Key Insights

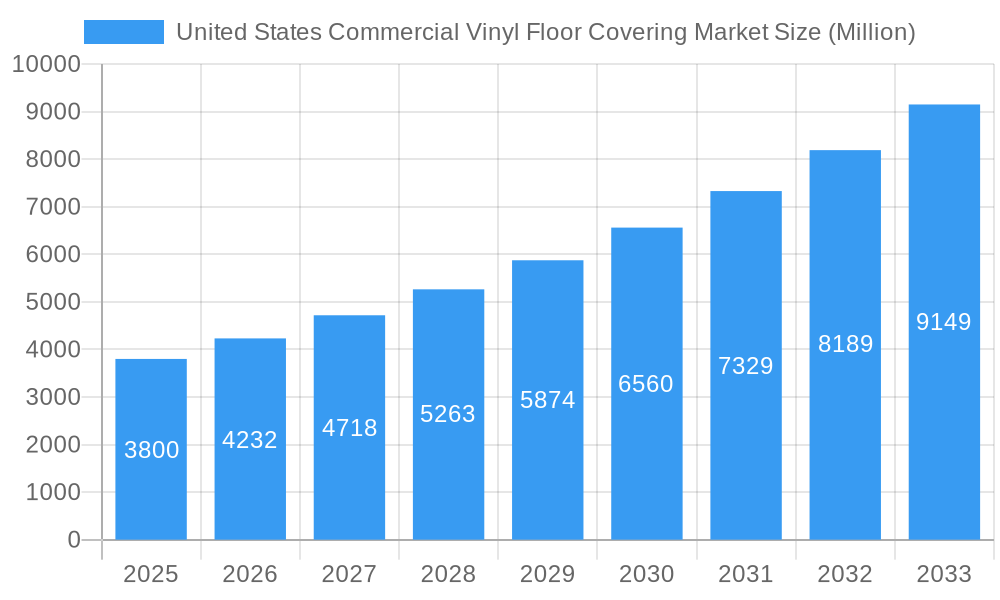

The United States commercial vinyl floor covering market is experiencing robust growth, projected to reach a substantial size by 2033. Driven by factors such as increasing construction activity in the commercial sector, the rising preference for durable and cost-effective flooring solutions, and a growing focus on hygiene and easy maintenance, the market shows a Compound Annual Growth Rate (CAGR) of 11.20%. This growth is further fueled by the introduction of innovative products featuring enhanced aesthetics, improved durability, and sustainable materials. Key players like Shaw Industries Group Inc., Mohawk Industries Inc., and Tarkett SA are constantly innovating to meet evolving market demands, offering diverse product portfolios catering to various commercial settings, including offices, healthcare facilities, and retail spaces. The market segmentation likely includes variations based on product type (e.g., sheet vinyl, tile, luxury vinyl plank/tile), end-use sector, and price point.

United States Commercial Vinyl Floor Covering Market Market Size (In Billion)

The market's expansion is not without challenges. Potential restraints include fluctuating raw material prices, potential supply chain disruptions, and increasing competition from alternative flooring materials such as ceramic tiles and hardwood. However, the ongoing trend towards sustainable and eco-friendly flooring options presents a significant opportunity for market players to develop and market environmentally conscious products, thus contributing to the market's overall growth. The forecast period of 2025-2033 promises continued expansion, largely due to the enduring popularity of vinyl flooring in commercial applications due to its cost-effectiveness, ease of installation, and superior resilience. Regional variations in growth might exist, reflecting differences in construction activity and economic conditions across the country.

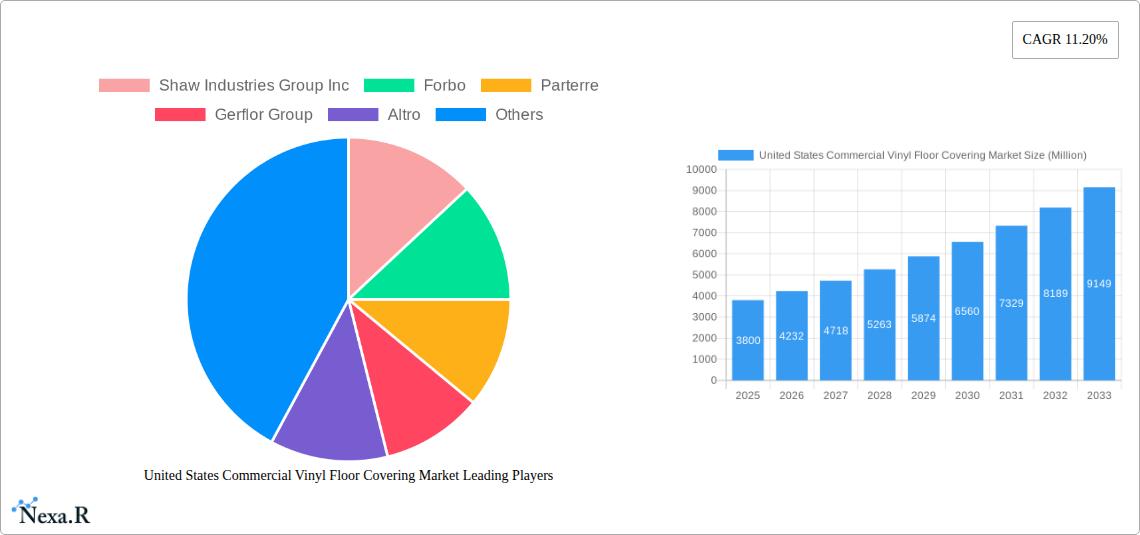

United States Commercial Vinyl Floor Covering Market Company Market Share

United States Commercial Vinyl Floor Covering Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Commercial Vinyl Floor Covering Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. This crucial analysis caters to industry professionals, investors, and stakeholders seeking insights into this dynamic sector. The report segments the market into various categories, providing granular data for informed decision-making. The parent market is the broader U.S. flooring market, while the child market is commercial vinyl flooring specifically. This detailed breakdown allows for a precise understanding of market size, share, and growth potential.

United States Commercial Vinyl Floor Covering Market Dynamics & Structure

The U.S. commercial vinyl floor covering market is characterized by moderate concentration, with several major players holding significant market share. Technological innovation, driven by demand for durable, aesthetically pleasing, and sustainable options, is a key driver. Regulatory frameworks concerning VOC emissions and material sourcing also significantly influence market dynamics. Commercial vinyl faces competition from other flooring materials like carpet, hardwood, and ceramic tiles. The end-user demographics are diverse, including offices, retail spaces, healthcare facilities, and educational institutions. Mergers and acquisitions (M&A) activity has been relatively steady, with larger players seeking to expand their product portfolios and market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on enhanced durability, water resistance, and design aesthetics. Innovation barriers include high R&D costs and the need for environmentally friendly manufacturing processes.

- Regulatory Landscape: Compliance with VOC emission standards and sustainable sourcing regulations are key considerations.

- Competitive Landscape: Intense competition from alternative flooring materials. Price competitiveness and product differentiation are crucial.

- M&A Activity: An average of xx M&A deals per year over the historical period (2019-2024).

United States Commercial Vinyl Floor Covering Market Growth Trends & Insights

The U.S. commercial vinyl floor covering market experienced a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. This growth is attributed to several factors, including increasing construction activity, renovation projects, and rising demand for cost-effective and low-maintenance flooring solutions. Technological advancements, such as the introduction of luxury vinyl plank (LVP) and luxury vinyl tile (LVT) with enhanced durability and design options, have significantly boosted market adoption. Consumer behavior shifts towards aesthetically appealing and sustainable options have also played a pivotal role. The forecast period (2025-2033) projects continued growth, driven by similar factors, with an anticipated CAGR of xx%. Market penetration is expected to increase significantly in under-penetrated segments like healthcare and education.

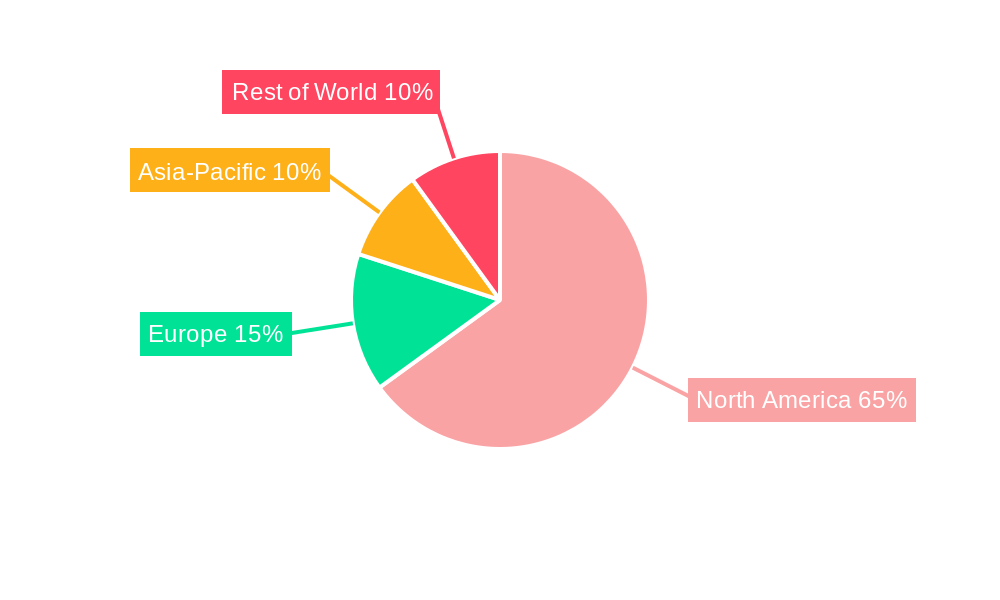

Dominant Regions, Countries, or Segments in United States Commercial Vinyl Floor Covering Market

The Northeast and Southeast regions of the U.S. currently dominate the commercial vinyl floor covering market, driven by high construction activity and a large concentration of commercial buildings. Factors contributing to this regional dominance include robust economic activity, favorable government policies supporting infrastructure development, and a strong presence of major flooring manufacturers. However, growth potential exists in other regions, particularly the Southwest and West Coast, as commercial construction expands. Within segments, LVP and LVT are the fastest-growing categories, accounting for xx% of market share in 2024 and expected to reach xx% by 2033.

- Key Drivers (Northeast & Southeast): High construction activity, favorable economic conditions, significant presence of major manufacturers, and established distribution networks.

- Growth Potential (Southwest & West Coast): Rapid urbanization, rising commercial construction projects, and increasing disposable income.

- Segment Dominance (LVP/LVT): Enhanced durability, aesthetic appeal, cost-effectiveness, and wide design options drive market share.

United States Commercial Vinyl Floor Covering Market Product Landscape

The commercial vinyl floor covering market offers a wide range of products, including sheet vinyl, VCT (vinyl composition tile), LVP, and LVT. Recent product innovations focus on enhanced durability, water resistance, and improved acoustic properties. Key performance metrics include abrasion resistance, indentation load deflection, and slip resistance. Unique selling propositions (USPs) often include realistic wood or stone designs, antimicrobial properties, and ease of installation. Technological advancements involve incorporating recycled materials and enhancing the manufacturing process for greater sustainability.

Key Drivers, Barriers & Challenges in United States Commercial Vinyl Floor Covering Market

Key Drivers:

- Increasing commercial construction activity and renovation projects.

- Growing preference for cost-effective and low-maintenance flooring options.

- Technological advancements leading to improved product performance and aesthetics.

- Favorable government policies supporting infrastructure development.

Key Challenges & Restraints:

- Fluctuations in raw material prices (e.g., PVC) impact product costs.

- Stringent environmental regulations necessitate investment in sustainable manufacturing practices.

- Intense competition from other flooring materials limits pricing power. This competition resulted in a price decrease of xx% over the past five years.

- Supply chain disruptions can impact production and availability.

Emerging Opportunities in United States Commercial Vinyl Floor Covering Market

- Growing demand for sustainable and eco-friendly vinyl flooring options presents significant opportunities.

- The healthcare sector offers considerable untapped potential for specialized antimicrobial vinyl flooring.

- Innovative designs and patterns, mimicking natural materials, are expanding market appeal.

- Customization options and modular flooring systems cater to diverse design preferences.

Growth Accelerators in the United States Commercial Vinyl Floor Covering Market Industry

Strategic partnerships between manufacturers and distributors are expanding market reach and streamlining distribution channels. Technological breakthroughs in material science and manufacturing processes are leading to more sustainable and high-performance products. The focus on improving product aesthetics, including realistic wood and stone designs, further boosts market growth. Expansion into new market segments, such as the education and healthcare sectors, represents a significant growth opportunity.

Key Players Shaping the United States Commercial Vinyl Floor Covering Market Market

- Shaw Industries Group Inc

- Forbo

- Parterre

- Gerflor Group

- Altro

- Karndean Designflooring

- Tarkett SA

- Mohawk Industries Inc

- Armstrong Flooring

- Mannington Commercial

- Flexco Floors

- Interface Inc

- Milliken

Notable Milestones in United States Commercial Vinyl Floor Covering Market Sector

- September 2023: AHF Products partners with Spartan Surfaces for exclusive distribution of Parterre luxury vinyl flooring.

- February 2024: MSI introduces two new luxury vinyl plank lines (Laurel and Laurel Reserve) to its Everlife collection.

- March 2024: AHF Products launches Unfazed Luxury Vinyl Flooring under the Parterre brand, manufactured in the US, eliminating acclimation requirements.

In-Depth United States Commercial Vinyl Floor Covering Market Market Outlook

The U.S. commercial vinyl floor covering market is poised for continued growth, driven by sustained construction activity, increasing demand for durable and aesthetically pleasing flooring solutions, and ongoing product innovation. Strategic partnerships, expansion into new segments, and a focus on sustainability will further propel market expansion. The market's future potential is substantial, particularly in regions with expanding commercial construction and a rising preference for high-performance, low-maintenance flooring options. Companies focusing on innovation and sustainable practices will be best positioned to capitalize on emerging opportunities.

United States Commercial Vinyl Floor Covering Market Segmentation

-

1. Product Type

- 1.1. Luxury Vinyl Tiles and Planks

- 1.2. Vinyl Sheets

- 1.3. Vinyl Composite Tiles

-

2. Application

-

2.1. Transport

- 2.1.1. Automotive Flooring

- 2.1.2. Aviation Flooring

- 2.1.3. Marine Flooring

- 2.1.4. Other Transport

- 2.2. Hospitality

- 2.3. Gym and Fitness

- 2.4. Hospitals

- 2.5. Retail

- 2.6. Corporate

- 2.7. Education

- 2.8. Other Commercial Applications

-

2.1. Transport

-

3. Distribution Channel

- 3.1. Directly From the Manufacturers

- 3.2. Dealers/Retailers

United States Commercial Vinyl Floor Covering Market Segmentation By Geography

- 1. United States

United States Commercial Vinyl Floor Covering Market Regional Market Share

Geographic Coverage of United States Commercial Vinyl Floor Covering Market

United States Commercial Vinyl Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Commercial Construction Projects; Increasing Demand from Fitness Facilities

- 3.3. Market Restrains

- 3.3.1. Growth in Commercial Construction Projects; Increasing Demand from Fitness Facilities

- 3.4. Market Trends

- 3.4.1. Resilient Flooring

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Commercial Vinyl Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Luxury Vinyl Tiles and Planks

- 5.1.2. Vinyl Sheets

- 5.1.3. Vinyl Composite Tiles

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Transport

- 5.2.1.1. Automotive Flooring

- 5.2.1.2. Aviation Flooring

- 5.2.1.3. Marine Flooring

- 5.2.1.4. Other Transport

- 5.2.2. Hospitality

- 5.2.3. Gym and Fitness

- 5.2.4. Hospitals

- 5.2.5. Retail

- 5.2.6. Corporate

- 5.2.7. Education

- 5.2.8. Other Commercial Applications

- 5.2.1. Transport

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Directly From the Manufacturers

- 5.3.2. Dealers/Retailers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shaw Industries Group Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Forbo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Parterre

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gerflor Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Altro

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Karndean Designflooring

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tarkett SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mohawk Industries Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Armstrong Flooring

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mannington Commercial

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Flexco Floors

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Interface Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Milliken

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Shaw Industries Group Inc

List of Figures

- Figure 1: United States Commercial Vinyl Floor Covering Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Commercial Vinyl Floor Covering Market Share (%) by Company 2025

List of Tables

- Table 1: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Commercial Vinyl Floor Covering Market?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the United States Commercial Vinyl Floor Covering Market?

Key companies in the market include Shaw Industries Group Inc, Forbo, Parterre, Gerflor Group, Altro, Karndean Designflooring, Tarkett SA, Mohawk Industries Inc, Armstrong Flooring, Mannington Commercial, Flexco Floors, Interface Inc, Milliken.

3. What are the main segments of the United States Commercial Vinyl Floor Covering Market?

The market segments include Product Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Commercial Construction Projects; Increasing Demand from Fitness Facilities.

6. What are the notable trends driving market growth?

Resilient Flooring.

7. Are there any restraints impacting market growth?

Growth in Commercial Construction Projects; Increasing Demand from Fitness Facilities.

8. Can you provide examples of recent developments in the market?

March 2024- AHF Products, a leading manufacturer known for its hard surface flooring tailored for commercial settings, introduced its newest offering under the Parterre brand: Unfazed Luxury Vinyl Flooring. Manufactured in Lancaster, Pennsylvania, this addition underscores AHF's dedication to quality, featuring a resilient, low-maintenance design. Notably, being crafted in the US, Unfazed Luxury Vinyl stands out by eliminating the acclimation requirement and streamlining the installation process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Commercial Vinyl Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Commercial Vinyl Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Commercial Vinyl Floor Covering Market?

To stay informed about further developments, trends, and reports in the United States Commercial Vinyl Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence