the use of landfill gas for power generation, creating a direct economic incentive for accurate and regular composition analysis to ensure efficient energy extraction.

Key Players Shaping the Landfill Gas Composition Testing Market

- Nexton

- Lucideon

- Enthalpy Analytical

- Airflo Sciences

- Geo Forward

- Intertek

- ORTECH

- SOCOTEC

- Element

Notable Milestones in Landfill Gas Composition Testing Sector

- 2019: Introduction of advanced portable gas chromatographs offering improved field portability and faster analysis times.

- 2020: Increased regulatory scrutiny on methane emissions from landfills globally, leading to a surge in testing demand.

- 2021: Development of AI-powered data analysis platforms for predictive landfill gas management.

- 2022: Strategic partnerships formed between testing labs and waste-to-energy project developers to optimize gas utilization.

- 2023: Enhanced adoption of infrared spectroscopy for real-time, continuous monitoring of landfill gas composition.

- 2024: Growing investment in testing infrastructure in emerging economies to address rising waste management challenges.

In-Depth Landfill Gas Composition Testing Market Outlook

The Landfill Gas Composition Testing market is poised for sustained growth, driven by a confluence of environmental imperatives, technological advancements, and economic opportunities. The increasing global emphasis on climate change mitigation, particularly the reduction of potent greenhouse gases like methane, will continue to be a primary growth accelerator. This will be further amplified by evolving regulatory frameworks that mandate more frequent and precise testing of landfill gas composition for Urban Environmental Protection and Industrial Safety. The expanding waste-to-energy sector presents a significant economic incentive for accurate gas analysis, transforming landfills from waste disposal sites into valuable energy resources. Innovations in analytical technologies, such as portable analyzers and AI-driven data interpretation, will enhance efficiency and accessibility. Strategic collaborations and investments in emerging markets will unlock new avenues for expansion. The market outlook remains highly positive, with robust demand anticipated from municipal authorities and industrial entities worldwide seeking to ensure compliance, optimize resource recovery, and contribute to a sustainable future.

Landfill Gas Composition Testing Segmentation

-

1. Application

- 1.1. Urban Environmental Protection

- 1.2. Industrial Safety

- 1.3. Others

-

2. Type

- 2.1. Gas Chromatography Analysis

- 2.2. Infrared Spectroscopy Analysis

- 2.3. Others

Landfill Gas Composition Testing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

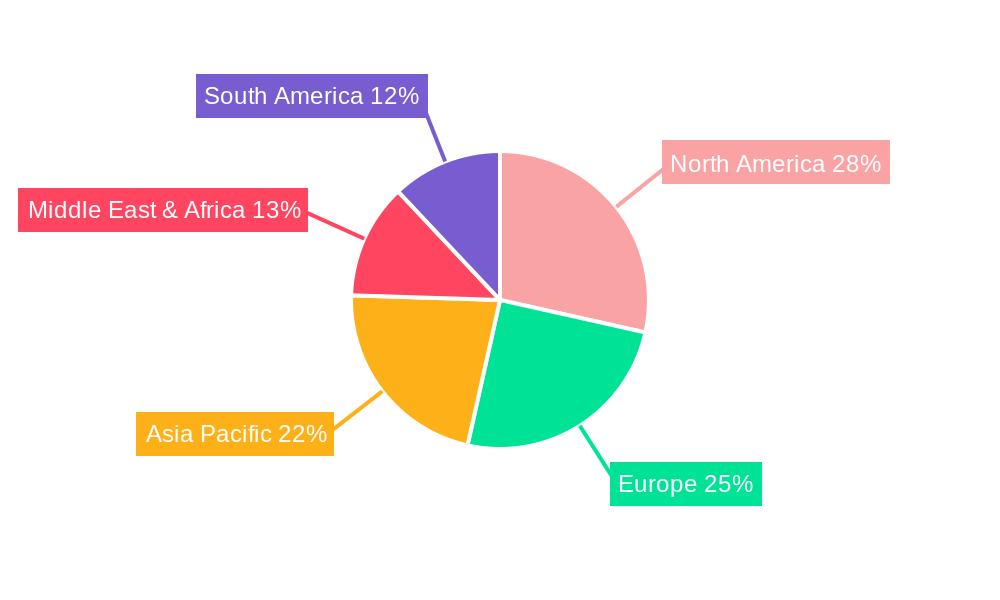

Landfill Gas Composition Testing Regional Market Share

Geographic Coverage of Landfill Gas Composition Testing

Landfill Gas Composition Testing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Landfill Gas Composition Testing Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Urban Environmental Protection

- 5.1.2. Industrial Safety

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Gas Chromatography Analysis

- 5.2.2. Infrared Spectroscopy Analysis

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Landfill Gas Composition Testing Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Urban Environmental Protection

- 6.1.2. Industrial Safety

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Gas Chromatography Analysis

- 6.2.2. Infrared Spectroscopy Analysis

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Landfill Gas Composition Testing Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Urban Environmental Protection

- 7.1.2. Industrial Safety

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Gas Chromatography Analysis

- 7.2.2. Infrared Spectroscopy Analysis

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Landfill Gas Composition Testing Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Urban Environmental Protection

- 8.1.2. Industrial Safety

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Gas Chromatography Analysis

- 8.2.2. Infrared Spectroscopy Analysis

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Landfill Gas Composition Testing Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Urban Environmental Protection

- 9.1.2. Industrial Safety

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Gas Chromatography Analysis

- 9.2.2. Infrared Spectroscopy Analysis

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Landfill Gas Composition Testing Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Urban Environmental Protection

- 10.1.2. Industrial Safety

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Gas Chromatography Analysis

- 10.2.2. Infrared Spectroscopy Analysis

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nexton

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lucideon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Enthalpy Analytical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airflo Sciences

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Geo Forward

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Intertek

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ORTECH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SOCOTEC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Element

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Nexton

List of Figures

- Figure 1: Global Landfill Gas Composition Testing Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Landfill Gas Composition Testing Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Landfill Gas Composition Testing Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Landfill Gas Composition Testing Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Landfill Gas Composition Testing Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Landfill Gas Composition Testing Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Landfill Gas Composition Testing Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Landfill Gas Composition Testing Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Landfill Gas Composition Testing Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Landfill Gas Composition Testing Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America Landfill Gas Composition Testing Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Landfill Gas Composition Testing Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Landfill Gas Composition Testing Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Landfill Gas Composition Testing Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Landfill Gas Composition Testing Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Landfill Gas Composition Testing Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Landfill Gas Composition Testing Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Landfill Gas Composition Testing Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Landfill Gas Composition Testing Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Landfill Gas Composition Testing Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Landfill Gas Composition Testing Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Landfill Gas Composition Testing Revenue (undefined), by Type 2025 & 2033

- Figure 23: Middle East & Africa Landfill Gas Composition Testing Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Landfill Gas Composition Testing Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Landfill Gas Composition Testing Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Landfill Gas Composition Testing Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Landfill Gas Composition Testing Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Landfill Gas Composition Testing Revenue (undefined), by Type 2025 & 2033

- Figure 29: Asia Pacific Landfill Gas Composition Testing Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Landfill Gas Composition Testing Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Landfill Gas Composition Testing Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global Landfill Gas Composition Testing Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Landfill Gas Composition Testing Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Landfill Gas Composition Testing?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Landfill Gas Composition Testing?

Key companies in the market include Nexton, Lucideon, Enthalpy Analytical, Airflo Sciences, Geo Forward, Intertek, ORTECH, SOCOTEC, Element.

3. What are the main segments of the Landfill Gas Composition Testing?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Landfill Gas Composition Testing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Landfill Gas Composition Testing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Landfill Gas Composition Testing?

To stay informed about further developments, trends, and reports in the Landfill Gas Composition Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence