Key Insights

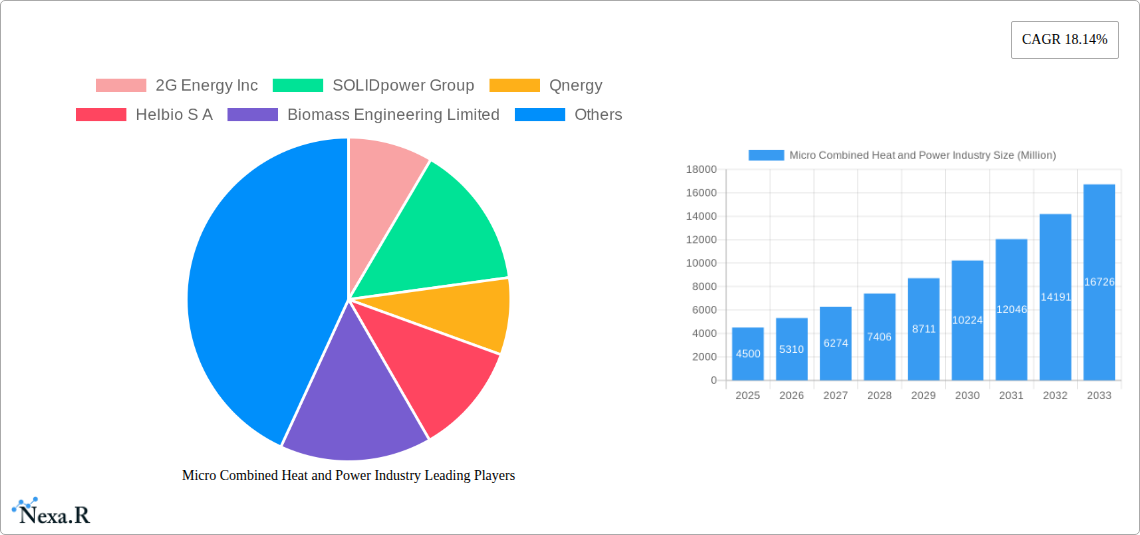

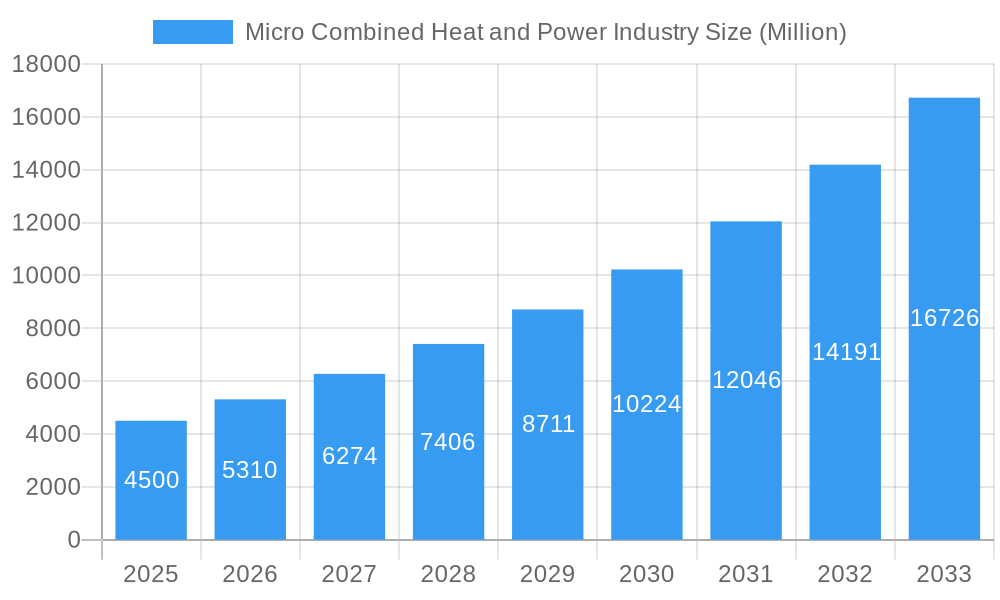

The Micro Combined Heat and Power (Micro CHP) market is projected for significant expansion, driven by rising energy costs, a global emphasis on sustainability, and government initiatives supporting decentralized energy generation. The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 18.14%, expanding from a market size of $1.4 billion in the base year 2025. This growth is propelled by the increasing demand for efficient energy solutions in residential and commercial sectors, the adoption of cleaner fuel sources like natural gas and biogas, and technological advancements making Micro CHP systems more compact, cost-effective, and user-friendly. Micro CHP’s ability to reduce energy bills and carbon footprints makes it a compelling alternative to traditional power grids.

Micro Combined Heat and Power Industry Market Size (In Billion)

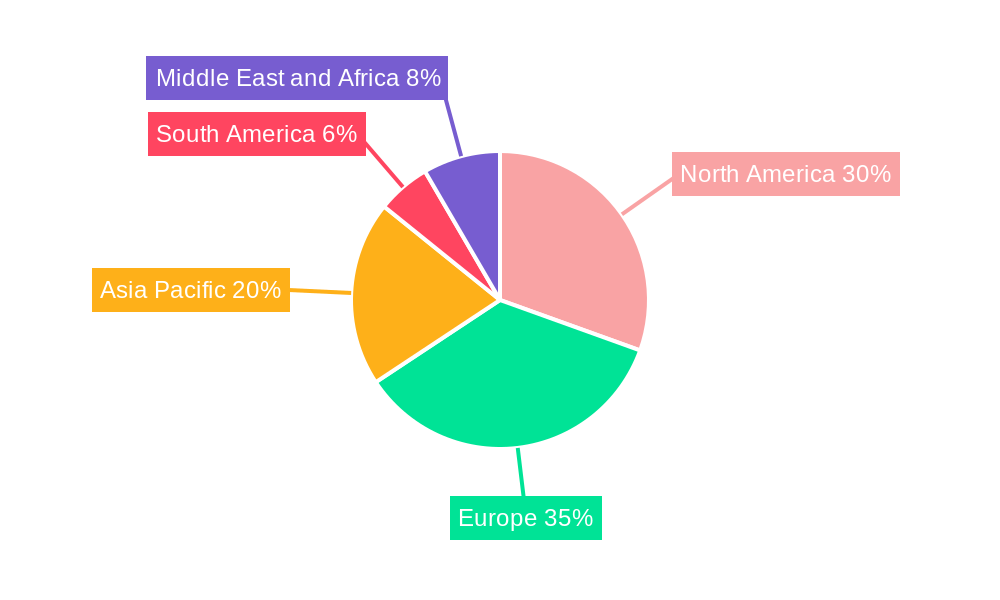

The market is segmented by fuel type, with natural gas and biogas leading due to their availability and environmental benefits. Biogas is gaining traction as a sustainable option aligning with circular economy principles. Residential and commercial applications are both experiencing strong demand, with homeowners adopting Micro CHP for heating and electricity, and businesses using it to improve operational efficiency and lower energy costs. North America and Europe are expected to dominate due to supportive regulations, high energy prices, and established gas infrastructure. However, the Asia Pacific region is anticipated to show the fastest growth, driven by industrialization and increasing energy needs. Emerging trends like smart grid integration and fuel cell-based systems will further boost market expansion, while addressing challenges such as initial installation costs and consumer awareness is crucial for realizing the full market potential.

Micro Combined Heat and Power Industry Company Market Share

Micro Combined Heat and Power (mCHP) Market Analysis 2024-2033

This report provides a comprehensive analysis of the Micro Combined Heat and Power (mCHP) industry, a key sector for sustainable energy. It examines market dynamics, growth trends, competitive landscapes, and emerging opportunities for residential, commercial, and industrial applications. Optimized with high-traffic keywords such as "mCHP," "micro CHP systems," "combined heat and power," "decentralized energy," "energy efficiency," and "sustainable energy solutions," this report aims for maximum search engine visibility. Explore parent and child market intricacies for unparalleled insights for professionals, investors, and policymakers. All quantitative data is presented in millions of units.

Micro Combined Heat and Power Industry Market Dynamics & Structure

The micro combined heat and power (mCHP) industry exhibits a dynamic market structure characterized by increasing technological innovation and evolving regulatory frameworks aimed at boosting energy efficiency and reducing carbon emissions. Market concentration is moderate, with key players like 2G Energy Inc., SOLIDpower Group, and TEDOM A S investing heavily in research and development for advanced fuel cell and engine technologies. Competitive product substitutes, primarily grid electricity and standalone heating systems, are being challenged by mCHP's superior energy utilization and cost-effectiveness over the long term. End-user demographics are shifting towards environmentally conscious homeowners and businesses seeking to reduce energy bills and their carbon footprint. Mergers and acquisitions (M&A) trends are on the rise as larger energy conglomerates and technology firms seek to integrate mCHP solutions into their portfolios, driving market consolidation and fostering specialized product development. Barriers to innovation include the initial capital investment required for mCHP systems and the need for greater public awareness regarding their benefits.

- Market Concentration: Moderate, with a mix of established players and emerging startups.

- Technological Innovation Drivers: Focus on increasing efficiency, reducing cost, and expanding fuel flexibility.

- Regulatory Frameworks: Supportive policies and incentives for renewable energy and energy efficiency are crucial.

- Competitive Product Substitutes: Grid electricity, traditional boilers, and other decentralized generation technologies.

- End-User Demographics: Growing interest from environmentally aware residential consumers and cost-conscious commercial entities.

- M&A Trends: Increasing activity as larger players seek to enter the mCHP market.

- Innovation Barriers: High upfront costs and limited public understanding of mCHP benefits.

Micro Combined Heat and Power Industry Growth Trends & Insights

The micro combined heat and power (mCHP) industry is poised for substantial growth, driven by a confluence of factors including escalating energy prices, growing environmental consciousness, and advancements in technology. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of over 10% from 2025 to 2033. Adoption rates are steadily increasing as more consumers and businesses recognize the economic and environmental advantages of on-site energy generation. Technological disruptions, such as the development of more compact, efficient, and cost-effective fuel cell technologies and advanced internal combustion engines optimized for mCHP applications, are significantly influencing market penetration. Consumer behavior is shifting towards a preference for self-sufficiency, reduced energy expenditure, and a commitment to sustainable living, further bolstering the demand for mCHP solutions. The integration of smart grid technologies and digital platforms for remote monitoring and control also enhances the appeal of mCHP systems.

The market is expected to grow from an estimated USD 5,000 million in 2025 to over USD 12,000 million by 2033. This expansion is fueled by a combination of policy support, technological advancements, and increasing awareness of the benefits of decentralized energy generation. The mCHP market's growth trajectory is also influenced by its ability to address grid stability concerns and provide resilient energy solutions, particularly in regions prone to power outages. The development of smaller, more modular mCHP units suitable for individual homes is a key driver for residential market expansion. Furthermore, the increasing availability and affordability of renewable fuels like biogas and hydrogen are opening new avenues for mCHP system deployment.

- Market Size Evolution: Expected to grow from approximately USD 5,000 million in 2025 to over USD 12,000 million by 2033.

- Adoption Rates: Steadily increasing across residential, commercial, and industrial sectors.

- Technological Disruptions: Innovations in fuel cells, engine efficiency, and smart integration are key enablers.

- Consumer Behavior Shifts: Growing demand for energy independence, cost savings, and environmental responsibility.

- Market Penetration: Projected to reach significant levels in developed economies with strong policy support.

- CAGR: Estimated to be above 10% during the forecast period.

Dominant Regions, Countries, or Segments in Micro Combined Heat and Power Industry

The micro combined heat and power (mCHP) industry's dominance is currently led by regions and segments that benefit from favorable government policies, robust energy infrastructure, and a strong emphasis on energy efficiency and sustainability. Among fuel types, Natural Gas continues to hold a dominant position due to its widespread availability, established infrastructure, and relatively lower cost compared to other fuels. However, Biogas is rapidly emerging as a significant segment, particularly in regions with strong agricultural sectors and a focus on circular economy principles, offering a renewable and carbon-neutral energy source.

In terms of application, the Residential segment is a key driver of mCHP market growth. This is attributed to increasing homeowner awareness of rising energy costs, a desire for energy independence, and government incentives promoting the adoption of energy-efficient technologies in homes. The ability of mCHP systems to provide both electricity and heat simultaneously makes them highly attractive for residential use, leading to substantial reductions in energy bills and a smaller carbon footprint. Countries like Germany, the UK, and Japan have been early adopters of mCHP in the residential sector, supported by feed-in tariffs and subsidies.

The Commercial segment is also experiencing significant growth, driven by businesses seeking to reduce operational costs and enhance their sustainability credentials. Hotels, hospitals, and office buildings, with their consistent demand for both heat and electricity, are prime candidates for mCHP deployment. The economic benefits, coupled with corporate social responsibility initiatives, are fueling adoption in this segment.

- Dominant Fuel Type: Natural Gas, owing to its accessibility and existing infrastructure.

- Emerging Fuel Type: Biogas, driven by sustainability goals and renewable energy mandates.

- Dominant Application Segment: Residential, benefiting from cost savings and energy independence.

- Key Drivers in Residential: Rising energy prices, government incentives, and environmental consciousness.

- Growing Application Segment: Commercial, driven by operational cost reduction and sustainability goals.

- Leading Regions: Europe (Germany, UK), North America (USA, Canada), and Asia-Pacific (Japan, South Korea) show strong adoption.

- Market Share Insights: Natural Gas applications in the residential sector are estimated to hold over 40% of the market share.

Micro Combined Heat and Power Industry Product Landscape

The micro combined heat and power (mCHP) product landscape is characterized by continuous innovation focused on enhancing efficiency, reducing size, and improving reliability. Key product developments include advanced Solid Oxide Fuel Cell (SOFC) systems offering high electrical efficiency and fuel flexibility, as seen in Magnex Co. Ltd's development of 1-5 kW SOFC CHP systems fueled by bio-gas or ethanol. Internal combustion engine-based mCHP units are also evolving, with companies like TEDOM A S and Vaillant Group offering highly efficient and compact solutions for residential and commercial applications. EC Power A/S is developing modular SOFC systems for distributed power generation. The focus is on creating plug-and-play solutions that simplify installation and maintenance, making mCHP more accessible to a wider range of users.

- Key Product Innovations: High-efficiency SOFC systems, advanced internal combustion engines, compact designs.

- Performance Metrics: Focus on >85% overall efficiency for heat and power generation.

- Unique Selling Propositions: Reduced energy bills, lower carbon emissions, energy independence, reliable power and heat supply.

- Technological Advancements: Development of modular systems, integration with smart home technology, and extended product lifespans.

Key Drivers, Barriers & Challenges in Micro Combined Heat and Power Industry

Key Drivers: The micro combined heat and power (mCHP) industry is propelled by a strong demand for energy efficiency and cost savings. Growing environmental concerns and stringent carbon emission regulations are major drivers, pushing consumers and businesses towards cleaner energy solutions. Government incentives and subsidies play a crucial role in making mCHP systems more financially attractive. Technological advancements leading to higher efficiencies and lower costs are also significant growth accelerators. The desire for energy independence and resilience against grid disruptions further fuels market expansion.

- Energy Efficiency Mandates: Increasing global focus on reducing energy consumption.

- Environmental Regulations: Stricter emission standards driving demand for cleaner technologies.

- Government Incentives: Subsidies, tax credits, and feed-in tariffs making mCHP economically viable.

- Technological Advancements: Improved efficiency and reduced manufacturing costs.

- Energy Independence: Desire for self-sufficiency and reduced reliance on utility grids.

Barriers & Challenges: The primary barrier to widespread mCHP adoption remains the high initial capital cost of the systems. Public awareness and understanding of mCHP technology and its benefits are still limited in many regions. Regulatory hurdles and complex permitting processes can also slow down deployment. Supply chain challenges for certain components and the need for specialized installation and maintenance expertise can pose additional difficulties. Intense competition from established energy providers and alternative heating and power solutions also presents a challenge.

- High Upfront Costs: Significant initial investment deterring some potential buyers.

- Limited Public Awareness: Lack of understanding of mCHP technology and its advantages.

- Regulatory Complexities: Navigating permits and local regulations can be challenging.

- Supply Chain Issues: Potential disruptions in the availability of key components.

- Specialized Installation & Maintenance: Requirement for trained technicians.

- Competitive Pressures: Competition from traditional energy sources and other renewable technologies.

Emerging Opportunities in Micro Combined Heat and Power Industry

Emerging opportunities in the micro combined heat and power (mCHP) industry are vast and varied, driven by innovation and evolving market needs. The development of hydrogen-powered mCHP systems presents a significant opportunity for decarbonization, aligning with global net-zero targets. The integration of mCHP with renewable energy sources, such as solar photovoltaic (PV) systems, offers hybrid solutions that maximize energy generation and minimize reliance on fossil fuels. Untapped markets in developing nations, with growing energy demands and a need for decentralized power solutions, represent substantial growth potential. The increasing adoption of smart home technologies and the demand for energy management solutions also create opportunities for mCHP systems to be integrated into intelligent energy networks. Furthermore, niche applications, such as powering remote communities or providing backup power for critical infrastructure, are opening new avenues for growth.

- Hydrogen-Powered mCHP: A key opportunity for deep decarbonization.

- Hybrid Systems: Integration with solar PV and other renewables.

- Untapped Markets: Significant potential in developing economies.

- Smart Home Integration: Enhanced by demand for energy management solutions.

- Niche Applications: Remote power, critical infrastructure backup.

Growth Accelerators in the Micro Combined Heat and Power Industry Industry

Several catalysts are accelerating the long-term growth of the micro combined heat and power (mCHP) industry. Technological breakthroughs in fuel cell efficiency and durability, particularly in Solid Oxide Fuel Cells (SOFCs) and PEM fuel cells, are making mCHP systems more cost-effective and reliable. Strategic partnerships between technology developers, energy companies, and construction firms are streamlining the adoption process and expanding market reach. Government policies that offer continuous support, such as feed-in tariffs for generated electricity and grants for system installation, are critical growth accelerators. The growing corporate focus on Environmental, Social, and Governance (ESG) principles is encouraging businesses to invest in sustainable energy solutions like mCHP. Market expansion strategies, including the development of standardized and scalable mCHP solutions for different building types, are also driving significant growth.

- Technological Breakthroughs: Enhancements in fuel cell technology and engine efficiency.

- Strategic Partnerships: Collaborations for wider market penetration and product integration.

- Supportive Government Policies: Consistent and long-term incentives and regulations.

- Corporate ESG Focus: Increasing investment in sustainable energy by businesses.

- Market Expansion Strategies: Development of standardized, scalable solutions.

Key Players Shaping the Micro Combined Heat and Power Industry Market

- 2G Energy Inc.

- SOLIDpower Group

- Qnergy

- Helbio S A

- Biomass Engineering Limited

- TEDOM A S

- Vaillant Group

- Enginuity Power Systems

- Axiom Energy Group LLC

- GRIDIRON LLC

- Enexor Bioenergy

- Navien Inc

- Remeha

- EC Power A/S

- Yanmar Holdings Co Ltd

- Viessmann Group

- ATCO Ltd

Notable Milestones in Micro Combined Heat and Power Industry Sector

- November 2021: A micro-CHP project worth EUR 199,956.88 was launched under the MCST Fusion R&I Programme, a collaboration between the University of Malta and Abertax Kemtronics Ltd. This project achieved an efficiency of over 85%, paving the way for compact, efficient, and low-cost mCHP units for small homes.

- April 2020: Magnex and Elcogen signed a Letter of Intent (LOI) for a commercial agreement on SOFC commercialization. Magnex Co. Ltd is developing SOFC systems, including a 1-5 kW mCHP generation system fueled by bio-gas or ethanol, targeting Japanese and Korean markets.

- August 2020: Axiom Energy Group planned to launch distributed micro combined heat and power (mCHP) systems through ATCO Group, aiming to deliver affordable, clean energy across North America. These systems offer highly efficient (over 93%) and near-zero emission electricity generation as a by-product of heat.

In-Depth Micro Combined Heat and Power Industry Market Outlook

The in-depth micro combined heat and power (mCHP) industry market outlook is exceptionally positive, driven by a confluence of strong technological advancements, supportive policy environments, and increasing global demand for sustainable energy solutions. Growth accelerators such as the ongoing development of more efficient and affordable fuel cell technologies, particularly SOFCs and PEM fuel cells, are set to significantly enhance the economic viability of mCHP systems for a broader consumer base. Strategic partnerships between manufacturers, installers, and energy providers are crucial for streamlining deployment and creating integrated energy solutions. Furthermore, governments worldwide are increasingly recognizing the role of mCHP in achieving energy security and decarbonization goals, leading to sustained policy support and financial incentives. The growing consumer awareness and demand for energy independence and reduced carbon footprints will continue to fuel market expansion, positioning mCHP as a key component of the future decentralized energy landscape. The projected market growth signifies immense potential for innovation, investment, and strategic development within this dynamic sector.

Micro Combined Heat and Power Industry Segmentation

-

1. Fuel Type

- 1.1. Natural Gas

- 1.2. Biogas

- 1.3. Other Fuel Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

Micro Combined Heat and Power Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Micro Combined Heat and Power Industry Regional Market Share

Geographic Coverage of Micro Combined Heat and Power Industry

Micro Combined Heat and Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities

- 3.3. Market Restrains

- 3.3.1. 4.; High Volatility of Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Residential Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Micro Combined Heat and Power Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Natural Gas

- 5.1.2. Biogas

- 5.1.3. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. North America Micro Combined Heat and Power Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Natural Gas

- 6.1.2. Biogas

- 6.1.3. Other Fuel Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Europe Micro Combined Heat and Power Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Natural Gas

- 7.1.2. Biogas

- 7.1.3. Other Fuel Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Asia Pacific Micro Combined Heat and Power Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Natural Gas

- 8.1.2. Biogas

- 8.1.3. Other Fuel Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. South America Micro Combined Heat and Power Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. Natural Gas

- 9.1.2. Biogas

- 9.1.3. Other Fuel Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. Middle East and Africa Micro Combined Heat and Power Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10.1.1. Natural Gas

- 10.1.2. Biogas

- 10.1.3. Other Fuel Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Fuel Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 2G Energy Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SOLIDpower Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Qnergy

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Helbio S A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Biomass Engineering Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TEDOM A S

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vaillant Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Enginuity Power Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Axiom Energy Group LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GRIDIRON LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Enexor Bioenergy

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Navien Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Remeha

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 EC Power A/S

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Yanmar Holdings Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Viessmann Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ATCO Ltd

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 2G Energy Inc

List of Figures

- Figure 1: Global Micro Combined Heat and Power Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Micro Combined Heat and Power Industry Volume Breakdown (Gigawatt, %) by Region 2025 & 2033

- Figure 3: North America Micro Combined Heat and Power Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 4: North America Micro Combined Heat and Power Industry Volume (Gigawatt), by Fuel Type 2025 & 2033

- Figure 5: North America Micro Combined Heat and Power Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 6: North America Micro Combined Heat and Power Industry Volume Share (%), by Fuel Type 2025 & 2033

- Figure 7: North America Micro Combined Heat and Power Industry Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Micro Combined Heat and Power Industry Volume (Gigawatt), by Application 2025 & 2033

- Figure 9: North America Micro Combined Heat and Power Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Micro Combined Heat and Power Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Micro Combined Heat and Power Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Micro Combined Heat and Power Industry Volume (Gigawatt), by Country 2025 & 2033

- Figure 13: North America Micro Combined Heat and Power Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Micro Combined Heat and Power Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Micro Combined Heat and Power Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 16: Europe Micro Combined Heat and Power Industry Volume (Gigawatt), by Fuel Type 2025 & 2033

- Figure 17: Europe Micro Combined Heat and Power Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 18: Europe Micro Combined Heat and Power Industry Volume Share (%), by Fuel Type 2025 & 2033

- Figure 19: Europe Micro Combined Heat and Power Industry Revenue (billion), by Application 2025 & 2033

- Figure 20: Europe Micro Combined Heat and Power Industry Volume (Gigawatt), by Application 2025 & 2033

- Figure 21: Europe Micro Combined Heat and Power Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Micro Combined Heat and Power Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Micro Combined Heat and Power Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Micro Combined Heat and Power Industry Volume (Gigawatt), by Country 2025 & 2033

- Figure 25: Europe Micro Combined Heat and Power Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Micro Combined Heat and Power Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Micro Combined Heat and Power Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 28: Asia Pacific Micro Combined Heat and Power Industry Volume (Gigawatt), by Fuel Type 2025 & 2033

- Figure 29: Asia Pacific Micro Combined Heat and Power Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 30: Asia Pacific Micro Combined Heat and Power Industry Volume Share (%), by Fuel Type 2025 & 2033

- Figure 31: Asia Pacific Micro Combined Heat and Power Industry Revenue (billion), by Application 2025 & 2033

- Figure 32: Asia Pacific Micro Combined Heat and Power Industry Volume (Gigawatt), by Application 2025 & 2033

- Figure 33: Asia Pacific Micro Combined Heat and Power Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Micro Combined Heat and Power Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Micro Combined Heat and Power Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Micro Combined Heat and Power Industry Volume (Gigawatt), by Country 2025 & 2033

- Figure 37: Asia Pacific Micro Combined Heat and Power Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Micro Combined Heat and Power Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Micro Combined Heat and Power Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 40: South America Micro Combined Heat and Power Industry Volume (Gigawatt), by Fuel Type 2025 & 2033

- Figure 41: South America Micro Combined Heat and Power Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 42: South America Micro Combined Heat and Power Industry Volume Share (%), by Fuel Type 2025 & 2033

- Figure 43: South America Micro Combined Heat and Power Industry Revenue (billion), by Application 2025 & 2033

- Figure 44: South America Micro Combined Heat and Power Industry Volume (Gigawatt), by Application 2025 & 2033

- Figure 45: South America Micro Combined Heat and Power Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Micro Combined Heat and Power Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Micro Combined Heat and Power Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: South America Micro Combined Heat and Power Industry Volume (Gigawatt), by Country 2025 & 2033

- Figure 49: South America Micro Combined Heat and Power Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Micro Combined Heat and Power Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Micro Combined Heat and Power Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 52: Middle East and Africa Micro Combined Heat and Power Industry Volume (Gigawatt), by Fuel Type 2025 & 2033

- Figure 53: Middle East and Africa Micro Combined Heat and Power Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 54: Middle East and Africa Micro Combined Heat and Power Industry Volume Share (%), by Fuel Type 2025 & 2033

- Figure 55: Middle East and Africa Micro Combined Heat and Power Industry Revenue (billion), by Application 2025 & 2033

- Figure 56: Middle East and Africa Micro Combined Heat and Power Industry Volume (Gigawatt), by Application 2025 & 2033

- Figure 57: Middle East and Africa Micro Combined Heat and Power Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Micro Combined Heat and Power Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Micro Combined Heat and Power Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Micro Combined Heat and Power Industry Volume (Gigawatt), by Country 2025 & 2033

- Figure 61: Middle East and Africa Micro Combined Heat and Power Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Micro Combined Heat and Power Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 2: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Fuel Type 2020 & 2033

- Table 3: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 5: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 8: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Fuel Type 2020 & 2033

- Table 9: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 11: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 14: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Fuel Type 2020 & 2033

- Table 15: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 17: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 19: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 20: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Fuel Type 2020 & 2033

- Table 21: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 23: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 26: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Fuel Type 2020 & 2033

- Table 27: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 29: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 31: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 32: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Fuel Type 2020 & 2033

- Table 33: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Application 2020 & 2033

- Table 35: Global Micro Combined Heat and Power Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Micro Combined Heat and Power Industry Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Micro Combined Heat and Power Industry?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Micro Combined Heat and Power Industry?

Key companies in the market include 2G Energy Inc, SOLIDpower Group, Qnergy, Helbio S A, Biomass Engineering Limited, TEDOM A S, Vaillant Group, Enginuity Power Systems, Axiom Energy Group LLC, GRIDIRON LLC, Enexor Bioenergy, Navien Inc, Remeha, EC Power A/S, Yanmar Holdings Co Ltd, Viessmann Group, ATCO Ltd.

3. What are the main segments of the Micro Combined Heat and Power Industry?

The market segments include Fuel Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.4 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities.

6. What are the notable trends driving market growth?

Residential Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Volatility of Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

A micro-CHP project worth EUR 199,956.88 was launched on November 2021, during a public engagement event held at the EsploraPlanetarium at Esplora Interactive Science Centre in Kalkara, under the MCST Fusion R&I Programme. This programme is a collaboration between the University of Malta and Abertax Kemtronics Ltd. The launched project has an efficiency of more than 85%, thus, enabling the development of a compact, efficient, and low-cost unit of combined heat and power system ideal for small homes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Micro Combined Heat and Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Micro Combined Heat and Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Micro Combined Heat and Power Industry?

To stay informed about further developments, trends, and reports in the Micro Combined Heat and Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence