Key Insights

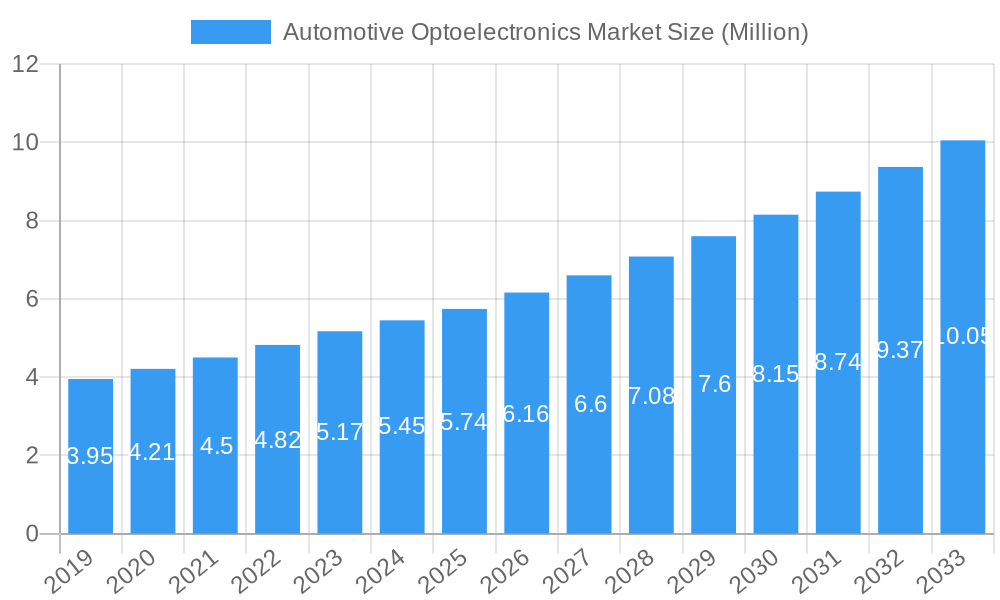

The global Automotive Optoelectronics Market is poised for significant expansion, projected to reach a substantial size of $5.74 billion by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 7.30% anticipated between 2025 and 2033, indicating a dynamic and thriving industry. This upward trajectory is primarily fueled by the accelerating adoption of advanced driver-assistance systems (ADAS) and the increasing sophistication of in-car infotainment and lighting solutions. The demand for enhanced safety features, such as adaptive headlights, pedestrian detection, and lane-keeping assist, directly translates into a higher need for optoelectronic components like image sensors and LED lighting. Furthermore, the burgeoning trend towards electric vehicles (EVs) and the associated integration of advanced battery management systems and charging indicators also contribute significantly to market expansion. The ongoing evolution of autonomous driving technologies will further necessitate a greater array of high-performance optoelectronic sensors and communication modules.

Automotive Optoelectronics Market Market Size (In Million)

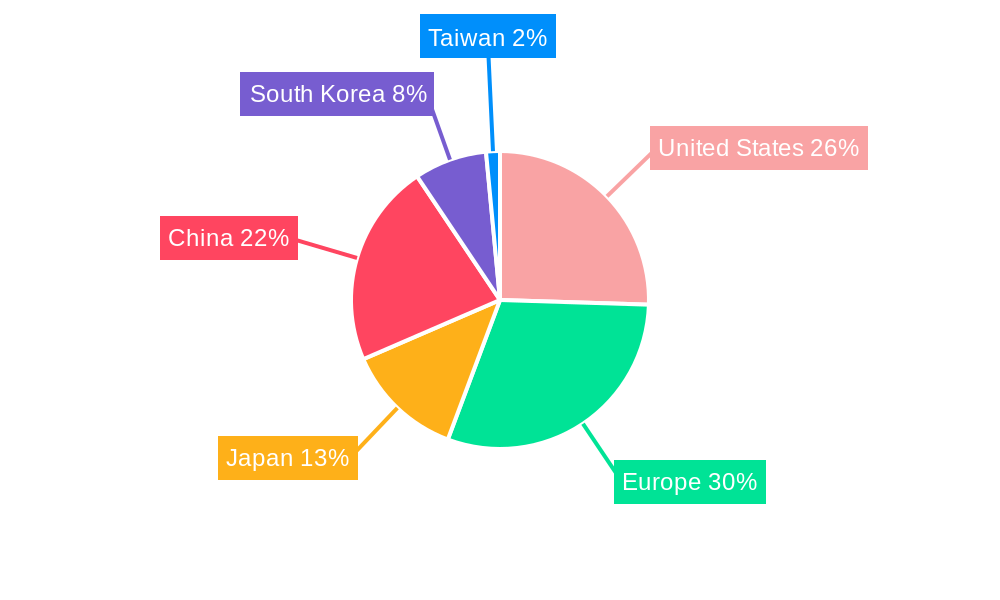

The market is segmented across a diverse range of device types, with LED and Laser Diode technologies leading the charge due to their widespread application in lighting, sensing, and communication. Image sensors are also experiencing robust demand, driven by the proliferation of cameras for ADAS and surveillance. Optocouplers play a crucial role in electrical isolation and signal transmission within complex automotive electronic systems. Photovoltaic cells are increasingly integrated for auxiliary power generation and smart window applications. Geographically, key regions like the United States and Europe are expected to lead market growth, driven by stringent safety regulations and high consumer demand for advanced automotive features. Asia-Pacific, particularly China and South Korea, are emerging as critical manufacturing hubs and rapidly expanding markets, fueled by their strong automotive industries and increasing investment in next-generation vehicle technologies. While the market presents immense opportunities, challenges such as the high cost of advanced optoelectronic components and the need for rigorous validation and certification processes in the automotive sector represent potential restraints that manufacturers and suppliers will need to navigate.

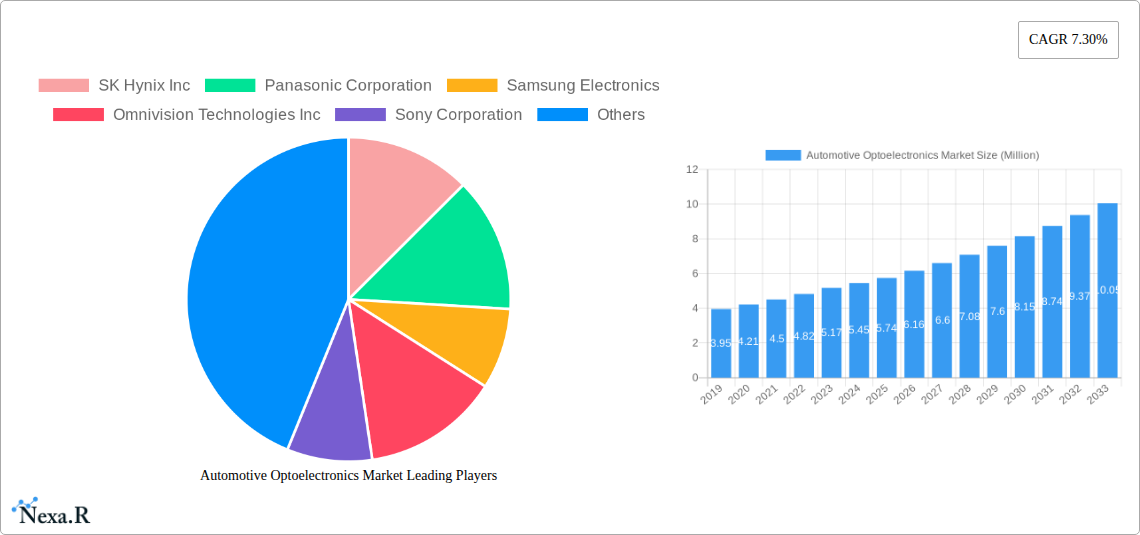

Automotive Optoelectronics Market Company Market Share

Automotive Optoelectronics Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the global Automotive Optoelectronics Market, exploring market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and the strategic initiatives of leading players. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this report offers critical insights for stakeholders seeking to navigate the evolving automotive technology sector. We delve into the parent market and child markets, presenting all values in million units to facilitate precise understanding.

Automotive Optoelectronics Market Market Dynamics & Structure

The Automotive Optoelectronics Market is characterized by a dynamic interplay of technological innovation, stringent regulatory frameworks, and an increasingly competitive landscape. Market concentration is moderate, with key players continuously investing in Research and Development to gain a competitive edge in areas like advanced lighting systems, LiDAR for autonomous driving, and sophisticated imaging sensors. Technological innovation drivers are primarily fueled by the accelerating adoption of Advanced Driver-Assistance Systems (ADAS), electric vehicles (EVs), and the pursuit of enhanced vehicle safety and user experience. Regulatory frameworks, particularly those concerning vehicle safety standards and emissions, indirectly influence the demand for energy-efficient and performance-driven optoelectronic components. Competitive product substitutes exist, particularly in lighting technologies, but the unique functionalities of optoelectronics in sensing and data acquisition create a distinct market niche. End-user demographics are shifting, with a growing demand for premium features and a heightened awareness of vehicle safety among consumers. Mergers and Acquisitions (M&A) trends are notable, with larger players acquiring innovative startups to expand their product portfolios and market reach. For instance, the historical period saw significant M&A activities aimed at consolidating market share and acquiring specialized technological expertise.

- Market Concentration: Moderate, with a few dominant players and a growing number of specialized suppliers.

- Technological Innovation Drivers: ADAS, autonomous driving, EV integration, advanced lighting, and in-cabin experience enhancements.

- Regulatory Frameworks: Focus on vehicle safety, emissions, and data privacy influencing component development.

- Competitive Product Substitutes: Primarily in basic lighting, but limited for advanced sensing and communication applications.

- End-User Demographics: Increasing demand for advanced features, safety, and connectivity.

- M&A Trends: Strategic acquisitions to enhance technology portfolios and market presence.

Automotive Optoelectronics Market Growth Trends & Insights

The global Automotive Optoelectronics Market is poised for robust growth, driven by the relentless pursuit of automotive innovation and technological advancements. The market size evolution is marked by a consistent upward trajectory, projected to witness a significant expansion in the coming years. Adoption rates of key optoelectronic components, such as image sensors for ADAS and LiDAR systems for autonomous driving, are accelerating rapidly. Technological disruptions, including the miniaturization of components, increased power efficiency, and enhanced performance under diverse environmental conditions, are reshaping the market. Consumer behavior shifts, with a growing preference for vehicles equipped with advanced safety features, intelligent lighting, and in-car connectivity, are further bolstering market demand. The parent market, encompassing all optoelectronic applications in vehicles, is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033. Within this, the child market for automotive LiDAR is expected to exhibit an even more aggressive CAGR, driven by the autonomous driving revolution. The increasing integration of sophisticated camera systems, essential for ADAS functionalities like lane keeping assist and automatic emergency braking, contributes significantly to the growth of the image sensor segment. Furthermore, the transition to LED lighting across all exterior and interior applications, owing to its energy efficiency and design flexibility, continues to be a major growth driver. The overall market penetration of advanced optoelectronic solutions is expected to reach 75% by 2033, up from an estimated 50% in 2025.

Dominant Regions, Countries, or Segments in Automotive Optoelectronics Market

The Image Sensors segment stands out as a dominant force driving growth within the Automotive Optoelectronics Market. The escalating demand for sophisticated ADAS, crucial for enhancing vehicle safety and enabling semi-autonomous driving capabilities, directly fuels the adoption of high-resolution and advanced image sensors. Countries and regions with strong automotive manufacturing bases and a proactive stance on safety regulations, such as North America and Europe, are leading the charge in adopting these technologies.

Dominant Segment: Image Sensors

- Key Drivers: Proliferation of ADAS features (e.g., AEB, LKA, traffic sign recognition), development of autonomous driving systems, increasing vehicle connectivity, and stringent safety standards.

- Market Share: Expected to command over 30% of the total automotive optoelectronics market by 2033.

- Growth Potential: High, driven by continuous improvements in resolution, low-light performance, and integration capabilities.

Leading Region: North America

- Key Drivers: Strong presence of automotive R&D hubs, significant investment in autonomous vehicle technology, favorable government initiatives promoting vehicle safety, and a consumer base receptive to advanced automotive features.

- Economic Policies: Tax incentives for EV adoption and autonomous driving research.

- Infrastructure: Well-developed road networks and a growing adoption of smart city concepts.

- Market Share: Estimated to hold a 35% market share in the automotive optoelectronics sector by 2030.

Leading Country: United States

- Key Drivers: Pioneering role in autonomous driving technology development, presence of major automotive OEMs and Tier-1 suppliers heavily investing in optoelectronics, and a strong consumer demand for advanced in-car technologies.

- Market Share: Anticipated to represent over 25% of the global automotive optoelectronics market by 2033.

The LED segment also plays a pivotal role, driven by the global shift towards energy-efficient and customizable lighting solutions for both exterior and interior applications. The increasing adoption of matrix LED headlights, ambient interior lighting, and signal lighting innovations contributes significantly to its market dominance. While LiDAR is a rapidly growing child market, image sensors currently represent a more established and broadly adopted segment.

Automotive Optoelectronics Market Product Landscape

The Automotive Optoelectronics Market is witnessing a surge in product innovations centered on enhanced safety, efficiency, and user experience. Advanced LED technologies are transforming automotive lighting with adaptive driving beams, dynamic turn signals, and interior mood lighting. Image sensors are evolving with higher resolutions, improved low-light performance, and integration of machine learning capabilities for sophisticated ADAS. Laser diodes are critical for LiDAR systems, enabling precise environmental perception for autonomous driving. Optocouplers are finding new applications in power management and safety systems within electric vehicles. Photovoltaic cells are being explored for integrated solar charging solutions.

Key Drivers, Barriers & Challenges in Automotive Optoelectronics Market

The Automotive Optoelectronics Market is propelled by several key drivers, including the escalating demand for advanced driver-assistance systems (ADAS), the burgeoning development of autonomous driving technologies, and the global shift towards electric vehicles (EVs) which often incorporate more complex electronic systems. Technological advancements in miniaturization, power efficiency, and performance under extreme conditions are also significant drivers. Furthermore, evolving consumer expectations for enhanced safety, connectivity, and in-car experiences contribute to market growth.

Conversely, the market faces several barriers and challenges. High development and manufacturing costs for cutting-edge optoelectronic components can be a restraint. Stringent and evolving automotive safety regulations, while driving innovation, also impose significant compliance burdens and testing requirements. Supply chain disruptions, as evidenced by recent global events, can impact the availability and cost of essential raw materials and components. Intense competition among established players and emerging startups also presents a challenge, requiring continuous innovation and competitive pricing strategies.

Emerging Opportunities in Automotive Optoelectronics Market

Emerging opportunities in the Automotive Optoelectronics Market are abundant, particularly in the realm of V2X (Vehicle-to-Everything) communication and advanced driver monitoring systems. The development of solid-state LiDAR and advanced sensor fusion techniques for enhanced autonomous driving reliability presents a significant growth avenue. Furthermore, the integration of optoelectronic components for in-cabin driver and passenger monitoring, including occupant detection and gesture control, is an expanding market. The growing demand for customizable and dynamic exterior lighting solutions, moving beyond static illumination, offers further opportunities for innovation and market penetration.

Growth Accelerators in the Automotive Optoelectronics Market Industry

Several catalysts are accelerating the long-term growth of the Automotive Optoelectronics Market. Technological breakthroughs in sensor sensitivity, processing power, and communication speeds are enabling more sophisticated functionalities. Strategic partnerships between automotive OEMs, Tier-1 suppliers, and semiconductor manufacturers are fostering collaborative innovation and accelerating product development cycles. Market expansion strategies, including the focus on emerging automotive markets and the increasing penetration of ADAS in mid-range and entry-level vehicles, are also significant growth accelerators. The continuous reduction in the cost of key optoelectronic components, driven by economies of scale and manufacturing advancements, is further democratizing access to these technologies.

Key Players Shaping the Automotive Optoelectronics Market Market

- SK Hynix Inc

- Panasonic Corporation

- Samsung Electronics

- Omnivision Technologies Inc

- Sony Corporation

- Ams Osram AG

- Signify Holding

- Vishay Intertechnology Inc

- Texas Instruments Inc

- LITE-ON Technology Corporation

- Rohm Company Limited

- Mitsubishi Electric Corporation

- Broadcom Inc

- Sharp Corporation

Notable Milestones in Automotive Optoelectronics Market Sector

- February 2024: TSMC, Sony Semiconductor Solutions Corporation, DENSO Corporation, and Toyota Motor Corporation bolstered their investment in Japan Advanced Semiconductor Manufacturing Inc. ("JASM"), a subsidiary primarily owned by TSMC in Kumamoto Prefecture, Japan. This investment aims to establish a second fab, slated to commence operations by the end of 2027. Coupled with JASM's first fab, set to launch in 2024, the collective investment in JASM will surpass USD 20 billion, backed by substantial support from the Japanese government. This signifies a major push towards bolstering domestic semiconductor manufacturing capabilities, crucial for the supply of advanced optoelectronic components.

- January 2024: Osram Licht AG unveiled a new line of side-looker, low-power LEDs. These LEDs, known as SYNIOS P1515 sidelookers, offer a simplified design, are easier to integrate, and facilitate a uniform appearance in applications like extended light bars and other automotive rear lighting. By opting for these side-looker LEDs over traditional top-looker ones, automotive manufacturers can achieve a seamless, uniform look across the vehicle's width. Notably, even with the same number of LEDs, the RCL or turn indicator can be made with a significantly slimmer and more straightforward optical setup. This product launch highlights ongoing innovation in automotive lighting solutions, emphasizing design flexibility and efficiency.

In-Depth Automotive Optoelectronics Market Market Outlook

The future outlook for the Automotive Optoelectronics Market is exceptionally promising, fueled by the ongoing technological revolution in the automotive industry. The sustained growth will be driven by the accelerating adoption of electrification, autonomous driving, and intelligent connectivity. Strategic partnerships, further technological advancements in sensor fusion and AI integration, and the expansion of manufacturing capacities will be critical for market players to capitalize on emerging opportunities. The increasing demand for personalized in-cabin experiences and enhanced vehicle safety will continue to push the boundaries of optoelectronic innovation, ensuring robust growth in the forecast period.

Automotive Optoelectronics Market Segmentation

-

1. Device Type

- 1.1. LED

- 1.2. Laser Diode

- 1.3. Image Sensors

- 1.4. Optocouplers

- 1.5. Photovoltaic cells

- 1.6. Other Device Types

Automotive Optoelectronics Market Segmentation By Geography

- 1. United States

- 2. Europe

- 3. Japan

- 4. China

- 5. South Korea

- 6. Taiwan

Automotive Optoelectronics Market Regional Market Share

Geographic Coverage of Automotive Optoelectronics Market

Automotive Optoelectronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Technology Advancements

- 3.2.2 and AI Developments will Drive the Growth; Growing Demand for Electric Vehicles

- 3.3. Market Restrains

- 3.3.1 Technology Advancements

- 3.3.2 and AI Developments will Drive the Growth; Growing Demand for Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Image Sensors are Expected to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. LED

- 5.1.2. Laser Diode

- 5.1.3. Image Sensors

- 5.1.4. Optocouplers

- 5.1.5. Photovoltaic cells

- 5.1.6. Other Device Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.2.2. Europe

- 5.2.3. Japan

- 5.2.4. China

- 5.2.5. South Korea

- 5.2.6. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. United States Automotive Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. LED

- 6.1.2. Laser Diode

- 6.1.3. Image Sensors

- 6.1.4. Optocouplers

- 6.1.5. Photovoltaic cells

- 6.1.6. Other Device Types

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe Automotive Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. LED

- 7.1.2. Laser Diode

- 7.1.3. Image Sensors

- 7.1.4. Optocouplers

- 7.1.5. Photovoltaic cells

- 7.1.6. Other Device Types

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Japan Automotive Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. LED

- 8.1.2. Laser Diode

- 8.1.3. Image Sensors

- 8.1.4. Optocouplers

- 8.1.5. Photovoltaic cells

- 8.1.6. Other Device Types

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. China Automotive Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. LED

- 9.1.2. Laser Diode

- 9.1.3. Image Sensors

- 9.1.4. Optocouplers

- 9.1.5. Photovoltaic cells

- 9.1.6. Other Device Types

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. South Korea Automotive Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. LED

- 10.1.2. Laser Diode

- 10.1.3. Image Sensors

- 10.1.4. Optocouplers

- 10.1.5. Photovoltaic cells

- 10.1.6. Other Device Types

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Taiwan Automotive Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 11.1.1. LED

- 11.1.2. Laser Diode

- 11.1.3. Image Sensors

- 11.1.4. Optocouplers

- 11.1.5. Photovoltaic cells

- 11.1.6. Other Device Types

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 SK Hynix Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Panasonic Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Samsung Electronics

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Omnivision Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Sony Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Ams Osram AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Signify Holding

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Vishay Intertechnology Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Texas Instruments Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 LITE-ON Technology Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Rohm Company Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Mitsubishi Electric Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Broadcom Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Sharp Corporatio

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 SK Hynix Inc

List of Figures

- Figure 1: Global Automotive Optoelectronics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Automotive Optoelectronics Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States Automotive Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 4: United States Automotive Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 5: United States Automotive Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: United States Automotive Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 7: United States Automotive Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 8: United States Automotive Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 9: United States Automotive Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United States Automotive Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Automotive Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 12: Europe Automotive Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 13: Europe Automotive Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 14: Europe Automotive Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 15: Europe Automotive Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Automotive Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Automotive Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Automotive Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Japan Automotive Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 20: Japan Automotive Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 21: Japan Automotive Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 22: Japan Automotive Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 23: Japan Automotive Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Japan Automotive Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Japan Automotive Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Japan Automotive Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: China Automotive Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 28: China Automotive Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 29: China Automotive Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 30: China Automotive Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 31: China Automotive Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 32: China Automotive Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 33: China Automotive Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: China Automotive Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South Korea Automotive Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 36: South Korea Automotive Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 37: South Korea Automotive Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 38: South Korea Automotive Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 39: South Korea Automotive Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South Korea Automotive Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 41: South Korea Automotive Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South Korea Automotive Optoelectronics Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Taiwan Automotive Optoelectronics Market Revenue (Million), by Device Type 2025 & 2033

- Figure 44: Taiwan Automotive Optoelectronics Market Volume (Billion), by Device Type 2025 & 2033

- Figure 45: Taiwan Automotive Optoelectronics Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 46: Taiwan Automotive Optoelectronics Market Volume Share (%), by Device Type 2025 & 2033

- Figure 47: Taiwan Automotive Optoelectronics Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Taiwan Automotive Optoelectronics Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Taiwan Automotive Optoelectronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Taiwan Automotive Optoelectronics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Global Automotive Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 3: Global Automotive Optoelectronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Optoelectronics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 6: Global Automotive Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 7: Global Automotive Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Automotive Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: Global Automotive Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 10: Global Automotive Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 11: Global Automotive Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Automotive Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Automotive Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 14: Global Automotive Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 15: Global Automotive Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Automotive Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Automotive Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 18: Global Automotive Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 19: Global Automotive Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Automotive Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: Global Automotive Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 22: Global Automotive Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 23: Global Automotive Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Automotive Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Automotive Optoelectronics Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 26: Global Automotive Optoelectronics Market Volume Billion Forecast, by Device Type 2020 & 2033

- Table 27: Global Automotive Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Automotive Optoelectronics Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Optoelectronics Market?

The projected CAGR is approximately 7.30%.

2. Which companies are prominent players in the Automotive Optoelectronics Market?

Key companies in the market include SK Hynix Inc, Panasonic Corporation, Samsung Electronics, Omnivision Technologies Inc, Sony Corporation, Ams Osram AG, Signify Holding, Vishay Intertechnology Inc, Texas Instruments Inc, LITE-ON Technology Corporation, Rohm Company Limited, Mitsubishi Electric Corporation, Broadcom Inc, Sharp Corporatio.

3. What are the main segments of the Automotive Optoelectronics Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Technology Advancements. and AI Developments will Drive the Growth; Growing Demand for Electric Vehicles.

6. What are the notable trends driving market growth?

Image Sensors are Expected to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Technology Advancements. and AI Developments will Drive the Growth; Growing Demand for Electric Vehicles.

8. Can you provide examples of recent developments in the market?

February 2024: TSMC, Sony Semiconductor Solutions Corporation, DENSO Corporation, and Toyota Motor Corporation bolstered their investment in Japan Advanced Semiconductor Manufacturing Inc. ("JASM"), a subsidiary primarily owned by TSMC in Kumamoto Prefecture, Japan. This investment aims to establish a second fab, slated to commence operations by the end of 2027. Coupled with JASM's first fab, set to launch in 2024, the collective investment in JASM will surpass USD 20 billion, backed by substantial support from the Japanese government.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Optoelectronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Optoelectronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Optoelectronics Market?

To stay informed about further developments, trends, and reports in the Automotive Optoelectronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence