Key Insights

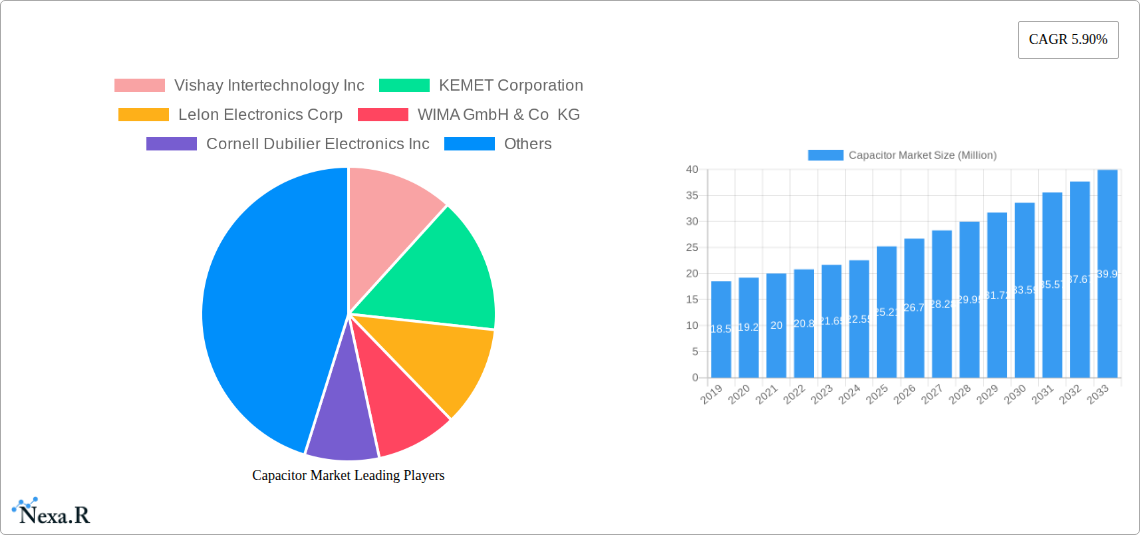

The global capacitor market is poised for significant expansion, projected to reach an estimated \$25.21 million by 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.90% through 2033. This robust growth is primarily fueled by the escalating demand across diverse end-user industries, including automotive, industrial automation, aerospace and defense, and the burgeoning energy sector. The proliferation of electric vehicles, advanced driver-assistance systems (ADAS), and smart grid technologies are major catalysts, requiring high-performance capacitors for power management and energy storage. Furthermore, the continuous innovation in consumer electronics, with an increasing emphasis on miniaturization and enhanced functionality, alongside the critical needs of communication infrastructure and data centers, are substantial growth drivers. The medical industry's increasing reliance on sophisticated electronic devices also contributes to sustained market demand.

Capacitor Market Market Size (In Million)

The market's trajectory is also shaped by critical trends such as the development of advanced capacitor technologies like supercapacitors (EDLCs) offering superior energy density and faster charging capabilities, and improvements in ceramic, tantalum, and aluminum electrolytic capacitors to meet stringent performance requirements. These advancements are crucial for enabling next-generation electronic designs. However, the market faces certain restraints, including the volatile pricing of raw materials like rare earth elements and lithium, which can impact manufacturing costs and profitability. Supply chain disruptions and geopolitical uncertainties also pose challenges to consistent market growth. Despite these headwinds, the inherent demand for reliable energy storage and power management solutions across a wide spectrum of applications, from cutting-edge industrial equipment to everyday consumer devices, ensures a promising outlook for the capacitor market in the coming years. The Asia Pacific region is expected to dominate due to its strong manufacturing base and rapidly growing electronics industry.

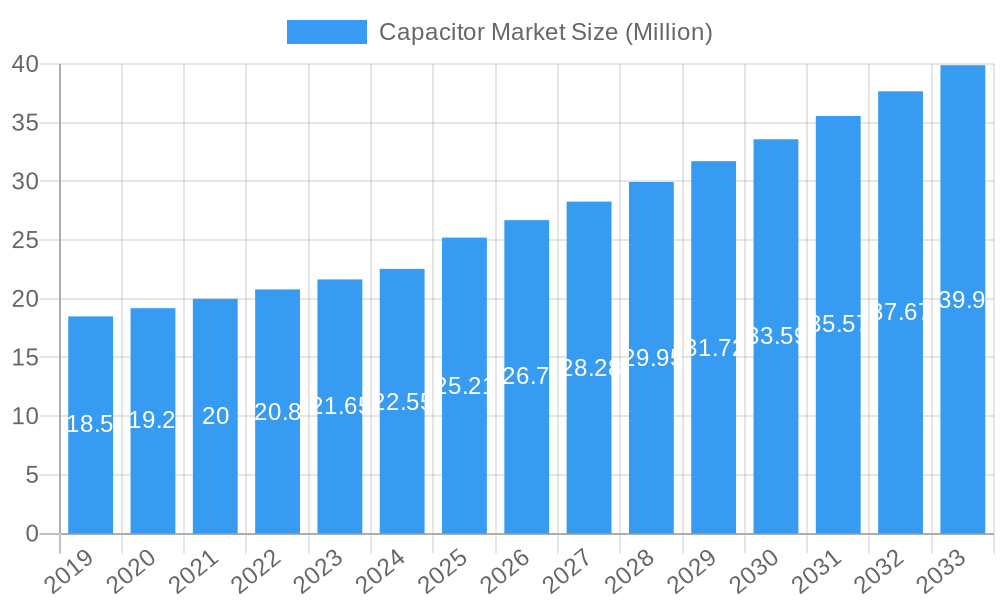

Capacitor Market Company Market Share

This in-depth report offers an indispensable analysis of the global capacitor market, projecting robust growth from 2019 to 2033, with a foundational focus on the base year of 2025. We delve into the intricate dynamics, growth trajectories, and future potential of this critical electronic component sector. The report covers a wide spectrum of capacitor types, including Ceramic Capacitors, Tantalum Capacitors, Aluminum Electrolytic Capacitors, Paper and Plastic Film Capacitors, and Supercapacitors/EDLCs, alongside their application across diverse end-user industries such as Automotive, Industrial, Aerospace and Defense, Energy, Communications/Servers/Data Storage, Consumer Electronics, and Medical.

Capacitor Market Dynamics & Structure

The global capacitor market exhibits a moderate to high level of concentration, driven by a few dominant players and a significant number of specialized manufacturers. Technological innovation serves as a primary driver, with continuous advancements in miniaturization, increased capacitance density, and improved performance characteristics. Regulatory frameworks, particularly concerning environmental standards and material sourcing, are influencing manufacturing processes and product development. Competitive product substitutes, such as advancements in semiconductor technology that reduce the need for certain capacitor types in specific applications, present a dynamic challenge. End-user demographics are shifting, with a burgeoning demand from the automotive sector for advanced driver-assistance systems (ADAS) and electric vehicles (EVs), and a consistent need from the industrial sector for robust and reliable components. Mergers and acquisitions (M&A) trends are observable as larger entities seek to consolidate market share and acquire specialized technologies. For instance, recent M&A activities indicate a strategic push towards acquiring companies with expertise in high-performance or niche capacitor technologies.

- Market Concentration: Dominated by a mix of global giants and specialized regional players.

- Technological Innovation: Driven by miniaturization, higher energy density, and enhanced reliability.

- Regulatory Impact: Environmental compliance and safety standards are key considerations.

- Competitive Landscape: Competition from alternative technologies and evolving end-user demands.

- M&A Activity: Strategic acquisitions to gain market share and technological prowess.

Capacitor Market Growth Trends & Insights

The capacitor market is poised for substantial expansion, driven by a confluence of technological advancements and escalating demand across critical industries. Over the forecast period of 2025–2033, we anticipate a Compound Annual Growth Rate (CAGR) that reflects the pivotal role capacitors play in modern electronics. Market size evolution is intrinsically linked to the proliferation of smart devices, the electrification of transportation, and the expansion of renewable energy infrastructure. Adoption rates for advanced capacitor technologies, such as supercapacitors and high-performance ceramic capacitors, are accelerating due to their superior energy storage capabilities and longer lifespans compared to traditional components. Technological disruptions, including the development of novel dielectric materials and advanced packaging techniques, are enabling smaller form factors with increased functionality, thereby fueling market penetration in space-constrained applications. Consumer behavior shifts towards more sophisticated and energy-efficient electronic products are also indirectly boosting demand for reliable and high-performance capacitors. The increasing complexity of electronic systems, from advanced automotive infotainment and autonomous driving features to sophisticated industrial automation and cutting-edge medical devices, necessitates a greater number of high-quality capacitors. Furthermore, the ongoing digitalization trend, with its insatiable demand for data processing and storage, significantly contributes to the growth of the communications and server segments, where high-reliability capacitors are indispensable. The forecast period will likely witness a considerable increase in the adoption of capacitors in emerging applications, such as advanced battery management systems for electric vehicles and energy harvesting solutions, further solidifying the market's upward trajectory.

Dominant Regions, Countries, or Segments in Capacitor Market

The Automotive end-user industry stands as a dominant segment within the global capacitor market, propelled by the transformative shift towards electric vehicles (EVs) and the widespread adoption of advanced driver-assistance systems (ADAS). The increasing integration of complex electronic control units (ECUs), sophisticated infotainment systems, and robust power management solutions in modern vehicles necessitates a significant increase in the number and types of capacitors used. For instance, EVs alone require a multitude of capacitors for battery management systems, onboard chargers, inverters, and motor control, driving substantial demand for high-voltage and high-reliability components.

- Automotive Sector Dominance:

- EV Revolution: Exponential demand for capacitors in battery systems, power electronics, and charging infrastructure.

- ADAS Proliferation: Crucial for sensor integration, processing units, and communication modules.

- Stringent Reliability Standards: Automotive-grade capacitors are essential due to the demanding operating environment.

- Market Share: Expected to hold a significant portion of the total market value in the forecast period.

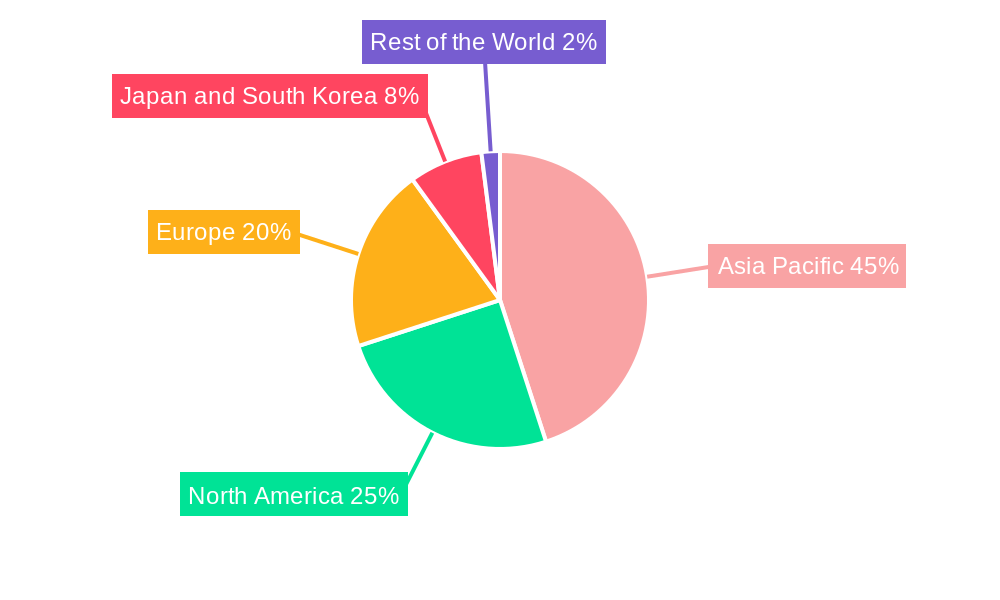

Geographically, Asia Pacific is anticipated to be the leading region, driven by its robust manufacturing base, substantial domestic demand for consumer electronics and automotive products, and significant investments in infrastructure development. Countries like China, South Korea, and Japan are at the forefront of capacitor production and consumption, benefiting from the presence of major electronics manufacturers and a burgeoning middle class.

- Asia Pacific Leadership:

- Manufacturing Hub: Concentration of leading capacitor manufacturers and supply chain infrastructure.

- Consumer Electronics Demand: High production and sales of smartphones, laptops, and other consumer devices.

- Automotive Growth: Rapid expansion of the automotive sector, particularly in EVs.

- Government Initiatives: Supportive policies for electronics manufacturing and innovation.

Capacitor Market Product Landscape

The capacitor market is characterized by continuous product innovation, leading to enhanced performance and expanded applications. Ceramic capacitors, particularly Multilayer Ceramic Capacitors (MLCCs), are leading the charge with advancements in miniaturization, higher volumetric efficiency, and improved temperature stability, making them indispensable for compact electronic devices. Tantalum and aluminum electrolytic capacitors remain vital for power supply applications requiring high capacitance values and ripple current handling. Supercapacitors/EDLCs are gaining traction due to their high power density, fast charging capabilities, and long cycle life, finding applications in energy storage for EVs, industrial equipment, and renewable energy systems. The development of specialized capacitors for high-frequency, high-voltage, and harsh environment applications continues to push the boundaries of what's technologically possible.

Key Drivers, Barriers & Challenges in Capacitor Market

Key Drivers:

- Growth of 5G Technology: The deployment of 5G networks requires a vast number of high-performance capacitors for base stations, mobile devices, and associated infrastructure, driving demand for specialized MLCCs and other high-frequency capacitors.

- Electrification of Vehicles: The rapidly expanding electric vehicle (EV) market is a significant growth accelerator, demanding a substantial volume of capacitors for battery management systems, power converters, and charging infrastructure.

- Internet of Things (IoT) Expansion: The proliferation of IoT devices, from smart home appliances to industrial sensors, creates a continuous need for miniaturized and energy-efficient capacitors.

- Industrial Automation and AI: Increased adoption of automation, robotics, and artificial intelligence in manufacturing and other sectors necessitates reliable and high-performance capacitors for control systems and power supplies.

Barriers & Challenges:

- Supply Chain Volatility: Disruptions in the supply of raw materials, such as tantalum and rare earth elements, can lead to price fluctuations and production bottlenecks.

- Intense Price Competition: The highly competitive nature of the capacitor market, particularly for commodity types, can put pressure on profit margins for manufacturers.

- Technological Obsolescence: Rapid advancements in electronic components can lead to the obsolescence of older capacitor technologies, requiring continuous investment in R&D.

- Skilled Labor Shortage: A lack of skilled engineers and technicians for specialized manufacturing processes and advanced R&D can hinder growth.

- Stringent Environmental Regulations: Evolving environmental regulations regarding material usage and disposal can increase compliance costs for manufacturers.

Emerging Opportunities in Capacitor Market

Emerging opportunities in the capacitor market lie in the development of next-generation materials for higher energy density and improved thermal performance, particularly for applications in advanced battery technologies and electric mobility. The growing demand for efficient energy storage solutions in renewable energy grids and smart grids presents a significant avenue for growth for supercapacitors and high-capacitance capacitors. Furthermore, the miniaturization trend in consumer electronics, coupled with the increasing complexity of medical devices and wearable technology, opens up opportunities for ultra-small, high-performance capacitors. The space and defense sectors, with their requirement for highly reliable and radiation-hardened components, also represent a niche but lucrative market for specialized capacitor solutions.

Growth Accelerators in the Capacitor Market Industry

Several key factors are accelerating growth in the capacitor market. The relentless pace of technological innovation, particularly in materials science and manufacturing processes, allows for the creation of capacitors with superior performance characteristics, catering to increasingly demanding applications. Strategic partnerships and collaborations between capacitor manufacturers and device developers are crucial for co-innovating and ensuring that capacitor technology keeps pace with evolving electronic designs. Market expansion strategies, including the penetration of emerging economies and the development of customized solutions for specific industries, are also key growth drivers. The increasing global focus on sustainability and energy efficiency is also indirectly fueling demand for capacitors that enable more efficient power management in electronic devices and systems.

Key Players Shaping the Capacitor Market Market

- Vishay Intertechnology Inc

- KEMET Corporation

- Lelon Electronics Corp

- WIMA GmbH & Co KG

- Cornell Dubilier Electronics Inc

- Eaton Corporation PLC

- Würth Elektronik eiSos GmbH & Co KG

- United Chemi-Con (Nippon Chemi-Con Corporation)

- Yageo Corporation

- TDK Corporation

- Murata Manufacturing Co Ltd

- KYOCERA AVX Components Corporation

- Panasonic Corporation

- Honeywell International Inc

Notable Milestones in Capacitor Market Sector

- November 2023: KYOCERA AVX introduced its inaugural safety-certified MLCCs, the KGK Series (Class X1/Y2) and KGH Series (Class X2), designed for AC line filtering applications, offering enhanced surge and transient protection and EMI filtering.

- March 2023: Murata Manufacturing Co., Ltd. expanded its silicon capacitor manufacturing capabilities by establishing a new 200-mm mass production line in Caen, France, catering to critical applications in telecommunication infrastructure, implantable medical systems, and mobile phones.

In-Depth Capacitor Market Market Outlook

The capacitor market is set for a period of sustained and dynamic growth, driven by the indispensable nature of capacitors in virtually all electronic applications. Future market potential is significantly influenced by the continued advancements in electric vehicles, the expansion of 5G networks, and the ubiquitous growth of the Internet of Things. Strategic opportunities abound in developing highly specialized capacitors for niche applications like aerospace and advanced medical devices, as well as in optimizing production for cost-effectiveness in high-volume consumer electronics. The industry's ability to innovate in materials science and manufacturing will be paramount in meeting the ever-increasing demands for higher capacitance, smaller form factors, and enhanced reliability.

Capacitor Market Segmentation

-

1. Type

- 1.1. Ceramic Capacitors

- 1.2. Tantalum Capacitors

- 1.3. Aluminum Electrolytic Capacitors

- 1.4. Paper and Plastic Film Capacitors

- 1.5. Supercapacitors/EDLCs

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Aerospace and Defense

- 2.4. Energy

- 2.5. Communications/Servers/Data Storage

- 2.6. Consumer Electronics

- 2.7. Medical

Capacitor Market Segmentation By Geography

- 1. Americas

- 2. Europe

- 3. Asia Pacific

- 4. Japan and South Korea

Capacitor Market Regional Market Share

Geographic Coverage of Capacitor Market

Capacitor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of EVs to Boost the Demand for Capacitors; Increasing Adoption of Capacitors in the Telecom and Electronics Industry

- 3.3. Market Restrains

- 3.3.1. Requirement of Technical Competence for Developing Advanced Capacitors

- 3.4. Market Trends

- 3.4.1. Ceramic Capacitors to Hold the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Capacitor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ceramic Capacitors

- 5.1.2. Tantalum Capacitors

- 5.1.3. Aluminum Electrolytic Capacitors

- 5.1.4. Paper and Plastic Film Capacitors

- 5.1.5. Supercapacitors/EDLCs

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Aerospace and Defense

- 5.2.4. Energy

- 5.2.5. Communications/Servers/Data Storage

- 5.2.6. Consumer Electronics

- 5.2.7. Medical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Americas

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Japan and South Korea

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Americas Capacitor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ceramic Capacitors

- 6.1.2. Tantalum Capacitors

- 6.1.3. Aluminum Electrolytic Capacitors

- 6.1.4. Paper and Plastic Film Capacitors

- 6.1.5. Supercapacitors/EDLCs

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Industrial

- 6.2.3. Aerospace and Defense

- 6.2.4. Energy

- 6.2.5. Communications/Servers/Data Storage

- 6.2.6. Consumer Electronics

- 6.2.7. Medical

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Capacitor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ceramic Capacitors

- 7.1.2. Tantalum Capacitors

- 7.1.3. Aluminum Electrolytic Capacitors

- 7.1.4. Paper and Plastic Film Capacitors

- 7.1.5. Supercapacitors/EDLCs

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Industrial

- 7.2.3. Aerospace and Defense

- 7.2.4. Energy

- 7.2.5. Communications/Servers/Data Storage

- 7.2.6. Consumer Electronics

- 7.2.7. Medical

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Capacitor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ceramic Capacitors

- 8.1.2. Tantalum Capacitors

- 8.1.3. Aluminum Electrolytic Capacitors

- 8.1.4. Paper and Plastic Film Capacitors

- 8.1.5. Supercapacitors/EDLCs

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Industrial

- 8.2.3. Aerospace and Defense

- 8.2.4. Energy

- 8.2.5. Communications/Servers/Data Storage

- 8.2.6. Consumer Electronics

- 8.2.7. Medical

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Japan and South Korea Capacitor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ceramic Capacitors

- 9.1.2. Tantalum Capacitors

- 9.1.3. Aluminum Electrolytic Capacitors

- 9.1.4. Paper and Plastic Film Capacitors

- 9.1.5. Supercapacitors/EDLCs

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Industrial

- 9.2.3. Aerospace and Defense

- 9.2.4. Energy

- 9.2.5. Communications/Servers/Data Storage

- 9.2.6. Consumer Electronics

- 9.2.7. Medical

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Vishay Intertechnology Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 KEMET Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lelon Electronics Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 WIMA GmbH & Co KG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cornell Dubilier Electronics Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Eaton Corporation PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Würth Elektronik eiSos GmbH & Co KG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 United Chemi-Con (Nippon Chemi-Con Corporation)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Yageo Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TDK Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Murata Manufacturing Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 KYOCERA AVX Components Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Panasonic Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Honeywell International Inc *List Not Exhaustive

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Capacitor Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Americas Capacitor Market Revenue (Million), by Type 2025 & 2033

- Figure 3: Americas Capacitor Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Americas Capacitor Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Americas Capacitor Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Americas Capacitor Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Americas Capacitor Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Capacitor Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Capacitor Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Capacitor Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Capacitor Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Capacitor Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Capacitor Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Capacitor Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Capacitor Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Capacitor Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Capacitor Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Capacitor Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Capacitor Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Japan and South Korea Capacitor Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Japan and South Korea Capacitor Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Japan and South Korea Capacitor Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Japan and South Korea Capacitor Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Japan and South Korea Capacitor Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Japan and South Korea Capacitor Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Capacitor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Capacitor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Capacitor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Capacitor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Capacitor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Capacitor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Capacitor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Capacitor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Capacitor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Capacitor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Capacitor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Capacitor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Capacitor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Capacitor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Capacitor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Capacitor Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Capacitor Market?

Key companies in the market include Vishay Intertechnology Inc, KEMET Corporation, Lelon Electronics Corp, WIMA GmbH & Co KG, Cornell Dubilier Electronics Inc, Eaton Corporation PLC, Würth Elektronik eiSos GmbH & Co KG, United Chemi-Con (Nippon Chemi-Con Corporation), Yageo Corporation, TDK Corporation, Murata Manufacturing Co Ltd, KYOCERA AVX Components Corporation, Panasonic Corporation, Honeywell International Inc *List Not Exhaustive.

3. What are the main segments of the Capacitor Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of EVs to Boost the Demand for Capacitors; Increasing Adoption of Capacitors in the Telecom and Electronics Industry.

6. What are the notable trends driving market growth?

Ceramic Capacitors to Hold the Largest Market Share.

7. Are there any restraints impacting market growth?

Requirement of Technical Competence for Developing Advanced Capacitors.

8. Can you provide examples of recent developments in the market?

November 2023: KYOCERA AVX, a respected global manufacturer of advanced electronic components, has enhanced its wide range of commercial surface-mount MLCCs by introducing its inaugural safety-certified MLCCs. These new additions include the KGK Series, which possesses the Class X1/Y2 safety certification, and the KGH Series, which boasts the Class X2 safety certification. These Class-X and Class-Y certified capacitors have been specifically engineered to safeguard against surges and transients while also delivering effective EMI filtering in AC line filtering applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Capacitor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Capacitor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Capacitor Market?

To stay informed about further developments, trends, and reports in the Capacitor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence