Key Insights

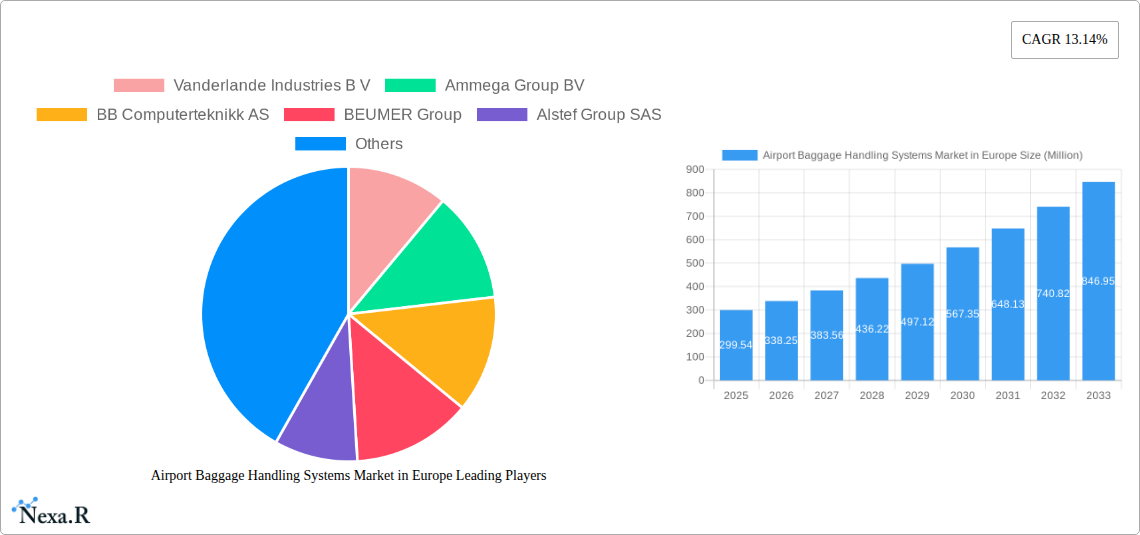

The European airport baggage handling systems market is experiencing robust growth, projected to reach €299.54 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 13.14% from 2025 to 2033. This expansion is driven primarily by increasing passenger traffic at major European airports, necessitating upgrades and expansions of existing baggage handling infrastructure. The rising adoption of automated baggage handling systems, aimed at improving efficiency, reducing delays, and enhancing passenger experience, is a significant contributing factor. Furthermore, the trend towards incorporating advanced technologies like AI and machine learning for real-time baggage tracking and predictive maintenance is fueling market growth. Segmentation reveals a strong demand across various airport capacities, with significant investment anticipated in systems for airports handling over 40 million passengers annually. Key players like Vanderlande Industries B.V., Siemens AG, and Daifuku Co. Ltd. are actively shaping the market through innovation and strategic partnerships. Germany, France, and the UK represent the largest national markets within Europe, reflecting their high passenger volumes and existing airport infrastructure. However, growth is expected across all major European countries, driven by ongoing airport modernization initiatives.

Airport Baggage Handling Systems Market in Europe Market Size (In Million)

The market's growth is, however, subject to certain restraints. High initial investment costs for advanced baggage handling systems can be a barrier for smaller airports. Furthermore, integrating new systems with existing infrastructure can pose technological challenges. Nonetheless, the long-term benefits of improved efficiency, enhanced security, and reduced operational costs are expected to outweigh these challenges, ensuring sustained market expansion. The increasing focus on sustainability and energy efficiency in airport operations is also influencing the market, with a growing demand for eco-friendly baggage handling solutions. This trend will likely accelerate in the coming years, shaping product development and innovation within the sector. The projected market size for 2033, based on the provided CAGR, points towards a substantial increase in market value, solidifying the long-term growth prospects of the European airport baggage handling systems market.

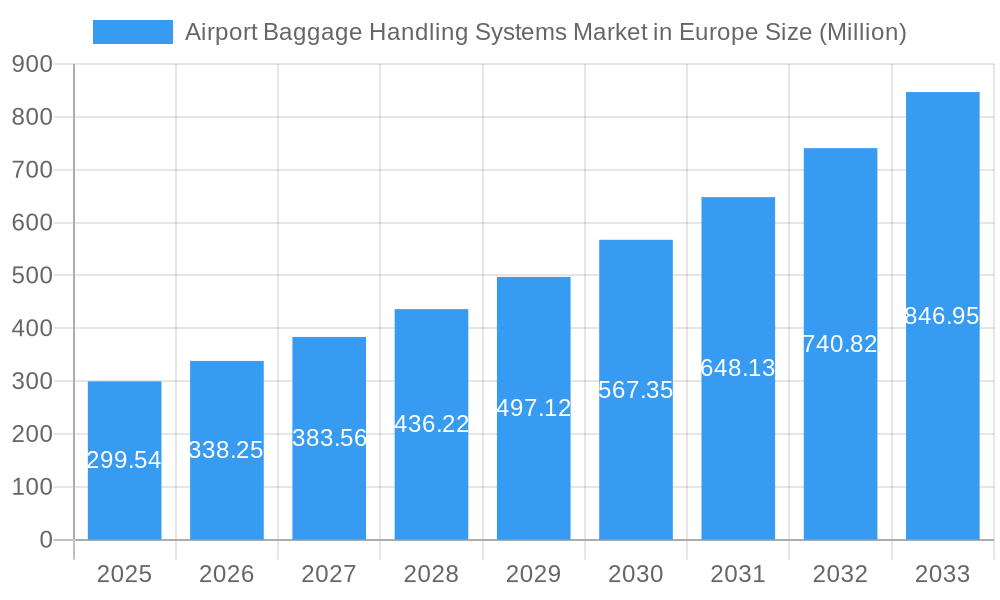

Airport Baggage Handling Systems Market in Europe Company Market Share

Airport Baggage Handling Systems Market in Europe: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Airport Baggage Handling Systems market in Europe, covering market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The report segments the market by airport capacity (Up to 15 million, 15-25 million, 25-40 million, Above 40 million) and offers granular insights into this crucial segment of the broader European aviation infrastructure market. The study period spans 2019-2033, with 2025 serving as the base and estimated year.

Airport Baggage Handling Systems Market in Europe Market Dynamics & Structure

This section delves into the intricate dynamics shaping the European Airport Baggage Handling Systems market. We analyze market concentration, revealing the market share held by key players and identifying any emerging trends in consolidation. Technological innovation is examined, pinpointing advancements such as AI-powered baggage sorting and automated guided vehicles (AGVs), and their impact on efficiency and cost-effectiveness. The regulatory landscape, encompassing EU aviation safety standards and environmental regulations, is thoroughly assessed. The report also explores competitive substitutes, including manual baggage handling, and analyzes their impact on market growth. Finally, we analyze end-user demographics (airport size, passenger volume), and M&A activity within the sector, providing quantitative data on deal volumes and qualitative insights into the drivers and barriers impacting such transactions.

- Market Concentration: The market exhibits a moderately concentrated structure with a xx% market share held by the top 5 players in 2025.

- Technological Innovation: Advancements in AI, robotics, and IoT are driving the adoption of advanced baggage handling systems.

- Regulatory Framework: Strict adherence to EASA standards and increasing focus on sustainability are key regulatory factors.

- M&A Activity: A total of xx M&A deals were recorded between 2019 and 2024, indicating a consolidating market. The average deal value was approximately xx Million.

- Innovation Barriers: High initial investment costs and the need for specialized expertise pose significant barriers to entry.

Airport Baggage Handling Systems Market in Europe Growth Trends & Insights

This section presents a detailed analysis of the market's growth trajectory, leveraging both quantitative and qualitative data. We examine the historical market size (2019-2024), providing insights into the compound annual growth rate (CAGR) and identifying factors contributing to the market's evolution. The analysis extends to future projections (2025-2033), forecasting market size and adoption rates for different baggage handling technologies. Technological disruptions, including the introduction of advanced automation and improved data analytics, are examined, along with their impact on market dynamics. Consumer behavior shifts, such as increasing passenger expectations for efficient baggage handling, are also considered. The influence of macroeconomic factors and the impact of industry-specific events on market growth are also discussed.

- Market Size (2025): xx Million

- CAGR (2025-2033): xx%

- Market Penetration: xx% of European airports are estimated to utilize advanced baggage handling systems by 2033.

Dominant Regions, Countries, or Segments in Airport Baggage Handling Systems Market in Europe

This section identifies the leading regions, countries, and segments within the European Airport Baggage Handling Systems market. We pinpoint the dominant airport capacity segment driving market growth, providing a detailed analysis of market share and growth potential for each category (Up to 15 million, 15-25 million, 25-40 million, Above 40 million). Key drivers for growth in these segments, including economic policies, infrastructure investments, and passenger traffic trends, are highlighted.

- Dominant Segment: The "25-40 million" passenger capacity airport segment is projected to be the fastest-growing segment between 2025 and 2033. This robust growth is attributed to substantial investments in airport infrastructure upgrades and expansion plans across major European cities, driven by increasing passenger volumes and the need for enhanced operational efficiency. Airports in this capacity range are actively seeking advanced solutions to manage growing throughput and improve the passenger experience.

- Key Drivers: The market is significantly propelled by a sustained increase in air passenger traffic, a direct consequence of economic recovery and a rebound in travel demand. Furthermore, governments across Europe are demonstrating a strong commitment to modernizing airport infrastructure through strategic investments. This includes the deployment of cutting-edge technologies and the expansion of existing facilities. The rising demand for highly automated and intelligent baggage handling solutions, aimed at reducing errors, improving speed, and enhancing security, is also a critical growth factor.

- Regional Dominance: Germany and the United Kingdom are anticipated to maintain their positions as the dominant markets for airport baggage handling systems in Europe. This sustained leadership is underpinned by their extensive airport networks, consistently high passenger volumes, and significant, ongoing investments in aviation infrastructure development and technological advancements.

Airport Baggage Handling Systems Market in Europe Product Landscape

The European Airport Baggage Handling Systems market features a diverse range of products, including automated sorting systems, conveyor belts, baggage screening systems, and baggage tracking solutions. Innovation is evident in the development of higher-capacity systems, improved baggage tracking technologies, and the integration of artificial intelligence to enhance efficiency and security. The unique selling propositions of different products are analyzed, and advancements in areas such as automation, data analytics, and improved security features are highlighted, along with their implications for efficiency and security.

Key Drivers, Barriers & Challenges in Airport Baggage Handling Systems Market in Europe

This section outlines the key factors driving market growth and the challenges hindering its expansion. Drivers include increasing passenger numbers, the need for improved baggage handling efficiency, and technological advancements. Challenges include high initial investment costs, the complexity of system integration, and the need for specialized maintenance expertise. Supply chain disruptions, impacting the availability of components, add further complexity. Regulatory hurdles, encompassing compliance requirements, can also impede market growth. Finally, intense competition from established and new market entrants presents a continuous challenge.

- Key Drivers: Rising air passenger traffic, demand for efficient baggage handling, and technological innovations.

- Key Challenges: High capital expenditure, complex system integration, skilled labor shortages, and supply chain uncertainties.

Emerging Opportunities in Airport Baggage Handling Systems Market in Europe

Emerging opportunities within the European Airport Baggage Handling Systems market are multifaceted, extending beyond large hubs to include untapped potential in smaller airports seeking modernization. A significant driver of innovation is the integration of advanced technologies such as Artificial Intelligence (AI) for predictive maintenance and route optimization, and the Internet of Things (IoT) for real-time tracking and enhanced data analysis. Changing consumer preferences for a seamless and stress-free baggage journey also present opportunities for providers to develop user-centric solutions. Furthermore, the growing emphasis on sustainability is spurring the development of more energy-efficient and environmentally friendly baggage handling systems, aligning with broader European green initiatives. The expansion of low-cost carriers and their continuous demand for highly efficient, cost-effective, and rapid baggage processing operations also opens up new avenues for market growth and technological adoption.

Growth Accelerators in the Airport Baggage Handling Systems Market in Europe Industry

The European Airport Baggage Handling Systems market is poised for sustained long-term growth, propelled by several key accelerators. Technological breakthroughs, particularly in automation, robotics, and AI, are revolutionizing the efficiency and capabilities of these systems, enabling higher throughput and reduced operational costs. Strategic partnerships and collaborations between established baggage handling system providers and airports are crucial for developing and implementing tailored solutions. Expansion strategies focusing on emerging aviation markets within Europe, including Eastern and Southern European countries, represent significant growth potential. Moreover, government incentives designed to promote airport infrastructure upgrades, coupled with a strong global push towards sustainability and environmental responsibility in aviation, are further fueling market expansion and the adoption of innovative, eco-friendly technologies.

Key Players Shaping the Airport Baggage Handling Systems Market in Europe Market

- Vanderlande Industries B V

- Ammega Group BV

- BB Computerteknikk AS

- BEUMER Group

- Alstef Group SAS

- Siemens AG

- Lift All A

- Daifuku Co Ltd

- SITA

- PSI Logistics GmbH

Notable Milestones in Airport Baggage Handling Systems Market in Europe Sector

- March 2023: Alstef Group further solidified its market presence by securing a significant contract valued at approximately USD 11.06 million for the implementation of a new, state-of-the-art baggage handling system at Sofia Airport Terminal 2. This strategic win underscores the company's growing influence and the demand for advanced solutions in the region.

- December 2022: Demonstrating a commitment to stringent safety and operational standards, Alstef Group successfully upgraded Strasbourg Airport's baggage handling system to comply with the demanding EASA Standard 3.1. This milestone highlights the industry's continuous focus on meeting and exceeding regulatory requirements and enhancing overall system reliability and security.

In-Depth Airport Baggage Handling Systems Market in Europe Market Outlook

The future of the European Airport Baggage Handling Systems market is promising, driven by continued investment in airport infrastructure, technological innovation, and the increasing demand for efficient and reliable baggage handling solutions. Strategic partnerships, mergers, and acquisitions will further shape the market landscape. The adoption of sustainable and environmentally friendly technologies will also play a key role in future growth. The focus on improving passenger experience through enhanced baggage tracking and automated systems will drive further market expansion.

Airport Baggage Handling Systems Market in Europe Segmentation

-

1. Airport Capacity

- 1.1. Up to 15 million

- 1.2. 15 - 25 million

- 1.3. 25 - 40 million

- 1.4. Above 40 Million

Airport Baggage Handling Systems Market in Europe Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Rest of Europe

Airport Baggage Handling Systems Market in Europe Regional Market Share

Geographic Coverage of Airport Baggage Handling Systems Market in Europe

Airport Baggage Handling Systems Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Above 40 Million Segment is Anticipated to Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Airport Baggage Handling Systems Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 5.1.1. Up to 15 million

- 5.1.2. 15 - 25 million

- 5.1.3. 25 - 40 million

- 5.1.4. Above 40 Million

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vanderlande Industries B V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ammega Group BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BB Computerteknikk AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BEUMER Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alstef Group SAS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lift All A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daifuku Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SITA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PSI Logistics GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vanderlande Industries B V

List of Figures

- Figure 1: Airport Baggage Handling Systems Market in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Airport Baggage Handling Systems Market in Europe Share (%) by Company 2025

List of Tables

- Table 1: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 2: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 4: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Europe Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Baggage Handling Systems Market in Europe?

The projected CAGR is approximately 13.14%.

2. Which companies are prominent players in the Airport Baggage Handling Systems Market in Europe?

Key companies in the market include Vanderlande Industries B V, Ammega Group BV, BB Computerteknikk AS, BEUMER Group, Alstef Group SAS, Siemens AG, Lift All A, Daifuku Co Ltd, SITA, PSI Logistics GmbH.

3. What are the main segments of the Airport Baggage Handling Systems Market in Europe?

The market segments include Airport Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 299.54 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Above 40 Million Segment is Anticipated to Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Alstef Group, an automated airport solutions provider in France, signed a USD 11.06 million contract to supply a new baggage handling system for Sofia Airport's Terminal 2. Under the contract, the company will supply, install, and maintain the baggage handling solution with a capacity of up to 2,400 bags per hour.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Baggage Handling Systems Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Baggage Handling Systems Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Baggage Handling Systems Market in Europe?

To stay informed about further developments, trends, and reports in the Airport Baggage Handling Systems Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence