Key Insights

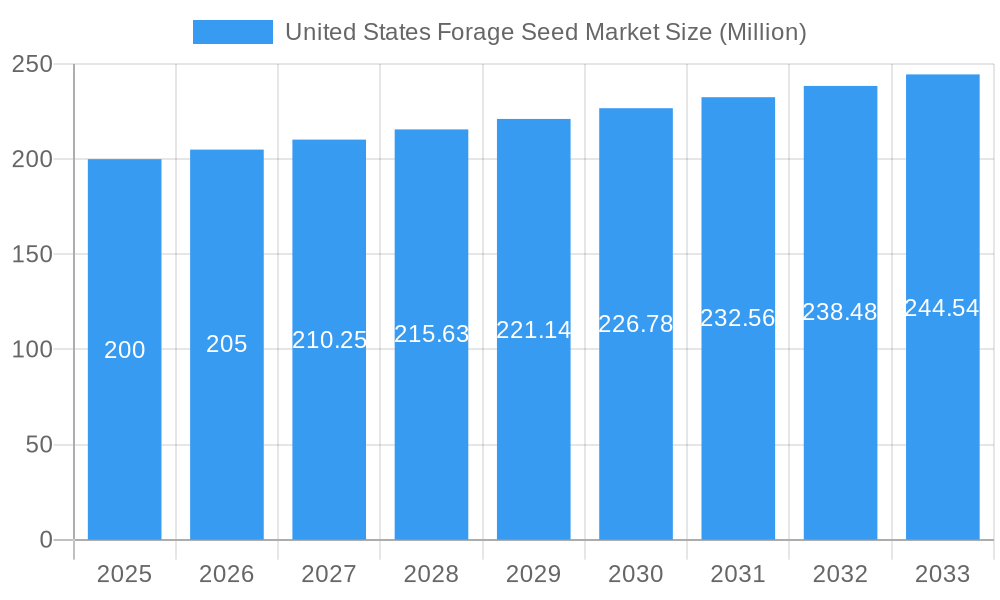

The United States forage seed market, a significant segment of the global forage seed industry, is projected to experience steady growth over the forecast period (2025-2033). While precise figures for the US market share within the global $724.99 million market are unavailable, a reasonable estimation, considering the US's significant agricultural sector and livestock production, places its 2025 market size at approximately $200 million. This estimation is derived from considering the US's substantial agricultural land and its position as a leading producer of livestock. Given the global CAGR of 2.66%, a conservative estimate for the US market CAGR would be around 2.5%, reflecting potential regional variations. Key drivers include increasing demand for high-quality forage to support the growing livestock industry, particularly in dairy and beef cattle production, as well as a rising focus on sustainable agricultural practices that enhance forage yield and quality. Trends indicate a shift toward improved seed varieties with enhanced disease resistance, drought tolerance, and improved nutritional profiles. Furthermore, the adoption of precision agriculture techniques and technological advancements in seed production contribute to market growth. However, factors like fluctuating weather patterns and variations in commodity prices could potentially restrain market expansion. The market segmentation reveals strong demand across ruminant, swine, and poultry animal types, with cereals and legumes being the primary crop types driving forage seed demand. Stored forage dominates the product type segment due to its convenience and longer shelf life.

United States Forage Seed Market Market Size (In Million)

The continued growth of the US livestock industry and the increasing focus on animal feed quality are likely to fuel demand for high-yield and nutrient-rich forage seeds. The market is characterized by a mix of established players and emerging companies, with competition centered on providing innovative seed varieties, superior customer service, and efficient distribution networks. The US market will likely witness further consolidation in the coming years, with larger companies acquiring smaller players to enhance their market reach and product portfolios. Technological advancements, including genomic selection and marker-assisted breeding, are anticipated to play a significant role in driving the development of improved forage seed varieties, thus propelling market growth during the forecast period. Government initiatives promoting sustainable agriculture and environmental conservation are also expected to play a supporting role in shaping the market's trajectory.

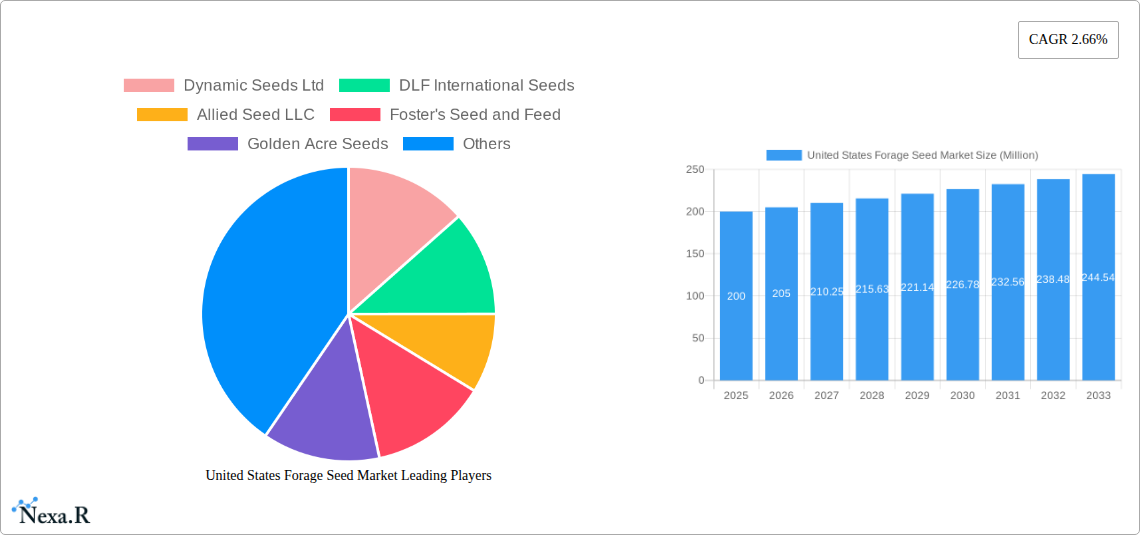

United States Forage Seed Market Company Market Share

United States Forage Seed Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States forage seed market, offering valuable insights for industry professionals, investors, and stakeholders. We delve into market dynamics, growth trends, competitive landscape, and future opportunities within this vital agricultural sector. The report covers the parent market of agricultural seeds and the child market of forage seeds, providing a granular understanding of this $XX million market (2025 Estimated Value).

Study Period: 2019-2033; Base Year: 2025; Estimated Year: 2025; Forecast Period: 2025-2033; Historical Period: 2019-2024

United States Forage Seed Market Dynamics & Structure

The U.S. forage seed market is characterized by moderate concentration, with key players holding significant market share. Technological innovation, driven by advancements in seed genetics and precision agriculture, plays a crucial role in enhancing yield and quality. Regulatory frameworks, including those related to seed certification and labeling, influence market operations. Competition from alternative feed sources, such as imported forages, also shapes market dynamics. The market is influenced by end-user demographics (primarily farmers and ranchers), with shifts in livestock production practices impacting demand. M&A activity within the sector has been relatively moderate in recent years, with approximately XX deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately XX% market share in 2024.

- Technological Innovation: Focus on improved drought tolerance, disease resistance, and nutritional value of forage seeds.

- Regulatory Framework: Compliance with seed certification standards and labeling regulations.

- Competitive Substitutes: Imported forages and alternative feed sources.

- End-User Demographics: Primarily driven by the needs of livestock farmers and ranchers.

- M&A Trends: Moderate level of activity, with an average of XX deals per year between 2019 and 2024.

United States Forage Seed Market Growth Trends & Insights

The U.S. forage seed market exhibits steady growth, driven by factors such as increasing livestock populations, rising demand for high-quality animal feed, and the adoption of improved farming practices. The market size has experienced a CAGR of XX% during the historical period (2019-2024), reaching an estimated value of $XX million in 2025. Technological disruptions, particularly in precision agriculture and seed breeding, have accelerated yield improvements and enhanced efficiency. Consumer behavior shifts, such as increased focus on sustainable and organic farming practices, are influencing market trends. Market penetration of improved forage varieties remains significant, with an estimated XX% adoption rate in 2025. The forecast period (2025-2033) projects a CAGR of XX%, leading to a market value of $XX million by 2033. This growth is projected to be fueled by continued technological advancements, increasing livestock production, and government initiatives promoting sustainable agriculture.

Dominant Regions, Countries, or Segments in United States Forage Seed Market

The Midwest region dominates the U.S. forage seed market due to its extensive agricultural land and favorable climate for forage production. Within this region, states like Iowa, Nebraska, and Wisconsin are key contributors. The ruminant animal segment represents the largest share of the market, driven by the significant demand for forage in beef and dairy cattle production. Grasses account for the largest share within crop types, owing to their wide adaptability and suitability for various livestock. Stored forage is the most dominant product type, due to its longer shelf life and ease of storage and handling.

- Key Drivers: Favorable climatic conditions in the Midwest, high livestock density, and government support for agriculture.

- Dominance Factors: Extensive arable land, established agricultural infrastructure, and high demand from livestock producers.

- Growth Potential: Continued growth is anticipated, driven by increasing demand for high-quality forage and technological advancements. The ruminant segment is projected to maintain its dominance, while growth in the poultry and swine segments is also expected.

United States Forage Seed Market Product Landscape

The U.S. forage seed market offers a diverse range of products, including improved varieties of grasses, legumes, and cereal forages. Innovations focus on enhanced traits such as drought tolerance, disease resistance, improved nutritional content, and increased yield. Products are tailored to specific animal types and farming systems, offering customized solutions for diverse needs. Performance metrics are typically measured in terms of yield, forage quality, and persistence. Many companies emphasize unique selling propositions such as superior germination rates, disease resistance packages, and enhanced nutritive values.

Key Drivers, Barriers & Challenges in United States Forage Seed Market

Key Drivers: Growing livestock populations, increasing demand for high-quality animal feed, technological advancements in seed genetics and farming practices, and government support for sustainable agriculture. For instance, government subsidies for forage production and research on improved seed varieties are significant drivers.

Key Challenges & Restraints: Fluctuations in commodity prices, inclement weather conditions affecting crop yields, increasing input costs (fertilizers, pesticides), and competition from imported forages can significantly impact profitability. Regulatory hurdles and stringent quality control standards also impose challenges. Supply chain disruptions, particularly those related to transportation and labor availability, can lead to production delays and increased costs.

Emerging Opportunities in United States Forage Seed Market

Emerging opportunities lie in developing and marketing improved forage varieties tailored to specific environmental conditions and livestock needs. The growing interest in organic and sustainable farming practices presents further opportunities for forage seed producers. Exploring novel applications of forage crops, such as bioenergy production, can also unlock new market segments.

Growth Accelerators in the United States Forage Seed Market Industry

Technological breakthroughs in seed genetics and precision agriculture are major catalysts for growth. Strategic partnerships between seed companies, agricultural research institutions, and livestock producers can foster innovation and market expansion. The development and adoption of new, improved forage varieties, including those with enhanced nutritional value and stress tolerance, will drive the market's expansion.

Key Players Shaping the United States Forage Seed Market Market

- Dynamic Seeds Ltd

- DLF International Seeds

- Allied Seed LLC

- Foster's Seed and Feed

- Golden Acre Seeds

- Northstar Seed Ltd

- Barenburg US

- Pickseed Canada Ltd

- Brett Young Seed Company

- Granite Seed Company

Notable Milestones in United States Forage Seed Market Sector

- 2020: Introduction of a new drought-tolerant alfalfa variety by DLF International Seeds.

- 2022: Acquisition of a smaller seed company by Allied Seed LLC.

- 2023: Launch of a precision agriculture platform for forage management by a major technology provider.

- 2024: Government funding secured for research on climate-resilient forage crops.

In-Depth United States Forage Seed Market Market Outlook

The U.S. forage seed market is poised for continued growth, driven by several factors including rising livestock populations, increasing demand for high-quality animal feed, and technological advancements in seed genetics. Strategic investments in research and development, coupled with strategic partnerships, will play a crucial role in shaping the market's future. Opportunities exist to expand into new market segments and explore the potential of innovative forage crop applications. The forecast indicates a strong trajectory of growth throughout the forecast period, presenting attractive opportunities for businesses in this sector.

United States Forage Seed Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Forage Seed Market Segmentation By Geography

- 1. United States

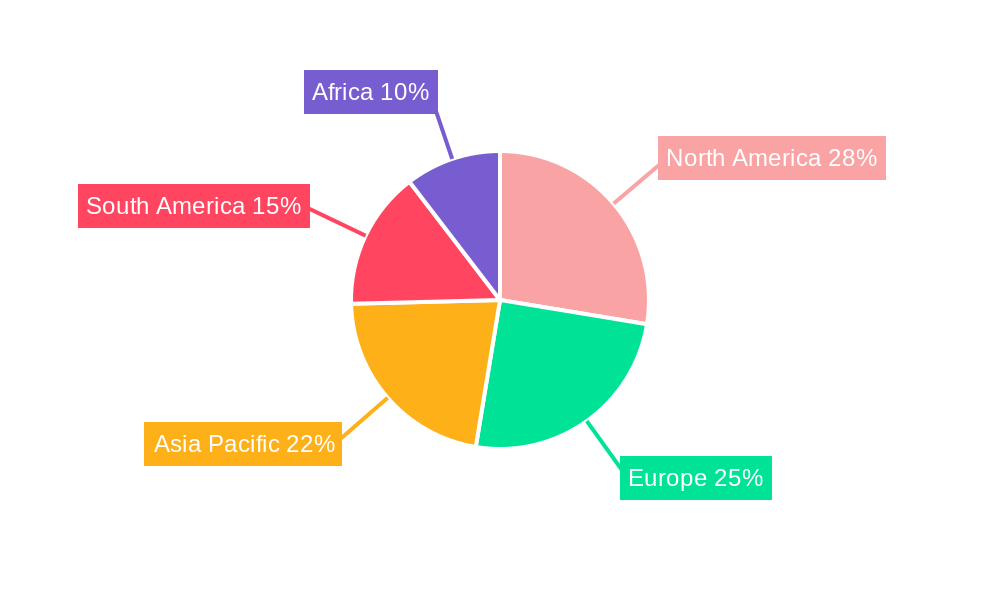

United States Forage Seed Market Regional Market Share

Geographic Coverage of United States Forage Seed Market

United States Forage Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Availability of Skilled Labor; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Increasing Farm Expenditure; Security Concerns in Modern Farming Machinery

- 3.4. Market Trends

- 3.4.1. Demand for Organic Food and Feed Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Forage Seed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dynamic Seeds Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DLF International Seeds

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Allied Seed LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Foster's Seed and Feed

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Golden Acre Seeds

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Northstar Seed Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Barenburg US

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pickseed Canada Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Brett Young Seed Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Granite Seed Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dynamic Seeds Ltd

List of Figures

- Figure 1: United States Forage Seed Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Forage Seed Market Share (%) by Company 2025

List of Tables

- Table 1: United States Forage Seed Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: United States Forage Seed Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: United States Forage Seed Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: United States Forage Seed Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: United States Forage Seed Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: United States Forage Seed Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: United States Forage Seed Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: United States Forage Seed Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: United States Forage Seed Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: United States Forage Seed Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: United States Forage Seed Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: United States Forage Seed Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Forage Seed Market?

The projected CAGR is approximately 2.66%.

2. Which companies are prominent players in the United States Forage Seed Market?

Key companies in the market include Dynamic Seeds Ltd, DLF International Seeds, Allied Seed LLC, Foster's Seed and Feed, Golden Acre Seeds, Northstar Seed Ltd, Barenburg US, Pickseed Canada Ltd, Brett Young Seed Company, Granite Seed Company.

3. What are the main segments of the United States Forage Seed Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 724.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Low Availability of Skilled Labor; Technological Advancements.

6. What are the notable trends driving market growth?

Demand for Organic Food and Feed Products.

7. Are there any restraints impacting market growth?

Increasing Farm Expenditure; Security Concerns in Modern Farming Machinery.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Forage Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Forage Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Forage Seed Market?

To stay informed about further developments, trends, and reports in the United States Forage Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence