Key Insights

The Thailand Travel Retail Market is poised for robust growth, projected to reach a significant valuation by 2025. This expansion is fueled by a confluence of factors, including the increasing number of international tourist arrivals and the growing disposable income of travelers. The market's dynamism is further amplified by evolving consumer preferences, with a heightened demand for premium and experiential retail offerings. Key product categories such as Beauty and Personal Care, Wines and Spirits, and Fashion Accessories are expected to lead this growth trajectory, driven by the desire of travelers to indulge in luxury goods and local specialties. The dominance of airport retail channels underscores their importance as primary touchpoints for duty-free purchases, though airlines and ferries are also contributing to the overall market penetration. Strategic expansions by major players and a focus on enhancing the shopping experience for travelers are crucial elements in capitalizing on these favorable market conditions.

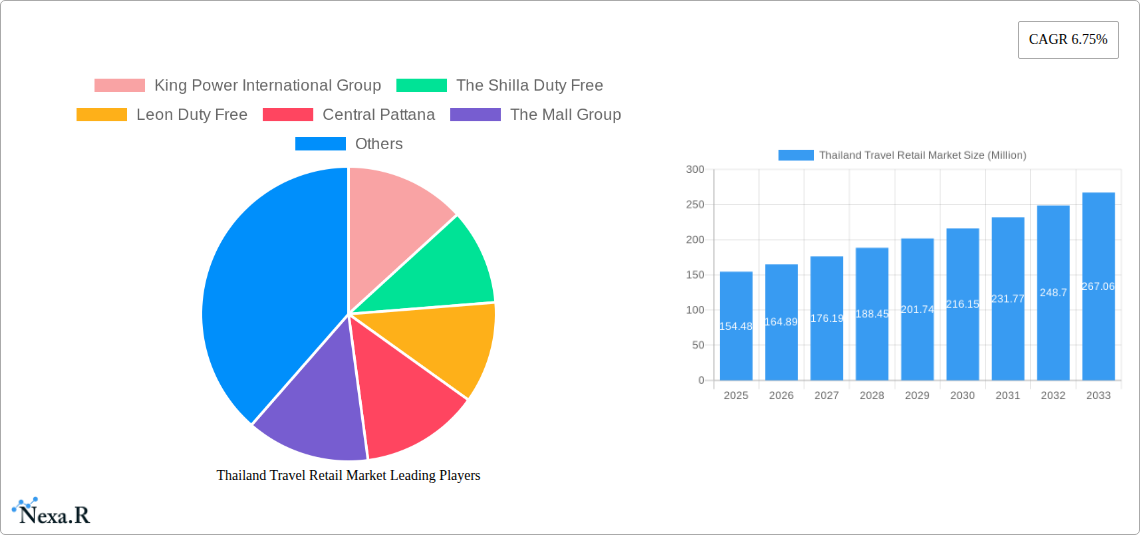

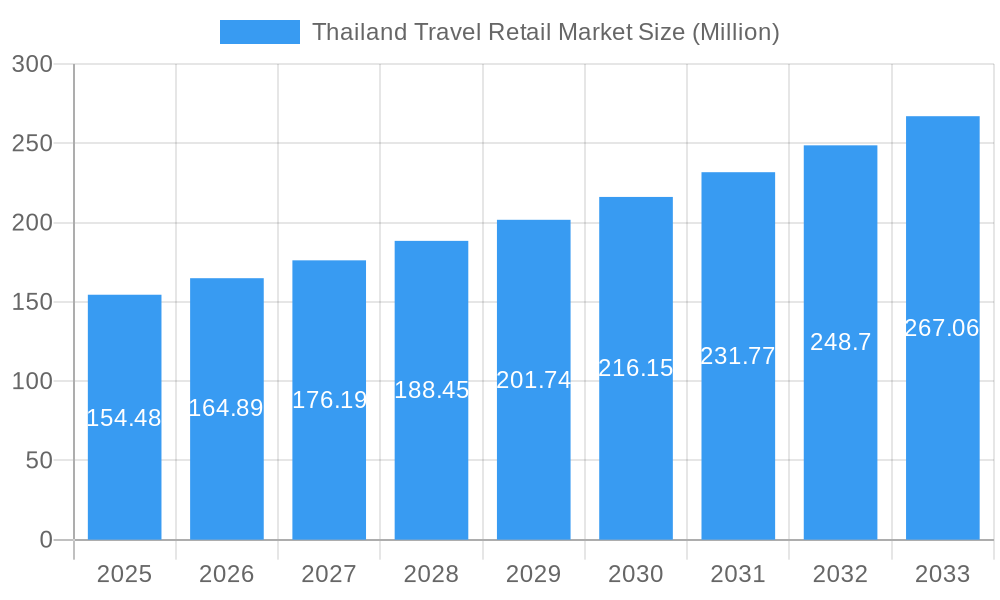

Thailand Travel Retail Market Market Size (In Million)

The projected Compound Annual Growth Rate (CAGR) of 6.75% for the Thailand Travel Retail Market from 2025 to 2033 signals a sustained period of expansion. This growth will be propelled by strategic initiatives aimed at stimulating travel and enhancing the retail infrastructure. While the market benefits from strong drivers, certain restraints such as fluctuating currency exchange rates and evolving regulatory landscapes could present challenges. However, the overarching trend indicates a resilient market that is adapting to these dynamics. The industry's ability to innovate in product offerings, personalize customer experiences, and leverage digital platforms will be pivotal in maintaining its upward momentum. Continued investment in prime retail locations, coupled with strategic partnerships among key stakeholders like airports, airlines, and brands, will be instrumental in securing the market's future prosperity and meeting the sophisticated demands of the modern traveler.

Thailand Travel Retail Market Company Market Share

Thailand Travel Retail Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Thailand travel retail market, encompassing historical performance, current dynamics, and robust future projections. Delve into the lucrative parent market of global travel retail and its child market in Thailand, exploring growth drivers, segment breakdowns, competitive landscapes, and emerging opportunities. With a focus on high-traffic keywords like "Thailand duty free," "travel retail APAC," "airport retail Thailand," and "Bangkok duty free," this report is optimized for industry professionals seeking actionable insights and strategic intelligence. All quantitative data is presented in Million Units for clarity and comparative analysis.

Thailand Travel Retail Market Market Dynamics & Structure

The Thailand travel retail market is characterized by a moderate to high market concentration, with key players like King Power International Group dominating significant portions of the landscape. Technological innovation is primarily driven by the adoption of advanced retail technologies, including AI-powered personalization, contactless payment solutions, and enhanced in-store digital experiences, aimed at improving traveler convenience and engagement. Regulatory frameworks, overseen by agencies managing customs, immigration, and aviation, are crucial in shaping operational mandates, tax structures, and product eligibility for duty-free status. Competitive product substitutes are relatively limited within the formal travel retail channel due to the duty-free status, but the grey market and online channels pose indirect competition. End-user demographics are diverse, comprising international tourists, expatriates, and, increasingly, domestic travelers engaging in "travel retail for locals" initiatives. Mergers and acquisitions (M&A) trends, while not overtly frequent, often involve strategic partnerships or acquisitions to expand store footprints, particularly within major airport hubs and downtown locations.

- Market Concentration: Dominated by a few large operators, with King Power International Group holding a substantial market share.

- Technological Innovation: Focus on enhancing customer experience through digital integration and AI-driven personalization.

- Regulatory Frameworks: Governed by government bodies ensuring compliance with customs, taxation, and aviation regulations.

- Competitive Landscape: Primarily driven by in-store experience and product assortment, with indirect competition from online and grey markets.

- End-User Demographics: A mix of international tourists and a growing segment of domestic consumers.

- M&A Trends: Characterized by strategic alliances and targeted expansions rather than large-scale consolidation.

Thailand Travel Retail Market Growth Trends & Insights

The Thailand travel retail market is poised for significant expansion, fueled by a confluence of economic recovery, resurgent tourism numbers, and strategic business initiatives. The parent market of global travel retail, encompassing a vast array of consumer goods purchased by travelers, directly influences the performance of its child market in Thailand. During the Historical Period (2019–2024), the market experienced fluctuations due to global events, but demonstrated resilience. The Base Year (2025) serves as a pivotal point, with the Forecast Period (2025–2033) projecting a robust Compound Annual Growth Rate (CAGR) of approximately 8.5%. This growth is underpinned by increasing passenger traffic at key airports like Suvarnabhumi and Don Mueang, coupled with a growing consumer appetite for premium products and unique local offerings.

Adoption rates for advanced retail technologies are steadily climbing, with a particular emphasis on seamless digital integration and personalized shopping experiences. Travelers increasingly expect omnichannel services, blurring the lines between online research and in-store purchases. Technological disruptions, such as the integration of augmented reality (AR) for product visualization and AI-powered recommendation engines, are set to redefine the shopping journey. Consumer behavior shifts are evident, with a growing demand for sustainable products, authentic experiences, and a preference for brands that align with their values. The resurgence of the "luxury" segment, coupled with a sustained interest in Beauty and Personal Care and Wines and Spirits, will continue to drive market penetration. The Estimated Year (2025) is projected to witness market value reaching xx Million Units, with continued upward trajectory through 2033. The expansion of downtown duty-free concepts, offering convenient access for locals and transit passengers, further accentuates market penetration and accessibility.

Dominant Regions, Countries, or Segments in Thailand Travel Retail Market

Within the Thailand Travel Retail Market, the Airports distribution channel unequivocally dominates, driven by its inherent captive audience and strategic importance for international arrivals and departures. Major international gateways such as Suvarnabhumi Airport (BKK) and Don Mueang International Airport (DMK) serve as primary hubs for travel retail operations, capturing a substantial share of passenger spending. The parent market's global trends in airport retail performance are mirrored here, with a strong emphasis on convenience, a wide product assortment, and often exclusive offerings.

The Beauty and Personal Care segment consistently emerges as a leading performer within the Product Type categories. This dominance is attributed to the high-margin nature of these products, their universal appeal across diverse demographics, and the continuous introduction of innovative and sought-after global brands. Consumers often view travel retail as an opportune moment to purchase premium skincare, cosmetics, and fragrances, either for personal use or as gifts.

Furthermore, Fashion Accessories and Hard Luxury segments are witnessing significant growth, reflecting an increasing trend among travelers to indulge in high-value purchases. This includes watches, jewelry, and designer accessories, catering to a segment of affluent travelers. The child market of Thailand's travel retail is also observing a rise in demand for Eatables, particularly premium Thai delicacies and snacks, offering travelers a taste of local culture.

Key drivers behind the dominance of these segments and channels include:

- Economic Policies: Government initiatives supporting tourism and trade, including favorable duty-free regulations.

- Infrastructure Development: Continuous upgrades and expansions of international airport facilities, enhancing the retail environment.

- Consumer Preferences: A growing demand for premium goods, along with an appreciation for both international brands and authentic local products.

- Strategic Brand Placement: Effective merchandising and prominent store locations within airports, maximizing visibility.

- Marketing and Promotions: Targeted campaigns and exclusive offers designed to attract and engage travelers.

The market share for Airports in terms of passenger spending is estimated to be around 75-80%, with Beauty and Personal Care accounting for approximately 30-35% of the total product sales. The Other Distribution Channels (Borders, Downtown), though smaller in current share, represent a significant growth potential, especially with the evolving retail strategies of major players like King Power and The Mall Group.

Thailand Travel Retail Market Product Landscape

The product landscape in the Thailand travel retail market is characterized by dynamic innovation and a keen understanding of traveler needs. Key developments include the increasing prominence of sustainable and ethically sourced products across all categories, particularly in Beauty and Personal Care and Fashion Accessories. Brands are actively launching travel-exclusive sets and limited-edition items to cater to the unique purchasing motivations of travelers. Performance metrics are consistently driven by brand recognition, perceived value, and the allure of duty-free pricing. Technological advancements are being integrated through interactive displays and augmented reality try-on features, enhancing product engagement. The Eatables segment is seeing a rise in premium, artisanal food products and unique local specialties, offering travelers an authentic taste of Thailand.

Key Drivers, Barriers & Challenges in Thailand Travel Retail Market

Key Drivers:

- Resurgent Tourism: The continuous recovery and growth of international tourist arrivals are the primary engine for market expansion.

- Economic Growth: Thailand's overall economic development and increasing disposable incomes for both locals and tourists.

- Strategic Retail Expansions: Investments by key players in prime airport locations and downtown duty-free stores.

- Product Diversification: Introduction of a wider range of products, including premium and niche offerings, catering to evolving consumer tastes.

- Government Support: Favorable policies and regulations supporting the travel retail industry and tourism sector.

Barriers & Challenges:

- Global Economic Uncertainty: Potential impact of international economic slowdowns or recessions on travel spending.

- Supply Chain Disruptions: Lingering effects of global supply chain issues can impact product availability and lead times.

- Intensifying Competition: Growing competition from e-commerce platforms and an increasing number of retail outlets offering comparable goods.

- Regulatory Changes: Potential shifts in customs regulations, import duties, or travel policies can affect operational viability.

- Fluctuating Exchange Rates: Currency volatility can influence the purchasing power of international travelers.

Emerging Opportunities in Thailand Travel Retail Market

Emerging opportunities within the Thailand travel retail market lie in the expansion of the "travel retail for locals" concept, providing domestic consumers with access to duty-free goods and unique retail experiences. The integration of smart technologies such as AI-driven personalization and augmented reality (AR) for product exploration presents significant potential to enhance customer engagement and streamline the purchasing process. Furthermore, there is a growing demand for experiential retail, offering not just products but also brand storytelling and interactive elements, particularly within the parent market of global luxury goods. The development of sustainable and ethically sourced product lines is another avenue for growth, aligning with the increasing eco-consciousness of consumers. Leveraging data analytics to understand traveler preferences and tailor offerings will be crucial for tapping into these opportunities.

Growth Accelerators in the Thailand Travel Retail Market Industry

Several growth accelerators are poised to propel the Thailand travel retail market forward. The continued recovery and projected increase in international tourist arrivals remain the most significant catalyst. Strategic investments by leading companies in enhancing the customer experience, through digital integration and personalized services, will foster greater spending. The expansion of airport infrastructure and the development of downtown duty-free locations provide increased accessibility and retail space. Furthermore, innovative marketing strategies, including partnerships with airlines and tourism boards, will drive awareness and foot traffic. The growing trend of experiential retail, offering more than just product transactions, is also a key accelerator, creating memorable shopping journeys for travelers.

Key Players Shaping the Thailand Travel Retail Market Market

- King Power International Group

- The Shilla Duty Free

- Leon Duty Free

- Central Pattana

- The Mall Group

- Jaidee Duty Free

- SIAM Gems Group

- Paradise Duty Free

- Regent Plaza Group

- Bangkok Airways

- The Airways International

- Airports of Thailand

- JR Duty Free

Notable Milestones in Thailand Travel Retail Market Sector

- October 2023: Foreo broadens its presence in Thailand's travel retail sector with a new outlet at Don Mueang Airport. This expansion, in collaboration with King Power, builds upon Foreo's existing launches at Suvarnabhumi and Phuket airports, along with its presence in King Power Rangnam, King Power Srivaree Complex, and King Power Phuket downtown stores.

- November 2023: Thailand's leading oil and retail company, PTT Oil and Retail Business, plans to expand into Southeast Asia due to the region's economic growth, investing $900 million to broaden operations beyond Southeast Asia, operating over 2,500 lifestyle outlets in Asia and supplying petrochemical products globally to over 40 countries.

In-Depth Thailand Travel Retail Market Market Outlook

The Thailand travel retail market is set for sustained and robust growth, driven by a favorable confluence of resurgent tourism, economic development, and strategic industry investments. The parent market's global momentum in travel retail is amplified within Thailand by the country's appeal as a premier tourist destination. Growth accelerators, including enhanced airport infrastructure and the expansion of downtown duty-free retail formats, will continue to broaden market reach. The increasing adoption of digital technologies for personalized shopping experiences and efficient operations will be pivotal. Emerging opportunities in experiential retail and sustainable product offerings are expected to cater to evolving consumer preferences, further solidifying Thailand's position as a leading destination for travel retail. The child market's trajectory is strongly optimistic, promising significant returns for stakeholders.

Thailand Travel Retail Market Segmentation

-

1. Product Type

- 1.1. Beauty and Personal Care

- 1.2. Wines and Spirits

- 1.3. Tobacco

- 1.4. Eatables

- 1.5. Fashion Accessories and Hard Luxury

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Other Distribution Channels (Borders, Downtown)

Thailand Travel Retail Market Segmentation By Geography

- 1. Thailand

Thailand Travel Retail Market Regional Market Share

Geographic Coverage of Thailand Travel Retail Market

Thailand Travel Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of the Tourism Industry in Thailand is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Travel Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beauty and Personal Care

- 5.1.2. Wines and Spirits

- 5.1.3. Tobacco

- 5.1.4. Eatables

- 5.1.5. Fashion Accessories and Hard Luxury

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Other Distribution Channels (Borders, Downtown)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 King Power International Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Shilla Duty Free

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Leon Duty Free

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Central Pattana

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Mall Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jaidee Duty Free

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SIAM Gems Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Paradise Duty Free

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Regent Plaza Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bangkok Airways

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Airways International

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Airports of Thailand

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 JR Duty Free**List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 King Power International Group

List of Figures

- Figure 1: Thailand Travel Retail Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Travel Retail Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Thailand Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Thailand Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Thailand Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Thailand Travel Retail Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Thailand Travel Retail Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Thailand Travel Retail Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Thailand Travel Retail Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Thailand Travel Retail Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Thailand Travel Retail Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Thailand Travel Retail Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Thailand Travel Retail Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Travel Retail Market?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the Thailand Travel Retail Market?

Key companies in the market include King Power International Group, The Shilla Duty Free, Leon Duty Free, Central Pattana, The Mall Group, Jaidee Duty Free, SIAM Gems Group, Paradise Duty Free, Regent Plaza Group, Bangkok Airways, The Airways International, Airports of Thailand, JR Duty Free**List Not Exhaustive.

3. What are the main segments of the Thailand Travel Retail Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.48 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of the Tourism Industry in Thailand is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2023, Foreo broadens its presence in Thailand's travel retail sector with a new outlet at Don Mueang Airport. This expansion, in collaboration with King Power, builds upon Foreo's existing launches at Suvarnabhumi and Phuket airports, along with its presence in King Power Rangnam, King Power Srivaree Complex, and King Power Phuket downtown stores.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Travel Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Travel Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Travel Retail Market?

To stay informed about further developments, trends, and reports in the Thailand Travel Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence