Key Insights

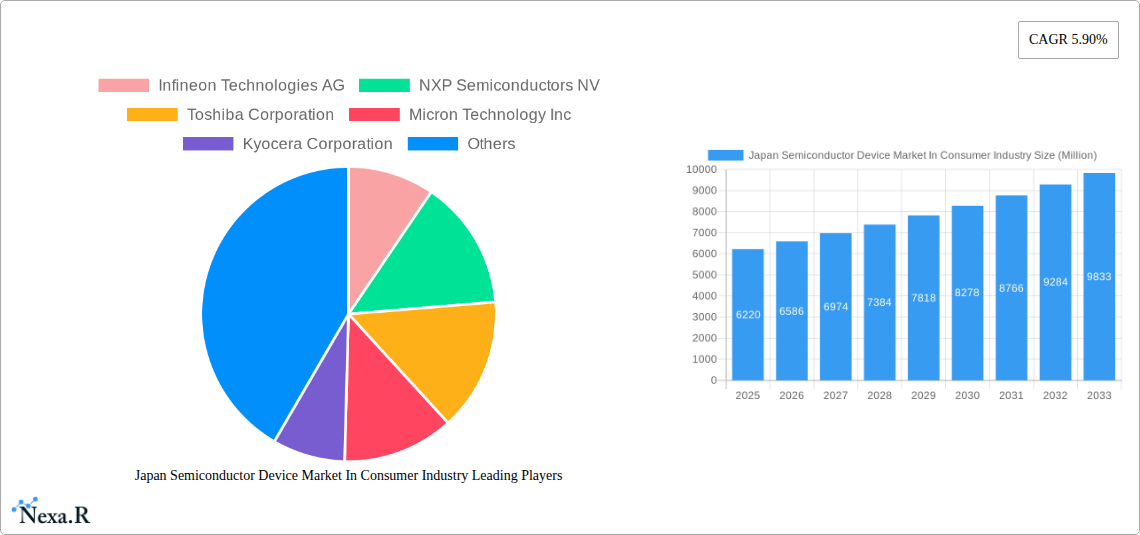

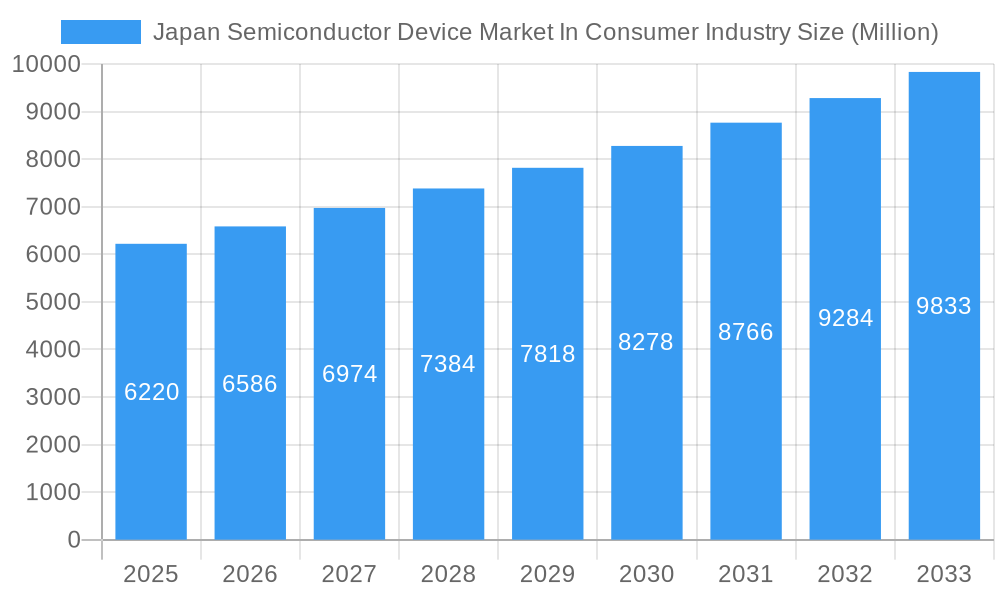

The Japan Semiconductor Device Market within the consumer industry is poised for robust expansion, projected to reach a significant market size of approximately USD 6.22 billion. This growth is fueled by a healthy Compound Annual Growth Rate (CAGR) of 5.90% over the forecast period from 2025 to 2033. This sustained upward trajectory indicates a strong and consistent demand for advanced semiconductor devices that are integral to the evolving landscape of consumer electronics. Key drivers for this market include the insatiable consumer appetite for innovative and feature-rich products, such as next-generation smartphones, advanced home appliances with enhanced connectivity and intelligence, and sophisticated entertainment systems. The increasing adoption of artificial intelligence (AI) and the Internet of Things (IoT) in everyday consumer goods further necessitates the integration of more powerful and specialized semiconductor components. Furthermore, the growing emphasis on energy efficiency and miniaturization in consumer electronics also contributes to the demand for advanced semiconductor solutions.

Japan Semiconductor Device Market In Consumer Industry Market Size (In Billion)

The market is characterized by distinct segment growth. Discrete Semiconductors are crucial for basic electronic functions, while Optoelectronics are vital for display technologies and lighting in consumer devices. Sensors are increasingly indispensable for smart functionalities, enabling devices to interact with their environment and users more effectively. The Integrated Circuits (IC) segment, encompassing Analog, Logic, Memory, and Microprocessors (MPU), Microcontrollers (MCU), and Digital Signal Processors, represents the core of innovation. The demand for higher processing power in smartphones, gaming consoles, and smart home hubs will drive growth in the MPU and MCU categories. Emerging trends like the miniaturization of components, the integration of AI at the edge, and the growing demand for high-performance computing in consumer applications are shaping the market's future. While Japan boasts a strong domestic semiconductor manufacturing and design ecosystem, the market also navigates challenges related to intense global competition and the need for continuous innovation to stay ahead of rapidly evolving consumer preferences and technological advancements.

Japan Semiconductor Device Market In Consumer Industry Company Market Share

Japan Semiconductor Device Market in Consumer Industry: A Comprehensive Analysis (2019-2033)

This in-depth report provides a meticulous examination of the Japan semiconductor device market within the consumer industry, forecasting its trajectory from 2019 to 2033 with a base year of 2025. Uncover critical insights into discrete semiconductors, optoelectronics, sensors, and integrated circuits (analog, logic, memory, microprocessors, microcontrollers, digital signal processors). Analyze the strategic moves of industry giants like Infineon Technologies AG, NXP Semiconductors NV, Toshiba Corporation, Micron Technology Inc, Kyocera Corporation, Xilinx Inc, Samsung Electronics Co Ltd, Texas Instruments Inc, Qualcomm Incorporated, STMicroelectronics NV, ON Semiconductor Corporation, Nvidia Corporation, and Intel Corporation. Gain a competitive edge by understanding market dynamics, growth trends, dominant segments, product landscapes, key drivers, challenges, emerging opportunities, growth accelerators, and notable industry milestones that are reshaping the Japanese semiconductor sector. This report is essential for stakeholders seeking to navigate the evolving demands of Japan's dynamic consumer electronics landscape, leveraging high-traffic keywords such as "Japan semiconductor market," "consumer electronics semiconductors," "Japanese chip industry," "semiconductor devices Japan," and "integrated circuits Japan" for maximum search visibility.

Japan Semiconductor Device Market In Consumer Industry Market Dynamics & Structure

The Japan semiconductor device market in the consumer industry is characterized by a moderately concentrated structure, with a few key global players dominating specific segments. Technological innovation serves as the primary driver, fueled by relentless consumer demand for advanced features in smartphones, home appliances, wearables, and automotive electronics. Regulatory frameworks, particularly government initiatives aimed at bolstering domestic semiconductor manufacturing and R&D, play a crucial role in shaping market access and investment. While direct competitive product substitutes are limited due to the foundational nature of semiconductor devices, innovation in system-level integration and miniaturization presents indirect competition. End-user demographics are increasingly sophisticated, prioritizing performance, energy efficiency, and smart functionalities. Mergers and acquisitions (M&A) trends indicate strategic consolidations to achieve economies of scale, expand product portfolios, and secure critical intellectual property.

- Market Concentration: Dominated by a blend of global semiconductor leaders and specialized Japanese manufacturers.

- Technological Innovation Drivers: Demand for AI-enabled devices, IoT integration, 5G connectivity, and advanced display technologies.

- Regulatory Frameworks: Government subsidies and policies supporting domestic production and R&D are significant.

- Competitive Product Substitutes: Primarily driven by advancements in system-on-chip (SoC) solutions and integrated module designs.

- End-User Demographics: A tech-savvy population with a high disposable income, seeking premium and innovative consumer electronics.

- M&A Trends: Focus on acquiring specialized technologies and expanding market reach in high-growth consumer segments.

Japan Semiconductor Device Market In Consumer Industry Growth Trends & Insights

The Japan semiconductor device market in the consumer industry is poised for sustained growth, propelled by an escalating demand for sophisticated consumer electronics. The market size has witnessed a consistent upward trajectory, driven by increasing adoption rates of smart home devices, advanced audio-visual equipment, and next-generation personal computing. Technological disruptions, such as the proliferation of AI in edge devices and the continued rollout of 5G infrastructure, are creating new avenues for semiconductor innovation and market penetration. Consumer behavior is shifting towards personalized experiences, energy efficiency, and seamless connectivity, placing a premium on advanced semiconductor solutions. Metrics such as Compound Annual Growth Rate (CAGR) are expected to remain robust throughout the forecast period, reflecting the dynamic nature of the consumer electronics sector. Market penetration is deepened by the integration of semiconductor components into an ever-wider array of consumer products.

The evolution of the market is intrinsically linked to the innovation cycles of major consumer electronics segments. Smartphones, with their intricate designs requiring high-performance processors, advanced memory, and sophisticated sensors, continue to be a primary demand generator. The burgeoning Internet of Things (IoT) ecosystem, encompassing smart home devices, wearable technology, and connected appliances, represents a significant growth area. Each of these applications relies on a diverse range of semiconductor devices, from microcontrollers (MCUs) managing device operations to sensors gathering environmental data, and logic chips enabling complex functionalities. The adoption of advanced materials and manufacturing techniques is crucial for meeting the miniaturization and power efficiency demands of these compact consumer devices. Furthermore, the increasing integration of AI and machine learning at the edge – directly within consumer devices – necessitates more powerful and specialized processing units, further stimulating demand for advanced microprocessors (MPUs) and digital signal processors (DSPs). The Japanese consumer semiconductor market is thus a complex interplay of technological advancement, shifting consumer preferences, and robust industry investment.

Dominant Regions, Countries, or Segments in Japan Semiconductor Device Market In Consumer Industry

Within the Japan semiconductor device market in consumer industry, Integrated Circuits (ICs), particularly Memory and Micro (Microprocessors (MPU), Microcontrollers (MCU)), stand out as the dominant segments driving market growth. This dominance is attributed to their pervasive application across the vast array of modern consumer electronics, from smartphones and gaming consoles to smart home devices and advanced computing systems. Japan's strong domestic consumer electronics manufacturing base, coupled with its reputation for high-quality, innovative products, creates an insatiable demand for sophisticated ICs. The market share within this segment is substantial, reflecting the critical role of these components in enabling the performance and functionality of consumer goods.

- Dominant Segment: Integrated Circuits, specifically Memory and Microprocessors/Microcontrollers.

- Key Drivers:

- High Demand for Smartphones: Japan is a leading market for advanced smartphones, requiring high-density memory and powerful MPUs.

- Growth of IoT and Wearable Devices: The proliferation of smart home gadgets and wearables necessitates a multitude of MCUs and sensors.

- Advancements in Gaming and Entertainment: Sophisticated gaming consoles and home entertainment systems rely on high-performance MPUs and specialized logic ICs.

- Automotive Consumer Electronics: Increasing integration of advanced infotainment and driver-assistance systems in vehicles further boosts demand for ICs.

- Government Support for Advanced Manufacturing: Initiatives promoting domestic production of high-end semiconductors benefit the IC segment.

- Key Drivers:

- Market Share & Growth Potential: The IC segment, particularly memory and microcontrollers, commands a significant market share and is projected to exhibit strong growth potential due to ongoing technological advancements and expanding application areas in the consumer space. The trend towards increased processing power and data storage in consumer devices directly fuels the expansion of these IC sub-segments.

Japan Semiconductor Device Market In Consumer Industry Product Landscape

The product landscape within the Japan semiconductor device market in consumer industry is characterized by relentless innovation focused on enhanced performance, reduced power consumption, and miniaturization. Companies are actively developing cutting-edge memory solutions offering higher capacities and faster access times, alongside more powerful and energy-efficient microprocessors and microcontrollers designed for AI-driven applications. Optoelectronics are seeing advancements in display technologies, including Micro-LEDs and advanced OLEDs, while sensors are becoming more sophisticated, enabling features like advanced biometrics and environmental monitoring. Unique selling propositions revolve around superior integration capabilities, optimized power management, and adherence to stringent Japanese quality standards.

Key Drivers, Barriers & Challenges in Japan Semiconductor Device Market In Consumer Industry

The Japan semiconductor device market in consumer industry is propelled by strong drivers including relentless consumer demand for advanced electronics, significant government investment in the semiconductor sector, and continuous technological innovation. The increasing adoption of AI, 5G, and IoT technologies in consumer devices further fuels market expansion.

However, the market faces substantial barriers and challenges such as intense global competition, particularly from countries with lower manufacturing costs. Supply chain vulnerabilities, highlighted by recent global disruptions, pose a significant risk. High R&D costs and the long product development cycles for advanced semiconductor devices also present challenges. Furthermore, the stringent quality and performance expectations of the Japanese consumer market require continuous investment in advanced manufacturing and quality control processes.

Emerging Opportunities in Japan Semiconductor Device Market In Consumer Industry

Emerging opportunities in the Japan semiconductor device market in consumer industry lie in the burgeoning field of edge AI for consumer devices, enabling more intelligent and responsive functionalities without constant cloud connectivity. The growing demand for sustainable and energy-efficient electronics presents a significant opportunity for low-power semiconductor solutions. Furthermore, advancements in augmented reality (AR) and virtual reality (VR) technologies are creating a new wave of demand for high-performance graphics processors and specialized sensors. The increasing need for robust cybersecurity in connected consumer devices also opens avenues for secure element semiconductors and specialized security chips.

Growth Accelerators in the Japan Semiconductor Device Market In Consumer Industry Industry

Catalysts driving long-term growth in the Japan semiconductor device market in the consumer industry include breakthrough innovations in materials science leading to more efficient chip designs and the strategic partnerships formed between semiconductor manufacturers and leading consumer electronics brands. The ongoing global shift towards digitalization and smart connectivity across all consumer segments provides a fertile ground for semiconductor adoption. Additionally, the Japanese government's continued commitment to fostering a robust domestic semiconductor ecosystem through substantial financial incentives and policy support acts as a significant growth accelerator, ensuring continued investment in advanced manufacturing capabilities and cutting-edge research and development.

Key Players Shaping the Japan Semiconductor Device Market In Consumer Industry Market

- Infineon Technologies AG

- NXP Semiconductors NV

- Toshiba Corporation

- Micron Technology Inc

- Kyocera Corporation

- Xilinx Inc

- Samsung Electronics Co Ltd

- Texas Instruments Inc

- Qualcomm Incorporated

- STMicroelectronics NV

- ON Semiconductor Corporation

- Nvidia Corporation

- Intel Corporation

Notable Milestones in Japan Semiconductor Device Market In Consumer Industry Sector

- April 2024: The Japanese government allocated JPY590 billion (USD 3.9 billion) to bolster Rapidus Corp's efforts in mass-producing 2nm logic chips. This funding supplements previous subsidies provided to Taiwan Semiconductor Manufacturing Co (TSMC) and Micron Technology.

- February 2024: Sony Semiconductor Solutions Corporation ("SSS"), DENSO Corporation ("DENSO"), and Toyota Motor Corporation ("Toyota") revealed plans for additional investments in Japan Advanced Semiconductor Manufacturing, Inc. ("JASM"), a subsidiary primarily owned by TSMC, located in Kumamoto Prefecture, Japan. This investment aims to establish a second fab, slated to commence operations by the end of 2027. Coupled with JASM's first fab, set to be operational in 2024, the collective investment in JASM is poised to surpass USD20 billion, bolstered by substantial backing from the Japanese government.

In-Depth Japan Semiconductor Device Market In Consumer Industry Market Outlook

The future outlook for the Japan semiconductor device market in consumer industry is exceptionally promising, driven by a confluence of technological advancements and evolving consumer demands. Growth accelerators such as the ongoing evolution of AI, the widespread adoption of 5G, and the expansion of the IoT ecosystem will continue to propel demand for sophisticated semiconductor solutions. Strategic opportunities are abundant in developing specialized components for emerging applications like advanced robotics, immersive entertainment systems, and the expanding electric vehicle market. The Japanese government's proactive industrial policies, coupled with the nation's prowess in precision manufacturing and innovation, position the market for sustained high growth and global competitiveness in the coming years.

Japan Semiconductor Device Market In Consumer Industry Segmentation

-

1. Device Type

- 1.1. Discrete Semiconductors

- 1.2. Optoelectronics

- 1.3. Sensors

-

1.4. Integrated Circuits

- 1.4.1. Analog

- 1.4.2. Logic

- 1.4.3. Memory

-

1.4.4. Micro

- 1.4.4.1. Microprocessors (MPU)

- 1.4.4.2. Microcontrollers (MCU)

- 1.4.4.3. Digital Signal Processors

Japan Semiconductor Device Market In Consumer Industry Segmentation By Geography

- 1. Japan

Japan Semiconductor Device Market In Consumer Industry Regional Market Share

Geographic Coverage of Japan Semiconductor Device Market In Consumer Industry

Japan Semiconductor Device Market In Consumer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G Smartphones; Growing Adoption of Technologies like IoT and AI

- 3.3. Market Restrains

- 3.3.1. Technological Complexities Arising due to Miniaturization

- 3.4. Market Trends

- 3.4.1. Increasing Smartphone Penetration

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Semiconductor Device Market In Consumer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Discrete Semiconductors

- 5.1.2. Optoelectronics

- 5.1.3. Sensors

- 5.1.4. Integrated Circuits

- 5.1.4.1. Analog

- 5.1.4.2. Logic

- 5.1.4.3. Memory

- 5.1.4.4. Micro

- 5.1.4.4.1. Microprocessors (MPU)

- 5.1.4.4.2. Microcontrollers (MCU)

- 5.1.4.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Infineon Technologies AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NXP Semiconductors NV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toshiba Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Micron Technology Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kyocera Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Xilinx Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samsung Electronics Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Texas Instruments Inc *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qualcomm Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 STMicroelectronics NV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ON Semiconductor Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Nvidia Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Intel Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Japan Semiconductor Device Market In Consumer Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Semiconductor Device Market In Consumer Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Japan Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Japan Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Device Type 2020 & 2033

- Table 4: Japan Semiconductor Device Market In Consumer Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Semiconductor Device Market In Consumer Industry?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Japan Semiconductor Device Market In Consumer Industry?

Key companies in the market include Infineon Technologies AG, NXP Semiconductors NV, Toshiba Corporation, Micron Technology Inc, Kyocera Corporation, Xilinx Inc, Samsung Electronics Co Ltd, Texas Instruments Inc *List Not Exhaustive, Qualcomm Incorporated, STMicroelectronics NV, ON Semiconductor Corporation, Nvidia Corporation, Intel Corporation.

3. What are the main segments of the Japan Semiconductor Device Market In Consumer Industry?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G Smartphones; Growing Adoption of Technologies like IoT and AI.

6. What are the notable trends driving market growth?

Increasing Smartphone Penetration.

7. Are there any restraints impacting market growth?

Technological Complexities Arising due to Miniaturization.

8. Can you provide examples of recent developments in the market?

April 2024: The Japanese government allocated JPY590 billion (USD 3.9 billion) to bolster Rapidus Corp's efforts in mass-producing 2nm logic chips. This funding supplements previous subsidies provided to Taiwan Semiconductor Manufacturing Co (TSMC) and Micron Technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Semiconductor Device Market In Consumer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Semiconductor Device Market In Consumer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Semiconductor Device Market In Consumer Industry?

To stay informed about further developments, trends, and reports in the Japan Semiconductor Device Market In Consumer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence