Key Insights

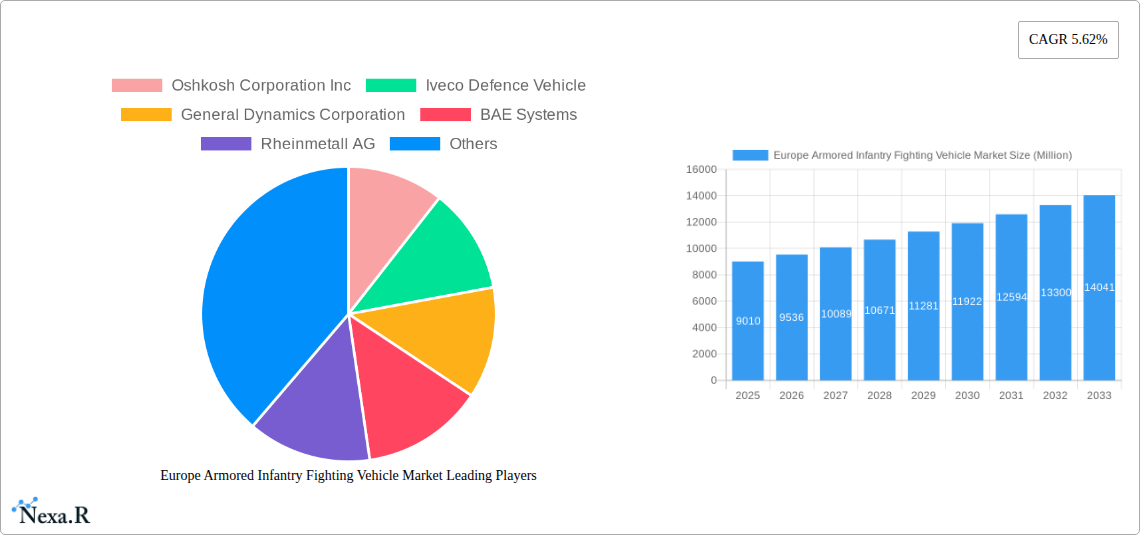

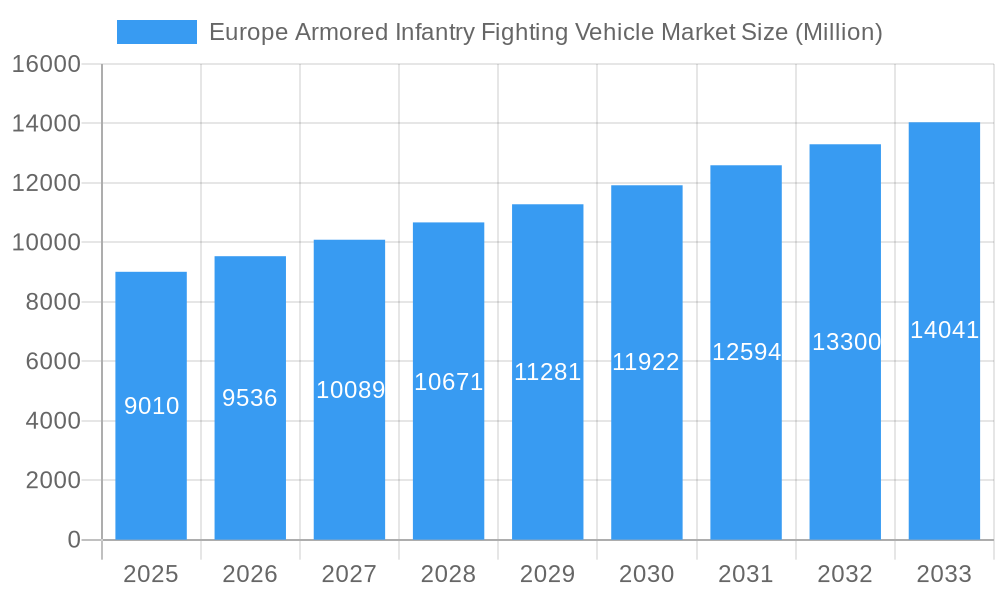

The European Armored Infantry Fighting Vehicle (IFV) market, valued at €9.01 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions and the need for modernized defense capabilities across the region. A Compound Annual Growth Rate (CAGR) of 5.62% from 2025 to 2033 indicates a significant expansion of the market. Key drivers include increasing defense budgets in major European nations like Germany, France, and the UK, coupled with a renewed focus on enhancing land-based combat capabilities. Technological advancements, such as the integration of advanced sensors, improved protection systems, and networked communication technologies, are also fueling market growth. The market is segmented by vehicle type (APC, IFV, MBT, and others), with IFVs anticipated to hold a significant market share due to their versatility in various combat scenarios. Competition among established players like Rheinmetall AG, BAE Systems, and General Dynamics Corporation is intense, driving innovation and pushing the boundaries of IFV technology. However, challenges such as economic fluctuations and evolving geopolitical landscapes could potentially restrain market growth. Germany, the UK, and France represent the largest national markets, reflecting their substantial defense spending and active participation in NATO initiatives.

Europe Armored Infantry Fighting Vehicle Market Market Size (In Billion)

The forecast period (2025-2033) promises continued growth, bolstered by government investments in military modernization programs and an increasing demand for technologically superior IFVs. The market's segmentation by country allows for a granular understanding of regional variations in demand, offering valuable insights for manufacturers targeting specific markets. While the "Rest of Europe" segment encompasses several countries, their collective contribution to overall market growth is significant and expected to increase as smaller nations prioritize defense modernization. This dynamic interplay of drivers, trends, and restraints makes the European IFV market an attractive but competitive landscape for existing and emerging players seeking to leverage technological advancements and address evolving military needs. The continuous development of more sophisticated and effective armored vehicles promises further market expansion in the long term.

Europe Armored Infantry Fighting Vehicle Market Company Market Share

Europe Armored Infantry Fighting Vehicle Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the European Armored Infantry Fighting Vehicle (AIFV) market, encompassing the parent market (European Defense Equipment Market) and its child market (Armored Vehicles). The study covers the period from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and policymakers seeking a deep understanding of this dynamic sector. The market is valued at xx Million units in 2025 and is projected to reach xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Europe Armored Infantry Fighting Vehicle Market Dynamics & Structure

The European AIFV market is characterized by moderate concentration, with key players like Oshkosh Corporation Inc, Iveco Defence Vehicles, General Dynamics Corporation, BAE Systems, and Rheinmetall AG holding significant market share. Technological innovation, driven by advancements in armor protection, fire control systems, and mobility, is a key growth driver. Stringent regulatory frameworks governing defense procurement influence market dynamics. The market also faces competition from alternative technologies like unmanned ground vehicles (UGVs). End-user demographics, primarily comprising national armies and allied forces, shape demand. M&A activity in the sector has been moderate, with xx major deals recorded between 2019 and 2024, resulting in a xx% market share shift amongst top players.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Technological Innovation: Focus on lightweight materials, advanced sensors, and autonomous capabilities.

- Regulatory Framework: Stringent regulations and standardization processes impact procurement cycles.

- Competitive Substitutes: Emerging UGV technologies pose a potential threat.

- End-User Demographics: Primarily national armies and international collaborations.

- M&A Trends: xx major deals in 2019-2024, leading to xx% market share shift.

Europe Armored Infantry Fighting Vehicle Market Growth Trends & Insights

The European AIFV market witnessed substantial growth during the historical period (2019-2024), driven by increased defense budgets and geopolitical instability. Adoption rates have been influenced by modernization programs across various European nations. Technological disruptions, particularly in areas like artificial intelligence and network-centric warfare, are reshaping the market landscape. Consumer behavior shifts, reflecting a focus on enhanced survivability, lethality, and operational efficiency, are shaping procurement decisions. Market size is estimated at xx Million units in 2025, expanding at a CAGR of xx% from 2025 to 2033. Market penetration in terms of AIFV units per military personnel is expected to increase from xx% in 2025 to xx% by 2033.

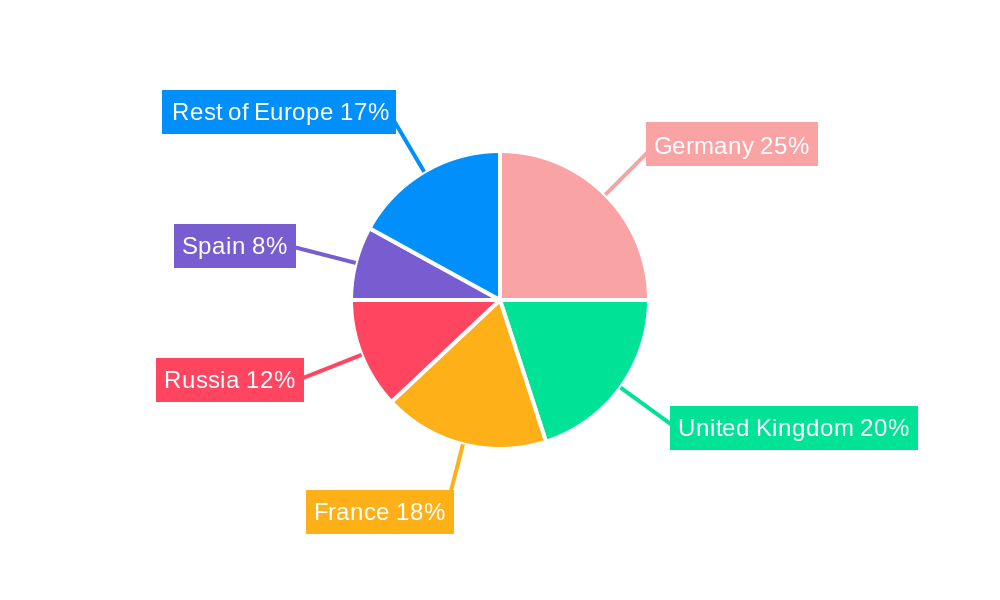

Dominant Regions, Countries, or Segments in Europe Armored Infantry Fighting Vehicle Market

Germany, the United Kingdom, and France are the dominant countries in the European AIFV market, driven by substantial defense budgets and ongoing modernization initiatives. Among segments, Infantry Fighting Vehicles (IFVs) hold the largest market share, followed by Armored Personal Carriers (APCs).

- Germany: Large defense budget, strong domestic industry, and focus on technological advancement.

- United Kingdom: Significant military expenditure, modernization programs, and strategic partnerships.

- France: Strong domestic industry, export potential, and focus on collaborative projects.

- Russia: Geopolitical factors and domestic production drive demand.

- Spain: Moderate defense spending and focus on specific IFV procurement programs.

- Rest of Europe: Variable defense budgets and localized demand patterns.

- Segment Dominance: IFVs account for xx% market share in 2025, followed by APCs at xx%.

Europe Armored Infantry Fighting Vehicle Market Product Landscape

The AIFV market features a diverse range of products, with continuous innovation in armor protection, weapon systems, and mobility features. Key features include advanced composite armor, sophisticated fire control systems, and improved crew protection. Unique selling propositions encompass enhanced situational awareness, increased firepower, and improved operational flexibility. Technological advancements focus on enhancing survivability, lethality, and network integration.

Key Drivers, Barriers & Challenges in Europe Armored Infantry Fighting Vehicle Market

Key Drivers: Increased defense spending across Europe, modernization programs to replace aging fleets, and geopolitical instability are primary drivers. Technological advancements, such as improved sensors and AI-powered systems, further stimulate growth.

Key Challenges: Budget constraints in some European countries, complex procurement processes, and competition from alternative technologies (e.g., UGVs) pose significant challenges. Supply chain disruptions can impact production timelines and costs. Regulatory hurdles related to export control and environmental regulations are also notable constraints.

Emerging Opportunities in Europe Armored Infantry Fighting Vehicle Market

Emerging opportunities lie in the development and adoption of lighter, more agile, and technologically advanced AIFVs. Untapped markets exist in Eastern European countries and within the specialized sectors such as peacekeeping operations. The integration of autonomous capabilities and the development of hybrid or electric-powered vehicles represent significant opportunities for innovation and market expansion.

Growth Accelerators in the Europe Armored Infantry Fighting Vehicle Market Industry

Long-term growth will be fueled by continued technological innovation, strategic partnerships between defense manufacturers and technology providers, and expanding global demand for advanced defense systems. The increasing emphasis on interoperability and network-centric warfare will further drive market expansion.

Key Players Shaping the Europe Armored Infantry Fighting Vehicle Market Market

- Oshkosh Corporation Inc

- Iveco Defence Vehicle

- General Dynamics Corporation

- BAE Systems

- Rheinmetall AG

- ARQUUS Defense

- KNDS N V

- Patria

- Supacat Limited (SC Group)

- Military Industrial Company

Notable Milestones in Europe Armored Infantry Fighting Vehicle Market Sector

- 2021: Launch of the Boxer IFV by ARTEC (Germany/Netherlands)

- 2022: Announcement of a major AIFV modernization program by the UK Ministry of Defence.

- 2023: Strategic partnership between Rheinmetall and a European defense company for collaborative development of next-generation AIFV technology. (Details of this partnership are still under wraps and hence the full description is not available.)

- 2024: Successful completion of field trials for a new APC model by a leading European defense manufacturer.

In-Depth Europe Armored Infantry Fighting Vehicle Market Market Outlook

The European AIFV market presents significant growth potential, driven by technological advancements, modernization initiatives, and sustained geopolitical uncertainties. Strategic partnerships and investments in research and development will be crucial for companies to gain a competitive edge. The focus on lightweight, technologically advanced, and interoperable AIFVs will shape the future of this dynamic market.

Europe Armored Infantry Fighting Vehicle Market Segmentation

-

1. Type

- 1.1. Armored Personal Carrier (APC)

- 1.2. Infantry Fighting Vehicle (IFV)

- 1.3. Main Battle Tank (MBT)

- 1.4. Other Types

Europe Armored Infantry Fighting Vehicle Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Armored Infantry Fighting Vehicle Market Regional Market Share

Geographic Coverage of Europe Armored Infantry Fighting Vehicle Market

Europe Armored Infantry Fighting Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Main Battle Tank Segment is Projected to Lead the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Armored Personal Carrier (APC)

- 5.1.2. Infantry Fighting Vehicle (IFV)

- 5.1.3. Main Battle Tank (MBT)

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Oshkosh Corporation Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Iveco Defence Vehicle

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Dynamics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BAE Systems

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rheinmetall AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ARQUUS Defense

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KNDS N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Patria

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Supacat Limited (SC Group)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Military Industrial Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Oshkosh Corporation Inc

List of Figures

- Figure 1: Europe Armored Infantry Fighting Vehicle Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Armored Infantry Fighting Vehicle Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Armored Infantry Fighting Vehicle Market?

The projected CAGR is approximately 5.62%.

2. Which companies are prominent players in the Europe Armored Infantry Fighting Vehicle Market?

Key companies in the market include Oshkosh Corporation Inc, Iveco Defence Vehicle, General Dynamics Corporation, BAE Systems, Rheinmetall AG, ARQUUS Defense, KNDS N V, Patria, Supacat Limited (SC Group), Military Industrial Company.

3. What are the main segments of the Europe Armored Infantry Fighting Vehicle Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.01 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Main Battle Tank Segment is Projected to Lead the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Armored Infantry Fighting Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Armored Infantry Fighting Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Armored Infantry Fighting Vehicle Market?

To stay informed about further developments, trends, and reports in the Europe Armored Infantry Fighting Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence