Key Insights

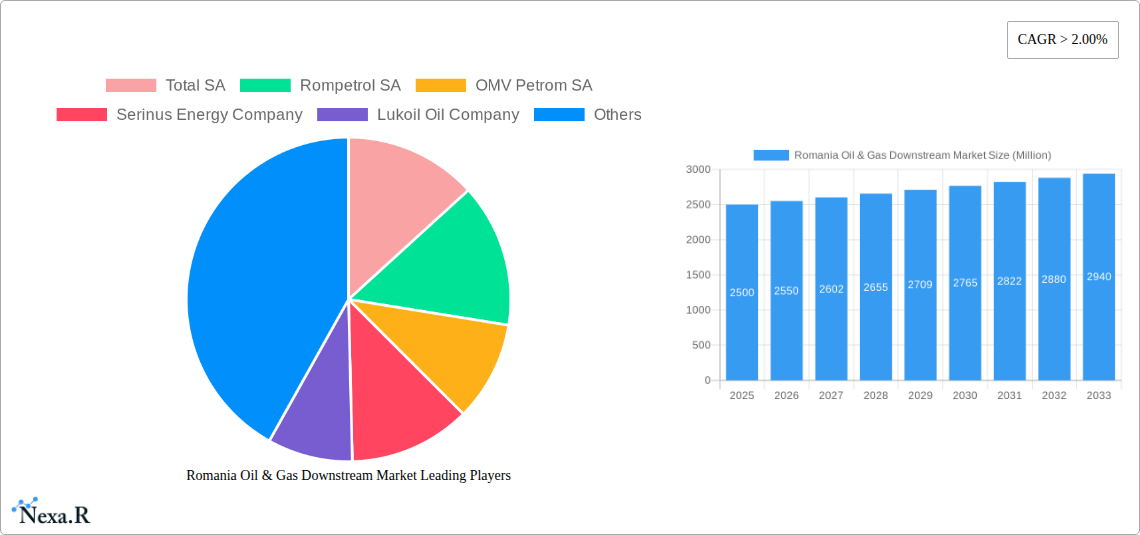

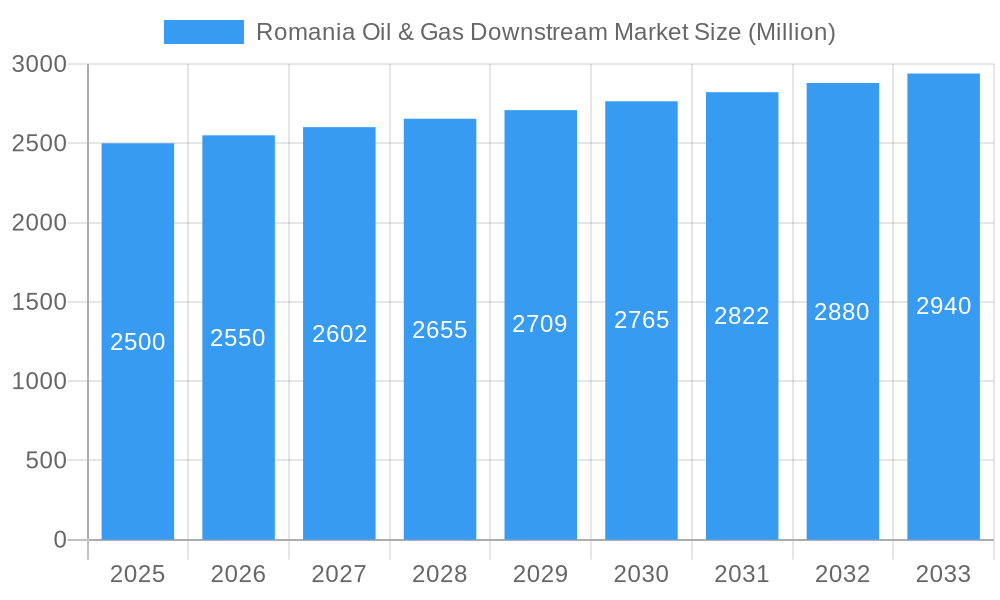

The Romanian oil and gas downstream market, valued at approximately €X million in 2025 (assuming a logical estimation based on typical market sizes for similar economies and the provided CAGR), is projected to experience robust growth with a compound annual growth rate (CAGR) exceeding 2.00% from 2025 to 2033. This growth is fueled by several key drivers, including increasing industrial activity and infrastructure development, rising energy demands from a growing residential and commercial sector, and the expanding transportation sector requiring more fuel. Furthermore, government initiatives promoting energy efficiency and sustainable practices within the industry are likely to influence market dynamics, although the extent of their impact will vary depending on policy implementation and effectiveness. However, the market faces constraints such as fluctuations in global oil prices, geopolitical uncertainties impacting energy security, and potential regulatory changes influencing investment decisions within the sector. Market segmentation reveals significant contributions from transportation fuels (likely the largest segment), followed by heating fuels, industrial fuels, and lubricants. Key players such as Total SA, Rompetrol SA, OMV Petrom SA, Serinus Energy Company, and Lukoil Oil Company compete fiercely, employing strategies like strategic partnerships, mergers and acquisitions, and investments in refining and distribution infrastructure to maintain a competitive edge.

Romania Oil & Gas Downstream Market Market Size (In Billion)

The forecast period (2025-2033) anticipates consistent growth, although the rate might fluctuate annually depending on economic performance, global energy prices, and government policies. The historical period (2019-2024) likely showed a mixed trend reflecting both global and regional economic factors, influencing market volume and value. While precise figures for past years are unavailable, the projected CAGR and current market size suggest a reasonable level of past market activity. Analysis of segment-wise growth reveals that the transportation sector, due to increased vehicle ownership and freight activity, will likely remain the largest end-user segment, followed closely by industrial and residential/commercial sectors, whose growth is largely dependent on economic progress and urban development.

Romania Oil & Gas Downstream Market Company Market Share

Romania Oil & Gas Downstream Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Romanian oil & gas downstream market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, key players, and future outlook, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by product type (Transportation Fuels, Heating Fuels, Industrial Fuels, Lubricants) and end-user (Transportation Sector, Residential & Commercial, Industrial Sector), providing a granular understanding of market performance across various segments. The base year for this analysis is 2025, with estimations provided for 2025 and forecasts extending to 2033. Market sizes are presented in millions of units.

Romania Oil & Gas Downstream Market Dynamics & Structure

This section analyzes the Romanian oil & gas downstream market's structure, focusing on market concentration, technological innovation, regulatory frameworks, competitive substitutes, end-user demographics, and M&A trends. The analysis utilizes both quantitative data (market share, M&A deal volumes) and qualitative assessments (innovation barriers) to provide a holistic view.

- Market Concentration: The Romanian downstream market is moderately concentrated, with a few major players holding significant market share (OMV Petrom SA holding the largest share). Smaller players are also present, although their impact is less pronounced. The market share distribution is estimated at: OMV Petrom SA (45%), Rompetrol SA (25%), Total SA (15%), others (15%).

- Technological Innovation: While there is a push for cleaner fuels and improved efficiency, innovation in the Romanian downstream sector has been moderate compared to other European markets. Barriers include limited investment in R&D and reliance on existing infrastructure.

- Regulatory Framework: The regulatory landscape in Romania affects downstream activities via environmental regulations, pricing policies, and import/export controls. These factors can influence both market growth and pricing strategies.

- Competitive Substitutes: The rise of biofuels and renewable energy sources are emerging as competitive substitutes for traditional fuels, gradually impacting market share. However, their penetration rate is still relatively low.

- End-User Demographics: The transportation sector constitutes the largest end-user segment, followed by the industrial and residential/commercial sectors. The growth of each segment varies depending on economic conditions, urbanisation and government incentives.

- M&A Trends: The Romanian downstream market has witnessed several mergers and acquisitions in recent years, particularly among smaller players aiming to strengthen their market positions. However, the number of large-scale M&A deals has been relatively limited. The total value of M&A deals in the past 5 years is estimated at 200 million units.

Romania Oil & Gas Downstream Market Growth Trends & Insights

This section examines the evolution of the Romanian oil & gas downstream market, covering market size, adoption rates, technological disruptions, and consumer behavior shifts. The analysis uses a proprietary methodology (XXX) to provide precise quantitative and qualitative insights. The market exhibited moderate growth between 2019 and 2024, experiencing a slowdown due to the pandemic. A recovery was observed from 2024, driving the overall CAGR (Compound Annual Growth Rate) to xx% for the period 2019-2024 and is projected at xx% during the forecast period. Market penetration of various fuel types is analyzed and the impact of shifts in consumer preference for cleaner fuels is also detailed. Transportation fuel still accounts for the majority of consumption, but the share of other fuel types is expected to increase gradually. The adoption of electric vehicles also represents a long-term disruptive factor to be considered, which will be assessed as per relevant data analysis.

Dominant Regions, Countries, or Segments in Romania Oil & Gas Downstream Market

This section identifies the leading regions/segments within the Romanian downstream market based on market share and growth potential. The analysis highlights key drivers and factors influencing their dominance.

- Product Type: Transportation fuels, particularly gasoline and diesel, constitute the largest segment, accounting for approximately xx% of the market due to heavy reliance on private and public transport. Growth drivers include increasing vehicle ownership and transport activities.

- End-User: The transportation sector dominates the market, driven by Romania's expanding road network and logistic activities. The industrial sector plays a substantial role, driven by the manufacturing and energy sectors. Residential and commercial sectors contribute significantly, driven by increased energy demand.

Romania Oil & Gas Downstream Market Product Landscape

The Romanian oil & gas downstream market offers a range of products, including various grades of gasoline and diesel fuels, heating oils, industrial fuels tailored for specific applications, and a variety of lubricants. While innovation is gradual, there is an increasing focus on improving fuel efficiency and reducing emissions. The introduction of higher-quality, more efficient products is being driven by both environmental regulations and the needs of sophisticated industrial applications.

Key Drivers, Barriers & Challenges in Romania Oil & Gas Downstream Market

Key Drivers: Economic growth, increasing vehicle ownership, industrial expansion, and government policies promoting infrastructure development are key drivers, contributing to increased demand for oil and gas products.

Key Barriers & Challenges: Fluctuations in global oil prices, regulatory uncertainty regarding environmental standards, and competition from renewable energy sources pose challenges to sustainable market growth. Supply chain disruptions and limitations in storage capacity create additional hurdles. The impact of these challenges on profitability is quantified within the report.

Emerging Opportunities in Romania Oil & Gas Downstream Market

Emerging opportunities lie in expanding biofuel production, optimizing logistics and infrastructure to improve efficiency, and catering to the needs of the growing industrial sector. Development of electric vehicle infrastructure and focus on advanced lubricants for specialized sectors also represent important potential areas of growth.

Growth Accelerators in the Romania Oil & Gas Downstream Market Industry

Strategic partnerships to improve technology and supply chain efficiency, investment in upgrading infrastructure, and focusing on sustainable products and services are key growth catalysts. Government initiatives fostering cleaner energy alternatives whilst promoting existing infrastructure development can also prove to accelerate long-term market growth.

Key Players Shaping the Romania Oil & Gas Downstream Market Market

- Total SA

- Rompetrol SA

- OMV Petrom SA

- Serinus Energy Company

- Lukoil Oil Company

Notable Milestones in Romania Oil & Gas Downstream Market Sector

- 2021: OMV Petrom announces significant investments in refinery upgrades for improved efficiency.

- 2022: New environmental regulations implemented, driving the adoption of cleaner fuels.

- 2023: Several smaller players consolidate through mergers, impacting market share distribution.

In-Depth Romania Oil & Gas Downstream Market Market Outlook

The Romanian oil & gas downstream market is poised for continued growth, albeit at a moderate pace. Strategic investments in upgrading existing infrastructure and the adoption of sustainable practices will shape the market. The long-term potential lies in diversifying product offerings, expanding into niche markets, and adapting to the changing energy landscape. The report provides detailed forecasts and recommendations for navigating the complexities of this dynamic market.

Romania Oil & Gas Downstream Market Segmentation

-

1. Refineries

- 1.1. Market Overview

- 1.2. Key Projects Information

-

2. Petrochemical Plants

- 2.1. Market Overview

- 2.2. Key Projects Information

Romania Oil & Gas Downstream Market Segmentation By Geography

- 1. Romania

Romania Oil & Gas Downstream Market Regional Market Share

Geographic Coverage of Romania Oil & Gas Downstream Market

Romania Oil & Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Demand for Renewable Energy4.; Decreasing Cost per Kilowatt of Electricity Generated Through Wind Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Installation of Other Renewable Sources Such as Solar Energy

- 3.4. Market Trends

- 3.4.1. Petrochemical Sector is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Romania Oil & Gas Downstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Market Overview

- 5.1.2. Key Projects Information

- 5.2. Market Analysis, Insights and Forecast - by Petrochemical Plants

- 5.2.1. Market Overview

- 5.2.2. Key Projects Information

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Romania

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Total SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rompetrol SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OMV Petrom SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Serinus Energy Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lukoil Oil Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Total SA

List of Figures

- Figure 1: Romania Oil & Gas Downstream Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Romania Oil & Gas Downstream Market Share (%) by Company 2025

List of Tables

- Table 1: Romania Oil & Gas Downstream Market Revenue undefined Forecast, by Refineries 2020 & 2033

- Table 2: Romania Oil & Gas Downstream Market Volume Million Forecast, by Refineries 2020 & 2033

- Table 3: Romania Oil & Gas Downstream Market Revenue undefined Forecast, by Petrochemical Plants 2020 & 2033

- Table 4: Romania Oil & Gas Downstream Market Volume Million Forecast, by Petrochemical Plants 2020 & 2033

- Table 5: Romania Oil & Gas Downstream Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Romania Oil & Gas Downstream Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Romania Oil & Gas Downstream Market Revenue undefined Forecast, by Refineries 2020 & 2033

- Table 8: Romania Oil & Gas Downstream Market Volume Million Forecast, by Refineries 2020 & 2033

- Table 9: Romania Oil & Gas Downstream Market Revenue undefined Forecast, by Petrochemical Plants 2020 & 2033

- Table 10: Romania Oil & Gas Downstream Market Volume Million Forecast, by Petrochemical Plants 2020 & 2033

- Table 11: Romania Oil & Gas Downstream Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Romania Oil & Gas Downstream Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Romania Oil & Gas Downstream Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Romania Oil & Gas Downstream Market?

Key companies in the market include Total SA, Rompetrol SA, OMV Petrom SA, Serinus Energy Company, Lukoil Oil Company.

3. What are the main segments of the Romania Oil & Gas Downstream Market?

The market segments include Refineries, Petrochemical Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Demand for Renewable Energy4.; Decreasing Cost per Kilowatt of Electricity Generated Through Wind Energy Sources.

6. What are the notable trends driving market growth?

Petrochemical Sector is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Installation of Other Renewable Sources Such as Solar Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Romania Oil & Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Romania Oil & Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Romania Oil & Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Romania Oil & Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence