Key Insights

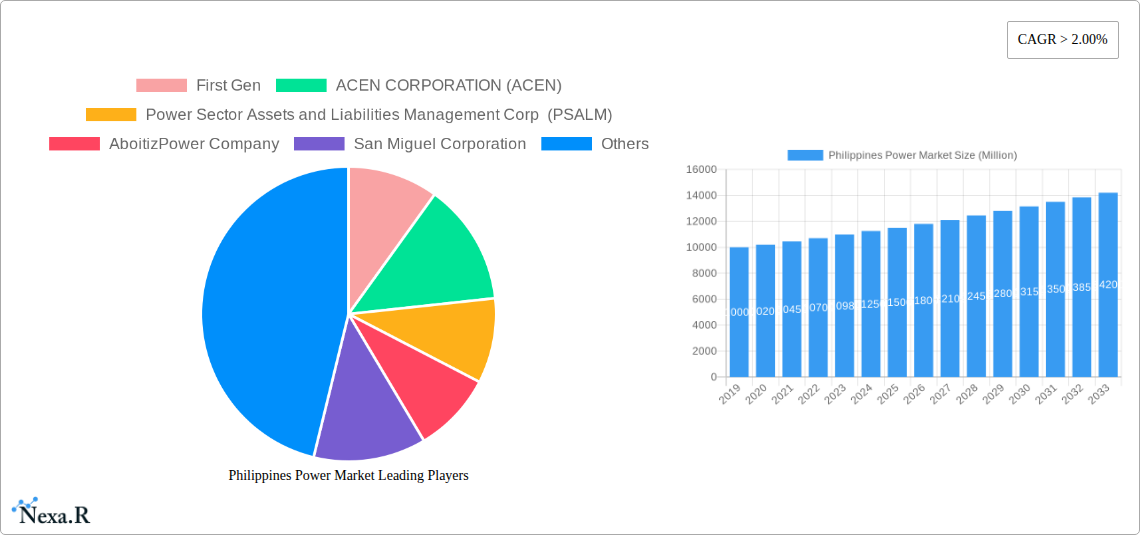

The Philippine power market is projected to reach a market size of 15,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of 9% through the forecast period of 2025-2033. This expansion is driven by rising electricity demand, government initiatives for energy security, infrastructure development, and the adoption of advanced grid technologies. A significant push towards renewable energy sources is also accelerating market growth and transforming the energy mix.

Philippines Power Market Market Size (In Billion)

Key trends include the increasing adoption of renewable energy, such as solar and wind power, due to declining costs and supportive policies. The market is also prioritizing grid modernization and smart grid technologies for enhanced efficiency and reliability. However, challenges such as high upfront capital costs for renewable projects and reliance on imported fossil fuels persist. Ensuring consistent and affordable energy supply, especially to remote areas, remains a critical focus.

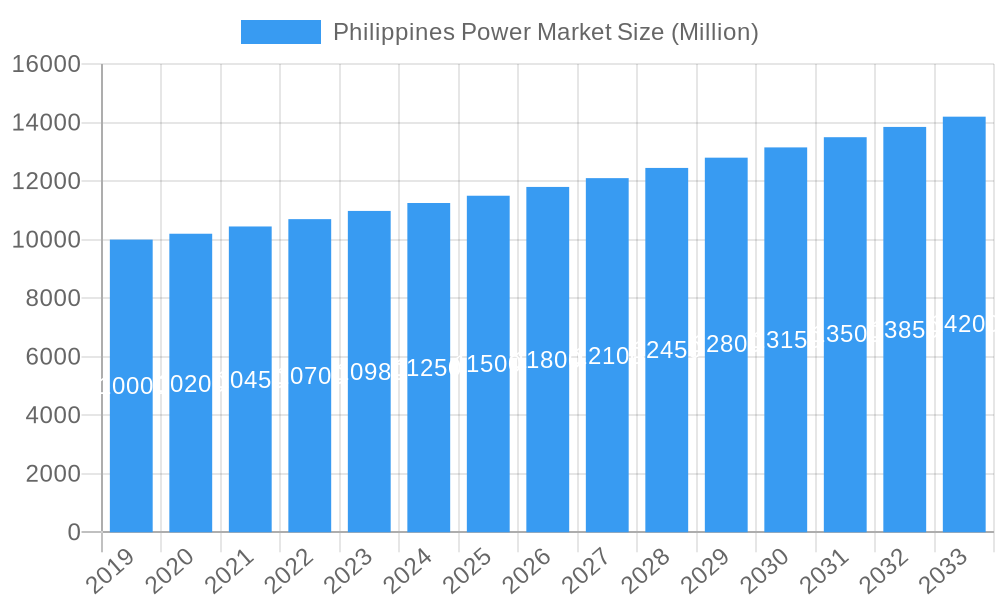

Philippines Power Market Company Market Share

This comprehensive report offers an in-depth analysis of the Philippines power market. It covers market dynamics, growth trends, and key players from the historical period of 2019 to 2024, with detailed projections from 2025 to 2033, using 2024 as the base year. All key quantitative data is presented in billion units for clarity, providing critical insights into the Philippines energy sector.

Philippines Power Market Market Dynamics & Structure

The Philippines power market is characterized by a moderate to high concentration, with key utilities and independent power producers (IPPs) dominating the generation source segments. Technological innovation is a significant driver, particularly in the renewable energy sector, spurred by government incentives and global decarbonization efforts. Regulatory frameworks, overseen by the Department of Energy (DOE) and the Energy Regulatory Commission (ERC), are constantly evolving to balance energy security, affordability, and environmental sustainability. Competitive product substitutes are emerging, especially within the renewable energy space, challenging the traditional dominance of thermal power. End-user demographics are shifting, with increasing demand from industrial and commercial sectors, alongside a growing awareness and adoption of clean energy solutions by residential consumers. Mergers and acquisitions (M&A) trends indicate consolidation and strategic partnerships aimed at expanding capacity and diversifying generation portfolios.

- Market Concentration: Dominated by a few major IPPs and state-owned entities, with increasing participation from new entrants in the renewable sector.

- Technological Innovation: Driven by advancements in solar PV, wind power, and energy storage solutions, impacting the efficiency and cost-effectiveness of electricity generation.

- Regulatory Frameworks: Influenced by policies promoting renewable energy adoption, grid modernization, and competitive electricity markets.

- Competitive Product Substitutes: Growing threat from distributed renewable energy solutions and advanced energy efficiency technologies.

- End-User Demographics: Shifting demand patterns influenced by economic growth, industrialization, and rising environmental consciousness.

- M&A Trends: Active consolidation and strategic alliances to gain market share and secure renewable energy project pipelines, with an estimated XX million units in deal values during the historical period.

Philippines Power Market Growth Trends & Insights

The Philippines power market is poised for significant growth, driven by robust economic expansion, increasing electrification rates, and a strong governmental push towards sustainable energy. The market size is projected to expand at a healthy Compound Annual Growth Rate (CAGR) of approximately X% during the forecast period. Adoption rates for renewable energy sources, particularly solar and wind, are accelerating, supported by favorable policies such as the Green Energy Auction Program (GEAP). Technological disruptions, including the integration of smart grid technologies and advancements in battery storage, are reshaping the operational efficiency and reliability of the power sector. Consumer behavior is also shifting, with a growing demand for cleaner, more affordable, and reliable electricity. This evolution is creating new opportunities for diversified generation sources and innovative energy service models.

The Philippines power market is witnessing a paradigm shift, moving towards a more diversified and sustainable energy mix. The market size, valued at approximately XXX million units in the base year 2025, is expected to experience substantial growth throughout the forecast period. This expansion is underpinned by several factors, including the nation's burgeoning economy, which necessitates a continuous and reliable supply of electricity for industrial, commercial, and residential sectors. The government's ambitious energy targets, particularly for increasing the share of renewable energy in the national grid, are a major catalyst. For instance, the adoption rates for solar photovoltaic (PV) installations have seen an exponential rise, driven by declining technology costs and attractive feed-in tariffs and net-metering schemes. Similarly, wind power projects are gaining traction, especially in regions with high wind potential.

Technological disruptions are playing a pivotal role in shaping the Philippines power market. The integration of advanced battery energy storage systems (BESS) is becoming increasingly crucial for stabilizing the grid and managing the intermittency of renewable sources. These storage solutions are not only enhancing grid reliability but also paving the way for greater penetration of renewables. Furthermore, the development of smart grid technologies is enabling better monitoring, control, and optimization of electricity distribution, leading to reduced transmission losses and improved operational efficiency.

Consumer behavior is also undergoing a significant transformation. There is a discernible shift in preference towards cleaner energy options, driven by environmental awareness and the potential for long-term cost savings. This is evident in the growing demand for rooftop solar installations among households and businesses, as well as an increasing interest in green energy certificates. The emphasis on energy efficiency measures is also gaining momentum, with consumers and industries actively seeking ways to reduce their energy consumption and carbon footprint.

The Philippines power market is also influenced by the evolving competitive landscape. New players are entering the market, attracted by the growth potential, while existing utilities are investing in diversifying their generation sources to meet future demand and regulatory requirements. Strategic partnerships and collaborations are becoming more common as companies aim to leverage each other's expertise and resources to develop large-scale renewable energy projects and enhance their market position. The future trajectory of the Philippines power market is intricately linked to its ability to successfully navigate these trends, balancing the need for energy security and affordability with the imperative of environmental sustainability.

Dominant Regions, Countries, or Segments in Philippines Power Market

Within the Philippines power market, the Renewable energy segment is emerging as the dominant force driving growth. While Thermal power currently holds a significant share due to existing infrastructure and the baseload capacity it provides, the trajectory clearly indicates a rapid ascendancy for renewables. The Renewable segment is propelled by strategic government initiatives and considerable investments from both domestic and international players. Regions like Luzon, with its high population density and industrial activity, are leading in overall electricity demand and are also prime locations for large-scale solar and wind farm developments.

- Renewable Energy Dominance: This segment is set to become the primary growth engine, fueled by decreasing technology costs and supportive government policies.

- Market Share Growth: Projected to increase from XX% in the historical period to an estimated XX% by the end of the forecast period.

- Key Drivers: Green Energy Auction Program (GEAP), Renewable Energy Act, attractive investment incentives, and increasing corporate demand for renewable energy procurement.

- Geographic Concentration: Development is concentrated in areas with high solar irradiation (e.g., Luzon, Visayas) and consistent wind resources (e.g., Northern Luzon, Panay).

- Thermal Power's Evolving Role: While still substantial, the share of Thermal power is expected to gradually decrease as the share of renewables increases.

- Current Market Share: Approximately XX% in the base year 2025.

- Challenges: Increasing environmental regulations, carbon pricing discussions, and the cost competitiveness of renewables.

- Continued Importance: Essential for baseload power and grid stability during the transition period.

- Hydro Power's Contribution: A stable contributor, particularly run-of-river projects, offering renewable and dispatchable power.

- Current Market Share: Approximately XX% in the base year 2025.

- Potential: Limited by geographic constraints and environmental impact assessments for large-scale dam projects.

- Other Generation Sources: Includes a smaller share of geothermal and biomass, with potential for growth depending on technological advancements and policy support.

- Current Market Share: Approximately XX% in the base year 2025.

- Growth Potential: Geothermal, leveraging the Philippines' volcanic activity, and biomass, utilizing agricultural waste, hold promise for diversified renewable portfolios.

The dominance of the Renewable segment is further reinforced by the significant investments being channeled into solar, wind, and, to a lesser extent, battery storage. The Green Energy Auction Program (GEAP) has been instrumental in driving this expansion, securing contracts for substantial capacities of renewable energy. Companies are actively pursuing projects in this segment to align with national climate goals and capitalize on market opportunities. While Thermal power will remain critical for baseload supply, the future of the Philippines power market undeniably lies in the accelerated development and integration of Renewable generation sources.

Philippines Power Market Product Landscape

The Philippines power market product landscape is defined by an increasing array of electricity generation technologies and supporting infrastructure. Innovations in renewable energy are particularly prominent, with advancements in solar panel efficiency, larger and more powerful wind turbines, and more cost-effective energy storage solutions. The application of these technologies is expanding rapidly, from large-scale utility projects to distributed generation systems for commercial and residential use. Performance metrics, such as levelized cost of energy (LCOE) for solar and wind, are continuously improving, making them more competitive with traditional thermal power sources. Unique selling propositions for these evolving products include their lower carbon footprint, reduced operational costs in the long run, and enhanced energy independence.

Key Drivers, Barriers & Challenges in Philippines Power Market

Key Drivers:

- Strong Economic Growth: Increasing energy demand from industrial, commercial, and residential sectors.

- Government Support for Renewables: Ambitious targets and incentives under the Renewable Energy Act and GEAP.

- Declining Renewable Energy Costs: Solar PV and wind technologies are becoming increasingly cost-competitive.

- Energy Security Concerns: Diversifying the energy mix to reduce reliance on imported fossil fuels.

- Environmental Sustainability Goals: National commitments to reduce greenhouse gas emissions.

Barriers & Challenges:

- Grid Modernization and Intermittency: Integrating variable renewable energy sources requires significant grid upgrades and energy storage solutions.

- Permitting and Land Acquisition: Delays in securing necessary permits and land for large-scale projects can hinder development.

- Financing and Investment Risks: Securing adequate and affordable financing for capital-intensive projects, especially in emerging markets.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of renewable energy components.

- Regulatory Uncertainty: Evolving regulatory frameworks can create uncertainty for investors.

- Affordability of Electricity: Balancing the transition to cleaner energy with the need to maintain affordable electricity prices for consumers.

Emerging Opportunities in Philippines Power Market

Emerging opportunities in the Philippines power market lie in the accelerated deployment of battery energy storage systems (BESS) to enhance grid stability and support the integration of variable renewables. The development of offshore wind projects presents a significant untapped market, given the country's extensive coastlines and strong wind resources. Furthermore, there is a growing demand for green hydrogen production, fueled by the potential to decarbonize hard-to-abate sectors. The increasing adoption of electric vehicles (EVs) also creates opportunities for smart charging infrastructure and grid integration solutions.

Growth Accelerators in the Philippines Power Market Industry

Growth accelerators in the Philippines Power Market Industry include continued government commitment to renewable energy targets, fostering a stable investment environment. Strategic partnerships between international technology providers and local developers are crucial for knowledge transfer and project execution. The increasing trend of corporate power purchase agreements (PPAs) for renewable energy by large corporations is a significant market expansion strategy, driving demand for new projects. Moreover, the ongoing development of transmission and distribution infrastructure is critical to accommodate the growing renewable capacity and ensure reliable power delivery.

Key Players Shaping the Philippines Power Market Market

- First Gen

- ACEN CORPORATION (ACEN)

- Power Sector Assets and Liabilities Management Corp (PSALM)

- AboitizPower Company

- San Miguel Corporation

- Shell PLC

- DIANTER Renewable Energy Resources Philippines

Notable Milestones in Philippines Power Market Sector

- 2022, June: The Philippines Department of Energy awarded 19 contracts for renewable energy projects with a capacity of 1.57 GW under the first round of the 2 GW Green Energy Auction Program (GEAP).

- 2022: Shell PLC plans for a joint venture with Nickel Asia Corp (NAC) to develop 3 GW of renewable energy projects in the Philippines and to develop 1 GW of renewable energy projects by 2028.

In-Depth Philippines Power Market Market Outlook

The Philippines power market is set for sustained and robust growth, driven by a confluence of factors including economic expansion, policy support for renewables, and technological advancements. The market outlook is highly positive, with significant opportunities for investment in renewable energy generation, battery energy storage systems, and grid modernization. Strategic partnerships and continued government commitment will be pivotal in unlocking the full potential of the market. The transition towards a cleaner and more sustainable energy future presents a compelling landscape for all stakeholders involved in the Philippines energy sector.

Philippines Power Market Segmentation

-

1. Generation Source

- 1.1. Thermal

- 1.2. Hydro

- 1.3. Renewable

- 1.4. Other Generation Sources

Philippines Power Market Segmentation By Geography

- 1. Philippines

Philippines Power Market Regional Market Share

Geographic Coverage of Philippines Power Market

Philippines Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Mobile Devices4.; Rising Adaption of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; Availability of Technical Challenges

- 3.4. Market Trends

- 3.4.1. Renewable Energy Growth in the nation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Generation Source

- 5.1.1. Thermal

- 5.1.2. Hydro

- 5.1.3. Renewable

- 5.1.4. Other Generation Sources

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Generation Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 First Gen

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ACEN CORPORATION (ACEN)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Power Sector Assets and Liabilities Management Corp (PSALM)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AboitizPower Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 San Miguel Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shell PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DIANTER Renewable Energy Resources Philippines

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 First Gen

List of Figures

- Figure 1: Philippines Power Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Philippines Power Market Share (%) by Company 2025

List of Tables

- Table 1: Philippines Power Market Revenue billion Forecast, by Generation Source 2020 & 2033

- Table 2: Philippines Power Market Volume Gigawatt Forecast, by Generation Source 2020 & 2033

- Table 3: Philippines Power Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Philippines Power Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 5: Philippines Power Market Revenue billion Forecast, by Generation Source 2020 & 2033

- Table 6: Philippines Power Market Volume Gigawatt Forecast, by Generation Source 2020 & 2033

- Table 7: Philippines Power Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Philippines Power Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Power Market?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Philippines Power Market?

Key companies in the market include First Gen, ACEN CORPORATION (ACEN), Power Sector Assets and Liabilities Management Corp (PSALM), AboitizPower Company, San Miguel Corporation, Shell PLC, DIANTER Renewable Energy Resources Philippines.

3. What are the main segments of the Philippines Power Market?

The market segments include Generation Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 12 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Mobile Devices4.; Rising Adaption of Electric Vehicles.

6. What are the notable trends driving market growth?

Renewable Energy Growth in the nation.

7. Are there any restraints impacting market growth?

4.; Availability of Technical Challenges.

8. Can you provide examples of recent developments in the market?

In 2022, Shell PLC plans for a joint venture with Nickel Asia Corp (NAC) to develop 3 GW of renewable energy projects in the Philippines and to develop 1 GW of renewable energy projects by 2028.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Power Market?

To stay informed about further developments, trends, and reports in the Philippines Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence