Key Insights

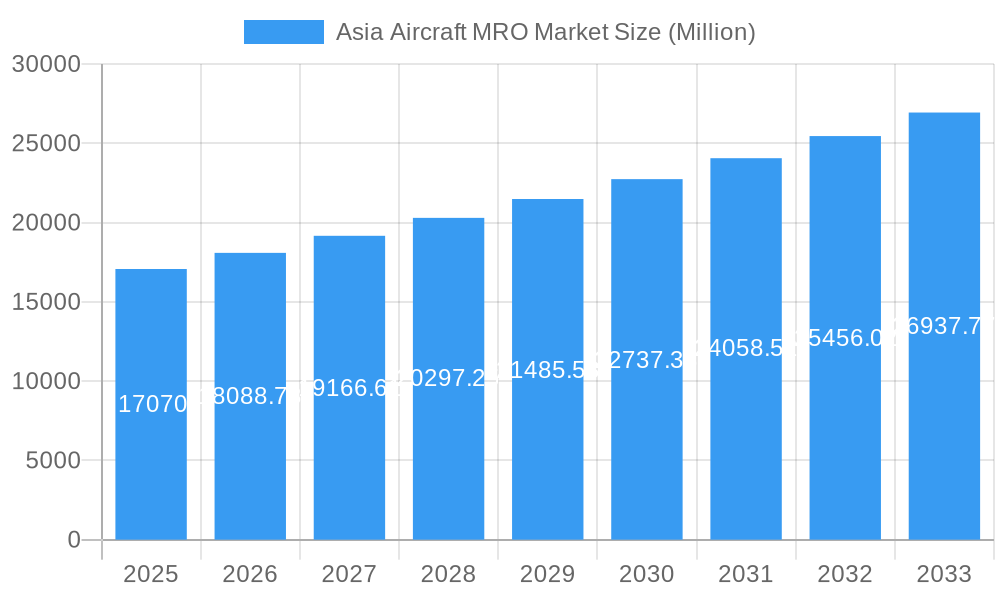

The Asia Aircraft Maintenance, Repair, and Overhaul (MRO) market, valued at $17.07 billion in 2025, is projected to experience robust growth, driven by a burgeoning air travel sector across the Asia-Pacific region. This expansion is fueled by increasing fleet sizes of both commercial and military aircraft, necessitating regular maintenance and upgrades. The rising demand for air travel, particularly in rapidly developing economies like India and China, is a major catalyst. Further fueling this growth is the increasing preference for outsourcing MRO services, as airlines seek cost-effective and efficient solutions. This trend benefits specialized MRO providers in the region, enabling them to scale their operations and capture a significant market share. However, challenges exist, including infrastructure limitations in certain areas and the need for skilled technicians to meet the growing demand. Competition among established players like Lufthansa Technik, HAECO, and SIA Engineering Company, alongside emerging local providers, is intense, leading to price pressures and the need for continuous technological advancements. The segment breakdown reveals a significant contribution from commercial aviation, with airframe MRO representing a substantial portion of the market. The forecast period (2025-2033) anticipates consistent growth, fueled by continued economic expansion and government initiatives promoting aviation infrastructure development.

Asia Aircraft MRO Market Market Size (In Billion)

The significant growth trajectory projected for the Asia Aircraft MRO market stems from several interconnected factors. The rising disposable incomes and expanding middle class across the Asia-Pacific region are driving increased passenger traffic and, consequently, aircraft utilization. This increased demand necessitates more frequent maintenance and overhaul services, creating a substantial market for MRO providers. Furthermore, technological advancements in aircraft maintenance, such as predictive analytics and digital twin technologies, are enhancing efficiency and reducing downtime. The strategic partnerships and investments by both international and domestic players are expected to drive innovation and further improve the efficiency of MRO services. However, potential restraints include geopolitical uncertainties and potential regulatory changes that could impact investment decisions and operational costs. Specific regional variations exist, with countries like China and India leading the market due to their size and rapid expansion of aviation infrastructure. The market's success will hinge on the ability of MRO providers to adapt to evolving technological advancements, optimize their operations, and meet the increasing demand for high-quality, cost-effective services.

Asia Aircraft MRO Market Company Market Share

Asia Aircraft MRO Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Aircraft Maintenance, Repair, and Overhaul (MRO) market, encompassing its current state, future trajectory, and key players. The study period covers 2019-2033, with 2025 serving as the base and estimated year, and 2025-2033 as the forecast period. The historical period analyzed is 2019-2024. The report meticulously examines the market across various segments, including MRO types (Airframe MRO, Engine MRO, Component MRO, Line Maintenance) and applications (Commercial Aviation, Military Aviation, General Aviation). The report’s insights are invaluable for industry professionals, investors, and stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. Market values are presented in million units.

Asia Aircraft MRO Market Dynamics & Structure

The Asia Aircraft MRO market is characterized by a complex interplay of factors driving its growth and shaping its structure. Market concentration is moderate, with a few large players and several regional specialists competing intensely. Technological innovation, particularly in areas like predictive maintenance and digital solutions, is a key growth driver. Stringent regulatory frameworks, including safety and environmental regulations, significantly influence market operations. The availability of competitive product substitutes, like third-party maintenance providers, presents both opportunities and challenges. The end-user demographics, primarily comprising airlines, military forces, and general aviation operators, significantly influence market demand. Finally, M&A activity within the industry has been steadily increasing, further consolidating market share and fostering innovation.

- Market Concentration: Moderate, with a mix of large multinational and regional players. The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Adoption of advanced technologies like AI, IoT, and big data analytics are driving efficiency and reducing maintenance costs.

- Regulatory Frameworks: Stringent safety and environmental regulations, particularly in countries like China and Japan, impact operational costs and compliance.

- Competitive Substitutes: The emergence of independent MRO providers increases competition, but also diversifies service offerings.

- M&A Activity: An average of xx M&A deals were recorded annually during the historical period (2019-2024), indicating consolidation within the market.

- Innovation Barriers: High initial investment costs for advanced technologies and a skilled workforce shortage pose challenges to innovation.

Asia Aircraft MRO Market Growth Trends & Insights

The Asia Aircraft MRO market experienced robust growth during the historical period (2019-2024), driven by a surge in air travel demand and a growing fleet size across various aviation segments. The market size is projected to reach xx million units by 2025, demonstrating a Compound Annual Growth Rate (CAGR) of xx% during the historical period. This growth is anticipated to continue, albeit at a slightly moderated pace, during the forecast period (2025-2033), reaching xx million units by 2033. Technological disruptions, such as the increased adoption of digital technologies and predictive maintenance, are significantly enhancing operational efficiency and driving cost optimization. Consumer behavior shifts, favoring faster turnaround times and customized service packages, are reshaping the market dynamics. Market penetration of advanced MRO technologies is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Asia Aircraft MRO Market

China and India are the dominant markets in Asia, followed by other Southeast Asian nations. Within MRO types, Airframe MRO holds the largest market share, driven by the increasing demand for aircraft maintenance and refurbishment. Commercial aviation accounts for the majority of MRO services demand, reflecting the rapid growth in passenger air travel.

- Key Drivers:

- Rapid Growth of Air Travel: Asia's burgeoning middle class and increasing tourism fuel the demand for air travel, leading to higher aircraft maintenance needs.

- Fleet Expansion: Airlines are expanding their fleets to cater to growing demand, driving the need for MRO services.

- Government Investments: Investments in airport infrastructure and aviation-related policies boost the overall aviation ecosystem.

- Dominant Segments:

- Commercial Aviation: This segment represents the largest portion of the MRO market in Asia.

- Airframe MRO: Larger market share compared to Engine MRO and Component MRO.

- China and India: These countries exhibit the highest market share and growth potential due to their large fleets and economic growth.

Asia Aircraft MRO Market Product Landscape

The Asia Aircraft MRO market features a wide range of products and services, ranging from basic line maintenance to highly specialized engine overhauls and component repairs. Innovation in areas like predictive maintenance, using data analytics to anticipate potential failures, and the deployment of automated inspection systems are defining the product landscape. Unique selling propositions (USPs) for MRO providers often center around faster turnaround times, lower costs, and specialized expertise in specific aircraft types or technologies.

Key Drivers, Barriers & Challenges in Asia Aircraft MRO Market

Key Drivers: The primary drivers are the burgeoning air travel sector, a rising number of aircraft in operation, increasing government investments in infrastructure, and the adoption of advanced technologies.

Key Challenges: Supply chain disruptions, skilled labor shortages, stringent regulatory compliance requirements, and intense competition from both domestic and international players pose significant challenges. The impact of these challenges can be quantified through lost revenue, delays in maintenance schedules, and increased operational costs. For example, supply chain issues could cause delays in obtaining crucial parts, leading to xx million units worth of lost revenue annually.

Emerging Opportunities in Asia Aircraft MRO Market

Emerging opportunities include the growth of low-cost carriers, which presents demand for efficient and cost-effective MRO services. The increasing focus on sustainability is creating opportunities for environmentally friendly MRO solutions. Untapped markets in less developed countries within Asia also present significant potential for growth.

Growth Accelerators in the Asia Aircraft MRO Market Industry

Technological advancements such as AI-powered predictive maintenance, coupled with strategic partnerships between MRO providers and airlines, are key growth catalysts. Expansion into new markets and geographic regions will continue to drive long-term growth for established players, fostering increased market penetration and revenue generation.

Key Players Shaping the Asia Aircraft MRO Market Market

- Dassault Aviation

- Rolls Royce PLC

- General Electric

- GMF AeroAsia

- Lockheed Martin Corporation

- Guangzhou Aircraft Maintenance Engineering Company Limited

- Sepang Aircraft Engineering Sdn Bh

- Avia Solutions Group PLC

- AAR Corporation

- Safran SA

- Lufthansa Technik

- Hong Kong Aircraft Engineering Company Limited (HAECO)

- SIA Engineering Company

- Air Works India (Engineering) Private Limited

- ST Engineering

- ExecuJet MRO Services

- The Boeing Company

Notable Milestones in Asia Aircraft MRO Market Sector

- 2021: Introduction of a new predictive maintenance system by SIA Engineering Company.

- 2022: Merger of two regional MRO providers in Southeast Asia, creating a larger entity.

- 2023: Launch of a new state-of-the-art MRO facility in China. (Further specific milestones require additional data)

In-Depth Asia Aircraft MRO Market Market Outlook

The future of the Asia Aircraft MRO market is bright, driven by the continuous growth of air travel, fleet expansion, and the adoption of advanced technologies. Strategic partnerships, investments in infrastructure, and a focus on sustainability will further propel market expansion. The market is poised for significant growth, with numerous opportunities for both established players and new entrants to capture market share and contribute to the overall development of the aviation industry.

Asia Aircraft MRO Market Segmentation

-

1. MRO Type

- 1.1. Airframe MRO

- 1.2. Engine MRO

- 1.3. Component MRO

- 1.4. Line Maintenance

-

2. Application

- 2.1. Commercial Aviation

- 2.2. Military Aviation

- 2.3. General Aviation

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. India

- 3.1.3. Japan

- 3.1.4. South Korea

- 3.1.5. Australia

- 3.1.6. Thailand

- 3.1.7. Singapore

- 3.1.8. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia Aircraft MRO Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Thailand

- 1.7. Singapore

- 1.8. Rest of Asia Pacific

Asia Aircraft MRO Market Regional Market Share

Geographic Coverage of Asia Aircraft MRO Market

Asia Aircraft MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Aviation Segment Projected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Aircraft MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Airframe MRO

- 5.1.2. Engine MRO

- 5.1.3. Component MRO

- 5.1.4. Line Maintenance

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Aviation

- 5.2.2. Military Aviation

- 5.2.3. General Aviation

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. India

- 5.3.1.3. Japan

- 5.3.1.4. South Korea

- 5.3.1.5. Australia

- 5.3.1.6. Thailand

- 5.3.1.7. Singapore

- 5.3.1.8. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dassault Aviation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rolls Royce PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Electric

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GMF AeroAsia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lockheed Martin Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Guangzhou Aircraft Maintenance Engineering Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sepang Aircraft Engineering Sdn Bh

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Avia Solutions Group PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AAR Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Safran SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lufthansa Technik

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hong Kong Aircraft Engineering Company Limited (HAECO)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 SIA Engineering Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Air Works India (Engineering) Private Limited

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 ST Engineering

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 ExecuJet MRO Services

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 The Boeing Company

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Dassault Aviation

List of Figures

- Figure 1: Asia Aircraft MRO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Aircraft MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Aircraft MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 2: Asia Aircraft MRO Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia Aircraft MRO Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Asia Aircraft MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Aircraft MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 6: Asia Aircraft MRO Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Asia Aircraft MRO Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Asia Aircraft MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Asia Pacific Asia Aircraft MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Aircraft MRO Market?

The projected CAGR is approximately 5.74%.

2. Which companies are prominent players in the Asia Aircraft MRO Market?

Key companies in the market include Dassault Aviation, Rolls Royce PLC, General Electric, GMF AeroAsia, Lockheed Martin Corporation, Guangzhou Aircraft Maintenance Engineering Company Limited, Sepang Aircraft Engineering Sdn Bh, Avia Solutions Group PLC, AAR Corporation, Safran SA, Lufthansa Technik, Hong Kong Aircraft Engineering Company Limited (HAECO), SIA Engineering Company, Air Works India (Engineering) Private Limited, ST Engineering, ExecuJet MRO Services, The Boeing Company.

3. What are the main segments of the Asia Aircraft MRO Market?

The market segments include MRO Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.07 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Aviation Segment Projected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Aircraft MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Aircraft MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Aircraft MRO Market?

To stay informed about further developments, trends, and reports in the Asia Aircraft MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence