Key Insights

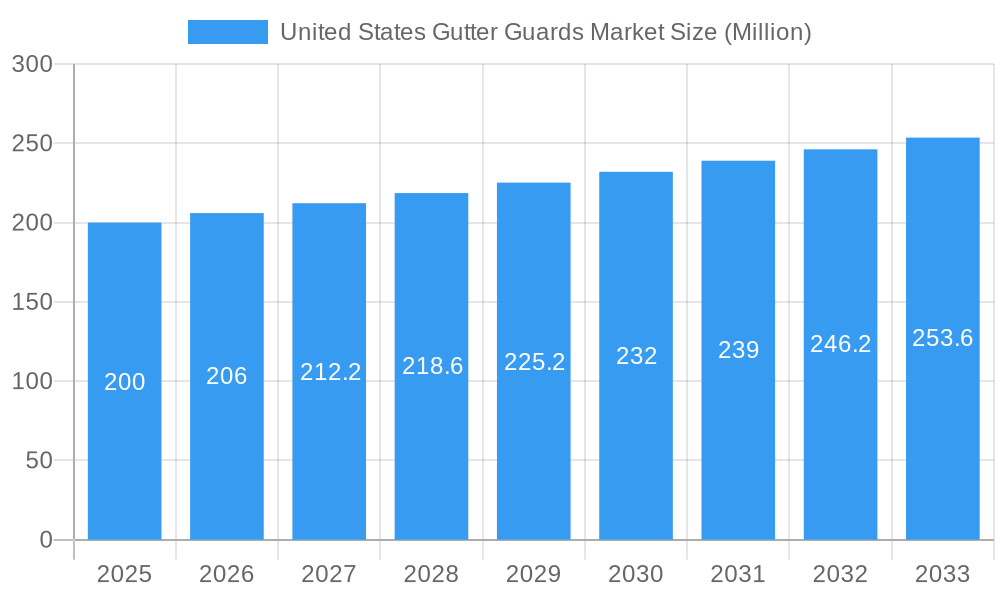

The United States Gutter Guards Market is projected to experience robust expansion, forecasting a Compound Annual Growth Rate (CAGR) of 2.2% from 2025 to 2033. This anticipated growth is propelled by escalating homeowner and commercial awareness of gutter protection system advantages. The market, valued at an estimated $2.88 billion in 2025, is set to surpass $2.88 billion by 2033. Primary growth catalysts include the increasing frequency of severe weather events, necessitating more consistent gutter maintenance, and the prevailing trend in home improvement and renovation initiatives nationwide. Within product categories, mesh and screen guards command a substantial market share, attributed to their efficacy and straightforward installation. Metal-based gutter guards also demonstrate significant popularity, valued for their resilience and extended service life, appealing to both residential and commercial clientele.

United States Gutter Guards Market Market Size (In Billion)

Market segmentation by end-user encompasses residential and commercial sectors. The residential segment currently leads, driven by the greater number of households adopting gutter protection. However, the commercial sector is poised for accelerated growth, fueled by extensive infrastructure developments and the demand for low-maintenance solutions in commercial properties. Geographically, the market exhibits broad distribution across the United States, with heightened adoption in areas susceptible to substantial rainfall and seasonal debris. Leading entities like All American Gutter Protection, Gutterglove, and Leaf Guard are committed to continuous innovation, delivering advanced solutions aligned with evolving consumer requirements. The competitive environment is shaped by strategic alliances, new product introductions, and corporate acquisitions, all aimed at broadening market reach and refining product portfolios.

United States Gutter Guards Market Company Market Share

United States Gutter Guards Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States Gutter Guards market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. It segments the market by product (Meshes and Screens, Hoods and Covers, Plastic Frames and Bristles), material type (Metal, Plastic, Others), and end-user (Residential, Commercial), providing a granular understanding of market dynamics and growth potential. The market size is projected to reach xx Million by 2033.

United States Gutter Guards Market Market Dynamics & Structure

The U.S. gutter guards market is characterized by moderate concentration, with key players like All American Gutter Protection, Gutterstuff, Gutterglove, GutterCraft, Gutter Pro USA, Gutter Guards America, Raptor, Amerimax, Leaf Guard, and Homecraft Gutter Protection vying for market share. The market is driven by technological innovations, particularly in material science and design, leading to more effective and aesthetically pleasing gutter protection solutions. Regulatory frameworks related to building codes and environmental concerns also play a significant role. Competitive substitutes include traditional gutter cleaning services, but the convenience and long-term cost savings offered by gutter guards provide a significant advantage. The residential segment dominates the market, driven by increasing homeowner awareness of the benefits of gutter protection. M&A activity in the sector has been relatively low in recent years, with a total of xx deals recorded between 2019 and 2024, representing a xx% market share.

- Market Concentration: Moderately concentrated, with several major players and numerous smaller regional competitors.

- Technological Innovation: Focus on enhancing durability, ease of installation, and aesthetic appeal.

- Regulatory Framework: Compliance with building codes and environmental regulations influences product design and materials.

- Competitive Substitutes: Traditional gutter cleaning services and DIY solutions pose a competitive challenge.

- End-User Demographics: The residential sector holds the largest market share, followed by the commercial sector.

- M&A Trends: Low M&A activity in recent years; xx deals from 2019-2024.

United States Gutter Guards Market Growth Trends & Insights

The U.S. gutter guards market experienced robust growth from 2019 to 2024, exhibiting a CAGR of [Insert Precise CAGR Percentage]%. This expansion is primarily fueled by a rising homeowner awareness of the significant benefits of gutter protection. These benefits include preventing costly clogs, mitigating water damage to homes and foundations, and substantially extending the lifespan of gutters themselves. Furthermore, technological advancements, such as the development of self-cleaning gutter guards and the utilization of increasingly durable and efficient materials, have significantly contributed to market expansion. A discernible consumer shift towards low-maintenance home solutions further propels demand. This positive trajectory is projected to continue throughout the forecast period (2025-2033), with market revenues expected to reach [Insert Precise Revenue Projection in Millions] by 2033, representing a projected CAGR of [Insert Precise CAGR Percentage]%. Despite noteworthy growth, market penetration remains relatively low, indicating substantial untapped potential across various segments and geographical regions. The emergence of smart gutter systems, incorporating innovative technologies, is poised to dramatically accelerate market expansion in the coming years.

Dominant Regions, Countries, or Segments in United States Gutter Guards Market

The residential sector constitutes the largest segment of the U.S. gutter guards market, driven by heightened homeowner awareness and the strong appeal of low-maintenance home solutions. Within the product spectrum, mesh and screen gutter guards command a substantial market share due to their cost-effectiveness and proven efficacy. Geographically, market distribution is widespread across the nation, although faster growth is observed in regions characterized by extreme weather patterns and significant leaf fall. States with a high concentration of older homes, particularly in the Northeast and Midwest, present particularly compelling growth opportunities. These regions often require more frequent gutter maintenance due to aging infrastructure and harsher weather conditions.

- By Product: Mesh and screen gutter guards dominate due to their affordability and effectiveness. Higher-end hoods and covers cater to premium residential segments, driving growth in this lucrative niche.

- By Material Type: Metal gutter guards maintain a significant market share due to their superior durability, while plastic guards are experiencing increased adoption due to their more economical pricing.

- By End User: The residential sector remains the market leader, followed by the commercial sector, encompassing apartment complexes, office buildings, and other multi-unit dwellings.

- Key Growth Drivers: Rising disposable incomes, increased awareness of gutter maintenance benefits, and favorable climatic conditions in certain regions are all contributing to market expansion. Furthermore, the increasing frequency of severe weather events is heightening homeowner concerns about protecting their homes from water damage.

United States Gutter Guards Market Product Landscape

The U.S. gutter guards market offers a diverse range of products, from simple mesh screens to sophisticated, self-cleaning systems. Recent innovations focus on improving durability, ease of installation, and aesthetic appeal. Products are designed to accommodate various gutter types and sizes, with features like adjustable widths and customizable designs. Key performance metrics include lifespan, effectiveness in preventing clogs, and ease of maintenance. Unique selling propositions often center on superior material quality, innovative design features, and warranty coverage. Technological advancements include the incorporation of smart sensors for clog detection and remote monitoring capabilities.

Key Drivers, Barriers & Challenges in United States Gutter Guards Market

Key Drivers: Increasing awareness of the benefits of gutter protection, rising disposable incomes, and the increasing prevalence of extreme weather events which increase the need for effective gutter protection systems are key drivers of the market's growth. Technological advancements leading to more efficient and durable products also contribute.

Key Barriers & Challenges: High initial costs, limited awareness in certain regions, and the presence of competitive substitute options like traditional gutter cleaning pose challenges. Supply chain disruptions and fluctuations in raw material prices can also impact market growth. Strict regulatory compliance requirements might create further hurdles for some market players.

Emerging Opportunities in United States Gutter Guards Market

Significant untapped market potential exists in regions where awareness of gutter guard benefits remains limited. Promising opportunities also include the continued development of smart gutter systems featuring integrated sensors for proactive clog detection and convenient remote monitoring capabilities. Furthermore, the market is ripe for personalized design options, enabling seamless integration with diverse architectural styles and compatibility with existing home automation systems. This focus on customization and technological integration is key to driving future growth within the market.

Growth Accelerators in the United States Gutter Guards Market Industry

Technological advancements in materials science and manufacturing processes are key growth accelerators. Strategic partnerships between gutter guard manufacturers and home improvement retailers are also expanding market reach. Expanding into new geographic markets with strong homeowner demand for improved home maintenance solutions further accelerates the market's growth.

Key Players Shaping the United States Gutter Guards Market Market

- All American Gutter Protection

- Gutterstuff

- Gutterglove

- GutterCraft

- Gutter Pro USA

- Gutter Guards America

- Raptor

- Amerimax

- Leaf Guard

- Homecraft Gutter Protection

Notable Milestones in United States Gutter Guards Market Sector

- 2020: Leaf Guard introduced a UPVC net, providing a maintenance-free gutter solution particularly beneficial in areas prone to heavy leaf accumulation.

- [Insert Year]: [Insert Company Name] launched [Insert Product Name], a [Insert Product Description - e.g., innovative micro-mesh gutter guard] that [Insert Key Benefit - e.g., offers superior debris protection with enhanced water flow].

In-Depth United States Gutter Guards Market Market Outlook

The U.S. gutter guards market is poised for sustained growth, driven by technological innovation, increasing homeowner awareness, and favorable economic conditions. Strategic partnerships, expansion into untapped markets, and the development of smart gutter systems will further fuel market expansion. The potential for growth in the coming years is significant, particularly within the residential sector and in regions with high precipitation or leaf fall. The market's future trajectory appears promising, with continued innovation and strong consumer demand.

United States Gutter Guards Market Segmentation

-

1. Product

- 1.1. Meshes and Screens

- 1.2. Hoods and Covers

- 1.3. Plastic Frames and Bristles

-

2. Material Type

- 2.1. Metal

- 2.2. Plastic

- 2.3. Others

-

3. End User

- 3.1. Residential

- 3.2. Commercial

United States Gutter Guards Market Segmentation By Geography

- 1. United States

United States Gutter Guards Market Regional Market Share

Geographic Coverage of United States Gutter Guards Market

United States Gutter Guards Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators

- 3.3. Market Restrains

- 3.3.1. Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues

- 3.4. Market Trends

- 3.4.1. The Aging US population is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Gutter Guards Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Meshes and Screens

- 5.1.2. Hoods and Covers

- 5.1.3. Plastic Frames and Bristles

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Metal

- 5.2.2. Plastic

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 All American Gutter Protection

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gutterstuff**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gutterglove

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GutterCraft

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gutter Pro USA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gutter Guards America

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Raptor

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amerimax

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Leaf Guard

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Homecraft Gutter Protection

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 All American Gutter Protection

List of Figures

- Figure 1: United States Gutter Guards Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Gutter Guards Market Share (%) by Company 2025

List of Tables

- Table 1: United States Gutter Guards Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United States Gutter Guards Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 3: United States Gutter Guards Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: United States Gutter Guards Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Gutter Guards Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: United States Gutter Guards Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 7: United States Gutter Guards Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: United States Gutter Guards Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Gutter Guards Market?

The projected CAGR is approximately 2.2%.

2. Which companies are prominent players in the United States Gutter Guards Market?

Key companies in the market include All American Gutter Protection, Gutterstuff**List Not Exhaustive, Gutterglove, GutterCraft, Gutter Pro USA, Gutter Guards America, Raptor, Amerimax, Leaf Guard, Homecraft Gutter Protection.

3. What are the main segments of the United States Gutter Guards Market?

The market segments include Product, Material Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators.

6. What are the notable trends driving market growth?

The Aging US population is driving the market.

7. Are there any restraints impacting market growth?

Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues.

8. Can you provide examples of recent developments in the market?

In 2020, Leaf Guard launched a UPVC net which can be clipped to the gutter in leaf prone areas whereby the leaf will fall in the flat surface and could fly away. This has enabled a maintenance free gutter.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Gutter Guards Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Gutter Guards Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Gutter Guards Market?

To stay informed about further developments, trends, and reports in the United States Gutter Guards Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence