Key Insights

The global Business Aviation Maintenance, Repair, and Overhaul (MRO) market is projected for significant growth, fueled by an expanding business jet fleet and the increasing demand for specialized, efficient maintenance solutions. The market is anticipated to reach $90.85 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.75% from the base year 2024. Key growth drivers include the rising number of high-net-worth individuals and corporations utilizing business aviation, advancements in aircraft maintenance technology, and the growing need for MRO services tailored to the unique specifications of business aircraft. Engine MRO leads the market segments, followed by Component MRO, Airframe MRO, and Interior MRO, with Field Maintenance playing a vital role in rapid service delivery. Major industry players are actively pursuing strategic initiatives, including mergers and acquisitions, to expand their service portfolios and market presence. North America and Europe currently dominate the market, owing to well-established aviation infrastructure, while the Asia-Pacific region presents substantial growth opportunities driven by increasing economic prosperity and business expansion.

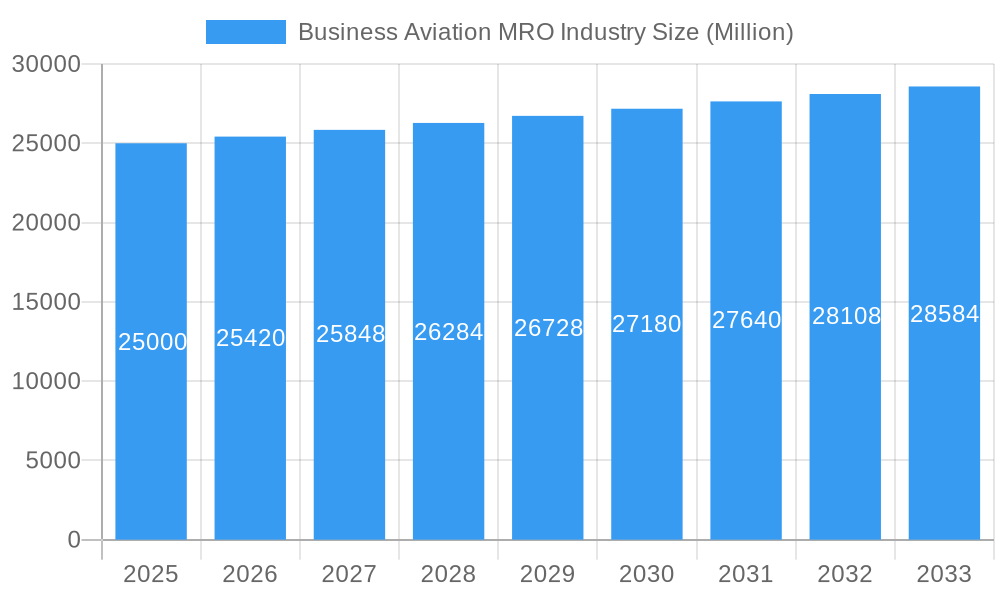

Business Aviation MRO Industry Market Size (In Billion)

Looking forward, the Business Aviation MRO market is set for sustained expansion, influenced by economic stability and geopolitical dynamics. Strategic collaborations, technological innovations such as predictive maintenance and digitalization, and a commitment to sustainability will be critical for competitive advantage. Market consolidation is expected to continue as leading entities seek to enhance their capabilities and reach. Regional growth disparities will likely persist, with Asia-Pacific anticipated to be a high-growth area. Enhancing operational efficiency and minimizing downtime through cutting-edge technologies will be crucial differentiators. Adherence to stringent safety standards and regulatory compliance will remain a core priority for all market participants.

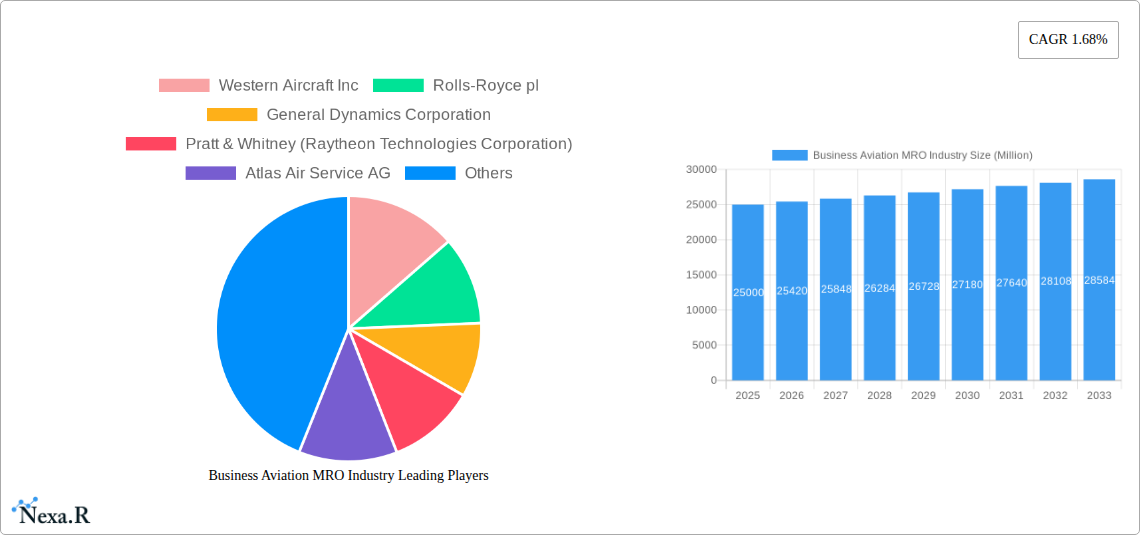

Business Aviation MRO Industry Company Market Share

Business Aviation MRO Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Business Aviation MRO (Maintenance, Repair, and Overhaul) industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. It examines market dynamics, growth trends, key players, and emerging opportunities within the parent market of Aviation MRO and its child market of Business Aviation MRO, providing a granular understanding of this dynamic sector. The market size is presented in Million units throughout.

Business Aviation MRO Industry Market Dynamics & Structure

This section analyzes the competitive landscape of the Business Aviation MRO industry, examining market concentration, technological innovation, regulatory frameworks, and industry consolidation. The market is characterized by a mix of large multinational corporations and smaller, specialized providers.

- Market Concentration: The market exhibits moderate concentration, with a few dominant players holding significant market share (estimated at xx% for the top 3 players in 2025). This is gradually changing due to M&A activity.

- Technological Innovation: Digitalization, predictive maintenance technologies, and advanced materials are key innovation drivers, impacting efficiency and reducing downtime. However, high initial investment costs and the need for skilled workforce present barriers to adoption.

- Regulatory Frameworks: Stringent safety regulations and compliance requirements significantly impact operational costs and necessitate continuous investment in training and infrastructure. Variations in regulations across regions further complicate operations.

- Competitive Product Substitutes: Limited direct substitutes exist, but the increasing efficiency of aircraft contributes to reduced MRO demand in the long run.

- End-User Demographics: The primary end-users are business jet operators, fractional ownership programs, and charter companies. Growth is driven by increasing demand for business aviation services among high-net-worth individuals and corporations.

- M&A Trends: The past 5 years have witnessed a significant increase in M&A activity, with xx deals recorded in the historical period (2019-2024). This consolidation is driven by the desire for economies of scale and expansion into new geographical markets.

Business Aviation MRO Industry Growth Trends & Insights

The Business Aviation MRO market is expected to exhibit robust growth throughout the forecast period (2025-2033). Driven by the increasing fleet size, the adoption of advanced technologies and the rise in business travel, the market is projected to reach xx Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Market penetration of advanced MRO technologies is anticipated to increase from xx% in 2025 to xx% by 2033. Technological disruptions, like the adoption of AI-powered predictive maintenance systems, are significantly impacting maintenance schedules and operational efficiency. Changes in consumer behavior, such as a preference for enhanced safety and reduced downtime, are further fueling demand for high-quality MRO services.

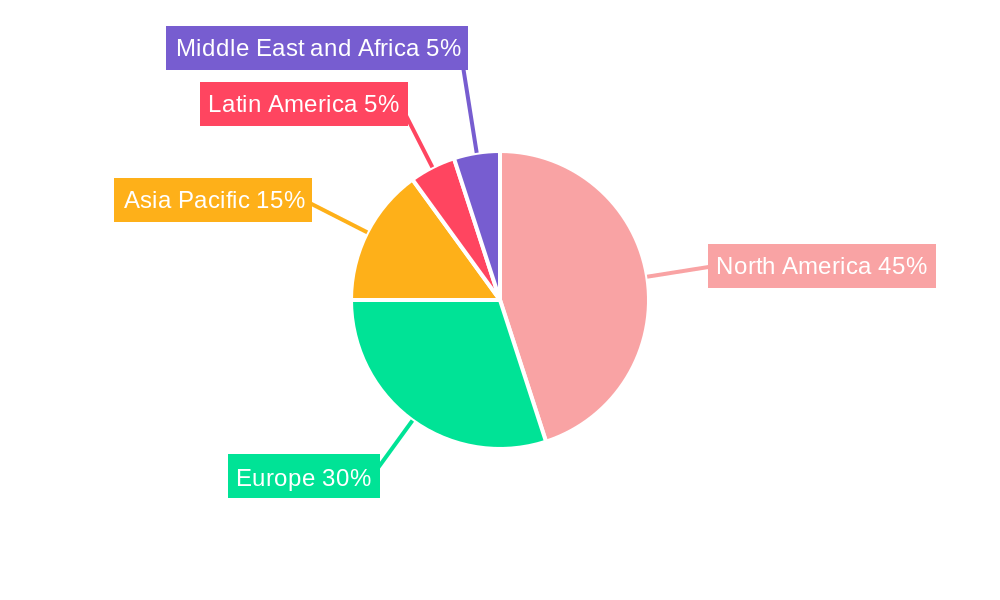

Dominant Regions, Countries, or Segments in Business Aviation MRO Industry

North America currently commands the largest market share within the Business Aviation MRO industry, a position bolstered by a substantial concentration of business jet operators and specialized MRO providers. Looking ahead, the Asia-Pacific region is poised for the most rapid expansion throughout the forecast period, driven by burgeoning business activities and significant investments in aviation infrastructure development.

- Engine MRO: This segment continues to hold the dominant market share. This is primarily attributable to the substantial costs associated with engine maintenance and the paramount importance of engines to overall aircraft operational integrity and safety.

- Airframe MRO: The growth trajectory of this segment is strongly influenced by the increasing average age of the global business aviation fleet, necessitating consistent and comprehensive airframe inspections, structural repairs, and upgrades.

- Component MRO: This segment is experiencing robust and rapid growth. The inherent complexity of modern aircraft systems, coupled with the specialized knowledge and precise handling required for the repair and maintenance of intricate components, fuels this expansion.

- Interior MRO: A heightened focus on cabin refurbishment, modernization, and bespoke customization is a key contributor to the sustained growth observed in this segment, catering to the evolving demands of discerning clientele.

- Field Maintenance: The demand for agile and responsive maintenance solutions is a primary driver for this segment. The increasing need for rapid turnaround times and efficient on-site maintenance services to minimize aircraft downtime is fueling its growth.

The overarching growth across all these segments is propelled by several critical factors: robust economic expansion in key global regions, sustained and increasing investments in aviation infrastructure, and the implementation of supportive and forward-thinking government policies that foster industry development.

Business Aviation MRO Industry Product Landscape

The Business Aviation MRO industry is characterized by a comprehensive and diverse array of products and services, encompassing critical areas such as engine overhaul and repair, intricate component servicing, routine and heavy airframe maintenance, sophisticated interior refurbishment, and responsive field maintenance operations. Recent advancements are sharply focused on enhancing operational efficiency, significantly reducing maintenance turnaround times, and the widespread adoption of proactive predictive maintenance techniques. Forward-thinking companies are increasingly integrating cutting-edge digital technologies, including sophisticated cloud-based maintenance management systems and advanced AI-powered predictive analytics platforms. These digital solutions are instrumental in optimizing maintenance strategies, thereby elevating overall operational efficiency. Their unique selling propositions lie in delivering unprecedented levels of transparency, substantial reductions in maintenance expenditure, and a marked improvement in aircraft operational availability.

Key Drivers, Barriers & Challenges in Business Aviation MRO Industry

Key Drivers: The continuous expansion of the business aviation MRO market is propelled by a confluence of factors. These include the aging business aviation fleet, which necessitates more frequent and intensive maintenance; the sustained and growing demand for business air travel; the relentless pace of technological advancements, particularly in predictive maintenance solutions; and the proactive role of government regulations in reinforcing aviation safety standards. Furthermore, the increasing integration of advanced materials and sophisticated technologies within aircraft design contributes significantly to enhanced operational performance and a reduction in overall maintenance costs.

Key Challenges: The industry is not without its hurdles. Persistent supply chain disruptions pose a significant threat, potentially impacting the timely procurement of essential parts and components. This, in turn, can lead to increased maintenance costs and undesirable delays in service delivery. Stringent regulatory compliance requirements and the non-negotiable adherence to rigorous safety standards necessitate substantial and ongoing investments in personnel training and state-of-the-art infrastructure. The highly competitive landscape among MRO providers also presents a considerable challenge, creating downward pressure on pricing and impacting profit margins. Current estimates suggest a potential impact of approximately XX% on profitability directly attributable to ongoing supply chain complexities.

Emerging Opportunities in Business Aviation MRO Industry

Significant growth opportunities are emerging in currently underserved markets within developing economies, alongside the expansion of fractional ownership programs and a burgeoning demand for highly customized cabin interiors. The industry is also witnessing a strong push towards the development and implementation of sustainable MRO practices. This includes the conscientious use of eco-friendly materials and a dedicated focus on minimizing waste generation, both presenting substantial avenues for innovation and market differentiation. Moreover, the strategic integration of advanced technologies such as blockchain for enhancing supply chain transparency and product traceability is charting a new and promising frontier for the industry.

Growth Accelerators in the Business Aviation MRO Industry Industry

Technological advancements in predictive maintenance and AI-powered diagnostics will play a crucial role in accelerating growth. Strategic partnerships between MRO providers and aircraft manufacturers to offer comprehensive maintenance solutions can further enhance market expansion. Geographical expansion into emerging markets with growing business aviation sectors will contribute to long-term sustainable growth.

Key Players Shaping the Business Aviation MRO Industry Market

- Western Aircraft Inc

- Rolls-Royce plc

- General Dynamics Corporation

- Pratt & Whitney (Raytheon Technologies Corporation)

- Atlas Air Service AG

- ExecuJet Aviation Group AG

- Lufthansa Technik AG

- DC Aviation GmbH

- Bombardier Inc

- Flying Colours Corp

- Constant Aviation LLC

- Comlux Aviation Services LLC

Notable Milestones in Business Aviation MRO Industry Sector

- December 2022: Embraer-X partnered with Pulse Aviation for Beacon, enhancing maintenance coordination.

- March 2022: Embraer signed a service agreement with Avantto for its executive jet fleet maintenance.

- December 2021: ExecuJet MRO Services Malaysia announced a new MRO facility in Kuala Lumpur.

In-Depth Business Aviation MRO Industry Market Outlook

The future of the Business Aviation MRO industry is bright, driven by the long-term growth in business aviation, technological advancements, and increasing focus on operational efficiency. The market offers lucrative opportunities for companies that can leverage technological innovations, optimize their operational efficiency, and effectively manage their supply chains. Strategic partnerships and expansion into new geographical markets will be key to capturing a larger market share and achieving sustainable growth in the coming years. The market is poised for substantial expansion, driven by sustained economic growth in key markets and ongoing demand for high-quality MRO services.

Business Aviation MRO Industry Segmentation

-

1. MRO Type

- 1.1. Engine MRO

- 1.2. Component MRO

- 1.3. Interior MRO

- 1.4. Airframe MRO

- 1.5. Field Maintenance

Business Aviation MRO Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Business Aviation MRO Industry Regional Market Share

Geographic Coverage of Business Aviation MRO Industry

Business Aviation MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Components MRO Segment of the Market is Expected to Witness Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Engine MRO

- 5.1.2. Component MRO

- 5.1.3. Interior MRO

- 5.1.4. Airframe MRO

- 5.1.5. Field Maintenance

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. North America Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 6.1.1. Engine MRO

- 6.1.2. Component MRO

- 6.1.3. Interior MRO

- 6.1.4. Airframe MRO

- 6.1.5. Field Maintenance

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 7. Europe Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 7.1.1. Engine MRO

- 7.1.2. Component MRO

- 7.1.3. Interior MRO

- 7.1.4. Airframe MRO

- 7.1.5. Field Maintenance

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 8. Asia Pacific Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 8.1.1. Engine MRO

- 8.1.2. Component MRO

- 8.1.3. Interior MRO

- 8.1.4. Airframe MRO

- 8.1.5. Field Maintenance

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 9. Latin America Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 9.1.1. Engine MRO

- 9.1.2. Component MRO

- 9.1.3. Interior MRO

- 9.1.4. Airframe MRO

- 9.1.5. Field Maintenance

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 10. Middle East and Africa Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 10.1.1. Engine MRO

- 10.1.2. Component MRO

- 10.1.3. Interior MRO

- 10.1.4. Airframe MRO

- 10.1.5. Field Maintenance

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Western Aircraft Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rolls-Royce pl

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Dynamics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pratt & Whitney (Raytheon Technologies Corporation)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Atlas Air Service AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ExecuJet Aviation Group AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lufthansa Technik AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DC Aviation GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bombardier Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Flying Colours Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Constant Aviation LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Comlux Aviation Services LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Western Aircraft Inc

List of Figures

- Figure 1: Global Business Aviation MRO Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 3: North America Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 4: North America Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 7: Europe Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 8: Europe Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 11: Asia Pacific Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 12: Asia Pacific Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 15: Latin America Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 16: Latin America Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 19: Middle East and Africa Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 20: Middle East and Africa Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 2: Global Business Aviation MRO Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 4: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 6: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 8: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 10: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 12: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Aviation MRO Industry?

The projected CAGR is approximately 4.75%.

2. Which companies are prominent players in the Business Aviation MRO Industry?

Key companies in the market include Western Aircraft Inc, Rolls-Royce pl, General Dynamics Corporation, Pratt & Whitney (Raytheon Technologies Corporation), Atlas Air Service AG, ExecuJet Aviation Group AG, Lufthansa Technik AG, DC Aviation GmbH, Bombardier Inc, Flying Colours Corp, Constant Aviation LLC, Comlux Aviation Services LLC.

3. What are the main segments of the Business Aviation MRO Industry?

The market segments include MRO Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 90.85 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Components MRO Segment of the Market is Expected to Witness Highest Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Embraer-X signed a contract with Pulse Aviation for the use of Beacon, the maintenance coordination platform connecting resources and professionals for faster return-to-service aircraft. Pulse Aviation, a Florida-based business aviation company that offers MRO services, will use Beacon to improve maintenance coordination, make it easier to communicate about maintenance events involving all different types of aircraft models, foster teamwork, enhance knowledge sharing, and speed up workflows related to maintenance events.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Business Aviation MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Business Aviation MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Business Aviation MRO Industry?

To stay informed about further developments, trends, and reports in the Business Aviation MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence