Key Insights

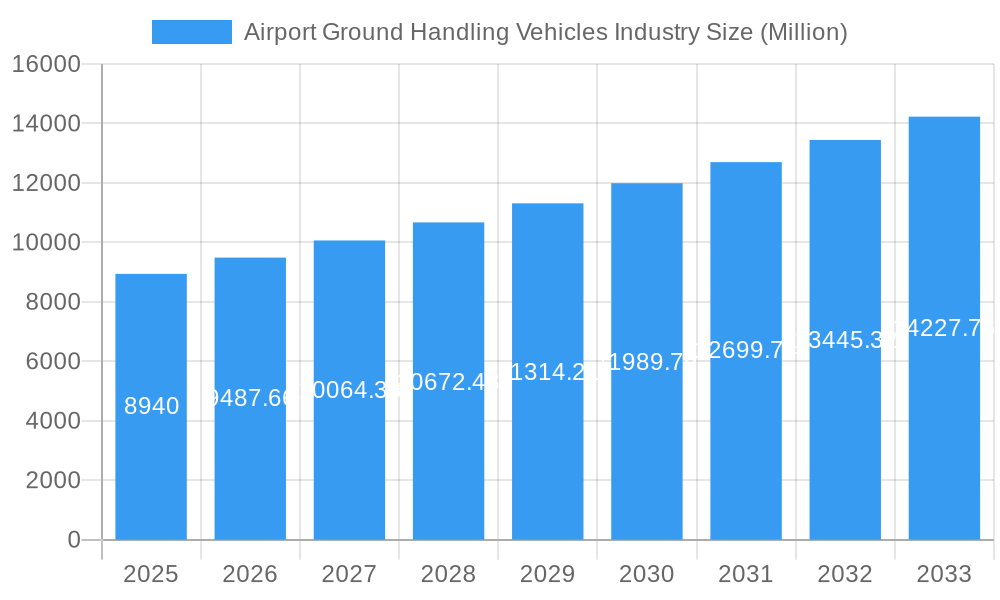

The Airport Ground Handling Vehicles (GSHV) market, valued at $8.94 billion in 2025, is projected to experience robust growth, driven by increasing air passenger traffic and the ongoing expansion of airport infrastructure globally. A compound annual growth rate (CAGR) of 5.99% is anticipated from 2025 to 2033, indicating a significant market expansion. Key growth drivers include the rising demand for efficient ground handling operations to reduce turnaround times and improve passenger experience. Automation and technological advancements, such as the integration of electric and hybrid power sources in ground support equipment, are further fueling market expansion. The adoption of these technologies is not only enhancing operational efficiency but also contributing to environmental sustainability by reducing carbon emissions. The market segmentation reveals a diverse landscape, with refuelers, tugs and tractors, and passenger buses comprising significant market shares. Electric power sources are gaining traction, driven by environmental concerns and government regulations promoting sustainable aviation practices. However, the high initial investment costs associated with electric and hybrid vehicles and potential infrastructural limitations in some regions could act as market restraints. Regional variations in market growth are expected, with North America and Europe leading the market initially, followed by a significant rise in demand from Asia-Pacific regions due to rapid airport development and increasing air travel.

Airport Ground Handling Vehicles Industry Market Size (In Billion)

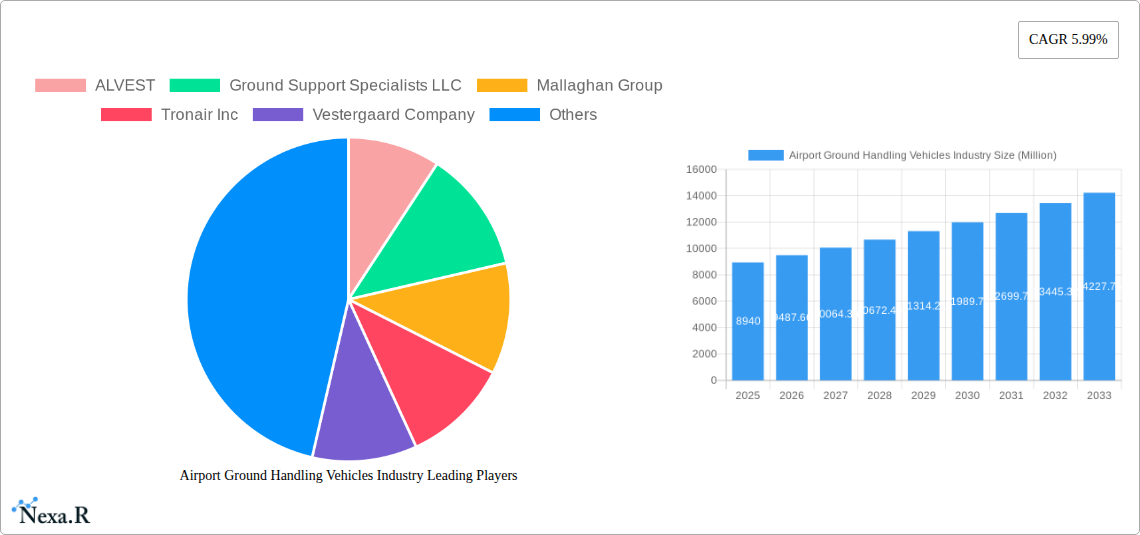

The competitive landscape is marked by a mix of established players and specialized niche companies. Leading companies such as ALVEST, JBT Corporation, and Textron Ground Support Equipment are leveraging their experience and technological capabilities to cater to the growing demand. The market's future trajectory suggests a continued shift towards sustainable and technologically advanced ground handling vehicles, driven by the need for improved efficiency and environmental responsibility. This trend is expected to create new opportunities for innovative companies specializing in electric and hybrid power solutions and advanced automation technologies. The increasing focus on safety and security at airports further necessitates the adoption of sophisticated GSHVs, underpinning consistent market growth through the forecast period.

Airport Ground Handling Vehicles Industry Company Market Share

Airport Ground Handling Vehicles Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Airport Ground Handling Vehicles (AGHV) industry, encompassing market dynamics, growth trends, regional insights, and competitive landscapes. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The total market size is projected to reach xx Million by 2033. This report is an essential resource for industry professionals, investors, and stakeholders seeking to understand and navigate this dynamic market. Parent market (Airport Services) and child markets (specific vehicle types) are analyzed for a complete understanding.

Airport Ground Handling Vehicles Industry Market Dynamics & Structure

The Airport Ground Handling Vehicles (AGHV) market is characterized by a **moderately concentrated landscape**, where a few prominent players command substantial market shares, indicating an established competitive environment. A primary **catalyst for market evolution is technological innovation**, spurred by the imperative for enhanced operational efficiency, increased safety protocols, and a steadfast commitment to environmental sustainability. Furthermore, **stringent regulatory frameworks** governing safety standards and emissions profoundly shape market dynamics, influencing product development, adoption cycles, and the overall competitive playing field. The emergence of **competitive substitutes**, such as advanced alternative fueling solutions and increasingly sophisticated autonomous systems, signals a dynamic shift in how ground handling operations are conceptualized and executed. Demand is intricately linked to **end-user demographics**, predominantly airports of varying scales and the diverse needs of airline operators. **Mergers and acquisitions (M&A) activity** remains a strategic tool for key players, focused on consolidating market presence, expanding comprehensive product portfolios, and broadening geographic reach to capitalize on emerging opportunities.

- Market Concentration: The market is moderately concentrated, with the top 5 players projected to hold approximately 55-65% of the global market share in 2025.

- Technological Innovation: A significant focus is placed on the development and integration of electric and hybrid power sources, advanced automation for enhanced efficiency and safety, and cutting-edge safety features that minimize human error and improve operational reliability.

- Regulatory Framework: Increasingly stringent safety and emission regulations are acting as a powerful influence on product development lifecycles and the rate of adoption for new technologies, pushing manufacturers towards greener and safer solutions.

- Competitive Substitutes: The advent of fully autonomous vehicles and the widespread adoption of alternative fuel sources are emerging as significant potential disruptors and competitive forces within the market.

- M&A Activity: Approximately 8-12 significant M&A deals were recorded between 2019-2024, with an estimated average deal value of $50-80 Million. This trend of strategic consolidation and expansion is anticipated to persist.

- Innovation Barriers: Key challenges include the substantial initial investment costs associated with adopting new technologies and the complexities of seamless integration with existing, often legacy, airport infrastructure.

Airport Ground Handling Vehicles Industry Growth Trends & Insights

The Airport Ground Handling Vehicles (AGHV) market demonstrated **robust and consistent growth** throughout the historical period spanning from 2019 to 2024. This upward trajectory was primarily fueled by the persistent increase in global air passenger traffic and the ambitious airport expansion and modernization projects undertaken worldwide. In 2024, the market size was estimated to be approximately $8.5 Billion. While the COVID-19 pandemic presented a temporary setback in 2020-2021, a strong recovery is well underway, indicating resilience and pent-up demand. **Technological disruptions**, particularly the rapid introduction and refinement of electric and autonomous AGHVs, are significantly accelerating the pace of market transformation, ushering in an era of smarter and more sustainable ground operations. Shifting consumer preferences and a growing global consciousness towards environmental responsibility are profoundly influencing demand for **eco-friendly and sustainable vehicle options**. Projections indicate a healthy Compound Annual Growth Rate (CAGR) of **7.5-8.5%** during the forecast period (2025-2033), with the market expected to reach a penetration of approximately **40-45%** by 2033. The adoption rate of electric AGHVs is poised for substantial acceleration, driven by heightened environmental awareness, supportive government incentives, and decreasing battery costs.

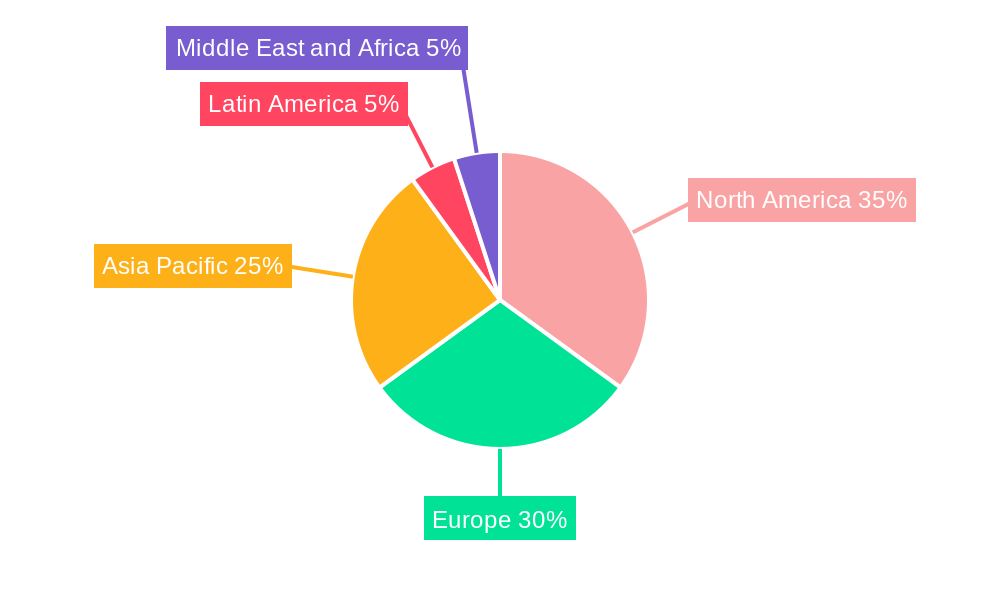

Dominant Regions, Countries, or Segments in Airport Ground Handling Vehicles Industry

Currently, **North America** stands as the leading market for AGHVs, a position attributed to its highly developed aviation sector and substantial, ongoing investments in airport infrastructure and upgrades. Within this dominant region, the **United States** spearheads market activity, owing to its extensive network of major international airports and consistently high air passenger volumes. The **European Union** represents another critically important market, propelled by a strong, coordinated push towards sustainable transportation solutions and comprehensive, forward-thinking regulatory frameworks that encourage environmental responsibility. Examining the vehicle segments, **Tugs and Tractors** command the largest market share, followed closely by **Refuelers** and **Passenger Buses**, reflecting their essential operational roles. Looking ahead, the **Electric power source segment** is projected to experience the most significant growth, outpacing non-electric and hybrid alternatives, driven by a confluence of environmental imperatives and long-term operational cost savings.

- Key Drivers in North America: A robust and mature aviation industry, substantial investments in large-scale airport infrastructure development, and strong government support for the adoption of sustainable and advanced technologies.

- Key Drivers in Europe: A pronounced and increasing focus on the transition to sustainable transportation modes and the implementation of stringent emission reduction regulations across the region.

- Dominant Segments: Tugs and Tractors currently hold a dominant market share of approximately 35-40% in 2025, followed by Refuelers at around 20-25% and Passenger Buses at approximately 15-20%.

- Power Source Trends: The electric power source segment is exhibiting the highest growth potential, driven by escalating environmental concerns among stakeholders and the anticipated long-term reduction in operational and maintenance costs.

Airport Ground Handling Vehicles Industry Product Landscape

The AGHV market features a diverse range of products, including refuelers, tugs and tractors, passenger buses, de-icing vehicles, and ground power units. Recent innovations focus on improving efficiency, safety, and sustainability. Electric and hybrid models are gaining traction, offering reduced emissions and operational cost savings. Autonomous features are being integrated into some vehicles, promising increased productivity and safety. Key selling propositions include reduced fuel consumption, improved maneuverability, and enhanced safety features.

Key Drivers, Barriers & Challenges in Airport Ground Handling Vehicles Industry

Key Drivers: The sustained growth in global air passenger traffic, coupled with ongoing airport expansion and modernization projects, continues to be a primary driver. Increasingly stringent emission regulations are compelling airlines and airport authorities to adopt greener solutions. The burgeoning demand for sustainable and environmentally friendly operations, alongside rapid technological advancements in vehicle design and efficient power sources, further bolsters market expansion.

Challenges: A significant barrier to entry and adoption is the **high initial investment cost** associated with acquiring advanced, technologically innovative vehicles. Integrating these new systems seamlessly with existing airport infrastructure often presents complex technical challenges. Furthermore, potential supply chain disruptions for critical components and intense competition among both established and emerging players can impact timelines and pricing. The confluence of these challenges can lead to project delays, increased operational expenditures, and potentially reduced profitability for companies that fail to adapt strategically.

Emerging Opportunities in Airport Ground Handling Vehicles Industry

The AGHV market is ripe with opportunities for innovation and expansion. The development and widespread adoption of **autonomous AGHVs** present a significant avenue for enhanced operational efficiency and reduced labor costs. Expanding into **emerging markets** with rapidly growing aviation sectors and developing airport infrastructure offers substantial growth potential. Furthermore, the increasing demand for integrated solutions has created a strong opportunity to offer comprehensive service packages, encompassing not only the sale of vehicles but also their ongoing maintenance, repair, and operational support. The escalating global focus on sustainability and the corresponding surge in demand for electric and hybrid models present a clear and lucrative opportunity for manufacturers to capitalize on this rapidly expanding and environmentally conscious market segment.

Growth Accelerators in the Airport Ground Handling Vehicles Industry Industry

Technological advancements, particularly in electric and hybrid power systems and autonomous driving capabilities, are significant growth accelerators. Strategic partnerships between AGHV manufacturers and airport operators are also contributing to market expansion. The focus on sustainable aviation is a crucial catalyst for long-term growth.

Key Players Shaping the Airport Ground Handling Vehicles Industry Market

- ALVEST

- Ground Support Specialists LLC

- Mallaghan Group

- Tronair Inc

- Vestergaard Company

- TIPS d o o

- JBT Corporation

- MULAG

- Textron Ground Support Equipment Inc (Textron Inc)

- COBUS Industries Gmb

Notable Milestones in Airport Ground Handling Vehicles Industry Sector

- 2021: JBT Corporation launched a new line of electric ground support equipment.

- 2022: Several major airport operators announced commitments to transition to electric AGHV fleets.

- 2023: A significant merger took place between two leading AGHV manufacturers. (Specific details of the merger would be provided in the full report)

In-Depth Airport Ground Handling Vehicles Industry Market Outlook

The AGHV market is poised for continued growth, driven by increasing air travel demand and a shift towards sustainable operations. Strategic opportunities exist for companies that can leverage technological advancements to offer innovative and cost-effective solutions to airport operators. The long-term outlook is positive, with significant potential for market expansion in emerging economies and continued innovation in vehicle technology.

Airport Ground Handling Vehicles Industry Segmentation

-

1. Type

- 1.1. Refuelers

- 1.2. Tugs and Tractors

- 1.3. Passenger Buses

- 1.4. De-icing Vehicles

- 1.5. Ground Power Units

- 1.6. Others

-

2. Power Source

- 2.1. Electric

- 2.2. Non-Electric

- 2.3. Hybrid

Airport Ground Handling Vehicles Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Qatar

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Airport Ground Handling Vehicles Industry Regional Market Share

Geographic Coverage of Airport Ground Handling Vehicles Industry

Airport Ground Handling Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Tugs and Tractor Segment is expected to Occupy the Largest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airport Ground Handling Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Refuelers

- 5.1.2. Tugs and Tractors

- 5.1.3. Passenger Buses

- 5.1.4. De-icing Vehicles

- 5.1.5. Ground Power Units

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Power Source

- 5.2.1. Electric

- 5.2.2. Non-Electric

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Airport Ground Handling Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Refuelers

- 6.1.2. Tugs and Tractors

- 6.1.3. Passenger Buses

- 6.1.4. De-icing Vehicles

- 6.1.5. Ground Power Units

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Power Source

- 6.2.1. Electric

- 6.2.2. Non-Electric

- 6.2.3. Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Airport Ground Handling Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Refuelers

- 7.1.2. Tugs and Tractors

- 7.1.3. Passenger Buses

- 7.1.4. De-icing Vehicles

- 7.1.5. Ground Power Units

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Power Source

- 7.2.1. Electric

- 7.2.2. Non-Electric

- 7.2.3. Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Airport Ground Handling Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Refuelers

- 8.1.2. Tugs and Tractors

- 8.1.3. Passenger Buses

- 8.1.4. De-icing Vehicles

- 8.1.5. Ground Power Units

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Power Source

- 8.2.1. Electric

- 8.2.2. Non-Electric

- 8.2.3. Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Airport Ground Handling Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Refuelers

- 9.1.2. Tugs and Tractors

- 9.1.3. Passenger Buses

- 9.1.4. De-icing Vehicles

- 9.1.5. Ground Power Units

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Power Source

- 9.2.1. Electric

- 9.2.2. Non-Electric

- 9.2.3. Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Airport Ground Handling Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Refuelers

- 10.1.2. Tugs and Tractors

- 10.1.3. Passenger Buses

- 10.1.4. De-icing Vehicles

- 10.1.5. Ground Power Units

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Power Source

- 10.2.1. Electric

- 10.2.2. Non-Electric

- 10.2.3. Hybrid

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ALVEST

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ground Support Specialists LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mallaghan Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tronair Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vestergaard Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TIPS d o o

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 JBT Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MULAG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Textron Ground Support Equipment Inc (Textron Inc )

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 COBUS Industries Gmb

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ALVEST

List of Figures

- Figure 1: Global Airport Ground Handling Vehicles Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Airport Ground Handling Vehicles Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Airport Ground Handling Vehicles Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Airport Ground Handling Vehicles Industry Revenue (Million), by Power Source 2025 & 2033

- Figure 5: North America Airport Ground Handling Vehicles Industry Revenue Share (%), by Power Source 2025 & 2033

- Figure 6: North America Airport Ground Handling Vehicles Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Airport Ground Handling Vehicles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Airport Ground Handling Vehicles Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Airport Ground Handling Vehicles Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Airport Ground Handling Vehicles Industry Revenue (Million), by Power Source 2025 & 2033

- Figure 11: Europe Airport Ground Handling Vehicles Industry Revenue Share (%), by Power Source 2025 & 2033

- Figure 12: Europe Airport Ground Handling Vehicles Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Airport Ground Handling Vehicles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Airport Ground Handling Vehicles Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Airport Ground Handling Vehicles Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Airport Ground Handling Vehicles Industry Revenue (Million), by Power Source 2025 & 2033

- Figure 17: Asia Pacific Airport Ground Handling Vehicles Industry Revenue Share (%), by Power Source 2025 & 2033

- Figure 18: Asia Pacific Airport Ground Handling Vehicles Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Airport Ground Handling Vehicles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Airport Ground Handling Vehicles Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Airport Ground Handling Vehicles Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Airport Ground Handling Vehicles Industry Revenue (Million), by Power Source 2025 & 2033

- Figure 23: Latin America Airport Ground Handling Vehicles Industry Revenue Share (%), by Power Source 2025 & 2033

- Figure 24: Latin America Airport Ground Handling Vehicles Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Airport Ground Handling Vehicles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Airport Ground Handling Vehicles Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Airport Ground Handling Vehicles Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Airport Ground Handling Vehicles Industry Revenue (Million), by Power Source 2025 & 2033

- Figure 29: Middle East and Africa Airport Ground Handling Vehicles Industry Revenue Share (%), by Power Source 2025 & 2033

- Figure 30: Middle East and Africa Airport Ground Handling Vehicles Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Airport Ground Handling Vehicles Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Power Source 2020 & 2033

- Table 3: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Power Source 2020 & 2033

- Table 6: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Power Source 2020 & 2033

- Table 11: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Power Source 2020 & 2033

- Table 19: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Power Source 2020 & 2033

- Table 27: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Argentina Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Latin America Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Power Source 2020 & 2033

- Table 33: Global Airport Ground Handling Vehicles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Qatar Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Airport Ground Handling Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Ground Handling Vehicles Industry?

The projected CAGR is approximately 5.99%.

2. Which companies are prominent players in the Airport Ground Handling Vehicles Industry?

Key companies in the market include ALVEST, Ground Support Specialists LLC, Mallaghan Group, Tronair Inc, Vestergaard Company, TIPS d o o, JBT Corporation, MULAG, Textron Ground Support Equipment Inc (Textron Inc ), COBUS Industries Gmb.

3. What are the main segments of the Airport Ground Handling Vehicles Industry?

The market segments include Type, Power Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Tugs and Tractor Segment is expected to Occupy the Largest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Ground Handling Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Ground Handling Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Ground Handling Vehicles Industry?

To stay informed about further developments, trends, and reports in the Airport Ground Handling Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence