Key Insights

The North American Automated Test Equipment (ATE) market is projected to reach $9.86 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.72% from 2025 to 2033. This robust growth is driven by the escalating demand for sophisticated electronic devices across key sectors including consumer electronics, automotive, and aerospace & defense. These industries require stringent testing to ensure product quality, reliability, and safety, thereby accelerating the adoption of advanced ATE solutions. The continuous trend of miniaturization and increasing complexity in electronic components necessitates more precise and advanced testing capabilities, fueling demand for high-performance ATE systems. Innovations in ATE, such as the integration of AI and ML for enhanced test efficiency and automation, are also significant market expansion contributors. The memory and non-memory test equipment segments are experiencing particularly strong growth due to the rising complexity of integrated circuits. The United States leads the North American market share, followed by Canada and Mexico.

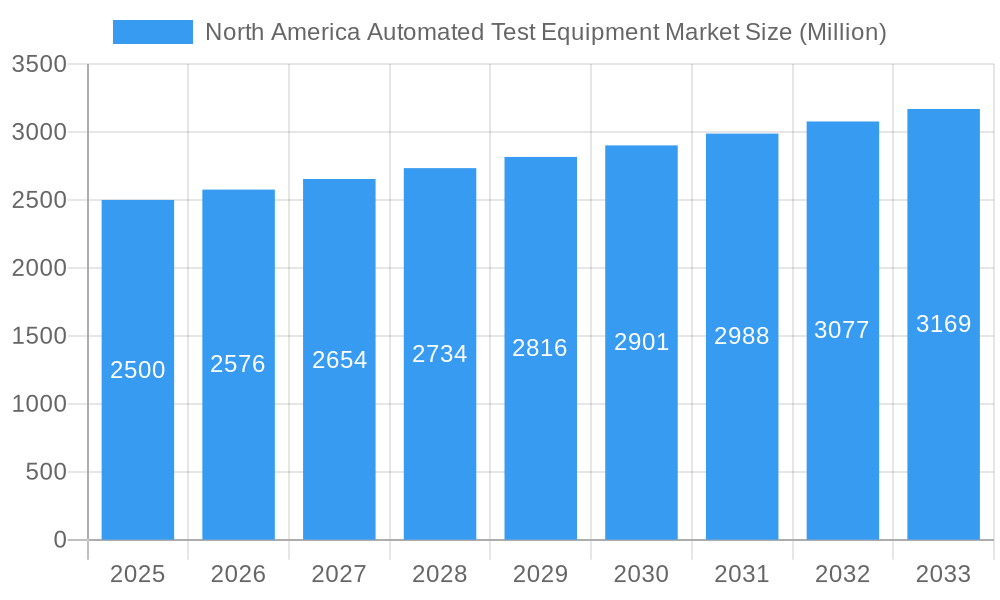

North America Automated Test Equipment Market Market Size (In Billion)

Market growth may be tempered by significant initial investment costs for advanced ATE systems, potentially limiting adoption by smaller enterprises. Ongoing technological evolution also necessitates continuous upgrades and maintenance, contributing to operational expenses. Intense competition among established ATE manufacturers shapes market dynamics. Despite these challenges, the long-term outlook for the North American ATE market is optimistic, propelled by ongoing technological advancements, increasing demand for high-quality electronics, and widespread automation adoption across industries. The market is segmented by ATE type (memory, non-memory, discrete, test handlers), end-user industry (aerospace & defense, consumer electronics, IT & telecommunications, automotive, healthcare), and geography (United States, Canada, Mexico).

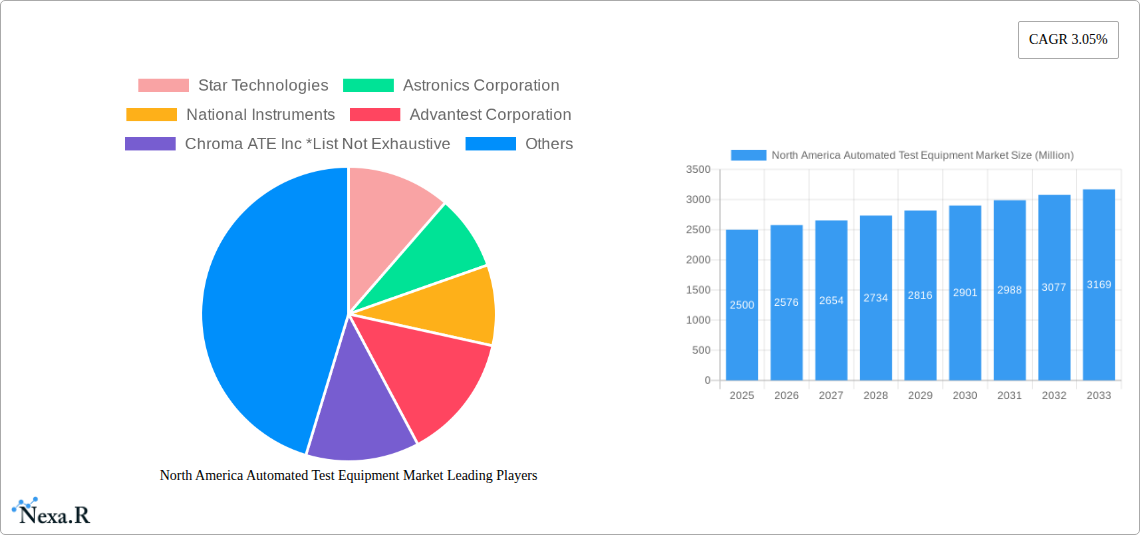

North America Automated Test Equipment Market Company Market Share

North America Automated Test Equipment Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Automated Test Equipment market, encompassing its dynamics, growth trends, key players, and future outlook. The study covers the period from 2019 to 2033, with 2025 serving as the base year and estimated year. The report segments the market by type of test equipment (Memory, Non-Memory, Discrete, Test Handlers), end-user industry (Aerospace & Defense, Consumer Electronics, IT & Telecommunications, Automotive, Healthcare, Other), and geography (United States, Canada). The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Automated Test Equipment Market Dynamics & Structure

The North American automated test equipment (ATE) market is characterized by a moderately concentrated landscape, with key players such as Star Technologies, Astronics Corporation, National Instruments, Advantest Corporation, and Chroma ATE Inc. holding significant market share. However, the presence of several smaller, specialized firms contributes to a dynamic competitive environment. Technological innovation, driven by the increasing complexity of electronic devices and the demand for faster and more accurate testing, is a major growth driver. Stringent regulatory frameworks, particularly within the aerospace and defense sector, influence ATE adoption and design. The market also experiences competition from substitute technologies, such as simulation software, though ATE remains crucial for rigorous physical testing. The end-user demographic is diverse, encompassing various industries with varying testing needs and budgets. M&A activity within the ATE sector has been moderate in recent years, with a total of xx deals recorded between 2019 and 2024, representing a xx% increase compared to the previous five-year period.

- Market Concentration: Moderately concentrated, with a few major players and numerous smaller specialized firms.

- Technological Innovation: A primary driver, fueled by the need for faster, more precise, and adaptable testing solutions.

- Regulatory Framework: Stringent regulations, especially in aerospace and defense, influence ATE adoption and features.

- Competitive Substitutes: Simulation software provides some competition, but physical testing remains critical.

- M&A Activity: Moderate, with xx deals recorded between 2019 and 2024, resulting in a xx% increase compared to the prior period.

- Innovation Barriers: High initial investment costs, integration complexities, and the need for specialized expertise.

North America Automated Test Equipment Market Growth Trends & Insights

The North America Automated Test Equipment market experienced significant growth during the historical period (2019-2024), driven by the increasing demand for electronic devices across various sectors. The market size grew from xx Million in 2019 to xx Million in 2024, representing a CAGR of xx%. This growth is attributed to factors such as the rising adoption of advanced technologies in consumer electronics, automotive, and healthcare, the increasing need for quality assurance in manufacturing processes, and continuous technological advancements in ATE. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) into ATE systems, are further accelerating market expansion. Consumer behavior shifts, such as the preference for sophisticated and reliable electronic devices, are also boosting demand. Market penetration rates are expected to increase steadily during the forecast period, with particular growth anticipated in the areas of 5G technology testing and advanced driver-assistance systems (ADAS) testing within the automotive sector.

- Market Size Evolution: Significant growth from xx Million in 2019 to xx Million in 2024, with a CAGR of xx%.

- Adoption Rates: Increasing steadily across various end-user industries, driven by rising demand for quality and reliability.

- Technological Disruptions: Integration of AI and ML enhances testing efficiency and accuracy, fueling market growth.

- Consumer Behavior Shifts: Demand for advanced and reliable electronic products drives the need for sophisticated ATE.

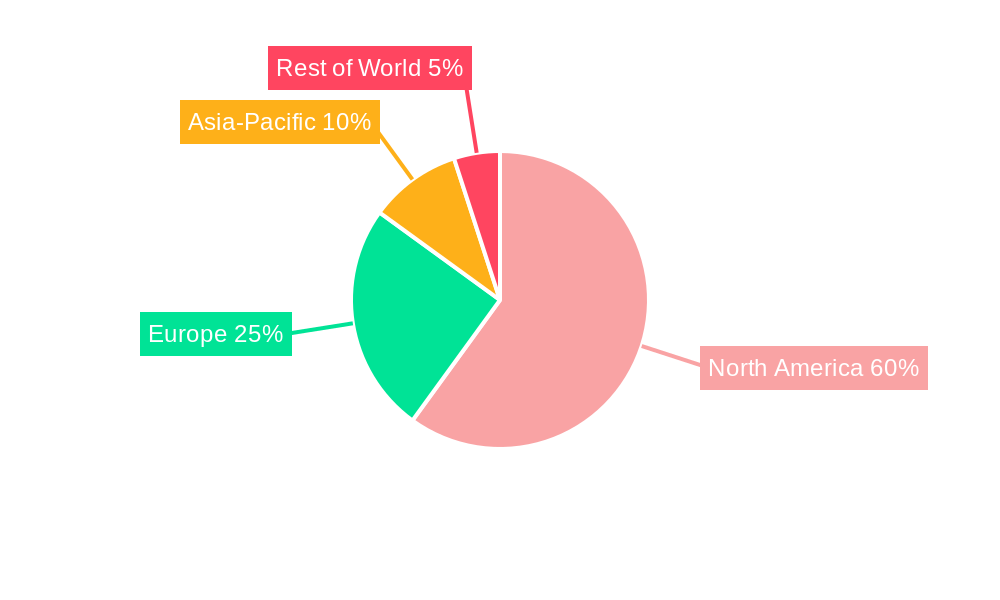

Dominant Regions, Countries, or Segments in North America Automated Test Equipment Market

The United States dominates the North America Automated Test Equipment market, accounting for approximately xx% of the total market share in 2025. This dominance is attributed to the presence of major ATE manufacturers, a robust electronics industry, and significant investments in research and development. The memory test equipment segment exhibits the highest growth potential, driven by the proliferation of high-density memory chips across various applications. Within end-user industries, the aerospace and defense sector displays strong growth due to rigorous quality control requirements. Canada's market is smaller but growing steadily, fueled by increasing investments in the IT and telecommunications sector.

- Leading Region: United States, with approximately xx% market share in 2025.

- Leading Segment (by type): Memory test equipment, due to the increasing demand for high-density memory chips.

- Leading Segment (by end-user): Aerospace & Defense, driven by stringent quality and reliability requirements.

- Key Drivers (US): Established electronics manufacturing base, robust R&D investments, and presence of major ATE manufacturers.

- Key Drivers (Canada): Growing investments in the IT and telecommunications sector.

North America Automated Test Equipment Market Product Landscape

The North America ATE market offers a diverse range of products, including memory testers, non-memory testers, discrete testers, and test handlers. Recent innovations focus on increased throughput, improved accuracy, and enhanced automation. The integration of AI and ML is revolutionizing testing capabilities, enabling faster fault detection and more efficient diagnostics. Manufacturers are increasingly emphasizing modularity and scalability to cater to the evolving needs of various industries. Unique selling propositions include features like advanced algorithms for faster test times, reduced test costs and improved ease of use.

Key Drivers, Barriers & Challenges in North America Automated Test Equipment Market

Key Drivers:

- Increasing demand for high-quality electronic products across various industries.

- Technological advancements leading to faster, more accurate, and automated testing.

- Stringent quality control regulations in several sectors.

Key Challenges & Restraints:

- High initial investment costs associated with acquiring and implementing ATE systems.

- Complex integration processes and the need for specialized expertise.

- Supply chain disruptions impacting the availability of components and increasing manufacturing lead times. This has resulted in a xx% increase in average lead time for crucial components between 2022 and 2024.

- Intense competition among ATE providers.

Emerging Opportunities in North America Automated Test Equipment Market

- Growing demand for ATE in emerging technologies like 5G and IoT.

- Increased adoption of cloud-based ATE solutions.

- Opportunities in developing customized ATE for specific industries.

- Expansion into untapped markets, such as renewable energy and medical devices.

Growth Accelerators in the North America Automated Test Equipment Market Industry

Technological advancements in areas such as AI, machine learning, and high-speed digital signal processing are driving long-term market growth. Strategic partnerships between ATE manufacturers and end-user industries are promoting the development of specialized testing solutions. Expansion into new and emerging markets, coupled with a focus on delivering customized solutions, offers significant growth potential.

Key Players Shaping the North America Automated Test Equipment Market Market

- Star Technologies

- Astronics Corporation

- National Instruments

- Advantest Corporation

- Chroma ATE Inc

- Virginia Panel Corporation (Mass-interconnect manufacturer)

- SPEA S p A

- Roos Instruments Inc

- MAC Panel Company (Mass-Interconnect solutions)

- Xcerra Corporation

- Aeroflex Inc

Notable Milestones in North America Automated Test Equipment Market Sector

- 2021 Q3: National Instruments launched a new generation of high-speed digital test systems.

- 2022 Q1: Advantest Corporation acquired a smaller ATE manufacturer, expanding its product portfolio.

- 2023 Q4: Several key players announced strategic partnerships to enhance their offerings in the 5G testing market. (Specific details unavailable, xx partnerships confirmed).

In-Depth North America Automated Test Equipment Market Outlook

The North America Automated Test Equipment market is poised for continued growth in the coming years, driven by technological advancements, increasing demand for high-quality electronic products, and expansion into new application areas. The integration of AI and machine learning will further enhance testing capabilities, leading to higher efficiency and lower costs. Strategic partnerships and mergers and acquisitions will continue to shape the competitive landscape. Companies that invest in R&D and adapt to the evolving needs of the market are expected to experience significant growth. The long-term forecast is positive, with considerable potential for market expansion across various segments and regions.

North America Automated Test Equipment Market Segmentation

-

1. Type of Test Equipment

- 1.1. Memory

- 1.2. Non Memory

- 1.3. Discrete

- 1.4. Test Handlers

-

2. End-User Industry

- 2.1. Aerospace and Defense

- 2.2. Consumer Electronics

- 2.3. IT and Telecommuications

- 2.4. Automotive

- 2.5. Healthcare

- 2.6. Other End-User

North America Automated Test Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Automated Test Equipment Market Regional Market Share

Geographic Coverage of North America Automated Test Equipment Market

North America Automated Test Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Emphasis of Test Market

- 3.3. Market Restrains

- 3.3.1. Too Much Competition Due to the Open Source; Network Congestion Due to Slow Network

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense Industry is one of the Factor Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automated Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 5.1.1. Memory

- 5.1.2. Non Memory

- 5.1.3. Discrete

- 5.1.4. Test Handlers

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Aerospace and Defense

- 5.2.2. Consumer Electronics

- 5.2.3. IT and Telecommuications

- 5.2.4. Automotive

- 5.2.5. Healthcare

- 5.2.6. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Star Technologies

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Astronics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 National Instruments

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Advantest Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chroma ATE Inc *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Virginia Panel Corporation (Mass-interconnect manufacturer)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SPEA S p A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roos Instruments Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MAC Panel Company (Mass-Interconnect solutions)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Xcerra Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Aeroflex Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Star Technologies

List of Figures

- Figure 1: North America Automated Test Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Automated Test Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Automated Test Equipment Market Revenue billion Forecast, by Type of Test Equipment 2020 & 2033

- Table 2: North America Automated Test Equipment Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 3: North America Automated Test Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Automated Test Equipment Market Revenue billion Forecast, by Type of Test Equipment 2020 & 2033

- Table 5: North America Automated Test Equipment Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: North America Automated Test Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Automated Test Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Automated Test Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Automated Test Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automated Test Equipment Market?

The projected CAGR is approximately 7.72%.

2. Which companies are prominent players in the North America Automated Test Equipment Market?

Key companies in the market include Star Technologies, Astronics Corporation, National Instruments, Advantest Corporation, Chroma ATE Inc *List Not Exhaustive, Virginia Panel Corporation (Mass-interconnect manufacturer), SPEA S p A, Roos Instruments Inc, MAC Panel Company (Mass-Interconnect solutions), Xcerra Corporation, Aeroflex Inc.

3. What are the main segments of the North America Automated Test Equipment Market?

The market segments include Type of Test Equipment, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.86 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Emphasis of Test Market.

6. What are the notable trends driving market growth?

Aerospace and Defense Industry is one of the Factor Driving the Market.

7. Are there any restraints impacting market growth?

Too Much Competition Due to the Open Source; Network Congestion Due to Slow Network.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automated Test Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automated Test Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automated Test Equipment Market?

To stay informed about further developments, trends, and reports in the North America Automated Test Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence