Key Insights

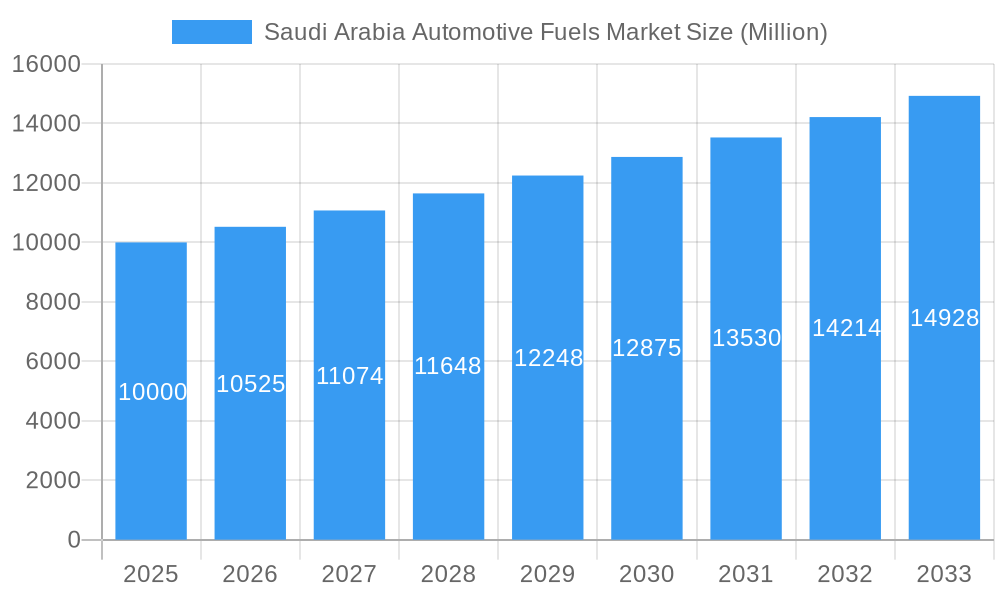

The Saudi Arabian automotive fuels market, projected to reach $13.23 million by 2024, anticipates substantial expansion. This growth is underpinned by a dynamic automotive sector and escalating vehicle ownership across the Kingdom. The compound annual growth rate (CAGR) of 7.5% from 2024 to 2033 highlights significant market evolution. Key growth drivers include rising disposable incomes fostering vehicle acquisition, government investments in infrastructure and tourism, and a steady increase in both private and commercial vehicle registrations. The market is primarily segmented by gasoline, followed by diesel and premium gasoline. Competitive forces are intense, with prominent entities including Saudi Aramco and TotalEnergies actively pursuing market share. Emerging challenges involve volatile global crude oil prices affecting fuel costs and consumer spending, alongside the increasing adoption of electric vehicles and alternative fuels potentially moderating future growth.

Saudi Arabia Automotive Fuels Market Market Size (In Million)

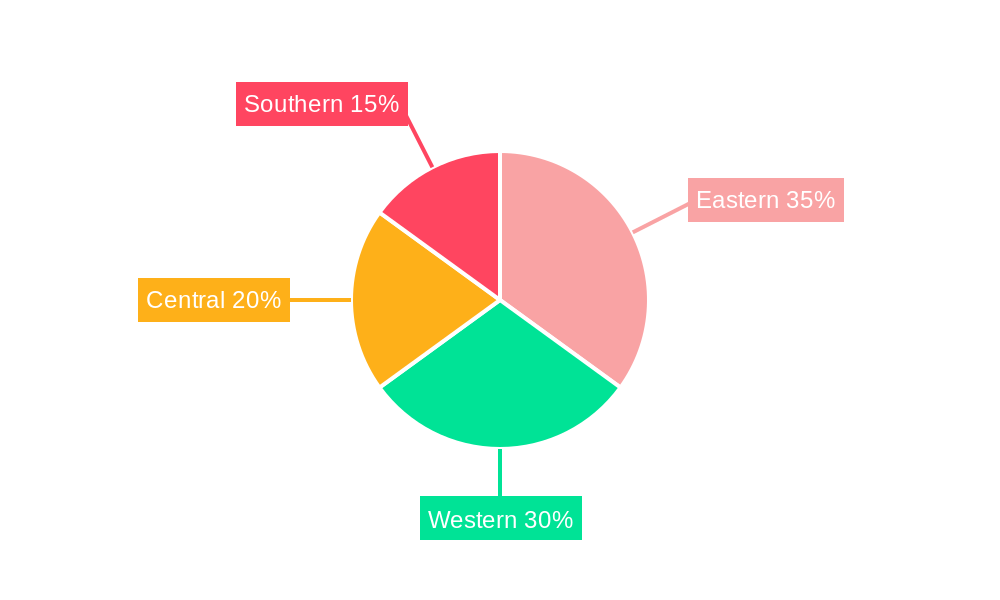

Regional market dynamics within Saudi Arabia reveal distinct consumption patterns. The Eastern Province, a key industrial and population hub, and the Western Province, home to major cities like Jeddah and Mecca, are anticipated to lead in fuel consumption and market share. Central and Southern regions are also projected for steady growth. The market's future is intrinsically linked to Saudi Arabia's sustained economic development, supportive government policies for sustainable transportation, and the pace of electric vehicle and alternative fuel technology adoption. Nevertheless, the enduring demand for gasoline and diesel will likely remain a primary catalyst for market expansion in the near term. Comprehensive analysis of each regional market (Central, Eastern, Western, Southern Saudi Arabia) offers granular insights crucial for informed investment and strategic business planning.

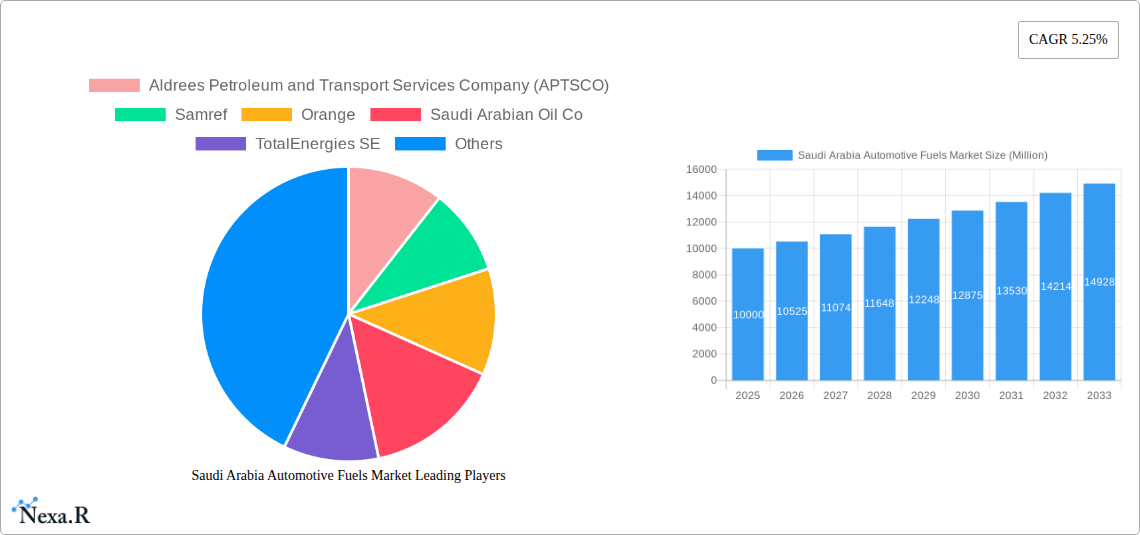

Saudi Arabia Automotive Fuels Market Company Market Share

Saudi Arabia Automotive Fuels Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia automotive fuels market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report examines the parent market (automotive fuels) and its child markets (Gasoline, PG95 Premium Grade Gasoline, and Diesel), offering granular insights for informed decision-making. Key players like Saudi Arabian Oil Co, TotalEnergies SE, and Aldrees Petroleum and Transport Services Company (APTSCO) are profiled. This report is invaluable for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market.

Saudi Arabia Automotive Fuels Market Market Dynamics & Structure

This section analyzes the Saudi Arabia automotive fuels market's structure, focusing on market concentration, technological advancements, regulatory landscapes, competitive substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. The analysis incorporates quantitative data such as market share percentages and M&A deal volumes, alongside qualitative factors like innovation barriers.

- Market Concentration: The market is characterized by a high level of concentration with xx% market share held by the top 3 players. This concentration is driven by factors such as economies of scale and government regulations.

- Technological Innovation: Technological advancements in fuel efficiency and alternative fuel technologies are driving innovation. However, high initial investment costs and regulatory hurdles pose challenges.

- Regulatory Framework: Government policies and regulations significantly influence the market, including pricing mechanisms, fuel quality standards, and environmental regulations. These factors directly impact market growth and player strategies.

- Competitive Product Substitutes: The rise of electric vehicles (EVs) and hybrid vehicles presents a significant challenge to traditional gasoline and diesel fuels. The market share of alternative fuels is currently xx% and is projected to reach xx% by 2033.

- End-User Demographics: The expanding vehicle ownership in Saudi Arabia, driven by population growth and rising disposable incomes, fuels demand for automotive fuels. However, changing consumer preferences towards fuel-efficient and environmentally friendly vehicles are impacting the market.

- M&A Trends: The automotive fuels sector has witnessed xx M&A deals in the past five years, mainly driven by strategies for market consolidation and diversification.

Saudi Arabia Automotive Fuels Market Growth Trends & Insights

This section details the evolution of the Saudi Arabia automotive fuels market size, adoption rates, technological disruptions, and shifts in consumer behavior from 2019 to 2033. Detailed metrics, including compound annual growth rate (CAGR) and market penetration rates, provide deeper insights. The market size in 2024 is estimated at xx million units, with a projected CAGR of xx% during the forecast period. Several factors, including government initiatives to promote fuel efficiency and the increasing adoption of hybrid and electric vehicles, are influencing market growth. Technological disruptions, like the introduction of biofuels and advanced engine technologies, are reshaping the market landscape. A significant shift in consumer behavior towards more environmentally conscious fuel choices is also observed.

Dominant Regions, Countries, or Segments in Saudi Arabia Automotive Fuels Market

This section identifies the leading region(s) or segment(s) within the Saudi Arabia automotive fuels market (Gasoline, PG95 Premium Grade Gasoline, and Diesel) driving market growth. The analysis focuses on dominance factors, including market share and growth potential, using both bullet points and paragraph analysis. Currently, Gasoline holds the largest market share (xx%), followed by Diesel (xx%) and PG95 Premium Grade Gasoline (xx%). The growth of Gasoline is driven by its widespread use in conventional vehicles. The demand for Diesel is primarily driven by the heavy commercial vehicle segment.

- Key Drivers for Gasoline Dominance: Widespread vehicle ownership, established infrastructure for distribution, and relatively lower cost compared to PG95 Premium Grade Gasoline are all key drivers.

- Key Drivers for Diesel Dominance: High demand from the heavy commercial vehicle sector and its comparatively higher energy density.

- Growth Potential of PG95 Premium Grade Gasoline: The segment is expected to witness significant growth driven by increasing consumer preference for higher-octane fuel, which enhances engine performance and fuel efficiency.

Saudi Arabia Automotive Fuels Market Product Landscape

The Saudi Arabia automotive fuels market offers a range of products catering to various vehicle types and consumer needs. Gasoline, Diesel, and PG95 Premium Grade Gasoline are the primary fuel types. Recent innovations focus on improving fuel efficiency, reducing emissions, and enhancing engine performance. The market is witnessing the gradual introduction of biofuels and other alternative fuels, reflecting a growing emphasis on sustainability. These new fuel types offer unique selling propositions like lower carbon emissions and improved engine performance, driving gradual market adoption.

Key Drivers, Barriers & Challenges in Saudi Arabia Automotive Fuels Market

Key Drivers: Factors driving the Saudi Arabia automotive fuels market include:

- Increasing vehicle ownership and population growth.

- Expanding infrastructure supporting fuel distribution networks.

- Government initiatives promoting fuel efficiency and sustainability.

Key Challenges & Restraints:

- The growing adoption of electric vehicles poses a significant challenge to traditional fuel markets.

- Fluctuations in global crude oil prices impact fuel costs and market profitability.

- Stringent environmental regulations necessitate investments in cleaner fuel technologies.

Emerging Opportunities in Saudi Arabia Automotive Fuels Market

Emerging opportunities include:

- Growing demand for higher-octane fuels and fuel additives enhancing engine performance.

- Increased interest in sustainable and bio-based fuels aligning with environmental goals.

- Potential for expansion into untapped markets in remote regions of the Kingdom.

Growth Accelerators in the Saudi Arabia Automotive Fuels Market Industry

Long-term growth is expected to be driven by technological advancements in fuel production and distribution, strategic partnerships between energy companies and automotive manufacturers, and expansion into new market segments. Government policies supporting energy diversification and the adoption of cleaner fuels will play a critical role in fostering growth.

Key Players Shaping the Saudi Arabia Automotive Fuels Market Market

- Aldrees Petroleum and Transport Services Company (APTSCO)

- Samref

- Orange

- Saudi Arabian Oil Co

- TotalEnergies SE

- NAFT Services Company Limited

- Liter Group

- Arabian Petroleum Supply Company

- Al-Dabbagh Group

- Alitco Group

Notable Milestones in Saudi Arabia Automotive Fuels Market Sector

- July 2023: Saudi Arabia’s fuel oil imports from Russia reached a record high of 193,000 barrels per day (bpd), driven by reduced crude oil production and increased summertime electricity demand.

- March 2023: Saudi Arabia's national oil producer partnered with Geely Automobile Holdings and Renault SA to develop automobile engines using gasoline, alternative fuels, and hybrid technology.

In-Depth Saudi Arabia Automotive Fuels Market Market Outlook

The Saudi Arabia automotive fuels market is poised for significant growth in the coming years, driven by continued economic expansion, rising vehicle ownership, and government investments in infrastructure. Strategic partnerships, innovation in fuel technologies, and a focus on sustainability will be key factors shaping the market's future. The market presents significant opportunities for players who can adapt to changing consumer preferences and meet evolving environmental regulations.

Saudi Arabia Automotive Fuels Market Segmentation

-

1. Fuel Type

-

1.1. Gasoline

- 1.1.1. PG91 Regular Grade Gasoline

- 1.1.2. PG95 Premium Grade Gasoline

- 1.2. Diesel

-

1.1. Gasoline

Saudi Arabia Automotive Fuels Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Automotive Fuels Market Regional Market Share

Geographic Coverage of Saudi Arabia Automotive Fuels Market

Saudi Arabia Automotive Fuels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Increasing Automotive Sales in Saudi Arabia to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Automotive Fuels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Gasoline

- 5.1.1.1. PG91 Regular Grade Gasoline

- 5.1.1.2. PG95 Premium Grade Gasoline

- 5.1.2. Diesel

- 5.1.1. Gasoline

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aldrees Petroleum and Transport Services Company (APTSCO)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samref

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Orange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saudi Arabian Oil Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TotalEnergies SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NAFT Services Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Liter Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arabian Petroleum Supply Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al-Dabbagh Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alitco Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aldrees Petroleum and Transport Services Company (APTSCO)

List of Figures

- Figure 1: Saudi Arabia Automotive Fuels Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Automotive Fuels Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Automotive Fuels Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 2: Saudi Arabia Automotive Fuels Market Volume Million Forecast, by Fuel Type 2020 & 2033

- Table 3: Saudi Arabia Automotive Fuels Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Automotive Fuels Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Automotive Fuels Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 6: Saudi Arabia Automotive Fuels Market Volume Million Forecast, by Fuel Type 2020 & 2033

- Table 7: Saudi Arabia Automotive Fuels Market Revenue million Forecast, by Country 2020 & 2033

- Table 8: Saudi Arabia Automotive Fuels Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Automotive Fuels Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Saudi Arabia Automotive Fuels Market?

Key companies in the market include Aldrees Petroleum and Transport Services Company (APTSCO), Samref, Orange, Saudi Arabian Oil Co, TotalEnergies SE, NAFT Services Company Limited, Liter Group, Arabian Petroleum Supply Company, Al-Dabbagh Group, Alitco Group.

3. What are the main segments of the Saudi Arabia Automotive Fuels Market?

The market segments include Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.23 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Increasing Automotive Sales in Saudi Arabia to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

Jul 2023: Saudi Arabia reached a new high in fuel oil imports from Russia, amounting to 193,000 barrels per day (bpd). Fuel oil demand is being driven by the Kingdom's reduction in crude oil production as well as an anticipated increase in summertime electricity consumption.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Automotive Fuels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Automotive Fuels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Automotive Fuels Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Automotive Fuels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence