Key Insights

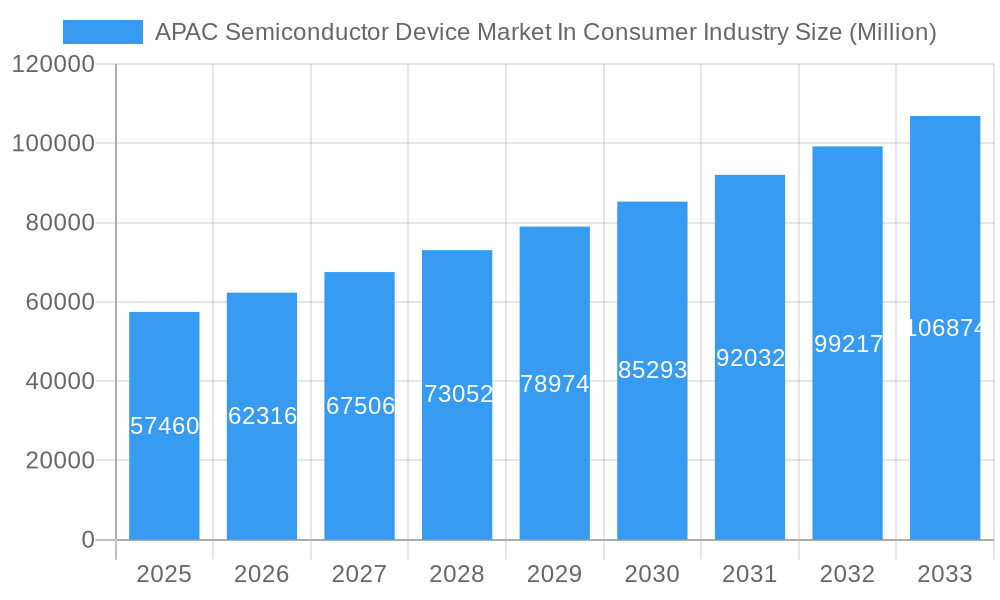

The APAC Semiconductor Device Market in the Consumer Industry is poised for robust expansion, projected to reach a market size of USD 57.46 billion by 2025 with a compelling Compound Annual Growth Rate (CAGR) of 8.50% throughout the forecast period (2025-2033). This significant growth is propelled by a confluence of factors, including the escalating demand for advanced consumer electronics, the pervasive integration of smart technologies across everyday devices, and the continuous innovation in semiconductor functionalities. Key drivers include the burgeoning adoption of Artificial Intelligence (AI) and Machine Learning (ML) in consumer products, the increasing prevalence of 5G-enabled devices, and the expanding middle class in key APAC economies, all of which fuel the need for sophisticated and high-performance semiconductor solutions. The market is witnessing a strong trend towards miniaturization, enhanced power efficiency, and increased processing capabilities, driven by the relentless pursuit of more compact and feature-rich consumer gadgets, from smartphones and wearables to smart home appliances and gaming consoles. Furthermore, the growing emphasis on the Internet of Things (IoT) ecosystem further accentuates the demand for a diverse range of semiconductor devices.

APAC Semiconductor Device Market In Consumer Industry Market Size (In Billion)

Despite the optimistic outlook, certain restraints could temper the market's full potential. Geopolitical tensions and supply chain vulnerabilities, particularly concerning raw material availability and manufacturing capacities, pose significant challenges. While the market is segmented by device type, including Discrete Semiconductors, Optoelectronics, Sensors, and various Integrated Circuits (ICs) like Analog, Logic, Memory, and Microprocessors (MPU), Microcontrollers (MCU), and Digital Signal Processors (DSP), the rapid evolution of technology means that staying ahead of the curve requires substantial R&D investment. The competitive landscape is dominated by prominent players such as Samsung Electronics, TSMC, Intel, and SK Hynix, creating an environment of intense innovation and price competition. Regional dynamics, with China, Japan, South Korea, and India leading consumption and innovation, are crucial to the market's trajectory. Addressing these challenges through strategic partnerships, diversified sourcing, and continued investment in cutting-edge research and development will be paramount for sustained growth in this dynamic sector.

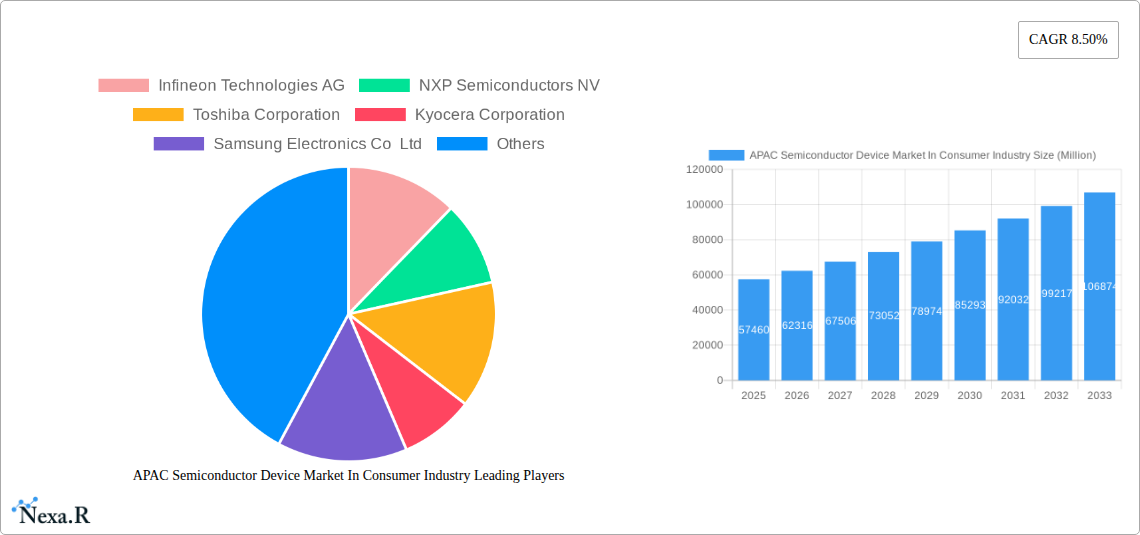

APAC Semiconductor Device Market In Consumer Industry Company Market Share

APAC Semiconductor Device Market In Consumer Industry: Comprehensive Market Report (2019-2033)

Unlock the future of consumer electronics with this definitive report on the APAC Semiconductor Device Market in the Consumer Industry. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report provides unparalleled insights into market dynamics, growth trends, regional dominance, and strategic opportunities. Analyze pivotal industry developments, key player strategies, and critical growth drivers and barriers impacting the market for Discrete Semiconductors, Optoelectronics, Sensors, and Integrated Circuits (Analog, Logic, Memory, Microprocessors (MPU), Microcontrollers (MCU), Digital Signal Processors) across Japan, China, India, and South Korea. All quantitative data is presented in Million units.

APAC Semiconductor Device Market In Consumer Industry Market Dynamics & Structure

The APAC semiconductor device market within the consumer industry is characterized by dynamic forces shaping its trajectory. Market concentration is moderately high, with key players like Samsung Electronics Co Ltd, SK Hynix Inc, and Taiwan Semiconductor Manufacturing Company (TSMC) Limited holding significant sway in specific segments, particularly memory and advanced logic. Technological innovation serves as a primary driver, fueled by the relentless demand for more powerful, energy-efficient, and feature-rich consumer electronics, from smartphones and wearables to smart home devices and advanced gaming consoles. Regulatory frameworks, while generally supportive of industry growth, can introduce complexities related to trade policies and intellectual property. Competitive product substitutes are constantly emerging, driven by advancements in materials science and alternative chip architectures, pushing incumbent players to innovate rapidly. End-user demographics are diverse, ranging from tech-savvy millennials and Gen Z consumers demanding the latest gadgets to a burgeoning middle class in emerging economies seeking accessible consumer electronics. Mergers and Acquisitions (M&A) trends are prevalent, with companies strategically consolidating to gain market share, acquire critical technologies, or secure supply chain resilience. For instance, strategic alliances and smaller-scale acquisitions are more common than mega-mergers, focusing on niche technology acquisition. The market's evolution is a testament to its adaptability, driven by both innovation and strategic business maneuvers.

APAC Semiconductor Device Market In Consumer Industry Growth Trends & Insights

The APAC semiconductor device market in the consumer industry is poised for substantial expansion, driven by a confluence of technological advancements and evolving consumer behaviors. Throughout the historical period (2019-2024), the market witnessed steady growth, with an estimated market size of approximately 75,500 million units in 2024, propelled by the increasing adoption of smartphones, IoT devices, and advanced display technologies. The base year, 2025, is projected to see this figure rise to around 82,000 million units, reflecting a robust growth trajectory. The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of approximately 8.5%, culminating in a projected market size exceeding 150,000 million units by 2033. This growth is underpinned by several key trends. Firstly, the relentless pursuit of miniaturization and increased processing power in consumer electronics continues to drive demand for sophisticated integrated circuits, particularly microcontrollers (MCU) and microprocessors (MPU). Secondly, the burgeoning Internet of Things (IoT) ecosystem, encompassing smart homes, wearable technology, and connected appliances, is a significant catalyst, requiring an array of specialized sensors and discrete semiconductors for connectivity and control. Consumer adoption rates for these connected devices are accelerating, moving beyond early adopters to mainstream consumers seeking convenience and enhanced living experiences. Technological disruptions, such as the ongoing advancements in AI and machine learning, are necessitating more powerful and specialized chips, creating new market opportunities. Furthermore, shifts in consumer preferences, including a growing demand for sustainable and energy-efficient devices, are influencing product development and the types of semiconductor solutions being prioritized. The penetration of premium features into mid-range devices also contributes to market volume growth.

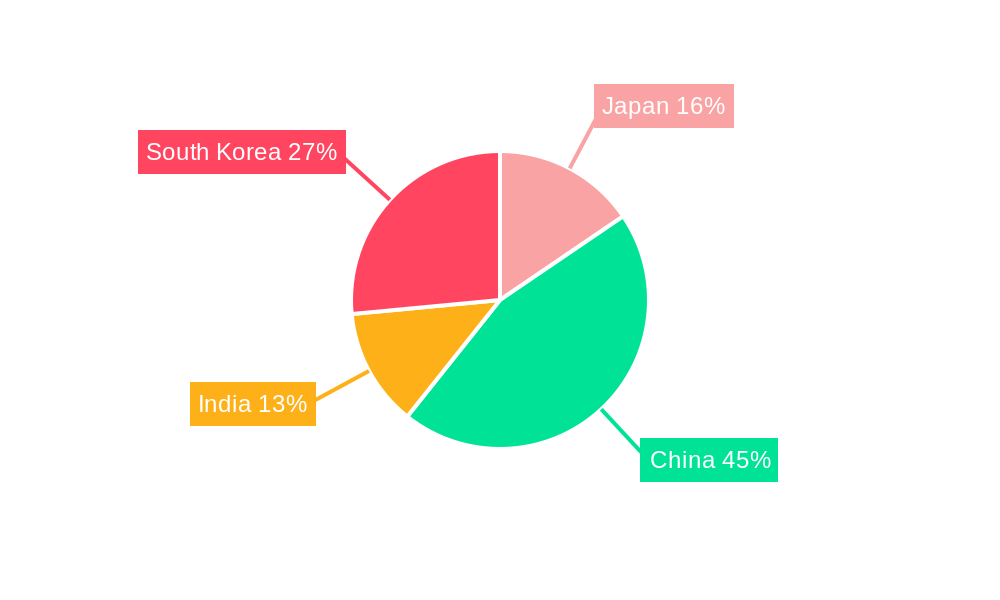

Dominant Regions, Countries, or Segments in APAC Semiconductor Device Market In Consumer Industry

China is undeniably the dominant force driving the APAC semiconductor device market in the consumer industry. Its sheer market size, massive manufacturing capabilities, and a rapidly expanding middle class with an insatiable appetite for consumer electronics position it as the epicenter of demand and production. In terms of Device Type, Integrated Circuits, especially Logic and Micro (MPUs and MCUs), are experiencing immense growth, directly supporting the production of smartphones, tablets, and an ever-expanding array of connected devices. By 2025, China is projected to account for over 60% of the total APAC consumer electronics semiconductor consumption, representing approximately 49,200 million units.

Key Drivers in China:

- Government Initiatives: Robust government support for the semiconductor industry through funding, tax incentives, and the establishment of national champion companies aims to reduce reliance on foreign technology and foster domestic innovation.

- Manufacturing Hub: China's position as the global manufacturing hub for consumer electronics translates to immense in-house demand for semiconductor components.

- Rising Disposable Income: The growing disposable income of the Chinese population fuels demand for premium and advanced consumer electronics.

- 5G Rollout and Adoption: The rapid deployment and widespread adoption of 5G technology necessitates advanced semiconductors for smartphones and other connected devices.

Dominance of Integrated Circuits:

- Logic Chips: Essential for the core functioning of virtually all digital consumer devices, logic chip demand is soaring with the proliferation of complex functionalities.

- Microprocessors (MPU) & Microcontrollers (MCU): Powering everything from smartphones to smart appliances, MCUs and MPUs are central to the intelligence and responsiveness of consumer electronics.

- Memory Chips: While SK Hynix and Samsung are global leaders, the immense scale of Chinese consumer electronics manufacturing creates significant demand for memory components.

Growth Potential in India and South Korea:

- India: Emerging as a significant consumer market with a growing tech-savvy population and government initiatives like "Make in India," India presents substantial growth potential, particularly in the smartphone and wearable segments. By 2025, India's consumption is estimated at around 7,000 million units.

- South Korea: A leader in innovation and high-end consumer electronics, South Korea, with companies like Samsung Electronics, remains a critical market for advanced semiconductor integration, particularly in memory and display technologies. Its consumption is projected around 6,000 million units in 2025.

Japan, while a leader in certain niche semiconductor technologies, has a more mature consumer market compared to China and India, with its growth driven by innovation in high-end and specialized consumer devices, contributing an estimated 5,000 million units in 2025. The interplay of these regions and segments underscores the multifaceted nature of the APAC semiconductor device market in the consumer industry.

APAC Semiconductor Device Market In Consumer Industry Product Landscape

The product landscape within the APAC semiconductor device market for the consumer industry is characterized by continuous innovation and the pursuit of enhanced performance and efficiency. Discrete semiconductors are evolving towards higher power density and smaller form factors for power management in portable devices. Optoelectronics are seeing advancements in display technologies, particularly OLEDs and MicroLEDs, offering superior brightness, color accuracy, and energy efficiency for smartphones, TVs, and wearables. Sensors are becoming more sophisticated, enabling advanced functionalities like biometric authentication, environmental monitoring, and precise motion tracking in smart devices. Integrated Circuits are at the forefront of innovation, with a focus on AI-enabled processing, ultra-low power consumption for IoT devices, and higher bandwidth for data-intensive applications. Microprocessors and Microcontrollers are becoming more specialized, catering to the unique demands of diverse consumer electronics, from high-performance gaming consoles to low-power smart home sensors.

Key Drivers, Barriers & Challenges in APAC Semiconductor Device Market In Consumer Industry

Key Drivers:

- Rapid Technological Advancements: The relentless pace of innovation in consumer electronics, driven by the demand for enhanced features, performance, and connectivity, is the primary propellant.

- Growing Middle Class and Disposable Income: A burgeoning middle class across APAC nations fuels demand for a wider range of consumer electronics.

- 5G Network Expansion: The widespread deployment of 5G technology necessitates advanced semiconductor components for smartphones, smart devices, and connected infrastructure.

- Internet of Things (IoT) Proliferation: The increasing adoption of smart home devices, wearables, and connected appliances creates substantial demand for sensors, MCUs, and other specialized semiconductors.

- Government Support and Investment: Many APAC governments are actively investing in and supporting the semiconductor ecosystem to foster domestic production and innovation.

Key Barriers & Challenges:

- Supply Chain Volatility and Geopolitical Risks: Disruptions in global supply chains, raw material shortages, and geopolitical tensions can significantly impact production and pricing.

- Intensifying Competition and Price Pressures: The highly competitive market leads to constant price pressures, impacting profitability margins for semiconductor manufacturers.

- Talent Shortage: A persistent shortage of skilled engineers and technicians in the semiconductor industry can hinder research, development, and manufacturing.

- Intellectual Property Protection: Ensuring robust protection of intellectual property in a rapidly evolving technological landscape remains a challenge.

- Environmental Regulations: Increasing stringency of environmental regulations can add to manufacturing costs and complexity.

Emerging Opportunities in APAC Semiconductor Device Market In Consumer Industry

Emerging opportunities lie in the increasing demand for Artificial Intelligence (AI) and Machine Learning (ML) capabilities within consumer devices, driving the need for specialized AI accelerators and edge computing processors. The expansion of the electric vehicle (EV) market, while a distinct industry, has spillover effects into consumer electronics through in-car infotainment systems and advanced driver-assistance systems (ADAS) requiring sophisticated semiconductors. The burgeoning metaverse and extended reality (XR) applications present a significant untapped market for high-performance graphics processors and specialized sensors. Furthermore, the growing consumer focus on health and wellness is spurring demand for advanced biosensors and wearable health monitoring devices. The development of more energy-efficient semiconductors to meet sustainability goals also presents a substantial opportunity for innovation and market differentiation.

Growth Accelerators in the APAC Semiconductor Device Market In Consumer Industry Industry

Several key catalysts are accelerating the growth of the APAC semiconductor device market in the consumer industry. The continuous miniaturization and increasing power efficiency of chips are enabling the development of more compact and feature-rich consumer electronics. Strategic partnerships and collaborations between chip manufacturers, device assemblers, and software developers are crucial for co-creating innovative solutions and accelerating time-to-market. Government initiatives focused on fostering domestic semiconductor production and R&D, such as those seen in China and Japan, are providing significant impetus. Furthermore, the expanding global reach of APAC-based consumer electronics brands is opening up new markets and driving demand for their semiconductor components. The ongoing digital transformation across various sectors, leading to increased adoption of smart devices, also acts as a significant growth accelerator.

Key Players Shaping the APAC Semiconductor Device Market In Consumer Industry Market

- Infineon Technologies AG

- NXP Semiconductors NV

- Toshiba Corporation

- Kyocera Corporation

- Samsung Electronics Co Ltd

- Broadcom Inc

- STMicroelectronics NV

- Renesas Electronics Corporation

- SK Hynix Inc

- Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- Intel Corporation

- Fujitsu Semiconductor Ltd

Notable Milestones in APAC Semiconductor Device Market In Consumer Industry Sector

- May 2024: Toshiba completed the construction of a 300-millimeter wafer fabrication facility for power semiconductors and an office building at KagaToshiba Electronics Corporation in Ishikawa Prefecture, Japan. This facility is poised to commence mass production in the second half of fiscal year 2024, enhancing Toshiba's capabilities in power semiconductor manufacturing.

- Feb 2024: TSMC unveiled expansion plans in Kumamoto, Japan, collaborating with Sony Group Corp. and Toyota Motor Corp. The company aims to commence shipments of logic chips for CMOS camera sensors and automotive applications by the close of 2024, with significant backing from the Japanese government (JPY 476 billion). This strategic move is expected to bolster the growth of the automotive and consumer electronics segments in Japan.

In-Depth APAC Semiconductor Device Market In Consumer Industry Market Outlook

The future outlook for the APAC semiconductor device market in the consumer industry is exceptionally bright, driven by sustained innovation and expanding demand. Growth accelerators such as the relentless pursuit of AI integration into everyday devices, the ongoing development of immersive XR experiences, and the critical role of semiconductors in the burgeoning electric vehicle ecosystem are poised to shape market dynamics. Strategic investments in advanced manufacturing capabilities, coupled with a focus on developing energy-efficient solutions to meet global sustainability mandates, will be key differentiators. The market's trajectory suggests continued expansion, fueled by both technological breakthroughs and the evolving preferences of a digitally connected global consumer base. This creates a fertile ground for companies that can adapt to rapidly changing technological landscapes and effectively cater to the diverse needs of the APAC consumer.

APAC Semiconductor Device Market In Consumer Industry Segmentation

-

1. Device Type

- 1.1. Discrete Semiconductors

- 1.2. Optoelectronics

- 1.3. Sensors

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Logic

- 1.4.3. Memory

-

1.4.4. Micro

- 1.4.4.1. Microprocessors (MPU)

- 1.4.4.2. Microcontrollers (MCU)

- 1.4.4.3. Digital Signal Processors

-

2. Geography

- 2.1. Japan

- 2.2. China

- 2.3. India

- 2.4. South Korea

APAC Semiconductor Device Market In Consumer Industry Segmentation By Geography

- 1. Japan

- 2. China

- 3. India

- 4. South Korea

APAC Semiconductor Device Market In Consumer Industry Regional Market Share

Geographic Coverage of APAC Semiconductor Device Market In Consumer Industry

APAC Semiconductor Device Market In Consumer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Emergence of new technologies like AI

- 3.2.2 and IoT; Increased Deployment of 5G and Rising Demand for 5G Smartphones; Increasing demand for smartphones and the introduction of budget friendly smartphones

- 3.3. Market Restrains

- 3.3.1. Low Demand Due to Impact of COVID-; Competitive Prices Led to Stiff Profit Margins

- 3.4. Market Trends

- 3.4.1. The Integrated Circuits Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Semiconductor Device Market In Consumer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Discrete Semiconductors

- 5.1.2. Optoelectronics

- 5.1.3. Sensors

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Logic

- 5.1.4.3. Memory

- 5.1.4.4. Micro

- 5.1.4.4.1. Microprocessors (MPU)

- 5.1.4.4.2. Microcontrollers (MCU)

- 5.1.4.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Japan

- 5.2.2. China

- 5.2.3. India

- 5.2.4. South Korea

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.3.2. China

- 5.3.3. India

- 5.3.4. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Japan APAC Semiconductor Device Market In Consumer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Discrete Semiconductors

- 6.1.2. Optoelectronics

- 6.1.3. Sensors

- 6.1.4. Integrated Circuits

- 6.1.4.1. Analog

- 6.1.4.2. Logic

- 6.1.4.3. Memory

- 6.1.4.4. Micro

- 6.1.4.4.1. Microprocessors (MPU)

- 6.1.4.4.2. Microcontrollers (MCU)

- 6.1.4.4.3. Digital Signal Processors

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Japan

- 6.2.2. China

- 6.2.3. India

- 6.2.4. South Korea

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. China APAC Semiconductor Device Market In Consumer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Discrete Semiconductors

- 7.1.2. Optoelectronics

- 7.1.3. Sensors

- 7.1.4. Integrated Circuits

- 7.1.4.1. Analog

- 7.1.4.2. Logic

- 7.1.4.3. Memory

- 7.1.4.4. Micro

- 7.1.4.4.1. Microprocessors (MPU)

- 7.1.4.4.2. Microcontrollers (MCU)

- 7.1.4.4.3. Digital Signal Processors

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Japan

- 7.2.2. China

- 7.2.3. India

- 7.2.4. South Korea

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. India APAC Semiconductor Device Market In Consumer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Discrete Semiconductors

- 8.1.2. Optoelectronics

- 8.1.3. Sensors

- 8.1.4. Integrated Circuits

- 8.1.4.1. Analog

- 8.1.4.2. Logic

- 8.1.4.3. Memory

- 8.1.4.4. Micro

- 8.1.4.4.1. Microprocessors (MPU)

- 8.1.4.4.2. Microcontrollers (MCU)

- 8.1.4.4.3. Digital Signal Processors

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Japan

- 8.2.2. China

- 8.2.3. India

- 8.2.4. South Korea

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. South Korea APAC Semiconductor Device Market In Consumer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Discrete Semiconductors

- 9.1.2. Optoelectronics

- 9.1.3. Sensors

- 9.1.4. Integrated Circuits

- 9.1.4.1. Analog

- 9.1.4.2. Logic

- 9.1.4.3. Memory

- 9.1.4.4. Micro

- 9.1.4.4.1. Microprocessors (MPU)

- 9.1.4.4.2. Microcontrollers (MCU)

- 9.1.4.4.3. Digital Signal Processors

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Japan

- 9.2.2. China

- 9.2.3. India

- 9.2.4. South Korea

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NXP Semiconductors NV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kyocera Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Samsung Electronics Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Broadcom Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 STMicroelectronics NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Renesas Electronics Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SK Hynix Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Intel Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Fujitsu Semiconductor Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: APAC Semiconductor Device Market In Consumer Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: APAC Semiconductor Device Market In Consumer Industry Share (%) by Company 2025

List of Tables

- Table 1: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 5: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 8: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 11: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 14: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: APAC Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Semiconductor Device Market In Consumer Industry?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the APAC Semiconductor Device Market In Consumer Industry?

Key companies in the market include Infineon Technologies AG, NXP Semiconductors NV, Toshiba Corporation, Kyocera Corporation, Samsung Electronics Co Ltd, Broadcom Inc, STMicroelectronics NV, Renesas Electronics Corporation, SK Hynix Inc, Taiwan Semiconductor Manufacturing Company (TSMC) Limited, Intel Corporation, Fujitsu Semiconductor Ltd.

3. What are the main segments of the APAC Semiconductor Device Market In Consumer Industry?

The market segments include Device Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 57.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of new technologies like AI. and IoT; Increased Deployment of 5G and Rising Demand for 5G Smartphones; Increasing demand for smartphones and the introduction of budget friendly smartphones.

6. What are the notable trends driving market growth?

The Integrated Circuits Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Low Demand Due to Impact of COVID-; Competitive Prices Led to Stiff Profit Margins.

8. Can you provide examples of recent developments in the market?

May 2024: Toshiba finished 300-millimeter wafer fabrication facility for power semiconductors and an office building at KagaToshiba Electronics Corporation in Ishikawa Prefecture, Japan, one of Toshiba’s key group companies. Toshiba will now proceed with equipment installation, aiming to start mass production in the second half of fiscal year 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Semiconductor Device Market In Consumer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Semiconductor Device Market In Consumer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Semiconductor Device Market In Consumer Industry?

To stay informed about further developments, trends, and reports in the APAC Semiconductor Device Market In Consumer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence