Key Insights

The global tower crane rental market is experiencing robust growth, driven by the burgeoning construction sector, particularly in developing economies across Asia-Pacific and the Middle East. A Compound Annual Growth Rate (CAGR) of 6.20% from 2019 to 2024 indicates a consistently expanding market, projected to continue its upward trajectory through 2033. Key drivers include increasing urbanization, infrastructure development projects (including high-rise buildings and large-scale industrial complexes), and the rising preference for rental services over outright ownership due to cost-effectiveness and flexibility. Market segmentation reveals a strong demand across various crane types, including hammerhead, luffing, and self-erecting cranes, catering to diverse project needs. Capacity segments, such as 5T, 10T, 16T, 20T, and 25T, reflect the versatility of the market, accommodating both small-scale and large-scale construction projects. While factors like economic downturns and material price fluctuations may pose temporary restraints, the overall outlook remains positive, fueled by sustained investment in infrastructure globally. Leading players like Manitowoc, Liebherr, and Sany are leveraging technological advancements and strategic partnerships to enhance their market position, contributing to further growth and innovation within the sector. The market’s regional distribution shows significant opportunities in rapidly developing regions, with Asia-Pacific expected to continue leading in terms of market share due to significant infrastructure investment and rapid urbanization.

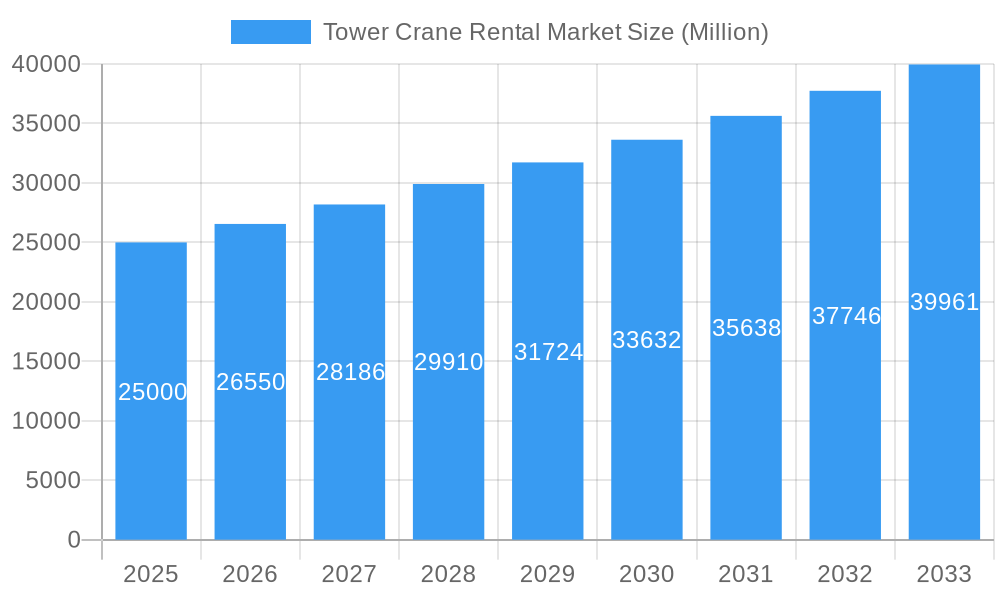

Tower Crane Rental Market Market Size (In Billion)

The competitive landscape features a mix of global giants and regional players. Established companies like Liebherr International AG and The Manitowoc Company benefit from brand recognition and extensive service networks. However, local and regional companies are also thriving, particularly in emerging markets, due to their localized expertise and competitive pricing. Future growth will be influenced by factors such as technological innovations (like automation and remote operation of cranes), evolving safety regulations, and the increasing adoption of sustainable construction practices. Companies are focusing on improving fleet modernization, adopting digital technologies for better asset management, and offering value-added services like maintenance contracts and operator training to gain a competitive edge and capture greater market share. The continued growth of the construction industry, coupled with a favorable regulatory environment in many regions, positions the tower crane rental market for sustained expansion in the coming years.

Tower Crane Rental Market Company Market Share

Tower Crane Rental Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Tower Crane Rental Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is essential for industry professionals, investors, and anyone seeking a deep understanding of this dynamic market. The parent market is the Construction Equipment Rental Market, and the child markets include various crane types and lifting capacities. This report is delivered in Million units.

Tower Crane Rental Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the Tower Crane Rental Market. The market exhibits a moderately concentrated structure, with key players such as Liebherr, Manitowoc, and Zoomlion holding significant market share (xx%). Technological innovation, particularly in areas like remote monitoring and automation, is a primary driver. Stringent safety regulations and environmental concerns also shape market dynamics. The report quantifies market concentration, M&A activity (xx deals in the past 5 years), and analyzes the impact of substitute technologies.

- Market Concentration: xx% held by top 5 players

- Technological Innovation: Focus on automation, remote monitoring, and improved safety features.

- Regulatory Frameworks: Emphasis on safety standards and environmental compliance.

- Competitive Product Substitutes: Analysis of alternatives and their market impact.

- End-User Demographics: Breakdown by construction type (residential, commercial, infrastructure).

- M&A Trends: Analysis of recent mergers and acquisitions and their impact on market share.

Tower Crane Rental Market Growth Trends & Insights

The Tower Crane Rental Market has witnessed significant growth (xx% CAGR) during the historical period (2019-2024). This growth is attributed to the expanding construction sector globally, particularly in developing economies. Increased infrastructure development projects and rising urbanization are key drivers. The report analyzes adoption rates across various segments and regions, considering technological disruptions and changing consumer preferences. The forecast period (2025-2033) projects continued growth, driven by factors such as sustainable construction practices and the increasing demand for specialized tower cranes. Specific metrics, including CAGR and market penetration rates for key segments, are provided.

Dominant Regions, Countries, or Segments in Tower Crane Rental Market

The Asia-Pacific region is currently the dominant market for tower crane rentals (xx% market share), driven by robust infrastructure development and construction activity in countries like China and India. Within the crane type segment, Hammerhead cranes hold the largest market share (xx%), owing to their versatility and high lifting capacity. In terms of lifting capacity, the 10T-20T segment shows the highest demand (xx%), reflecting the needs of various construction projects.

- Key Drivers (Asia-Pacific): Government investment in infrastructure, rapid urbanization, and industrial growth.

- Key Drivers (Hammerhead Cranes): Versatility, high lifting capacity, and suitability for diverse projects.

- Key Drivers (10T-20T segment): Wide applicability across a range of construction projects.

- Dominance Factors: Market share analysis, growth potential, and regional economic factors.

Tower Crane Rental Market Product Landscape

The tower crane rental market offers a diverse range of cranes, including Hammerhead, Luffing, and Self-Erecting cranes, each with specific applications and performance metrics. Recent innovations focus on enhancing safety features, improving lifting capacity, and integrating advanced technologies like remote monitoring systems (e.g., Manitowoc's CONNECT). These advancements aim to improve operational efficiency and reduce downtime. Unique selling propositions include improved fuel efficiency and reduced environmental impact.

Key Drivers, Barriers & Challenges in Tower Crane Rental Market

Key Drivers: Rising construction activity globally, increasing demand for infrastructure projects, advancements in crane technology, and supportive government policies. For instance, government initiatives promoting sustainable urban development directly boost demand.

Key Challenges: Supply chain disruptions impacting component availability, fluctuating raw material prices, stringent safety regulations, and intense competition among rental providers. These factors can lead to increased operational costs and potentially limit market expansion.

Emerging Opportunities in Tower Crane Rental Market

Untapped markets in developing economies, particularly in Africa and South America, offer significant growth potential. The rising adoption of modular construction techniques and the growing demand for specialized cranes for renewable energy projects create new opportunities. The increasing focus on sustainable construction practices opens avenues for eco-friendly crane solutions.

Growth Accelerators in the Tower Crane Rental Market Industry

Technological breakthroughs, strategic partnerships between rental companies and crane manufacturers, and expansion into new geographic markets will accelerate long-term growth. The development of advanced monitoring systems and automation technologies will further enhance efficiency and safety, driving market expansion.

Key Players Shaping the Tower Crane Rental Market Market

- NFT Group

- Maxim Crane Works

- Tat Hong Equipment Service

- The Manitowoc Company

- Morrow Equipment

- Liebherr International AG

- Action Construction Equipment Ltd

- SANY Group

- Zoomlion Heavy Industry Science and Technology Co Ltd

- Terex Corporation

Notable Milestones in Tower Crane Rental Market Sector

- October 2021: Zoomlion introduced the W12000-450, the world's largest top-slewing tower crane, significantly impacting the heavy-lifting segment.

- February 2022: Liebherr launched the 470 EC-B Flat-Top crane, expanding its range of high-capacity cranes.

- June 2022: Manitowoc's launch of the CONNECT app enhanced remote monitoring capabilities, improving operational efficiency.

- June 2022: XCMG's introduction of the XGT15000-600S super-scale tower crane addressed the demand for large-scale modular bridge construction.

- July 2022: Liebherr introduced the 300 EC-B 12 Fibre and 270 EC-B 12 cranes, improving the EC-B series' lifespan and height capabilities.

In-Depth Tower Crane Rental Market Market Outlook

The future of the Tower Crane Rental Market looks promising, with continued growth driven by sustained infrastructure development globally and technological advancements that enhance safety and efficiency. Strategic partnerships, expansions into new markets, and the adoption of sustainable construction practices will further fuel market expansion. The focus on automation and digitalization will create new opportunities for innovation and market leadership.

Tower Crane Rental Market Segmentation

-

1. Crane type

- 1.1. Hammerhead Cranes

- 1.2. Luffing Cranes

- 1.3. Self-erecting Cranes

-

2. Lifting Capacity

- 2.1. Up to 5 Ton

- 2.2. 5 to 10 Ton

- 2.3. 11 to 16 Ton

- 2.4. 17 to 25 Ton

- 2.5. Above 25 Ton

-

3. End User

- 3.1. Infrastructure

- 3.2. Residential Buildings

- 3.3. Commercial Buildings

- 3.4. Mining and Excavation

- 3.5. Other End Users (Marine, Offshore, Etc.)

Tower Crane Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Tower Crane Rental Market Regional Market Share

Geographic Coverage of Tower Crane Rental Market

Tower Crane Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Superiority of LiDAR; Increasing Vehicle Safety Regulations and Growing Adoption of Adas Technology By OEM's

- 3.3. Market Restrains

- 3.3.1. Lack of Electric Charging Infrastructure May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The 5T and 10T Lifting Capacity Segments Lead the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tower Crane Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Crane type

- 5.1.1. Hammerhead Cranes

- 5.1.2. Luffing Cranes

- 5.1.3. Self-erecting Cranes

- 5.2. Market Analysis, Insights and Forecast - by Lifting Capacity

- 5.2.1. Up to 5 Ton

- 5.2.2. 5 to 10 Ton

- 5.2.3. 11 to 16 Ton

- 5.2.4. 17 to 25 Ton

- 5.2.5. Above 25 Ton

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Infrastructure

- 5.3.2. Residential Buildings

- 5.3.3. Commercial Buildings

- 5.3.4. Mining and Excavation

- 5.3.5. Other End Users (Marine, Offshore, Etc.)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Crane type

- 6. North America Tower Crane Rental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Crane type

- 6.1.1. Hammerhead Cranes

- 6.1.2. Luffing Cranes

- 6.1.3. Self-erecting Cranes

- 6.2. Market Analysis, Insights and Forecast - by Lifting Capacity

- 6.2.1. Up to 5 Ton

- 6.2.2. 5 to 10 Ton

- 6.2.3. 11 to 16 Ton

- 6.2.4. 17 to 25 Ton

- 6.2.5. Above 25 Ton

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Infrastructure

- 6.3.2. Residential Buildings

- 6.3.3. Commercial Buildings

- 6.3.4. Mining and Excavation

- 6.3.5. Other End Users (Marine, Offshore, Etc.)

- 6.1. Market Analysis, Insights and Forecast - by Crane type

- 7. Europe Tower Crane Rental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Crane type

- 7.1.1. Hammerhead Cranes

- 7.1.2. Luffing Cranes

- 7.1.3. Self-erecting Cranes

- 7.2. Market Analysis, Insights and Forecast - by Lifting Capacity

- 7.2.1. Up to 5 Ton

- 7.2.2. 5 to 10 Ton

- 7.2.3. 11 to 16 Ton

- 7.2.4. 17 to 25 Ton

- 7.2.5. Above 25 Ton

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Infrastructure

- 7.3.2. Residential Buildings

- 7.3.3. Commercial Buildings

- 7.3.4. Mining and Excavation

- 7.3.5. Other End Users (Marine, Offshore, Etc.)

- 7.1. Market Analysis, Insights and Forecast - by Crane type

- 8. Asia Pacific Tower Crane Rental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Crane type

- 8.1.1. Hammerhead Cranes

- 8.1.2. Luffing Cranes

- 8.1.3. Self-erecting Cranes

- 8.2. Market Analysis, Insights and Forecast - by Lifting Capacity

- 8.2.1. Up to 5 Ton

- 8.2.2. 5 to 10 Ton

- 8.2.3. 11 to 16 Ton

- 8.2.4. 17 to 25 Ton

- 8.2.5. Above 25 Ton

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Infrastructure

- 8.3.2. Residential Buildings

- 8.3.3. Commercial Buildings

- 8.3.4. Mining and Excavation

- 8.3.5. Other End Users (Marine, Offshore, Etc.)

- 8.1. Market Analysis, Insights and Forecast - by Crane type

- 9. Rest of the World Tower Crane Rental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Crane type

- 9.1.1. Hammerhead Cranes

- 9.1.2. Luffing Cranes

- 9.1.3. Self-erecting Cranes

- 9.2. Market Analysis, Insights and Forecast - by Lifting Capacity

- 9.2.1. Up to 5 Ton

- 9.2.2. 5 to 10 Ton

- 9.2.3. 11 to 16 Ton

- 9.2.4. 17 to 25 Ton

- 9.2.5. Above 25 Ton

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Infrastructure

- 9.3.2. Residential Buildings

- 9.3.3. Commercial Buildings

- 9.3.4. Mining and Excavation

- 9.3.5. Other End Users (Marine, Offshore, Etc.)

- 9.1. Market Analysis, Insights and Forecast - by Crane type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 NFT Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Maxim Crane Works

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tat Hong Equipment Service

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Manitowoc Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Morrow Equipmen

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Liebherr International AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Action Construction Equipment Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SANY Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Zoomlion Heavy Industry Science and Technology Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Terex Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 NFT Group

List of Figures

- Figure 1: Global Tower Crane Rental Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Tower Crane Rental Market Revenue (undefined), by Crane type 2025 & 2033

- Figure 3: North America Tower Crane Rental Market Revenue Share (%), by Crane type 2025 & 2033

- Figure 4: North America Tower Crane Rental Market Revenue (undefined), by Lifting Capacity 2025 & 2033

- Figure 5: North America Tower Crane Rental Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 6: North America Tower Crane Rental Market Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America Tower Crane Rental Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Tower Crane Rental Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Tower Crane Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Tower Crane Rental Market Revenue (undefined), by Crane type 2025 & 2033

- Figure 11: Europe Tower Crane Rental Market Revenue Share (%), by Crane type 2025 & 2033

- Figure 12: Europe Tower Crane Rental Market Revenue (undefined), by Lifting Capacity 2025 & 2033

- Figure 13: Europe Tower Crane Rental Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 14: Europe Tower Crane Rental Market Revenue (undefined), by End User 2025 & 2033

- Figure 15: Europe Tower Crane Rental Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Tower Crane Rental Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Tower Crane Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Tower Crane Rental Market Revenue (undefined), by Crane type 2025 & 2033

- Figure 19: Asia Pacific Tower Crane Rental Market Revenue Share (%), by Crane type 2025 & 2033

- Figure 20: Asia Pacific Tower Crane Rental Market Revenue (undefined), by Lifting Capacity 2025 & 2033

- Figure 21: Asia Pacific Tower Crane Rental Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 22: Asia Pacific Tower Crane Rental Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Asia Pacific Tower Crane Rental Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Tower Crane Rental Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Tower Crane Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Tower Crane Rental Market Revenue (undefined), by Crane type 2025 & 2033

- Figure 27: Rest of the World Tower Crane Rental Market Revenue Share (%), by Crane type 2025 & 2033

- Figure 28: Rest of the World Tower Crane Rental Market Revenue (undefined), by Lifting Capacity 2025 & 2033

- Figure 29: Rest of the World Tower Crane Rental Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 30: Rest of the World Tower Crane Rental Market Revenue (undefined), by End User 2025 & 2033

- Figure 31: Rest of the World Tower Crane Rental Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Rest of the World Tower Crane Rental Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Rest of the World Tower Crane Rental Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tower Crane Rental Market Revenue undefined Forecast, by Crane type 2020 & 2033

- Table 2: Global Tower Crane Rental Market Revenue undefined Forecast, by Lifting Capacity 2020 & 2033

- Table 3: Global Tower Crane Rental Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Tower Crane Rental Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Tower Crane Rental Market Revenue undefined Forecast, by Crane type 2020 & 2033

- Table 6: Global Tower Crane Rental Market Revenue undefined Forecast, by Lifting Capacity 2020 & 2033

- Table 7: Global Tower Crane Rental Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global Tower Crane Rental Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Tower Crane Rental Market Revenue undefined Forecast, by Crane type 2020 & 2033

- Table 13: Global Tower Crane Rental Market Revenue undefined Forecast, by Lifting Capacity 2020 & 2033

- Table 14: Global Tower Crane Rental Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Tower Crane Rental Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Russia Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Tower Crane Rental Market Revenue undefined Forecast, by Crane type 2020 & 2033

- Table 23: Global Tower Crane Rental Market Revenue undefined Forecast, by Lifting Capacity 2020 & 2033

- Table 24: Global Tower Crane Rental Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global Tower Crane Rental Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: India Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: China Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Japan Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: South Korea Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Global Tower Crane Rental Market Revenue undefined Forecast, by Crane type 2020 & 2033

- Table 32: Global Tower Crane Rental Market Revenue undefined Forecast, by Lifting Capacity 2020 & 2033

- Table 33: Global Tower Crane Rental Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 34: Global Tower Crane Rental Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: South America Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Middle East and Africa Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tower Crane Rental Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Tower Crane Rental Market?

Key companies in the market include NFT Group, Maxim Crane Works, Tat Hong Equipment Service, The Manitowoc Company, Morrow Equipmen, Liebherr International AG, Action Construction Equipment Ltd, SANY Group, Zoomlion Heavy Industry Science and Technology Co Ltd, Terex Corporation.

3. What are the main segments of the Tower Crane Rental Market?

The market segments include Crane type, Lifting Capacity, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Technological Superiority of LiDAR; Increasing Vehicle Safety Regulations and Growing Adoption of Adas Technology By OEM's.

6. What are the notable trends driving market growth?

The 5T and 10T Lifting Capacity Segments Lead the Market.

7. Are there any restraints impacting market growth?

Lack of Electric Charging Infrastructure May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

In July 2022, Liebherr International AG introduced 300 EC-B 12 Fibre and 270 EC-B 12 to its EC-B series of flat top tower cranes. Both tower cranes have a longer service life and give a maximum freestanding height of 91.7 meters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tower Crane Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tower Crane Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tower Crane Rental Market?

To stay informed about further developments, trends, and reports in the Tower Crane Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence