Key Insights

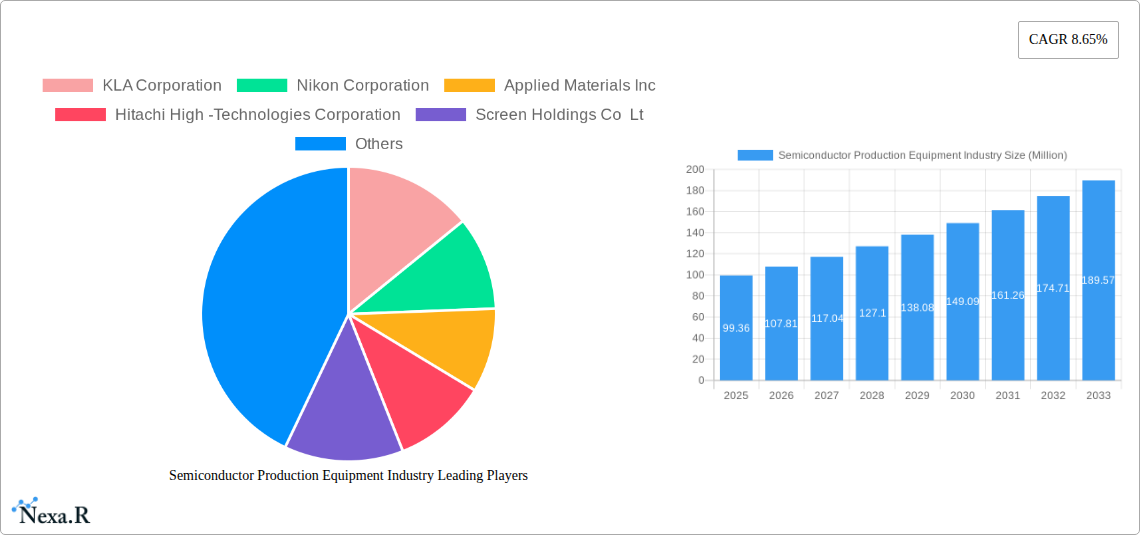

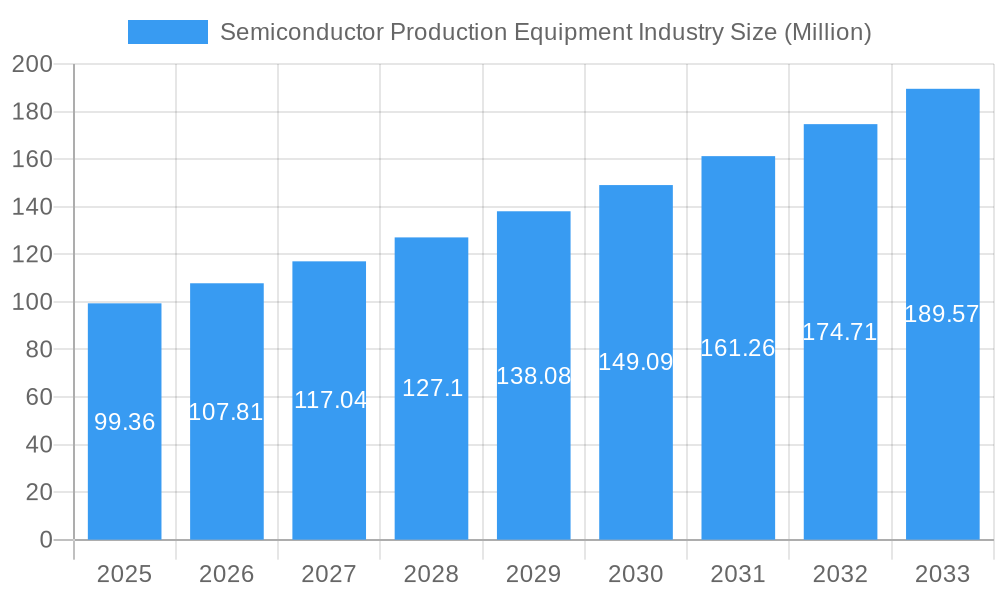

The global Semiconductor Production Equipment market is poised for significant expansion, with a projected market size of USD 99.36 billion in 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 8.65%. This robust growth is underpinned by the escalating demand for advanced semiconductor devices across a multitude of sectors, including artificial intelligence, 5G telecommunications, automotive electronics, and the Internet of Things (IoT). The increasing complexity of chip architectures and the relentless pursuit of smaller, more powerful, and energy-efficient processors necessitate continuous investment in cutting-edge fabrication technologies. Key market segments include lithography equipment, etching equipment, and deposition equipment, all of which are experiencing heightened demand due to their critical roles in the semiconductor manufacturing process. The semiconductor fabrication plants and electronics manufacturing industries represent the primary end-user segments, directly benefiting from and contributing to this market's dynamism.

Semiconductor Production Equipment Industry Market Size (In Million)

Several influential companies, such as ASML Holding NV, Applied Materials Inc., and Tokyo Electron Limited, are at the forefront of innovation, driving advancements in equipment performance and manufacturing yields. Emerging trends like the adoption of extreme ultraviolet (EUV) lithography, advanced packaging techniques, and the increasing focus on sustainable manufacturing practices are shaping the competitive landscape. While the market exhibits strong growth potential, certain restraints, such as the high capital expenditure required for advanced equipment and the cyclical nature of the semiconductor industry, warrant careful consideration by market participants. Geographically, regions like China, South Korea, and Taiwan are expected to be major contributors to market growth, fueled by substantial investments in domestic semiconductor manufacturing capabilities and a thriving electronics ecosystem. The United States and Europe also represent significant markets, driven by strong R&D initiatives and a demand for high-performance chips in various industries.

Semiconductor Production Equipment Industry Company Market Share

Unveiling the Future: Semiconductor Production Equipment Industry Market Report (2019–2033)

This comprehensive report delves into the dynamic Semiconductor Production Equipment Industry, offering an in-depth analysis of its market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. Covering the historical period from 2019–2024 and projecting through the forecast period of 2025–2033, with 2025 serving as both the base and estimated year, this report is an indispensable resource for stakeholders seeking to navigate the complexities of semiconductor manufacturing equipment, wafer fabrication equipment, and the broader microelectronics equipment sector. We meticulously examine the evolution of lithography equipment, etching equipment, deposition equipment, and other critical segments, providing actionable insights for strategic decision-making in this high-stakes industry.

Semiconductor Production Equipment Industry Market Dynamics & Structure

The Semiconductor Production Equipment Industry is characterized by a highly concentrated market, dominated by a few global giants. Technological innovation serves as the primary growth driver, with continuous advancements in chip miniaturization and performance demanding increasingly sophisticated semiconductor manufacturing equipment. Regulatory frameworks, particularly those related to export controls and intellectual property, play a significant role in shaping market access and competitive strategies. The competitive landscape features robust product substitutes within equipment categories, but fundamental technological shifts often create significant barriers to entry for new players. End-user demographics are shifting towards advanced logic and memory chip manufacturers, necessitating specialized and high-precision wafer fabrication equipment. Merger and acquisition (M&A) trends are driven by the need for synergistic technology development and market consolidation, with recent deal volumes indicating a strategic focus on expanding capabilities in areas like advanced lithography and metrology solutions.

- Market Concentration: Dominated by a few key players, requiring significant capital investment and R&D.

- Technological Innovation Drivers: Pushing the boundaries of chip node technology (e.g., 2nm and below) and enabling advanced packaging.

- Regulatory Frameworks: Impacting global trade, intellectual property protection, and national semiconductor strategies.

- Competitive Product Substitutes: Intense competition within specific equipment types, spurring innovation in performance and cost-effectiveness.

- End-User Demographics: Increasing demand from foundries and integrated device manufacturers (IDMs) for leading-edge process nodes.

- M&A Trends: Strategic acquisitions to gain access to critical technologies and expand market share in semiconductor equipment solutions.

Semiconductor Production Equipment Industry Growth Trends & Insights

The Semiconductor Production Equipment Industry is poised for substantial growth, driven by the insatiable demand for advanced electronics across diverse sectors like artificial intelligence, automotive, and telecommunications. Market size evolution is directly correlated with the cadence of chip technology advancements, particularly the transition to smaller process nodes. Adoption rates of new semiconductor fabrication equipment are influenced by the capital expenditure cycles of major chip manufacturers and the perceived return on investment for next-generation technologies. Technological disruptions, such as the increasing reliance on Extreme Ultraviolet (EUV) lithography and novel materials engineering, are fundamentally reshaping the semiconductor equipment market. Consumer behavior shifts, characterized by an ever-increasing demand for more powerful and energy-efficient devices, are indirectly fueling the need for more advanced semiconductor manufacturing equipment. The compound annual growth rate (CAGR) for the industry is projected to remain robust, with significant market penetration expected for specialized equipment catering to advanced packaging and heterogeneous integration. The development and widespread adoption of quantum computing and advanced AI hardware will further accelerate the demand for specialized semiconductor production tools.

- Market Size Evolution: Driven by global demand for semiconductors in AI, 5G, IoT, and advanced computing.

- Adoption Rates: Influenced by the capital expenditure cycles of major foundries and IDMs, and the economic viability of new process technologies.

- Technological Disruptions: EUV lithography, next-generation etching techniques, and novel deposition methods are key disruptors.

- Consumer Behavior Shifts: Increasing demand for higher performance, smaller form factors, and enhanced functionality in electronic devices.

- Market Penetration: Strong growth in specialized equipment for advanced logic, memory, and power semiconductors.

- CAGR: Expected to remain healthy, reflecting sustained investment in semiconductor R&D and manufacturing capacity.

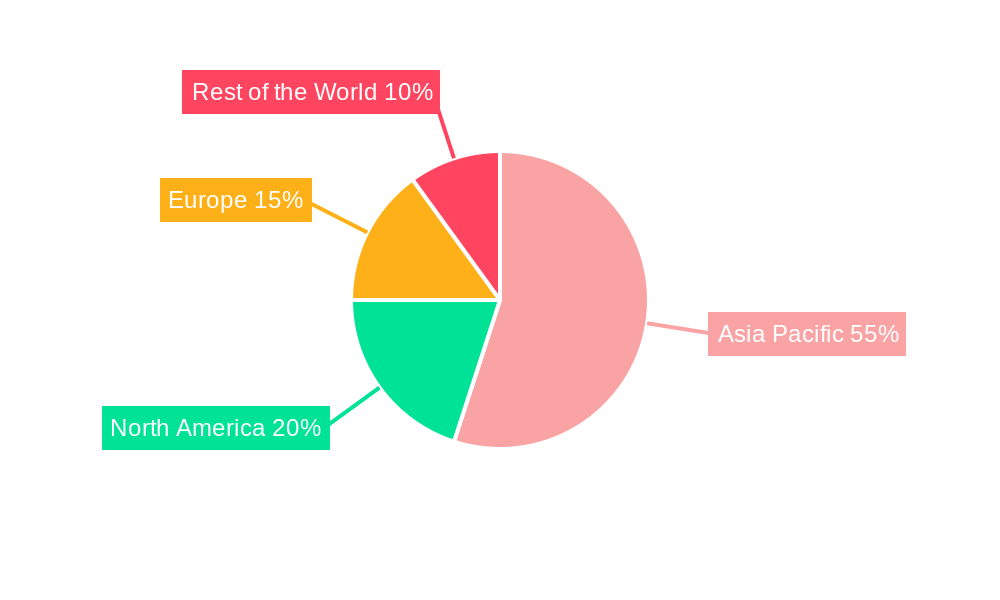

Dominant Regions, Countries, or Segments in Semiconductor Production Equipment Industry

The Semiconductor Production Equipment Industry exhibits distinct regional dominance and segment leadership. Asia-Pacific, particularly Taiwan, South Korea, and China, currently leads the market, driven by the presence of major foundries and a strong government focus on bolstering domestic semiconductor manufacturing capabilities. Within the semiconductor equipment segments, Lithography Equipment stands out as a critical driver of market growth, due to its pivotal role in defining chip feature sizes. The Semiconductor Fabrication Plant is the primary end-user industry, representing the core demand for all types of production equipment. Economic policies promoting domestic chip production, substantial investments in advanced research and development, and the rapid expansion of wafer fabrication plant infrastructure are key drivers behind Asia-Pacific's leadership. The strategic importance of semiconductor manufacturing has led to significant government incentives and subsidies across these nations, fostering a hyper-competitive environment for semiconductor production equipment suppliers.

- Dominant Region: Asia-Pacific, spearheaded by Taiwan, South Korea, and China, due to their concentrated semiconductor manufacturing base.

- Leading Segment (Type): Lithography Equipment, essential for defining critical dimensions on wafers, with ongoing innovation in EUV and high-NA EUV technologies.

- Primary End-User Industry: Semiconductor Fabrication Plant, the primary consumer of all semiconductor production equipment.

- Key Drivers of Regional Dominance:

- Economic Policies: Government incentives, subsidies, and national semiconductor strategies.

- Infrastructure Development: Significant investments in building and expanding advanced wafer fabs.

- Concentrated Manufacturing Base: Presence of leading foundries and integrated device manufacturers.

- Growth Potential: Continued expansion of fabrication capacity and the imperative to adopt cutting-edge technologies to remain competitive.

Semiconductor Production Equipment Industry Product Landscape

The Semiconductor Production Equipment Industry product landscape is defined by an relentless pursuit of precision, throughput, and yield enhancement. Innovations in lithography equipment are pushing the boundaries of optical physics, enabling pattern transfer at sub-2nm nodes. Etching equipment technologies are evolving to provide atomic-level control and selectivity, crucial for complex 3D architectures. Deposition equipment is witnessing advancements in conformal deposition techniques and the introduction of novel materials for next-generation devices. The unique selling propositions of leading products lie in their ability to reduce process variability, improve defect reduction, and increase wafer output, directly impacting the cost per chip. Technological advancements are focused on enhancing process control, automation, and data analytics integration for real-time process optimization.

Key Drivers, Barriers & Challenges in Semiconductor Production Equipment Industry

The Semiconductor Production Equipment Industry is propelled by several key drivers, including the escalating demand for high-performance computing, the proliferation of AI-driven applications, and the continuous push for miniaturization in consumer electronics. Technological advancements in chip architectures and materials science necessitate constant innovation in manufacturing equipment.

- Key Drivers:

- AI and Machine Learning: Driving demand for advanced processors and memory.

- 5G and IoT Expansion: Requiring higher volume and specialized semiconductor production.

- Technological Miniaturization: The relentless pursuit of smaller process nodes.

- Advanced Packaging: Enabling complex chip integration and enhanced functionality.

Conversely, significant barriers and challenges exist. The extremely high capital investment required for R&D and manufacturing of semiconductor production tools is a substantial barrier. Supply chain disruptions, particularly for specialized components and raw materials, can lead to production delays and increased costs. Stringent quality control and the need for ultra-high purity environments pose significant operational challenges.

- Key Barriers & Challenges:

- High Capital Expenditure: Significant R&D and manufacturing costs.

- Supply Chain Volatility: Dependence on specialized components and global logistics.

- Stringent Quality Control: Maintaining ultra-high purity and process precision.

- Talent Shortage: Demand for highly skilled engineers and technicians.

- Geopolitical Tensions: Impacting global trade and technology transfer.

Emerging Opportunities in Semiconductor Production Equipment Industry

Emerging opportunities in the Semiconductor Production Equipment Industry lie in the development of specialized equipment for emerging technologies such as quantum computing, advanced sensors, and neuromorphic chips. The increasing adoption of heterogeneous integration and advanced packaging techniques presents a significant avenue for growth in related semiconductor manufacturing equipment. Furthermore, the demand for more sustainable and energy-efficient chip manufacturing processes opens up opportunities for innovative equipment designs and materials. The expansion of semiconductor manufacturing in new geographical regions also presents untapped markets for equipment providers.

Growth Accelerators in the Semiconductor Production Equipment Industry Industry

Growth accelerators in the Semiconductor Production Equipment Industry are largely driven by groundbreaking technological breakthroughs in areas like quantum dot lithography and novel deposition chemistries. Strategic partnerships between equipment manufacturers, chip designers, and material suppliers are crucial for co-developing next-generation solutions. Market expansion strategies, including entering new geographical markets and catering to niche application segments within semiconductor electronics manufacturing, will further propel growth. The increasing focus on circular economy principles and sustainability within the semiconductor industry will also act as a growth accelerator, driving demand for more efficient and eco-friendly semiconductor production equipment.

Key Players Shaping the Semiconductor Production Equipment Industry Market

- KLA Corporation

- Nikon Corporation

- Applied Materials Inc

- Hitachi High -Technologies Corporation

- Screen Holdings Co Lt

- Plasma Therm

- Tokyo Electron Limited

- ASML Holding NV

- Carl Zeiss AG

- LAM Research Corporation

- VEECO Instruments Inc

Notable Milestones in Semiconductor Production Equipment Industry Sector

- February 2024: Applied Materials unveiled a new lineup of products at SPIE Advanced Lithography + Patterning to address intricate patterning demands for chips at 2nm and below process nodes, leveraging advanced materials engineering and metrology for EUV and high-NA EUV patterning. This expansion of their Patterning Solutions Portfolio aims to mitigate challenges like line edge roughness and edge placement errors for chipmakers.

- December 2023: Tokyo Electron announced the launch of Ulucus G, a wafer thinning system for 300 mm wafer fabrication. This system integrates a newly developed grinding unit with the LITHIUS Pro Z platform, enabling higher-quality silicon wafer fabrication and reducing workforce requirements in mass production.

In-Depth Semiconductor Production Equipment Industry Market Outlook

The Semiconductor Production Equipment Industry is set for a future characterized by sustained innovation and strategic expansion. Growth accelerators will include the continued evolution of EUV and high-NA EUV lithography, alongside advancements in advanced etching and deposition techniques essential for sub-2nm nodes. Strategic partnerships and collaborative R&D efforts will be pivotal in addressing the complex technological challenges ahead. Market expansion into new geographical regions and the development of specialized equipment for emerging applications like AI accelerators and advanced connectivity will unlock significant future market potential. The industry's ability to adapt to evolving geopolitical landscapes and supply chain dynamics will be crucial for sustained growth and market leadership in the semiconductor equipment solutions domain.

Semiconductor Production Equipment Industry Segmentation

-

1. Type

- 1.1. Lithography Equipment

- 1.2. Etching Equipment

- 1.3. Deposition Equipment

- 1.4. Other Equipment Types

-

2. End-user Industry

- 2.1. Semiconductor Fabrication Plant

- 2.2. Semiconductor Electronics Manufacturing

Semiconductor Production Equipment Industry Segmentation By Geography

- 1. United States

- 2. Europe

- 3. China

- 4. South Korea

- 5. Taiwan

- 6. Japan

- 7. Latin America

- 8. Middle East and Africa

Semiconductor Production Equipment Industry Regional Market Share

Geographic Coverage of Semiconductor Production Equipment Industry

Semiconductor Production Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Needs of Consumer Electronic Devices Boosting the Manufacturing Prospects; Proliferation of Artificial Intelligence

- 3.2.2 IoT

- 3.2.3 and Connected Devices Across Industry Verticals

- 3.3. Market Restrains

- 3.3.1. Dynamic Nature of Technologies Requires Several Changes in Manufacturing Equipment

- 3.4. Market Trends

- 3.4.1. Semiconductor Fabrication Plant to be the Largest End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Production Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lithography Equipment

- 5.1.2. Etching Equipment

- 5.1.3. Deposition Equipment

- 5.1.4. Other Equipment Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Semiconductor Fabrication Plant

- 5.2.2. Semiconductor Electronics Manufacturing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Europe

- 5.3.3. China

- 5.3.4. South Korea

- 5.3.5. Taiwan

- 5.3.6. Japan

- 5.3.7. Latin America

- 5.3.8. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States Semiconductor Production Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lithography Equipment

- 6.1.2. Etching Equipment

- 6.1.3. Deposition Equipment

- 6.1.4. Other Equipment Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Semiconductor Fabrication Plant

- 6.2.2. Semiconductor Electronics Manufacturing

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Semiconductor Production Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lithography Equipment

- 7.1.2. Etching Equipment

- 7.1.3. Deposition Equipment

- 7.1.4. Other Equipment Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Semiconductor Fabrication Plant

- 7.2.2. Semiconductor Electronics Manufacturing

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. China Semiconductor Production Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lithography Equipment

- 8.1.2. Etching Equipment

- 8.1.3. Deposition Equipment

- 8.1.4. Other Equipment Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Semiconductor Fabrication Plant

- 8.2.2. Semiconductor Electronics Manufacturing

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Semiconductor Production Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lithography Equipment

- 9.1.2. Etching Equipment

- 9.1.3. Deposition Equipment

- 9.1.4. Other Equipment Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Semiconductor Fabrication Plant

- 9.2.2. Semiconductor Electronics Manufacturing

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Taiwan Semiconductor Production Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Lithography Equipment

- 10.1.2. Etching Equipment

- 10.1.3. Deposition Equipment

- 10.1.4. Other Equipment Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Semiconductor Fabrication Plant

- 10.2.2. Semiconductor Electronics Manufacturing

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Japan Semiconductor Production Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Lithography Equipment

- 11.1.2. Etching Equipment

- 11.1.3. Deposition Equipment

- 11.1.4. Other Equipment Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Semiconductor Fabrication Plant

- 11.2.2. Semiconductor Electronics Manufacturing

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Latin America Semiconductor Production Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Lithography Equipment

- 12.1.2. Etching Equipment

- 12.1.3. Deposition Equipment

- 12.1.4. Other Equipment Types

- 12.2. Market Analysis, Insights and Forecast - by End-user Industry

- 12.2.1. Semiconductor Fabrication Plant

- 12.2.2. Semiconductor Electronics Manufacturing

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Middle East and Africa Semiconductor Production Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. Lithography Equipment

- 13.1.2. Etching Equipment

- 13.1.3. Deposition Equipment

- 13.1.4. Other Equipment Types

- 13.2. Market Analysis, Insights and Forecast - by End-user Industry

- 13.2.1. Semiconductor Fabrication Plant

- 13.2.2. Semiconductor Electronics Manufacturing

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 KLA Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Nikon Corporation

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Applied Materials Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Hitachi High -Technologies Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Screen Holdings Co Lt

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Plasma Therm

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Tokyo Electron Limited

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 ASML Holding NV

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Carl Zeiss AG

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 LAM Research Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 VEECO Instruments Inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 KLA Corporation

List of Figures

- Figure 1: Global Semiconductor Production Equipment Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Semiconductor Production Equipment Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: United States Semiconductor Production Equipment Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: United States Semiconductor Production Equipment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: United States Semiconductor Production Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: United States Semiconductor Production Equipment Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: United States Semiconductor Production Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 8: United States Semiconductor Production Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 9: United States Semiconductor Production Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: United States Semiconductor Production Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: United States Semiconductor Production Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: United States Semiconductor Production Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: United States Semiconductor Production Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: United States Semiconductor Production Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Semiconductor Production Equipment Industry Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe Semiconductor Production Equipment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 17: Europe Semiconductor Production Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Semiconductor Production Equipment Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Semiconductor Production Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 20: Europe Semiconductor Production Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: Europe Semiconductor Production Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Semiconductor Production Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Semiconductor Production Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Semiconductor Production Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Semiconductor Production Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Semiconductor Production Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: China Semiconductor Production Equipment Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: China Semiconductor Production Equipment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 29: China Semiconductor Production Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: China Semiconductor Production Equipment Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: China Semiconductor Production Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 32: China Semiconductor Production Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 33: China Semiconductor Production Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: China Semiconductor Production Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: China Semiconductor Production Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: China Semiconductor Production Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: China Semiconductor Production Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: China Semiconductor Production Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South Korea Semiconductor Production Equipment Industry Revenue (Million), by Type 2025 & 2033

- Figure 40: South Korea Semiconductor Production Equipment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 41: South Korea Semiconductor Production Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: South Korea Semiconductor Production Equipment Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: South Korea Semiconductor Production Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: South Korea Semiconductor Production Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: South Korea Semiconductor Production Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: South Korea Semiconductor Production Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: South Korea Semiconductor Production Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: South Korea Semiconductor Production Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: South Korea Semiconductor Production Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South Korea Semiconductor Production Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Taiwan Semiconductor Production Equipment Industry Revenue (Million), by Type 2025 & 2033

- Figure 52: Taiwan Semiconductor Production Equipment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: Taiwan Semiconductor Production Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Taiwan Semiconductor Production Equipment Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Taiwan Semiconductor Production Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 56: Taiwan Semiconductor Production Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 57: Taiwan Semiconductor Production Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Taiwan Semiconductor Production Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Taiwan Semiconductor Production Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Taiwan Semiconductor Production Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Taiwan Semiconductor Production Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Taiwan Semiconductor Production Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Japan Semiconductor Production Equipment Industry Revenue (Million), by Type 2025 & 2033

- Figure 64: Japan Semiconductor Production Equipment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 65: Japan Semiconductor Production Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 66: Japan Semiconductor Production Equipment Industry Volume Share (%), by Type 2025 & 2033

- Figure 67: Japan Semiconductor Production Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 68: Japan Semiconductor Production Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 69: Japan Semiconductor Production Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 70: Japan Semiconductor Production Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 71: Japan Semiconductor Production Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 72: Japan Semiconductor Production Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 73: Japan Semiconductor Production Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Japan Semiconductor Production Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 75: Latin America Semiconductor Production Equipment Industry Revenue (Million), by Type 2025 & 2033

- Figure 76: Latin America Semiconductor Production Equipment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 77: Latin America Semiconductor Production Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 78: Latin America Semiconductor Production Equipment Industry Volume Share (%), by Type 2025 & 2033

- Figure 79: Latin America Semiconductor Production Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 80: Latin America Semiconductor Production Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 81: Latin America Semiconductor Production Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 82: Latin America Semiconductor Production Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 83: Latin America Semiconductor Production Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 84: Latin America Semiconductor Production Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 85: Latin America Semiconductor Production Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 86: Latin America Semiconductor Production Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 87: Middle East and Africa Semiconductor Production Equipment Industry Revenue (Million), by Type 2025 & 2033

- Figure 88: Middle East and Africa Semiconductor Production Equipment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 89: Middle East and Africa Semiconductor Production Equipment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 90: Middle East and Africa Semiconductor Production Equipment Industry Volume Share (%), by Type 2025 & 2033

- Figure 91: Middle East and Africa Semiconductor Production Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 92: Middle East and Africa Semiconductor Production Equipment Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 93: Middle East and Africa Semiconductor Production Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 94: Middle East and Africa Semiconductor Production Equipment Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 95: Middle East and Africa Semiconductor Production Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 96: Middle East and Africa Semiconductor Production Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 97: Middle East and Africa Semiconductor Production Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Middle East and Africa Semiconductor Production Equipment Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 33: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 39: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 41: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 45: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 46: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 47: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 50: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 51: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 52: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 53: Global Semiconductor Production Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Semiconductor Production Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Production Equipment Industry?

The projected CAGR is approximately 8.65%.

2. Which companies are prominent players in the Semiconductor Production Equipment Industry?

Key companies in the market include KLA Corporation, Nikon Corporation, Applied Materials Inc, Hitachi High -Technologies Corporation, Screen Holdings Co Lt, Plasma Therm, Tokyo Electron Limited, ASML Holding NV, Carl Zeiss AG, LAM Research Corporation, VEECO Instruments Inc.

3. What are the main segments of the Semiconductor Production Equipment Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 99.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Needs of Consumer Electronic Devices Boosting the Manufacturing Prospects; Proliferation of Artificial Intelligence. IoT. and Connected Devices Across Industry Verticals.

6. What are the notable trends driving market growth?

Semiconductor Fabrication Plant to be the Largest End-user Industry.

7. Are there any restraints impacting market growth?

Dynamic Nature of Technologies Requires Several Changes in Manufacturing Equipment.

8. Can you provide examples of recent developments in the market?

February 2024 - At the SPIE Advanced Lithography + Patterning conference, Applied Materials unveiled a new lineup of products to address the intricate patterning demands of chips in the "Angstrom era," specifically at 2nm and below process nodes. The portfolio leverages innovative materials engineering and metrology techniques to tackle challenges associated with EUV and high-NA EUV patterning, such as line edge roughness and edge placement errors. This expansion in Applied Materials' Patterning Solutions Portfolio aims to assist chipmakers in navigating issues like tip-to-tip spacing limitations and bridge defects as they advance towards increasingly minuscule chip dimensions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Production Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Production Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Production Equipment Industry?

To stay informed about further developments, trends, and reports in the Semiconductor Production Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence