Key Insights

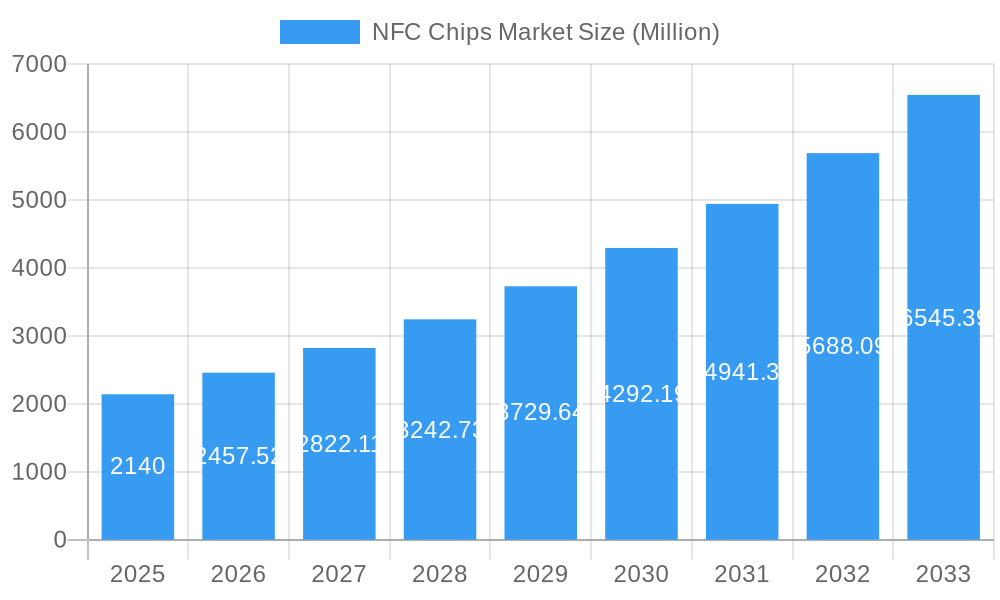

The Near Field Communication (NFC) Chips Market is poised for substantial growth, projected to reach a market size of approximately USD 2.14 billion. This expansion is driven by a compelling Compound Annual Growth Rate (CAGR) of 14.80% throughout the forecast period from 2025 to 2033. The proliferation of contactless payment systems, the increasing adoption of smartphones and other consumer electronics equipped with NFC capabilities, and the growing demand for enhanced security in various applications are significant catalysts for this upward trajectory. The market is segmented into "Non-auxiliary" and "Auxiliary" product types, with "Auxiliary" NFC chips likely experiencing higher demand due to their integration into a wider array of devices. End devices such as smartphones, PCs, and other consumer electronics are expected to dominate the market, reflecting the pervasive integration of NFC technology in our daily lives. Furthermore, the expanding use of NFC in medical equipment for patient identification and data transfer, as well as in retail for inventory management and loyalty programs, is contributing to market diversification.

NFC Chips Market Market Size (In Billion)

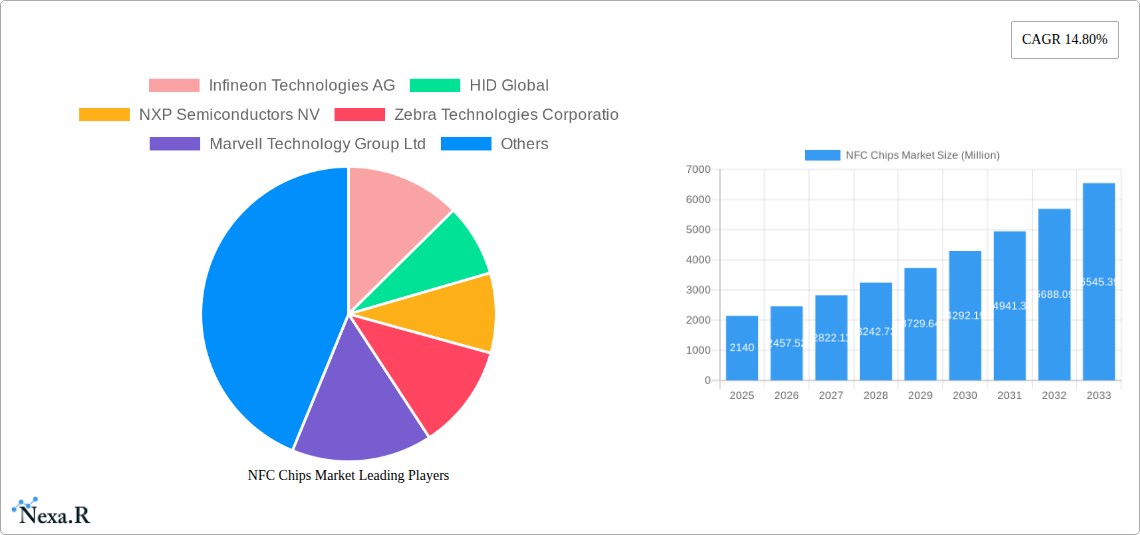

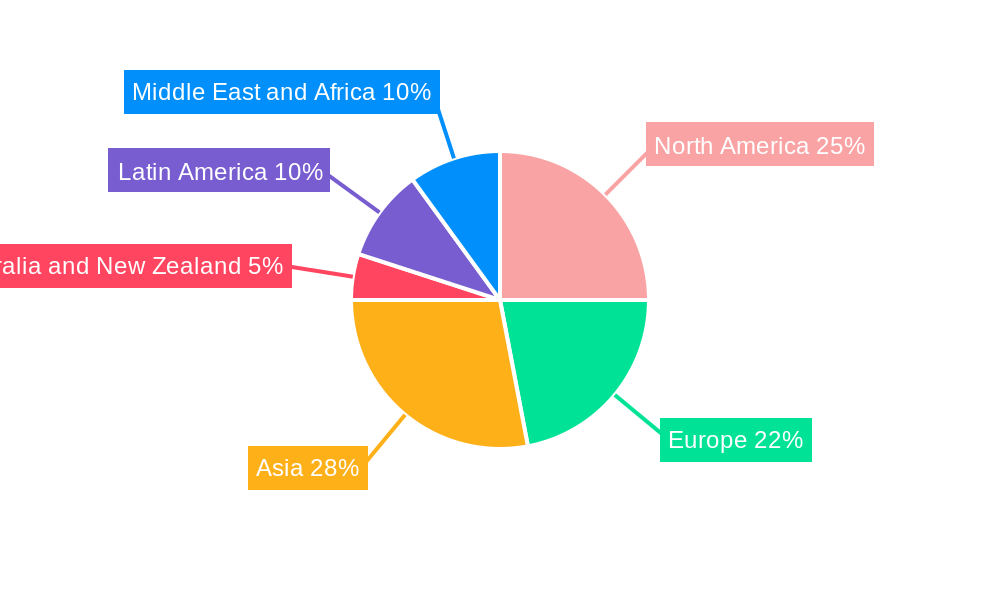

The competitive landscape features prominent players like Infineon Technologies AG, HID Global, NXP Semiconductors NV, Zebra Technologies Corporation, Marvell Technology Group Ltd, STMicroelectronics NV, Toshiba Electronic Devices & Storage Corporation, Renesas Electronics Corporation, Qualcomm Technologies Inc, and Texas Instruments Incorporated. These companies are investing heavily in research and development to innovate and expand their product portfolios, catering to the evolving needs of diverse end-user verticals including Consumer Electronics, BFSI, IT and Telecommunications, Retail, Healthcare, Hospitality and Transportation. Geographically, North America and Asia are expected to lead the market in terms of adoption and revenue, owing to strong technological infrastructure and high consumer spending. While the widespread adoption of NFC technology presents significant growth opportunities, potential challenges such as the cost of integration in certain legacy systems and evolving data privacy regulations could act as minor restraints. However, the overall outlook for the NFC Chips Market remains exceptionally positive, underscoring its critical role in enabling seamless and secure connectivity across a multitude of devices and services.

NFC Chips Market Company Market Share

This in-depth report provides an unparalleled analysis of the NFC chips market, delving into its intricate dynamics, growth trajectories, and future potential. Discover how Near Field Communication (NFC) technology is revolutionizing contactless interactions across diverse industries, from consumer electronics and BFSI to healthcare and transportation. With a detailed segmentation of the market by product type (Non-auxiliary, Auxiliary), end device (Smartphone, PCs and Other Consumer Electronics, Medical Equipment, Other End Devices), and end-user vertical (Consumer Electronics, BFSI, IT and Telecommunications, Retail, Healthcare, Hospitality and Transportation, Other End-user Verticals), this report offers granular insights for strategic decision-making. Featuring a study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this research equips stakeholders with actionable intelligence on market size, CAGR, and adoption rates.

NFC Chips Market Market Dynamics & Structure

The global NFC chips market is characterized by a moderate to high level of concentration, with key players like Infineon Technologies AG, HID Global, NXP Semiconductors NV, Zebra Technologies Corporation, Marvell Technology Group Ltd, STMicroelectronics NV, Toshiba Electronic Devices & Storage Corporation, Renesas Electronics Corporation, Qualcomm Technologies Inc, and Texas Instruments Incorporated holding significant market shares. Technological innovation serves as a primary driver, with continuous advancements in chip miniaturization, power efficiency, and enhanced security features propelling market expansion. Robust regulatory frameworks surrounding data privacy and payment security, particularly for applications in BFSI and healthcare, are shaping product development and adoption. While direct competitive product substitutes for the core functionality of NFC are limited, advancements in other contactless technologies and evolving security protocols present indirect competitive pressures. End-user demographics are increasingly tech-savvy, demanding seamless and secure contactless experiences, thereby fueling the demand for NFC-enabled devices. Mergers and acquisitions (M&A) trends are also influencing market structure, with strategic consolidations aimed at expanding product portfolios and geographical reach. For instance, the M&A landscape has seen an average of 5-7 significant deals annually between 2019-2024, reflecting the industry's drive for consolidation and synergy. Innovation barriers include the high cost of R&D for cutting-edge solutions and the need for widespread ecosystem adoption to realize the full potential of NFC applications.

NFC Chips Market Growth Trends & Insights

The NFC chips market is poised for substantial growth, driven by the escalating adoption of contactless payment solutions, enhanced security features in authentication, and the expanding use of NFC in smart devices and Internet of Things (IoT) applications. The market size is projected to witness a significant evolution from an estimated $X,XXX million units in 2025, growing at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This growth is fueled by increasing consumer comfort and preference for contactless transactions, accelerated by global events that emphasized hygiene and reduced physical contact. Technological disruptions, such as the integration of NFC into a wider array of consumer electronics beyond smartphones, including wearables, smart home devices, and automotive systems, are broadening the market's scope. Furthermore, advancements in the performance and cost-effectiveness of NFC chips are making them more accessible for deployment in diverse applications, including asset tracking, ticketing, and access control. Consumer behavior shifts towards convenience and instant gratification are strongly aligned with the capabilities of NFC technology, further solidifying its market penetration. The historical period (2019-2024) has already demonstrated a robust upward trend, with market penetration increasing from XX% to XX% for contactless payments alone. The widespread availability of NFC-enabled smartphones, now exceeding X,XXX million units globally, acts as a foundational catalyst for the broader NFC ecosystem. The evolution of NFC tag capabilities, offering enhanced data storage and security, is also opening new avenues for personalized marketing and interactive experiences. This sustained growth trajectory is indicative of NFC's transition from a niche technology to a fundamental enabler of the connected world.

Dominant Regions, Countries, or Segments in NFC Chips Market

The Smartphone segment, within the End Device category, is currently the dominant force propelling the NFC chips market. This dominance is primarily driven by the sheer ubiquity of smartphones globally, with over X,XXX million units shipped annually and a significant portion of these devices incorporating NFC capabilities. The accessibility and familiarity of smartphones make them the primary gateway for consumers to engage with NFC functionalities, particularly for contactless payments and tap-to-connect applications.

- Key Drivers in Smartphone Segment Dominance:

- Ubiquitous Adoption: Over 80% of mid-range and high-end smartphones now feature integrated NFC, creating a massive install base.

- Contactless Payment Ecosystem: The widespread acceptance of mobile payment solutions like Apple Pay and Google Pay, powered by NFC, has created a powerful network effect.

- App Ecosystem Growth: A burgeoning ecosystem of NFC-enabled applications for loyalty programs, ticketing, and transit further enhances smartphone utility.

- Technological Integration: Continuous improvements in NFC chip performance and integration within smartphone architectures ensure seamless user experiences.

Regionally, Asia Pacific is emerging as a significant growth engine for the NFC chips market, driven by its large and rapidly expanding consumer base, increasing disposable incomes, and the aggressive adoption of mobile technologies.

- Dominance Factors in Asia Pacific:

- Rapid Digital Transformation: Countries like China, India, and South Korea are at the forefront of digital payments and smart device adoption.

- Government Initiatives: Supportive government policies and investments in digital infrastructure are fostering NFC technology integration.

- E-commerce Boom: The massive growth of e-commerce in the region is closely linked to mobile transactions, boosting NFC demand.

- Smart City Development: Investments in smart city projects across the region are creating opportunities for NFC in public transportation, access control, and smart utilities.

Within the End-user Vertical, Consumer Electronics and BFSI are leading the charge, with significant market share contributions. The seamless integration of NFC into consumer electronics enhances user experience and functionality, while its critical role in secure, contactless transactions within the banking and financial services sector is undeniable.

NFC Chips Market Product Landscape

The NFC chips market is defined by a range of innovative products catering to diverse needs. Non-auxiliary NFC chips, integral to device functionality, are crucial for applications requiring direct interaction and payment processing. Auxiliary NFC chips, often used in tags and labels, enable smart functionalities for various objects and environments. These chips boast enhanced performance metrics, including faster read/write speeds, improved security protocols, and lower power consumption. Unique selling propositions lie in their miniaturization for embedded applications and robust data integrity features for secure transactions. Technological advancements are focused on increasing data transfer rates, expanding memory capacity, and developing tamper-proof security mechanisms, making NFC chips indispensable for the modern connected landscape.

Key Drivers, Barriers & Challenges in NFC Chips Market

Key Drivers:

- Growing demand for contactless payments and transactions: This is a primary catalyst, driven by convenience and hygiene concerns.

- Expansion of IoT ecosystems: NFC integration in smart devices, wearables, and home appliances creates new application frontiers.

- Technological advancements in chip miniaturization and efficiency: Enabling seamless integration into smaller and more power-constrained devices.

- Increasing adoption in healthcare for patient identification and device authentication: Enhancing patient safety and data security.

- Supportive government initiatives and standardization efforts: Promoting interoperability and wider adoption.

Barriers & Challenges:

- High initial implementation costs for some niche applications: Requiring significant investment in infrastructure and R&D.

- Fragmented global payment infrastructure and varying acceptance rates: Can hinder seamless cross-border transactions.

- Security concerns and the need for robust data protection measures: Ongoing efforts are required to build consumer trust against potential vulnerabilities.

- Competition from alternative contactless technologies: While NFC has strong footholds, other technologies are also evolving.

- Supply chain disruptions and component availability: Can impact production timelines and costs.

Emerging Opportunities in NFC Chips Market

Emerging opportunities in the NFC chips market lie in the burgeoning fields of smart retail, where NFC can personalize customer experiences and streamline inventory management, and the expanding use in industrial IoT for asset tracking and predictive maintenance. The development of ultra-low power NFC chips is opening doors for battery-less smart tags and sensors. Furthermore, the integration of NFC with augmented reality (AR) applications promises to create interactive and immersive consumer experiences. The growing demand for secure access control in both physical and digital environments presents a significant untapped market for NFC solutions.

Growth Accelerators in the NFC Chips Market Industry

Several catalysts are accelerating the long-term growth of the NFC chips market. The ongoing innovation in NFC tag capabilities, offering enhanced memory and processing power, is expanding its utility beyond simple data storage. Strategic partnerships between chip manufacturers, device makers, and service providers are crucial for building a robust NFC ecosystem and driving widespread adoption. The continuous market expansion into new geographical regions, particularly emerging economies with a growing middle class and increasing smartphone penetration, is a key growth accelerator. Furthermore, the development of advanced encryption algorithms and secure element integration in NFC chips is bolstering confidence in their security, thereby fostering wider deployment in sensitive applications.

Key Players Shaping the NFC Chips Market Market

- Infineon Technologies AG

- HID Global

- NXP Semiconductors NV

- Zebra Technologies Corporation

- Marvell Technology Group Ltd

- STMicroelectronics NV

- Toshiba Electronic Devices & Storage Corporation

- Renesas Electronics Corporation

- Qualcomm Technologies Inc

- Texas Instruments Incorporated

Notable Milestones in NFC Chips Market Sector

- May 2023: Nidec Instruments Corporation, a group company of Nidec Corporation, announced that it had launched an industry-first card reader integrated with NFC.

- March 2023: Identiv announced the expansion of its partnership with STMicroelectronics to offer new NFC inlays for all end users. To strengthen its RFID/NFC market position, Identiv offers specialized NFC and high-frequency designs with type 2 NFC chips ST25TN from STMicroelectronics.

In-Depth NFC Chips Market Market Outlook

The NFC chips market is on a strong upward trajectory, with future potential amplified by ongoing technological innovation and expanding application landscapes. Growth accelerators such as the increasing integration of NFC into next-generation wearables, advancements in NFC-based authentication for enhanced cybersecurity, and the development of sophisticated NFC-enabled smart city infrastructure will continue to drive market expansion. Strategic opportunities lie in the penetration of NFC into underserved sectors like agriculture for supply chain traceability and the further integration of NFC into automotive systems for seamless vehicle access and personalization. The market is expected to witness sustained demand, driven by a global push towards a more connected and contactless future.

NFC Chips Market Segmentation

-

1. Product

- 1.1. Non-auxiliary

- 1.2. Auxiliary

-

2. End Device

- 2.1. Smartphone

- 2.2. PCs and Other Consumer Electronics

- 2.3. Medical Equipment

- 2.4. Other End Devices

-

3. End-user Vertical

- 3.1. Consumer Electronics

- 3.2. BFSI

- 3.3. IT and Telecommunications

- 3.4. Retail

- 3.5. Healthcare

- 3.6. Hospitality and Transportation

- 3.7. Other End-user Verticals

NFC Chips Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

NFC Chips Market Regional Market Share

Geographic Coverage of NFC Chips Market

NFC Chips Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Acceptance of Contactless Payments and Authentication; Rising Demand for NFC Chips in Consumer Electronics

- 3.3. Market Restrains

- 3.3.1. Higher Cost of Advanced Featured Vehicles

- 3.4. Market Trends

- 3.4.1. Consumer Electronics to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NFC Chips Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Non-auxiliary

- 5.1.2. Auxiliary

- 5.2. Market Analysis, Insights and Forecast - by End Device

- 5.2.1. Smartphone

- 5.2.2. PCs and Other Consumer Electronics

- 5.2.3. Medical Equipment

- 5.2.4. Other End Devices

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Consumer Electronics

- 5.3.2. BFSI

- 5.3.3. IT and Telecommunications

- 5.3.4. Retail

- 5.3.5. Healthcare

- 5.3.6. Hospitality and Transportation

- 5.3.7. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America NFC Chips Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Non-auxiliary

- 6.1.2. Auxiliary

- 6.2. Market Analysis, Insights and Forecast - by End Device

- 6.2.1. Smartphone

- 6.2.2. PCs and Other Consumer Electronics

- 6.2.3. Medical Equipment

- 6.2.4. Other End Devices

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Consumer Electronics

- 6.3.2. BFSI

- 6.3.3. IT and Telecommunications

- 6.3.4. Retail

- 6.3.5. Healthcare

- 6.3.6. Hospitality and Transportation

- 6.3.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe NFC Chips Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Non-auxiliary

- 7.1.2. Auxiliary

- 7.2. Market Analysis, Insights and Forecast - by End Device

- 7.2.1. Smartphone

- 7.2.2. PCs and Other Consumer Electronics

- 7.2.3. Medical Equipment

- 7.2.4. Other End Devices

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Consumer Electronics

- 7.3.2. BFSI

- 7.3.3. IT and Telecommunications

- 7.3.4. Retail

- 7.3.5. Healthcare

- 7.3.6. Hospitality and Transportation

- 7.3.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia NFC Chips Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Non-auxiliary

- 8.1.2. Auxiliary

- 8.2. Market Analysis, Insights and Forecast - by End Device

- 8.2.1. Smartphone

- 8.2.2. PCs and Other Consumer Electronics

- 8.2.3. Medical Equipment

- 8.2.4. Other End Devices

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Consumer Electronics

- 8.3.2. BFSI

- 8.3.3. IT and Telecommunications

- 8.3.4. Retail

- 8.3.5. Healthcare

- 8.3.6. Hospitality and Transportation

- 8.3.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Australia and New Zealand NFC Chips Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Non-auxiliary

- 9.1.2. Auxiliary

- 9.2. Market Analysis, Insights and Forecast - by End Device

- 9.2.1. Smartphone

- 9.2.2. PCs and Other Consumer Electronics

- 9.2.3. Medical Equipment

- 9.2.4. Other End Devices

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Consumer Electronics

- 9.3.2. BFSI

- 9.3.3. IT and Telecommunications

- 9.3.4. Retail

- 9.3.5. Healthcare

- 9.3.6. Hospitality and Transportation

- 9.3.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Latin America NFC Chips Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Non-auxiliary

- 10.1.2. Auxiliary

- 10.2. Market Analysis, Insights and Forecast - by End Device

- 10.2.1. Smartphone

- 10.2.2. PCs and Other Consumer Electronics

- 10.2.3. Medical Equipment

- 10.2.4. Other End Devices

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Consumer Electronics

- 10.3.2. BFSI

- 10.3.3. IT and Telecommunications

- 10.3.4. Retail

- 10.3.5. Healthcare

- 10.3.6. Hospitality and Transportation

- 10.3.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Middle East and Africa NFC Chips Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Non-auxiliary

- 11.1.2. Auxiliary

- 11.2. Market Analysis, Insights and Forecast - by End Device

- 11.2.1. Smartphone

- 11.2.2. PCs and Other Consumer Electronics

- 11.2.3. Medical Equipment

- 11.2.4. Other End Devices

- 11.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.3.1. Consumer Electronics

- 11.3.2. BFSI

- 11.3.3. IT and Telecommunications

- 11.3.4. Retail

- 11.3.5. Healthcare

- 11.3.6. Hospitality and Transportation

- 11.3.7. Other End-user Verticals

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Infineon Technologies AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 HID Global

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 NXP Semiconductors NV

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Zebra Technologies Corporatio

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Marvell Technology Group Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 STMicroelectronics NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Toshiba Electronic Devices & Storage Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Renesas Electronics Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Qualcomm Technologies Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Texas Instruments Incorporated

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global NFC Chips Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America NFC Chips Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America NFC Chips Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America NFC Chips Market Revenue (Million), by End Device 2025 & 2033

- Figure 5: North America NFC Chips Market Revenue Share (%), by End Device 2025 & 2033

- Figure 6: North America NFC Chips Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 7: North America NFC Chips Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America NFC Chips Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America NFC Chips Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe NFC Chips Market Revenue (Million), by Product 2025 & 2033

- Figure 11: Europe NFC Chips Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe NFC Chips Market Revenue (Million), by End Device 2025 & 2033

- Figure 13: Europe NFC Chips Market Revenue Share (%), by End Device 2025 & 2033

- Figure 14: Europe NFC Chips Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: Europe NFC Chips Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe NFC Chips Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe NFC Chips Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia NFC Chips Market Revenue (Million), by Product 2025 & 2033

- Figure 19: Asia NFC Chips Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia NFC Chips Market Revenue (Million), by End Device 2025 & 2033

- Figure 21: Asia NFC Chips Market Revenue Share (%), by End Device 2025 & 2033

- Figure 22: Asia NFC Chips Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Asia NFC Chips Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia NFC Chips Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia NFC Chips Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand NFC Chips Market Revenue (Million), by Product 2025 & 2033

- Figure 27: Australia and New Zealand NFC Chips Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Australia and New Zealand NFC Chips Market Revenue (Million), by End Device 2025 & 2033

- Figure 29: Australia and New Zealand NFC Chips Market Revenue Share (%), by End Device 2025 & 2033

- Figure 30: Australia and New Zealand NFC Chips Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 31: Australia and New Zealand NFC Chips Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Australia and New Zealand NFC Chips Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand NFC Chips Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America NFC Chips Market Revenue (Million), by Product 2025 & 2033

- Figure 35: Latin America NFC Chips Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: Latin America NFC Chips Market Revenue (Million), by End Device 2025 & 2033

- Figure 37: Latin America NFC Chips Market Revenue Share (%), by End Device 2025 & 2033

- Figure 38: Latin America NFC Chips Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Latin America NFC Chips Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Latin America NFC Chips Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America NFC Chips Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa NFC Chips Market Revenue (Million), by Product 2025 & 2033

- Figure 43: Middle East and Africa NFC Chips Market Revenue Share (%), by Product 2025 & 2033

- Figure 44: Middle East and Africa NFC Chips Market Revenue (Million), by End Device 2025 & 2033

- Figure 45: Middle East and Africa NFC Chips Market Revenue Share (%), by End Device 2025 & 2033

- Figure 46: Middle East and Africa NFC Chips Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 47: Middle East and Africa NFC Chips Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 48: Middle East and Africa NFC Chips Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa NFC Chips Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global NFC Chips Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global NFC Chips Market Revenue Million Forecast, by End Device 2020 & 2033

- Table 3: Global NFC Chips Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global NFC Chips Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global NFC Chips Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global NFC Chips Market Revenue Million Forecast, by End Device 2020 & 2033

- Table 7: Global NFC Chips Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global NFC Chips Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global NFC Chips Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Global NFC Chips Market Revenue Million Forecast, by End Device 2020 & 2033

- Table 11: Global NFC Chips Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global NFC Chips Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global NFC Chips Market Revenue Million Forecast, by Product 2020 & 2033

- Table 14: Global NFC Chips Market Revenue Million Forecast, by End Device 2020 & 2033

- Table 15: Global NFC Chips Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global NFC Chips Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global NFC Chips Market Revenue Million Forecast, by Product 2020 & 2033

- Table 18: Global NFC Chips Market Revenue Million Forecast, by End Device 2020 & 2033

- Table 19: Global NFC Chips Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global NFC Chips Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global NFC Chips Market Revenue Million Forecast, by Product 2020 & 2033

- Table 22: Global NFC Chips Market Revenue Million Forecast, by End Device 2020 & 2033

- Table 23: Global NFC Chips Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 24: Global NFC Chips Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global NFC Chips Market Revenue Million Forecast, by Product 2020 & 2033

- Table 26: Global NFC Chips Market Revenue Million Forecast, by End Device 2020 & 2033

- Table 27: Global NFC Chips Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global NFC Chips Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NFC Chips Market?

The projected CAGR is approximately 14.80%.

2. Which companies are prominent players in the NFC Chips Market?

Key companies in the market include Infineon Technologies AG, HID Global, NXP Semiconductors NV, Zebra Technologies Corporatio, Marvell Technology Group Ltd, STMicroelectronics NV, Toshiba Electronic Devices & Storage Corporation, Renesas Electronics Corporation, Qualcomm Technologies Inc, Texas Instruments Incorporated.

3. What are the main segments of the NFC Chips Market?

The market segments include Product, End Device, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Acceptance of Contactless Payments and Authentication; Rising Demand for NFC Chips in Consumer Electronics.

6. What are the notable trends driving market growth?

Consumer Electronics to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Higher Cost of Advanced Featured Vehicles.

8. Can you provide examples of recent developments in the market?

May 2023: Nidec Instruments Corporation, a group company of Nidec Corporation, announced that it had launched an industry-first card reader integrated with NFC*1.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NFC Chips Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NFC Chips Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NFC Chips Market?

To stay informed about further developments, trends, and reports in the NFC Chips Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence