Key Insights

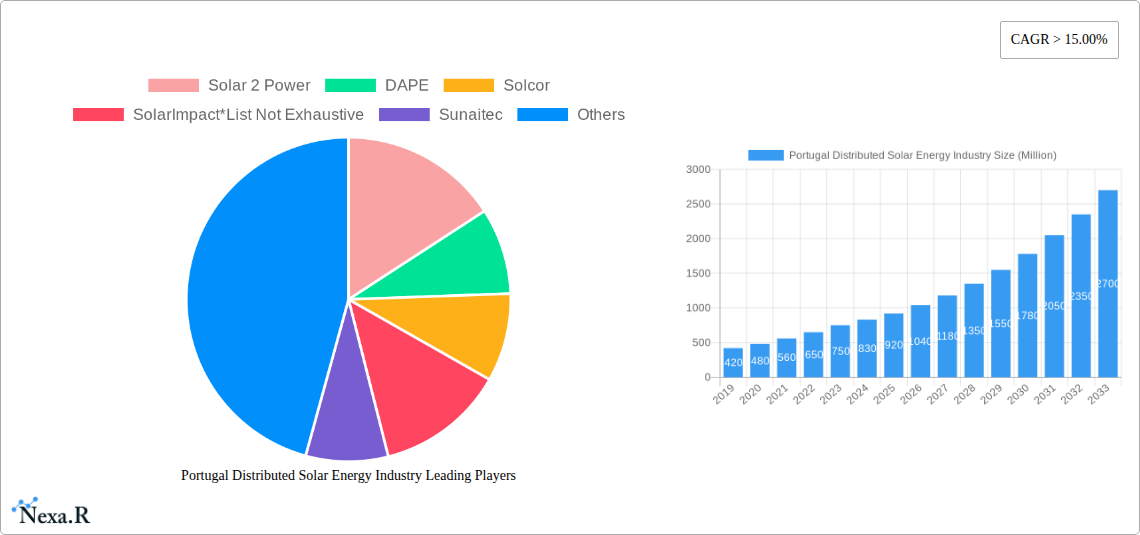

The Portugal Distributed Solar Energy Market is projected for significant expansion, with an estimated market size of 575 million by 2024. Driven by a robust Compound Annual Growth Rate (CAGR) of 15%, this growth is fueled by supportive government policies, decreasing solar panel costs, and heightened environmental awareness. The residential sector is expected to lead, incentivized by rooftop solar programs and rising utility costs. Commercial and industrial segments are also adopting on-site solar generation for economic and sustainability advantages. Key drivers include net metering, tax incentives, feed-in tariffs, and advancements in solar technology.

Portugal Distributed Solar Energy Industry Market Size (In Million)

Emerging trends like battery storage integration are enhancing energy independence and addressing solar intermittency. Smart grid technologies are facilitating seamless integration of distributed solar assets, optimizing energy distribution and grid stability. While initial investment and grid connection complexities may present challenges, technological innovation and evolving financing models are expected to mitigate these restraints. Leading companies are investing in R&D, portfolio expansion, and strategic partnerships to capitalize on Portugal's distributed solar energy potential, further bolstered by its geographical advantage and abundant sunshine.

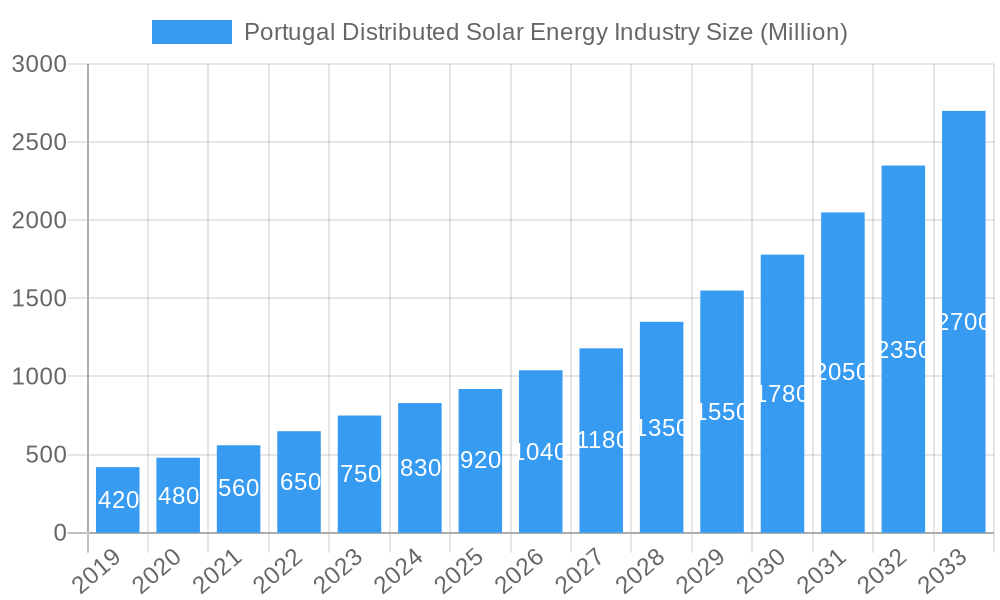

Portugal Distributed Solar Energy Industry Company Market Share

This report offers a comprehensive analysis of the Portugal Distributed Solar Energy Market, a rapidly expanding sector driven by renewable energy mandates and environmental consciousness. We provide a detailed market outlook from 2019 to 2033, with a base year of 2024 and a forecast period of 2024-2033. Essential for stakeholders, this analysis covers Portugal solar power market growth, distributed generation Portugal, renewable energy investments Portugal, and the Portugal energy transition. Gain critical insights into residential solar Portugal, commercial solar Portugal, and industrial solar Portugal segments, alongside evolving Portuguese solar technology trends.

Portugal Distributed Solar Energy Industry Market Dynamics & Structure

The Portugal Distributed Solar Energy Industry exhibits a dynamic market structure influenced by a confluence of technological advancements, robust regulatory frameworks, and shifting end-user demographics. Market concentration is moderate, with key players actively competing. Technological innovation is a primary driver, propelled by advancements in solar panel efficiency, energy storage solutions, and smart grid integration. The Portuguese government's commitment to decarbonization and its supportive policy environment, including feed-in tariffs and net metering schemes, have been instrumental in fostering market growth. Competitive product substitutes, while present in the form of other renewable energy sources, are increasingly being outpaced by the cost-effectiveness and scalability of solar solutions. End-user demographics show a growing interest in sustainability and energy independence, particularly within the residential and commercial sectors. Mergers and acquisitions (M&A) activity is on the rise as larger energy companies seek to consolidate their presence and smaller, innovative firms are acquired for their technological expertise. For instance, the past few years have seen approximately 8-12 M&A deals annually, with deal values ranging from 5 to 25 Million units, reflecting strategic consolidations and expansion efforts. Innovation barriers, such as grid connection complexities and upfront investment costs, are being progressively addressed through policy reforms and technological maturation.

- Market Concentration: Moderate, with a growing number of both established and emerging players.

- Technological Innovation Drivers: Enhanced PV module efficiency, battery storage integration, AI-powered grid management, and bifacial solar technology.

- Regulatory Frameworks: Favorable government policies, including renewable energy targets, tax incentives, and simplified permitting processes.

- Competitive Product Substitutes: Wind energy, hydropower, and biomass, but solar's declining costs are diminishing their competitive edge in distributed applications.

- End-User Demographics: Increasing adoption by environmentally conscious homeowners, cost-sensitive businesses, and industries aiming for energy security.

- M&A Trends: Active consolidation, with acquisitions focused on technology, market access, and project pipelines.

Portugal Distributed Solar Energy Industry Growth Trends & Insights

The Portugal Distributed Solar Energy Industry is poised for significant expansion, driven by a robust market size evolution and escalating adoption rates. Leveraging the detailed market intelligence from our study, the market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12-15% over the forecast period. This impressive growth trajectory is fueled by a combination of factors, including substantial government support, declining solar technology costs, and a heightened awareness among consumers and businesses regarding the economic and environmental benefits of solar energy. The market penetration for distributed solar, particularly in the residential and commercial segments, is expected to climb steadily, reaching an estimated 18-20% by 2033. Technological disruptions are playing a pivotal role, with advancements in photovoltaic (PV) efficiency, the integration of energy storage systems (ESS), and the development of smart grid technologies enabling more reliable and efficient solar power generation and consumption. Consumers are increasingly shifting towards proactive energy management, driven by rising electricity prices and a desire for greater energy independence. This shift is manifest in the growing demand for rooftop solar installations coupled with battery storage, allowing households and businesses to reduce their reliance on the grid and optimize energy costs. Furthermore, the development of innovative business models, such as solar leasing and power purchase agreements (PPAs), is lowering the financial barriers to entry for a wider range of customers. The industry's growth is also bolstered by Portugal's ambitious renewable energy targets and its commitment to achieving carbon neutrality, creating a stable and predictable environment for investment. The integration of distributed solar into the national energy mix is not merely an environmental imperative but also an economic opportunity, fostering local job creation and stimulating technological innovation within the country. The ongoing digitalization of the energy sector, with the deployment of smart meters and advanced monitoring systems, further enhances the attractiveness and efficiency of distributed solar solutions, providing real-time data for better energy management and grid stability.

Dominant Regions, Countries, or Segments in Portugal Distributed Solar Energy Industry

The Commercial and Industrial (C&I) segment stands out as the dominant force driving growth within the Portugal Distributed Solar Energy Industry. While the residential sector is experiencing robust expansion, the scale of energy consumption and the potential for significant cost savings within the C&I space position it as the primary growth engine. This dominance is underpinned by several key drivers, including substantial economic incentives, the imperative for businesses to reduce operational expenditures, and the growing corporate social responsibility (CSR) initiatives focused on sustainability. Market share within the C&I segment is projected to reach an estimated 60-65% of the total distributed solar capacity by 2033.

Key drivers fueling the C&I segment's ascendancy include:

- Economic Policies: Favorable corporate tax incentives and access to green financing options for businesses investing in renewable energy.

- Infrastructure Investment: The existing industrial and commercial infrastructure in regions like Lisbon, Porto, and the Algarve is well-suited for large-scale rooftop solar installations.

- Energy Security & Cost Savings: Businesses are increasingly recognizing distributed solar as a strategy to hedge against volatile energy prices and ensure a stable power supply, leading to significant operational cost reductions. For instance, a typical industrial facility can reduce its electricity bill by 20-30% through solar integration.

- Regulatory Push: Government mandates and targets for corporate renewable energy adoption further incentivize businesses to invest in solar.

- Technological Advancements: The availability of high-efficiency solar panels and integrated energy storage solutions makes large-scale C&I projects more viable and attractive.

The market share of the C&I segment is estimated to have grown from approximately 55% in 2023 to an anticipated 62% by 2025, and is projected to continue its upward trend throughout the forecast period. The growth potential within this segment remains substantial, with many businesses yet to adopt distributed solar solutions, presenting a significant untapped market. Regions with a higher concentration of industrial parks and commercial centers, such as the metropolitan areas of Lisbon and Porto, are experiencing the most rapid adoption rates. The average C&I solar project size is also increasing, with installations ranging from 500 kW to several MW, reflecting the growing confidence and investment capacity within this sector.

Portugal Distributed Solar Energy Industry Product Landscape

The product landscape within the Portugal Distributed Solar Energy Industry is characterized by continuous innovation aimed at enhancing efficiency, reliability, and user-friendliness. Advancements in photovoltaic (PV) module technology, including higher power output bifacial panels and more efficient PERC (Passivated Emitter and Rear Contact) cells, are becoming standard. Integrated battery energy storage systems (ESS) are crucial, offering grid stabilization, peak shaving, and backup power capabilities, with capacities ranging from 5 kWh to 50 kWh for residential use and significantly higher for C&I applications. Smart inverters with advanced monitoring and control features are now commonplace, enabling seamless grid integration and remote management. Unique selling propositions revolve around higher energy yield per square meter, extended product warranties (often 25-30 years for panels), and sophisticated software platforms for performance tracking and optimization.

Key Drivers, Barriers & Challenges in Portugal Distributed Solar Energy Industry

The Portugal Distributed Solar Energy Industry is propelled by a combination of powerful drivers. These include supportive government policies and ambitious renewable energy targets, which provide a stable investment environment. Declining solar technology costs, driven by global manufacturing economies of scale and innovation, make solar increasingly competitive against traditional energy sources. Growing environmental awareness and the demand for sustainable energy solutions from consumers and businesses are significant market forces. Furthermore, the pursuit of energy independence and reduced electricity bills are key economic motivators for adoption.

However, the industry faces several significant barriers and challenges. High upfront installation costs, despite decreasing panel prices, can still be a deterrent for some residential customers. Grid integration complexities and the need for grid upgrades to accommodate distributed generation can create bottlenecks. Regulatory uncertainties and changes in policy frameworks can impact investment confidence. Supply chain disruptions, particularly for components like inverters and batteries, can lead to project delays and increased costs. Intense competition among installers and manufacturers can also put pressure on profit margins.

Emerging Opportunities in Portugal Distributed Solar Energy Industry

Emerging opportunities in the Portugal Distributed Solar Energy Industry lie in the expanding market for integrated energy storage solutions, which are becoming increasingly vital for grid stability and energy independence. The growth of electric vehicles (EVs) presents a synergistic opportunity, with the potential for vehicle-to-grid (V2G) technology to leverage EV batteries for distributed energy services. Furthermore, the development of community solar projects is opening up new avenues for collective investment and participation, particularly in areas where individual rooftop installations may not be feasible. Innovations in smart building integration, where solar energy systems are seamlessly incorporated into the design and operation of new constructions, also represent a significant growth area. The exploration of offshore floating solar farms, though nascent, offers potential for areas with limited land availability.

Growth Accelerators in the Portugal Distributed Solar Energy Industry Industry

Several key growth accelerators are propelling the Portugal Distributed Solar Energy Industry forward. Technological breakthroughs in solar cell efficiency and durability are continuously improving the economic viability of installations. Strategic partnerships between solar developers, energy utilities, and financial institutions are unlocking significant investment capital and streamlining project development. The ongoing digitalization of the energy sector, with the widespread adoption of smart meters and advanced data analytics, facilitates more efficient grid management and demand-side response, further enhancing the value proposition of distributed solar. Market expansion strategies, including the development of innovative financing models and accessible installation services, are broadening the appeal of solar energy to a wider consumer base.

Key Players Shaping the Portugal Distributed Solar Energy Industry Market

- Solar 2 Power

- DAPE

- Solcor

- SolarImpact

- Sunaitec

- FF Solar

Notable Milestones in Portugal Distributed Solar Energy Industry Sector

- 2019: Introduction of new renewable energy auctions by the Portuguese government, significantly boosting utility-scale and distributed solar project development.

- 2020: Increased adoption of net metering schemes, encouraging more residential and commercial entities to install solar PV systems.

- 2021: Significant growth in solar PV capacity additions, exceeding government targets for the year.

- 2022: Rise in M&A activity as larger energy companies acquire smaller solar installation firms to expand their distributed generation portfolios.

- 2023: Growing interest and initial deployments of battery energy storage systems coupled with solar PV in both residential and commercial sectors.

- Early 2024: Introduction of new incentives for energy efficiency and renewable energy adoption as part of Portugal's post-pandemic recovery plan.

In-Depth Portugal Distributed Solar Energy Industry Market Outlook

The future outlook for the Portugal Distributed Solar Energy Industry is exceptionally bright, characterized by sustained growth driven by a confluence of favorable factors. The industry's growth accelerators, including ongoing technological advancements in solar efficiency and storage, coupled with supportive government policies aimed at decarbonization, will continue to fuel expansion. Strategic partnerships between key industry players and financial institutions are anticipated to unlock further investment, enabling larger-scale deployments and the development of innovative financing models. The digitalization of the energy sector will further enhance the integration and management of distributed solar assets. The market’s trajectory indicates a strong upward trend, solidifying Portugal's position as a leader in renewable energy adoption within Europe.

Portugal Distributed Solar Energy Industry Segmentation

-

1. End-User

- 1.1. Residential

- 1.2. Commercial and Industrial

Portugal Distributed Solar Energy Industry Segmentation By Geography

- 1. Portugal

Portugal Distributed Solar Energy Industry Regional Market Share

Geographic Coverage of Portugal Distributed Solar Energy Industry

Portugal Distributed Solar Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Investment in LNG Infrastructure4.; Rising Demand for LNG in Bunkering

- 3.2.2 Road Transportation

- 3.2.3 and Off-grid Power

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Supporting Infrastructure in the Regions such as the Middle East and Africa

- 3.4. Market Trends

- 3.4.1. Residential Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Portugal Distributed Solar Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Residential

- 5.1.2. Commercial and Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Portugal

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Solar 2 Power

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DAPE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Solcor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SolarImpact*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sunaitec

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FF Solar

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Solar 2 Power

List of Figures

- Figure 1: Portugal Distributed Solar Energy Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Portugal Distributed Solar Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: Portugal Distributed Solar Energy Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 2: Portugal Distributed Solar Energy Industry Revenue million Forecast, by Region 2020 & 2033

- Table 3: Portugal Distributed Solar Energy Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 4: Portugal Distributed Solar Energy Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portugal Distributed Solar Energy Industry?

The projected CAGR is approximately 15%.

2. Which companies are prominent players in the Portugal Distributed Solar Energy Industry?

Key companies in the market include Solar 2 Power, DAPE, Solcor, SolarImpact*List Not Exhaustive, Sunaitec, FF Solar.

3. What are the main segments of the Portugal Distributed Solar Energy Industry?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 575 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in LNG Infrastructure4.; Rising Demand for LNG in Bunkering. Road Transportation. and Off-grid Power.

6. What are the notable trends driving market growth?

Residential Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Lack of Supporting Infrastructure in the Regions such as the Middle East and Africa.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portugal Distributed Solar Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portugal Distributed Solar Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portugal Distributed Solar Energy Industry?

To stay informed about further developments, trends, and reports in the Portugal Distributed Solar Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence