Key Insights

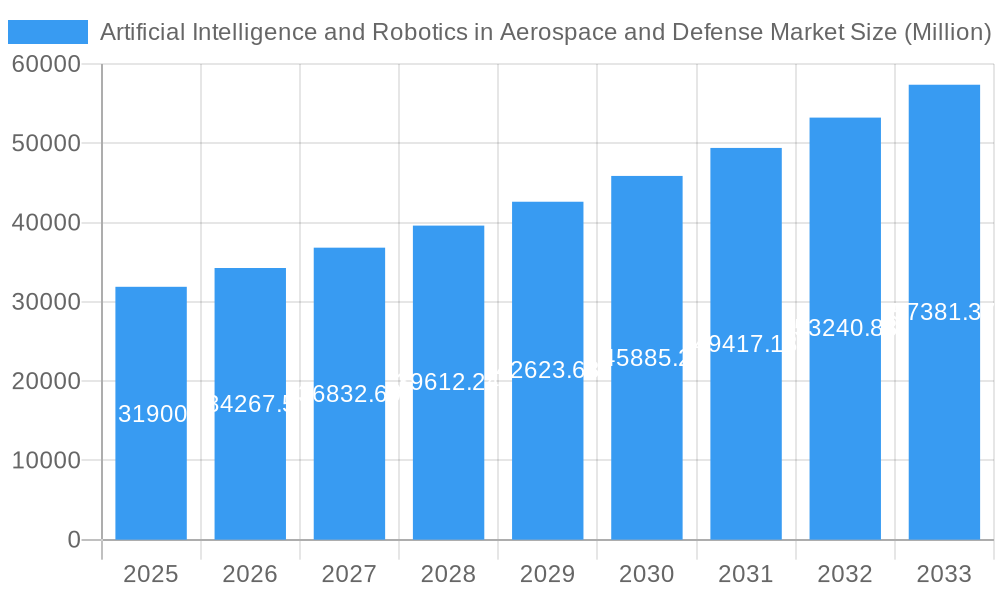

The Artificial Intelligence (AI) and Robotics market within the Aerospace and Defense sector is experiencing robust growth, projected to reach \$31.90 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.50% from 2025 to 2033. This expansion is fueled by several key factors. Increased automation needs in manufacturing and maintenance processes are driving demand for AI-powered solutions that improve efficiency and reduce human error. Furthermore, the escalating need for autonomous systems in unmanned aerial vehicles (UAVs), autonomous ground vehicles, and advanced surveillance systems is significantly contributing to market growth. The integration of AI and robotics enhances situational awareness, improves decision-making speed, and enables the development of more sophisticated weapon systems. Government initiatives focusing on technological advancement and defense modernization are further propelling market expansion, particularly in North America and Europe, which currently hold significant market share. However, challenges remain, including the high cost of development and implementation, concerns about data security and ethical implications of autonomous weapon systems, and the need for robust regulatory frameworks to ensure safe and responsible AI deployment.

Artificial Intelligence and Robotics in Aerospace and Defense Market Market Size (In Billion)

Market segmentation reveals significant opportunities across different offerings (hardware, software, services) and applications (military, commercial aviation, space). The hardware segment, encompassing sensors, actuators, and robotic platforms, is expected to dominate due to the extensive use of robotics in various aerospace and defense operations. Software solutions, including AI algorithms for image recognition, predictive maintenance, and mission planning, are experiencing rapid growth, driven by the rising adoption of AI across the industry. Services, encompassing integration, maintenance, and training, are also witnessing considerable growth. The military segment remains the largest application area, fueled by the demand for autonomous systems and improved defense capabilities. However, the commercial aviation and space sectors present significant growth opportunities, with AI and robotics increasingly used for flight automation, air traffic management, and satellite operations. Key players such as Microsoft, Lockheed Martin, and Boeing are actively involved in developing and deploying AI and robotic solutions, fostering competition and driving innovation within the market. The Asia-Pacific region is poised for significant growth, driven by increased investments in defense modernization and technological advancements.

Artificial Intelligence and Robotics in Aerospace and Defense Market Company Market Share

Artificial Intelligence and Robotics in Aerospace and Defense Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Artificial Intelligence (AI) and Robotics in Aerospace and Defense market, encompassing market dynamics, growth trends, regional analysis, and key player insights. The report covers the parent market of Aerospace and Defense and its child market segments of AI and Robotics, offering a granular view of this rapidly evolving sector. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The market size is projected in Million units.

Artificial Intelligence and Robotics in Aerospace and Defense Market Dynamics & Structure

The AI and Robotics in Aerospace and Defense market exhibits a moderately concentrated structure, with key players like Boeing, Lockheed Martin, and Raytheon holding significant market shares. However, the emergence of specialized AI and robotics firms and increasing collaborations are fostering competition. Technological innovation, driven by advancements in machine learning, computer vision, and autonomous systems, is a primary growth driver. Stringent regulatory frameworks and safety standards, particularly concerning autonomous systems in aviation and defense, present both challenges and opportunities. The market witnesses substantial M&A activity, reflecting consolidation and the pursuit of technological capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Technological Innovation: Rapid advancements in AI, machine learning, and robotics are key drivers.

- Regulatory Framework: Stringent safety and security regulations influence market growth and adoption.

- Competitive Substitutes: Limited direct substitutes, but traditional systems pose indirect competition.

- End-User Demographics: Primarily government agencies (military and defense), commercial aviation companies, and space exploration organizations.

- M&A Trends: Significant M&A activity, with xx major deals recorded between 2019 and 2024. Deal value estimated at xx Million.

Artificial Intelligence and Robotics in Aerospace and Defense Market Growth Trends & Insights

The Artificial Intelligence (AI) and Robotics market within the aerospace and defense sectors is experiencing explosive growth, fueled by the escalating demand for enhanced situational awareness, autonomous operations, and significantly improved efficiency. Market projections indicate a substantial expansion, reaching [Insert Updated Market Size in Millions] by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR]% during the forecast period (2025-2033). This accelerated adoption is particularly evident in military applications, with significant investments in AI-powered systems for surveillance, precision targeting, logistics optimization, and predictive maintenance. Furthermore, transformative technological advancements, including breakthroughs in quantum computing and the rise of edge AI, are fundamentally reshaping market trajectories. The evolving consumer landscape, marked by increased acceptance and trust in autonomous systems, is also a key driver of market dynamics. Market penetration is projected to reach [Insert Updated Penetration Percentage]% by 2033, reflecting the growing integration of AI and robotics across the industry.

Dominant Regions, Countries, or Segments in Artificial Intelligence and Robotics in Aerospace and Defense Market

North America, particularly the United States, maintains its leading position in the AI and Robotics Aerospace and Defense market, driven by substantial defense budgets, a robust technological infrastructure, and a high concentration of major industry players. Europe holds a significant market share, fueled by a strong aerospace industry and substantial government investments in research and development (R&D) focused on AI-driven solutions. The military segment continues to command the largest market share, followed by commercial aviation and the rapidly expanding space exploration sector. In terms of offerings, the software segment is experiencing particularly rapid growth, reflecting the increasing reliance on sophisticated AI algorithms and advanced data analytics for mission-critical applications.

- Key Drivers for North America: High defense expenditure, a robust technological ecosystem, and the presence of numerous key industry players fostering innovation and competition.

- Key Drivers for Europe: A strong aerospace manufacturing base, substantial government investments in AI R&D, and a growing focus on developing cutting-edge AI-driven solutions for defense and aerospace applications.

- Segment Dominance: Military ([Insert Updated Market Share Percentage]% market share), followed by Commercial Aviation ([Insert Updated Market Share Percentage]%) and Space ([Insert Updated Market Share Percentage]%).

- Offering Dominance: Software ([Insert Updated Market Share Percentage]% market share), Hardware ([Insert Updated Market Share Percentage]% ), Services ([Insert Updated Market Share Percentage]%).

Artificial Intelligence and Robotics in Aerospace and Defense Market Product Landscape

The market features a diverse range of products, including AI-powered sensor systems, autonomous drones and unmanned aerial vehicles (UAVs), robotic maintenance systems, and AI-driven flight control systems. These products offer enhanced capabilities such as improved accuracy, reduced human error, and increased operational efficiency. Key technological advancements include the integration of machine learning algorithms for real-time data processing, advanced sensor fusion techniques, and the development of robust and reliable autonomous navigation systems. Unique selling propositions often center on enhanced safety, reduced operational costs, and improved decision-making capabilities.

Key Drivers, Barriers & Challenges in Artificial Intelligence and Robotics in Aerospace and Defense Market

Key Drivers: The increasing demand for enhanced security, operational automation, and improved efficiency across the board; substantial increases in defense budgets globally; rapid technological advancements in AI and robotics; and the growing adoption of autonomous systems in diverse applications. Specific examples include the deployment of autonomous aerial refueling systems, AI-powered threat detection and identification systems, and sophisticated unmanned aerial vehicle (UAV) control systems.

Key Barriers and Challenges: High initial investment costs associated with the development and implementation of AI and robotic systems; legitimate concerns about cybersecurity vulnerabilities and data privacy; stringent regulatory hurdles and approval processes; ethical considerations surrounding the development and use of autonomous weapons systems; and potential supply chain disruptions and the persistent challenge of skilled labor shortages. These factors can significantly impact project timelines, overall market growth, and potentially reduce adoption rates by [Insert Updated Percentage]% in specific segments.

Emerging Opportunities in Artificial Intelligence and Robotics in Aerospace and Defense Market

Emerging opportunities include the integration of AI and robotics in next-generation fighter jets, development of AI-powered predictive maintenance systems for aircraft and spacecraft, utilization of drones for various commercial applications (e.g., package delivery, infrastructure inspections), expansion into space exploration applications (e.g., autonomous rovers and spacecraft), and adoption of AI for improving air traffic management.

Growth Accelerators in the Artificial Intelligence and Robotics in Aerospace and Defense Market Industry

Sustained long-term growth will be significantly accelerated by continued breakthroughs in quantum computing, exponentially enhancing AI capabilities; strategic collaborations and partnerships between technology firms and established aerospace/defense companies, driving synergistic innovation; expansion into emerging markets such as space exploration and the rapidly growing commercial drone sector; and supportive government initiatives promoting the widespread adoption of AI and robotic technologies within the defense and aerospace sectors. Government funding and incentivization programs are increasingly vital in promoting this adoption.

Key Players Shaping the Artificial Intelligence and Robotics in Aerospace and Defense Market Market

- Microsoft

- Indra Sistemas SA

- Honeywell International Inc

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Iris Automation Inc

- Lockheed Martin Corporation

- IBM Corporation

- Airbus SE

- Spark Cognition

- Thales Group

- SITA

- T-Systems International GmbH

- GE Aviation

- The Boeing Company

- Nvidia Corporation

- Northrop Grumman Corporation

- Intel Corporation

Notable Milestones in Artificial Intelligence and Robotics in Aerospace and Defense Market Sector

- October 2021: IBM and Raytheon Technologies partnered to develop advanced AI, cryptographic, and quantum solutions for aerospace and defense.

- March 2021: HamiltonJet and Sea Machines Robotics agreed to develop a pilot-assist system using computer vision and autonomous technologies for waterjets.

In-Depth Artificial Intelligence and Robotics in Aerospace and Defense Market Market Outlook

The AI and Robotics in Aerospace and Defense market is poised for continued robust growth, driven by technological advancements and increasing demand for autonomous and intelligent systems. Strategic partnerships, expansion into new applications, and government investments will be key drivers of future market potential. The market presents significant opportunities for companies with strong technological capabilities and a deep understanding of the aerospace and defense industry. This will be reflected in the continued growth of the market, with projections showing xx Million in market value by 2033.

Artificial Intelligence and Robotics in Aerospace and Defense Market Segmentation

-

1. Offering

- 1.1. Hardware

- 1.2. Software

- 1.3. Service

-

2. Application

- 2.1. Military

- 2.2. Commercial Aviation

- 2.3. Space

Artificial Intelligence and Robotics in Aerospace and Defense Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Artificial Intelligence and Robotics in Aerospace and Defense Market Regional Market Share

Geographic Coverage of Artificial Intelligence and Robotics in Aerospace and Defense Market

Artificial Intelligence and Robotics in Aerospace and Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Military Application Segment is Expected to Dominate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Service

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military

- 5.2.2. Commercial Aviation

- 5.2.3. Space

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Service

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Military

- 6.2.2. Commercial Aviation

- 6.2.3. Space

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Service

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Military

- 7.2.2. Commercial Aviation

- 7.2.3. Space

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Service

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Military

- 8.2.2. Commercial Aviation

- 8.2.3. Space

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Service

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Military

- 9.2.2. Commercial Aviation

- 9.2.3. Space

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Microsoft

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Indra Sistemas SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Honeywell International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Raytheon Technologies Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 General Dynamics Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Iris Automation Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Lockheed Martin Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 IBM Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Airbus SE

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Spark Cognition

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Thales Group

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 SITA

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 T-Systems International Gmb

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 GE Aviation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 The Boeing Comapny

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Nvidia Corporation

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Northrop Grumman Corporation

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Intel Corporation

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.1 Microsoft

List of Figures

- Figure 1: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Offering 2025 & 2033

- Figure 3: North America Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 4: North America Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Offering 2025 & 2033

- Figure 9: Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 10: Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Offering 2025 & 2033

- Figure 15: Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 16: Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Offering 2025 & 2033

- Figure 21: Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 22: Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 5: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 8: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 11: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 14: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Intelligence and Robotics in Aerospace and Defense Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Artificial Intelligence and Robotics in Aerospace and Defense Market?

Key companies in the market include Microsoft, Indra Sistemas SA, Honeywell International Inc, Raytheon Technologies Corporation, General Dynamics Corporation, Iris Automation Inc, Lockheed Martin Corporation, IBM Corporation, Airbus SE, Spark Cognition, Thales Group, SITA, T-Systems International Gmb, GE Aviation, The Boeing Comapny, Nvidia Corporation, Northrop Grumman Corporation, Intel Corporation.

3. What are the main segments of the Artificial Intelligence and Robotics in Aerospace and Defense Market?

The market segments include Offering, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.90 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Military Application Segment is Expected to Dominate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2021, IBM and Raytheon Technologies signed a partnership agreement to develop advanced AI, cryptographic, and quantum solutions for the aerospace, defense, and intelligence industries. The systems integrated with AI and quantum technologies are expected to have better-secured communication networks and improved decision-making processes for aerospace and government customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Artificial Intelligence and Robotics in Aerospace and Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Artificial Intelligence and Robotics in Aerospace and Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Artificial Intelligence and Robotics in Aerospace and Defense Market?

To stay informed about further developments, trends, and reports in the Artificial Intelligence and Robotics in Aerospace and Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence