Key Insights

The United States semiconductor memory market is experiencing robust growth, projected to reach a substantial size over the next decade. Driven by the increasing demand for high-performance computing, particularly in data centers and the burgeoning automotive sector, the market is witnessing significant investment and innovation. The prevalence of smartphones, tablets, and other consumer electronics continues to fuel demand for memory solutions, with NAND flash and DRAM technologies leading the charge. While the market faces certain restraints such as supply chain disruptions and geopolitical factors, technological advancements and the expanding applications of memory chips in emerging technologies like artificial intelligence and the Internet of Things (IoT) are poised to offset these challenges and sustain robust growth. The dominance of major players such as Micron Technology, Samsung, and SK Hynix is likely to persist, although emerging companies and increased competition are expected to influence market dynamics. Specific growth within segments will be determined by factors like the adoption rate of 5G technology, the expansion of cloud computing infrastructure, and the continued development of autonomous vehicles. The North American region, driven largely by the U.S. market, will retain a significant share of the global market, underpinned by strong domestic demand and significant investments in semiconductor manufacturing.

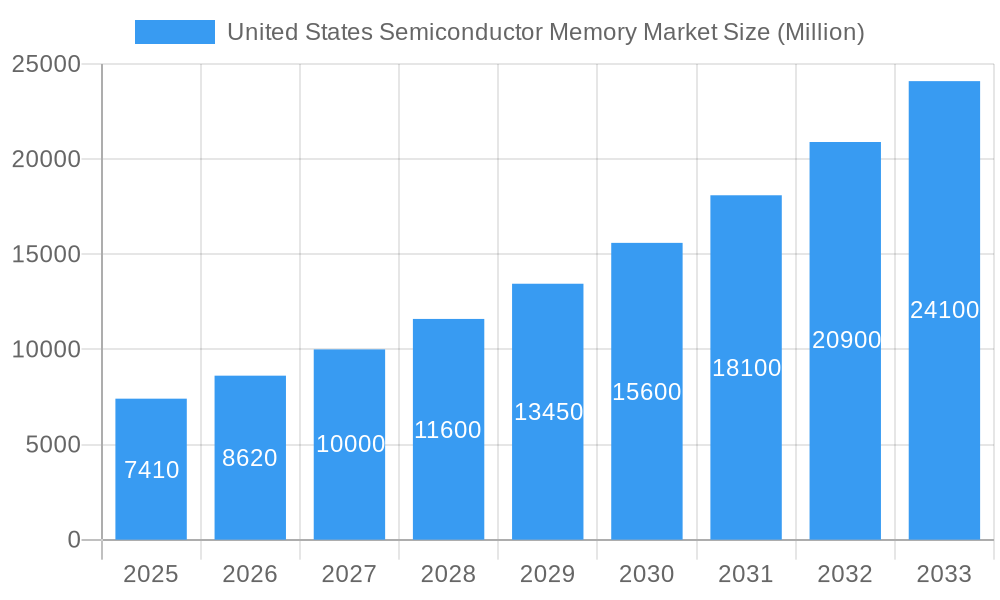

United States Semiconductor Memory Market Market Size (In Billion)

Given the global CAGR of 16.51% and a global market size of $24.70 billion in 2025, a reasonable estimation for the US market share can be made. Assuming the US holds approximately 30% of the global semiconductor memory market (a conservative estimate considering its technological leadership and domestic demand), the US market size in 2025 would be around $7.41 billion. Projecting this forward using the CAGR requires a more nuanced approach considering potential fluctuations in regional demand and market penetration. However, with a sustained CAGR, the market is expected to show substantial growth throughout the forecast period (2025-2033). This growth will be largely driven by increasing data storage needs, technological advancements, and the expanding applications of semiconductor memory in various industries.

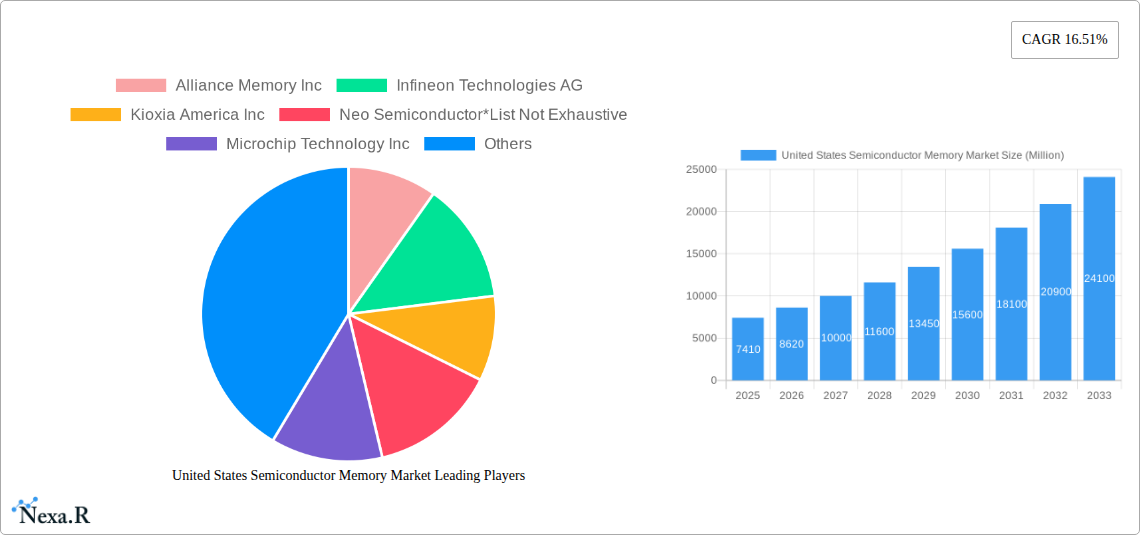

United States Semiconductor Memory Market Company Market Share

United States Semiconductor Memory Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States semiconductor memory market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It delves into market dynamics, growth trends, key players, and emerging opportunities within the parent market of semiconductors and the child market of memory devices. The report uses Million units as the unit of measurement throughout.

United States Semiconductor Memory Market Dynamics & Structure

This section analyzes the competitive landscape of the US semiconductor memory market, focusing on market concentration, technological advancements, regulatory influences, and M&A activity. The analysis includes quantitative data such as market share percentages and qualitative insights into innovation barriers. The report covers the following aspects:

- Market Concentration: The US semiconductor memory market exhibits a moderately concentrated structure with a few dominant players holding significant market share (xx%). However, emerging companies are steadily increasing their presence.

- Technological Innovation: Continuous innovation in areas like 3D NAND, DRAM, and high-bandwidth memory (HBM) are key drivers, pushing capacity limits and performance improvements. Significant barriers to entry include high R&D costs and specialized manufacturing facilities.

- Regulatory Framework: Government regulations concerning data security and export controls significantly impact market dynamics and investment strategies. Compliance costs and restrictions on technology transfer pose challenges for companies.

- Competitive Substitutes: The market faces competition from alternative memory technologies and storage solutions, including hard disk drives (HDDs) and solid-state drives (SSDs). The competitive pressure drives innovation and price optimization.

- End-User Demographics: The primary end-users are diverse, including consumer electronics (smartphones, PCs), data centers, automotive, and industrial applications. The demand from each segment influences overall market growth.

- M&A Trends: The industry has witnessed considerable merger and acquisition activity (xx deals in the last 5 years), leading to consolidation and reshaping the competitive landscape. These transactions often aim to secure technological advantages or expand market reach.

United States Semiconductor Memory Market Growth Trends & Insights

This section provides a detailed analysis of the US semiconductor memory market's growth trajectory, using historical data and projections to calculate the Compound Annual Growth Rate (CAGR). The analysis examines market size evolution, technological disruptions, and shifts in consumer behavior affecting adoption rates. Specific metrics, including market penetration rates for different memory types across various applications, are provided. The analysis will also discuss how factors like increasing data storage needs, the rise of artificial intelligence, and the proliferation of IoT devices contribute to market growth. This section will include insights on the impact of economic downturns and the cyclical nature of the semiconductor industry on market growth. Further, it will assess the effects of geopolitical factors and supply chain disruptions on the market. The analysis will cover xx Million units for 2025. The forecasted CAGR for the period 2025-2033 is estimated to be xx%.

Dominant Regions, Countries, or Segments in United States Semiconductor Memory Market

This section pinpoints the leading geographical regions, countries, and market segments (by type and application) within the US semiconductor memory market, explaining factors contributing to their dominance.

By Type:

- NAND Flash: This segment holds the largest market share (xx%) driven by increasing demand from data centers and mobile devices.

- DRAM: The DRAM segment maintains a significant market share (xx%), driven by its crucial role in computing and server infrastructure.

- NOR Flash: This segment exhibits a more moderate growth rate (xx%) due to its use in embedded systems and niche applications.

- SRAM: The SRAM market displays consistent demand (xx%) due to its high-speed performance, critical in high-performance computing.

- ROM & EEPROM: These segments are expected to register steady growth (xx%) due to their use in embedded systems and applications requiring non-volatile memory.

By Application:

- Data Centers: This segment is the fastest-growing application (xx% market share), propelled by the exponential growth of cloud computing and big data.

- Consumer Electronics (Smartphones, PCs): This remains a substantial market segment (xx%), consistently requiring large volumes of memory.

- Automotive: The automotive sector's demand for memory is growing rapidly (xx%) as vehicles become more sophisticated and integrated.

United States Semiconductor Memory Market Product Landscape

The US semiconductor memory market is characterized by a constant stream of product innovations focusing on increased density, improved performance, and lower power consumption. Recent advancements include the introduction of high-bandwidth memory (HBM) for high-performance computing and advanced node processes for denser chips. These advancements address the growing demand for faster data processing and higher storage capacities. Unique selling propositions often center on power efficiency, performance benchmarks, and reliability under diverse operating conditions.

Key Drivers, Barriers & Challenges in United States Semiconductor Memory Market

Key Drivers:

- Growth of data centers: The expanding cloud computing industry and big data analytics drive massive demand for memory solutions.

- IoT proliferation: The widespread adoption of IoT devices necessitates robust memory solutions to manage the increasing volume of data generated.

- Technological advancements: Innovations in memory technologies, such as 3D NAND and HBM, enhance performance and density.

Key Challenges:

- Supply chain disruptions: Geopolitical events and natural disasters impact the availability of raw materials and manufacturing capacity, leading to potential shortages. This has a direct impact on production and market stability.

- Regulatory hurdles: Stringent export controls and data security regulations increase the complexity of operations.

- Competitive intensity: The market is highly competitive, with established players and emerging companies vying for market share, leading to price pressure and increased R&D investments.

Emerging Opportunities in United States Semiconductor Memory Market

- Automotive applications: The growing demand for advanced driver-assistance systems (ADAS) and autonomous driving features presents substantial opportunities for memory manufacturers.

- Edge computing: The decentralized processing of data at the network edge creates a need for high-performance, low-latency memory solutions.

- Artificial intelligence (AI) and machine learning (ML): The expanding use of AI and ML applications increases demand for high-capacity, high-speed memory.

Growth Accelerators in the United States Semiconductor Memory Market Industry

Long-term growth will be accelerated by continued technological breakthroughs that increase memory density and performance while simultaneously reducing power consumption. Strategic partnerships and acquisitions among key players will also play a vital role in expanding market reach and securing access to advanced technologies. Further expansion into emerging application areas such as the automotive sector and the Internet of Things (IoT) will contribute to market growth.

Key Players Shaping the United States Semiconductor Memory Market Market

- Alliance Memory Inc

- Infineon Technologies AG

- Kioxia America Inc

- Neo Semiconductor

- Microchip Technology Inc

- Micron Technology Inc

- Samsung Electronics Co Ltd

- SK Hynix Memory Solutions America Inc

- STMicroelectronics NV

- Fujitsu Semiconductor Memory Solution (Fujitsu Ltd)

- Analog Devices Inc

- ROHM Semiconductor

Notable Milestones in United States Semiconductor Memory Market Sector

- May 2023: NEO Semiconductor launched its 3D X-DRAM, a new 3D NAND-like DRAM cell array technology aimed at solving DRAM's capacity bottleneck.

- May 2023: Honeywell Aerospace launched a new high-performance monolithic 128K x 8 SRAM (HLX6228) designed for radiation-prone environments.

In-Depth United States Semiconductor Memory Market Market Outlook

The US semiconductor memory market is poised for sustained growth driven by ongoing technological advancements, increasing demand from diverse application segments, and strategic investments by key players. The market's future hinges on successfully navigating challenges related to supply chain stability and geopolitical uncertainties. Companies strategically focusing on innovation, operational efficiency, and strategic partnerships are expected to capture significant market share and drive future growth. The market is expected to reach xx Million units by 2033.

United States Semiconductor Memory Market Segmentation

-

1. Type

- 1.1. DRAM

- 1.2. SRAM

- 1.3. NOR Flash

- 1.4. NAND Flash

- 1.5. ROM & EEPROM

- 1.6. Other Types

-

2. Application

- 2.1. Consumer Products

- 2.2. PC/Laptop

- 2.3. Smartphone/Tablet

- 2.4. Data Center

- 2.5. Automotive

- 2.6. Other Applications

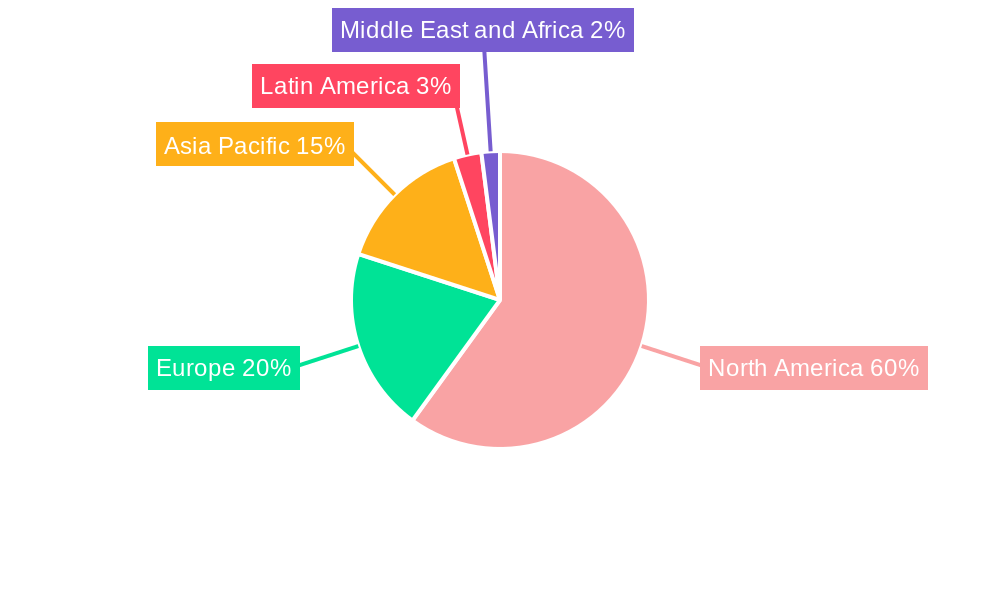

United States Semiconductor Memory Market Segmentation By Geography

- 1. United States

United States Semiconductor Memory Market Regional Market Share

Geographic Coverage of United States Semiconductor Memory Market

United States Semiconductor Memory Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Recent Initiatives by the U.S. Government to Drive the Chip Production Industry; Increasing Use & Interest in Smart Devices

- 3.3. Market Restrains

- 3.3.1. Increasing Fabrication Complexity & Time Involved

- 3.4. Market Trends

- 3.4.1. Recent Initiatives by the US Government to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Semiconductor Memory Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. DRAM

- 5.1.2. SRAM

- 5.1.3. NOR Flash

- 5.1.4. NAND Flash

- 5.1.5. ROM & EEPROM

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Products

- 5.2.2. PC/Laptop

- 5.2.3. Smartphone/Tablet

- 5.2.4. Data Center

- 5.2.5. Automotive

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Alliance Memory Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infineon Technologies AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kioxia America Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Neo Semiconductor*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Microchip Technology Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Micron Technology Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samsung Electronics Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SK Hynix Memory Solutions America Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 STMicroelectronics NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fujitsu Semiconductor Memory Solution (Fujitsu Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Analog Devices Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ROHM Semiconductor

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Alliance Memory Inc

List of Figures

- Figure 1: United States Semiconductor Memory Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Semiconductor Memory Market Share (%) by Company 2025

List of Tables

- Table 1: United States Semiconductor Memory Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Semiconductor Memory Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: United States Semiconductor Memory Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Semiconductor Memory Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: United States Semiconductor Memory Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: United States Semiconductor Memory Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Semiconductor Memory Market?

The projected CAGR is approximately 16.51%.

2. Which companies are prominent players in the United States Semiconductor Memory Market?

Key companies in the market include Alliance Memory Inc, Infineon Technologies AG, Kioxia America Inc, Neo Semiconductor*List Not Exhaustive, Microchip Technology Inc, Micron Technology Inc, Samsung Electronics Co Ltd, SK Hynix Memory Solutions America Inc, STMicroelectronics NV, Fujitsu Semiconductor Memory Solution (Fujitsu Ltd), Analog Devices Inc, ROHM Semiconductor.

3. What are the main segments of the United States Semiconductor Memory Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Recent Initiatives by the U.S. Government to Drive the Chip Production Industry; Increasing Use & Interest in Smart Devices.

6. What are the notable trends driving market growth?

Recent Initiatives by the US Government to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Increasing Fabrication Complexity & Time Involved.

8. Can you provide examples of recent developments in the market?

May 2023: NEO Semiconductor, a developer of DRAM and 3D NAND flash memory technologies, launched its latest 3D X-DRAM. According to the company, it is the world's first 3D NAND-like DRAM cell array that aims to solve DRAM's capacity bottleneck and replace the entire 2D DRAM market. The company published the relevant patent applications with the United States Patent Application Publication in April 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Semiconductor Memory Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Semiconductor Memory Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Semiconductor Memory Market?

To stay informed about further developments, trends, and reports in the United States Semiconductor Memory Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence