Key Insights

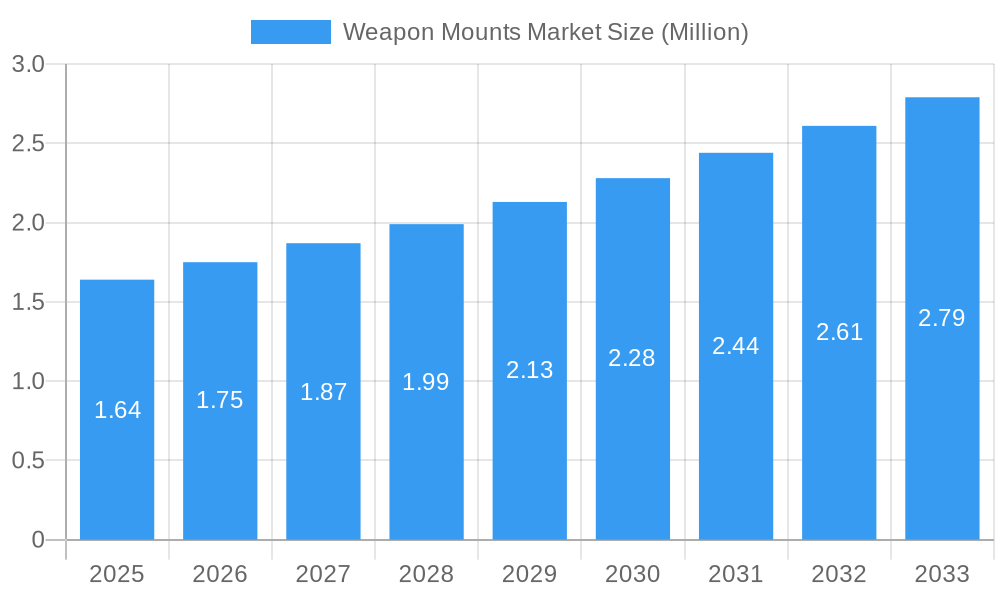

The global Weapon Mounts Market is poised for robust expansion, projected to reach \$1.64 million with a compound annual growth rate (CAGR) of 6.86% from 2025 to 2033. This significant growth is fueled by escalating geopolitical tensions and the continuous need for advanced defense capabilities across various nations. The market is characterized by a dynamic interplay of innovation and demand, driven by the increasing integration of sophisticated weapon systems into land, air, and sea platforms. Key drivers include modernization efforts within armed forces, the development of next-generation combat vehicles, naval vessels, and aircraft, all of which necessitate specialized and adaptable weapon mounting solutions. Furthermore, the rising procurement of advanced military hardware by emerging economies and the ongoing conflicts in various regions are bolstering the demand for reliable and high-performance weapon mounts. The market's evolution is also shaped by a strong emphasis on enhanced survivability, precision targeting, and reduced operational footprints for military assets, pushing manufacturers to innovate in areas such as lighter materials, improved stabilization, and remote operation capabilities.

Weapon Mounts Market Market Size (In Million)

The market is segmented into static and non-static mount types, with manual and remotely operated modes of operation catering to diverse tactical requirements. Static mounts offer robust and fixed support, crucial for certain land-based platforms and naval installations, while non-static mounts provide enhanced flexibility and maneuverability, particularly vital for aerial and rapidly deployable land systems. Remotely operated systems are gaining prominence due to their ability to enhance operator safety and situational awareness, allowing for precise control from a protected position. The application scope spans land-based vehicles, aerial platforms like drones and aircraft, and naval vessels, each with unique mounting challenges and specifications. Leading companies such as Leonardo SpA, RTX Corporation, and BAE Systems PLC are at the forefront of this market, investing heavily in research and development to introduce cutting-edge solutions. Technological advancements in areas like intelligent stabilization, guided munitions integration, and miniaturization are expected to further propel market growth, alongside a sustained focus on fulfilling the evolving operational demands of global defense forces.

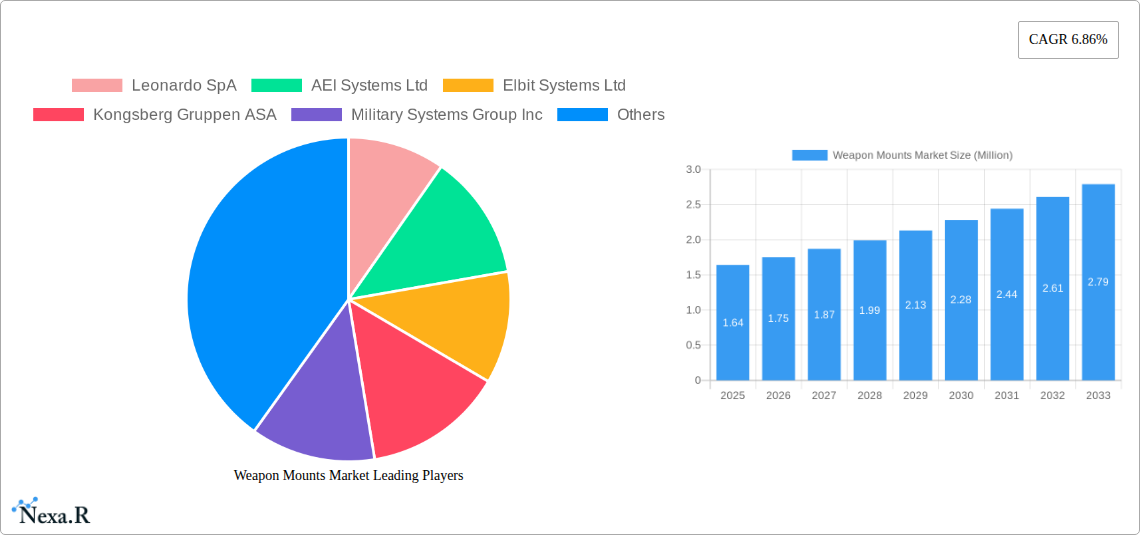

Weapon Mounts Market Company Market Share

This in-depth report delves into the dynamic Weapon Mounts Market, analyzing its intricate structure, growth trajectory, and future potential. With a focus on providing actionable insights for industry stakeholders, this research covers a comprehensive study period from 2019 to 2033, with 2025 serving as the base and estimated year, and the forecast period spanning 2025 to 2033. The historical performance from 2019 to 2024 is also meticulously examined. Explore the evolution of weapon mounting solutions across Static and Non-Static types, Manual and Remotely Operated modes of operation, and diverse Land, Air, and Sea applications. This report integrates high-traffic keywords such as "defense weapon mounts," "military gun mounts," "vehicle weapon systems," "aircraft weapon platforms," "naval weapon turrets," and "remote weapon stations" to maximize SEO visibility and attract a global audience of defense procurement professionals, military strategists, defense contractors, and technology innovators.

Weapon Mounts Market Market Dynamics & Structure

The Weapon Mounts Market is characterized by a moderately concentrated competitive landscape, with key players such as Leonardo SpA, AEI Systems Ltd, Elbit Systems Ltd, Kongsberg Gruppen ASA, Military Systems Group Inc, FN Herstal, Dillion Aero, RTX Corporation, BAE Systems PLC, and Saab AB vying for market share. Technological innovation serves as a significant driver, with advancements in materials science, automation, and digital integration enabling the development of lighter, more versatile, and sophisticated weapon mounts. Regulatory frameworks, particularly those governing the international arms trade and military modernization programs, exert considerable influence on market dynamics. Competitive product substitutes, though limited in the core defense sector, can emerge from dual-use technologies or innovations in less conventional weaponry. End-user demographics are primarily government defense agencies and military organizations, with evolving tactical requirements and operational doctrines shaping demand. Mergers and acquisitions (M&A) trends are notable, reflecting consolidation efforts and strategic partnerships aimed at expanding product portfolios and global reach. For instance, the acquisition of a specialized avionics firm by a major defense contractor could significantly enhance its capabilities in integrated weapon systems for aircraft. Innovation barriers include lengthy development cycles, stringent testing and certification requirements, and substantial R&D investments.

- Market Concentration: Moderate, with a few dominant global players and several specialized regional manufacturers.

- Technological Innovation Drivers: Advancements in robotics, AI for target acquisition, lightweight composite materials, and enhanced survivability features.

- Regulatory Frameworks: Export controls, defense procurement policies, and international arms treaties influencing R&D and market access.

- Competitive Product Substitutes: Limited direct substitutes, but indirect competition from evolving asymmetric warfare tactics and counter-measure technologies.

- End-User Demographics: Primarily national defense forces, special operations units, and paramilitary organizations.

- M&A Trends: Strategic acquisitions to gain technological edge, expand market presence, and integrate product lines. Expected M&A deal volume for the historical period (2019-2024) is approximately 7 significant transactions, with an estimated total deal value in the range of $1.5 billion to $2.0 billion million units.

Weapon Mounts Market Growth Trends & Insights

The Weapon Mounts Market is poised for robust growth, driven by escalating geopolitical tensions, ongoing military modernization programs across major economies, and the increasing adoption of advanced warfare technologies. The market size is projected to expand significantly, fueled by substantial investments in upgrading existing defense platforms and developing new ones incorporating sophisticated weapon integration capabilities. We project the global weapon mounts market to grow from an estimated $4.5 billion in the 2025 to $7.8 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.2% during the forecast period. Adoption rates for advanced weapon mounts, particularly remotely operated systems, are surging as militaries seek to enhance soldier safety and operational effectiveness. Technological disruptions, including the integration of AI-powered fire control systems and advanced stabilization technologies, are transforming the capabilities of weapon mounts, enabling greater precision and adaptability in dynamic combat environments. Consumer behavior shifts are evident, with a growing demand for modular, adaptable, and networked weapon systems that can be quickly reconfigured for various mission profiles and platforms. The increasing focus on drone defense and counter-unmanned aerial systems (C-UAS) presents a significant new market segment.

- Market Size Evolution: Significant expansion driven by defense spending and technological advancements. Estimated market size for 2025 is $4.5 billion million units, projected to reach $7.8 billion million units by 2033.

- Adoption Rates: Rapid adoption of Remotely Operated Weapon Stations (ROWS) and advanced stabilization technologies.

- Technological Disruptions: Integration of AI, advanced sensor fusion, and automated targeting systems.

- Consumer Behavior Shifts: Demand for modularity, network-centric capabilities, and enhanced survivability features.

- Market Penetration: Increasing penetration of advanced weapon mounts in land-based armored vehicles and naval platforms.

- CAGR: Estimated CAGR of 7.2% from 2025 to 2033.

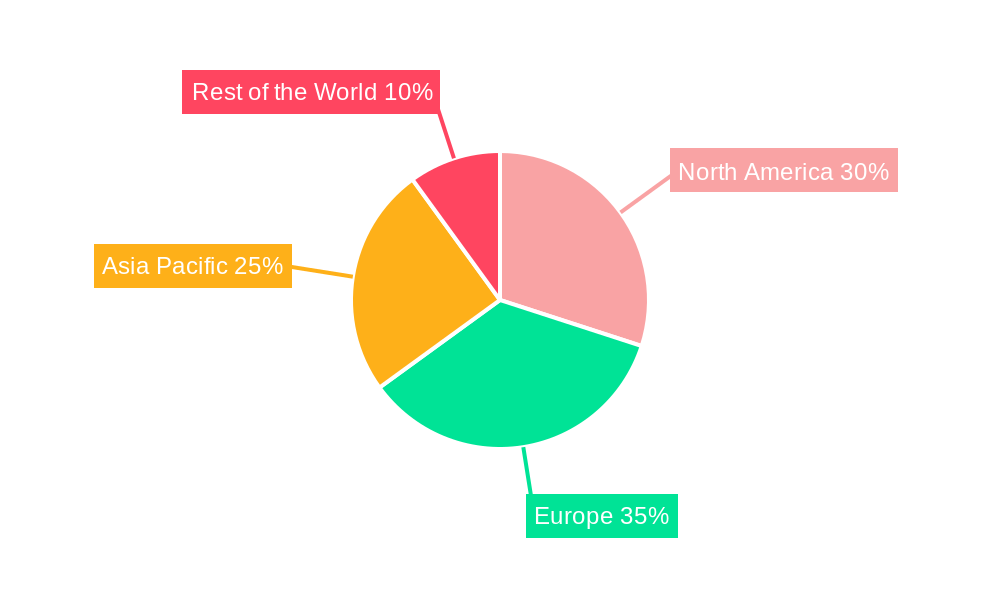

Dominant Regions, Countries, or Segments in Weapon Mounts Market

The Land segment is currently the dominant force driving growth within the Weapon Mounts Market, largely propelled by extensive military modernization efforts and the persistent need for robust ground-based defense systems. Countries such as the United States, with its significant defense budget and ongoing deployments, and China, with its rapid military expansion, are key contributors to this dominance. The North America region, led by the U.S., accounts for an estimated 35% of the global market share, driven by substantial defense expenditures and technological innovation. The region's focus on equipping armored vehicles, strategic ground platforms, and counter-terrorism operations with advanced weapon mounts underpins this leadership.

Within the Land application, the Static type of weapon mounts, particularly those designed for heavy artillery and anti-tank systems, still holds a significant market share due to their established role in traditional warfare. However, the Non-Static segment, encompassing stabilized turrets and remotely operated weapon stations (ROWS), is experiencing accelerated growth. These systems offer enhanced flexibility, precision, and soldier protection, making them increasingly sought after for modern combat scenarios. The Remotely Operated mode of operation is a key growth driver within the Land segment, with a projected market share increase of 5-7% annually.

- Dominant Application: Land application, driven by armored vehicle modernization and ground force requirements.

- Leading Region: North America, primarily the United States, accounting for an estimated 35% of the global market.

- Key Countries: United States, China, Russia, and European nations with significant defense investments.

- Segmental Dominance Drivers (Land):

- Extensive armored vehicle fleets requiring upgrades.

- Ongoing counter-insurgency and territorial defense operations.

- Government procurement of advanced ground combat systems.

- Technological advancements in stabilization and remote operation.

- Growing Segment: Non-Static weapon mounts (e.g., stabilized turrets, ROWS) are outpacing the growth of static mounts.

- Fastest Growing Mode of Operation: Remotely Operated systems, offering enhanced safety and precision.

Weapon Mounts Market Product Landscape

The Weapon Mounts Market product landscape is characterized by continuous innovation aimed at enhancing precision, survivability, and operational flexibility. Advanced materials like high-strength alloys and composites are being utilized to reduce weight while maintaining structural integrity, crucial for aerial and naval platforms. Integration with sophisticated fire control systems, including AI-driven target recognition and tracking, is a key differentiator. Notable advancements include the development of highly stabilized mounts for reducing platform movement impact on firing accuracy, modular designs for rapid reconfiguration to accommodate different weapon systems, and enhanced protection features against battlefield threats. Unique selling propositions revolve around improved lethality, reduced crew exposure, and seamless integration with networked battlefield management systems.

Key Drivers, Barriers & Challenges in Weapon Mounts Market

Key Drivers:

- Geopolitical Instability: Rising global tensions and regional conflicts necessitate increased defense spending and platform modernization.

- Military Modernization Programs: Nations are actively upgrading their armed forces with advanced weapon systems, including sophisticated mounts.

- Technological Advancements: Innovations in automation, AI, and sensor technology enable more effective and safer weapon deployment.

- Demand for Soldier Safety: The imperative to reduce personnel risk in combat drives the adoption of remotely operated weapon stations (ROWS).

- Emergence of Unmanned Systems: The proliferation of drones and the need for effective counter-UAS solutions are creating new market opportunities for specialized mounts.

Barriers & Challenges:

- High R&D and Production Costs: Developing and manufacturing advanced weapon mounts requires substantial financial investment.

- Stringent Regulatory and Certification Processes: Defense procurement involves lengthy and complex approval procedures.

- Supply Chain Vulnerabilities: Dependence on specialized components and global supply chain disruptions can impact production. The global supply chain disruptions observed during the historical period (2019-2024) led to an estimated 5-10% increase in lead times for critical components and a 3-5% rise in manufacturing costs for several key players.

- Budgetary Constraints: Defense budgets, while increasing in some regions, can still be a limiting factor for widespread adoption of the most advanced systems.

- Interoperability Issues: Ensuring seamless integration of new weapon mounts with existing military platforms can be technically challenging and costly.

Emerging Opportunities in Weapon Mounts Market

Emerging opportunities in the Weapon Mounts Market lie in the burgeoning sector of counter-unmanned aerial systems (C-UAS) where specialized mounts for directed energy weapons and advanced projectile systems are in high demand. The increasing integration of AI and machine learning into weapon systems presents a significant opportunity for developing intelligent mounts capable of autonomous target acquisition and engagement. Furthermore, the growing emphasis on naval modernization and the expansion of naval capabilities in various regions create a substantial market for advanced naval weapon turrets and mounts. The development of lightweight, modular mounts for rapidly deployable systems and special forces operations also represents an untapped market.

Growth Accelerators in the Weapon Mounts Market Industry

Growth accelerators in the Weapon Mounts Market industry are primarily driven by relentless technological innovation, strategic partnerships between defense manufacturers and technology firms, and the sustained global focus on enhancing national security capabilities. The continuous evolution of threats, such as asymmetric warfare and the proliferation of advanced drones, compels militaries to invest in cutting-edge weapon mounting solutions. Furthermore, market expansion strategies, including the penetration of emerging defense markets and the development of cost-effective solutions for smaller nations, will significantly fuel long-term growth. The successful integration of artificial intelligence and advanced sensor fusion into weapon mount systems is a critical accelerator.

Key Players Shaping the Weapon Mounts Market Market

- Leonardo SpA

- AEI Systems Ltd

- Elbit Systems Ltd

- Kongsberg Gruppen ASA

- Military Systems Group Inc

- FN Herstal

- Dillion Aero

- RTX Corporation

- BAE Systems PLC

- Saab AB

Notable Milestones in Weapon Mounts Market Sector

- 2022: Introduction of next-generation remotely operated weapon stations with enhanced AI targeting capabilities by Elbit Systems Ltd.

- 2021: BAE Systems PLC secures a major contract for the upgrade of Abrams tank weapon stabilization systems.

- 2020: Kongsberg Gruppen ASA unveils a new modular weapon mount system designed for integration with unmanned ground vehicles.

- 2019: Leonardo SpA announces advancements in lightweight naval weapon mounts utilizing composite materials.

- 2023: FN Herstal launches a new series of .50 caliber remote weapon stations for enhanced vehicle protection.

In-Depth Weapon Mounts Market Market Outlook

The Weapon Mounts Market is set for sustained growth, propelled by an unyielding demand for advanced defense solutions. Strategic opportunities abound in the rapidly expanding counter-drone defense sector and the integration of AI-powered capabilities for enhanced operational effectiveness. The ongoing modernization of land, air, and naval platforms globally will continue to be a primary growth catalyst. Future market potential will also be shaped by the development of adaptable, modular, and networked weapon systems that can meet the diverse and evolving needs of modern armed forces. Investment in research and development focused on increasing survivability and precision will be crucial for competitive advantage.

Weapon Mounts Market Segmentation

-

1. Type

- 1.1. Static

- 1.2. Non-Static

-

2. Mode of Operation

- 2.1. Manual

- 2.2. Remotely Operated

-

3. Application

- 3.1. Land

- 3.2. Air

- 3.3. Sea

Weapon Mounts Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Weapon Mounts Market Regional Market Share

Geographic Coverage of Weapon Mounts Market

Weapon Mounts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Land Segment is Expected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Weapon Mounts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static

- 5.1.2. Non-Static

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Manual

- 5.2.2. Remotely Operated

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Land

- 5.3.2. Air

- 5.3.3. Sea

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Weapon Mounts Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Static

- 6.1.2. Non-Static

- 6.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 6.2.1. Manual

- 6.2.2. Remotely Operated

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Land

- 6.3.2. Air

- 6.3.3. Sea

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Weapon Mounts Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Static

- 7.1.2. Non-Static

- 7.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 7.2.1. Manual

- 7.2.2. Remotely Operated

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Land

- 7.3.2. Air

- 7.3.3. Sea

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Weapon Mounts Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Static

- 8.1.2. Non-Static

- 8.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 8.2.1. Manual

- 8.2.2. Remotely Operated

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Land

- 8.3.2. Air

- 8.3.3. Sea

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Weapon Mounts Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Static

- 9.1.2. Non-Static

- 9.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 9.2.1. Manual

- 9.2.2. Remotely Operated

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Land

- 9.3.2. Air

- 9.3.3. Sea

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Leonardo SpA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 AEI Systems Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Elbit Systems Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kongsberg Gruppen ASA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Military Systems Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 FN Herstal

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dillion Aero

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 RTX Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 BAE Systems PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Saab AB

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Leonardo SpA

List of Figures

- Figure 1: Global Weapon Mounts Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Weapon Mounts Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Weapon Mounts Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Weapon Mounts Market Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 5: North America Weapon Mounts Market Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 6: North America Weapon Mounts Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Weapon Mounts Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Weapon Mounts Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Weapon Mounts Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Weapon Mounts Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Weapon Mounts Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Weapon Mounts Market Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 13: Europe Weapon Mounts Market Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 14: Europe Weapon Mounts Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Weapon Mounts Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Weapon Mounts Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Weapon Mounts Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Weapon Mounts Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Weapon Mounts Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Weapon Mounts Market Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 21: Asia Pacific Weapon Mounts Market Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 22: Asia Pacific Weapon Mounts Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Weapon Mounts Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Weapon Mounts Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Weapon Mounts Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Weapon Mounts Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Rest of the World Weapon Mounts Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Weapon Mounts Market Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 29: Rest of the World Weapon Mounts Market Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 30: Rest of the World Weapon Mounts Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Rest of the World Weapon Mounts Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World Weapon Mounts Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Weapon Mounts Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Weapon Mounts Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Weapon Mounts Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 3: Global Weapon Mounts Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Weapon Mounts Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Weapon Mounts Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Weapon Mounts Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 7: Global Weapon Mounts Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Weapon Mounts Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Weapon Mounts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Weapon Mounts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Weapon Mounts Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Weapon Mounts Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 13: Global Weapon Mounts Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Weapon Mounts Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Weapon Mounts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Weapon Mounts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Weapon Mounts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Weapon Mounts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Weapon Mounts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Weapon Mounts Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Weapon Mounts Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 22: Global Weapon Mounts Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Weapon Mounts Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Weapon Mounts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Weapon Mounts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Weapon Mounts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Weapon Mounts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Weapon Mounts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Weapon Mounts Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Weapon Mounts Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 31: Global Weapon Mounts Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Weapon Mounts Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Weapon Mounts Market?

The projected CAGR is approximately 6.86%.

2. Which companies are prominent players in the Weapon Mounts Market?

Key companies in the market include Leonardo SpA, AEI Systems Ltd, Elbit Systems Ltd, Kongsberg Gruppen ASA, Military Systems Group Inc, FN Herstal, Dillion Aero, RTX Corporation, BAE Systems PLC, Saab AB.

3. What are the main segments of the Weapon Mounts Market?

The market segments include Type, Mode of Operation, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Land Segment is Expected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Weapon Mounts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Weapon Mounts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Weapon Mounts Market?

To stay informed about further developments, trends, and reports in the Weapon Mounts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence