Key Insights

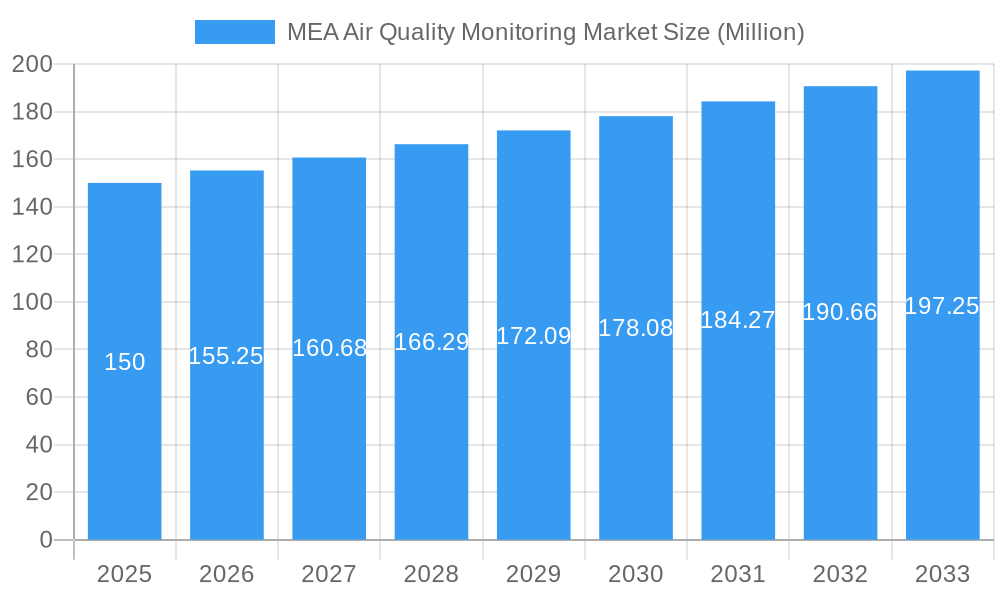

The Middle East & Africa (MEA) Air Quality Monitoring Market is poised for substantial growth, driven by heightened environmental consciousness, evolving regulatory frameworks, and expanding industrial activities across the region. The market, valued at 5.5 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.2% through 2033. This surge is attributed to escalating air pollution levels in key MEA urban centers, particularly in the UAE and Saudi Arabia, consequently increasing the demand for sophisticated air quality monitoring solutions. Primary growth catalysts include the imperative for real-time pollution data to safeguard public health, optimize environmental management, and ensure regulatory compliance. The market encompasses segmentation by product type (indoor and outdoor monitors), sampling method (continuous, manual, and intermittent), pollutant type (chemical, physical, and biological), and end-user industry (residential and commercial, power generation, petrochemicals, and others). The continuous monitoring segment is anticipated to capture a significant market share due to its real-time data capabilities, while chemical pollutant monitoring is expected to lead owing to prevalent industrial emissions.

MEA Air Quality Monitoring Market Market Size (In Billion)

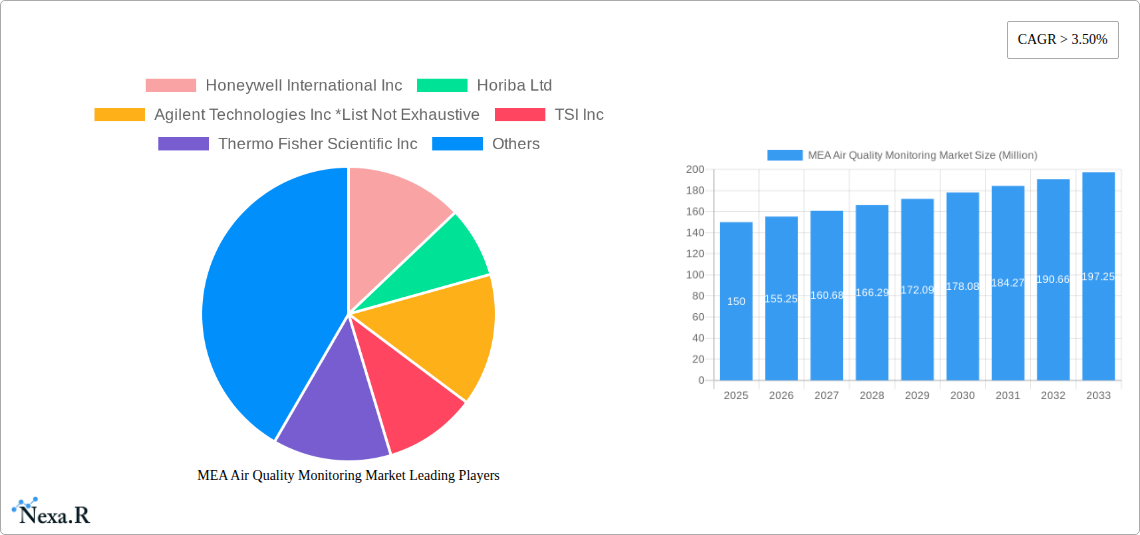

The accelerating adoption of advanced technologies, including IoT-enabled sensors and AI-driven data analytics, is further propelling market expansion. Potential growth inhibitors include the substantial initial investment required for advanced monitoring systems and limited awareness in certain regions regarding the benefits of comprehensive air quality monitoring. Nevertheless, government initiatives focused on sustainable development and air quality improvement are expected to counteract these challenges, fostering considerable market expansion. Key market participants such as Honeywell, Horiba, Agilent Technologies, TSI, Thermo Fisher Scientific, Emerson Electric, Siemens, 3M, and Teledyne Technologies are actively engaged in fostering innovation and market penetration. The future outlook for the MEA Air Quality Monitoring Market is highly positive, fueled by a convergence of technological advancements, stringent regulatory measures, and heightened public awareness of air pollution's health and environmental ramifications. The UAE and Saudi Arabia, characterized by their rapidly growing urban populations and industrial bases, are expected to be pivotal contributors to the market's growth trajectory.

MEA Air Quality Monitoring Market Company Market Share

MEA Air Quality Monitoring Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa (MEA) Air Quality Monitoring Market, offering valuable insights for industry professionals, investors, and policymakers. The report covers the period from 2019 to 2033, with a focus on market dynamics, growth trends, key players, and future opportunities. The market is segmented by product type (indoor and outdoor monitors), sampling method (continuous, manual, intermittent), pollutant type (chemical, physical, biological), and end-user (residential & commercial, power generation, petrochemicals, and others). The total market value is projected to reach XX Million by 2033.

MEA Air Quality Monitoring Market Dynamics & Structure

The MEA air quality monitoring market is characterized by a moderately concentrated landscape with key players like Honeywell International Inc, Horiba Ltd, Agilent Technologies Inc, TSI Inc, Thermo Fisher Scientific Inc, Emerson Electric Co, Siemens AG, 3M Co, and Teledyne Technologies Inc. However, the market also features several smaller, specialized firms.

Market Concentration: The market is experiencing consolidation, with larger players acquiring smaller companies to expand their product portfolio and geographical reach. We estimate that the top 5 players hold approximately XX% of the market share in 2025.

Technological Innovation: Advancements in sensor technology, data analytics, and IoT connectivity are driving innovation. However, high initial investment costs and lack of skilled workforce can act as barriers.

Regulatory Frameworks: Stringent environmental regulations across several MEA countries are boosting market growth. The increasing focus on air quality standards and compliance requirements fuels the demand for sophisticated monitoring systems.

Competitive Product Substitutes: Limited direct substitutes exist, but cost-effective solutions and alternative technologies continue to emerge, impacting market share dynamics.

End-User Demographics: Rapid urbanization, industrialization, and rising environmental awareness are key factors driving market growth across various end-user segments.

M&A Trends: Strategic mergers and acquisitions are expected to continue, further consolidating market share amongst major players. We predict approximately XX M&A deals within the forecast period.

MEA Air Quality Monitoring Market Growth Trends & Insights

The MEA air quality monitoring market is experiencing robust growth, driven by increasing government initiatives to address air pollution. From 2019 to 2024, the market registered a CAGR of XX%, and is projected to grow at a CAGR of XX% from 2025 to 2033, reaching a market value of XX Million by 2033. This growth is fueled by a rising awareness of the health impacts of poor air quality, technological advancements in monitoring devices, and supportive government policies. Adoption rates are highest in urban areas with significant industrial activities, while penetration remains relatively low in rural areas. Technological disruptions, such as the integration of AI and machine learning for predictive modeling, are transforming the market landscape. Consumer behavior is shifting towards greater demand for real-time air quality data and user-friendly monitoring solutions.

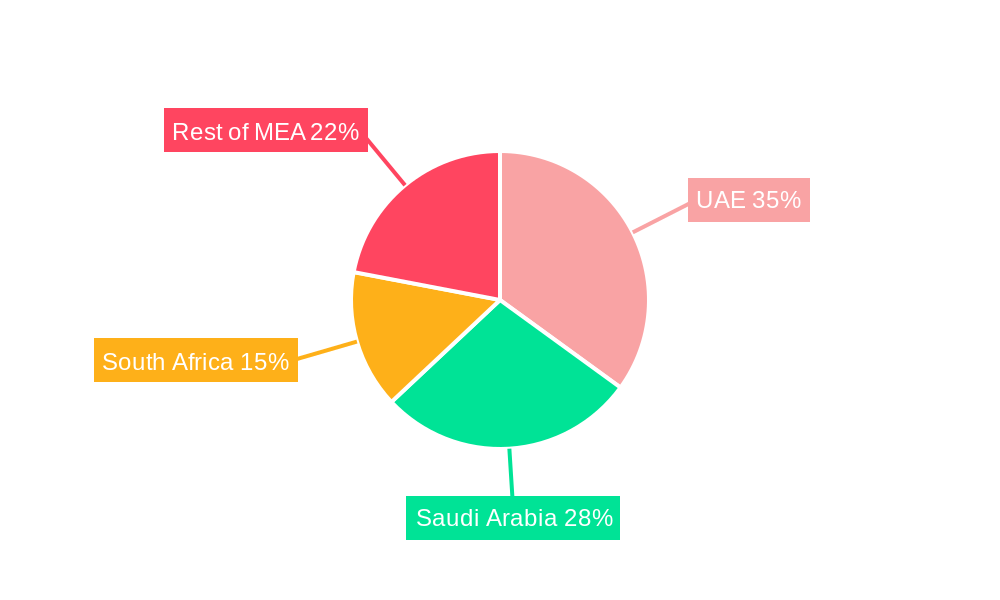

Dominant Regions, Countries, or Segments in MEA Air Quality Monitoring Market

The UAE, Saudi Arabia, and other Gulf Cooperation Council (GCC) countries are currently leading the MEA air quality monitoring market, driven by substantial investments in infrastructure development and stringent environmental regulations. Within the product segments, the demand for outdoor monitors is significantly higher due to the need for comprehensive environmental monitoring.

Key Drivers:

- Stringent environmental regulations

- Government initiatives and funding

- Rapid urbanization and industrialization

- Increasing awareness of air pollution's health impacts

- Investments in smart city infrastructure

Dominant Segments:

- Outdoor Monitors: The largest market segment driven by the need for wide-area monitoring of ambient air quality.

- Continuous Sampling: Preferred for real-time data and trend analysis.

- Chemical Pollutants: A significant focus on monitoring key pollutants like particulate matter (PM2.5 and PM10), nitrogen oxides (NOx), and sulfur dioxide (SO2).

- Power Generation & Petrochemicals: These end-user segments are major contributors due to stricter emission regulations.

The UAE demonstrates exceptional growth potential due to its proactive environmental policies. Initiatives such as the National Air Quality Agenda 2031 (June 2022) and the expansion of air monitoring networks in Abu Dhabi (March 2022) contribute significantly to this growth. Saudi Arabia is also showing strong growth potential due to their Vision 2030 initiatives.

MEA Air Quality Monitoring Market Product Landscape

The MEA air quality monitoring market offers a diverse range of products, from basic stationary monitors to advanced mobile and portable systems equipped with sophisticated sensors and data analysis capabilities. These systems typically measure multiple pollutants simultaneously, providing comprehensive data for environmental monitoring and compliance purposes. Recent innovations include wireless sensor networks, real-time data visualization platforms, and integrated pollution control solutions, offering improved data accuracy, ease of use, and cost-effectiveness. Unique selling propositions frequently include enhanced data analytics capabilities, user-friendly interfaces, remote monitoring capabilities, and compliance with international standards.

Key Drivers, Barriers & Challenges in MEA Air Quality Monitoring Market

Key Drivers:

- Stringent environmental regulations and government mandates

- Growing awareness of air pollution health risks

- Technological advancements driving cost reduction and improved accuracy

- Investment in smart city infrastructure

Challenges & Restraints:

- High initial investment costs for advanced monitoring systems

- Lack of skilled personnel for operation and maintenance

- Data management and analysis challenges, especially with large-scale deployments.

- Supply chain disruptions affecting component availability (impact estimated at XX% in 2024)

Emerging Opportunities in MEA Air Quality Monitoring Market

- Expansion into underserved rural areas

- Development of low-cost, user-friendly monitoring solutions for residential use

- Integration of air quality monitoring with smart city initiatives

- Leveraging IoT and AI for predictive modeling and early warning systems.

Growth Accelerators in the MEA Air Quality Monitoring Market Industry

Technological advancements in sensor technologies, data analytics, and connectivity continue to drive market growth. Strategic partnerships between technology providers and government agencies are crucial for accelerating market penetration. Expansion into untapped markets through targeted marketing campaigns and localized solutions is expected to further fuel market growth.

Key Players Shaping the MEA Air Quality Monitoring Market Market

- Honeywell International Inc

- Horiba Ltd

- Agilent Technologies Inc

- TSI Inc

- Thermo Fisher Scientific Inc

- Emerson Electric Co

- Siemens AG

- 3M Co

- Teledyne Technologies Inc

Notable Milestones in MEA Air Quality Monitoring Market Sector

- July 2022: Ajman Free Zone implemented an AirSense-based ambient air quality monitoring system, showcasing the adoption of cutting-edge technology.

- June 2022: The UAE's National Air Quality Agenda 2031 was launched, providing a long-term framework for air quality management and driving market growth.

- March 2022: Abu Dhabi expanded its air monitoring network to 22 monitors, reinforcing commitment to air quality improvement and attracting international collaboration.

In-Depth MEA Air Quality Monitoring Market Outlook

The MEA air quality monitoring market exhibits significant long-term growth potential, driven by continued urbanization, industrial expansion, and stringent environmental regulations. Strategic opportunities exist for companies focusing on innovative, cost-effective solutions, particularly in underserved markets. The integration of AI and IoT technologies will continue to transform the market, offering advanced analytics and predictive capabilities. This presents substantial opportunities for technology providers, fostering sustainable development and improving public health.

MEA Air Quality Monitoring Market Segmentation

-

1. Product Type

- 1.1. Indoor Monitor

- 1.2. Outdoor Monitor

-

2. Sampling Method

- 2.1. Continuous

- 2.2. Manual

- 2.3. Intermittent

-

3. Pollutant Type

- 3.1. Chemical Pollutants

- 3.2. Physical Pollutants

- 3.3. Biological Pollutants

-

4. End User

- 4.1. Residential and Commercial

- 4.2. Power Generation

- 4.3. Petrochemicals

- 4.4. Other End Users

-

5. Geography

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle-East and Africa

MEA Air Quality Monitoring Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Rest of Middle East and Africa

MEA Air Quality Monitoring Market Regional Market Share

Geographic Coverage of MEA Air Quality Monitoring Market

MEA Air Quality Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Awareness and Favorable Government Policies and Non-government Initiatives for Curbing Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; High Costs of Air Quality Monitoring Systems

- 3.4. Market Trends

- 3.4.1. The Outdoor Monitor Segment is Expected to be the Fastest growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Indoor Monitor

- 5.1.2. Outdoor Monitor

- 5.2. Market Analysis, Insights and Forecast - by Sampling Method

- 5.2.1. Continuous

- 5.2.2. Manual

- 5.2.3. Intermittent

- 5.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 5.3.1. Chemical Pollutants

- 5.3.2. Physical Pollutants

- 5.3.3. Biological Pollutants

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Residential and Commercial

- 5.4.2. Power Generation

- 5.4.3. Petrochemicals

- 5.4.4. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. Rest of Middle-East and Africa

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.6.2. United Arab Emirates

- 5.6.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia MEA Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Indoor Monitor

- 6.1.2. Outdoor Monitor

- 6.2. Market Analysis, Insights and Forecast - by Sampling Method

- 6.2.1. Continuous

- 6.2.2. Manual

- 6.2.3. Intermittent

- 6.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 6.3.1. Chemical Pollutants

- 6.3.2. Physical Pollutants

- 6.3.3. Biological Pollutants

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Residential and Commercial

- 6.4.2. Power Generation

- 6.4.3. Petrochemicals

- 6.4.4. Other End Users

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Saudi Arabia

- 6.5.2. United Arab Emirates

- 6.5.3. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates MEA Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Indoor Monitor

- 7.1.2. Outdoor Monitor

- 7.2. Market Analysis, Insights and Forecast - by Sampling Method

- 7.2.1. Continuous

- 7.2.2. Manual

- 7.2.3. Intermittent

- 7.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 7.3.1. Chemical Pollutants

- 7.3.2. Physical Pollutants

- 7.3.3. Biological Pollutants

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Residential and Commercial

- 7.4.2. Power Generation

- 7.4.3. Petrochemicals

- 7.4.4. Other End Users

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Saudi Arabia

- 7.5.2. United Arab Emirates

- 7.5.3. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East and Africa MEA Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Indoor Monitor

- 8.1.2. Outdoor Monitor

- 8.2. Market Analysis, Insights and Forecast - by Sampling Method

- 8.2.1. Continuous

- 8.2.2. Manual

- 8.2.3. Intermittent

- 8.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 8.3.1. Chemical Pollutants

- 8.3.2. Physical Pollutants

- 8.3.3. Biological Pollutants

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Residential and Commercial

- 8.4.2. Power Generation

- 8.4.3. Petrochemicals

- 8.4.4. Other End Users

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Saudi Arabia

- 8.5.2. United Arab Emirates

- 8.5.3. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Honeywell International Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Horiba Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Agilent Technologies Inc *List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 TSI Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Thermo Fisher Scientific Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Emerson Electric Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Siemens AG

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 3M Co

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Teledyne Technologies Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Honeywell International Inc

List of Figures

- Figure 1: MEA Air Quality Monitoring Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: MEA Air Quality Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: MEA Air Quality Monitoring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: MEA Air Quality Monitoring Market Revenue billion Forecast, by Sampling Method 2020 & 2033

- Table 3: MEA Air Quality Monitoring Market Revenue billion Forecast, by Pollutant Type 2020 & 2033

- Table 4: MEA Air Quality Monitoring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: MEA Air Quality Monitoring Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: MEA Air Quality Monitoring Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: MEA Air Quality Monitoring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: MEA Air Quality Monitoring Market Revenue billion Forecast, by Sampling Method 2020 & 2033

- Table 9: MEA Air Quality Monitoring Market Revenue billion Forecast, by Pollutant Type 2020 & 2033

- Table 10: MEA Air Quality Monitoring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 11: MEA Air Quality Monitoring Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: MEA Air Quality Monitoring Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: MEA Air Quality Monitoring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: MEA Air Quality Monitoring Market Revenue billion Forecast, by Sampling Method 2020 & 2033

- Table 15: MEA Air Quality Monitoring Market Revenue billion Forecast, by Pollutant Type 2020 & 2033

- Table 16: MEA Air Quality Monitoring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 17: MEA Air Quality Monitoring Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: MEA Air Quality Monitoring Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: MEA Air Quality Monitoring Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: MEA Air Quality Monitoring Market Revenue billion Forecast, by Sampling Method 2020 & 2033

- Table 21: MEA Air Quality Monitoring Market Revenue billion Forecast, by Pollutant Type 2020 & 2033

- Table 22: MEA Air Quality Monitoring Market Revenue billion Forecast, by End User 2020 & 2033

- Table 23: MEA Air Quality Monitoring Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: MEA Air Quality Monitoring Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Air Quality Monitoring Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the MEA Air Quality Monitoring Market?

Key companies in the market include Honeywell International Inc, Horiba Ltd, Agilent Technologies Inc *List Not Exhaustive, TSI Inc, Thermo Fisher Scientific Inc, Emerson Electric Co, Siemens AG, 3M Co, Teledyne Technologies Inc.

3. What are the main segments of the MEA Air Quality Monitoring Market?

The market segments include Product Type, Sampling Method, Pollutant Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Awareness and Favorable Government Policies and Non-government Initiatives for Curbing Air Pollution.

6. What are the notable trends driving market growth?

The Outdoor Monitor Segment is Expected to be the Fastest growing Segment.

7. Are there any restraints impacting market growth?

4.; High Costs of Air Quality Monitoring Systems.

8. Can you provide examples of recent developments in the market?

July 2022: Ajman Free Zone established an ambient air quality monitoring system in Gate 2 of its industrial sector in collaboration with the Municipality and Planning Department of Ajman. As part of the project, the free zone implemented cutting-edge AirSense technology to measure and evaluate the industrial area's pollution levels by current international regulations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Air Quality Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Air Quality Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Air Quality Monitoring Market?

To stay informed about further developments, trends, and reports in the MEA Air Quality Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence