Key Insights

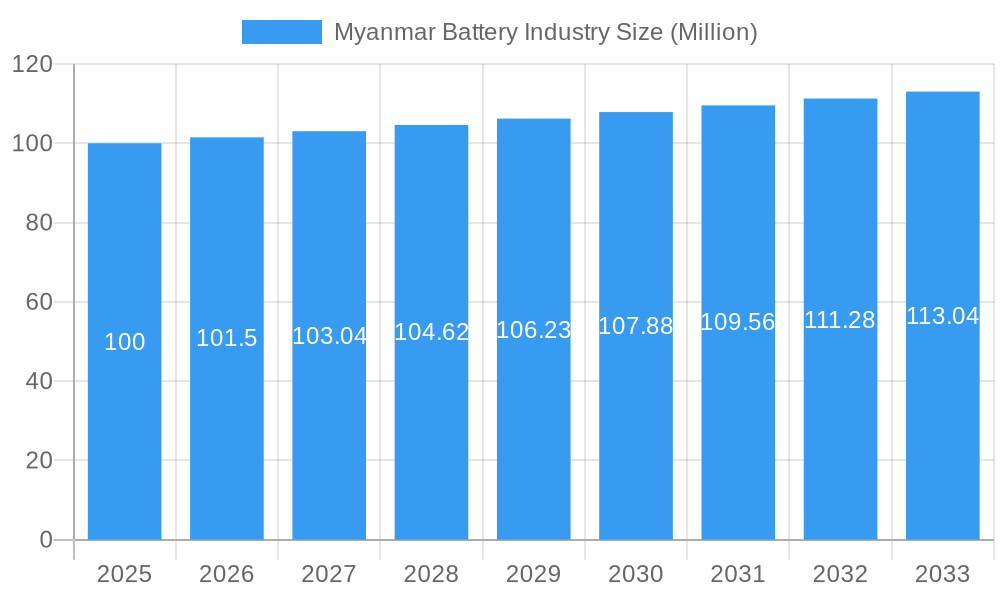

The Myanmar battery market is exhibiting strong expansion, presenting a significant investment prospect. Projecting a Compound Annual Growth Rate (CAGR) of 17.9%, the market is anticipated to reach $151.54 billion by 2025. This growth trajectory, spanning from the base year 2025 to 2033, is underpinned by key drivers including the electrification of transportation, particularly two- and three-wheeled vehicles, escalating consumer electronics demand, and broader industrial sector expansion. The market is segmented by battery technology (lead-acid, lithium-ion, others) and application (automotive, industrial, consumer electronics, others). While lead-acid batteries currently lead due to cost-effectiveness, lithium-ion batteries are projected for substantial market share growth, driven by electric vehicle adoption and energy storage advancements.

Myanmar Battery Industry Market Size (In Billion)

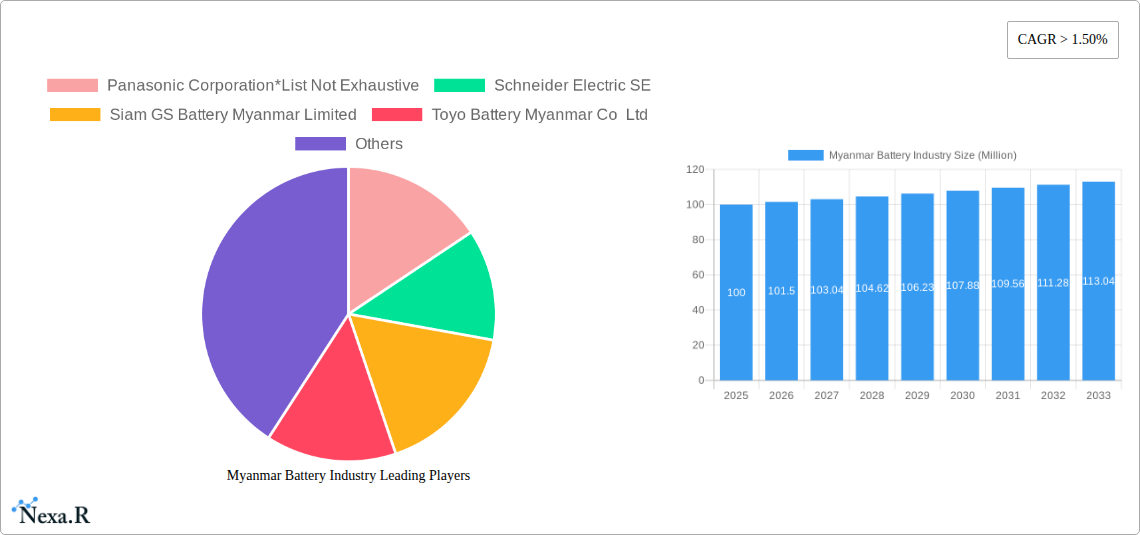

Key market restraints include constrained domestic manufacturing, reliance on imported components, and underdeveloped infrastructure. Leading industry players such as Panasonic Corporation, Schneider Electric SE, Siam GS Battery Myanmar Limited, and Toyo Battery Myanmar Co Ltd are pursuing strategic alliances, technological innovation, and localization efforts. Government initiatives supporting sustainable energy and economic development are expected to further fuel market growth, with urban centers and industrial zones anticipated to lead expansion. Detailed analysis of automotive and industrial sub-segments will offer deeper market insights. Overcoming infrastructure deficits and cultivating domestic manufacturing capabilities are crucial for maximizing the Myanmar battery industry's potential.

Myanmar Battery Industry Company Market Share

Myanmar Battery Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Myanmar battery industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report is invaluable for industry professionals, investors, and policymakers seeking insights into this rapidly evolving market. The report segments the market by battery technology (Lead Acid Battery, Lithium-ion Battery, Other Battery Types) and application (Automotive, Industrial, Consumer Electronics, Other Applications).

Myanmar Battery Industry Market Dynamics & Structure

The Myanmar battery market exhibits a moderately concentrated structure, with key players like Panasonic Corporation, Schneider Electric SE, Siam GS Battery Myanmar Limited, and Toyo Battery Myanmar Co Ltd holding significant market share. However, the market is witnessing increased competition from new entrants, particularly in the lithium-ion battery segment. Technological innovation is driven by the growing demand for electric vehicles and energy storage systems, although infrastructure limitations and access to advanced technology pose challenges. Regulatory frameworks are evolving, aiming to promote sustainable energy practices and attract foreign investment. The market is also influenced by the availability of substitute products and evolving end-user demographics, particularly the rise of the middle class and increasing smartphone penetration.

- Market Concentration: Moderately concentrated, with a few dominant players but increasing competition.

- Technological Innovation: Driven by EV and energy storage demand, hindered by infrastructure limitations.

- Regulatory Framework: Evolving to support sustainable energy and foreign investment.

- Competitive Substitutes: Presence of alternative energy storage solutions impacts market growth.

- End-User Demographics: Rising middle class and smartphone adoption fuels demand.

- M&A Trends: xx M&A deals recorded between 2019 and 2024, indicating a moderate level of consolidation (estimated).

Myanmar Battery Industry Growth Trends & Insights

The Myanmar battery market experienced xx Million units growth between 2019 and 2024, driven primarily by increased demand from the consumer electronics and automotive sectors. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), reaching an estimated market size of xx Million units by 2033. This growth is fueled by the expansion of the telecommunications infrastructure, increased electrification efforts, and rising disposable incomes. However, factors like unreliable power supply and import restrictions might affect the market's trajectory. Technological advancements, particularly in lithium-ion battery technology, are significantly impacting market dynamics, leading to increased adoption and improved performance characteristics. Consumer behavior is shifting toward preference for longer-lasting and more efficient batteries, especially in portable electronics.

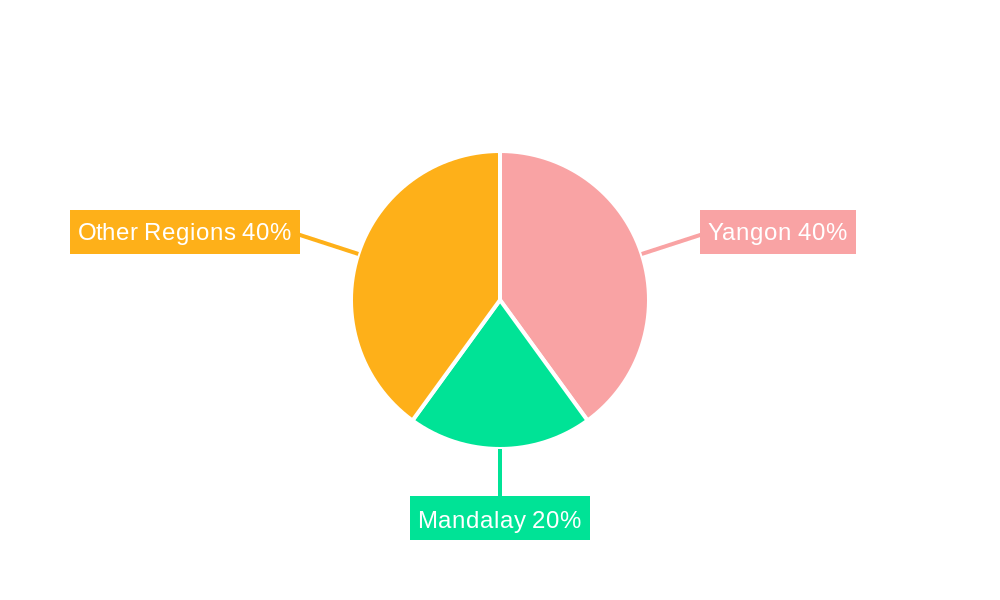

Dominant Regions, Countries, or Segments in Myanmar Battery Industry

The Yangon region dominates the Myanmar battery market, accounting for approximately xx% of total market share in 2024, owing to its concentration of industrial activities and higher consumer spending. The automotive segment is projected to be the fastest-growing application segment, with a CAGR of xx% during the forecast period, driven by rising vehicle sales and government initiatives promoting electric vehicle adoption. Lead-acid batteries currently hold the largest market share, but lithium-ion batteries are expected to experience significant growth due to their superior performance and increasing demand in the electronics industry.

- Key Drivers for Yangon Region Dominance: High concentration of industries, significant consumer base.

- Key Drivers for Automotive Segment Growth: Rising vehicle sales, government initiatives promoting EVs.

- Key Drivers for Lithium-ion Battery Growth: Superior performance, increasing electronics demand.

Myanmar Battery Industry Product Landscape

The Myanmar battery market offers a diverse range of products, including lead-acid batteries, lithium-ion batteries, and other specialized battery types. Significant advancements are observed in lithium-ion battery technology, with a focus on improving energy density, lifespan, and safety features. The automotive industry demands high-performance batteries with enhanced energy storage capacity and rapid charging capabilities. Companies are actively developing unique selling propositions through improved battery management systems and customized solutions for specific applications.

Key Drivers, Barriers & Challenges in Myanmar Battery Industry

Key Drivers:

- Increasing demand from consumer electronics and the automotive sector.

- Government initiatives promoting sustainable energy and electric vehicle adoption.

- Technological advancements in battery technology, enhancing performance and efficiency.

Key Barriers & Challenges:

- Import restrictions and supply chain disruptions affecting raw material availability.

- Inadequate infrastructure, hindering the efficient distribution and deployment of batteries.

- Regulatory uncertainties and lack of standardized testing protocols for battery safety. These factors impact market growth by an estimated xx% annually.

Emerging Opportunities in Myanmar Battery Industry

- Growing demand for energy storage solutions to address power outages.

- Increasing adoption of electric two-wheelers and three-wheelers.

- Opportunities in renewable energy integration with battery storage systems.

Growth Accelerators in the Myanmar Battery Industry Industry

Technological breakthroughs in battery chemistry, particularly in solid-state batteries, are poised to significantly improve energy density and safety, fueling market growth. Strategic partnerships between battery manufacturers and automotive companies will accelerate electric vehicle adoption. Market expansion strategies, targeting underserved regions and expanding distribution networks, will unlock significant potential.

Key Players Shaping the Myanmar Battery Industry Market

- Panasonic Corporation

- Schneider Electric SE

- Siam GS Battery Myanmar Limited

- Toyo Battery Myanmar Co Ltd

Notable Milestones in Myanmar Battery Industry Sector

- August 2019: Mytel launches Myanmar's first 5G network, showcasing VR and 4K video capabilities. This boosted demand for high-performance batteries in mobile devices.

- November 2019: MPT upgrades infrastructure with USD 64 million investment, paving the way for future 5G expansion and increased power demands.

In-Depth Myanmar Battery Industry Market Outlook

The Myanmar battery industry is poised for substantial growth, driven by technological advancements, infrastructure development, and increasing demand across various sectors. Strategic investments in research and development, coupled with supportive government policies, are crucial for unlocking the full market potential. Opportunities exist in exploring niche applications, developing customized battery solutions, and expanding into rural markets to further accelerate growth and drive adoption.

Myanmar Battery Industry Segmentation

-

1. Battery Technology

- 1.1. Lead Acid Battery

- 1.2. Lithium-ion Battery

- 1.3. Other Battery Types

-

2. Application

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Consumer Electronics

- 2.4. Other Ap

Myanmar Battery Industry Segmentation By Geography

- 1. Myanmar

Myanmar Battery Industry Regional Market Share

Geographic Coverage of Myanmar Battery Industry

Myanmar Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Myanmar Battery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Technology

- 5.1.1. Lead Acid Battery

- 5.1.2. Lithium-ion Battery

- 5.1.3. Other Battery Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Consumer Electronics

- 5.2.4. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Battery Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Schneider Electric SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siam GS Battery Myanmar Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toyo Battery Myanmar Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.1 Panasonic Corporation*List Not Exhaustive

List of Figures

- Figure 1: Myanmar Battery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Myanmar Battery Industry Share (%) by Company 2025

List of Tables

- Table 1: Myanmar Battery Industry Revenue billion Forecast, by Battery Technology 2020 & 2033

- Table 2: Myanmar Battery Industry Volume K Units Forecast, by Battery Technology 2020 & 2033

- Table 3: Myanmar Battery Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Myanmar Battery Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 5: Myanmar Battery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Myanmar Battery Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Myanmar Battery Industry Revenue billion Forecast, by Battery Technology 2020 & 2033

- Table 8: Myanmar Battery Industry Volume K Units Forecast, by Battery Technology 2020 & 2033

- Table 9: Myanmar Battery Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Myanmar Battery Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 11: Myanmar Battery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Myanmar Battery Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Myanmar Battery Industry?

The projected CAGR is approximately 17.9%.

2. Which companies are prominent players in the Myanmar Battery Industry?

Key companies in the market include Panasonic Corporation*List Not Exhaustive, Schneider Electric SE, Siam GS Battery Myanmar Limited, Toyo Battery Myanmar Co Ltd.

3. What are the main segments of the Myanmar Battery Industry?

The market segments include Battery Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.54 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Automotive Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

Myanmar fourth mobile operator Mytel, in August 2019, announced the launch of its first 5G network in Myanmar. The pilot was achieved using 3.5GHz frequency and reached 1.6Gbps download speed on a single handset device. During this event, customers had the opportunity to experience Virtual Reality (VR) as well as Video 4K, both applications taking full advantage of Mytel 5G network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Myanmar Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Myanmar Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Myanmar Battery Industry?

To stay informed about further developments, trends, and reports in the Myanmar Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence