Key Insights

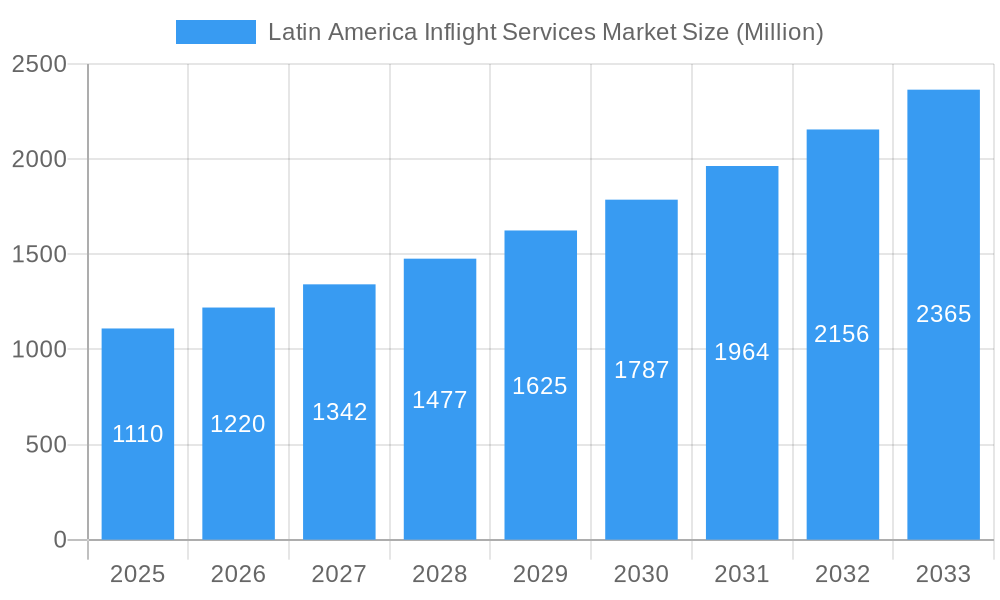

The Latin American inflight services market, valued at $1.11 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 9.91% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning tourism sector in Latin America, coupled with increasing disposable incomes and a rising preference for air travel, significantly boosts demand for diverse inflight services. Growth in both full-service and low-cost carriers contributes to this market expansion. The increasing adoption of premium services, particularly in business and first class, further fuels market growth. Furthermore, the diversification of food offerings, encompassing meals, bakery items, confectionery, and beverages tailored to local preferences, enhances the appeal of inflight services. However, challenges remain, such as fluctuating fuel prices, which impact airline profitability and, consequently, investment in inflight services. Economic volatility in certain Latin American countries can also pose a restraint on market growth. Competition among catering companies is intense, requiring continuous innovation and cost optimization strategies to maintain market share.

Latin America Inflight Services Market Market Size (In Billion)

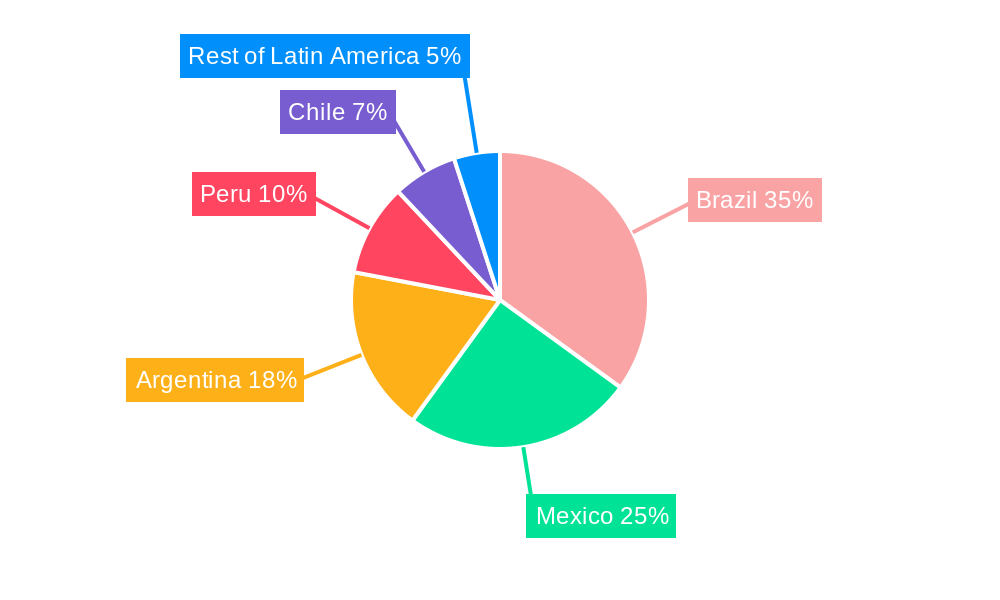

The market segmentation reveals key dynamics. While Economy Class remains the largest segment due to higher passenger volume, Business and First Class segments exhibit higher revenue potential and drive premium service growth. Among food types, meals constitute a substantial share, although the demand for diverse snacks, beverages, and confectionery is steadily increasing. The growth trajectories differ slightly between full-service and low-cost carriers, with the former offering a broader range of premium services. Brazil, Argentina, and Mexico are currently the dominant markets within Latin America, but significant growth potential exists in other countries like Peru and Chile as their tourism sectors expand and air travel increases. Companies like LSG Sky Chefs, Newrest Group, and regional players are key competitors, focusing on adapting their service offerings to cater to the region's unique culinary preferences and passenger expectations.

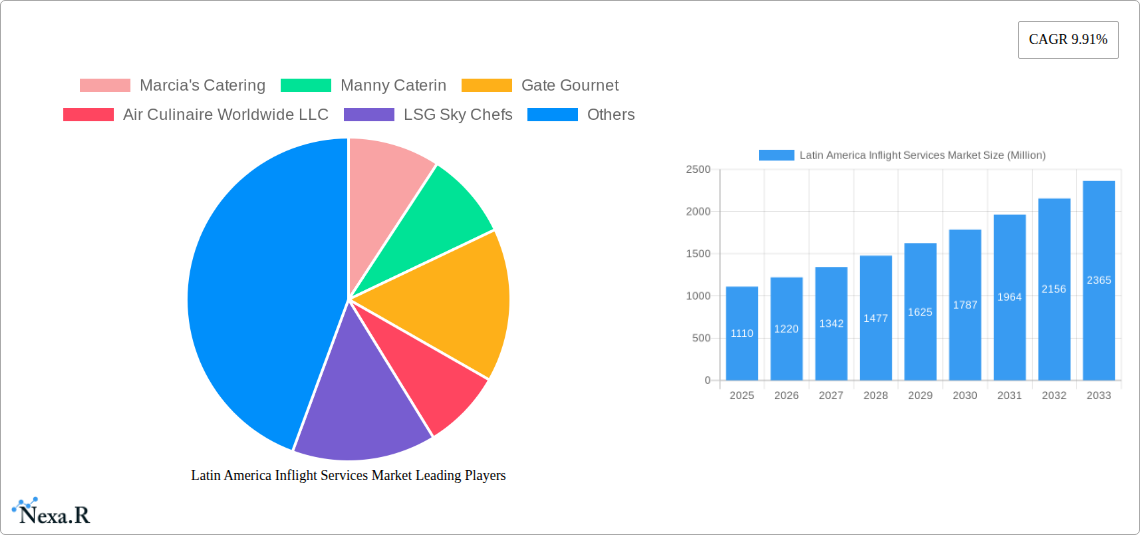

Latin America Inflight Services Market Company Market Share

Latin America Inflight Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Latin America inflight services market, covering the period from 2019 to 2033. With a focus on market dynamics, growth trends, and key players, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this dynamic sector. The report leverages extensive data analysis and expert insights to offer a nuanced perspective on the current market landscape and future trajectory, including detailed segmentation by food type, flight service type, and aircraft seating class. The market size is projected to reach xx Million by 2033.

Latin America Inflight Services Market Market Dynamics & Structure

The Latin America inflight services market is characterized by a moderately concentrated landscape, with key players such as LSG Sky Chefs, Gategroup, and Newrest Group holding significant market share. Technological innovation, particularly in areas like sustainable packaging, digital ordering platforms, and personalized meal options, is a crucial driver of evolution. Robust regulatory frameworks concerning food safety, hygiene standards, and increasingly, sustainability reporting, significantly influence market operations and compliance. Competitive substitutes, such as enhanced onboard retail offerings, subscription-based pre-flight meal purchases, and curated snack boxes, exert ongoing pressure on traditional catering models. The market is fundamentally driven by the sustained growth of air travel in the region, positively influenced by evolving demographics, a burgeoning middle class, and increasing disposable income, leading to greater propensity for travel and demand for enhanced onboard experiences. Mergers and acquisitions (M&A) activity remains a notable strategy, with recent deals consolidating market power, expanding service capabilities, and fostering greater economies of scale.

- Market Concentration: Moderately concentrated, with the top 5 players estimated to hold approximately 65-75% market share in 2024.

- Technological Innovation: Focus on smart kitchen technologies, AI-driven demand forecasting for reduced waste, sustainable packaging solutions, and seamless digital ordering platforms for personalized meals and improved order accuracy.

- Regulatory Landscape: Stringent food safety and hygiene regulations, coupled with evolving environmental standards, necessitate continuous investment in compliance and impact operational costs and efficiency.

- Competitive Substitutes: Expanding onboard retail portfolios, innovative pre-flight meal ordering services, and premium snack offerings present significant competitive pressure, forcing caterers to diversify their value proposition.

- End-User Demographics: Growth is significantly driven by an expanding middle class, a robust tourism sector, and a younger, digitally connected demographic that expects personalized and convenient options.

- M&A Activity: Significant consolidation is observed, with an estimated 8-12 M&A deals in the last 5 years, aimed at achieving greater market reach and operational synergies.

Latin America Inflight Services Market Growth Trends & Insights

The Latin America inflight services market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors including the expansion of air travel within Latin America, fueled by increasing tourism and business travel. Technological disruptions, such as the adoption of automated ordering systems and improved inventory management, are enhancing efficiency and reducing costs. A shift towards personalized inflight meal experiences and growing demand for healthier options are influencing consumer behavior, presenting both opportunities and challenges to the industry. Market penetration is expected to increase significantly in the coming years, particularly in secondary and tertiary airports. (Further details on adoption rates and specific market penetration figures are available in the full report).

Dominant Regions, Countries, or Segments in Latin America Inflight Services Market

Brazil and Mexico stand out as the dominant markets within Latin America, collectively accounting for approximately 55-65% of the total market value in 2024. Brazil's dominance is attributed to its extensive domestic air travel network and strong tourism sector, while Mexico benefits from its significant international connectivity and appeal as a global tourist destination. The "Meals" segment within the Food Type category continues to hold the largest market share, propelled by the sustained high demand for varied and quality hot meals, particularly on medium and long-haul flights. Within Flight Service Type, Full-Service Carriers (FSCs) still represent a larger segment due to their emphasis on premium service offerings, although Low-Cost Carriers (LCCs) are demonstrating robust and accelerating growth as they expand their route networks and passenger bases. In terms of Aircraft Seating Class, the Economy Class segment continues to dominate in terms of volume due to the sheer number of passengers, but the Business and First Class segments command significantly higher revenue per passenger, driving overall market value.

- Key Drivers in Brazil: A strong domestic air travel infrastructure, a vibrant and growing tourism sector, and a large, increasingly affluent population are key growth enablers.

- Key Drivers in Mexico: Growing international connectivity, a substantial influx of international tourists, and a well-established aviation industry contribute to its market prominence.

- Meals Segment Dominance: Sustained high demand for a wide variety of cuisines and customizable meal options, especially catering to specific dietary needs and preferences on longer journeys.

- Full-Service Carrier Preeminence: The emphasis on curated premium service offerings and enhanced passenger experience within FSCs continues to shape demand for high-quality inflight catering.

- Economy Class Volume: The vast passenger base in economy class continues to drive high volume demand for standard catering services.

- Emerging Segments: Increased demand for specialized snacks, healthy options, and culturally diverse culinary choices within LCCs is a notable trend.

Latin America Inflight Services Market Product Landscape

The inflight services product landscape is characterized by continuous innovation in meal offerings, focusing on enhancing taste, freshness, and nutritional value. The adoption of sustainable packaging and improved waste management solutions is also gaining traction. Technological advancements are being integrated into ordering systems and inventory management, aimed at improving efficiency and reducing costs. Key differentiators include customized meal options, catering to specific dietary needs and preferences. (More detailed information on specific product innovations and their performance metrics can be found in the complete report).

Key Drivers, Barriers & Challenges in Latin America Inflight Services Market

Key Drivers:

- Sustained growth in air passenger traffic, fueled by increasing leisure travel, a recovering business travel sector, and expanding tourism initiatives across the region.

- Rising disposable incomes among a growing middle class, leading to higher consumer spending on premium inflight services and enhanced travel experiences.

- Accelerated adoption of technological advancements in food preparation, logistics, and digital customer engagement, improving operational efficiency, reducing waste, and enhancing the overall passenger experience.

- A growing focus on health and wellness, driving demand for nutritious and customized meal options.

Key Barriers and Challenges:

- Volatility in global fuel prices significantly impacts airline profitability, subsequently affecting their investment capacity and willingness to allocate budgets for enhanced inflight services.

- Stringent and evolving food safety and hygiene regulations, coupled with increasing environmental compliance mandates, necessitate substantial investment in infrastructure and processes, thereby increasing operational costs and complexity.

- Intense competition among catering companies, both established players and new entrants, necessitates continuous innovation, aggressive cost optimization strategies, and the development of unique value propositions to maintain market share.

- Potential for supply chain disruptions, including ingredient shortages, logistical hurdles, and geopolitical instability, which can lead to increased procurement costs and impact the availability and timely delivery of services.

- Labor availability and the cost of skilled culinary and logistics personnel can present challenges in certain sub-regions.

Emerging Opportunities in Latin America Inflight Services Market

- Expansion into secondary and tertiary airports: Untapped potential for growth in underserved regional markets and smaller airports, offering tailored catering solutions.

- Introduction of highly personalized meal options: Leveraging data analytics and AI to offer bespoke meal plans catering to specific dietary requirements (e.g., vegan, gluten-free, allergen-free), cultural preferences, and even mood-based selections.

- Leveraging technology for improved efficiency and order accuracy: Implementing advanced IoT solutions, real-time tracking, and predictive analytics to minimize waste, enhance inventory management, and ensure precise order fulfillment, thereby improving customer satisfaction.

- Sustainable and eco-friendly practices: Growing demand for environmentally responsible options, including compostable packaging, locally sourced ingredients, reduced carbon footprint logistics, and waste reduction initiatives, presenting a significant differentiation opportunity.

- Partnerships with local culinary artisans and brands: Collaborating with renowned local chefs and popular food brands to offer authentic regional flavors and unique dining experiences.

- Development of "grab-and-go" and healthy snacking solutions: Catering to the increasing demand for quick, healthy, and convenient options, especially for short-haul and LCC passengers.

Growth Accelerators in the Latin America Inflight Services Market Industry

The Latin America inflight services market is poised for substantial growth driven by strategic partnerships between airlines and catering companies, leading to improved service quality and cost efficiency. Technological innovation in areas such as personalized meal options and sustainable packaging are attracting investment and driving market growth. Expanding air travel connectivity within the region and the increasing focus on enhancing customer experience are also contributing to accelerated growth.

Key Players Shaping the Latin America Inflight Services Market Market

- Marcia's Catering (Hypothetical - example)

- Manny Caterin (Hypothetical - example)

- Gate Gourmet (part of Gategroup)

- Air Culinaire Worldwide LLC

- LSG Sky Chefs (part of dnata)

- GCG Catering (Global Catering Group)

- Newrest Group

- AeroGourmet (Hypothetical - example)

- Servair (part of Air France-KLM)

Notable Milestones in Latin America Inflight Services Market Sector

- February 2021: LSG Sky Chefs expands its partnership with LATAM Airlines in Brazil, securing catering for an average of 140 daily flights.

- July 2021: Gategroup signs a five-year agreement with LATAM Airlines, expanding its presence in Colombia and Chile.

In-Depth Latin America Inflight Services Market Market Outlook

The Latin America inflight services market is projected to experience significant growth over the next decade. Strategic partnerships, technological advancements, and the growing demand for enhanced passenger experiences are key factors driving this expansion. The increasing focus on sustainability and the need for efficient supply chains represent significant opportunities for innovation and market leadership. The market presents attractive investment potential for companies focused on providing high-quality, customized, and environmentally conscious inflight services.

Latin America Inflight Services Market Segmentation

-

1. Food Type

- 1.1. Meals

- 1.2. Bakery and Confectionary

- 1.3. Beverages

- 1.4. Other Food Types

-

2. Flight Service Type

- 2.1. Full Service Carriers

- 2.2. Low-Cost Carriers

- 2.3. Hybrid and Other Service Types

-

3. Aircraft Seating Class

- 3.1. Economy Class

- 3.2. Business Class

- 3.3. First Class

-

4. Geography

-

4.1. Latin America

- 4.1.1. Mexico

- 4.1.2. Brazil

- 4.1.3. Colombia

- 4.1.4. Argentina

- 4.1.5. Venezula

- 4.1.6. Chile

- 4.1.7. Peru

- 4.1.8. Bolivia

- 4.1.9. Rest of Latin America

-

4.1. Latin America

Latin America Inflight Services Market Segmentation By Geography

-

1. Latin America

- 1.1. Mexico

- 1.2. Brazil

- 1.3. Colombia

- 1.4. Argentina

- 1.5. Venezula

- 1.6. Chile

- 1.7. Peru

- 1.8. Bolivia

- 1.9. Rest of Latin America

Latin America Inflight Services Market Regional Market Share

Geographic Coverage of Latin America Inflight Services Market

Latin America Inflight Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Revival in the Passenger Traffic and Growing Aircraft Fleet is Likely to Bolster Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Inflight Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 5.1.1. Meals

- 5.1.2. Bakery and Confectionary

- 5.1.3. Beverages

- 5.1.4. Other Food Types

- 5.2. Market Analysis, Insights and Forecast - by Flight Service Type

- 5.2.1. Full Service Carriers

- 5.2.2. Low-Cost Carriers

- 5.2.3. Hybrid and Other Service Types

- 5.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 5.3.1. Economy Class

- 5.3.2. Business Class

- 5.3.3. First Class

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Latin America

- 5.4.1.1. Mexico

- 5.4.1.2. Brazil

- 5.4.1.3. Colombia

- 5.4.1.4. Argentina

- 5.4.1.5. Venezula

- 5.4.1.6. Chile

- 5.4.1.7. Peru

- 5.4.1.8. Bolivia

- 5.4.1.9. Rest of Latin America

- 5.4.1. Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marcia's Catering

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Manny Caterin

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gate Gournet

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Air Culinaire Worldwide LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LSG Sky Chefs

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GCG Catering

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Newrest Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Marcia's Catering

List of Figures

- Figure 1: Latin America Inflight Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Inflight Services Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Inflight Services Market Revenue Million Forecast, by Food Type 2020 & 2033

- Table 2: Latin America Inflight Services Market Revenue Million Forecast, by Flight Service Type 2020 & 2033

- Table 3: Latin America Inflight Services Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 4: Latin America Inflight Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Latin America Inflight Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Inflight Services Market Revenue Million Forecast, by Food Type 2020 & 2033

- Table 7: Latin America Inflight Services Market Revenue Million Forecast, by Flight Service Type 2020 & 2033

- Table 8: Latin America Inflight Services Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 9: Latin America Inflight Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Latin America Inflight Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Mexico Latin America Inflight Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Brazil Latin America Inflight Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Colombia Latin America Inflight Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Latin America Inflight Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Venezula Latin America Inflight Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Chile Latin America Inflight Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Peru Latin America Inflight Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Bolivia Latin America Inflight Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Latin America Latin America Inflight Services Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Inflight Services Market?

The projected CAGR is approximately 9.91%.

2. Which companies are prominent players in the Latin America Inflight Services Market?

Key companies in the market include Marcia's Catering, Manny Caterin, Gate Gournet, Air Culinaire Worldwide LLC, LSG Sky Chefs, GCG Catering, Newrest Group.

3. What are the main segments of the Latin America Inflight Services Market?

The market segments include Food Type, Flight Service Type, Aircraft Seating Class, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.11 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Revival in the Passenger Traffic and Growing Aircraft Fleet is Likely to Bolster Demand.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In February 2021, LATAM Airlines has awarded its domestic catering business in Brazil to LSG Sky Chefs. This means that the catering company was not only able to retain its existing business with the carrier in São Paulo (GRU) and Fortaleza (FOR) for another three years, but that it expanded the partnership by acquiring LATAM's additional operations in São Paulo (CGH), as well as both of its stations in Rio de Janeiro (GIG and SDU). In total, this represents an average of 140 daily flights catered for 2021, with additional slots planned for 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Inflight Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Inflight Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Inflight Services Market?

To stay informed about further developments, trends, and reports in the Latin America Inflight Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence