Key Insights

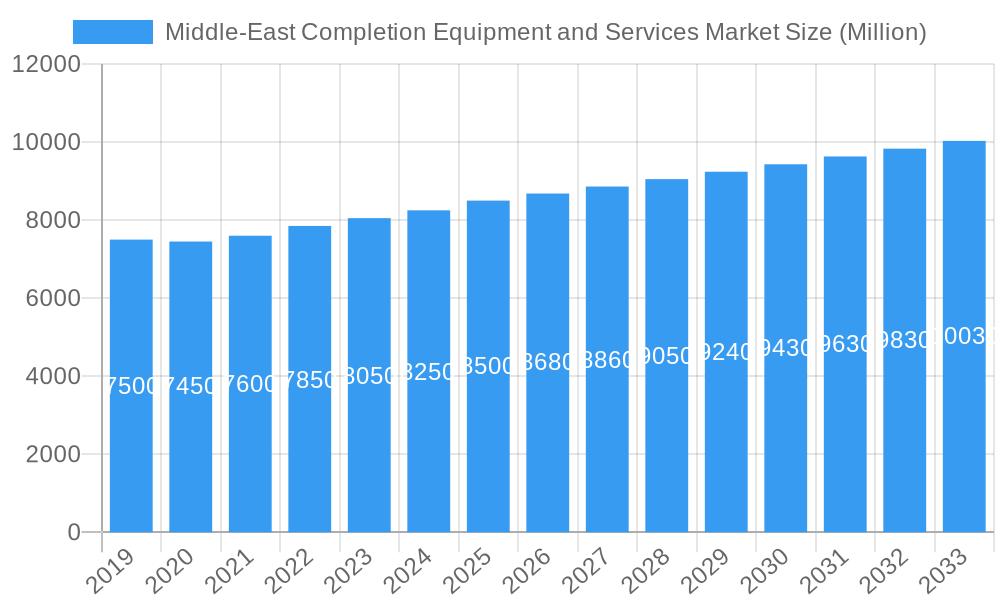

The Middle East Completion Equipment and Services Market is poised for robust growth, projected to reach a substantial market size of approximately $8,500 million by 2025, with a CAGR exceeding 1.00% in the coming years. This expansion is primarily fueled by significant investments in oil and gas exploration and production (E&P) activities across the region, driven by the ongoing demand for hydrocarbons. Key drivers include the substantial untapped reserves, particularly in Saudi Arabia and the UAE, alongside ongoing efforts to optimize production from existing fields and develop new ones. Technological advancements in completion technologies, such as intelligent completions and advanced artificial lift systems, are also playing a crucial role, enabling operators to enhance recovery rates and operational efficiency. The increasing focus on maximizing output from mature fields, coupled with the strategic importance of oil and gas in the region's economy, underpins the sustained demand for specialized completion equipment and services.

Middle-East Completion Equipment and Services Market Market Size (In Billion)

The market dynamics are further shaped by evolving trends such as the adoption of digital solutions for real-time monitoring and data analytics, and a growing emphasis on environmentally friendly completion practices. While the market is generally optimistic, certain restraints like fluctuating crude oil prices, geopolitical instability in some sub-regions, and stringent environmental regulations can pose challenges. However, the inherent resilience of the Middle Eastern oil and gas sector, coupled with proactive government initiatives to diversify economies and attract foreign investment, is expected to mitigate these concerns. Geographically, Saudi Arabia and the United Arab Emirates are anticipated to lead the market, owing to their dominant production capacities and substantial E&P budgets. The competitive landscape is characterized by the presence of major global players and regional specialists, all vying for market share through innovation, strategic partnerships, and comprehensive service offerings.

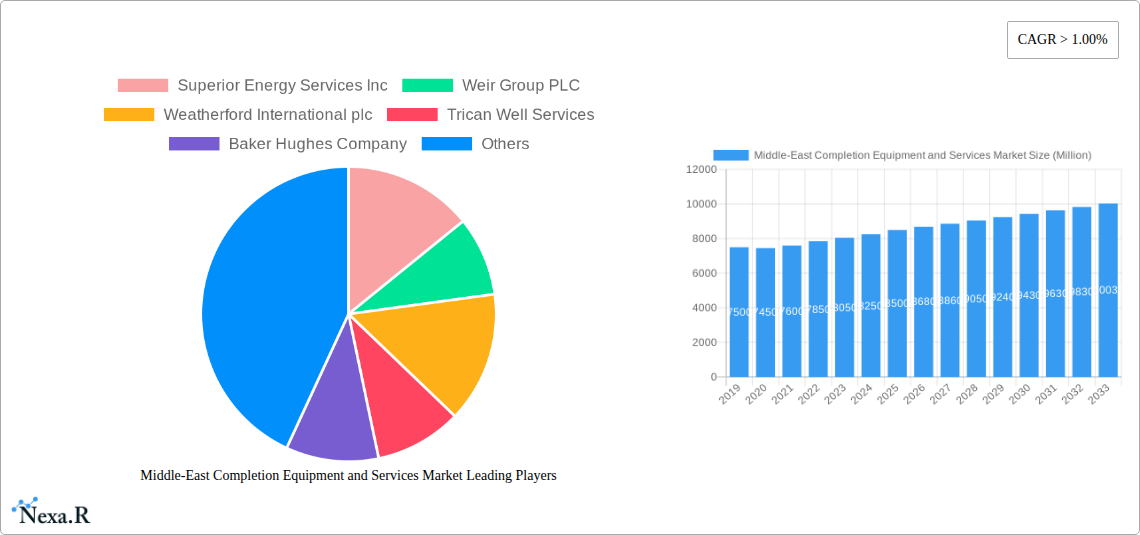

Middle-East Completion Equipment and Services Market Company Market Share

Middle-East Completion Equipment and Services Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report offers a strategic analysis of the Middle-East Completion Equipment and Services Market, a critical sector for the region's energy industry. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report provides unparalleled insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and the competitive environment. Leveraging high-traffic keywords, this analysis is designed to maximize search engine visibility and engage industry professionals, including oil and gas operators, service providers, equipment manufacturers, investors, and policymakers. The report delves into both parent and child market segments, offering a holistic view of the completion equipment and services ecosystem, with all values presented in Million USD units.

Middle-East Completion Equipment and Services Market Market Dynamics & Structure

The Middle-East Completion Equipment and Services Market exhibits a moderately concentrated structure, with a blend of global giants and regional specialists. Technological innovation is a primary driver, propelled by the ongoing pursuit of enhanced recovery rates and cost efficiencies in exploration and production (E&P) activities. Regulatory frameworks, influenced by national oil companies' strategic objectives and environmental concerns, are shaping operational standards and adoption of advanced technologies. Competitive product substitutes are emerging, particularly in areas like intelligent completion systems and advanced downhole tools, pushing for continuous improvement and differentiation. End-user demographics are characterized by national oil companies (NOCs) and international oil companies (IOCs) with sophisticated operational requirements and a strong focus on maximizing hydrocarbon recovery. Mergers and acquisitions (M&A) trends are dynamic, as larger entities seek to consolidate market share, expand service portfolios, and acquire niche technological capabilities. For instance, the historical period (2019-2024) saw a XX volume of M&A deals, indicating strategic consolidation efforts.

- Market Concentration: Moderate, with key global players holding significant market share.

- Technological Innovation Drivers: Enhanced oil recovery (EOR) techniques, digitalization, and automation in well completions.

- Regulatory Frameworks: Evolving environmental regulations and NOC-driven localization policies.

- Competitive Product Substitutes: Advanced artificial lift systems and smart well completion technologies.

- End-User Demographics: Dominance of NOCs (e.g., Saudi Aramco, ADNOC) and major IOCs.

- M&A Trends: Strategic acquisitions for technology integration and market expansion.

Middle-East Completion Equipment and Services Market Growth Trends & Insights

The Middle-East Completion Equipment and Services Market is poised for robust growth, driven by the region's substantial hydrocarbon reserves and ongoing investments in upstream activities. The market size evolution is projected to witness a significant upward trajectory, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025–2033). Adoption rates of advanced completion technologies, such as intelligent completions, multi-stage fracturing, and sand control systems, are rapidly increasing as operators strive to optimize production from challenging reservoirs and extend the life of existing wells. Technological disruptions, including the integration of artificial intelligence (AI) for real-time data analysis and predictive maintenance, are transforming service delivery and operational efficiency. Consumer behavior shifts are evident, with a growing demand for integrated solutions, remote monitoring capabilities, and sustainable completion practices. The market penetration of specialized completion services is expected to deepen, reflecting the increasing complexity of E&P projects. Based on projected market data, the overall market size is estimated to reach $XX,XXX million in 2025, growing to $YY,YYY million by 2033.

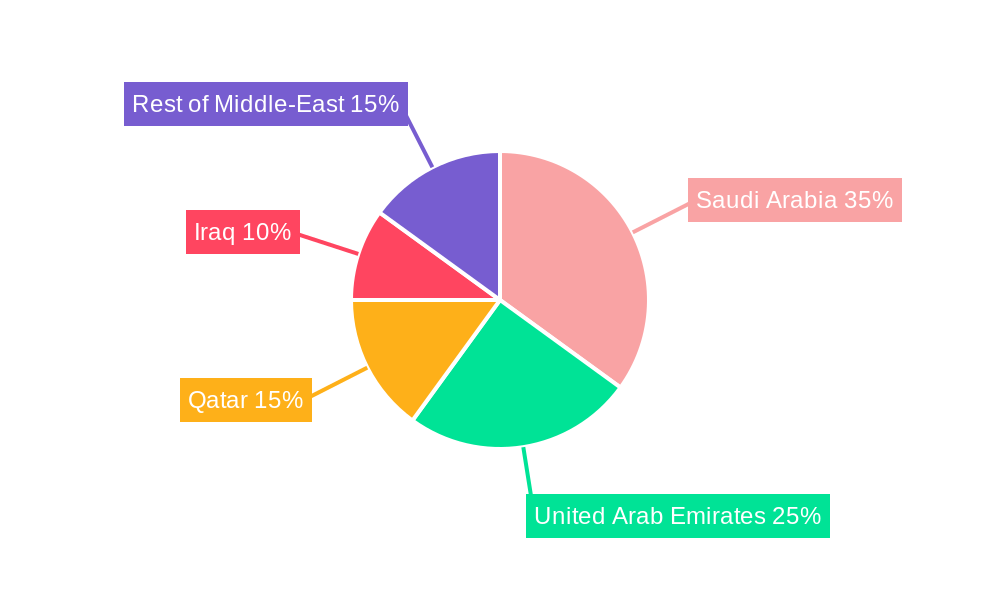

Dominant Regions, Countries, or Segments in Middle-East Completion Equipment and Services Market

Saudi Arabia is identified as the dominant country within the Middle-East Completion Equipment and Services Market, exhibiting substantial growth potential and commanding a significant market share. This dominance is fueled by Saudi Arabia's position as the world's largest oil exporter and its ambitious Vision 2030, which includes aggressive upstream investment plans to maintain and expand oil production capacity. Key drivers of this dominance include substantial untapped hydrocarbon reserves, extensive onshore and offshore exploration and production activities, and government policies that encourage technological adoption and localization of services. The United Arab Emirates (UAE) and Qatar also represent significant markets, with their own strategic initiatives to enhance oil and gas production and develop their downstream industries. Iraq, despite facing historical challenges, presents a substantial growth opportunity as it continues to rebuild and attract foreign investment in its E&P sector.

- Saudi Arabia: Leading market share driven by massive production capacity and strategic E&P investments.

- Key drivers: Vision 2030, extensive oil reserves, large-scale projects.

- Dominant segments: Onshore completions, advanced well intervention services.

- United Arab Emirates (UAE): Significant market with substantial offshore operations and technological advancements.

- Key drivers: ADNOC's expansion plans, focus on complex offshore fields.

- Dominant segments: Offshore completions, subsea services.

- Qatar: Strong focus on natural gas production, driving demand for specialized completion solutions.

- Key drivers: LNG export dominance, development of North Field.

- Dominant segments: Offshore gas well completions.

- Iraq: Emerging market with high growth potential fueled by infrastructure development and investment attraction.

- Key drivers: Reconstruction efforts, untapped reserves, IOC partnerships.

- Dominant segments: Onshore completions, well integrity services.

- Rest of Middle-East: Encompasses markets like Kuwait, Oman, and Bahrain, with steady demand for completion equipment and services.

Middle-East Completion Equipment and Services Market Product Landscape

The product landscape within the Middle-East Completion Equipment and Services Market is characterized by advanced technologies designed to maximize hydrocarbon recovery and ensure well integrity. Innovations include intelligent completion systems with real-time downhole data acquisition and control, multi-stage fracturing tools for enhanced reservoir stimulation, and high-performance sand control solutions for unconsolidated formations. Performance metrics are continuously being optimized for durability, efficiency, and reliability in harsh operating environments, both onshore and offshore. Unique selling propositions often lie in the customization of completion designs to specific reservoir characteristics and the integration of digital solutions for enhanced operational visibility and performance. Technological advancements are also focused on developing more sustainable and environmentally friendly completion fluids and methods.

Key Drivers, Barriers & Challenges in Middle-East Completion Equipment and Services Market

Key Drivers:

- Sustained Hydrocarbon Demand: The region's crucial role in global energy supply ensures continued investment in oil and gas exploration and production.

- Technological Advancements: Adoption of AI, IoT, and advanced materials in completion equipment and services for improved efficiency and recovery.

- Government Initiatives: National visions and policies promoting local content development and investment in the energy sector.

- Evolving Reservoir Complexity: Increasing extraction from challenging deepwater and unconventional reservoirs necessitates sophisticated completion solutions.

Key Barriers & Challenges:

- Geopolitical Instability: Regional conflicts and political uncertainties can impact investment and operational continuity.

- Price Volatility of Crude Oil: Fluctuations in oil prices directly affect E&P spending and, consequently, demand for completion services.

- Skilled Workforce Shortages: A deficit in specialized engineering and operational talent can hinder the adoption of advanced technologies.

- Supply Chain Disruptions: Global supply chain issues can lead to delays and increased costs for essential equipment and materials. The estimated impact of these disruptions on project timelines can be up to xx%.

- Stringent Environmental Regulations: Increasing focus on emissions reduction and sustainable practices requires adaptation and investment in greener technologies.

Emerging Opportunities in Middle-East Completion Equipment and Services Market

Emerging opportunities in the Middle-East Completion Equipment and Services Market lie in the growing demand for digital solutions, including AI-powered well diagnostics, remote monitoring systems, and data analytics platforms for optimizing completion performance. The expansion of offshore fields, particularly in the UAE and Qatar, presents significant opportunities for specialized subsea completion equipment and services. Furthermore, the increasing focus on natural gas production, especially in Qatar, is driving demand for tailored completion technologies for gas wells. Untapped opportunities also exist in providing integrated project management and lifecycle services, moving beyond single-component provision to offer comprehensive solutions.

Growth Accelerators in the Middle-East Completion Equipment and Services Market Industry

Growth accelerators for the Middle-East Completion Equipment and Services Market industry include significant upstream investment by national oil companies to meet global energy demand and maintain market share. Technological breakthroughs in areas like expandable tubulars, advanced stimulation techniques, and intelligent completion design are creating new avenues for service providers. Strategic partnerships between global technology providers and local entities are fostering knowledge transfer and the development of bespoke solutions for the region. Market expansion strategies, including the development of new offshore fields and the revitalization of mature onshore assets, are continuously driving the demand for specialized completion equipment and services.

Key Players Shaping the Middle-East Completion Equipment and Services Market Market

- Superior Energy Services Inc

- Weir Group PLC

- Weatherford International plc

- Trican Well Services

- Baker Hughes Company

- Halliburton Company

- National-Oilwell Varco Inc

- Schoeller-Bleckmann Oilfield Equipment AG

- Welltec A/S

- Schlumberger Limited

Notable Milestones in Middle-East Completion Equipment and Services Market Sector

- 2019: Schlumberger launches its advanced artificial lift solutions, enhancing production efficiency in mature fields.

- 2020: Baker Hughes announces strategic collaborations for digital oilfield technologies in the region.

- 2021: Halliburton secures major contracts for well completion services in Saudi Arabia, boosting its market presence.

- 2022: Weatherford International introduces innovative sand control solutions for complex offshore wells in the UAE.

- 2023: National-Oilwell Varco expands its manufacturing capabilities in the Middle East to meet growing demand for wellhead equipment.

- 2024: Superior Energy Services focuses on expanding its coiled tubing services for well intervention in Iraq.

In-Depth Middle-East Completion Equipment and Services Market Market Outlook

The future outlook for the Middle-East Completion Equipment and Services Market is exceptionally bright, underpinned by sustained investment in hydrocarbon production and a progressive embrace of technological innovation. Growth accelerators such as ambitious E&P programs driven by national energy strategies, coupled with the relentless pursuit of operational efficiency through digitalization and automation, will continue to propel market expansion. The increasing demand for complex completion solutions in both onshore and offshore environments, alongside a growing emphasis on sustainable energy practices, presents strategic opportunities for companies offering advanced, eco-friendly technologies. The market is expected to witness significant growth in integrated service offerings, reflecting the evolving needs of operators seeking end-to-end solutions.

Middle-East Completion Equipment and Services Market Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Qatar

- 2.4. Iraq

- 2.5. Rest of Middle-East

Middle-East Completion Equipment and Services Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Iraq

- 5. Rest of Middle East

Middle-East Completion Equipment and Services Market Regional Market Share

Geographic Coverage of Middle-East Completion Equipment and Services Market

Middle-East Completion Equipment and Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 1.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Offshore to be a Significant Segment in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East Completion Equipment and Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. United Arab Emirates

- 5.2.3. Qatar

- 5.2.4. Iraq

- 5.2.5. Rest of Middle-East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. Iraq

- 5.3.5. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Saudi Arabia Middle-East Completion Equipment and Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. United Arab Emirates

- 6.2.3. Qatar

- 6.2.4. Iraq

- 6.2.5. Rest of Middle-East

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. United Arab Emirates Middle-East Completion Equipment and Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. United Arab Emirates

- 7.2.3. Qatar

- 7.2.4. Iraq

- 7.2.5. Rest of Middle-East

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Qatar Middle-East Completion Equipment and Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. United Arab Emirates

- 8.2.3. Qatar

- 8.2.4. Iraq

- 8.2.5. Rest of Middle-East

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Iraq Middle-East Completion Equipment and Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. United Arab Emirates

- 9.2.3. Qatar

- 9.2.4. Iraq

- 9.2.5. Rest of Middle-East

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Rest of Middle East Middle-East Completion Equipment and Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. United Arab Emirates

- 10.2.3. Qatar

- 10.2.4. Iraq

- 10.2.5. Rest of Middle-East

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Superior Energy Services Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Weir Group PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Weatherford International plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Trican Well Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Baker Hughes Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Halliburton Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 National-Oilwell Varco Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schoeller-Bleckmann Oilfield Equipment AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Welltec A/S

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Schlumberger Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Superior Energy Services Inc

List of Figures

- Figure 1: Middle-East Completion Equipment and Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle-East Completion Equipment and Services Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 2: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 5: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 8: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 11: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 14: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Location of Deployment 2020 & 2033

- Table 17: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Middle-East Completion Equipment and Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East Completion Equipment and Services Market?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Middle-East Completion Equipment and Services Market?

Key companies in the market include Superior Energy Services Inc, Weir Group PLC, Weatherford International plc, Trican Well Services, Baker Hughes Company, Halliburton Company, National-Oilwell Varco Inc, Schoeller-Bleckmann Oilfield Equipment AG, Welltec A/S, Schlumberger Limited.

3. What are the main segments of the Middle-East Completion Equipment and Services Market?

The market segments include Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Offshore to be a Significant Segment in the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East Completion Equipment and Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East Completion Equipment and Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East Completion Equipment and Services Market?

To stay informed about further developments, trends, and reports in the Middle-East Completion Equipment and Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence