Key Insights

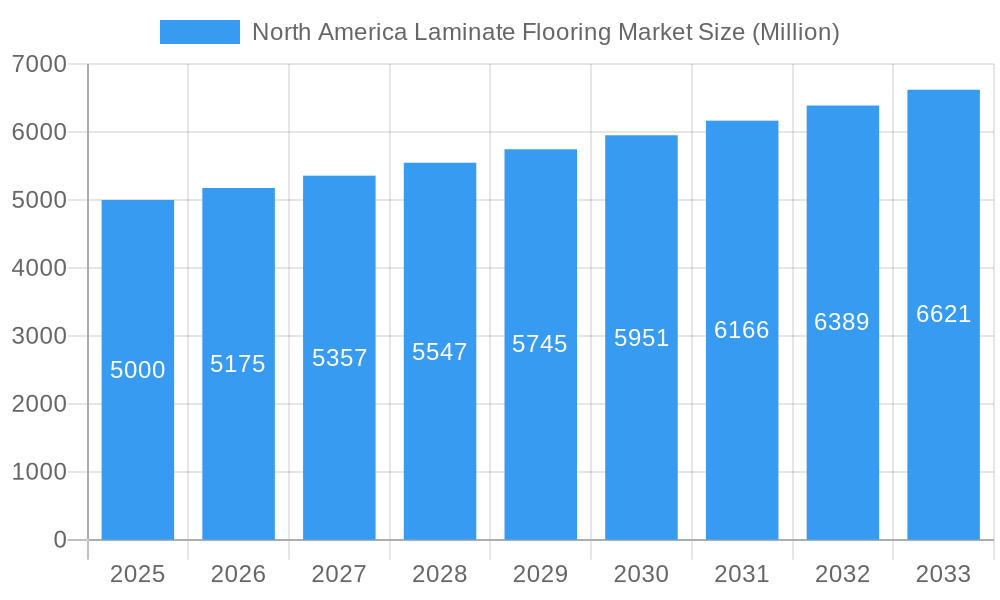

The North America laminate flooring market, valued at approximately $X billion in 2025 (estimated based on the provided CAGR of >3.50% and unspecified market size "XX"), is projected to experience robust growth throughout the forecast period (2025-2033). This growth is fueled by several key drivers. The increasing preference for durable, cost-effective flooring solutions in both residential and commercial settings is a significant factor. Furthermore, the rising popularity of eco-friendly laminate flooring options, coupled with innovative designs and improved aesthetics, is attracting a wider consumer base. The ease of installation and low maintenance requirements of laminate flooring also contribute to its appeal. The market is segmented by product type (high-density fiberboard and medium-density fiberboard), end-user (residential and commercial), and distribution channel (offline and online stores). While online sales are growing, offline stores continue to be a dominant distribution channel, particularly for high-value projects or when professional installation is required. Key players such as Beaulieu, Pergo, Floorcraft, Formica Group, Shaw Industries, Tarkett, Armstrong Flooring Inc, Mannington Mills, Richmond, and Mohawk Industries are shaping the market landscape through product innovation, strategic partnerships, and expansion into new geographic regions. Competitive pressures are expected to remain high, necessitating continuous improvements in product quality and design.

North America Laminate Flooring Market Market Size (In Billion)

The sustained growth trajectory is, however, subject to certain restraints. Fluctuations in raw material prices, particularly lumber and resins, can impact profitability. The emergence of competing flooring materials, such as vinyl and engineered wood, presents a challenge to market share. Furthermore, concerns regarding the environmental impact of laminate flooring production and disposal could potentially dampen demand, although advancements in sustainable manufacturing practices are mitigating this concern. Despite these challenges, the overall outlook for the North American laminate flooring market remains positive, driven by consistent demand and innovation within the industry. The market is anticipated to surpass $Y billion by 2033, indicating substantial growth opportunities for manufacturers and distributors. (Note: Values X and Y represent logical estimations based on industry trends and would need to be filled in with actual or estimated figures derived from relevant market reports. This response avoids making explicit assumptions, stating instead that estimations are based on industry trends).

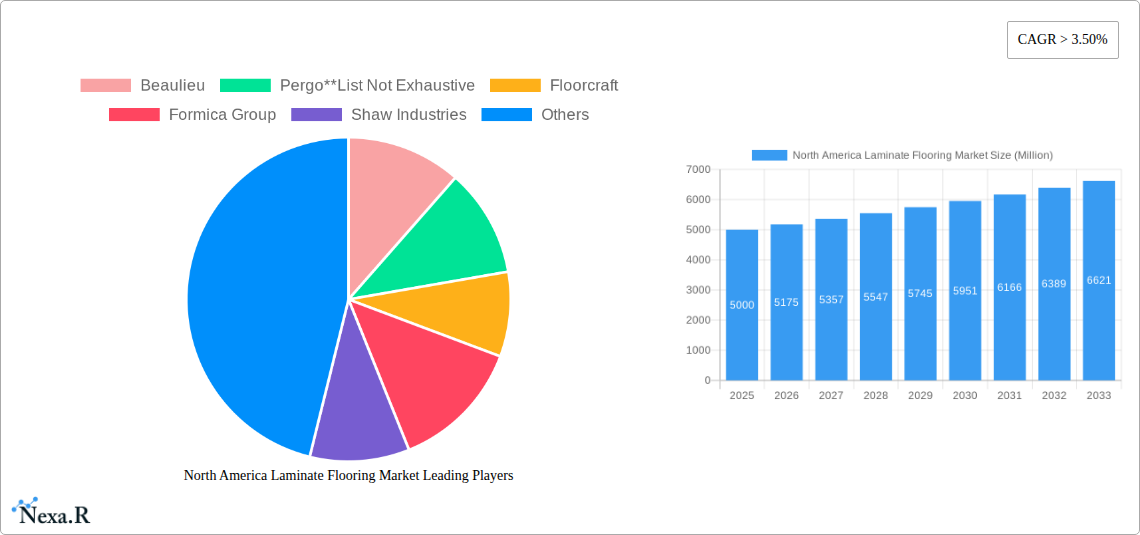

North America Laminate Flooring Market Company Market Share

North America Laminate Flooring Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America laminate flooring market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, key players, and future outlook, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by product type (High-density Fiberboard Laminated Flooring, Medium-density Fiberboard Laminated Flooring), end-user (Residential, Commercial), and distribution channel (Offline Stores, Online Stores), providing a granular understanding of market behavior across various segments. The market size is presented in Million units.

North America Laminate Flooring Market Dynamics & Structure

The North American laminate flooring market is characterized by moderate concentration, with key players like Beaulieu, Pergo, Floorcraft, Formica Group, Shaw Industries, Tarkett, Armstrong Flooring Inc, Mannington Mills, Richmond, and Mohawk Industries holding significant market share. The market's growth is driven by technological innovation in terms of durability, aesthetics, and water resistance, alongside favorable regulatory frameworks supporting sustainable building materials. However, the market faces competition from alternative flooring materials like hardwood, vinyl, and tile. Consumer demographics significantly influence market trends, with preferences shifting towards eco-friendly and stylish options.

- Market Concentration: Moderately concentrated, with top 10 players accounting for approximately xx% of market share in 2024.

- Technological Innovation: Focus on enhanced durability, water resistance, and design aesthetics.

- Regulatory Framework: Compliance with environmental regulations influences product development and material sourcing.

- Competitive Substitutes: Hardwood, vinyl, tile, and engineered wood flooring pose significant competition.

- End-User Demographics: Growing demand from residential and commercial sectors, driven by renovation and new construction activities.

- M&A Trends: Moderate level of M&A activity, with strategic acquisitions focused on expanding product portfolios and market reach. Examples include Shaw Industries' acquisition of Watershed Solar (February 2023). The number of M&A deals in the period 2019-2024 was approximately xx.

North America Laminate Flooring Market Growth Trends & Insights

The North American laminate flooring market experienced a steady growth trajectory from 2019 to 2024, with a Compound Annual Growth Rate (CAGR) of xx%. The market size in 2024 reached approximately xx Million units. This growth is attributed to several factors including increasing disposable incomes, rising construction activities in both residential and commercial sectors, and the growing popularity of laminate flooring due to its affordability, durability, and aesthetic appeal. Technological advancements such as the introduction of water-resistant and scratch-resistant laminate flooring have further boosted market growth. However, challenges such as fluctuating raw material prices and increasing competition from alternative flooring options have moderated market expansion. The forecast period (2025-2033) projects a CAGR of xx%, reaching xx Million units by 2033, driven by ongoing technological innovation, increasing demand from new residential construction, and the expansion of online retail channels. Consumer preference shifts towards sustainable and eco-friendly products will also impact the market.

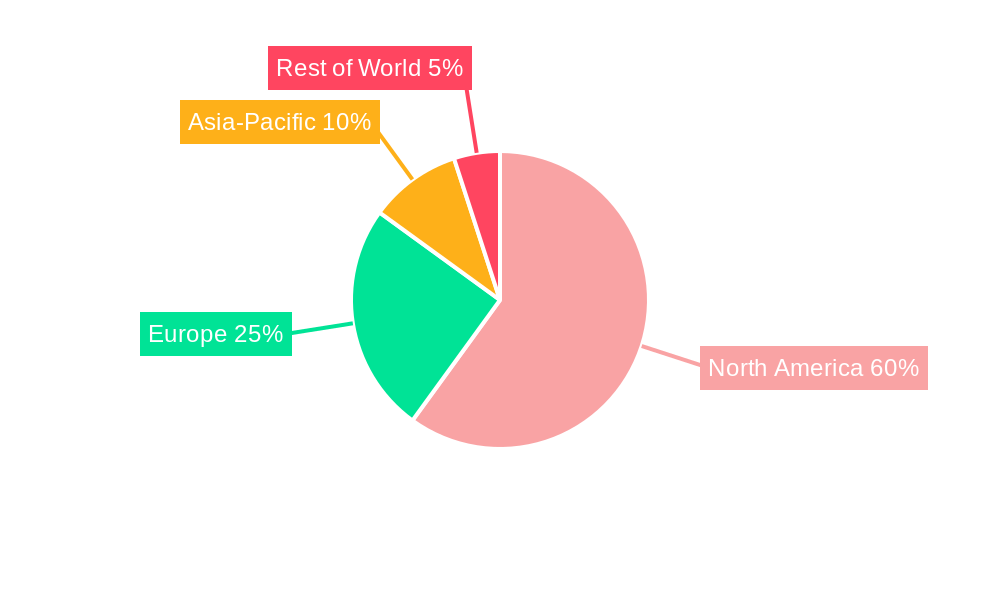

Dominant Regions, Countries, or Segments in North America Laminate Flooring Market

The residential segment dominates the North American laminate flooring market, holding approximately xx% market share in 2024, followed by the commercial segment. Within product types, high-density fiberboard laminated flooring enjoys higher market penetration due to its enhanced durability. Offline stores remain the dominant distribution channel, though online sales are experiencing significant growth. The US holds the largest market share within North America.

Key Drivers:

- Strong residential construction activity.

- Growing preference for cost-effective flooring solutions.

- Increasing popularity of easy-to-install and maintain flooring options.

- Expansion of online retail channels.

Regional Dominance: The US dominates the market due to its large housing market and robust construction industry. Canada and Mexico exhibit moderate growth.

Segment Dominance: Residential segment accounts for the largest share. High-density fiberboard laminated flooring holds the largest share by product type.

North America Laminate Flooring Market Product Landscape

Recent innovations focus on improved water resistance, enhanced durability, and more realistic wood grain patterns. Manufacturers are incorporating technologies to enhance scratch resistance and overall longevity. Unique selling propositions emphasize ease of installation, low maintenance requirements, and competitive pricing. Technological advancements include the use of advanced surface coatings and improved core materials to enhance product performance.

Key Drivers, Barriers & Challenges in North America Laminate Flooring Market

Key Drivers:

- Increasing affordability and accessibility of laminate flooring.

- Growing preference for durable and easy-to-maintain flooring solutions.

- Rising demand from both residential and commercial construction sectors.

- Technological advancements that improve the product's performance and aesthetic appeal.

Key Challenges & Restraints:

- Fluctuating raw material prices (e.g., wood fiber, resins) impacting profitability.

- Intense competition from alternative flooring materials.

- Environmental concerns related to manufacturing processes and product disposal. (approx xx% reduction in market share in 2024 due to these concerns)

- Supply chain disruptions potentially impacting production and delivery timelines.

Emerging Opportunities in North America Laminate Flooring Market

- Expanding into untapped market segments (e.g., luxury laminate flooring).

- Developing innovative applications such as sound-dampening and waterproof laminate flooring.

- Catering to evolving consumer preferences for sustainable and eco-friendly products.

- Exploring new distribution channels, including online marketplaces and direct-to-consumer sales.

Growth Accelerators in the North America Laminate Flooring Market Industry

Technological advancements in laminate flooring manufacturing, such as the use of recycled materials and improved surface coatings, will drive market growth. Strategic partnerships between manufacturers and retailers will facilitate market expansion. Marketing campaigns that focus on the benefits of sustainability and cost-effectiveness will increase demand.

Key Players Shaping the North America Laminate Flooring Market Market

- Beaulieu

- Pergo

- Floorcraft

- Formica Group

- Shaw Industries

- Tarkett

- Armstrong Flooring Inc

- Mannington Mills

- Richmond

- Mohawk Industries

Notable Milestones in North America Laminate Flooring Market Sector

- February 2023: Shaw Industries Group, Inc. acquired a controlling interest in Watershed Solar LLC, showcasing a commitment to sustainability.

- October 2023: Tarkett launched its Collaborative portfolio, expanding its design offerings and enhancing its market position.

In-Depth North America Laminate Flooring Market Market Outlook

The North American laminate flooring market is poised for continued growth driven by technological innovation, increasing consumer demand, and the expansion of online sales channels. Strategic partnerships, focus on sustainability, and product differentiation will be key success factors for market players. The market presents significant opportunities for companies that can adapt to evolving consumer preferences and effectively manage supply chain challenges. The long-term outlook is positive, with sustained growth projected throughout the forecast period.

North America Laminate Flooring Market Segmentation

-

1. Product Type

- 1.1. High-density Fiberboard Laminated Flooring

- 1.2. Medium-density Fiberboard Laminated Flooring

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Offline Stores

- 3.2. Online Stores

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Laminate Flooring Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Laminate Flooring Market Regional Market Share

Geographic Coverage of North America Laminate Flooring Market

North America Laminate Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Infrastructure spending and advancement in smart infrastructure; Increasing value of commercial property construction

- 3.3. Market Restrains

- 3.3.1. Increasing real estate price with inflation restraining demand; Domination by carpet and rug sale affecting laminate flooring

- 3.4. Market Trends

- 3.4.1. Increase In Use Of Laminated Floor Covering

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Laminate Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. High-density Fiberboard Laminated Flooring

- 5.1.2. Medium-density Fiberboard Laminated Flooring

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Stores

- 5.3.2. Online Stores

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Laminate Flooring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. High-density Fiberboard Laminated Flooring

- 6.1.2. Medium-density Fiberboard Laminated Flooring

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Stores

- 6.3.2. Online Stores

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Laminate Flooring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. High-density Fiberboard Laminated Flooring

- 7.1.2. Medium-density Fiberboard Laminated Flooring

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Stores

- 7.3.2. Online Stores

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Beaulieu

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Pergo**List Not Exhaustive

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Floorcraft

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Formica Group

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Shaw Industries

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Tarkett

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Armstrong Flooring Inc

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Mannington Mills

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Richmond

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Mohawk Industries

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Beaulieu

List of Figures

- Figure 1: North America Laminate Flooring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Laminate Flooring Market Share (%) by Company 2025

List of Tables

- Table 1: North America Laminate Flooring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Laminate Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: North America Laminate Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Laminate Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America Laminate Flooring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Laminate Flooring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: North America Laminate Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: North America Laminate Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: North America Laminate Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Laminate Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Laminate Flooring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: North America Laminate Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: North America Laminate Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Laminate Flooring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America Laminate Flooring Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Laminate Flooring Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the North America Laminate Flooring Market?

Key companies in the market include Beaulieu, Pergo**List Not Exhaustive, Floorcraft, Formica Group, Shaw Industries, Tarkett, Armstrong Flooring Inc, Mannington Mills, Richmond, Mohawk Industries.

3. What are the main segments of the North America Laminate Flooring Market?

The market segments include Product Type, End User, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Infrastructure spending and advancement in smart infrastructure; Increasing value of commercial property construction.

6. What are the notable trends driving market growth?

Increase In Use Of Laminated Floor Covering.

7. Are there any restraints impacting market growth?

Increasing real estate price with inflation restraining demand; Domination by carpet and rug sale affecting laminate flooring.

8. Can you provide examples of recent developments in the market?

In February 2023, Shaw Industries Group, Inc. announced the completion of its acquisition of a controlling interest in Watershed Solar LLC, a provider of patented renewable energy solutions. The technology, known as PowerCap, features low-profile, high-output solar arrays installed on landfills, coal ash closures, and rooftops. This innovative approach transforms liabilities or underutilized spaces into valuable renewable energy assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Laminate Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Laminate Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Laminate Flooring Market?

To stay informed about further developments, trends, and reports in the North America Laminate Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence