Key Insights

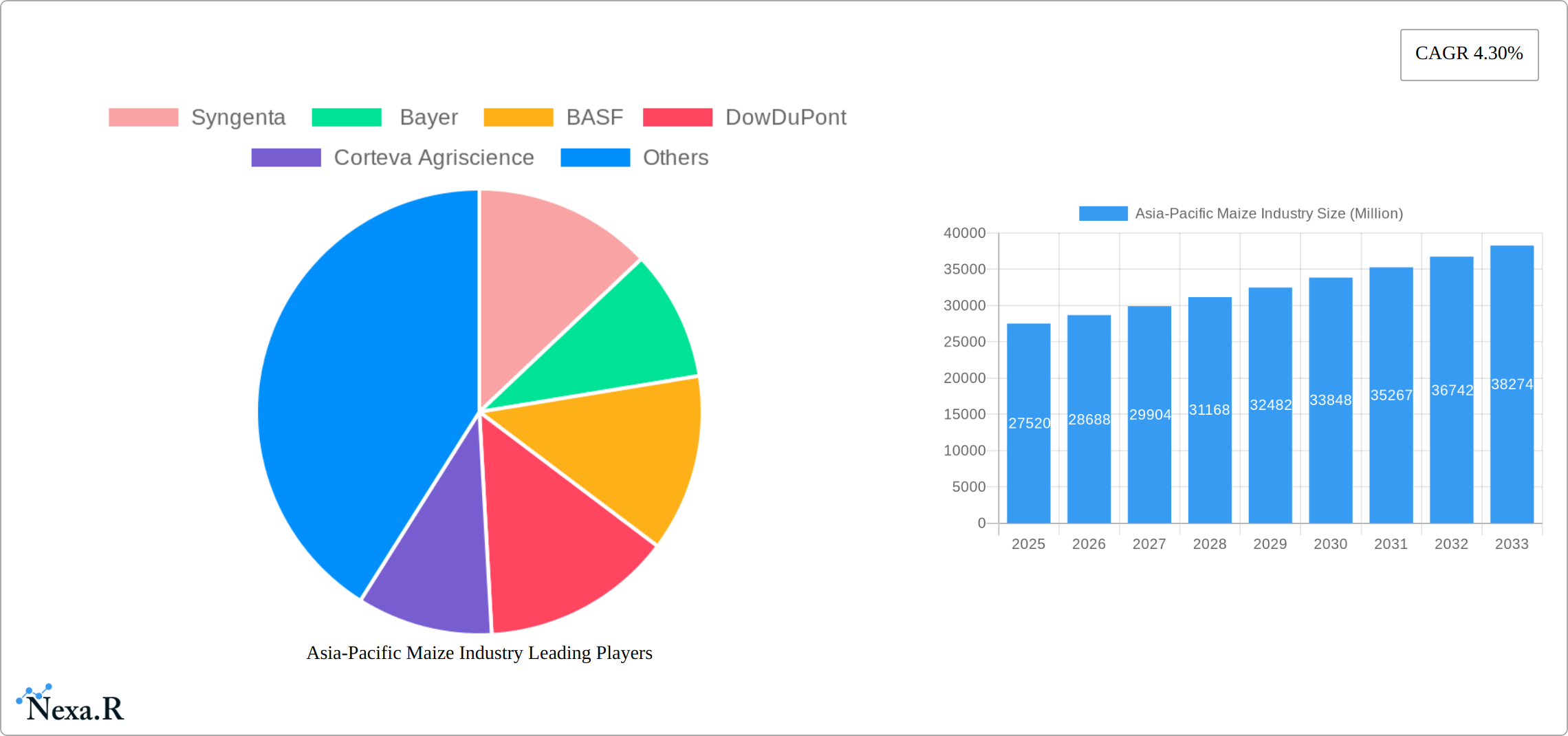

The Asia-Pacific maize industry, valued at $27.52 billion in 2025, is projected to experience robust growth, driven by rising demand for animal feed, biofuels, and food processing. A Compound Annual Growth Rate (CAGR) of 4.30% is anticipated from 2025 to 2033, indicating a significant expansion of the market. Key drivers include increasing population and per capita income, leading to higher consumption of maize-based products. Furthermore, government initiatives promoting agricultural development and sustainable farming practices in countries like India and China are fostering growth. The industry faces challenges such as climate change, impacting yields and potentially increasing production costs. However, technological advancements in seed breeding and precision agriculture are expected to mitigate these risks. China, India, and Indonesia represent significant market segments, characterized by varying levels of maize production and consumption. Price fluctuations, influenced by global supply chains and weather patterns, are a key factor to consider, especially in price-sensitive markets such as the Philippines. The competitive landscape is dominated by major players like Syngenta, Bayer, BASF, Corteva Agriscience, and Cargill, all vying for market share through innovation and strategic partnerships.

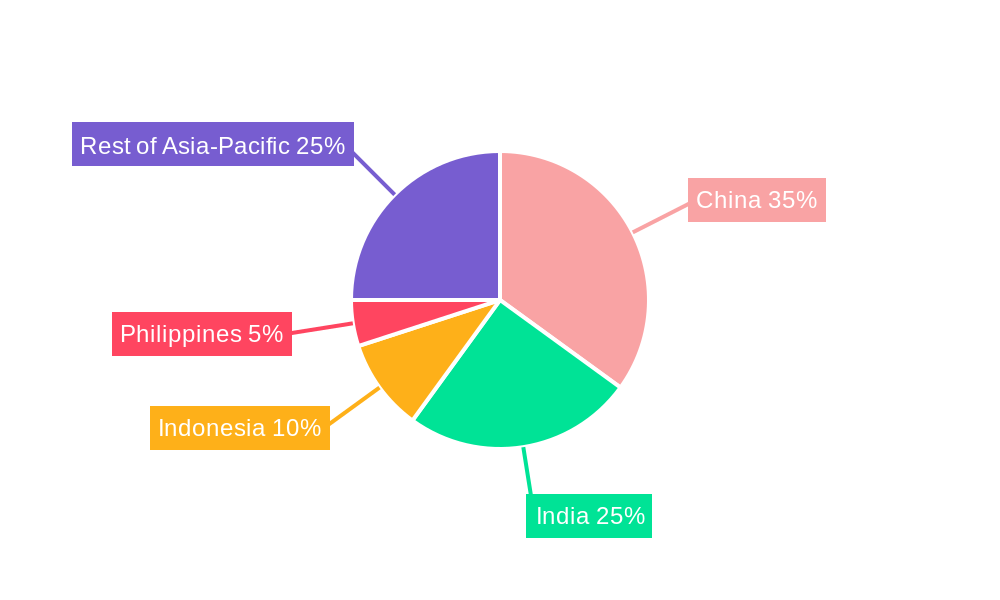

The industry's segmentation reveals a diverse landscape. China, a major producer and consumer, is expected to significantly influence price trends in the coming years, impacting the entire Asia-Pacific region. India's growing demand, driven by increasing livestock populations and rising disposable incomes, presents immense growth opportunities. Indonesia and the Philippines, while smaller than China and India, are also vital markets with their own unique dynamics and growth potential. The "Rest of Asia-Pacific" segment demonstrates the collective potential of other countries within the region. Growth projections for the next decade point towards continued expansion, albeit potentially with fluctuations determined by global economic conditions and agricultural policies. Understanding these nuances is crucial for companies seeking to capitalize on the expanding opportunities within the Asia-Pacific maize industry.

Asia-Pacific Maize Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific maize industry, encompassing market dynamics, growth trends, dominant regions, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and stakeholders seeking a clear understanding of this dynamic market. It leverages extensive data analysis to deliver actionable insights for strategic decision-making.

Asia-Pacific Maize Industry Market Dynamics & Structure

This section analyzes the market structure, competitive landscape, and influencing factors within the Asia-Pacific maize industry. We examine market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and mergers & acquisitions (M&A) trends. The analysis incorporates both quantitative data (market share, M&A deal volumes) and qualitative factors (innovation barriers).

- Market Concentration: The Asia-Pacific maize market exhibits a moderately concentrated structure, with a few multinational corporations holding significant market share (estimated at xx%). Smaller regional players also contribute significantly, particularly in specific countries.

- Technological Innovation: Technological advancements in seed genetics, crop protection, and precision agriculture are driving productivity gains and shaping industry competitiveness. However, access to these technologies varies across the region, creating disparities in adoption rates.

- Regulatory Frameworks: Varying government regulations across countries influence production practices, trade policies, and market access. These regulations can create both opportunities and challenges for industry players.

- Competitive Substitutes: Alternative crops and feed sources compete with maize, impacting demand and influencing pricing dynamics. The competitive landscape is complex and subject to shifts in consumer preferences and global food security concerns.

- End-User Demographics: The end-user base is diverse, encompassing food processors, livestock feed producers, and industrial users. Understanding the varying needs and preferences of these segments is crucial for effective market penetration.

- M&A Trends: The past five years have witnessed xx M&A deals in the Asia-Pacific maize industry, signaling consolidation and strategic alliances amongst players seeking expansion and market dominance.

Asia-Pacific Maize Industry Growth Trends & Insights

The Asia-Pacific maize industry is experiencing robust and sustained growth, fueled by a confluence of escalating demand for food and animal feed, coupled with transformative technological advancements that are significantly enhancing crop yields and operational efficiencies. This section provides a comprehensive analysis of historical market evolution and future projections, scrutinizing factors that influence market size, adoption rates of innovative agricultural practices, the impact of technological disruptions, and discernible shifts in consumer preferences and consumption patterns. Our analysis incorporates key performance indicators such as the Compound Annual Growth Rate (CAGR) and market penetration rates, offering granular insights into the industry's trajectory. Leveraging proprietary data and in-depth industry expertise, we present a detailed panorama of prevailing market trends. Notably, the burgeoning demand for maize as a feedstock for biofuels is a significant growth catalyst, particularly within specific market segments and geographical regions across the Asia-Pacific. Detailed CAGR figures and more specific segment analyses are elaborated upon in the full report.

Dominant Regions, Countries, or Segments in Asia-Pacific Maize Industry

This section pinpoints the leading regions and countries driving growth within the Asia-Pacific maize market, including India, China, Indonesia, Philippines, and the Rest of Asia-Pacific. The analysis focuses on factors contributing to market dominance, such as economic policies, infrastructure development, and consumer preferences.

- India: India is a significant maize producer and consumer, with strong growth potential driven by increasing population and rising disposable incomes. This is fueled by robust domestic demand and government support for agricultural development.

- China: China's maize industry is characterized by price volatility and a focus on ensuring food security. Price trend analysis reveals fluctuations influenced by weather patterns, government policies, and import/export dynamics.

- Indonesia: Indonesia's maize production is growing, albeit at a slower pace compared to India and China. Infrastructure limitations and regional disparities in agricultural practices pose challenges to further expansion.

- Philippines: The Philippines relies heavily on maize imports, making it vulnerable to global price fluctuations. Government policies aim to boost domestic production to improve food security.

- Rest of Asia-Pacific: This segment encompasses diverse markets with varying growth trajectories. Several countries show significant potential for maize production expansion, driven by increasing demand and favorable agricultural conditions.

Asia-Pacific Maize Industry Product Landscape

The Asia-Pacific maize market features a diverse range of products catering to various applications. Key innovations involve genetically modified (GM) maize varieties offering improved yields, pest resistance, and nutritional enhancements. Precision agriculture technologies are also gaining traction, optimizing resource utilization and enhancing productivity. These innovations contribute to improved efficiency and sustainability across the value chain.

Key Drivers, Barriers & Challenges in Asia-Pacific Maize Industry

Key Drivers:

- Surging global and regional demand for maize to meet the nutritional needs of a growing human population and to support the expansion of the livestock sector.

- Continuous innovation in seed genetics, leading to higher-yielding, disease-resistant, and climate-resilient maize varieties, alongside advancements in precision agriculture and cultivation techniques.

- Proactive government policies and financial incentives aimed at bolstering agricultural productivity, ensuring food security, and promoting rural development across numerous Asia-Pacific nations.

- The increasing integration of maize into industrial applications beyond food and feed, including the production of bioplastics and other value-added products.

Key Challenges:

- The escalating threat of climate change, characterized by unpredictable weather patterns such as droughts, floods, and extreme temperatures, which poses a significant risk to maize production stability and yield consistency. (Estimated impact on production: [Specific Data Point/Range to be inserted])

- Pronounced price volatility influenced by complex global market dynamics, international trade policies, geopolitical events, and fluctuating input costs.

- Intensified competition from alternative crops and feed sources, requiring continuous improvement in maize competitiveness and efficiency.

- Pervasive infrastructure deficits and inefficiencies within supply chains in various sub-regions, leading to increased post-harvest losses and reduced market access. (Estimated loss due to inefficiency: [Specific Data Point/Range to be inserted])

- Navigating diverse regulatory landscapes and trade barriers across different countries within the Asia-Pacific region.

Emerging Opportunities in Asia-Pacific Maize Industry

- The significant and growing global demand for biofuels presents a substantial opportunity for maize to serve as a primary feedstock, driving increased production and consumption.

- The expanding market for diverse processed maize products, including starches, sweeteners, corn oil, and convenience foods, caters to evolving consumer lifestyles and preferences for readily available, value-added food options.

- Untapped or underserved markets in less-developed regions within the Asia-Pacific offer considerable potential for growth through increased cultivation, improved market access, and the introduction of modern agricultural practices.

- The ongoing development and adoption of advanced maize varieties engineered for enhanced drought tolerance, pest resistance, and improved nutritional profiles are critical for boosting production resilience and sustainability in challenging environments.

- Opportunities exist in the development of niche maize products for specific culinary traditions and health-conscious markets.

Growth Accelerators in the Asia-Pacific Maize Industry Industry

Pioneering technological breakthroughs in precision agriculture, encompassing advanced sensor technologies, data analytics, and automated farming equipment, are acting as powerful catalysts for sustained long-term growth. Furthermore, the formation of strategic alliances and collaborative partnerships between leading seed technology providers and agricultural stakeholders, including farmers and cooperatives, is instrumental in accelerating the adoption of best practices and innovative solutions. Expanding market reach into new geographical territories and the concerted development of a diverse range of value-added maize-derived products are crucial avenues for further market penetration and revenue diversification. Robust government support, characterized by favorable policies, infrastructure development investments in irrigation, transportation, and storage, and research funding, plays an indispensable role in unlocking the full economic and productive potential of the Asia-Pacific maize industry.

Key Players Shaping the Asia-Pacific Maize Industry Market

- Syngenta - A global leader in crop protection and seeds, offering a wide range of maize solutions.

- Bayer - A major player with a strong portfolio in seeds, crop protection, and digital farming tools.

- BASF - Known for its innovative agricultural solutions, including seed treatments and crop protection products for maize.

- Corteva Agriscience - A prominent agricultural company with a significant presence in the maize seed market.

- Cargill - A global food and agriculture giant involved in trading, processing, and distributing maize and its derivatives.

- Limagrain - A significant international seed group with a strong focus on maize breeding and production.

- Charoen Pokphand Foods (CP Foods) - A leading agro-industrial and food conglomerate in Asia, with substantial interests in maize cultivation and utilization.

Notable Milestones in Asia-Pacific Maize Industry Sector

- 2020: Launch of a new drought-resistant maize variety by Syngenta in India.

- 2022: Acquisition of a regional maize producer by Cargill in Indonesia.

- 2023: Implementation of a new precision agriculture program by Bayer in the Philippines.

In-Depth Asia-Pacific Maize Industry Market Outlook

The Asia-Pacific maize industry is poised for robust growth over the next decade, driven by increasing demand, technological innovation, and supportive government policies. Strategic investments in research and development, sustainable farming practices, and efficient supply chains will be crucial for unlocking the industry's full potential and achieving long-term market dominance. The market is expected to reach xx Million units by 2033.

Asia-Pacific Maize Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Maize Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Maize Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Maize as Animal Feed Protein Source

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Syngenta

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Bayer

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 BASF

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 DowDuPont

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Corteva Agriscience

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Cargill

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 Syngenta

List of Figures

- Figure 1: Asia-Pacific Maize Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Maize Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Maize Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Maize Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: Asia-Pacific Maize Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Asia-Pacific Maize Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Asia-Pacific Maize Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Asia-Pacific Maize Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Asia-Pacific Maize Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: Asia-Pacific Maize Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: China Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: China Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: South Korea Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: Taiwan Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Taiwan Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 27: Australia Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 29: Rest of Asia-Pacific Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia-Pacific Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 31: Asia-Pacific Maize Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 32: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 33: Asia-Pacific Maize Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 34: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 35: Asia-Pacific Maize Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 36: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Asia-Pacific Maize Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 38: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 39: Asia-Pacific Maize Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 40: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 41: Asia-Pacific Maize Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 43: China Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: China Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 45: Japan Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 47: South Korea Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 49: India Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 51: Australia Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 53: New Zealand Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: New Zealand Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 55: Indonesia Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Indonesia Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 57: Malaysia Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Malaysia Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 59: Singapore Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Singapore Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 61: Thailand Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Thailand Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 63: Vietnam Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Vietnam Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 65: Philippines Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Philippines Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Maize Industry?

The projected CAGR is approximately 4.30%.

2. Which companies are prominent players in the Asia-Pacific Maize Industry?

Key companies in the market include Syngenta , Bayer , BASF, DowDuPont , Corteva Agriscience , Cargill.

3. What are the main segments of the Asia-Pacific Maize Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

Increasing Demand for Maize as Animal Feed Protein Source.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Maize Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Maize Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Maize Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Maize Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence