Key Insights

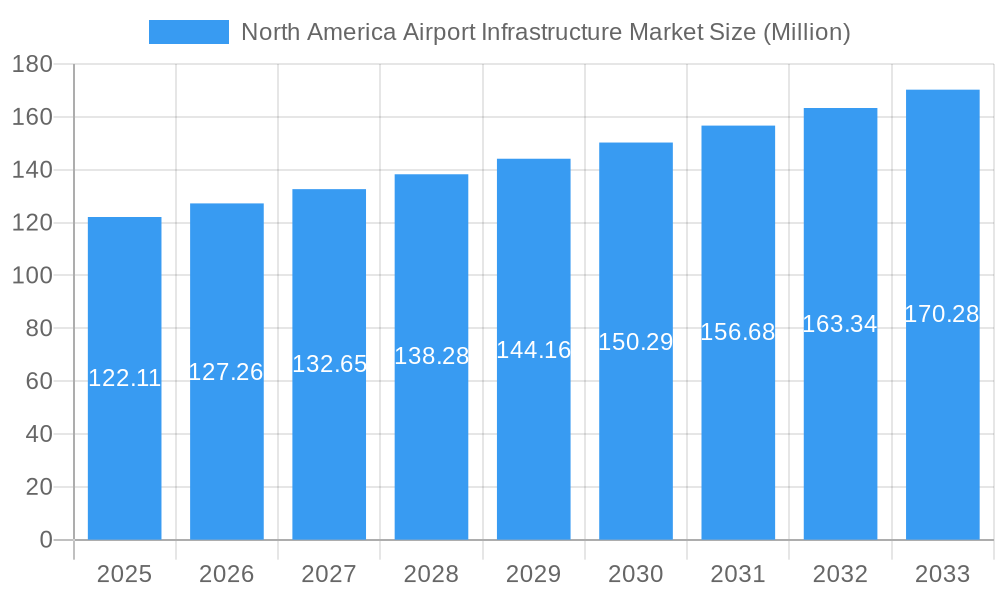

The North America airport infrastructure market is poised for substantial growth, projected to reach a value of $122.11 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 4.18% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing air passenger traffic, particularly in major hubs across the United States, Canada, and Mexico, necessitates upgrades and expansions to existing airport infrastructure. Furthermore, a surge in e-commerce and related air freight necessitates the development of larger, more efficient cargo handling facilities. Government investments in infrastructure modernization, coupled with a focus on improving passenger experience and safety, further stimulate market growth. The market segmentation reveals significant activity across various infrastructure types, including terminals, taxiways and runways, aprons, control towers, and hangars. Brownfield airport projects, involving upgrades and expansions of existing facilities, comprise a significant portion of the market. Greenfield airport development, while representing a smaller share, also contributes to overall growth, particularly in regions experiencing rapid population and economic expansion. While specific challenges such as potential regulatory hurdles and economic fluctuations can act as restraints, the overall long-term outlook remains positive, driven by the strong underlying demand for improved air travel infrastructure.

North America Airport Infrastructure Market Market Size (In Million)

The leading companies in the North American airport infrastructure construction market – PCL Constructors Inc, McCarthy Building Companies Inc, The Walsh Group, Austin Industries, Hensel Phelps, Turner Construction Company, J E Dunn Construction Company, and AECOM – are well-positioned to benefit from this growth. Their expertise in large-scale construction projects, coupled with their understanding of the unique demands of airport infrastructure, provides them with a competitive advantage. The market is geographically concentrated, with the United States representing the largest segment within North America, followed by Canada and Mexico. Continued investment in airport infrastructure across these nations, alongside planned expansions and upgrades, will further bolster market growth throughout the forecast period. The strategic expansion plans by major airlines and the continuous focus on improving operational efficiency within airports ensures the sustained demand for modernized and enhanced infrastructure will continue driving market expansion for the foreseeable future.

North America Airport Infrastructure Market Company Market Share

North America Airport Infrastructure Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Airport Infrastructure market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The parent market is the North American Construction market, while the child market is Airport Infrastructure specifically. The market size in 2025 is estimated at $XX Million, projected to reach $XX Million by 2033, exhibiting a CAGR of XX%.

North America Airport Infrastructure Market Dynamics & Structure

The North American airport infrastructure market is characterized by moderate concentration, with a few large players dominating the construction and engineering segments. Technological innovation, particularly in sustainable building materials and smart airport technologies, is a key driver. Regulatory frameworks, including environmental regulations and safety standards, significantly influence market operations. Competitive substitutes are limited, primarily focusing on alternative construction methodologies. The end-user demographics comprise primarily government agencies and private airport operators. M&A activity has been relatively steady, with an average of XX deals per year in the historical period (2019-2024).

- Market Concentration: Moderately concentrated, with top 5 players holding approximately XX% market share in 2025.

- Technological Innovation: Focus on sustainable materials (e.g., recycled concrete), automation in construction, and smart airport technologies (e.g., AI-powered security systems).

- Regulatory Framework: Stringent safety and environmental regulations impacting project timelines and costs.

- Competitive Substitutes: Limited, with alternative construction methods (e.g., modular construction) gaining traction.

- End-User Demographics: Primarily government agencies (federal, state, and local) and private airport operators.

- M&A Trends: Average of XX M&A deals per year (2019-2024), driven by market consolidation and expansion strategies.

North America Airport Infrastructure Market Growth Trends & Insights

The North America airport infrastructure market experienced substantial growth during the historical period (2019-2024), driven by increasing passenger traffic, aging infrastructure, and government investments in airport modernization. Adoption rates of new technologies are gradually increasing, while technological disruptions (e.g., automation and digital twin technology) are influencing construction practices. Consumer behavior shifts are primarily driven by increased demand for efficient and sustainable airport facilities. The market is projected to maintain a steady growth trajectory over the forecast period (2025-2033), fueled by continued investments in both brownfield and greenfield airport projects across the region. This growth is expected to vary across different infrastructure types, with terminals and runway expansion projects leading the charge. Factors influencing market size evolution include fluctuations in government funding, economic conditions, and passenger demand.

Dominant Regions, Countries, or Segments in North America Airport Infrastructure Market

The Northeastern and Western United States are currently the dominant regions, driven by high passenger traffic volume at major hubs and ongoing infrastructure upgrades. Within infrastructure types, terminals represent the largest segment, followed by taxiways and runways. Brownfield airport projects dominate in terms of volume due to the prevalence of existing infrastructure needing modernization.

- Key Drivers in Northeastern US: High passenger traffic at major hubs like JFK, LGA, and Boston Logan; significant government investments in modernization.

- Key Drivers in Western US: Growth in air travel to and from major cities like Los Angeles, San Francisco, and Seattle; investment in new facilities and expansions.

- Dominant Infrastructure Type: Terminals (XX% market share in 2025), driven by increasing passenger numbers and demand for improved passenger experience.

- Dominant Airport Type: Brownfield airports (XX% market share in 2025), reflecting the need for refurbishment and expansion of existing facilities.

North America Airport Infrastructure Market Product Landscape

The product landscape encompasses a range of infrastructure components, construction technologies, and services. Recent innovations include prefabricated modular components for faster construction, advanced materials for enhanced durability, and integrated building management systems for improved operational efficiency. These innovations offer unique selling propositions like reduced construction time and cost, enhanced sustainability, and improved operational performance.

Key Drivers, Barriers & Challenges in North America Airport Infrastructure Market

Key Drivers: Increased air passenger traffic, government funding for airport improvements, and technological advancements in construction methods.

Challenges: Funding limitations, lengthy approval processes, labor shortages, and supply chain disruptions (resulting in a XX% increase in material costs from 2024 to 2025).

Emerging Opportunities in North America Airport Infrastructure Market

Emerging opportunities lie in the adoption of sustainable building practices, the integration of smart airport technologies, and the development of specialized infrastructure for emerging aviation technologies like drones and eVTOLs. Untapped markets exist in smaller regional airports and underserved communities.

Growth Accelerators in the North America Airport Infrastructure Market Industry

Long-term growth will be accelerated by strategic partnerships between airport operators and construction companies, increased private sector investment in airport infrastructure, and continued technological innovation in construction and airport operations. Government initiatives promoting sustainable infrastructure will also contribute significantly.

Key Players Shaping the North America Airport Infrastructure Market Market

Notable Milestones in North America Airport Infrastructure Market Sector

- 2022: Increased federal funding allocated to airport infrastructure improvement projects under the Bipartisan Infrastructure Law.

- 2023: Several major airport expansion projects commenced across the US.

- 2024: Significant advancements in sustainable construction materials and methods adopted by major construction firms.

- 2025: Several notable M&A transactions reshaped the competitive landscape.

In-Depth North America Airport Infrastructure Market Outlook

The North America airport infrastructure market is poised for continued growth over the forecast period, driven by sustained investments in airport modernization and expansion. Strategic opportunities exist for companies that can leverage technological advancements, adopt sustainable practices, and effectively navigate regulatory complexities. The market's long-term outlook is positive, reflecting the increasing importance of air travel and the need for efficient and sustainable airport infrastructure.

North America Airport Infrastructure Market Segmentation

-

1. Infrastructure Type

- 1.1. Terminals

- 1.2. Taxiway and Runways

- 1.3. Aprons

- 1.4. Control Towers

- 1.5. Hangars

- 1.6. Others

-

2. Airport Type

- 2.1. Brownfield Airports

- 2.2. Greenfield Airports

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Airport Infrastructure Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Airport Infrastructure Market Regional Market Share

Geographic Coverage of North America Airport Infrastructure Market

North America Airport Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Terminal Segment to Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.1.1. Terminals

- 5.1.2. Taxiway and Runways

- 5.1.3. Aprons

- 5.1.4. Control Towers

- 5.1.5. Hangars

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Airport Type

- 5.2.1. Brownfield Airports

- 5.2.2. Greenfield Airports

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6. United States North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.1.1. Terminals

- 6.1.2. Taxiway and Runways

- 6.1.3. Aprons

- 6.1.4. Control Towers

- 6.1.5. Hangars

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Airport Type

- 6.2.1. Brownfield Airports

- 6.2.2. Greenfield Airports

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7. Canada North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.1.1. Terminals

- 7.1.2. Taxiway and Runways

- 7.1.3. Aprons

- 7.1.4. Control Towers

- 7.1.5. Hangars

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Airport Type

- 7.2.1. Brownfield Airports

- 7.2.2. Greenfield Airports

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8. Mexico North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8.1.1. Terminals

- 8.1.2. Taxiway and Runways

- 8.1.3. Aprons

- 8.1.4. Control Towers

- 8.1.5. Hangars

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Airport Type

- 8.2.1. Brownfield Airports

- 8.2.2. Greenfield Airports

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 PCL Constructors Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 McCarthy Building Companies Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 The Walsh Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Austin Industries

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Hensel Phelps

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Turner Construction Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 J E Dunn Construction Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 AECOM

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 PCL Constructors Inc

List of Figures

- Figure 1: North America Airport Infrastructure Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Airport Infrastructure Market Share (%) by Company 2025

List of Tables

- Table 1: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 2: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 3: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Airport Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 7: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Airport Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 10: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 11: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Airport Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 14: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 15: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Airport Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Airport Infrastructure Market?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the North America Airport Infrastructure Market?

Key companies in the market include PCL Constructors Inc, McCarthy Building Companies Inc, The Walsh Group, Austin Industries, Hensel Phelps, Turner Construction Company, J E Dunn Construction Company, AECOM.

3. What are the main segments of the North America Airport Infrastructure Market?

The market segments include Infrastructure Type, Airport Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 122.11 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Terminal Segment to Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Airport Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Airport Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Airport Infrastructure Market?

To stay informed about further developments, trends, and reports in the North America Airport Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence