Key Insights

The North American Industrial Air Quality Control Systems market is projected to reach $127.11 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.3% from 2025 to 2033. This expansion is driven by stringent environmental regulations and escalating industrial activity. Key industries such as power generation, cement, and chemicals are prioritizing emission mitigation for nitrogen oxides (NOx), sulfur oxides (SO2), and particulate matter (PM). Advancements in technologies like electrostatic precipitators (ESPs), flue gas desulfurization (FGD) systems, selective catalytic reduction (SCR), and fabric filters are enhancing efficiency and reducing operational expenses, thereby stimulating market growth. Challenges include high initial investment costs and potential economic downturns. The market is segmented by technology (ESPs, FGDs, SCRs, fabric filters, others) and application (power generation, cement, chemicals, iron & steel, automotive, oil & gas, others), presenting diverse opportunities, with significant growth anticipated in the power generation sector due to the increasing demand for cleaner energy.

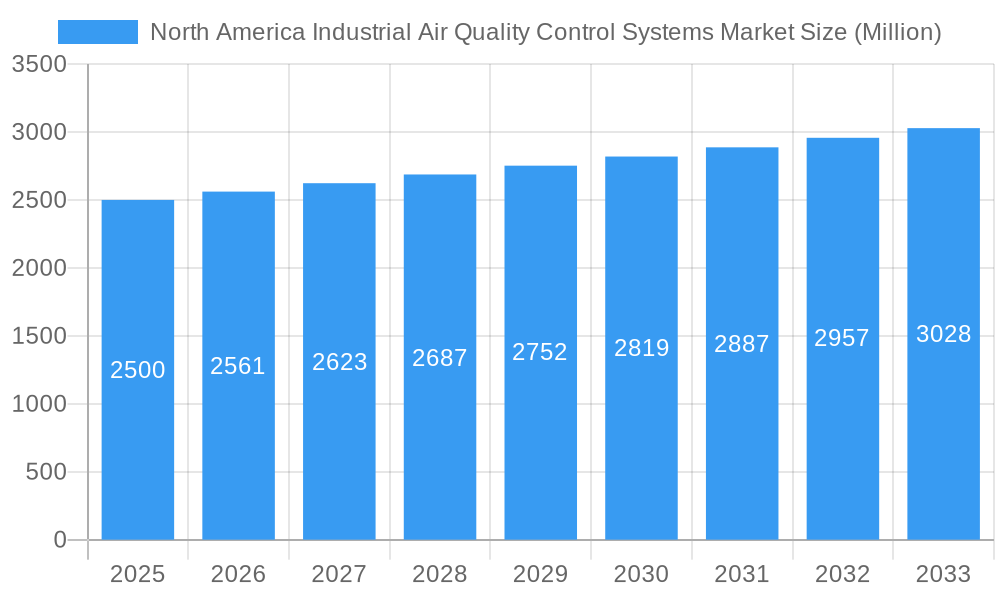

North America Industrial Air Quality Control Systems Market Market Size (In Billion)

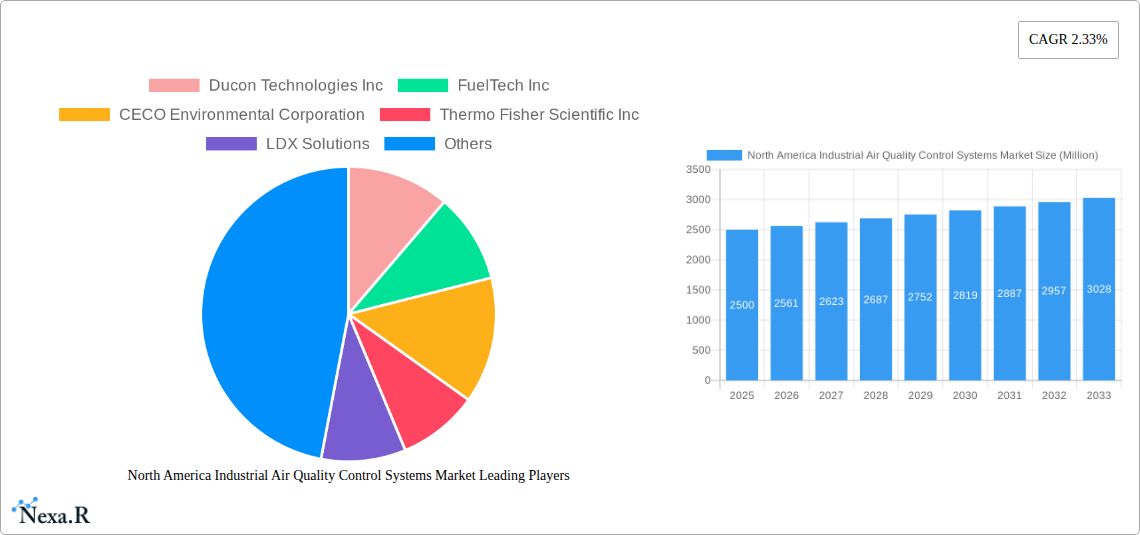

The competitive arena features established entities such as Babcock & Wilcox Enterprises Ltd and General Electric Company, alongside specialized firms like Ducon Technologies Inc and FuelTech Inc. These companies are actively pursuing technological innovation, strategic alliances, and market expansion to sustain their competitive positions. The North American market benefits from a strong regulatory framework dedicated to environmental protection, fostering the adoption of advanced air quality control systems. Future growth will be contingent upon the evolution of environmental policies, technological breakthroughs, and the broader economic climate, indicating a steady and predictable market trajectory over the next decade. The ongoing shift towards cleaner energy and a heightened focus on sustainability will further accelerate demand for sophisticated air quality control solutions.

North America Industrial Air Quality Control Systems Market Company Market Share

North America Industrial Air Quality Control Systems Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the North America Industrial Air Quality Control Systems market, encompassing market dynamics, growth trends, regional dominance, product landscape, key challenges, emerging opportunities, and leading players. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The market is segmented by type (Electrostatic Precipitators (ESP), Flue Gas Desulfurization (FGD) and Scrubbers, Selective Catalytic Reduction (SCR), Fabric Filters, Others) and application (Power Generation Industry, Cement Industry, Chemicals and Fertilizers, Iron and Steel Industry, Automotive Industry, Oil & Gas Industry, Other Applications). The report also provides a qualitative analysis of emissions (Nitrogen Oxides (NOx), Sulphur Oxides (SO2), Particulate Matter (PM)). Market size is presented in Million Units.

North America Industrial Air Quality Control Systems Market Dynamics & Structure

This section delves into the intricate structure of the North America Industrial Air Quality Control Systems market, analyzing its concentration, technological advancements, regulatory landscape, competitive dynamics, and end-user trends. The market exhibits a moderately concentrated structure, with a few large players commanding significant market share (estimated at xx%). However, a vibrant ecosystem of smaller, specialized companies also exists.

- Market Concentration: xx% held by top 5 players in 2024.

- Technological Innovation: Continuous advancements in ESP, SCR, and FGD technologies are driving efficiency gains and reduced emissions. Innovation barriers include high R&D costs and stringent regulatory approvals.

- Regulatory Framework: Stringent environmental regulations in North America, particularly concerning NOx, SO2, and PM emissions, are crucial market drivers. Compliance mandates fuel demand for advanced air quality control systems.

- Competitive Product Substitutes: Limited direct substitutes exist, but advancements in alternative emission reduction techniques (e.g., carbon capture) present indirect competition.

- End-User Demographics: The market is primarily driven by large industrial facilities in energy, cement, chemicals, and metals sectors. Growing awareness of environmental responsibility influences adoption rates.

- M&A Trends: The past five years have witnessed xx M&A deals in the North America industrial air quality control systems sector, primarily driven by strategic expansion and technology acquisition.

North America Industrial Air Quality Control Systems Market Growth Trends & Insights

The North America Industrial Air Quality Control Systems market witnessed robust growth during the historical period (2019-2024), driven by increased industrial activity and stringent emission regulations. The market size expanded from xx Million Units in 2019 to xx Million Units in 2024, achieving a CAGR of xx%. This upward trajectory is expected to continue during the forecast period (2025-2033), with a projected CAGR of xx%, reaching xx Million Units by 2033. This growth is fueled by increased industrial investments, government incentives promoting cleaner technologies, and rising awareness of environmental sustainability. Technological advancements, like AI-powered optimization and predictive maintenance for air quality control systems, are further accelerating market expansion. Shifting consumer preferences towards environmentally responsible practices are creating new market opportunities.

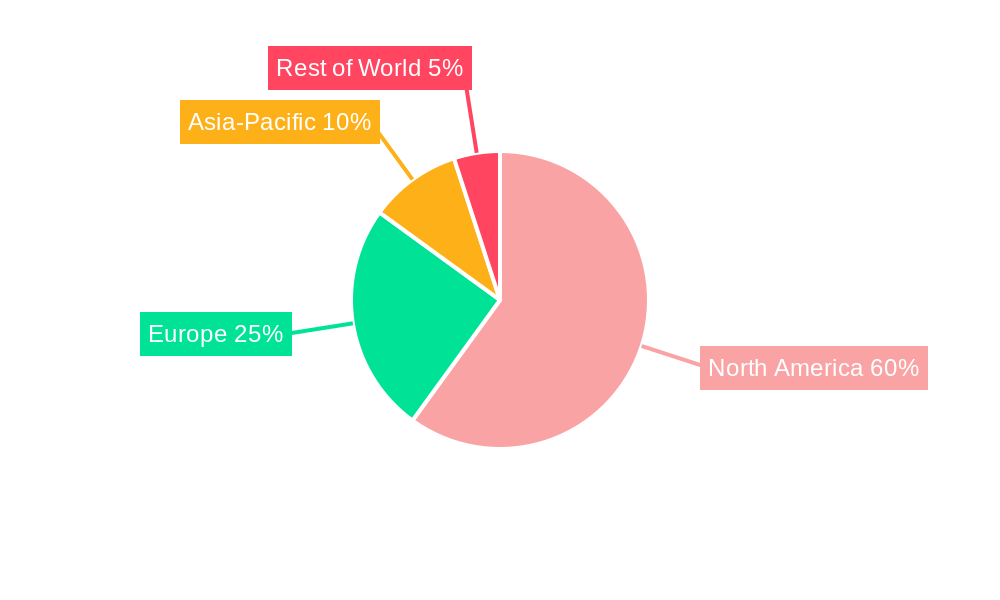

Dominant Regions, Countries, or Segments in North America Industrial Air Quality Control Systems Market

The United States and Canada dominate the North American industrial air quality control systems market. The US, with its substantial industrial base and stringent environmental regulations, holds the larger market share.

- Dominant Segments: The Power Generation and Cement industries are the largest consumers of air quality control systems, followed by the Chemicals and Fertilizers sector. Within the "Type" segment, ESPs and Fabric Filters hold the largest market shares due to their established application and cost-effectiveness.

- Regional Growth Drivers: Stringent emission standards in California and the Northeastern US are driving higher adoption rates. Government incentives for cleaner technologies, along with growing industrial output in specific regions, also contribute to regional growth variations. Canada's increasing focus on sustainable industrial practices presents promising growth prospects.

North America Industrial Air Quality Control Systems Market Product Landscape

The market features a diverse range of products, including Electrostatic Precipitators (ESPs), Flue Gas Desulfurization (FGD) systems, Selective Catalytic Reduction (SCR) systems, Fabric Filters, and other specialized technologies. Recent innovations focus on enhanced efficiency, reduced maintenance needs, and improved emission reduction capabilities. Key performance metrics include particulate matter removal efficiency, gas emission reduction rates, and operating costs. The integration of advanced analytics and automation features distinguishes leading products.

Key Drivers, Barriers & Challenges in North America Industrial Air Quality Control Systems Market

Key Drivers:

Stringent environmental regulations, growing industrial output, increasing awareness of environmental sustainability, and government incentives for clean technologies are major drivers. Technological advancements leading to higher efficiency, lower operating costs, and improved emission control further stimulate market expansion.

Key Challenges & Restraints:

High initial investment costs for advanced systems, complex installation and maintenance requirements, and potential supply chain disruptions pose challenges. Furthermore, competition from alternative emission reduction technologies and regulatory uncertainties can impact market growth. The fluctuating cost of raw materials and energy also influences the overall market dynamics.

Emerging Opportunities in North America Industrial Air Quality Control Systems Market

Emerging opportunities exist in the adoption of advanced technologies like AI and IoT for predictive maintenance and real-time emission monitoring. The increasing focus on carbon capture and utilization offers significant growth potential. Furthermore, expanding into niche industrial applications and exploring untapped markets in smaller industrial facilities present promising avenues for market expansion.

Growth Accelerators in the North America Industrial Air Quality Control Systems Market Industry

Technological breakthroughs in emission control technologies, strategic partnerships to integrate innovative solutions, and the expansion of market reach to emerging industrial sectors are key accelerators. Government initiatives promoting clean technologies and increased investments in R&D further contribute to sustainable market growth.

Key Players Shaping the North America Industrial Air Quality Control Systems Market Market

- Ducon Technologies Inc

- FuelTech Inc

- CECO Environmental Corporation

- Thermo Fisher Scientific Inc

- LDX Solutions

- Babcock & Wilcox Enterprises Ltd

- Pollution Systems

- Tri-Mer Corporation

- General Electric Company

- Sly Inc

Notable Milestones in North America Industrial Air Quality Control Systems Market Sector

- December 2022: General Electric Company announced a technical solution to reduce carbon emissions by over 90%, surpassing World Bank Emissions Standards.

- December 2022: ProcessBarron established a wholly-owned subsidiary in Canada to offer electrostatic precipitator and air pollution control services.

In-Depth North America Industrial Air Quality Control Systems Market Outlook

The North America Industrial Air Quality Control Systems market exhibits substantial growth potential, driven by sustained industrial expansion, continuous technological advancements, and strengthening environmental regulations. Strategic partnerships, market diversification, and a focus on sustainable solutions will be vital for companies to capitalize on future market opportunities. The market is poised for robust expansion, with significant growth anticipated across various segments and regions.

North America Industrial Air Quality Control Systems Market Segmentation

-

1. Type

- 1.1. Electrostatic Precipitators (ESP)

- 1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 1.3. Selective Catalytic Reduction (SCR)

- 1.4. Fabric Filters

- 1.5. Others

-

2. Application

- 2.1. Power Generation Industry

- 2.2. Cement Industry

- 2.3. Chemicals and Fertilizers

- 2.4. Iron and Steel Industry

- 2.5. Automotive Industry

- 2.6. Oil & Gas Industry

- 2.7. Other Applications

-

3. Emissions (Qualitative Analysis only)

- 3.1. Nitrogen Oxides (NOx)

- 3.2. Sulphur Oxides (SO2)

- 3.3. Particulate Matter (PM)

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Industrial Air Quality Control Systems Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Industrial Air Quality Control Systems Market Regional Market Share

Geographic Coverage of North America Industrial Air Quality Control Systems Market

North America Industrial Air Quality Control Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Strict Government Regulations to Control Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Power Generation Industry Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electrostatic Precipitators (ESP)

- 5.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 5.1.3. Selective Catalytic Reduction (SCR)

- 5.1.4. Fabric Filters

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation Industry

- 5.2.2. Cement Industry

- 5.2.3. Chemicals and Fertilizers

- 5.2.4. Iron and Steel Industry

- 5.2.5. Automotive Industry

- 5.2.6. Oil & Gas Industry

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 5.3.1. Nitrogen Oxides (NOx)

- 5.3.2. Sulphur Oxides (SO2)

- 5.3.3. Particulate Matter (PM)

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Electrostatic Precipitators (ESP)

- 6.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 6.1.3. Selective Catalytic Reduction (SCR)

- 6.1.4. Fabric Filters

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Generation Industry

- 6.2.2. Cement Industry

- 6.2.3. Chemicals and Fertilizers

- 6.2.4. Iron and Steel Industry

- 6.2.5. Automotive Industry

- 6.2.6. Oil & Gas Industry

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 6.3.1. Nitrogen Oxides (NOx)

- 6.3.2. Sulphur Oxides (SO2)

- 6.3.3. Particulate Matter (PM)

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Electrostatic Precipitators (ESP)

- 7.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 7.1.3. Selective Catalytic Reduction (SCR)

- 7.1.4. Fabric Filters

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Generation Industry

- 7.2.2. Cement Industry

- 7.2.3. Chemicals and Fertilizers

- 7.2.4. Iron and Steel Industry

- 7.2.5. Automotive Industry

- 7.2.6. Oil & Gas Industry

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 7.3.1. Nitrogen Oxides (NOx)

- 7.3.2. Sulphur Oxides (SO2)

- 7.3.3. Particulate Matter (PM)

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Industrial Air Quality Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Electrostatic Precipitators (ESP)

- 8.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 8.1.3. Selective Catalytic Reduction (SCR)

- 8.1.4. Fabric Filters

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Generation Industry

- 8.2.2. Cement Industry

- 8.2.3. Chemicals and Fertilizers

- 8.2.4. Iron and Steel Industry

- 8.2.5. Automotive Industry

- 8.2.6. Oil & Gas Industry

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 8.3.1. Nitrogen Oxides (NOx)

- 8.3.2. Sulphur Oxides (SO2)

- 8.3.3. Particulate Matter (PM)

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Ducon Technologies Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 FuelTech Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CECO Environmental Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Thermo Fisher Scientific Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 LDX Solutions

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Babcock & Wilcox Enterprises Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Pollution Systems

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Tri-Mer Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 General Electric Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Sly Inc*List Not Exhaustive

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Ducon Technologies Inc

List of Figures

- Figure 1: North America Industrial Air Quality Control Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Industrial Air Quality Control Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 4: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 9: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Application 2020 & 2033

- Table 13: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 14: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 19: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Industrial Air Quality Control Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Industrial Air Quality Control Systems Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the North America Industrial Air Quality Control Systems Market?

Key companies in the market include Ducon Technologies Inc, FuelTech Inc, CECO Environmental Corporation, Thermo Fisher Scientific Inc, LDX Solutions, Babcock & Wilcox Enterprises Ltd, Pollution Systems, Tri-Mer Corporation, General Electric Company, Sly Inc*List Not Exhaustive.

3. What are the main segments of the North America Industrial Air Quality Control Systems Market?

The market segments include Type, Application, Emissions (Qualitative Analysis only), Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 127.11 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Strict Government Regulations to Control Air Pollution.

6. What are the notable trends driving market growth?

Power Generation Industry Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In December 2022, General Electric Company announced a technical solution to reduce carbon emissions. The solution includes engineering studies for integrating and installing a Selective Catalytic Reduction (SCR) technology system. The solution reduced nitrogen oxide (NOx) and carbon monoxide (CO) emissions by over 90%, surpassing World Bank Emissions Standards.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Industrial Air Quality Control Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Industrial Air Quality Control Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Industrial Air Quality Control Systems Market?

To stay informed about further developments, trends, and reports in the North America Industrial Air Quality Control Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence