Key Insights

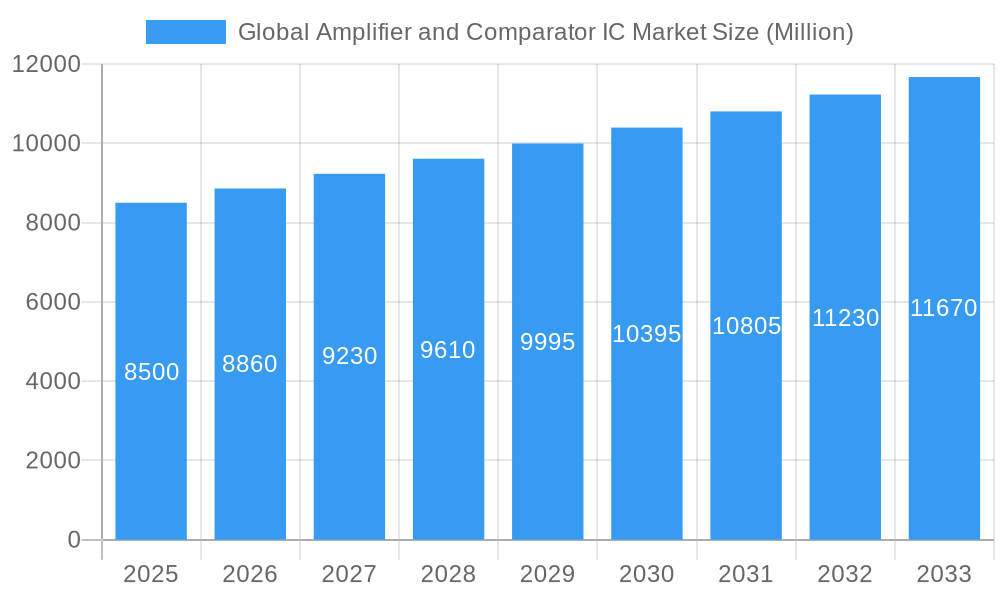

The global amplifier and comparator IC market is projected for substantial growth, expected to reach $15 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 7% from 2025 to 2033. This expansion is fueled by increasing demand for advanced electronic devices across key sectors. The automotive industry, with its integration of ADAS, infotainment, and EV components, is a significant growth driver. The consumer electronics market, propelled by innovations in smartphones, wearables, smart home devices, and audio equipment, also contributes heavily. Furthermore, the healthcare sector's reliance on precision medical devices and diagnostic equipment, along with manufacturing automation and industrial IoT, are crucial demand boosters.

Global Amplifier and Comparator IC Market Market Size (In Billion)

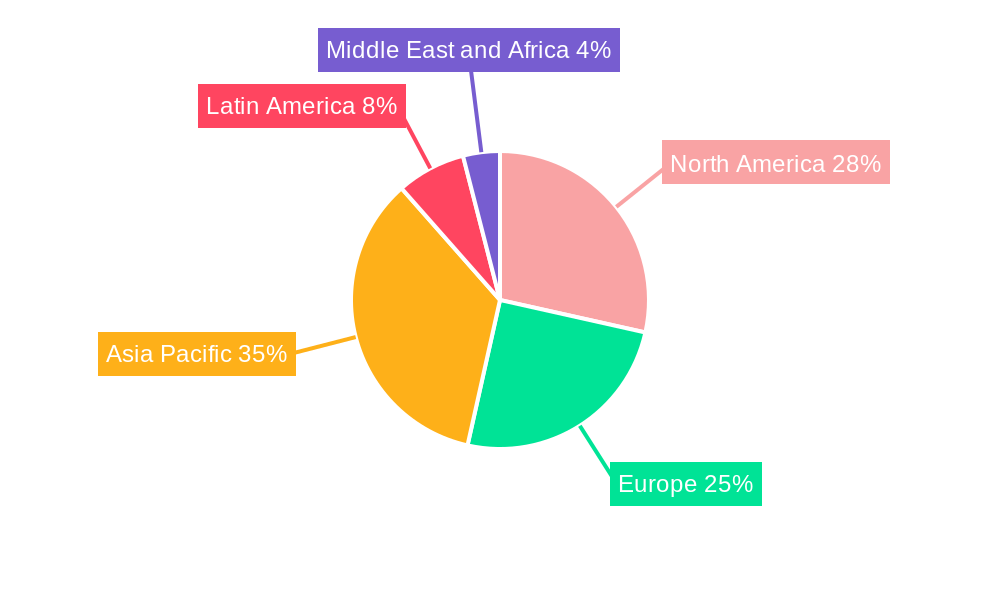

Within the market, "Inverting" and "Non-Inverting" amplifier and comparator ICs are anticipated to maintain consistent demand due to their foundational roles in signal processing. While growth drivers are robust, the market may face challenges such as intense competition, pricing pressures, and the necessity for continuous R&D investment to align with technological advancements. Global supply chain dynamics and raw material availability also pose potential hurdles. Geographically, the Asia Pacific region is expected to lead, supported by its strong manufacturing base and industrialization. North America and Europe are also key markets, driven by innovation and a strong presence of end-user industries.

Global Amplifier and Comparator IC Market Company Market Share

Global Amplifier and Comparator IC Market Report: Driving Innovation and Connectivity

This comprehensive report provides an in-depth analysis of the Global Amplifier and Comparator IC Market, a critical sector underpinning advancements in automotive, consumer electronics, healthcare, and manufacturing. Explore intricate market dynamics, growth trajectories, dominant regional influences, and the innovative product landscape. Uncover the key drivers, emerging opportunities, and challenges that are shaping the future of this vital semiconductor market. Our analysis spans from 2019 to 2033, with a base and estimated year of 2025, offering granular insights into the historical period (2019-2024) and the forecast period (2025-2033). We present all values in Million Units for clear quantitative understanding.

Global Amplifier and Comparator IC Market Market Dynamics & Structure

The Global Amplifier and Comparator IC Market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and intense competition. While the market exhibits moderate concentration, with key players like Texas Instruments Incorporated and Analog Devices Inc. holding significant shares, the landscape is continuously reshaped by new entrants and strategic partnerships. Technological innovation serves as a primary driver, with advancements in power efficiency, miniaturization, and integrated functionalities fueling demand across diverse end-user industries. Regulatory frameworks, particularly concerning environmental standards and safety certifications, influence product development and market access. Competitive product substitutes, such as discrete components and alternative amplification technologies, pose a constant challenge, necessitating continuous improvement and differentiation by IC manufacturers. End-user demographics are shifting towards increasingly sophisticated and interconnected devices, demanding higher performance and lower power consumption from amplifier and comparator ICs. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, gain market share, and acquire critical technologies. For instance, recent M&A activities have focused on consolidating expertise in high-frequency amplification and advanced signal processing.

- Market Concentration: Moderately concentrated with a few dominant players, but with room for specialized innovators.

- Technological Innovation Drivers: Miniaturization, increased power efficiency, enhanced signal integrity, integration of complex functionalities.

- Regulatory Frameworks: Environmental compliance (e.g., RoHS), safety standards, and regional certifications impacting product design and deployment.

- Competitive Product Substitutes: Discrete amplifier circuits, alternative IC architectures, and evolving signal processing techniques.

- End-User Demographics: Growing demand for smart devices, IoT applications, advanced automotive systems, and portable electronics.

- M&A Trends: Strategic acquisitions aimed at portfolio expansion, technology integration, and market consolidation.

Global Amplifier and Comparator IC Market Growth Trends & Insights

The Global Amplifier and Comparator IC Market is poised for robust growth, driven by escalating demand for sophisticated electronic devices across numerous sectors. The market size evolution showcases a consistent upward trajectory, reflecting the indispensable role of these components in modern electronics. Adoption rates for advanced amplifier and comparator ICs are accelerating, particularly in high-growth segments like automotive and consumer electronics, where features such as enhanced audio quality, precise signal processing, and low-power operation are paramount. Technological disruptions, including the advent of more efficient Class-D amplifiers and ultra-low power comparator ICs, are fundamentally reshaping the market, enabling new application possibilities and improving device performance. Consumer behavior shifts are also playing a significant role; as consumers increasingly seek feature-rich, compact, and energy-efficient devices, manufacturers are compelled to integrate cutting-edge amplifier and comparator solutions. This is particularly evident in the booming market for wireless communication devices, wearable technology, and sophisticated infotainment systems. The proliferation of the Internet of Things (IoT) continues to be a major catalyst, creating a vast ecosystem of connected devices that rely heavily on accurate signal amplification and comparison for their functionality. The healthcare industry's demand for precision instrumentation and diagnostic tools also contributes significantly to market expansion. Furthermore, the increasing sophistication of manufacturing processes, with a growing reliance on automation and industrial IoT, is driving the adoption of high-performance amplifier and comparator ICs for control systems and sensor interfaces. The automotive sector, with its rapid electrification and integration of advanced driver-assistance systems (ADAS), is another key growth engine, demanding specialized ICs for audio, sensor signal conditioning, and power management. The continuous push for higher bandwidth, lower latency, and improved power efficiency across all these sectors ensures a sustained demand for innovation and growth in the amplifier and comparator IC market. The overall CAGR for the forecast period is projected to be xx%, indicating a healthy expansion of the market in the coming years. Market penetration is expected to deepen as new applications emerge and existing ones become more complex.

Dominant Regions, Countries, or Segments in Global Amplifier and Comparator IC Market

The Global Amplifier and Comparator IC Market exhibits distinct regional dominance and segment leadership, driven by a confluence of economic factors, technological adoption, and industry-specific demand. Asia Pacific, particularly China, South Korea, and Taiwan, consistently emerges as a leading region due to its robust manufacturing base for consumer electronics, automotive components, and industrial equipment. This region benefits from significant government support for the semiconductor industry, substantial investments in research and development, and a vast domestic market for electronic devices. Within this region, the Consumer Electronics segment is a major driver of growth for both amplifier and comparator ICs. The insatiable demand for smartphones, televisions, audio systems, and wearable technology in countries like China and India fuels the consumption of a wide array of these ICs.

In the Type segment, Non-Inverting amplifiers and comparators are experiencing particularly strong growth. This is attributed to their widespread use in signal amplification where maintaining the phase relationship is crucial, such as in audio processing, sensor signal conditioning, and many analog-to-digital conversion front-ends. Their versatility and ability to provide high input impedance make them suitable for a broad range of applications across various end-user industries.

The Automotive industry, while a significant end-user globally, is a key contributor to market growth in regions with strong automotive manufacturing presence, including North America and Europe, alongside Asia Pacific. The increasing sophistication of in-car electronics, from advanced infotainment systems and premium audio setups to ADAS and electric vehicle (EV) powertrains, necessitates a high volume of high-performance amplifier and comparator ICs. Economic policies that promote technological advancement and infrastructure development, such as investments in 5G deployment which indirectly boosts demand for related electronic components, further bolster market expansion in these dominant regions.

- Dominant Region: Asia Pacific, driven by its manufacturing prowess and large consumer base.

- Dominant Country: China, as a global hub for electronics manufacturing and consumption.

- Dominant Segment (End-User Industry): Consumer Electronics, due to widespread adoption of smart devices and entertainment systems.

- Dominant Segment (Type): Non-Inverting Amplifiers & Comparators, owing to their broad applicability in signal integrity and amplification.

- Key Drivers of Dominance in Asia Pacific: Strong manufacturing ecosystem, government support for semiconductors, massive domestic market, and rapid technological adoption.

- Key Drivers of Dominance in Consumer Electronics: Proliferation of smart devices, demand for enhanced user experiences, and affordability of electronic gadgets.

- Market Share in Dominant Segments: Estimated xx% of the total market is driven by the Consumer Electronics segment. Non-Inverting amplifier and comparator ICs are projected to capture xx% of the total IC type market share.

- Growth Potential in Automotive: Significant growth expected due to the rise of EVs and autonomous driving technologies.

Global Amplifier and Comparator IC Market Product Landscape

The Global Amplifier and Comparator IC Market product landscape is defined by continuous innovation focused on enhancing performance, reducing power consumption, and increasing integration. Manufacturers are developing highly precise operational amplifiers and comparators with exceptionally low noise and offset voltages, crucial for sensitive applications in healthcare and scientific instrumentation. Advancements in low-power comparator ICs are enabling the proliferation of battery-operated portable devices and IoT sensors, extending operational life. The product portfolio includes a diverse range of amplifier types, such as operational amplifiers, instrumentation amplifiers, audio amplifiers, and RF amplifiers, each tailored for specific functionalities. Comparator ICs range from simple voltage comparators to window comparators and precision comparators with high-speed switching capabilities. Unique selling propositions often lie in achieving industry-leading specifications, such as higher bandwidth, faster slew rates, wider operating voltage ranges, and superior thermal performance. Technological advancements like integrated power management units within amplifier ICs and built-in diagnostics in comparator ICs are further streamlining designs for end-users.

Key Drivers, Barriers & Challenges in Global Amplifier and Comparator IC Market

The Global Amplifier and Comparator IC Market is propelled by several key drivers: the ever-increasing demand for sophisticated electronic devices across consumer electronics, automotive, and healthcare sectors; the ongoing miniaturization trend demanding smaller, more efficient ICs; and the pervasive growth of the Internet of Things (IoT) ecosystem requiring reliable signal processing. Technological advancements, such as improved power efficiency in Class-D amplifiers and enhanced precision in comparator ICs, are also significant growth catalysts.

However, the market faces several barriers and challenges. Supply chain disruptions, including raw material shortages and geopolitical uncertainties, can impact production and pricing. Intense price competition among manufacturers, especially for commodity-grade ICs, can squeeze profit margins. Stringent regulatory requirements related to environmental impact and product safety necessitate significant compliance investments. Furthermore, the rapid pace of technological evolution requires continuous R&D investment to stay competitive, posing a challenge for smaller players.

- Key Drivers:

- Exponential growth in consumer electronics and IoT devices.

- Demand for advanced driver-assistance systems (ADAS) and electric vehicles (EVs).

- Innovation in medical devices requiring high precision.

- Technological advancements in power efficiency and miniaturization.

- Barriers & Challenges:

- Global supply chain volatility and material scarcity.

- Intense price competition and market saturation in certain segments.

- Evolving and stringent regulatory compliance.

- High R&D investment demands for continuous innovation.

Emerging Opportunities in Global Amplifier and Comparator IC Market

Emerging opportunities in the Global Amplifier and Comparator IC Market are manifold, driven by the relentless pursuit of enhanced functionality and efficiency. The expansion of 5G and beyond wireless infrastructure presents a significant avenue for high-frequency amplifier and comparator ICs. The growing adoption of artificial intelligence (AI) and machine learning (ML) in edge computing devices creates demand for specialized ICs that can efficiently process sensor data. The burgeoning field of augmented reality (AR) and virtual reality (VR) also requires advanced audio and visual processing capabilities, creating opportunities for high-performance amplifier and comparator solutions. Furthermore, the increasing focus on sustainable technologies and smart grid development offers potential for energy-efficient amplifier and comparator ICs in power management and control applications. The development of new bio-sensors and advanced diagnostic tools in the healthcare sector also opens doors for highly sensitive and accurate comparator and amplifier ICs.

Growth Accelerators in the Global Amplifier and Comparator IC Market Industry

Several key growth accelerators are poised to fuel the long-term expansion of the Global Amplifier and Comparator IC Market. The continuous evolution of automotive technology, particularly in the domains of autonomous driving and electrification, will necessitate increasingly sophisticated amplifier and comparator solutions for sensors, infotainment, and power management. The widespread adoption of AI and IoT across industrial automation, smart cities, and consumer applications will drive demand for highly integrated and power-efficient ICs capable of complex signal processing and reliable data acquisition. Strategic partnerships and collaborations between IC manufacturers and system integrators will accelerate product development and market penetration. Furthermore, ongoing research into novel semiconductor materials and advanced packaging techniques promises to unlock new levels of performance and efficiency, further expanding the application scope for amplifier and comparator ICs. The increasing demand for immersive audio experiences in consumer electronics will continue to be a strong growth driver.

Key Players Shaping the Global Amplifier and Comparator IC Market Market

- Microchip Technology Inc

- Skyworks Solutions Inc

- NXP Semiconductors

- Broadcom Inc

- Qualcomm Technologies Inc

- Texas Instruments Incorporated

- BONN Elektronik GmbH

- MediaTek Inc

- Analog Devices Inc

- Renesas Electronics Corporation

Notable Milestones in Global Amplifier and Comparator IC Market Sector

- April 2022: Hypex Electronics announced the NCx500 OEM, the first of a new NCOREx family of modules, and a new and improved version of their NCORE Class-D amplifier technology.

In-Depth Global Amplifier and Comparator IC Market Market Outlook

The Global Amplifier and Comparator IC Market is projected for sustained and robust growth, driven by the undeniable trajectory of technological advancement and the pervasive integration of electronics into everyday life. The escalating demand from the automotive sector, fueled by the electrification and automation revolution, alongside the insatiable appetite of consumer electronics for enhanced performance and connectivity, will continue to be primary growth accelerators. The expansion of IoT and the burgeoning field of AI at the edge present significant opportunities for innovative, power-efficient, and highly integrated amplifier and comparator solutions. Strategic collaborations between semiconductor giants and application-specific developers will further propel market penetration. Emerging technologies like advanced sensors, augmented reality, and sophisticated medical devices will also create new avenues for specialized ICs. The market's future success hinges on continuous innovation in power management, signal integrity, and miniaturization, ensuring these fundamental components remain indispensable to the connected world.

Global Amplifier and Comparator IC Market Segmentation

-

1. Type

- 1.1. Inverting

- 1.2. Non-Inverting

-

2. End-User Industry

- 2.1. Automotive

- 2.2. Consumer Electronics

- 2.3. Health Care

- 2.4. Manufacturing

- 2.5. Other End-user Industries

Global Amplifier and Comparator IC Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Global Amplifier and Comparator IC Market Regional Market Share

Geographic Coverage of Global Amplifier and Comparator IC Market

Global Amplifier and Comparator IC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Usage of Amplifier and Comparator IC in Consumer Electronics Applications; High Adoption of Smartphones and Tablets and Growing Requirement for Amplifers

- 3.3. Market Restrains

- 3.3.1. Higher Costs of Advanced Featured Vehicles

- 3.4. Market Trends

- 3.4.1. Automotive Expected to Witness Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Amplifier and Comparator IC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inverting

- 5.1.2. Non-Inverting

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Automotive

- 5.2.2. Consumer Electronics

- 5.2.3. Health Care

- 5.2.4. Manufacturing

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Amplifier and Comparator IC Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Inverting

- 6.1.2. Non-Inverting

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Automotive

- 6.2.2. Consumer Electronics

- 6.2.3. Health Care

- 6.2.4. Manufacturing

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Amplifier and Comparator IC Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Inverting

- 7.1.2. Non-Inverting

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Automotive

- 7.2.2. Consumer Electronics

- 7.2.3. Health Care

- 7.2.4. Manufacturing

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Amplifier and Comparator IC Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Inverting

- 8.1.2. Non-Inverting

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Automotive

- 8.2.2. Consumer Electronics

- 8.2.3. Health Care

- 8.2.4. Manufacturing

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Global Amplifier and Comparator IC Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Inverting

- 9.1.2. Non-Inverting

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Automotive

- 9.2.2. Consumer Electronics

- 9.2.3. Health Care

- 9.2.4. Manufacturing

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Global Amplifier and Comparator IC Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Inverting

- 10.1.2. Non-Inverting

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Automotive

- 10.2.2. Consumer Electronics

- 10.2.3. Health Care

- 10.2.4. Manufacturing

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Microchip Technology Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Skyworks Solutions Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NXP Semiconductors

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Broadcom Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Qualcomm Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Texas Instruments Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BONN Elektronik GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MediaTek Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Analog Devices Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Renesas Electronics Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Microchip Technology Inc

List of Figures

- Figure 1: Global Global Amplifier and Comparator IC Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Global Amplifier and Comparator IC Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Global Amplifier and Comparator IC Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Global Amplifier and Comparator IC Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 5: North America Global Amplifier and Comparator IC Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America Global Amplifier and Comparator IC Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Global Amplifier and Comparator IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Global Amplifier and Comparator IC Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Global Amplifier and Comparator IC Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Global Amplifier and Comparator IC Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 11: Europe Global Amplifier and Comparator IC Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: Europe Global Amplifier and Comparator IC Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Global Amplifier and Comparator IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Global Amplifier and Comparator IC Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Global Amplifier and Comparator IC Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Global Amplifier and Comparator IC Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 17: Asia Pacific Global Amplifier and Comparator IC Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Asia Pacific Global Amplifier and Comparator IC Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Global Amplifier and Comparator IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Global Amplifier and Comparator IC Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Global Amplifier and Comparator IC Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Global Amplifier and Comparator IC Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 23: Latin America Global Amplifier and Comparator IC Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Latin America Global Amplifier and Comparator IC Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Global Amplifier and Comparator IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Global Amplifier and Comparator IC Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Global Amplifier and Comparator IC Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Global Amplifier and Comparator IC Market Revenue (billion), by End-User Industry 2025 & 2033

- Figure 29: Middle East and Africa Global Amplifier and Comparator IC Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Middle East and Africa Global Amplifier and Comparator IC Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Global Amplifier and Comparator IC Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Amplifier and Comparator IC Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Amplifier and Comparator IC Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Amplifier and Comparator IC Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Amplifier and Comparator IC Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Amplifier and Comparator IC Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Amplifier and Comparator IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Amplifier and Comparator IC Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Amplifier and Comparator IC Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 9: Global Amplifier and Comparator IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Amplifier and Comparator IC Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Amplifier and Comparator IC Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Amplifier and Comparator IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Amplifier and Comparator IC Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Amplifier and Comparator IC Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 15: Global Amplifier and Comparator IC Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Amplifier and Comparator IC Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Amplifier and Comparator IC Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 18: Global Amplifier and Comparator IC Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Amplifier and Comparator IC Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Global Amplifier and Comparator IC Market?

Key companies in the market include Microchip Technology Inc, Skyworks Solutions Inc, NXP Semiconductors, Broadcom Inc, Qualcomm Technologies Inc, Texas Instruments Incorporated, BONN Elektronik GmbH, MediaTek Inc, Analog Devices Inc, Renesas Electronics Corporation.

3. What are the main segments of the Global Amplifier and Comparator IC Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 15 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Usage of Amplifier and Comparator IC in Consumer Electronics Applications; High Adoption of Smartphones and Tablets and Growing Requirement for Amplifers.

6. What are the notable trends driving market growth?

Automotive Expected to Witness Significant Market Share.

7. Are there any restraints impacting market growth?

Higher Costs of Advanced Featured Vehicles.

8. Can you provide examples of recent developments in the market?

April 2022 - Hypex Electronics announced the NCx500 OEM, the first of a new NCOREx family of modules, and a new and improved version of their NCORE Class-D amplifier technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Amplifier and Comparator IC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Amplifier and Comparator IC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Amplifier and Comparator IC Market?

To stay informed about further developments, trends, and reports in the Global Amplifier and Comparator IC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence