Key Insights

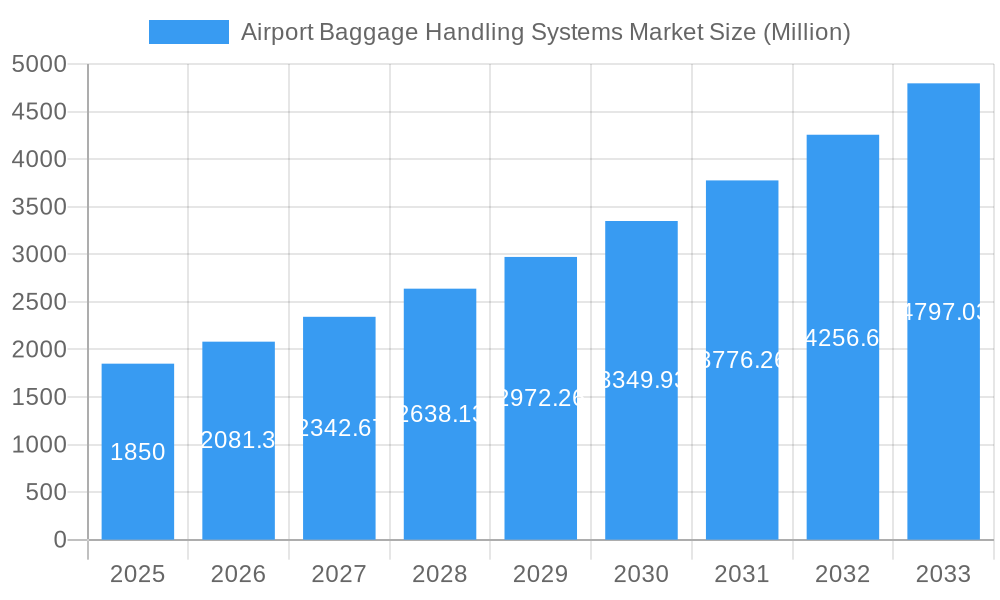

The global Airport Baggage Handling Systems market is experiencing robust growth, projected to reach \$1.85 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.88% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, increasing passenger traffic at airports worldwide necessitates efficient and automated baggage handling solutions to avoid delays and improve passenger experience. Secondly, technological advancements, such as the integration of Artificial Intelligence (AI) and Internet of Things (IoT) devices for real-time tracking and improved baggage management, are driving market innovation and adoption. Furthermore, the growing focus on enhancing airport security and minimizing baggage mishandling incidents is significantly impacting the demand for sophisticated baggage handling systems. Finally, the ongoing expansion and modernization of existing airports, coupled with the construction of new airports globally, further contribute to market growth. The market is segmented by airport capacity, reflecting the varying needs of different sized airports. Larger airports (above 40 million passengers annually) represent a substantial segment, driving demand for high-throughput, advanced systems. Key players like Vanderlande, Siemens, and Daifuku are leveraging their technological expertise and global reach to capitalize on these trends, while smaller, specialized companies target niche segments. Regional variations in growth are expected, with North America and Asia-Pacific leading the market due to significant investments in airport infrastructure and technological advancements.

Airport Baggage Handling Systems Market Market Size (In Billion)

The competitive landscape is characterized by a blend of established multinational corporations and specialized niche players. The competitive intensity is expected to increase as companies strive to differentiate their offerings through technological innovations and service enhancements. Despite this positive outlook, market growth could face some challenges. High initial investment costs associated with implementing and maintaining these complex systems could pose a barrier for smaller airports. Furthermore, potential integration issues between legacy systems and new technologies could lead to delays and increased costs. However, ongoing technological advancements and the increasing importance of efficient baggage handling are anticipated to overcome these limitations, ultimately driving continued market expansion over the forecast period.

Airport Baggage Handling Systems Market Company Market Share

Airport Baggage Handling Systems Market: A Comprehensive Report 2019-2033

This in-depth report provides a comprehensive analysis of the Airport Baggage Handling Systems market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period spans 2019-2024. The market is segmented by airport capacity: Up to 15 million passengers, 15-25 million passengers, 25-40 million passengers, and Above 40 million passengers. This detailed analysis is essential for industry professionals, investors, and stakeholders seeking a clear understanding of this dynamic market. The total market size in 2025 is estimated at xx Million.

Airport Baggage Handling Systems Market Market Dynamics & Structure

The Airport Baggage Handling Systems market exhibits a moderately concentrated structure, with a handful of leading global players dominating a significant portion of the market share. This concentration is a testament to the high barriers to entry, largely driven by substantial capital investment requirements and the intricate nature of system integration. Technological innovation stands as a pivotal catalyst for market evolution, with a pronounced emphasis on the integration of automation, Artificial Intelligence (AI), and Radio-Frequency Identification (RFID) technologies. These advancements are crucial for enhancing efficiency, reducing errors, and improving traceability throughout the baggage handling process. The escalating volume of global air passenger traffic, coupled with the imperative for seamless and rapid baggage transfer, directly fuels the demand for advanced handling solutions. Stringent regulatory frameworks governing aviation security and safety standards exert a profound influence, dictating the design, implementation, and operational protocols of these systems. While direct competitive substitutes are scarce, the market landscape is characterized by continuous efforts to refine and upgrade existing systems rather than outright replacements. End-user demographics are intrinsically linked to airport scale, passenger throughput, and the strategic vision of airport authorities. Mergers and Acquisitions (M&A) activity has been a notable, albeit moderate, feature of the market in recent years. Between 2019 and 2024, approximately **[Insert Number]** deals were recorded, contributing to a shift in market share of roughly **[Insert Percentage]%** among the top 5 players, underscoring the ongoing consolidation and strategic realignments within the industry.

- Market Concentration: Moderately concentrated, with the top 5 players commanding an estimated **[Insert Percentage]%** market share in 2024.

- Technological Innovation: A primary growth engine, with a strong focus on advancing automation, AI-driven insights, and seamless RFID integration for enhanced tracking and sorting.

- Regulatory Frameworks: Play a critical role in shaping system development and ensuring adherence to stringent international safety and security protocols.

- Competitive Substitutes: Limited, with competition primarily revolving around the continuous enhancement and modernization of existing baggage handling infrastructure.

- M&A Activity: Moderate, with around **[Insert Number]** significant merger and acquisition transactions observed between 2019 and 2024.

- Innovation Barriers: Substantial initial capital outlay, the complexities of integrating new technologies with legacy airport systems, and the need for specialized expertise pose significant hurdles.

Airport Baggage Handling Systems Market Growth Trends & Insights

The Airport Baggage Handling Systems market has demonstrated a trajectory of consistent and robust growth throughout the historical period spanning 2019 to 2024. This expansion has been primarily propelled by the sustained and significant increase in global air passenger traffic. The market size experienced a substantial expansion, growing from approximately **[Insert Value]** Million in 2019 to **[Insert Value]** Million in 2024, reflecting a Compound Annual Growth Rate (CAGR) of **[Insert Percentage]%**. Adoption rates for advanced baggage handling systems are on an upward trend, particularly within rapidly expanding airports and those undertaking comprehensive infrastructure modernization initiatives. Emerging technological disruptions, such as the sophisticated integration of AI for predictive analysis and advanced automation for streamlined operations, are fundamentally reshaping baggage handling processes. Furthermore, evolving consumer behavior, characterized by an increasing expectation for faster, more reliable, and frictionless baggage handling experiences, acts as a potent stimulus for market expansion. Projections for the forecast period, from 2025 to 2033, indicate a continued healthy CAGR of approximately **[Insert Percentage]%**, with the market anticipated to reach a substantial **[Insert Value]** Million by 2033. This projected growth is underpinned by the persistent expansion of air travel, ongoing technological advancements, and escalating investments in upgrading airport infrastructure worldwide. The penetration of advanced systems in emerging economies is expected to be a significant contributor to this future market expansion.

Dominant Regions, Countries, or Segments in Airport Baggage Handling Systems Market

The North American region currently holds the largest market share, driven by significant investment in airport infrastructure upgrades and modernization, particularly in large hub airports. Within this region, the segment of airports with capacity exceeding 40 million passengers shows the highest growth potential. Other regions like Europe and Asia-Pacific also exhibit robust growth, fueled by expanding air travel and ongoing infrastructure development. Countries with rapidly developing aviation industries, such as China and India, are experiencing significant market expansion.

- North America: Largest market share due to high investment in airport infrastructure. The "Above 40 million" passenger segment is experiencing the fastest growth.

- Europe: Steady growth, driven by modernization of existing airports and increasing passenger numbers.

- Asia-Pacific: Rapid expansion, fueled by the growth of low-cost carriers and new airport construction.

- Key Drivers: Government initiatives promoting aviation growth, rising disposable incomes, and increasing tourism.

Airport Baggage Handling Systems Market Product Landscape

The market offers a range of baggage handling systems, from traditional conveyor belts to advanced automated systems incorporating RFID technology, AI-powered sorting, and self-service baggage drop-off kiosks. These systems are designed to improve efficiency, reduce delays, and enhance passenger experience. Unique selling propositions often focus on speed, reliability, scalability, and integration with other airport systems. Technological advancements are constantly improving the accuracy, speed, and security of baggage handling, reducing the chances of mishandling and delays.

Key Drivers, Barriers & Challenges in Airport Baggage Handling Systems Market

Key Drivers:

- The unabated surge in global air passenger traffic, creating constant demand for efficient handling solutions.

- The escalating requirement for enhanced speed, accuracy, and reliability in baggage processing to improve passenger satisfaction.

- Continuous technological advancements, particularly in automation, AI-powered analytics, and IoT for real-time tracking, driving innovation and efficiency.

- Supportive government initiatives and substantial investments in modernizing and expanding airport infrastructure across key regions.

- The increasing adoption of smart airport concepts and the focus on creating a seamless passenger journey, including baggage handling.

Key Challenges and Restraints:

- The substantial initial capital investment required for the deployment of state-of-the-art, automated baggage handling systems.

- The inherent complexity involved in integrating advanced systems with existing, often legacy, airport infrastructure and IT systems.

- Growing cybersecurity concerns, including the protection of sensitive passenger data and the vulnerability of interconnected systems to potential breaches.

- The potential for disruptions in global supply chains, impacting the availability and timely delivery of critical components, which has historically led to delays in project completions. These disruptions have resulted in an estimated **[Insert Percentage]%** of project delays in **[Insert Percentage]%** of cases during the historical period.

- Ensuring interoperability and standardization across different systems and vendor solutions within a single airport environment.

Emerging Opportunities in Airport Baggage Handling Systems Market

- The integration of advanced data analytics and predictive maintenance capabilities to optimize system performance, minimize downtime, and forecast potential issues proactively.

- The development and implementation of more sustainable and energy-efficient baggage handling solutions, aligning with global environmental initiatives.

- Significant growth opportunities in emerging markets with rapidly expanding aviation sectors and a rising need for modernized airport infrastructure.

- The increasing demand for passenger-centric solutions such as self-service baggage drop-off kiosks and advanced smart baggage tracking technologies for enhanced convenience and visibility.

- The potential for leveraging blockchain technology for secure and transparent baggage tracking and provenance.

- The development of modular and scalable systems that can adapt to evolving airport needs and passenger volumes.

Growth Accelerators in the Airport Baggage Handling Systems Market Industry

Long-term growth will be fueled by continuous technological innovation, strategic partnerships between baggage handling system providers and airports, and market expansion into new geographical regions. The adoption of AI and machine learning in baggage handling will further optimize processes and improve efficiency. Collaborative efforts between technology providers and airport operators will play a vital role in driving market growth.

Key Players Shaping the Airport Baggage Handling Systems Market Market

- Ansir Systems

- Alstef Group

- CIMC TianDa Holdings Co Ltd

- BEUMER Group

- Vanderlande Industries Holding BV

- Siemens AG

- G&S Airport Conveyer

- Daifuku Co Ltd

- SITA

- Leonardo Sp

Notable Milestones in Airport Baggage Handling Systems Market Sector

- 2021-Q4: Vanderlande launched its next-generation baggage handling system incorporating AI-powered predictive maintenance.

- 2022-Q2: Alstef Group acquired a smaller baggage handling company, expanding its market share in Europe.

- 2023-Q1: Siemens AG unveiled a new RFID-based baggage tracking system, improving accuracy and speed.

- 2024-Q3: Significant investment in airport infrastructure in the Asia-Pacific region resulted in new orders for baggage handling systems.

In-Depth Airport Baggage Handling Systems Market Market Outlook

The outlook for the Airport Baggage Handling Systems market is exceptionally promising, propelled by the sustained and projected growth in global air travel, an ever-increasing demand for highly efficient and dependable baggage handling processes, and the continuous wave of technological advancements. Strategic alliances, significant investments in research and development (R&D) for innovative solutions, and aggressive expansion into burgeoning emerging markets are poised to redefine the competitive landscape. The market's upward trajectory is anticipated to be further bolstered by the rising imperative to enhance the overall passenger experience and optimize baggage flow within increasingly congested airport environments. Significant opportunities are emerging for forward-thinking companies that can provide innovative solutions addressing critical areas such as sustainability, advanced automation, sophisticated data analytics, and enhanced passenger convenience. The drive towards fully integrated, intelligent, and resilient baggage handling systems will be a defining characteristic of the market's future evolution.

Airport Baggage Handling Systems Market Segmentation

-

1. Airport Capacity

- 1.1. Up to 15 million

- 1.2. 15-25 million

- 1.3. 25-40 million

- 1.4. Above 40 million

Airport Baggage Handling Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Kuwait

- 5.4. Rest of Middle East and Africa

Airport Baggage Handling Systems Market Regional Market Share

Geographic Coverage of Airport Baggage Handling Systems Market

Airport Baggage Handling Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Above 40 million Segment Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 5.1.1. Up to 15 million

- 5.1.2. 15-25 million

- 5.1.3. 25-40 million

- 5.1.4. Above 40 million

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6. North America Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6.1.1. Up to 15 million

- 6.1.2. 15-25 million

- 6.1.3. 25-40 million

- 6.1.4. Above 40 million

- 6.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 7. Europe Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 7.1.1. Up to 15 million

- 7.1.2. 15-25 million

- 7.1.3. 25-40 million

- 7.1.4. Above 40 million

- 7.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 8. Asia Pacific Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 8.1.1. Up to 15 million

- 8.1.2. 15-25 million

- 8.1.3. 25-40 million

- 8.1.4. Above 40 million

- 8.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 9. Latin America Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 9.1.1. Up to 15 million

- 9.1.2. 15-25 million

- 9.1.3. 25-40 million

- 9.1.4. Above 40 million

- 9.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 10. Middle East and Africa Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 10.1.1. Up to 15 million

- 10.1.2. 15-25 million

- 10.1.3. 25-40 million

- 10.1.4. Above 40 million

- 10.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ansir Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alstef Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CIMC TianDa Holdings Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BEUMER Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vanderlande Industries Holding BV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 G&S Airport Conveyer

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Daifuku Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SITA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Leonardo Sp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ansir Systems

List of Figures

- Figure 1: Global Airport Baggage Handling Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Airport Baggage Handling Systems Market Revenue (Million), by Airport Capacity 2025 & 2033

- Figure 3: North America Airport Baggage Handling Systems Market Revenue Share (%), by Airport Capacity 2025 & 2033

- Figure 4: North America Airport Baggage Handling Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Airport Baggage Handling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Airport Baggage Handling Systems Market Revenue (Million), by Airport Capacity 2025 & 2033

- Figure 7: Europe Airport Baggage Handling Systems Market Revenue Share (%), by Airport Capacity 2025 & 2033

- Figure 8: Europe Airport Baggage Handling Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Airport Baggage Handling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Airport Baggage Handling Systems Market Revenue (Million), by Airport Capacity 2025 & 2033

- Figure 11: Asia Pacific Airport Baggage Handling Systems Market Revenue Share (%), by Airport Capacity 2025 & 2033

- Figure 12: Asia Pacific Airport Baggage Handling Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Airport Baggage Handling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Airport Baggage Handling Systems Market Revenue (Million), by Airport Capacity 2025 & 2033

- Figure 15: Latin America Airport Baggage Handling Systems Market Revenue Share (%), by Airport Capacity 2025 & 2033

- Figure 16: Latin America Airport Baggage Handling Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Airport Baggage Handling Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Airport Baggage Handling Systems Market Revenue (Million), by Airport Capacity 2025 & 2033

- Figure 19: Middle East and Africa Airport Baggage Handling Systems Market Revenue Share (%), by Airport Capacity 2025 & 2033

- Figure 20: Middle East and Africa Airport Baggage Handling Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Airport Baggage Handling Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 2: Global Airport Baggage Handling Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 4: Global Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 8: Global Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: France Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Germany Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 14: Global Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: China Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Asia Pacific Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 21: Global Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Latin America Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 25: Global Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Saudi Arabia Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: United Arab Emirates Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Kuwait Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Middle East and Africa Airport Baggage Handling Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Baggage Handling Systems Market?

The projected CAGR is approximately 12.88%.

2. Which companies are prominent players in the Airport Baggage Handling Systems Market?

Key companies in the market include Ansir Systems, Alstef Group, CIMC TianDa Holdings Co Ltd, BEUMER Group, Vanderlande Industries Holding BV, Siemens AG, G&S Airport Conveyer, Daifuku Co Ltd, SITA, Leonardo Sp.

3. What are the main segments of the Airport Baggage Handling Systems Market?

The market segments include Airport Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.85 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Above 40 million Segment Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Baggage Handling Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Baggage Handling Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Baggage Handling Systems Market?

To stay informed about further developments, trends, and reports in the Airport Baggage Handling Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence