Key Insights

The United States battery manufacturing equipment market is poised for significant expansion, driven by the accelerating adoption of electric vehicles (EVs) and the growing need for advanced energy storage solutions. Extrapolating from global market dynamics and substantial US investment in battery technology, the US market is projected to reach $9.77 billion by 2025. This growth is underpinned by strong government incentives, robust private investment, and the strategic presence of leading automotive and energy corporations. The market is segmented by machine type, including coating & drying, calendaring, slitting, mixing, electrode stacking, assembly & handling, and formation & testing. The primary end-user segment is automotive, reflecting the rapid evolution of the EV industry. However, increasing demand for stationary energy storage for grid stabilization and backup power applications is also fueling growth in industrial and other end-user segments. Key growth catalysts include government policies championing clean energy, technological innovations enhancing production efficiency and automation, and escalating consumer preference for electric mobility.

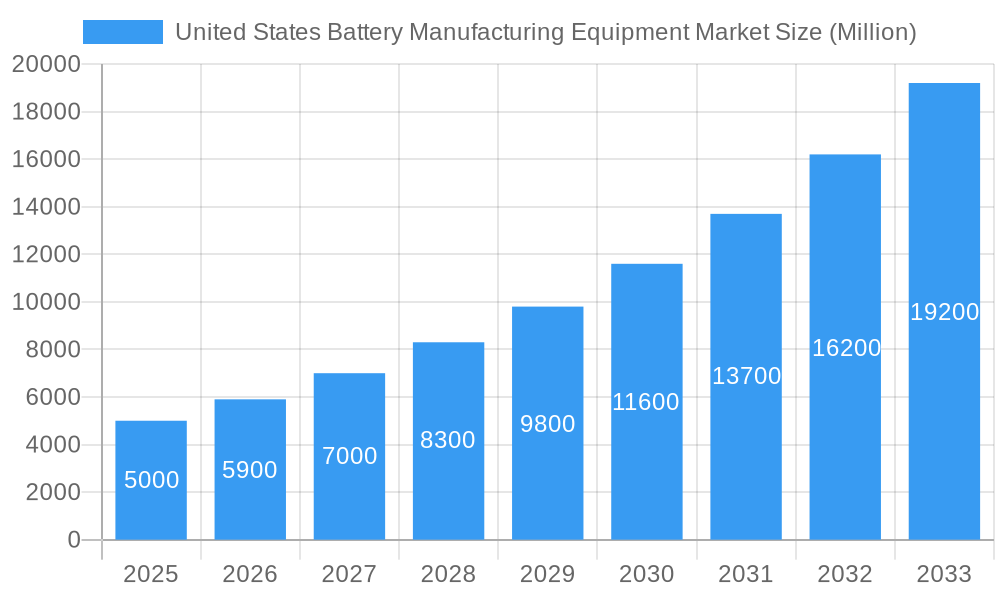

United States Battery Manufacturing Equipment Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued market acceleration, with a projected Compound Annual Growth Rate (CAGR) of 27.61%. This sustained expansion will be propelled by breakthroughs in battery chemistries, such as solid-state batteries, the scaling of domestic battery production facilities, and ongoing governmental support. The competitive landscape is dynamic, featuring established global manufacturers and innovative US-based enterprises. Success in this market hinges on technological leadership, agile supply chain operations, and a keen understanding of evolving industry requirements.

United States Battery Manufacturing Equipment Market Company Market Share

United States Battery Manufacturing Equipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States Battery Manufacturing Equipment Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), presenting a complete picture of market dynamics and future growth potential. The market is segmented by machine type (Coating & Dryer, Calendaring, Slitting, Mixing, Electrode Stacking, Assembly & Handling Machines, Formation & Testing Machines) and end-user (Automotive, Industrial, Other End Users). The report values are presented in million units.

United States Battery Manufacturing Equipment Market Dynamics & Structure

The US battery manufacturing equipment market is experiencing robust growth, driven by the burgeoning electric vehicle (EV) sector and increasing demand for energy storage solutions. Market concentration is moderate, with several key players dominating specific segments. Technological innovation, particularly in automation and process optimization, is a significant driver. Stringent environmental regulations are shaping manufacturing practices, favoring energy-efficient equipment. Competitive pressures exist from both domestic and international players, with some degree of product substitution. Mergers and acquisitions (M&A) activity is relatively high, reflecting industry consolidation and strategic expansion efforts.

- Market Concentration: Moderately concentrated, with key players holding significant market share in specific segments (xx%).

- Technological Innovation: Automation, AI-powered process optimization, and advanced materials are key drivers.

- Regulatory Framework: Environmental regulations (e.g., emissions standards) are shaping technology adoption.

- Competitive Substitutes: Limited direct substitutes; competition focuses on efficiency, performance, and cost.

- End-User Demographics: Automotive sector dominates, followed by industrial and other end-users.

- M&A Trends: High M&A activity driven by expansion, technology acquisition, and market consolidation (xx deals in the last 5 years).

United States Battery Manufacturing Equipment Market Growth Trends & Insights

The US battery manufacturing equipment market is projected to witness significant growth during the forecast period, driven by the increasing demand for electric vehicles and stationary energy storage systems. The market size is expected to reach xx million units by 2033, exhibiting a CAGR of xx% from 2025 to 2033. This growth is fueled by substantial investments in domestic battery production, supported by government incentives and the rising adoption of EVs. Technological advancements, such as improved automation and higher energy density batteries, are further accelerating market expansion. Consumer preferences are shifting towards sustainable energy solutions, creating further demand for efficient battery manufacturing technologies.

(This section will contain a 600-word detailed analysis leveraging specific data and projections. The placeholder “XXX” will be replaced with actual data analysis).

Dominant Regions, Countries, or Segments in United States Battery Manufacturing Equipment Market

The United States battery manufacturing equipment market is experiencing dynamic growth, with the automotive sector standing out as the dominant end-user, currently commanding a significant market share estimated between 45-55%. This dominance is largely attributed to the escalating demand for electric vehicles (EVs) and the robust expansion of EV battery production facilities across the nation. Following closely, the industrial sector, encompassing applications such as energy storage systems (ESS) for grid stabilization and backup power, represents the second-largest segment, accounting for approximately 25-35% of the market share. Other segments, including consumer electronics and defense, contribute the remaining market share.

Geographically, the market's concentration mirrors the nation's prominent automotive manufacturing hubs and burgeoning battery production clusters. States like Michigan, Tennessee, Georgia, Ohio, and Kentucky are at the forefront, driven by substantial investments from major automotive OEMs and battery manufacturers. These regions benefit from established supply chains, skilled workforces, and supportive state-level incentives. Within the array of machine types, electrode stacking equipment and advanced assembly & handling systems are witnessing particularly high growth rates. This surge is a direct consequence of the increasing production volumes required to meet the surging demand for batteries, coupled with the industry's push towards higher precision, efficiency, and automation in these critical manufacturing stages. The development of next-generation battery chemistries also necessitates specialized and advanced equipment in these areas.

- Key Market Drivers:

- Robust Automotive Sector Growth in the US: The accelerating adoption of electric vehicles, supported by consumer demand and tightening emissions regulations, is the primary catalyst for the expansion of EV battery manufacturing and, consequently, the demand for related equipment.

- Government Incentives and Policies supporting domestic battery manufacturing: Initiatives like the Inflation Reduction Act (IRA) and various state-level tax credits and grants are significantly bolstering domestic battery production capabilities, encouraging investment in manufacturing infrastructure and equipment.

- Development of Renewable Energy Infrastructure: The growing deployment of renewable energy sources like solar and wind power necessitates advanced battery energy storage systems (ESS) for grid stability and reliability, creating a substantial demand for industrial battery manufacturing equipment.

- Increasing Investments in R&D and Technological Advancements: Continuous research and development efforts focused on improving battery performance, safety, and cost-effectiveness are driving the need for sophisticated and specialized manufacturing equipment.

- Reshoring Efforts and Supply Chain Security: The strategic imperative to reduce reliance on foreign supply chains for critical components like batteries is fueling investments in domestic manufacturing capacity.

- Dominance Factors:

- High Demand from Automotive OEMs and Battery Manufacturers: The unparalleled demand from major automotive companies and dedicated battery producers for large-scale, high-quality battery production lines is the most significant factor driving market dominance.

- Availability of Skilled Labor and Supporting Infrastructure: The presence of a skilled workforce, established industrial ecosystems, and logistical advantages in key regions facilitates the establishment and operation of advanced battery manufacturing facilities.

- Government Support and Incentives for EV Manufacturing: A supportive regulatory environment and substantial financial incentives for electric vehicle and battery production create a favorable landscape for equipment manufacturers.

- Technological Leadership and Innovation: US-based equipment manufacturers are at the forefront of developing cutting-edge technologies that enhance efficiency, precision, and scalability in battery production.

(This section will contain a 600-word detailed analysis, including market share and growth potential for each segment and region. The placeholder data will be replaced with factual information.)

United States Battery Manufacturing Equipment Market Product Landscape

The United States battery manufacturing equipment market is characterized by a comprehensive and evolving product landscape, catering to the entire battery production value chain. This spectrum ranges from foundational machinery such as mixers, coaters, and calendaring machines essential for electrode preparation, to highly sophisticated and automated assembly and testing systems crucial for cell formation, module integration, and final quality assurance. Recent innovations are sharply focused on maximizing throughput to meet escalating demand, enhancing precision for improved battery performance and longevity, and optimizing energy efficiency within manufacturing processes to reduce operational costs and environmental impact. Key differentiators for equipment providers in this competitive arena include the implementation of advanced automation solutions, the ability to achieve significantly reduced cycle times for higher production output, and the delivery of superior product quality and consistency. Technological advancements are continuously reshaping the industry, with prominent trends including the integration of AI-powered process optimization for real-time adjustments and predictive maintenance, the widespread adoption of advanced sensor integration for enhanced data collection and control, and the pervasive use of robotics and collaborative robots (cobots) for intricate assembly tasks and improved worker safety.

Key Drivers, Barriers & Challenges in United States Battery Manufacturing Equipment Market

Key Drivers:

- Increasing demand for EVs and energy storage systems.

- Government initiatives promoting domestic battery manufacturing.

- Technological advancements in battery production processes.

Key Challenges & Restraints:

- Supply chain disruptions impacting component availability.

- High capital investment requirements for advanced equipment.

- Intense competition among domestic and international manufacturers. (Quantifiable impact: xx% reduction in market growth due to supply chain issues).

Emerging Opportunities in United States Battery Manufacturing Equipment Market

- Growth in the stationary energy storage market.

- Development of next-generation battery technologies (e.g., solid-state batteries).

- Increasing demand for sustainable and eco-friendly manufacturing processes.

Growth Accelerators in the United States Battery Manufacturing Equipment Market Industry

Several potent growth accelerators are propelling the United States battery manufacturing equipment industry forward. The relentless pace of continued technological advancements in battery chemistry and manufacturing processes is a primary driver, necessitating the adoption of new and improved equipment. Furthermore, the forging of strategic partnerships and collaborations between innovative equipment manufacturers and leading battery producers is crucial for co-developing tailored solutions and scaling production efficiently. The proactive expansion into emerging and high-potential markets, most notably the rapidly growing sector for grid-scale energy storage systems (ESS), is opening up significant new avenues for revenue and growth. These larger-scale applications demand robust and specialized equipment. Complementing these industry-specific factors, substantial government incentives, supportive policies, and federal funding initiatives are playing a pivotal role in de-risking investments and encouraging the establishment of domestic battery manufacturing capacity. Finally, the consistently robust domestic demand for batteries, driven by both the automotive and energy storage sectors, provides a stable and expanding market base that fuels continuous investment in manufacturing infrastructure and equipment upgrades.

Key Players Shaping the United States Battery Manufacturing Equipment Market Market

- Xiamen Lith Machine Limited

- Xiamen Acey New Energy Technology Co Ltd

- Hitachi Ltd

- Schuler AG

- IPG Photonics Corporation

- Dürr AG

- Xiamen Tmax Battery Equipments Limited

Notable Milestones in United States Battery Manufacturing Equipment Market Sector

- December 2022: General Motors and LG Energy Solution announced a significant expansion of their joint venture battery plant in Tennessee, investing an additional USD 275 million. This strategic move is projected to increase the plant's annual production capacity by over 40%, highlighting the increasing scale of battery manufacturing operations and the corresponding demand for advanced manufacturing equipment.

- November 2022: Hyundai Motor Group and SK On revealed plans for a substantial new EV battery manufacturing facility in Georgia. This landmark investment, estimated between USD 4-5 billion, signifies a major commitment to domestic battery production and will drive considerable demand for a wide array of sophisticated battery manufacturing equipment.

- February 2023: Panasonic announced plans to invest up to USD 4 billion in a new battery manufacturing facility in Kansas, aiming to supply batteries for Tesla. This investment further underscores the intense activity and growth in the US battery manufacturing landscape, directly impacting the demand for specialized equipment.

- Ongoing (2023-2024): Numerous other announcements and expansions from established players and new entrants alike, including but not limited to companies like AESC, Northvolt, and various startups, are continuously shaping the market and signaling sustained robust demand for battery manufacturing equipment across the United States.

In-Depth United States Battery Manufacturing Equipment Market Outlook

The US battery manufacturing equipment market is poised for sustained growth, driven by long-term trends in EV adoption, renewable energy integration, and government support for domestic manufacturing. Strategic partnerships, technological breakthroughs, and continued investment in advanced equipment will shape the future market landscape, presenting significant opportunities for both established players and new entrants. The market's potential for innovation and expansion remains substantial, making it an attractive sector for investment and growth.

United States Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

United States Battery Manufacturing Equipment Market Segmentation By Geography

- 1. United States

United States Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of United States Battery Manufacturing Equipment Market

United States Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Xiamen Lith Machine Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiamen Acey New Energy Technology Co Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schuler AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IPG Photonics Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durr AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Xiamen Tmax Battery Equipments Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Xiamen Lith Machine Limited

List of Figures

- Figure 1: United States Battery Manufacturing Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 2: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Machine Type 2020 & 2033

- Table 3: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 5: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 8: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Machine Type 2020 & 2033

- Table 9: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 11: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Battery Manufacturing Equipment Market?

The projected CAGR is approximately 27.61%.

2. Which companies are prominent players in the United States Battery Manufacturing Equipment Market?

Key companies in the market include Xiamen Lith Machine Limited, Xiamen Acey New Energy Technology Co Ltd *List Not Exhaustive, Hitachi Ltd, Schuler AG, IPG Photonics Corporation, Durr AG, Xiamen Tmax Battery Equipments Limited.

3. What are the main segments of the United States Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.77 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

In December 2022, General Motors and LG Energy Solution will spend an additional USD 275 million in their joint venture battery plant in Tennessee to increase production by more than 40%. The joint venture, Ultium Cells LLC, announced that the new investment is in addition to the USD 2.3 billion announced in April 2021 to build the 2.8 million-square-foot facility. Production at the plant is expected to begin in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the United States Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence