Key Insights

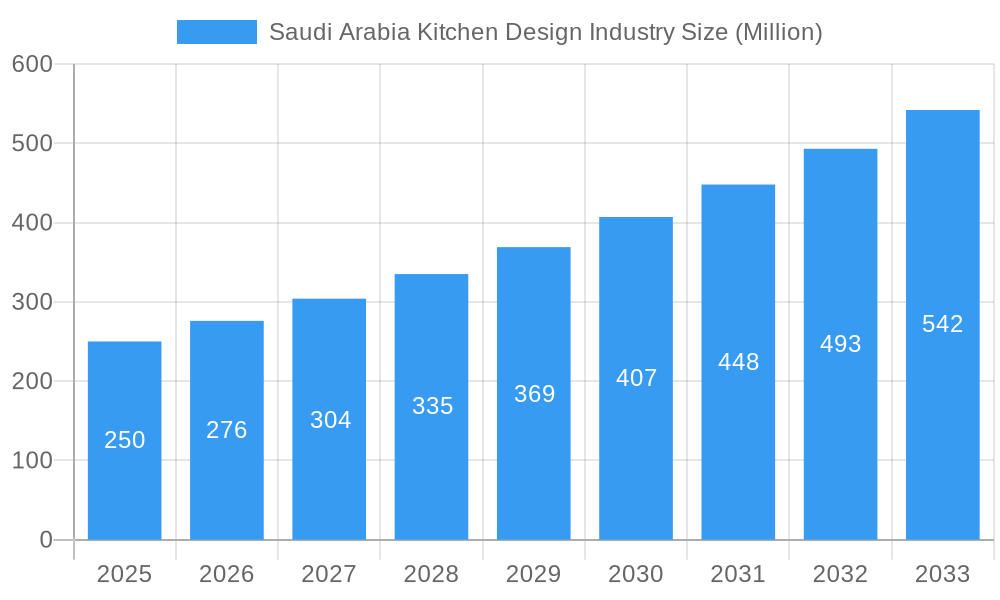

The Saudi Arabian kitchen design market is poised for substantial expansion, driven by robust construction activity, increasing consumer purchasing power, and a heightened demand for contemporary, visually appealing kitchen spaces. With an estimated market size of $2.06 billion in the base year of 2025, the industry is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.12% from 2025 to 2033. Key growth drivers include escalating urbanization, a growing middle class investing in home enhancements, and the rising popularity of open-concept kitchen layouts. The burgeoning e-commerce sector further facilitates market growth by offering consumers broader access to diverse kitchen furniture and design solutions. Kitchen cabinets represent the dominant segment, followed by kitchen tables and chairs. While supermarkets and hypermarkets currently lead distribution, e-commerce is rapidly emerging as a significant channel. Leading companies like Snaidero, KAFCO Kitchens, and Ikea are strategically positioned to leverage this growth through innovation, partnerships, and targeted marketing. Potential challenges include volatile material costs and economic uncertainties that could affect discretionary spending.

Saudi Arabia Kitchen Design Industry Market Size (In Billion)

The long-term forecast for the Saudi Arabian kitchen design market remains optimistic, supported by government investments in infrastructure and affordable housing programs. The industry will likely see increased specialization, focusing on bespoke designs, smart kitchen technologies, and sustainable materials. The influence of global design trends and the adoption of online design tools are also expected to shape the market landscape, ensuring sustained growth through the forecast period. Businesses must adapt to evolving consumer preferences and technological advancements, emphasizing innovative designs, competitive pricing, and superior customer service to secure market share.

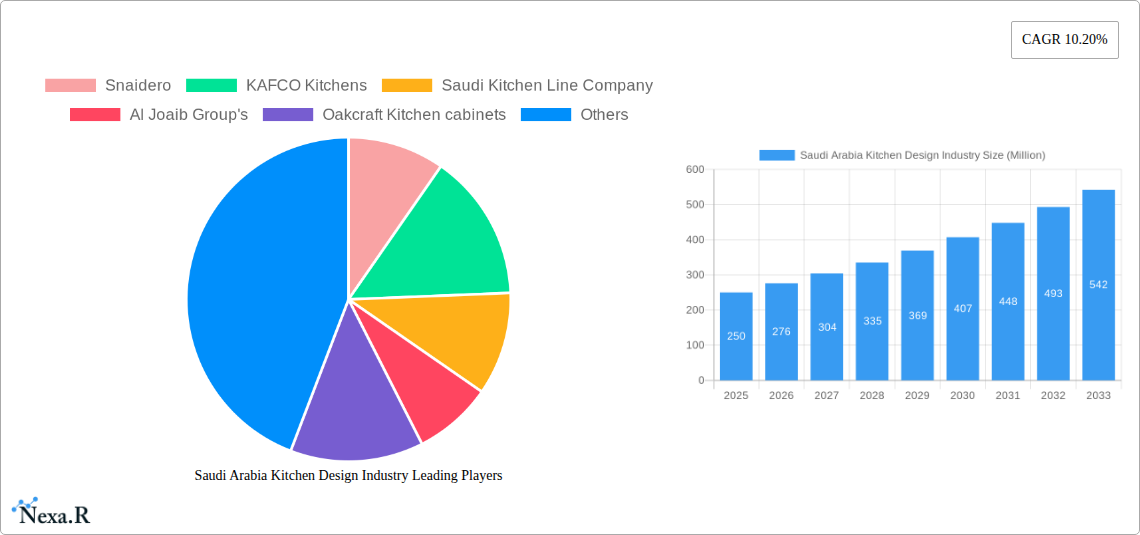

Saudi Arabia Kitchen Design Industry Company Market Share

Saudi Arabia Kitchen Design Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Saudi Arabia kitchen design industry, covering market dynamics, growth trends, key players, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic planners. The report segments the market by furniture type (kitchen cabinets, kitchen chairs, kitchen tables, other furniture types) and distribution channel (supermarkets/hypermarkets, specialty stores, e-commerce, other channels). Market size is presented in million units.

Saudi Arabia Kitchen Design Industry Market Dynamics & Structure

The Saudi Arabian kitchen design industry is experiencing significant growth, driven by factors such as rising disposable incomes, a burgeoning construction sector, and evolving consumer preferences towards modern and aesthetically pleasing kitchens. Market concentration is currently moderate, with several large players alongside numerous smaller, local businesses. Technological innovation, particularly in smart kitchen technologies and sustainable materials, is a major driver, while regulatory frameworks related to building codes and safety standards play a significant role. Competitive product substitutes include ready-to-assemble (RTA) kitchen units and imported furniture, impacting market share dynamics. The end-user demographics are predominantly middle and upper-income households, with a growing demand for customized and luxury kitchen designs. M&A activity remains moderate, with approximately xx deals recorded in the historical period (2019-2024), representing xx million units in market value.

- Market Concentration: Moderate, with a few major players commanding xx% market share in 2024.

- Technological Innovation: Strong emphasis on smart kitchen technologies, sustainable materials (e.g., Riciclantica series by Valcucine), and ergonomic designs.

- Regulatory Framework: Compliance with building codes and safety standards influences product design and manufacturing.

- Competitive Substitutes: RTA furniture and imported products present significant competition.

- End-User Demographics: Predominantly middle and upper-income households, with increasing demand for customization.

- M&A Trends: xx deals between 2019 and 2024, with xx million units total value. Innovation barriers include high initial investment costs for advanced technologies and lack of skilled labor in certain areas.

Saudi Arabia Kitchen Design Industry Growth Trends & Insights

The Saudi Arabian kitchen design market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. This growth is projected to continue, with a forecast CAGR of xx% from 2025 to 2033. Increased urbanization, rising construction activity, and a shift towards modern living styles are key factors contributing to this expansion. Market penetration of modern kitchen designs is increasing steadily, particularly in urban areas. Technological disruptions, such as the integration of smart appliances and the rise of online design tools, are reshaping consumer behavior and driving demand for innovative products. Consumers are increasingly seeking customizable options, sustainable materials, and energy-efficient designs.

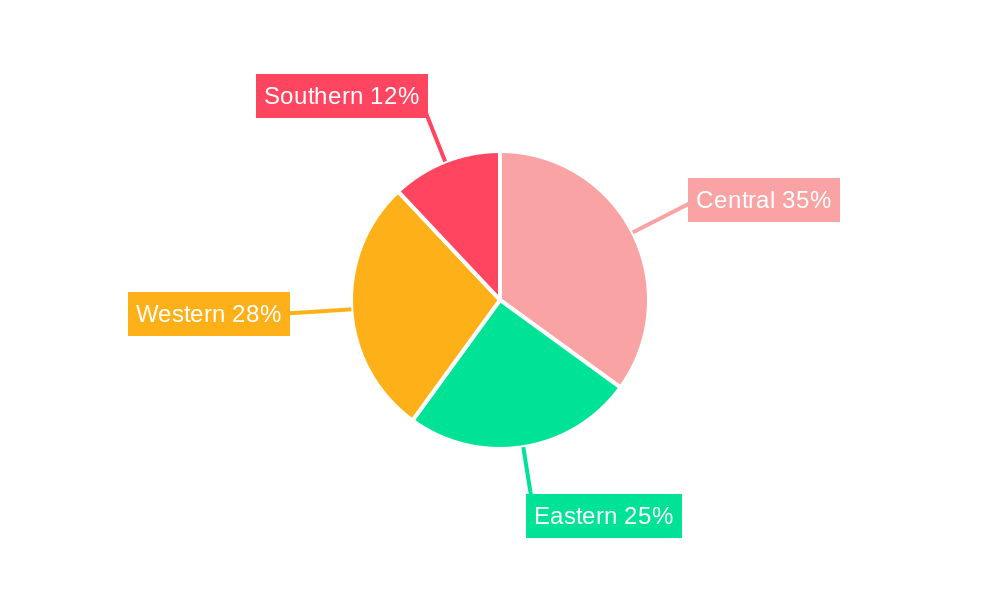

Dominant Regions, Countries, or Segments in Saudi Arabia Kitchen Design Industry

The Riyadh and Jeddah regions are the dominant market segments in the Saudi Arabian kitchen design industry, owing to higher population density, greater disposable incomes, and a higher concentration of construction projects. Within furniture types, kitchen cabinets command the largest market share (xx%), followed by kitchen tables (xx%) and kitchen chairs (xx%). The specialty stores distribution channel holds a significant market share (xx%), attributable to the preference for personalized service and product demonstrations. However, e-commerce is emerging as a rapidly growing segment, driven by convenience and broader product selection.

- Key Drivers (Riyadh & Jeddah): High population density, high disposable incomes, significant construction activity, and strong preference for modern homes.

- Key Drivers (Kitchen Cabinets): Essential component of any kitchen, wide range of styles and materials available, high customization potential.

- Key Drivers (Specialty Stores): Personalized service, product demonstrations, and expertise in kitchen design consultation.

- Key Drivers (E-commerce): Growing online shopping penetration, convenience, broader selection.

Saudi Arabia Kitchen Design Industry Product Landscape

The Saudi Arabian kitchen design market offers a diverse range of products, from budget-friendly RTA cabinets to high-end, custom-designed kitchens incorporating the latest smart technologies and sustainable materials. Product innovation focuses on enhancing functionality, aesthetics, and durability. Recent examples include the introduction of space-saving designs, modular units, and smart appliances with integrated connectivity. Unique selling propositions often include superior craftsmanship, customized designs, and the use of premium materials. Technological advancements are driving the integration of smart features, energy-efficient appliances, and sustainable manufacturing processes.

Key Drivers, Barriers & Challenges in Saudi Arabia Kitchen Design Industry

Key Drivers: Rising disposable incomes, increasing urbanization, strong government support for infrastructure development, and a growing preference for modern and technologically advanced kitchens. Government initiatives promoting sustainable construction practices also play a significant role.

Key Challenges: Intense competition, particularly from imported products, fluctuating raw material costs, and potential supply chain disruptions. Regulatory compliance and skilled labor shortages pose additional challenges. Import duties and tariffs also influence pricing and competitiveness. These factors can affect the production costs by approximately xx% and reduce the profit margins by xx%.

Emerging Opportunities in Saudi Arabia Kitchen Design Industry

The Saudi Arabian kitchen design market presents several emerging opportunities. The growing trend towards minimalist and sustainable designs offers significant potential, along with the increasing demand for smart kitchens and customized solutions. Untapped markets include smaller cities and rural areas, where awareness of modern kitchen designs is growing. Moreover, the integration of augmented reality and virtual reality technologies in the design process can enhance the customer experience and drive sales.

Growth Accelerators in the Saudi Arabia Kitchen Design Industry

Long-term growth in the Saudi Arabian kitchen design industry will be fueled by continuous technological innovation, particularly in smart kitchen technologies and sustainable materials. Strategic partnerships between manufacturers, designers, and retailers can enhance product development and distribution. Furthermore, expansion into untapped markets and a greater focus on customization and personalized design services will be crucial for sustaining market growth.

Key Players Shaping the Saudi Arabia Kitchen Design Industry Market

- Snaidero

- KAFCO Kitchens

- Saudi Kitchen Line Company

- Al Joaib Group's

- Oakcraft Kitchen cabinets

- Al Farsi Aluminum Kitchens

- Ikea

- AlKhaleejion Kitchens

- Pedini

- Kitchen Net

Notable Milestones in Saudi Arabia Kitchen Design Industry Sector

- May 2023: Valcucine launches Riciclantica kitchen furniture, highlighting sustainable and lightweight design. This launch signals a growing market interest in environmentally conscious kitchen solutions.

- April 2023: IKEA launches its ÖMSESIDIG collection, focusing on home entertaining. This indicates a shift in consumer preferences towards functional and social kitchens.

In-Depth Saudi Arabia Kitchen Design Industry Market Outlook

The Saudi Arabian kitchen design industry is poised for substantial growth in the coming years, driven by strong economic growth, rising consumer spending, and a supportive regulatory environment. Strategic investments in technology, sustainable manufacturing practices, and customer-centric design approaches will be crucial for capturing a larger share of the market. The focus on smart kitchens, sustainable materials, and personalized designs will shape the future of the industry, opening up exciting opportunities for innovation and expansion.

Saudi Arabia Kitchen Design Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Saudi Arabia Kitchen Design Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Kitchen Design Industry Regional Market Share

Geographic Coverage of Saudi Arabia Kitchen Design Industry

Saudi Arabia Kitchen Design Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Durable & functional Products; Boom in Real-Estate

- 3.3. Market Restrains

- 3.3.1. Continuous Change in Prefrences of Consumers

- 3.4. Market Trends

- 3.4.1. Rising Housing Construction Helping to boost the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Kitchen Design Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Snaidero

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KAFCO Kitchens

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saudi Kitchen Line Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al Joaib Group's

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oakcraft Kitchen cabinets

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al Farsi Aluminum Kitchens

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ikea**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AlKhaleejion Kitchens

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pedini

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kitchen Net

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Snaidero

List of Figures

- Figure 1: Saudi Arabia Kitchen Design Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Kitchen Design Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Kitchen Design Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Saudi Arabia Kitchen Design Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Saudi Arabia Kitchen Design Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Saudi Arabia Kitchen Design Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Saudi Arabia Kitchen Design Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Saudi Arabia Kitchen Design Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Kitchen Design Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Saudi Arabia Kitchen Design Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Saudi Arabia Kitchen Design Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Saudi Arabia Kitchen Design Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Saudi Arabia Kitchen Design Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Saudi Arabia Kitchen Design Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Kitchen Design Industry?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the Saudi Arabia Kitchen Design Industry?

Key companies in the market include Snaidero, KAFCO Kitchens, Saudi Kitchen Line Company, Al Joaib Group's, Oakcraft Kitchen cabinets, Al Farsi Aluminum Kitchens, Ikea**List Not Exhaustive, AlKhaleejion Kitchens, Pedini, Kitchen Net.

3. What are the main segments of the Saudi Arabia Kitchen Design Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.06 billion as of 2022.

5. What are some drivers contributing to market growth?

Durable & functional Products; Boom in Real-Estate.

6. What are the notable trends driving market growth?

Rising Housing Construction Helping to boost the Market.

7. Are there any restraints impacting market growth?

Continuous Change in Prefrences of Consumers.

8. Can you provide examples of recent developments in the market?

May 2023: Gabriele Centazzo developed Valcucine's Riciclantica kitchen furniture series, which is based on the notion of dematerialization, which tries to decrease the quantity of material used while achieving flight and lightness. The series includes an aluminum frame and a 2mm-thick door that saves up to 85% of the material used in standard doors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Kitchen Design Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Kitchen Design Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Kitchen Design Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Kitchen Design Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence