Key Insights

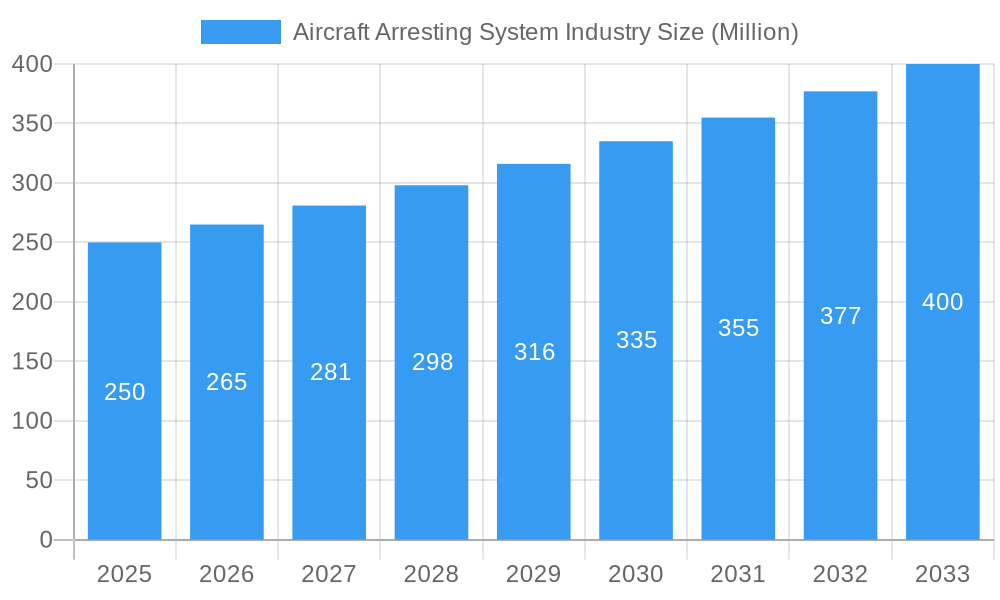

The Aircraft Arresting System market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a 6% Compound Annual Growth Rate (CAGR) through 2033. This expansion is driven by several key factors. Increasing military spending globally, particularly on naval modernization and airbase infrastructure, fuels significant demand for reliable arresting systems. Furthermore, the ongoing development of more advanced aircraft, including larger and heavier models, necessitates more sophisticated arresting technology capable of handling increased landing forces. The market's growth is also propelled by a rising focus on enhancing flight safety, particularly in challenging conditions or during emergency landings. Technological advancements, such as the integration of advanced materials and intelligent control systems, are contributing to the development of lighter, more efficient, and durable arresting systems, further driving market expansion.

Aircraft Arresting System Industry Market Size (In Million)

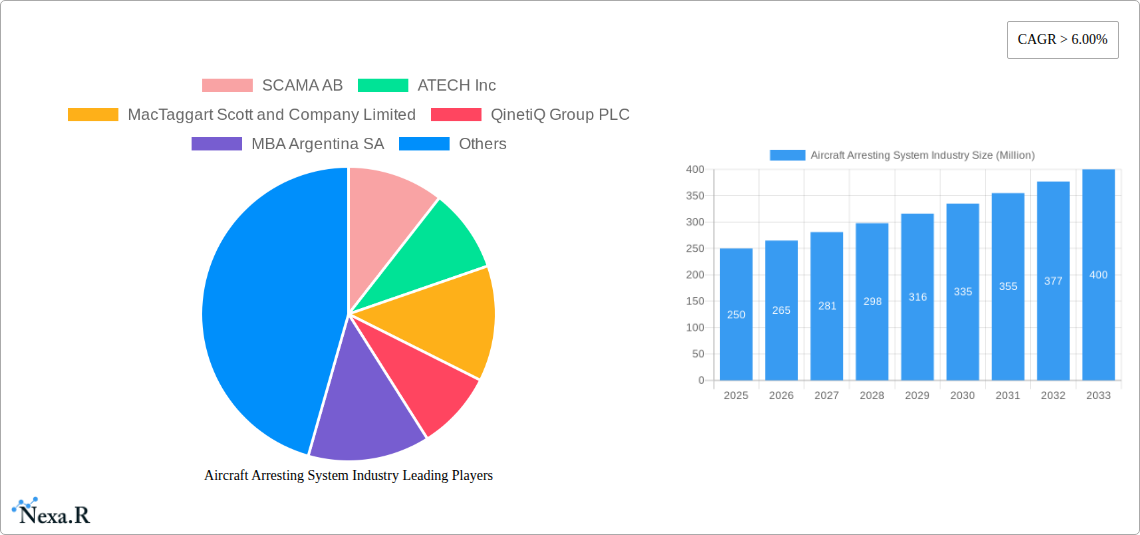

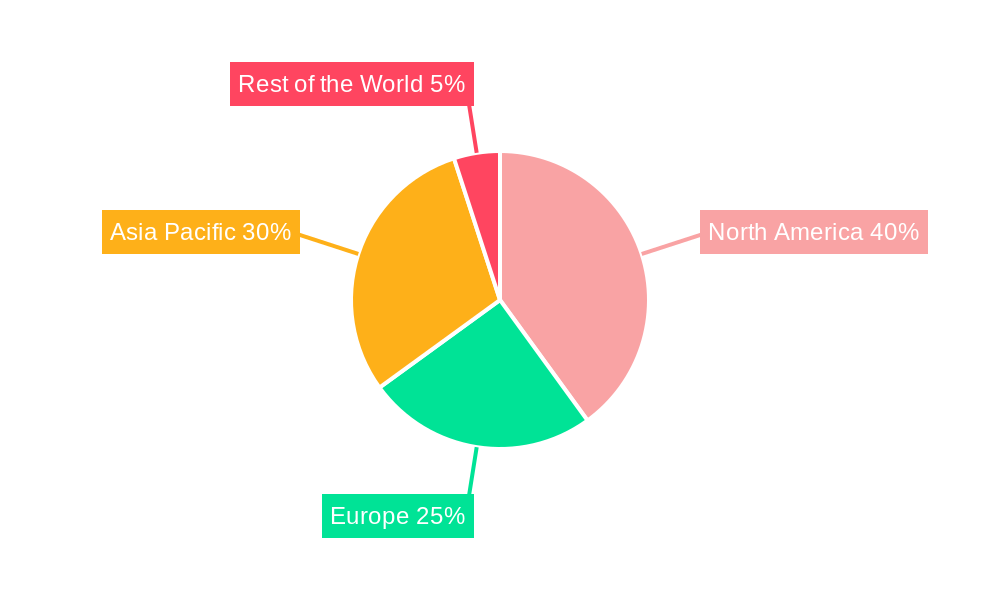

Market segmentation reveals a significant share held by land-based systems, given their prevalence in military airfields and training facilities. However, sea-based systems are witnessing rapid growth due to the expansion of naval aviation and the requirement for safer aircraft operations on aircraft carriers and amphibious assault ships. While the precise regional breakdown is unavailable, considering global military spending patterns, North America and Asia Pacific likely command the largest market shares, followed by Europe. Competitive landscape analysis reveals numerous prominent players, including SCAMA AB, ATECH Inc, MacTaggart Scott, QinetiQ Group PLC, and Safran SA, vying for market share through technological innovation and strategic partnerships. Future growth will likely depend on sustained investments in military modernization, continued technological advancements in arresting system design, and the increasing demand for enhanced flight safety measures.

Aircraft Arresting System Industry Company Market Share

Aircraft Arresting System Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Aircraft Arresting System industry, encompassing market dynamics, growth trends, regional analysis, product landscape, and key players. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033. This report is essential for industry professionals, investors, and researchers seeking a comprehensive understanding of this critical sector within the defense and aerospace industries. The parent market is the broader aerospace and defense sector, while the child market is specifically aircraft ground support equipment.

Aircraft Arresting System Industry Market Dynamics & Structure

The global Aircraft Arresting System (AAS) market is characterized by a moderately concentrated landscape, with a few leading manufacturers holding a substantial share, projected to be around 60% by 2025. This concentration is driven by the specialized nature of AAS technology and the significant barriers to entry. Continuous technological innovation is a pivotal force, propelled by the unwavering demand for enhanced aircraft safety, operational efficiency, and reduced maintenance burdens across diverse operational environments. Stringent national and international regulatory frameworks governing safety standards and operational procedures play a crucial role in shaping market growth, often mandating specific performance criteria and reliability levels. While alternative landing technologies are emerging, their widespread adoption rate remains relatively low due to cost, complexity, and established infrastructure. The primary end-users of AAS are military and naval forces worldwide, where mission-critical operations necessitate robust and reliable arresting solutions. Civilian airports represent a smaller but steadily growing segment, driven by the increasing emphasis on aviation safety and the development of new airport infrastructure.

- Market Concentration: Moderately concentrated, with the top 5 players anticipated to command approximately 60% of the global market share in 2025.

- Technological Innovation: A primary focus on developing systems with improved safety features, enhanced operational efficiency, reduced environmental impact, and streamlined maintenance procedures.

- Regulatory Frameworks: Adherence to rigorous safety regulations and certification processes is a critical factor influencing market entry and product development.

- Competitive Substitutes: While alternative landing technologies exist, their competitive threat to traditional AAS remains minimal in the short to medium term.

- End-User Demographics: The market is predominantly driven by military and naval aviation sectors, with a noticeable and growing demand from civilian aviation authorities.

- M&A Trends: The sector is expected to witness moderate merger and acquisition (M&A) activity, reflecting consolidation and strategic partnerships aimed at expanding market reach and technological capabilities. Specific deal volumes are subject to ongoing market analysis.

Aircraft Arresting System Industry Growth Trends & Insights

The global Aircraft Arresting System market demonstrated consistent and robust growth throughout the historical period (2019-2024). This expansion was primarily fueled by escalating global defense expenditures and the critical need to bolster aviation safety across a multitude of airfields, including forward operating bases and carrier decks. By 2024, the market had reached an estimated size of approximately [Insert Market Size in Units/Value] units. Projections indicate a continued upward trajectory, with the market anticipated to grow at a Compound Annual Growth Rate (CAGR) of approximately [Insert CAGR]% during the forecast period (2025-2033), potentially reaching an estimated [Insert Forecasted Market Size in Units/Value] units by the end of 2033. Key technological advancements, such as the integration of advanced composite materials for lighter yet stronger components, intelligent sensor systems for real-time performance monitoring, and innovative energy absorption mechanisms, are significantly enhancing system performance, reliability, and longevity. Evolving end-user preferences for more sophisticated, automated, and data-driven arresting solutions are also contributing to higher adoption rates, particularly in technologically advanced economies. While market penetration is already high in developed nations, substantial growth opportunities are foreseen in developing countries as their aviation infrastructure and defense capabilities expand.

Dominant Regions, Countries, or Segments in Aircraft Arresting System Industry

The land-based segment currently dominates the Aircraft Arresting System industry, largely attributed to the extensive and globally distributed network of military and civilian airfields. North America and Europe stand out as the leading geographical regions, collectively accounting for an estimated [Insert Percentage]% of the global market share in 2025. This regional dominance is underpinned by substantial defense budgets, the significant presence of naval aviation assets and air bases, and continuous investments in modernizing airfield infrastructure. These factors create a consistent demand for advanced AAS solutions. Looking ahead, the Asia-Pacific region is poised for substantial growth throughout the forecast period. This surge is expected to be driven by increasing defense spending, the expansion of air force fleets and capabilities, and a growing emphasis on enhancing aviation safety and operational readiness in developing nations within the region.

- Key Drivers (Land-Based Segment):

- Extensive existing network of land-based military and civilian airfields.

- Robust and growing defense budgets in key nations.

- Ongoing investment in airfield infrastructure upgrades and modernization projects.

- Key Drivers (Sea-Based Segment):

- Increasing global naval power projection and the expansion of carrier strike groups.

- Mandatory modernization of arresting gear systems on aircraft carriers to accommodate advanced aircraft.

- Emphasis on operational flexibility and rapid deployment of naval air assets.

- Regional Dominance: North America and Europe currently lead the market due to high defense spending and well-established airbase infrastructure. The Asia-Pacific region presents significant untapped potential and is projected to be a key growth engine.

Aircraft Arresting System Industry Product Landscape

The Aircraft Arresting System market offers a diverse portfolio of products designed to meet varied operational needs. The widely recognized and deployed Barrier Arresting Kit 12 (BAK-12) systems represent a significant portion of the installed base. Beyond the BAK-12, the industry features a range of specialized arresting systems, including but not limited to net systems, hydraulic arresters, and advanced arresting gear (AAG) specifically engineered for naval aviation. Recent innovations are heavily focused on the development of lightweight yet incredibly durable composite materials, enhanced braking mechanisms that offer superior energy dissipation, and robust designs capable of withstanding increasingly higher impact forces from next-generation aircraft. These advancements collectively aim to optimize safety margins, reduce the risk of catastrophic failures, and lower lifecycle operational and maintenance costs. Key differentiators and unique selling propositions for manufacturers often revolve around features such as rapid system deployment and recovery, simplified maintenance procedures, modular designs for adaptability to various aircraft types and configurations, and integrated data logging and diagnostics capabilities for performance monitoring and predictive maintenance.

Key Drivers, Barriers & Challenges in Aircraft Arresting System Industry

Key Drivers:

- Escalating Global Defense Budgets: Increased spending on military aviation infrastructure and modernization directly fuels demand for advanced AAS.

- Unwavering Focus on Aviation Safety: The paramount importance of ensuring safe landings and emergency egress for all aircraft types drives the need for reliable arresting systems.

- Technological Advancements: Continuous innovation in materials science, engineering, and sensor technology leads to more efficient, durable, and safer AAS.

- Airfield Expansion and Modernization: The development of new airbases and the upgrading of existing ones necessitate the installation or replacement of arresting systems.

- Naval Aviation Growth: The expansion and modernization of naval fleets and aircraft carriers create a consistent demand for sea-based arresting solutions.

Key Challenges and Restraints:

- High Initial Investment Costs: The procurement, installation, and integration of sophisticated AAS can represent a significant capital expenditure for end-users.

- Stringent Regulatory Compliance and Certification: Meeting rigorous safety standards and obtaining necessary certifications can be a complex and time-consuming process, acting as a barrier to entry and product rollout.

- Competition from Emerging Technologies: While currently limited, the long-term potential of alternative landing technologies could pose a competitive threat.

- Supply Chain Vulnerabilities: Geopolitical instability, trade restrictions, and reliance on specialized raw materials can lead to potential disruptions in the supply chain for critical components.

- Maintenance and Training Requirements: Ensuring the continued operational readiness of AAS requires specialized maintenance expertise and comprehensive training for personnel, adding to the overall cost of ownership.

Emerging Opportunities in Aircraft Arresting System Industry

- Expansion into emerging markets with growing air traffic and defense budgets.

- Development of more compact and lightweight systems suitable for smaller airfields.

- Integration of advanced technologies like smart sensors and data analytics for predictive maintenance.

- Growing demand for systems compatible with unmanned aerial vehicles (UAVs).

Growth Accelerators in the Aircraft Arresting System Industry Industry

Technological breakthroughs, such as the development of lighter and more durable materials and advanced braking systems, are key growth drivers. Strategic partnerships between system manufacturers and defense contractors can facilitate market penetration and accelerate adoption. Furthermore, expansion into new markets and diversification into emerging applications, such as UAV landing systems, present significant growth opportunities.

Key Players Shaping the Aircraft Arresting System Market

- SCAMA AB

- ATECH Inc

- MacTaggart Scott and Company Limited

- QinetiQ Group PLC

- MBA Argentina SA

- Safran SA

- General Atomics

- A-laskuvarj

- Curtiss-Wright Corp

- Sojitz Aerospace Corporation

Notable Milestones in Aircraft Arresting System Industry Sector

- July 2022: 435th Contingency Response Support Squadron conducted BAK-12 training with the Romanian Air Force, highlighting the system's international adoption.

- April 2022: Anderson Air Force Base replaced its BAK-12 system after a 10-year lifespan, demonstrating the system's reliability and replacement cycle.

In-Depth Aircraft Arresting System Industry Market Outlook

The Aircraft Arresting System market is poised for sustained growth, driven by continuous technological advancements, increasing defense spending, and a growing demand for enhanced safety in air operations. Strategic partnerships and investments in research and development will be crucial for market players to maintain a competitive edge and capitalize on emerging opportunities, particularly in the rapidly evolving landscape of unmanned aerial systems. The expansion into newer markets and the development of advanced system functionalities will further contribute to market growth.

Aircraft Arresting System Industry Segmentation

-

1. Platform

- 1.1. Sea-based

- 1.2. Land-based

Aircraft Arresting System Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Rest of the World

Aircraft Arresting System Industry Regional Market Share

Geographic Coverage of Aircraft Arresting System Industry

Aircraft Arresting System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Land-based Segment to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Arresting System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Sea-based

- 5.1.2. Land-based

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Asia Pacific

- 5.2.3. Europe

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America Aircraft Arresting System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Sea-based

- 6.1.2. Land-based

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Asia Pacific Aircraft Arresting System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Sea-based

- 7.1.2. Land-based

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Europe Aircraft Arresting System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Sea-based

- 8.1.2. Land-based

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Rest of the World Aircraft Arresting System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Sea-based

- 9.1.2. Land-based

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 SCAMA AB

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ATECH Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MacTaggart Scott and Company Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 QinetiQ Group PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 MBA Argentina SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Safran SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 General Atomics

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 A-laskuvarj

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Curtiss-Wright Corp

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sojitz Aerospace Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 SCAMA AB

List of Figures

- Figure 1: Global Aircraft Arresting System Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aircraft Arresting System Industry Revenue (Million), by Platform 2025 & 2033

- Figure 3: North America Aircraft Arresting System Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America Aircraft Arresting System Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Aircraft Arresting System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Aircraft Arresting System Industry Revenue (Million), by Platform 2025 & 2033

- Figure 7: Asia Pacific Aircraft Arresting System Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 8: Asia Pacific Aircraft Arresting System Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Aircraft Arresting System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aircraft Arresting System Industry Revenue (Million), by Platform 2025 & 2033

- Figure 11: Europe Aircraft Arresting System Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Europe Aircraft Arresting System Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Aircraft Arresting System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Aircraft Arresting System Industry Revenue (Million), by Platform 2025 & 2033

- Figure 15: Rest of the World Aircraft Arresting System Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Rest of the World Aircraft Arresting System Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Aircraft Arresting System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aircraft Arresting System Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Global Aircraft Arresting System Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Aircraft Arresting System Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Global Aircraft Arresting System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Aircraft Arresting System Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 6: Global Aircraft Arresting System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Aircraft Arresting System Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Global Aircraft Arresting System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Aircraft Arresting System Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 10: Global Aircraft Arresting System Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Arresting System Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Aircraft Arresting System Industry?

Key companies in the market include SCAMA AB, ATECH Inc, MacTaggart Scott and Company Limited, QinetiQ Group PLC, MBA Argentina SA, Safran SA, General Atomics, A-laskuvarj, Curtiss-Wright Corp, Sojitz Aerospace Corporation.

3. What are the main segments of the Aircraft Arresting System Industry?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Land-based Segment to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In July 2022, 435th Contingency Response Support Squadron air advisors worked alongside the Romanian air force while leading a training on the Barrier Arresting Kit 12 at Fetesti Air Base, Romania. The BAK-12 aircraft arresting system is used by both the US and Romania to decelerate landing fighter aircraft in emergencies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Arresting System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Arresting System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Arresting System Industry?

To stay informed about further developments, trends, and reports in the Aircraft Arresting System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence