Key Insights

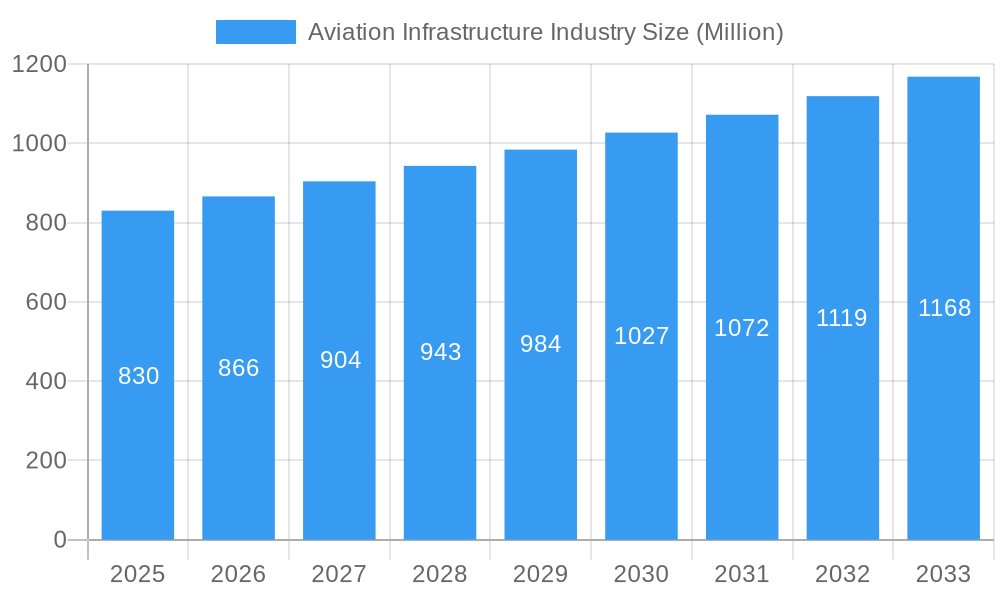

The global aviation infrastructure market, valued at $0.83 billion in 2025, is projected to experience robust growth, driven by increasing air passenger traffic, expansion of existing airports, and the development of new airport infrastructure globally. A compound annual growth rate (CAGR) of 4.40% from 2025 to 2033 indicates a significant market expansion, reaching an estimated value exceeding $1.2 billion by 2033. Key drivers include rising demand for air travel, particularly in emerging economies, necessitating substantial investments in airport capacity and modernization. Government initiatives promoting sustainable aviation and airport infrastructure development, alongside technological advancements in airport management systems, also contribute to this growth. The market is segmented by infrastructure type (terminals, control towers, taxiways and runways, aprons, hangars, and other infrastructure) and airport type (commercial, military, and general aviation). The commercial airport segment holds the largest market share, driven by the high volume of passenger and cargo traffic. North America and Asia-Pacific are expected to be the leading regional markets, driven by strong economic growth and substantial investments in airport infrastructure upgrades and new constructions. However, the market faces potential constraints such as fluctuating fuel prices, economic downturns affecting travel demand, and regulatory hurdles concerning environmental impact and safety standards. Leading construction companies such as PCL Constructors Inc., McCarthy Building Companies Inc., and AECOM are actively involved in shaping this dynamic market landscape.

Aviation Infrastructure Industry Market Size (In Million)

The competitive landscape is characterized by a mix of large multinational corporations and specialized regional contractors. Companies are focusing on strategic partnerships, technological innovation, and sustainable construction practices to enhance their market position. Future growth will be influenced by factors such as the adoption of advanced technologies (e.g., AI-powered air traffic management systems), sustainable development initiatives, and the integration of smart airport technologies. Effective risk management strategies and adaptation to evolving global economic conditions are crucial for companies to maintain profitability and competitive edge within this growing market. The market is expected to witness increased consolidation through mergers and acquisitions, further impacting the competitive dynamics in the years to come.

Aviation Infrastructure Industry Company Market Share

Aviation Infrastructure Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Aviation Infrastructure Industry, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by infrastructure type (Terminal, Control Tower, Taxiway and Runway, Apron, Hangar, Other Infrastructure Types) and airport type (Commercial Airport, Military Airport, General Aviation Airport). Market values are presented in Million USD.

Aviation Infrastructure Industry Market Dynamics & Structure

The global aviation infrastructure market, projected to reach a valuation of $XX million in 2025, is characterized by a dynamic landscape of moderate concentration. This sector sees a healthy interplay between established global players and a robust network of specialized regional contractors vying for significant projects. Key drivers of this market include relentless technological advancements, with a pronounced emphasis on the adoption of sustainable materials and pioneering construction methodologies. Furthermore, the industry's trajectory is significantly shaped by stringent international safety regulations and an ever-increasing focus on environmental stewardship and sustainability.

Market consolidation, primarily through strategic mergers and acquisitions (M&A), is anticipated to continue its upward trend. This consolidation is propelled by the pursuit of economies of scale, the acquisition of specialized expertise, and the need to navigate increasingly complex project requirements. While innovative solutions like prefabricated modular structures are steadily gaining traction, traditional, yet advanced, construction methods continue to form the bedrock of the industry. The primary end-users of aviation infrastructure development are diverse, encompassing government agencies, airport operators, and substantial private investment entities.

- Market Concentration: Moderately concentrated, with the top 5 players collectively holding an estimated xx% market share in 2025. This indicates a competitive yet structured market with significant influence from leading entities.

- Technological Innovation: The industry is witnessing a pronounced focus on sustainable materials such as recycled concrete and green steel, alongside the integration of automation through robotics and 3D printing. The development and application of digital twins are revolutionizing project lifecycle management, from design and simulation to ongoing operational efficiency.

- Regulatory Framework: Adherence to stringent safety standards, as mandated by bodies like ICAO and FAA, alongside evolving environmental regulations aimed at reducing carbon footprints, significantly impacts project planning, execution timelines, and overall cost structures.

- M&A Activity: The historical period (2019-2024) saw approximately xx strategic M&A deals. The forecast period anticipates an acceleration, with an expected average of xx M&A deals annually, underscoring a trend towards industry consolidation and strategic expansion.

- Innovation Barriers: Despite the drive for innovation, significant barriers persist, including the substantial initial investment costs for adopting new technologies, the absence of universally standardized protocols for implementation, and a degree of organizational inertia or resistance to embracing novel approaches within established workflows.

Aviation Infrastructure Industry Growth Trends & Insights

The aviation infrastructure market is poised for substantial and sustained growth throughout the forecast period, spanning from 2025 to 2033. This expansion is primarily propelled by the continuous surge in global passenger traffic, the strategic development and extension of air travel networks, and significant government investments earmarked for airport modernization and capacity enhancement. The market is projected to expand at a robust Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, ultimately reaching an impressive projected value of $XX million by 2033.

This upward trajectory is further fueled by rapid advancements in technologies that are significantly boosting operational efficiency and sustainability across airport operations. Concurrently, there is an escalating demand for state-of-the-art airport infrastructure capable of accommodating not only the growing volume of passengers but also larger and more sophisticated aircraft. Emerging priorities, such as enhanced airport security and an elevated passenger experience, are also acting as significant catalysts for development. The rate of adoption for new and innovative technologies is steadily increasing, with major industry players making substantial investments in digitalization and automation to stay competitive and meet future demands.

Dominant Regions, Countries, or Segments in Aviation Infrastructure Industry

The Asia-Pacific region is anticipated to emerge as the dominant force in the aviation infrastructure market throughout the forecast period. This regional leadership is attributed to its remarkable economic growth, rapid urbanization, and substantial investments channeled into extensive airport development projects across a multitude of countries, with a particular emphasis on emerging giants like China and India. Within the various infrastructure types, Terminals and Runway/Taxiway projects are expected to command the largest market share. This dominance stems from the sheer volume of passenger traffic handled and the critical operational requirements for efficient airside and landside operations.

Furthermore, commercial airports represent the most significant segment by airport type, a direct reflection of the vigorous and ongoing growth in passenger air travel worldwide. The dynamic expansion in this segment highlights the critical role of commercial aviation in global connectivity and economic development.

- Key Drivers (Asia-Pacific): The region's dominance is underpinned by robust government support for infrastructure development initiatives, a consistently increasing volume of air passenger traffic, and sustained rapid economic growth, creating a fertile ground for airport expansion.

- Dominant Segments: As of 2025, Terminals are estimated to contribute $XX million to the market, followed closely by Taxiway and Runway projects valued at $XX million. Commercial Airports, as a segment, also represent a substantial market share of $XX million in 2025.

- Growth Potential: Significant untapped opportunities exist in emerging economies and regions experiencing accelerated air travel expansion. Notably, Africa and Latin America present considerable potential for future growth and development in aviation infrastructure.

Aviation Infrastructure Industry Product Landscape

The aviation infrastructure product landscape comprises a range of materials, technologies, and services supporting airport construction and maintenance. Innovations focus on sustainable and durable materials, efficient construction techniques (e.g., prefabricated components, modular design), and advanced technologies such as smart sensors for real-time monitoring and predictive maintenance. The unique selling propositions include enhanced safety, reduced construction time, and improved operational efficiency. Technological advancements continue to drive product innovation, including the integration of renewable energy sources into airport infrastructure.

Key Drivers, Barriers & Challenges in Aviation Infrastructure Industry

Key Drivers: Increasing air passenger traffic globally, government investments in airport infrastructure upgrades, technological advancements leading to improved efficiency and sustainability, and the growth of e-commerce increasing air freight demand.

Challenges: High initial investment costs, complex regulatory approvals processes, skilled labor shortages, potential supply chain disruptions leading to material cost increases (estimated impact: xx% increase in construction costs in 2025), and intense competition among contractors.

Emerging Opportunities in Aviation Infrastructure Industry

Emerging opportunities include the growing adoption of sustainable building practices and materials (reduction of carbon footprint), the use of advanced technologies like Building Information Modeling (BIM) and digital twins for improved project management, and the expansion into underserved markets in developing countries. Furthermore, the increasing demand for smart airport technologies presents significant growth potential.

Growth Accelerators in the Aviation Infrastructure Industry

Several key factors are accelerating the long-term growth trajectory of the aviation infrastructure industry. These include the formation of strategic partnerships between experienced airport operators and innovative construction companies, which foster collaboration and expertise sharing. Government incentives designed to promote the development and adoption of sustainable infrastructure projects are also playing a crucial role in driving environmentally conscious construction. Furthermore, the development and implementation of innovative financing mechanisms are proving essential in supporting the substantial capital requirements for large-scale airport modernization and expansion projects. Technological breakthroughs in advanced construction materials and techniques, coupled with the increasingly widespread adoption of automation and digital technologies, will continue to be powerful engines of market growth.

Key Players Shaping the Aviation Infrastructure Industry Market

- PCL Constructors Inc

- Manhattan Construction Group Inc

- McCarthy Building Companies Inc

- The Walsh Group

- Austin Industries

- Hill International Inc

- The Sundt Companies Inc

- Hensel Phelps

- Royal BAM Group NV

- Turner Construction Company

- J E Dunn Construction Company

- Skanska

- BIC Contracting LLC

- TAV Construction

- AECOM

- ALEC Engineering and Contracting

Notable Milestones in Aviation Infrastructure Industry Sector

- 2022-Q4: Successful implementation of a large-scale sustainable airport development project in Singapore.

- 2023-Q1: Launch of a new prefabricated terminal module system by a leading construction company, reducing construction time by xx%.

- 2023-Q3: Merger between two significant regional airport construction companies, increasing market share in the Middle East.

In-Depth Aviation Infrastructure Industry Market Outlook

The aviation infrastructure market presents a compelling outlook for strong and sustained long-term growth. This optimistic forecast is underpinned by the consistent and robust expansion of global air travel and the imperative for substantial investments in the modernization and expansion of existing airport facilities. Strategic collaborations, relentless technological innovation, and a steadfast commitment to sustainable development initiatives are identified as critical determinants that will shape and drive future market expansion. The increasing global emphasis on significantly improving the passenger experience and enhancing operational efficiency at airports will also exert a profound influence on market growth in the years to come. Consequently, companies that proactively embrace and leverage innovative technologies and sustainable practices are exceptionally well-positioned to capture substantial market share and lead the industry forward.

Aviation Infrastructure Industry Segmentation

-

1. Airport Type

- 1.1. Commercial Airport

- 1.2. Military Airport

- 1.3. General Aviation Airport

-

2. Infrastructure Type

- 2.1. Terminal

- 2.2. Control Tower

- 2.3. Taxiway and Runway

- 2.4. Apron

- 2.5. Hangar

- 2.6. Other Infrastructure Types

Aviation Infrastructure Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Aviation Infrastructure Industry Regional Market Share

Geographic Coverage of Aviation Infrastructure Industry

Aviation Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Terminal Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 5.1.1. Commercial Airport

- 5.1.2. Military Airport

- 5.1.3. General Aviation Airport

- 5.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.2.1. Terminal

- 5.2.2. Control Tower

- 5.2.3. Taxiway and Runway

- 5.2.4. Apron

- 5.2.5. Hangar

- 5.2.6. Other Infrastructure Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 6. North America Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 6.1.1. Commercial Airport

- 6.1.2. Military Airport

- 6.1.3. General Aviation Airport

- 6.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.2.1. Terminal

- 6.2.2. Control Tower

- 6.2.3. Taxiway and Runway

- 6.2.4. Apron

- 6.2.5. Hangar

- 6.2.6. Other Infrastructure Types

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 7. Europe Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 7.1.1. Commercial Airport

- 7.1.2. Military Airport

- 7.1.3. General Aviation Airport

- 7.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.2.1. Terminal

- 7.2.2. Control Tower

- 7.2.3. Taxiway and Runway

- 7.2.4. Apron

- 7.2.5. Hangar

- 7.2.6. Other Infrastructure Types

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 8. Asia Pacific Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Airport Type

- 8.1.1. Commercial Airport

- 8.1.2. Military Airport

- 8.1.3. General Aviation Airport

- 8.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8.2.1. Terminal

- 8.2.2. Control Tower

- 8.2.3. Taxiway and Runway

- 8.2.4. Apron

- 8.2.5. Hangar

- 8.2.6. Other Infrastructure Types

- 8.1. Market Analysis, Insights and Forecast - by Airport Type

- 9. Latin America Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Airport Type

- 9.1.1. Commercial Airport

- 9.1.2. Military Airport

- 9.1.3. General Aviation Airport

- 9.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 9.2.1. Terminal

- 9.2.2. Control Tower

- 9.2.3. Taxiway and Runway

- 9.2.4. Apron

- 9.2.5. Hangar

- 9.2.6. Other Infrastructure Types

- 9.1. Market Analysis, Insights and Forecast - by Airport Type

- 10. Middle East and Africa Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Airport Type

- 10.1.1. Commercial Airport

- 10.1.2. Military Airport

- 10.1.3. General Aviation Airport

- 10.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 10.2.1. Terminal

- 10.2.2. Control Tower

- 10.2.3. Taxiway and Runway

- 10.2.4. Apron

- 10.2.5. Hangar

- 10.2.6. Other Infrastructure Types

- 10.1. Market Analysis, Insights and Forecast - by Airport Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PCL Constructors Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Manhattan Construction Group Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 McCarthy Building Companies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Walsh Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Austin Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hill International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Sundt Companies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hensel Phelps

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Royal BAM Group NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Turner Construction Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 J E Dunn Construction Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Skanska

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BIC Contracting LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TAV Construction

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AECOM

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ALEC Engineering and Contracting

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 PCL Constructors Inc

List of Figures

- Figure 1: Global Aviation Infrastructure Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 3: North America Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 4: North America Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 5: North America Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 6: North America Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 9: Europe Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 10: Europe Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 11: Europe Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 12: Europe Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 15: Asia Pacific Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 16: Asia Pacific Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 17: Asia Pacific Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 18: Asia Pacific Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 21: Latin America Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 22: Latin America Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 23: Latin America Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 24: Latin America Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 27: Middle East and Africa Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 28: Middle East and Africa Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 29: Middle East and Africa Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 30: Middle East and Africa Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 2: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 3: Global Aviation Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 5: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 10: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 11: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 17: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 18: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 25: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 26: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 30: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 31: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: United Arab Emirates Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Infrastructure Industry?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the Aviation Infrastructure Industry?

Key companies in the market include PCL Constructors Inc, Manhattan Construction Group Inc, McCarthy Building Companies Inc, The Walsh Group, Austin Industries, Hill International Inc, The Sundt Companies Inc, Hensel Phelps, Royal BAM Group NV, Turner Construction Company, J E Dunn Construction Company, Skanska, BIC Contracting LLC, TAV Construction, AECOM, ALEC Engineering and Contracting.

3. What are the main segments of the Aviation Infrastructure Industry?

The market segments include Airport Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.83 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Terminal Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Infrastructure Industry?

To stay informed about further developments, trends, and reports in the Aviation Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence